GS

DailyPlay – Opening Trade (GS) – July 10, 2025

GS Bullish Opening Trade Signal

Investment Rationale

Investment Thesis

Goldman Sachs (GS) approaches its July 16th earnings report with strong momentum, having exceeded consensus expectations in each of the past four quarters. The firm’s disciplined approach, simplified post-restructuring model, and strong capital markets presence position it well in a gradually improving macro environment. Additionally, a potential easing in M&A regulation could serve as a tailwind, reducing compliance costs, accelerating deal approvals, and boosting transaction volume. These dynamics would not only enhance advisory fee revenue but also reinforce Goldman’s leadership in M&A advisory. With shares pulling back modestly within a well-established uptrend, current levels may present a tactical opportunity for bullish exposure ahead of the print.

Technical Analysis

GS remains in a strong uptrend, having advanced more than 25% from its May lows. The stock recently pulled back from the $705 level and is now consolidating near its 20-day moving average, which has acted as reliable support during this rally. A bullish continuation pattern may be forming, with $726 marked as the next key resistance. Momentum remains constructive, RSI is holding above 60, and a recent dip in the Commodity Channel Index (CCI) during the broader trend suggests a potential entry point as the indicator begins to recover.

Fundamental Analysis

While Goldman’s forward growth expectations trail the industry average, the firm continues to deliver superior profitability and attractive relative valuation. Its high-margin business mix and operational efficiency support sustained earnings power. Notably, GS trades well below peers on a price-to-book basis, reinforcing its value proposition.

- Price to Book (PB) Ratio: 1.96 vs. Industry Average 4.29

- Expected EPS Growth: 9.77% vs. Industry Average 11.9%

- Expected Revenue Growth: 3.39% vs. Industry Average 7.01%

- Net Margins: 27.38% vs. Industry Average 21.10%

Goldman’s net margins of 27.38% significantly outperform the industry average, underscoring the firm’s operating efficiency and consistent earnings quality.

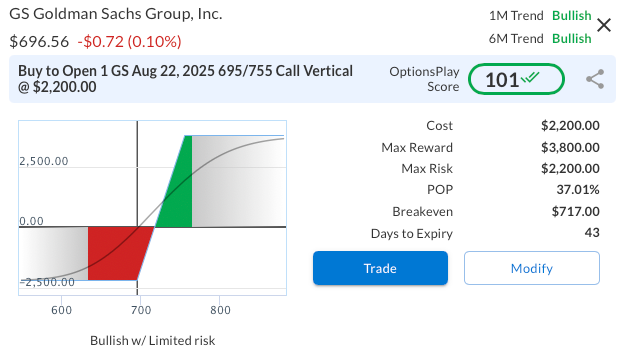

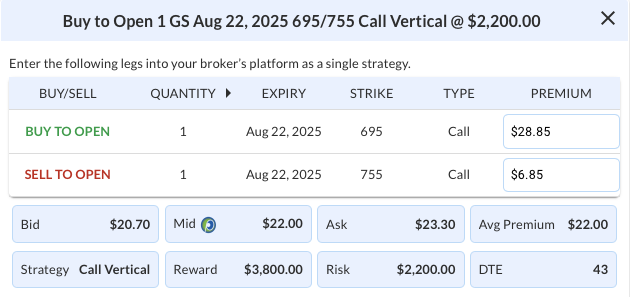

Options Trade

To position for a continued move higher, consider the GS Aug 22nd 695/755 call spread at a $22.00 debit. This vertical spread risks $2,200 to target a potential $3,800 profit, offering a reward-to-risk ratio of 1.73:1. The 695 strike sits just below current levels and aligns with recent consolidation support, while the 755 strike provides room for upside toward key post-earnings technical levels. With 43 days to expiration, the trade allows for both an earnings-driven move and post-event continuation.

GS – Daily

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 1 GS Aug 22 $695/$755 Call Vertical Spreads @ $22.00 Debit per Contract.

