$NEE

DailyPlay – Opening Trade (NEE) – October 10, 2022

NEE Bearish Opening Trade

View NEE Trade

Strategy Details

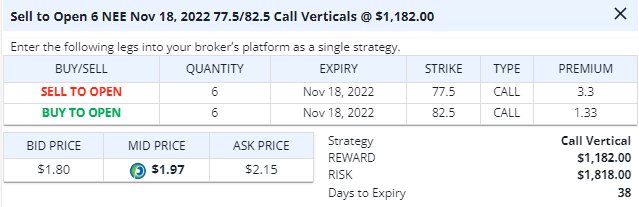

Strategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell to Open 6 Contracts Nov. 18th $77.50/$82.50 Call Vertical Spreads @ $1.97 Credit.

Total Risk: This trade has a max risk of $1,818 (6 Contracts x $303).

Trend Continuation Signal: This is a Bearish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 6/10

OptionsPlay Score: 106

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

Stocks traded back and forth in a range on Monday, taking out both overnight highs and lows of where S&P futures traded. The SPX declined 75 bps. to 3612, less than 30 pts. from the recent 2022 low. (As I mentioned I would do in yesterday’s morning webinar, I did kick out the S&P futures at the same price I had bought them at on Sunday night (3634), as I didn’t see any reason to keep them into today. The market remains heavy and, in my view, headed downward to my mid-3400 target, where I will likely start to replace some of SPYs that I sold out of earlier this year.

A new recommendation for today is to enter a bearish bet on Nextera Energy. After seeing five failures this year north of the upper-$80s – three of which were accompanied by Setup +9s – I think this still has room to the downside to near $70. So, let’s look to short an NEE November 18th $77.50/$82.50 call spread for what closed yesterday at $1.975 mid, collecting just about 40% of the spread.

NEE – Weekly

$DHR

DailyPlay – Partial Closing Trade (DHR) – October 10, 2022

Partial Closing Trade

DHR -18.11% Loss: Buy to Close 1 Contract Oct. 21st $265/$282.5 Call Vertical @ $7.50 Debit. DailyPlay Portfolio: By Closing 1 of the 2 Contracts, we will be paying $750.

Investment Rationale

Bulls will tell you that last week was a gain of 1.5% and that the bottom is in. I disagree. The SPX gave back ~80% of last week’s early gains, and it still remains in a downward Setup count (coming into this week on a -7). I suspect there are still good odds that we see a move down to the mid-3400s this month, and then we might see a decent trading bounce into elections (and possibly through them depending upon how successful Republicans are at gaining House and Senate seats.

Tactically, the SPX is down into the support area that we were hoping for early last week to get a chance to buy into. Tactical bulls can look to buy now, with a stop under the 2022 low (~2% lower than Friday’s close). It’s not a crazy thing to do from a pure trading stance, but don’t look for last week’s high to be taken out.

This week has both FOMC Minutes (on Wednesday, but with no new rate decision or press conference), and key PPI and CPI figures on Wednesday and Thursday, respectively. Expect them to move markets, along with the kickoff of a new earnings reports from Taiwan Semi and key financial institutions later in the week.

We have a short DHR Oct. 21st $265/$282.5 call spread that closed on Friday at $268ish and should open lower today based upon futures down 36 as I write this Sunday night. Today, let’s take off 1 of the 2 spreads we have on.

DailyPlay Updates – October 7, 2022

Investment Rationale

Today is one of the more important trading days of the month, with the Sept. jobs numbers coming out at 8:30am ET. Given yesterday’s decline of 1%, some must already be expecting a bad number and sold in advance. A well-higher than expected number (consensus is about 250K jobs created) could send the week’s gains away by the close. (Maybe even by the open.) On the flip side, bulls are hoping for a lower than expected number with what I believe is a false hope that the Fed will change their course at all come next Wednesday’s FOMC statement.

As you probably have already figured, given the unknown news of the day – along with a weekly option expiration – I am not putting out a new DP today. It’s just too hard to guess what price action will be with both 8:30 and then 10am (i.e., Wholesale Inventories) economic reports coming.

With this past Monday’s weekly market outlook webinar; yesterday’s Institutional Mindset webinar, and then this morning’s open Q&A session that I am hosting at 8:45am, you will have heard enough from Rick for a while. (And heck, I’m back Monday morning again, too.) I’ve been clear in my thoughts: I see virtually no chance that the Fed is going to pivot just weeks after its chairman made it very clear what they need to do, regardless of the “pain felt to individuals or businesses”. He drew the line in the sand. He’s not crossing it anytime in the near future.

