NET

DailyPlay – Closing Trade (NET) – December 18, 2025

Closing Trade

- NET – 55% gain: Buy to Close 3 Contracts (or 100% of your Contracts) Jan 16 $210/$220 Call Vertical Spreads @ $1.72 Debit. DailyPlay Portfolio: By Closing 3 Contracts, we will be paying $516. We initially opened these 3 contracts on December 12 @ $3.80 Credit. Our gain, therefore, is $624.

FDX

DailyPlay – Opening Trade (FDX) – December 17, 2025

FDX Bullish Opening Trade Signal

Investment Rationale

Investment Thesis

FedEx Corp. (FDX), We recently closed a bullish credit spread and realized profits ahead of the company’s earnings report scheduled for this Thursday, December 18th, after the close. While the decision was driven by prudent risk management ahead of the event, our broader bullish thesis on FedEx remains unchanged. FDX continues to show strengthening momentum within the transportation sector, while supportive valuation metrics underpin a constructive setup heading into potential earnings-related volatility.

Technical Analysis

FDX is exhibiting solid bullish momentum, trading comfortably above its rising 20-day, 50-day, and 200-day moving averages, a hallmark of a healthy and well-supported uptrend. The chart reflects a clear shift out of consolidation and into sustained higher highs and higher lows, underscoring improving trend strength. With $300 serving as our primary upside objective, last reached in December of last year, the technical setup remains favorable as long as price holds above its key moving averages in the wake of this week’s earnings event.

Fundamental Analysis

Fundamentally, FedEx screens as modestly undervalued relative to peers, with growth and profitability metrics broadly in line with industry norms.

- Forward PE Ratio: 15.61x vs. Industry Median 19.44x

- Expected EPS Growth: 9.33% vs. Industry Median 9.56%

- Expected Revenue Growth: 4.05% vs. Industry Median 4.16%

- Net Margins: 4.65% vs. Industry Median 5.20%

This valuation discount provides a favorable backdrop, particularly as operational efficiency initiatives and cyclical stabilization support earnings durability.

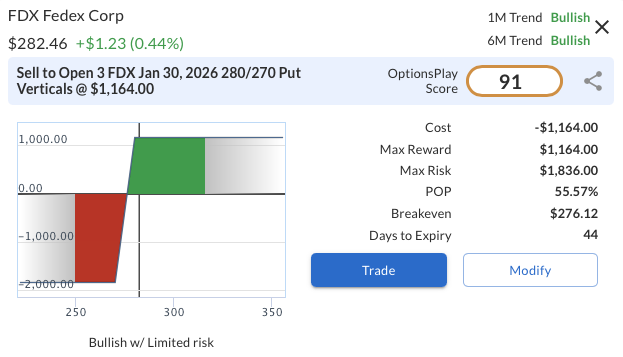

Options Trade

To align with our bullish outlook, consistent with the view we held into earnings, we look to establish a bullish put vertical spread by selling the FDX January 30, 2026 $280/$270 put vertical for a net credit of $3.88. This structure offers a maximum reward of $3.88 against a maximum risk of $6.12, resulting in a reward-to-risk ratio of approximately 0.63. The trade provides clearly defined downside risk and reward, allowing us to maintain bullish exposure while managing potential volatility that may be created by the earnings announcement.

FDX – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 3 FDX Jan 30 $280/$270 Put Vertical Spreads @ $3.88 Credit per Contract.

Total Risk: This trade has a max risk of $1,836 (3 Contracts x $612) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $612 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 91

Stop Loss: @ $7.76 (100% loss to value of premium)

View FDX Trade

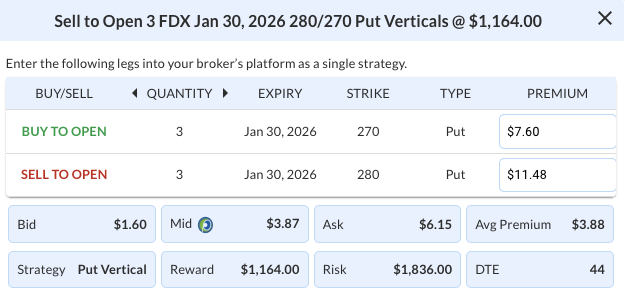

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View FDX Trade

AFRM

DailyPlay – Opening Trade (AFRM) & Closing Trade (FDX) – December 16, 2025

Closing Trade

- FDX – 52% gain: Buy to Close 3 Contracts (or 100% of your Contracts) Jan 02 $265/$255 Put Vertical Spreads @ $1.94 Debit. DailyPlay Portfolio: By Closing 3 Contracts, we will be paying $582. We initially opened these 3 contracts on November 25 @ $4.07 Credit. Our gain, therefore, is $639.