Total Risk: This trade has a max risk of $2,200 (1 Contract x $2,200) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $2,200 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 101

Stop Loss: @ $11.00 (50% loss of premium)

View GS Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View GS Trade

TMUS

DailyPlay – Opening Trade (TMUS) – July 09, 2025

TSLA Bearish Opening Trade Signal

Investment Rationale

Investment Thesis

T-Mobile US Inc. (TMUS) presents an attractive bearish setup as it rallies within a broader downtrend, creating a potential opportunity to initiate bearish exposure with defined risk. Despite its modest growth profile, TMUS continues to trade at a substantial premium to peers, suggesting that recent strength could reverse if the market refocuses on its valuation concerns. With price action confirming technical weakness and fundamentals offering limited justification for its premium, the risk/reward favors positioning for downside continuation towards key support levels. Additionally, TMUS is scheduled to report earnings on Wednesday, July 23rd after market close, which may act as a potential catalyst for volatility in line with this bearish thesis.

Technical Analysis

TMUS has recently experienced a rally back into its $240 resistance area within a longer-term bearish trend, creating a favorable entry for trend-following shorts. Notably, today the stock crossed below its 200-day moving average at $236.08, reinforcing its medium-term technical weakness. The recent rejection near the declining 50-day moving average further confirms the bearish momentum, with the next major support sitting near $220. Relative strength remains middling, offering no evidence of bullish leadership, and instead aligning with the broader technical deterioration.

Fundamental Analysis

TMUS remains significantly overvalued relative to industry peers despite only moderately stronger growth expectations, suggesting limited fundamental support at current prices:

- Forward PE Ratio: 22.55x vs. Industry Median 10.03x

- Expected EPS Growth: 15.89% vs. Industry Median 5.56%

- Expected Revenue Growth: 5.21% vs. Industry Median 2.54%

- Net Margins: 14.41% vs. Industry Median 12.72%

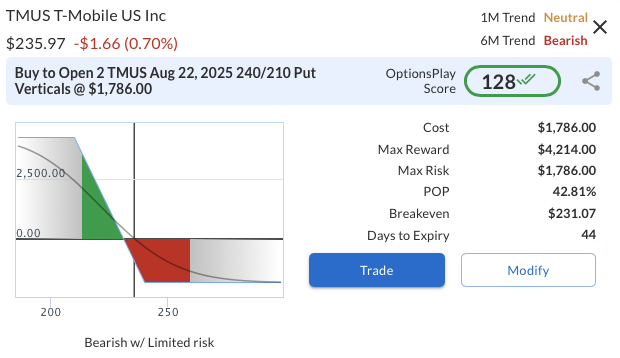

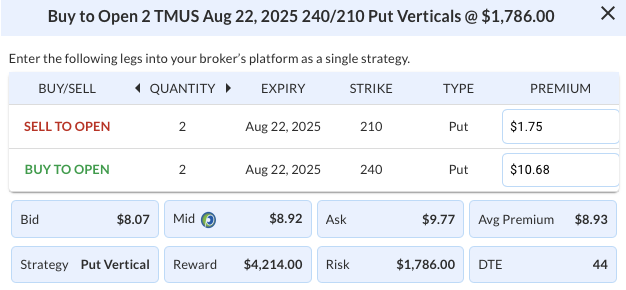

Options Trade

A bearish put vertical is structured via buying the TMUS Aug 22, 2025 $240 put and selling the $210 put for a net debit of $8.93 ($893 total risk). The trade risks $893 to potentially gain $2,107 if TMUS closes below $210 at expiration.This setup results in a risk/reward ratio of approximately 1:2.4, meaning for every $1.00 of risk, the trade offers $2.40 of potential reward. This vertical spread limits risk to the premium paid, aligning with the technical breakdown, upcoming earnings catalyst, and overvaluation thesis while maintaining favorable capital efficiency.

TMUS – Daily

Trade Details

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 2 TMUS Aug 22 $240/$210 Put Vertical Spreads @ $8.93 Debit per Contract.

Total Risk: This trade has a max risk of $1,786 (2 Contract x $893) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $893 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower over the duration of this trade.

1M/6M Trends: Neutral/Bearish

Relative Strength: 6/10

OptionsPlay Score: 128

Stop Loss: @ $4.47 (50% loss of premium)

View TMUS Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View TMUS Trade

TSLA

DailyPlay – Opening Trade (TSLA) – July 08, 2025

TSLA Bearish Opening Trade Signal

Investment Rationale

Investment Thesis:

Tesla Inc. (TSLA) presents a compelling bearish setup ahead of its Q2 earnings report, scheduled for Wednesday, July 23rd after market close. Despite optimism around its long-term innovation narrative, near-term price action and valuation continue to decouple from realistic fundamental support. The stock has recently failed to sustain momentum above key resistance levels, while sentiment has turned more cautious amid broader EV demand concerns and increasingly competitive market dynamics. With earnings risk approaching and limited upside catalysts, TSLA offers a tactically favorable short opportunity into the event.