So, maybe the market still has some legs to it. I hope so. It would still give us an opportunity to lighten exposure before 2023 earnings numbers get lowered, which will virtually force the market lower to more closely match what will be new PE ratios.

– Rick Bensignor

Chief Market Strategist

$TLT

DailyPlay – Partial Closing Trade (TLT) – October 6, 2022

Partial Closing Trade

- TLT -19.33% Gain: Buy to Close 2 Contracts Oct. 14th $102/$98 Put Verticals @ $0.96 Debit. DailyPlay Portfolio: By Closing 2 of the 6 Contracts, we will be paying $192.

Investment Rationale

Stocks pulled back on Wednesday, but nothing like I think it should have given the rather significant rally in the DXY (+0.9%). Is this telling us just how bullish investors have turned this week, or was it also related to lighter volumes because of Yom Kippur? I’m not sure, but I suspect we’ll have the answer by Friday after seeing the reaction to the new employment/non- farm payrolls numbers that could easily influence the Fed’s upcoming rate decision next week.

Monday’s daily SPX Sequential -13 that, by chance, came at the 200-WMA gave bulls all they needed to come back with a buying spree, pushing the SPX up 6% in a couple of days. In fact, I’m hoping that today is another higher close day, because if tomorrow’s jobs numbers come in higher than expected, you could see the market give back 100+ SPX handles even before the NYSE opens. (For those of you who trade the pre-open, you want to be ready to make a trading decision as soon as those 8:30am ET numbers get released.)

In the meantime, I want to adjust one of the trades I’ve recently recommended: We are short 6 TLT Oct 14. $102/$98 put spreads. Let’s take 2 of these off today. (Personally, I’d probably do one in the morning and one near the close.)

The DHR short call spread has now rallied to right near the upper “hedge” strike we have on (the $282.50 area). As that is a level I purposely chose as I knew it to be important resistance, I don’t want to take off the trade now until it proves itself up through there. So, we’ll wait until after tomorrow’s numbers come out to see if we exit or not.

Join me at 4:15pm ET today for one of OP’s great educational webinars that I’ll be doing on how to develop and master an “Institutional Mindset”.

$SLV

DailyPlay – Opening Trade (SLV) – October 5, 2022

SLV Bearish Opening Trade

View SLV Trade

Strategy Details

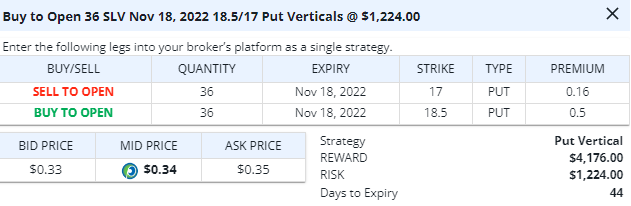

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 36 Contracts Nov. 18th $18.50/$17 Put Vertical Spreads @ $0.34 Debit.

Total Risk: This trade has a max risk of $1,224 (36 Contracts x $34).

Counter Trend Signal: This is a Bearish trade on a stock that is experiencing a bullish trend.

1M/6M Trends: Bullish/Mildly Bullish

Technical Score: 8/10

OptionsPlay Score: 123

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

With the strength of the US Dollar, gold and silver have broken below their key support levels. After breaking the major $20 support level in early May and collapsing to $16, the pullback in the US Dollar this week has Silver rallying to levels just shy of this key $20 resistance level. Given the macro headwinds of a slowing global economy and persistent dollar strength, the risks skew to the downside. Moreover, this rally puts silver a full 2 standard deviations above its 40 period moving average, generating a short signal. We are targeting a return back towards its Sept lows by purchasing a Nov $19/$17 Put vertical for a $0.55 Debit.

SLV – Daily

$SPY

DailyPlay – Opening Trade (SPY) – October 4, 2022

SPY Bullish Opening Trade

View SPY Trade

Strategy Details

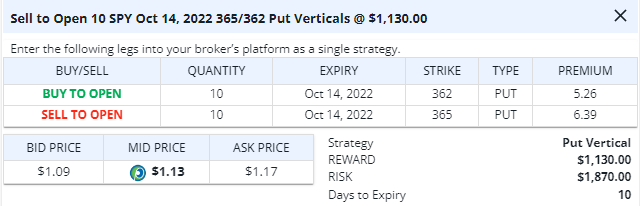

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 10 Contracts Oct. 14th $362/365 Put Vertical Spreads @ $1.13 Credit.