AFRM Bearish Opening Trade Signal

Investment Rationale

Investment Thesis

Affirm (AFRM) presents an attractive bearish opportunity as optimism around long-term growth continues to run ahead of the company’s underlying profitability profile and competitive positioning. While sentiment across consumer fintech has improved, AFRM remains vulnerable to valuation compression and execution risk as investors reassess the sustainability of growth in a more normalized credit and rate environment. With the stock already pricing in a favorable forward narrative, upside appears capped, creating a favorable setup for a defined-risk bearish options structure that benefits from consolidation or downside drift rather than requiring a sharp selloff.

Technical Analysis

From a technical perspective, AFRM has struggled to maintain momentum following prior rallies, with price repeatedly stalling near overhead resistance and failing to establish a sustained uptrend. Recent advances have occurred on diminishing momentum, leaving the stock susceptible to mean reversion as buyers lose conviction at higher levels. The broader structure suggests a range-bound to bearish bias, where rallies into resistance are more likely to fade than accelerate, favoring strategies that benefit from time decay and limited upside follow-through.

Fundamental Analysis

AFRM’s valuation reflects aggressive growth assumptions that leave little margin for error. While EPS and revenue growth expectations significantly outpace peers, the stock trades at nearly four times the industry valuation multiple despite operating with inferior margins, raising concerns around the sustainability of returns.

- Forward PE Ratio: 71.70x vs. Industry Median 22.53x

- Expected EPS Growth: 142.88% vs. Industry Median 10.99%

- Expected Revenue Growth: 25.14% vs. Industry Median 9.35%

- Net Margins: 6.74% vs. Industry Median 9.08%

Absent continued flawless execution, AFRM’s elevated multiple appears vulnerable, with downside risk driven by even modest growth or margin disappointments.

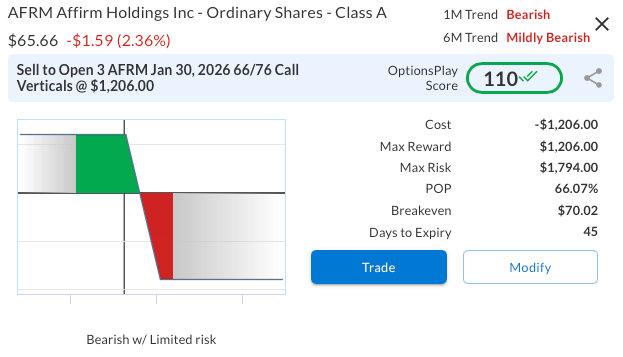

Options Trade

To express this view, consider selling the AFRM Jan 30, 2026 66/76 call vertical for approximately $4.02. This trade sells the 66 call and buys the 76 call, defining risk while positioning the trade to profit if AFRM remains below the lower strike through expiration. The structure offers maximum profit of $4.02 versus maximum risk of $5.98, resulting in a 0.67:1 reward-to-risk ratio. This setup is well-suited for a bearish-to-neutral outlook, as the long-dated expiration provides ample time for valuation pressure or technical weakness to emerge, while the capped call spread limits upside exposure and allows time decay to work in favor of the position.

AFRM – Daily

Trade Details

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 3 AFRM Jan 30 $66/$76 Call Vertical Spreads @ $4.02 Credit per Contract.

Total Risk: This trade has a max risk of $1,794 (3 Contracts x $598) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $598 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower over the duration of this trade.