Technical Analysis:

Price action in TSLA shows persistent distribution beneath the $350 resistance zone, where sellers have repeatedly capped rallies over the past year. The stock has now broken below its 50-day and 20-day moving averages, with a fresh bearish crossover developing between the short-term MAs. The rejection near $318 in early July reinforces this technical weakness, and momentum indicators like RSI have slipped toward neutral-bearish territory at 40. A breakdown below $290 confirms a lower high and opens the door toward the $250 support region, with the $180 level representing a longer-term downside target.

Fundamental Analysis:

TSLA remains fundamentally overvalued even as growth expectations compress and margins tighten under macro and competitive pressure. While Tesla’s topline metrics continue to outpace the sector, the extreme premium attached to its stock is increasingly difficult to defend.

- Forward PE Ratio: 167.38x vs. Industry Median 11.45x

- Expected EPS Growth: 17.82% vs. Industry Median 8.30%

- Expected Revenue Growth: 12.95% vs. Industry Median 3.06%

- Net Margins: 6.70% vs. Industry Median 2.71%

Options Trade:

With implied volatility elevated ahead of earnings and recent news headlines adding downside pressure, this structure offers a defined-risk way to express a bearish view. The 295/245 bear put vertical spread balances risk while providing strong convexity to the downside. The maximum potential reward of $3,344 vs. a defined risk of $1,656 delivers a favorable risk-reward ratio into a potentially volatile setup with 31 days to expiration.

TSLA – Daily

Trade Details

Strategy Details

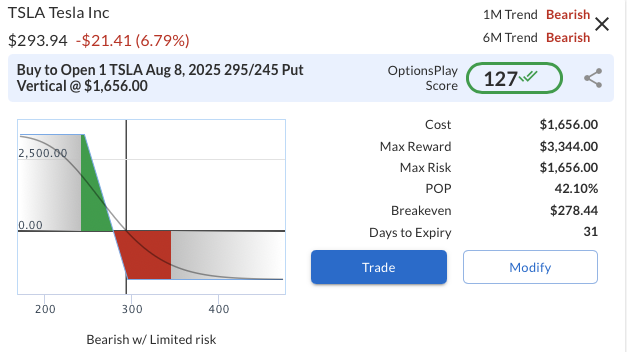

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 1 TSLA Aug 08 $295/$245 Put Vertical Spreads @ $16.56 Debit per Contract.

Total Risk: This trade has a max risk of $1,656 (1 Contract x $1,656) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $1,656 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower over the duration of this trade.

1M/6M Trends: Bearish/Bearish

Relative Strength: 2/10

OptionsPlay Score: 127

Stop Loss: @ $8.28 (50% loss of premium)