Total Risk: This trade has a max risk of $1,870 (10 Contracts x $187).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/ Bearish

Technical Score: 5/10

OptionsPlay Score: 87

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

Yesterday’s rally didn’t come out of nowhere. It came from Friday’s new 2022 lows that were done at end of month/end of quarter/and an expiration day. It also came on a daily Sequential -12 signal, upping the odds quite a bit that Monday would be a -13 count (which it was, and the first daily standard Sequential -13 reading since May 12 – almost five months ago).

SPX – Daily

The first question to ask oneself – after seeing a rip higher like we did yesterday – is “Has anything changed the bigger story?” And the answer to that question was found in looking at the charts showing the dollar’s rally further falling beneath the 112.63 target we’ve had, and bond yields continuing their pullback from last week’s 4% high. Those two non-equity markets – that have so much to do with how equities have traded this year – both gave reasons to be buying yesterday. Or at the very least, suggesting one not press the overall bearish bet at that place and time.

The second question is how much duration does a potential rally have? Was this a one day affair, with today going to give it all back like what happened last Wednesday and Thursday? Does it last a few days? A week? A month That, of course, is the bigger and more important question to decipher. To me, that answer can only come by also seeing what rates and the greenback do going forward, for their inverse relationship to the stock market is still quite prevalent and will likely be so through year’s end.

Right now, the dollar has hit an important target and halted – at least for now. The bonds hit an important target and halted – at least for now. The SPX hit its 200-WMA and saw but a one day breach of the June lows and halted its decline – at least for now. So, watch for any of these two non-equity benchmarks to continue their declines or to properly break above them and you’ll likely have the direction the stock market will go. At least for now.

I’ve looked closely into Monday’s SPY price action and have determined that if a pullback is going to hold, the SPY should not get lower than the $364.50 to $362 zone. Use that as a potential bullish area to buy today or tomorrow on an intra-day decline. So, turning this into an actual trade idea, let’s sell the short-dated October 14th SPY $365/$362 put spread when/if we see a pullback into this zone. (On Monday this spread closed at $1.14, but it will be higher when/if we get filled.)

I’d suggest you do this trade with more than one entry price, rather than picking the midpoint (i.e., just in case it doesn’t get to $363.50). So put some on near each of those 4 whole dollar levels to try to get an average entry at $363.50, but having something on should it, let’s say, only pullback to $364 (in which case you’d still have some partial bullish exposure on).

If I’m right that sometime in October we’re going to see the SPX mid-3400s trade, I don’t want to go out to any further expiration date for a bullish play from the current SPX level (which is now some 200 points higher than that target zone).