1M/6M Trends: Bearish/Mildly Bearish

Relative Strength: 4/10

OptionsPlay Score: 110

Stop Loss: @ $8.04 (100% loss to value of premium)

View AFRM Trade

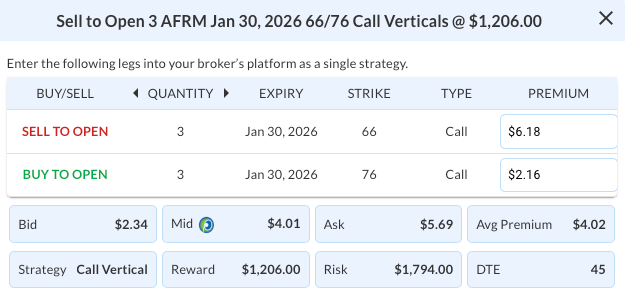

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AFRM Trade

DailyPlay – Portfolio Review – December 15, 2025

DailyPlay Portfolio Review

Our Trades

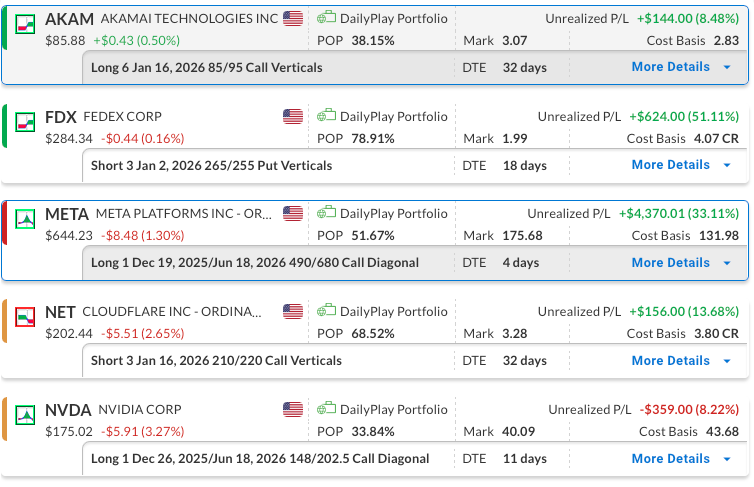

AKAM – 32 DTE

Bullish Debit Spread – Akamai Technologies, Inc. (AKAM) – We recently established this position, currently have a small gain, and plan to stay the course for now.

FDX – 18 DTE

Bullish Credit Spread – FedEx Corp (FDX) – We have a solid gain in this position and plan to stay the course for now. The company is set to report earnings on Thursday, December 18, after the close.

META – 4 DTE & 185 DTE

Bullish Diagonal Debit Spread – Meta Platforms, Inc. (META) – Our outlook supports a longer-term bullish approach. The position is currently showing a gain, and we plan to maintain it. We recently sold a short-term call against the longer-dated call to help reduce the overall cost basis.

NET – 32 DTE

Bullish Credit Spread – Cloudflare Inc (NET) – We recently established this position, currently have a small gain, and plan to stay the course for now.

NVDA – 11 DTE & 185 DTE

Bullish Diagonal Debit Spread – NVIDIA Corporation (NVDA) – We remain longer-term bullish following strong earnings and solid fundamentals. Despite a recent short-term bearish signal, we hedged modest losses by selling a shorter-dated call to collect premium, lower our cost basis, and maintain upside exposure.

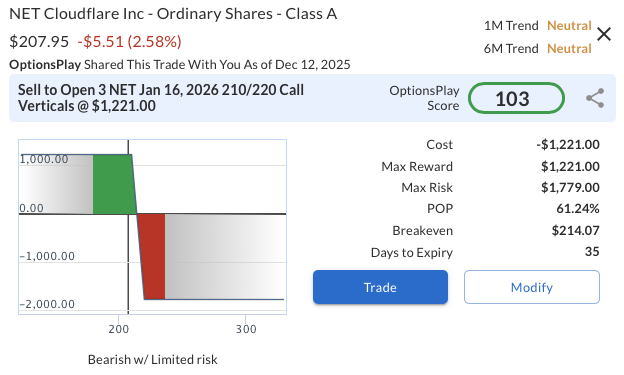

NET

DailyPlay – Opening Trade (NET) – December 12, 2025

NET Bearish Opening Trade Signal

Investment Rationale

Investment Thesis

Cloudflare Inc. (NET) continues to show signs of vulnerability as its recent rebound occurs against a backdrop of stretched valuations and deteriorating profitability. While the stock has displayed strong multi-year growth, the current setup suggests limited upside relative to downside potential. With sentiment stabilizing after a failed breakout and sector momentum showing signs of fatigue, the risk/reward profile supports a bearish stance as the stock approaches prior resistance.