View TSLA Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View TSLA Trade

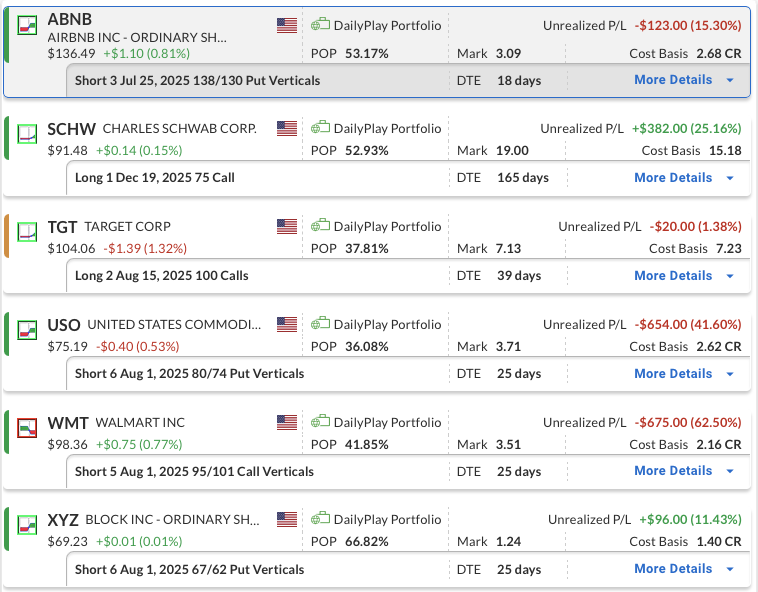

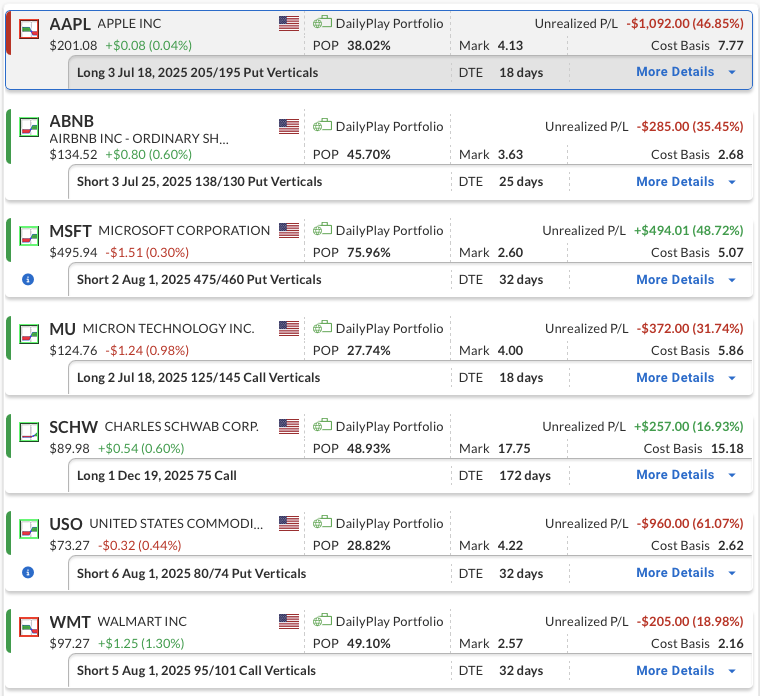

DailyPlay – Portfolio Review – July 07, 2025

DailyPlay Portfolio Review

Our Trades

ABNB – 18 DTE

Bullish Credit Spread – Airbnb Inc. (ABNB) – The position is slightly down, as the stock broke out to the upside from its range and is now trading above its 200-day moving average, generating upside momentum. We plan to stay the course for now.

SCHW – 165 DTE

Bullish Long Call – Charles Schwab Corp. (SCHW) – Our outlook remains positive, supported by strong company fundamentals and continued strength in both SCHW and the broader financial sector.

TGT – 39 DTE

Bullish Long Call – Target Corporation (TGT) – We recently established this position and have a slight profit. We will stay the course for now, as the setup remains intact and the potential for additional upside is still in play.

USO – 25 DTE

Bullish Credit Spread – United States Oil Fund, LP (USO) – The position is down at the moment, and we’re keeping a close eye on oil prices leading into the OPEC International Seminar on July 9th and 10th, a key event that could move the market. With plenty of time left until expiration, we intend to stay the course.

WMT – 25 DTE

Bearish Credit Spread – Walmart Inc. (WMT) – The position is currently down, as the stock has remained range-bound. The bottom of the channel, near the 95 level, is an important downside support level that needs to break to generate momentum. At this stage, we plan to hold steady.