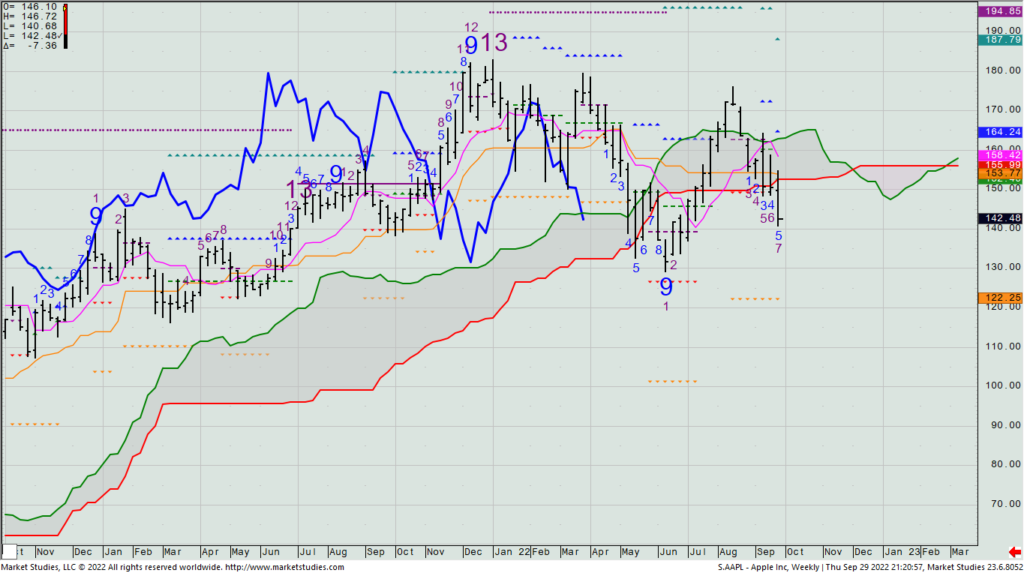

$AAPL

DailyPlay – Opening Trade (AAPL) Closing Trades (HLT, ARKK) Partial Closing Trade (SRE) September 30, 2022

Closing Trades

- HLT – 87.65% Gain: Sell to Close 4 Contracts October 21, 2022 $135/$125 Put Verticals @ $7.60 Credit. DailyPlay Portfolio: By Closing the remaining 4 of 8 Contracts, we will be receiving $3, 040. We took partial profit for this trade on September 22 at $6.30 Credit by closing half of the positions. Our average cost basis to exit the trade is, therefore, $6.95 Credit and the average gain is 71.61%.

- ARKK – 62.87% Loss: Sell to Close 8 Contracts November 18, 2022 $45/$54 Call Verticals @ $1.01 Credit. DailyPlay Portfolio: By Closing all 8 Contracts, we will be receiving $808.

Partial Closing Trades

SRE -164.77% Gain: Sell to Close 1 Contract Oct. 21st $165/$145 Put Vertical @ $11.65 Credit. DailyPlay Portfolio: By Closing 1 of the remaining 3 Contracts, we will be receiving $1,165.

AAPL Bearish Opening Trade

View AAPL Trade

Strategy Details

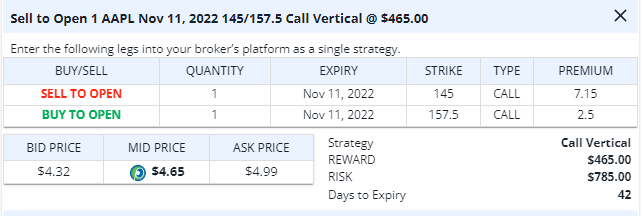

Strategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell to Open 1 Contract Nov. 11th $145/$157.5 Call Vertical Spread @ $4.65 Credit.

Total Risk: This trade has a max risk of $785 (1 Contract x $785).

Trend Continuation Signal: This is a Bearish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/ Bearish

Technical Score: 5/10

OptionsPlay Score: 105

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

Stocks gave back Wednesday’s large gain (and more), and gave agata to all bulls who boasted that “the double bottom is in”. ell… nope. At least not yet. Today is end of month and quarter, so it’d be no surprise to see some major swings in price. Even if we see a rally off of the DeMark -13s in many, many names, I don’t think the bounce gets materially above the 3819 level – the properly broken weekly TDST Line that previously had not been properly broken on the late-Spring decline to the June low. (It should now present resistance.)

As mentioned in yesterday’s post-close webinar Tony and I hosted, we are going to look to sell an upside call spread in Apple, with our belief that it will likely test its 2022 low area (if not further) in the fall. As such, we will look to put on a half-position today (i.e., 1% risk of a theoretical $100K size account vs. the normal 2% we risk on most trades) by selling the Nov. 11th $145/$157.5 call spread, collecting a $4.65 credit, or ~38% of the spread differential (that was $2.5 OTM as of Thursday’s close). That’s how much AAPL vol is juiced up right now.

AAPL – Weekly

Today, we also want to close out our remaining 4 HLT Oct. 21st $135/$125 put spreads.

I will also take off one more of our long SRE Oct. 21 $165/$145 put spreads, bringing us down to now holding 2 of the original 5 spreads. This one is up 165% as of yesterday’s close.

And don’t forget that we can still look to enter yesterday’s TLT idea if it pulls back to the $102.50/$101.50 level by putting on the Oct. 14th $102/$98 put spread.

So, lots to do today. Have a good weekend.