Technical Analysis

Cloudflare’s recent price action has weakened, with the 20-day moving average crossing below the 50-day in late November, marking the first time since May that the 20-day has traded beneath the 50-day and signaling a shift in short-term momentum toward a bearish bias. The 50-day moving average recently proved to be a resistance zone. Additionally, a Bearish Trend Following alert triggered on the OptionsPlay platform, indicating that the latest rebound occurred within a broader downtrend and may offer a favorable setup for downside continuation. With momentum indicators rolling over and price rejecting overhead resistance, the technical backdrop remains aligned with further weakness ahead.

Fundamental Analysis

Cloudflare’s long-term growth profile remains impressive, yet its valuation continues to exceed sector norms by a wide margin. Profitability challenges persist, and despite robust top-line expansion expectations, the firm is still contending with negative margins—leaving limited room for operational missteps. These factors, combined with elevated forward multiples, strengthen the case for downside risk as the market reassesses premium-priced growth.

- Forward PE Ratio: 177.15x vs. Industry Median 22.53x

- Expected EPS Growth: 29.13% vs. Industry Median 10.99%

- Expected Revenue Growth: 27.88% vs. Industry Median 9.35%

- Net Margins: -5.12% vs. Industry Median 9.08%

Options Trade

A defined-risk bearish position can be expressed through a bearish call vertical spread using the Jan 16, 2026 210/220 Call Vertical—selling the 210 call and buying the 220 call—for a net credit of $4.07. This establishes a maximum potential reward of $4.07 with defined risk capped at $5.93, creating a risk-reward profile of roughly 1:1.46. The trade reaches maximum profit if Cloudflare remains below the 210 strike at expiration, while losses are limited as long as the spread does not fully move in-the-money above 220.

NET – Daily

Trade Details

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 3 NET Jan 16 $210/$220 Call Vertical Spreads @ $4.07 Credit per Contract.

Total Risk: This trade has a max risk of $1,779 (3 Contracts x $593) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $593 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower over the duration of this trade.

1M/6M Trends: Neutral/Neutral

Relative Strength: 7/10

OptionsPlay Score: 103

Stop Loss: @ $8.17 (100% loss to value of premium)

View NET Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View NET Trade

MU

DailyPlay – Closing Trade (MU) – December 11, 2025

Closing Trade

- MU – 58% gain: Buy to Close 3 Contracts (or 100% of your Contracts) Jan 02 $230/$220 Put Vertical Spreads @ $1.97 Debit. DailyPlay Portfolio: By Closing 3 Contracts, we will be paying $591. We initially opened these 3 contracts on December 04 @ $4.67 Credit. Our gain, therefore, is $810.

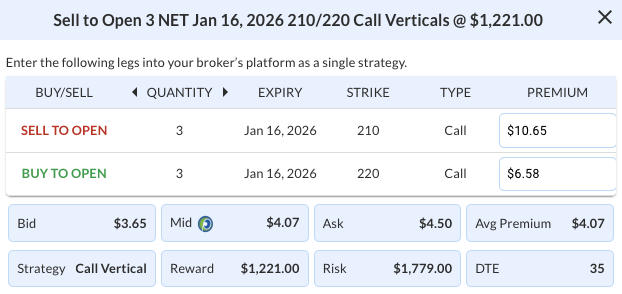

NVDA

DailyPlay – Adjusting Trade (NVDA) – December 10, 2025

NVDA Bullish Trade Adjustment Signal

Investment Rationale

Adjustment Rationale:

Bullish Long Call – NVIDIA Corporation (NVDA) – We maintain our longer-term bullish outlook following NVIDIA’s recent earnings report, which delivered a beat on both the top and bottom line, alongside strong forward guidance. The company continues to demonstrate healthy fundamentals, and market tone has turned more favorable as the stock stabilizes after its consolidation phase. That said, the OptionsPlay platform has triggered a short-term Bearish Trend Following signal, suggesting that the recent rebound is unfolding within a broader downtrend and could be susceptible to near-term weakness. With modest gains in our existing long call, we will use this signal as an opportunity to hedge by selling a shorter-dated call against our longer-dated position. This strategy allows us to collect premium, reduce the overall cost basis of the long call position, and maintain long-term upside exposure.