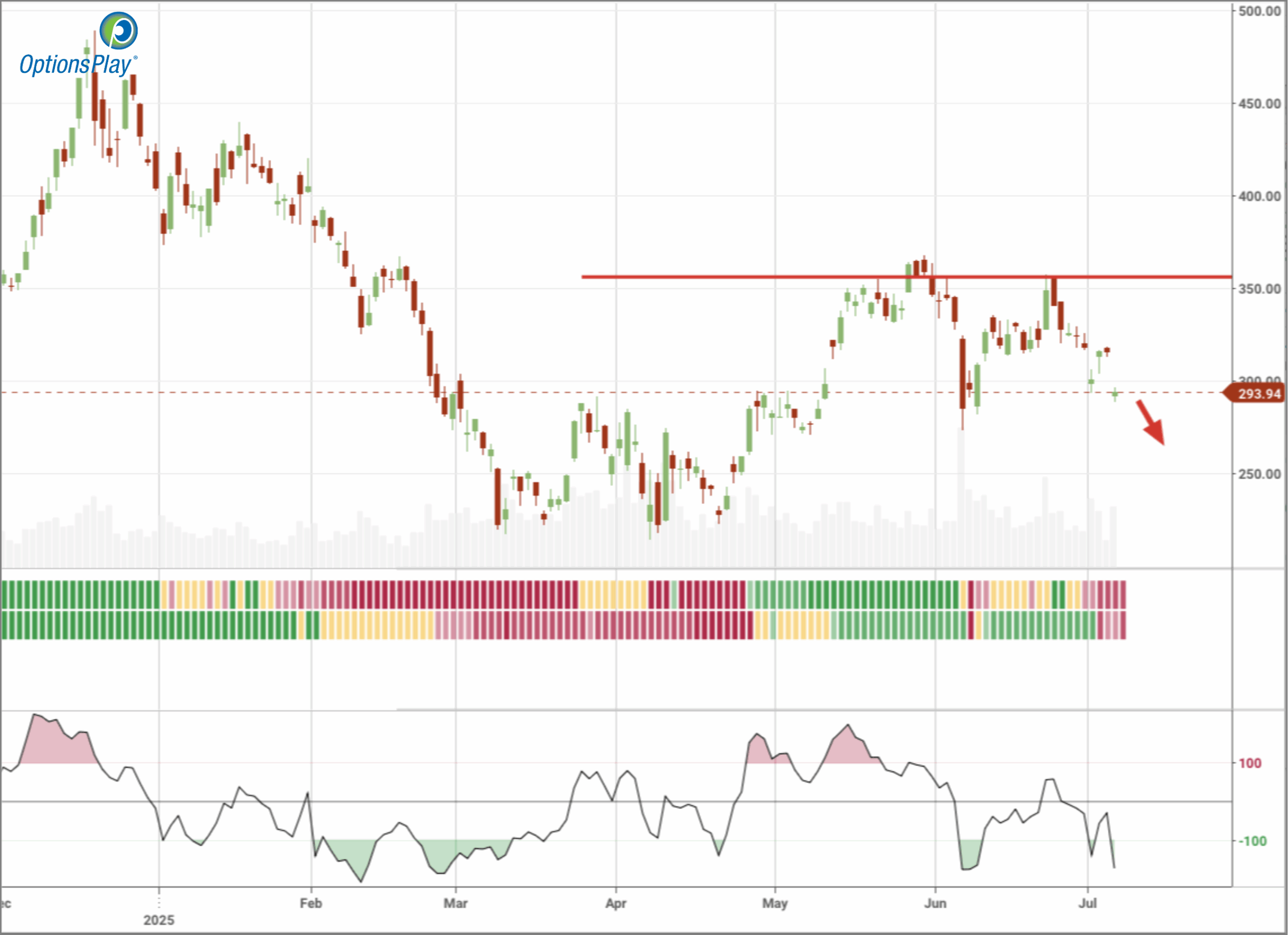

XYZ – 25 DTE

Block is trading above its 20-day and 50-day moving averages and is now testing the 200-day level near $71. The stock’s bullish trend remains intact, supported by steady volume and neutral RSI. We plan to stay the course for now.

MU, AAPL

DailyPlay – Closing Trade (MU, AAPL) – July 03, 2025

MU – 61% loss: Sell to Close 2 Contracts (or 100% of your Contracts) July 18 $125/$145 Call Vertical Spreads @ $2.30 Credit.

DailyPlay Portfolio: By Closing 2 Contracts, we will be collecting $460. We initially opened these 2 contracts on June 25 @ $5.86 Debit. Our loss, therefore, is $356 per contract.

AAPL – 78% loss: Sell to Close 3 Contracts (or 100% of your Contracts) July 18 $205/$195 Put Vertical Spreads @ $1.15 Credit.

DailyPlay Portfolio: By Closing 3 Contracts, we will be collecting $345. We adjusted the 3 short puts on June 26 reducing our cost basis to $1,590 Debit. Our loss, therefore, is $415 per contract.

TGT

DailyPlay – Opening Trade (TGT) – July 02, 2025

TGT Bullish Opening Trade Signal

Investment Rationale

Investment Thesis:

Target Corp. (TGT) appears to be at a potential inflection point following a multi-year drawdown, offering an attractive setup for investors seeking value with upside optionality. Despite being down more than 50% from its highs, the stock has recently shown signs of stabilization and regained critical levels, suggesting improving sentiment. In a defensive retail space where peers trade at rich valuations and compressing margins, Target stands out with its attractive earnings multiple, strong dividend yield, and industry-leading profitability. As macro pressures from tariffs and inflation persist, TGT’s lean cost structure and disciplined capital return profile offer an edge in a risk-conscious market.