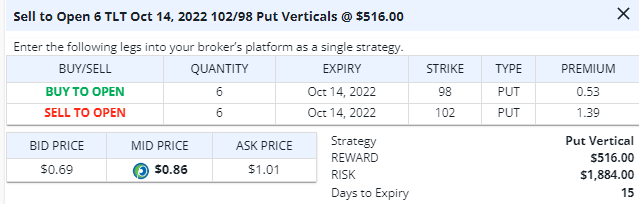

$TLT

DailyPlay – Conditional Opening Trade (TLT) – September 29, 2022

TLT Bullish Conditional Opening Trade

View TLT Trade

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 6 Contracts Oct. 14th $102/$98 Put Vertical Spreads @ $0.86 Credit.

Total Risk: This trade has a max risk of $1,884 (6 Contracts x $314).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/ Bearish

Technical Score: 5/10

OptionsPlay Score: 95

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note that this is a conditional trade. The condition that has to be met, before you enter this bullish trade is if we see a pullback to between $102.50 and $101.50. Therefore, the credit received for this trade will be different than what we are showing here, which is only acting as a guideline.

Investment Rationale

Stocks lifted off from a full test of the June lows, with the SPX crossing back above 3700 on a day that also got some relief from bond yields substantially pulling back. There is good reason to believe that bond rates have hit an important short-term high, and as such, stocks may still see a lift (as I mentioned we’d likely see this week from last week’s weekly QQQ -13 signal).

I don’t think that the SPX would get much above what is now a properly broken weekly TDST line at 3819, so let the bulls have their fun for a few days, and then we’ll look to lean into the rally again. But in the meantime – seeing yesterday’s solid bond yields’ reversal session – we’re going to look to enter a bullish TLT trade if we see a pullback to between $102.50 and $101.50. So, if we see this price decline to our target zone today or tomorrow, we will then look to sell a short-dated TLT October 14th $102/$98 put spread at the then current mid-price. (For reference – but nothing more than that – this spread closed at 84 cents yesterday.)

THIS IS A CONDITIONAL TRADE.

TLT – Daily

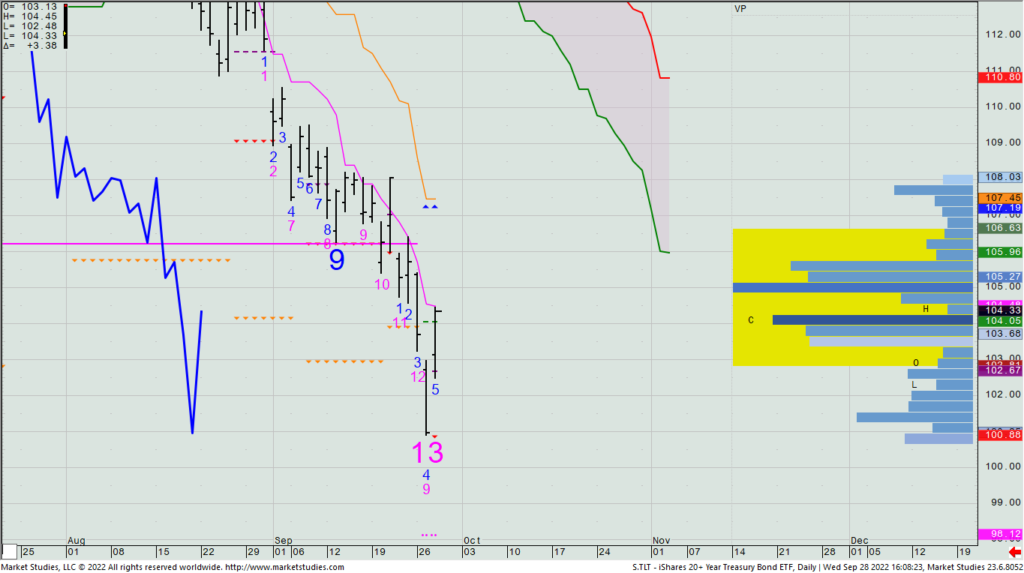

$SRE, $BKR, $UNG

DailyPlay – Closing Trades (BKR, UNG) Partial Closing Trade (SRE) – September 28, 2022

Closing Trades

- BKR – 32.43% Loss: Sell to Close 1 Contract October 21, 2022 $24/$26/$29 Call Spread Risk Reversal @ $3.45 Credit. DailyPlay Portfolio: By Closing 1 Contract, we will be receiving $345.