Adjustment Trade:

NVDA @ $184.97

Days to Expiration (DTE): 16

Sell to Open 1 Dec 26, 2025 202.5 Call @ $0.93

Mid: $0.93

Premium Received: $93.00 per call option sold

or $93 total adjustment in the cost basis for the position.

The total risk for the new position is $4,463 (original cost basis) minus $93 (credit), resulting in a revised cost basis of $4,370.

Resulting Position:

Long 1 NVDA Jun 18, 2026 148 Call

Short 1 NVDA Dec 26, 2025 202.5 Call

New cost basis and total risk: $4,370

NVDA – Daily

Trade Details

Strategy Details

Strategy: Short Call

Direction: Resulting in a new Bullish Diagonal Spread

Details: Sell to Open 1 NVDA Dec 26 $202.50 Call @ $0.93 Credit.

Total Risk: The resulting position has a maximum risk of $4,370 (4,463-93), calculated as the initial cost basis of the long call ($4,463) minus the premium received from the adjustment ($93).

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of the trade.

1M/6M Trends: Neutral/Neutral

Relative Strength: 9/10

Stop Loss: @ $21.85 (50% loss of premium)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

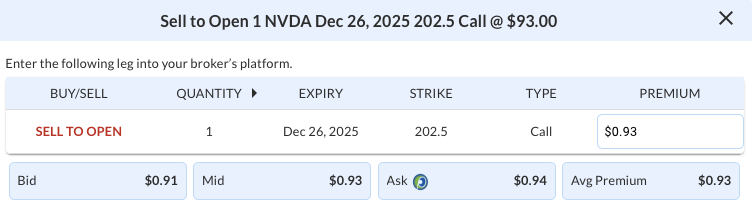

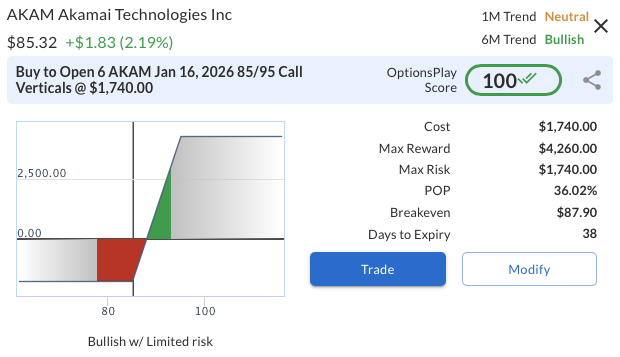

AKAM

DailyPlay – Opening Trade (AKAM) – December 09, 2025

AKAM Bullish Opening Trade Signal

Investment Rationale

Investment Thesis

Akamai Technologies (AKAM) presents a compelling bullish opportunity supported by a combination of attractive valuation, improving sentiment in edge infrastructure and cloud security, and a steady shift toward higher-margin service lines. With the stock resetting into support following a prior breakout, the current setup offers a balanced blend of trend durability and asymmetrical upside potential. The company’s stable cash-flow profile and continued momentum in security and compute services reinforce a positive outlook as the market increasingly values quality software infrastructure names.

Technical Analysis

The chart shows AKAM recently reclaiming the 200-day moving average, with both the 20-day and 50-day moving averages now crossing above it. Notably, a bullish trend-following alert was triggered on the OptionsPlay platform, underscoring that Akamai’s recent pullback is occurring within a broader upward trend and reinforcing a favorable bullish risk-reward profile. The pullback from the $90 region has brought price back into the rising 20-day and 50-day moving averages, levels that historically act as supportive retracement zones within an established trend.

Fundamental Analysis

AKAM continues to trade at a discount to peers on forward earnings, despite maintaining a meaningfully stronger margin profile. Growth expectations sit modestly below the industry median, yet the company’s recurring-revenue base, disciplined operational execution, and expanding security portfolio provide a durable backdrop that is not fully priced in. This combination of discounted valuation and above-average profitability supports a favorable risk-adjusted bullish stance.