Technical Analysis:

TGT has broken out above the key $100 psychological level after months of basing, supported by rising short-term moving averages and strengthening volume trends. The price action now shows early trend development, with the stock pressing against the $104 level and attracting momentum buyers. RSI at 64 indicates building upside pressure without entering overbought territory, while the upward-sloping 20-day and 50-day MAs reflect a short-term shift in trend. The setup favors a move toward the $120–130 resistance zone, offering an asymmetric opportunity for early entry before broader confirmation.

Fundamental Analysis:

TGT trades at a substantial discount to its peers despite growth expectations that are in line and net margins that beat more than 75% of its peers.

- Forward PE Ratio: 13.49x vs. Industry Median 18.09x

- Expected EPS Growth: 9.22% vs. Industry Median 8.99%

- Expected Revenue Growth: 1.15% vs. Industry Median 5.26%

- Net Margins: 3.95% vs. Industry Median 2.29%

Options Trade:

After the breakout, we are considering Buy to Open 1 TGT Aug 15, 2025 $100 Call @ $723. This long call strategy provides upside exposure with defined risk, controlling 100 shares for just 7% of the stock’s price. The $100 strike is now slightly in-the-money, aligning with the recent technical breakout and capturing further upside toward the $120–130 resistance zone. The maximum risk is the $723 premium paid, while the potential reward exceeds 3:1 if shares approach $130, offering a leveraged way to play a continued recovery in TGT.

TGT – Daily

Trade Details

Strategy Details

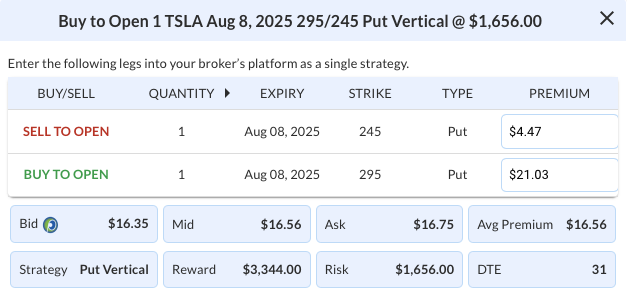

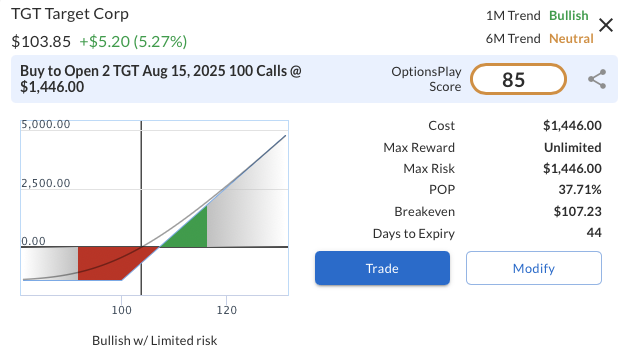

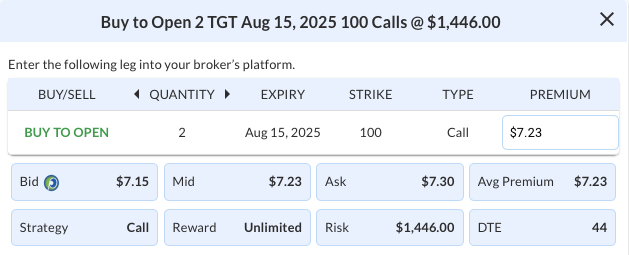

Strategy: Long Call

Direction: Bullish Call

Details: Buy to Open 2 TGT Aug 15 $100 Call @ $7.23 Debit per Contract.

Total Risk: This trade has a max risk of $1,446 (2 Contracts x $723) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $723 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Neutral

Relative Strength: 2/10

OptionsPlay Score: 85

Stop Loss: @ $3.62 (50% loss of premium)

View TGT Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View TGT Trade

XYZ

DailyPlay – Opening Trade (XYZ) & Closing Trade (MSFT) – July 01, 2025

Closing Trade

- MSFT – 52% gain: Buy to Close 2 Contracts (or 100% of your Contracts) Aug 01 $475/$460 Put Vertical Spreads @ $2.45 Debit. DailyPlay Portfolio: By Closing 2 Contracts, we will be paying $490. We initially opened these 2 contracts on June 17 @ $5.07 Credit. Our gain, therefore, is $524.

XYZ Bullish Opening Trade Signal

Investment Rationale

Investment Thesis:

Block Inc. (XYZ) presents a timely bullish setup, supported by strong recent price action and an attractive valuation. With earnings scheduled for August 7, 2025, traders have an opportunity to position ahead of the event without taking on direct earnings risk. Momentum has continued to build, and as the stock outperforms the broader market, our $85 upside target remains in focus. Our options strategy is designed to capture this strength while avoiding earnings-related volatility.

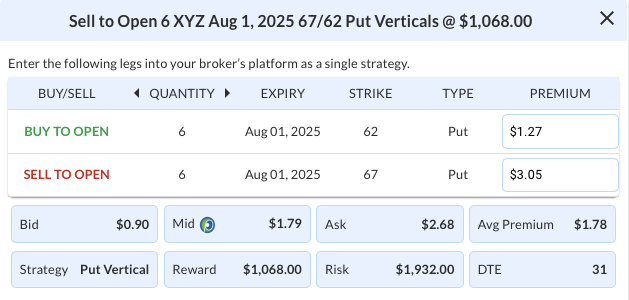

Technical Analysis:

XYZ recently broke out above multi-month consolidation with sustained accumulation and a constructive pattern of higher lows and higher highs. The stock has reclaimed both the 20-day and 50-day moving averages and is now pushing toward the 200-day at $71.32, which marks the next key resistance level. Relative strength continues to improve, and with volume building and RSI trending higher, the price action supports a bullish continuation setup. The $62 level marks solid support, aligning with the breakout base and prior resistance zone from late May.

Fundamental Analysis:

XYZ trades at a discount relative to its industry while boasting growth and profitability metrics that exceed its sector peers. The valuation gap, coupled with strong earnings and revenue projections, signals potential for multiple expansion and continued investor re-rating.

- Forward PE Ratio: 14.65x vs. Industry Median 26.35x

- Expected EPS Growth: 23.90% vs. Industry Median 11.69%

- Expected Revenue Growth: 11.39% vs. Industry Median 9.38%

- Net Margins: 10.93% vs. Industry Median 8.59%

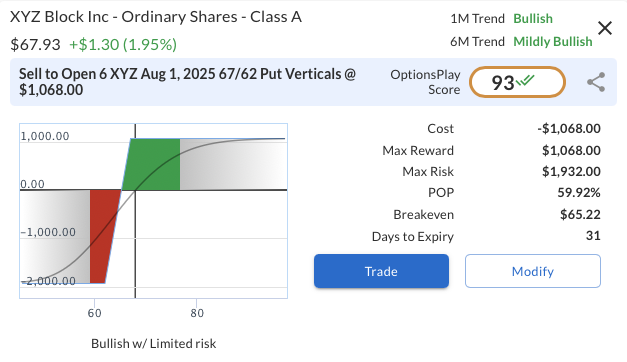

Options Trade:

To capitalize on the bullish setup while avoiding earnings risk, we recommend selling a short-dated put vertical: Sell to Open 1 XYZ Aug 1, 2025 67/62 Put Vertical @ $1.78. This trade collects a net credit of $1.78 ($178) with a defined risk of $3.22 ($322), yielding a potential 55% return on risk if XYZ stays above $67 through expiration. With 31 days to expiry, the setup benefits from time decay and technical support near $62, while avoiding the Aug 7 earnings event altogether.

XYZ – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 6 XYZ Aug 01 $67/$62 Put Vertical Spreads @ $1.78 Credit per Contract.

Total Risk: This trade has a max risk of $1,932 (6 Contracts x $322) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $322 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Mildly Bullish

Relative Strength: 2/10

OptionsPlay Score: 93

Stop Loss: @ $3.56 (100% loss to value of premium)

View XYZ Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View XYZ Trade

DailyPlay – Portfolio Review – June 30, 2025

DailyPlay Portfolio Review

Our Trades

AAPL – 18 DTE

Bearish Debit Spread – Apple Inc. (AAPL) – The trade has seen limited movement, fluctuating just above and below breakeven. Apple’s valuation remains elevated compared to its peers, while trade and tariff concerns persist. We made an adjustment last week to reduce the cost basis, decreasing overall risk and giving the bearish outlook more time to materialize.