- Forward PE Ratio: 11.43x vs. Industry Median 22.53x

- Expected EPS Growth: 7.21% vs. Industry Median 10.99%

- Expected Revenue Growth: 5.62% vs. Industry Median 9.35%

- Net Margins: 12.26% vs. Industry Median 9.08%

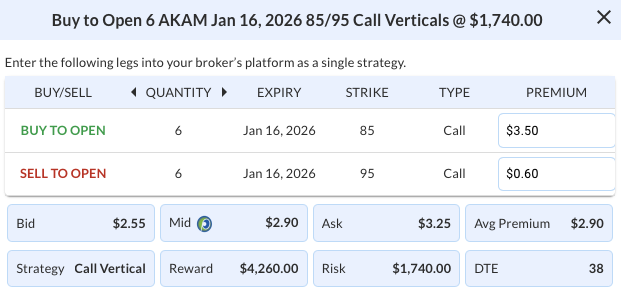

Options Trade

The proposed bullish call vertical spread involves buying the Jan 16, 2026 $85 call and selling the Jan 16, 2026 $95 call for a net debit of approximately $2.90. This trade offers a maximum potential gain of $7.10 if AKAM closes at or above $95 at expiration, while the risk is limited to the net debit paid. The trade’s reward-to-risk ratio of about 2.4:1 aligns with a bullish outlook while keeping risk defined and controlled.

AKAM – Daily

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 6 AKAM Jan 16 $85/$95 Call Vertical Spreads @ $2.90 Debit per Contract.

Total Risk: This trade has a max risk of $1,740 (6 Contracts x $290) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $290 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Neutral/Bullish

Relative Strength: 6/10

OptionsPlay Score: 100

Stop Loss: @ $1.45 (50% loss of premium)

View AKAM Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AKAM Trade

DailyPlay – Portfolio Review – December 08, 2025

DailyPlay Portfolio Review

Our Trades

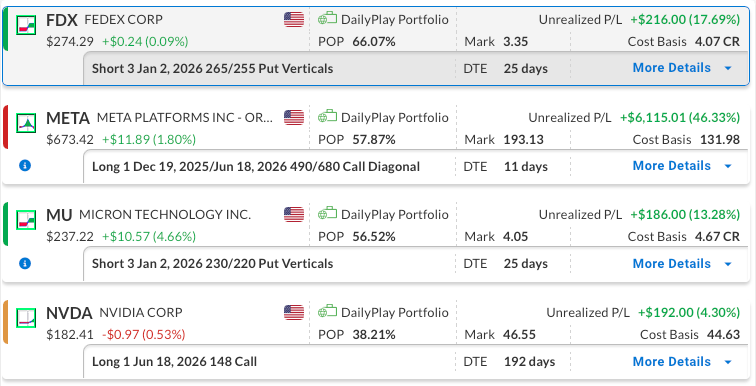

FDX – 25 DTE

Bullish Credit Spread – FedEx Corp (FDX) – We have a solid gain in this position and plan to stay the course for now.

META – 11 DTE & 192 DTE

Bullish Diagonal Debit Spread – Meta Platforms, Inc. (META) – Our outlook supports a longer-term bullish approach. The position is currently showing a gain, and we plan to maintain it. We recently sold a short-term call against the longer-dated call to help reduce the overall cost basis.

MU – 25 DTE

Bullish Credit Spread – Micron Technology, Inc. (MU) – The position is showing a gain, with earnings scheduled for Wednesday, December 17th, after the close. We will maintain the position for now, and if the bullish momentum continues, we may look to exit before taking on the risk associated with the earnings announcement.

NVDA – 192 DTE

Bullish Long Call – NVIDIA Corporation (NVDA) – NVIDIA’s fundamentals remain robust, and sentiment has begun to build bullish momentum after its recent consolidation. This continues to make the long call an attractive way to participate in the longer-term outlook without the cost of owning shares outright. We plan to hold the position for now.

PM

DailyPlay – Closing Trade (PM) – December 05, 2025

Closing Trade

- PM – 38% gain: Buy to Close 3 Contracts (or 100% of your Contracts) Dec 19 $150/$160 Call Vertical Spreads @ $2.30 Debit. DailyPlay Portfolio: By Closing 3 Contracts, we will be paying $690. We initially opened these 3 contracts on November 07 @ $3.70 Credit. Our gain, therefore, is $420.