ABNB – 25 DTE

Bullish Credit Spread – Airbnb Inc. (ABNB) – The position is currently down, as the stock has remained range-bound. A breakout above the $135 level is needed to generate upside momentum. With the stock trading near the upper end of its range, we plan to stay the course for now.

MSFT – 32 DTE

Bullish Credit Spread – Microsoft Corporation (MSFT) – The stock continues to show strong upside momentum, trading well above its 20-day, 50-day, and 200-day moving averages. With a solid gain in place, we intend to maintain our current position.

MU – 18 DTE

Bullish Credit Spread, Micron Technology, Inc. (MU), Micron (MU) released earnings last week. Prior to the report, we took some profits on a MU bull call vertical spread and repositioned accordingly. Despite solid results and guidance, the stock pulled back. We continue to hold a bullish outlook and will maintain the adjusted position.

SCHW – 172 DTE

Bullish Long Call – Charles Schwab Corp. (SCHW) – Our outlook remains positive, supported by strong company fundamentals and continued strength in both SCHW and the broader financial sector.

USO – 32 DTE

Bullish Credit Spread, United States Oil Fund, LP (USO), The position is currently down, and we’re closely monitoring oil prices ahead of the OPEC International Seminar on July 9th, a key event that will most likely impact the market.

WMT – 32 DTE

Bearish Credit Spread – Walmart Inc. (WMT) – We’re currently down slightly on this position. At this stage, we plan to hold steady.

GOOGL

DailyPlay – Closing Trade (GOOGL) – June 27, 2025

- GOOGL – 64% gain: Buy to Close 4 Contracts (or 100% of your Contracts) July 18 $165/$157.5 Put Vertical Spreads @ $0.88 Debit. DailyPlay Portfolio: By Closing 4 Contracts, we will be paying $352. We initially opened these 4 contracts on June 24 @ $2.43 Credit. Our gain, therefore, is $620.

AAPL

DailyPlay – Adjusting Trade (AAPL) – June 26, 2025

AAPL Bearish Trade Adjustment Signal

Investment Rationale

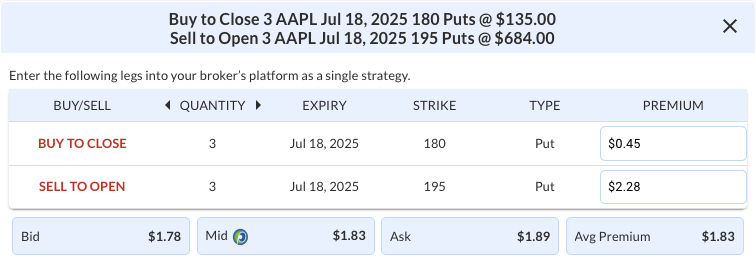

Adjustment Rationale:

Our bearish stance on Apple, Inc. (AAPL) remains intact, and we are holding 3 AAPL Jul 18, 2025 205/180 Bear Put Vertical Spreads within the Daily Play portfolio. Apple’s valuation continues to outpace peers, while unresolved trade and tariff risks persist. With the initial trade now at the halfway point to expiration, we’re managing risk by rolling the short 180 put up to the 195 strike, same expiration, for a net credit. Closing the position is also a viable alternative, but the roll effectively keeps the bearish idea in play and reduces the max risk of the position.

Adjustment Trade

Days to Expiration (DTE): 22

Buy to Close: 3 AAPL Jul 18, 2025 180 Puts @ $0.45

Sell to Open: 3 AAPL Jul 18, 2025 195 Puts @ $2.28

Mid: $1.83

Average Premium Received: $1.83 net credit

or $549 (300 x $1.83) for the adjustment trade

AAPL – Daily

Trade Details

Strategy Details

Strategy: Rolling a Short Put option up in strike

Direction: Resulting in a new Bearish Debit Spread

Details: Buy to Close 3 AAPL July 18 $180 Puts and Sell to Open 3 AAPL July 18 $195 Puts @ $1.83

Total Risk: The resulting position has a maximum risk of $1701 (2250 – 549), calculated as the initial cost basis of the 3 spreads purchased ($2250) minus the premium received from the adjustment ($549).

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower off a recent area of resistance.

1M/6M Trends: Neutral/Bearish

Relative Strength: 2/10

Stop Loss: @ $2.84(50% loss of premium)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.