- UNG – 35.81% Loss: Buy to Close 7 Contracts October 21, 2022 $27/$24 Put Verticals@ $2.01 Debit. DailyPlay Portfolio: By Closing the remaining 7 of 14 Contracts, we will be paying $1,407. We took partial profits for this trade on September 16 at a $1.11 Debit. Therefore, the average loss on this trade is 5.41% and the average cost basis to exit this trade is $1.56 Debit.

Partial Closing Trades

SRE -126.14% Gain: Sell to Close 1 Contract Oct. 21st $165/$145 Put Verticals @ $9.95 Credit. DailyPlay Portfolio: By Closing 1 of the remaining 4 Contracts, we will be receiving $995.

Investment Rationale

Yesterday, stocks were first up, then down, and finished mixed depending upon which index you were focused on. The one we do, the SPX, closed down 7.75 points (0.21%) at 3647 – the lowest close of 2022 and is now just 10 points above the June low.

There is a slew of tech names that are getting daily downside DeMark exhaustion signals, and those who are trading mavericks can look for some of them to play should they want. To me, any rally is still a selling opportunity, so I welcome bounces in order to be able to sell into a move higher (something almost always preferable to selling into weakness). I still think the market is going well lower, and after we get the noise out of the way from those looking to buy the test of the June lows, the steamroll will persist. (Think of the bear market possibly on a quick coffee break.) When the SPX gets to 3300/3100, I will put back on the bulk of money I’ve raised throughout the year back into play.

For today, I want to again take off 1 contract of the 5 remaining we have in the long SRE Oct. 21 $165/$145 put spread. (We took the first one off yesterday.) We are now up $126% on these 5, and I am a fan of locking in profits like that, but gingerly so. But it’s sold down to the level it broke out from in July ($154), so let’s take a little more off the table.

SRE – Daily

We’re also going to exit the long BKR Oct. 1 $24/$26/$29 Financed spread reversal today @ $3.45. We’re down 12% on it (not the incorrectly displayed loss showing in the DP portfolio, where the margin was incorrectly calculated).

Lastly, let’s also exit the short UNG Oct. 21 $27/$24 put spread. The remaining 7 contracts we have on are down 60% as I write this.

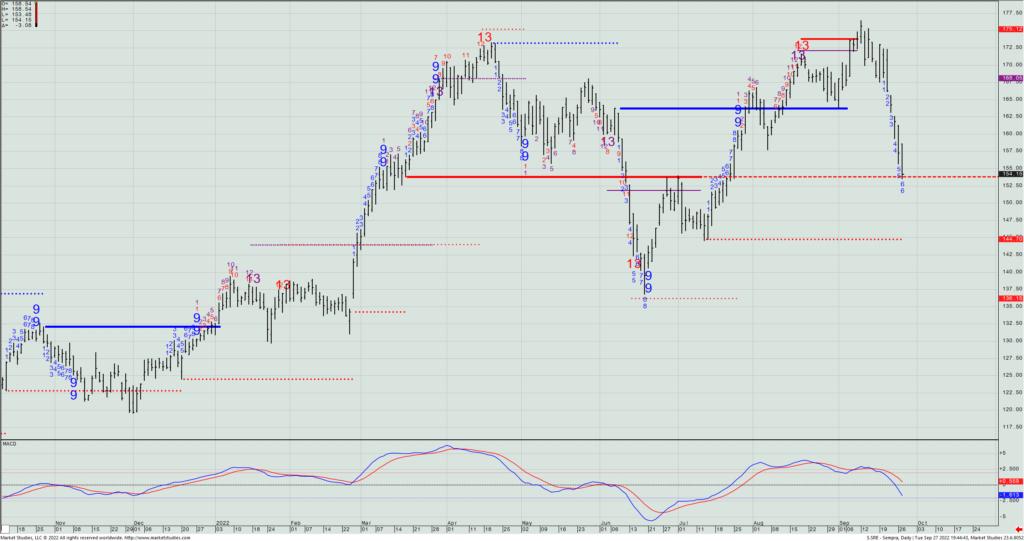

$DHR

DailyPlay – Opening Trade (DHR) Partial Closing Trade (SRE) – September 27, 2022

Partial Closing Trade

SRE -76.14% Gain: Sell to Close 1 Contract Oct. 21st $165/$145 Put Vertical @ $7.75 Credit. DailyPlay Portfolio: By Closing 1 of the 5 Contracts, we will be receiving $775.

DHR Bearish Opening Trade

View DHR Trade

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish

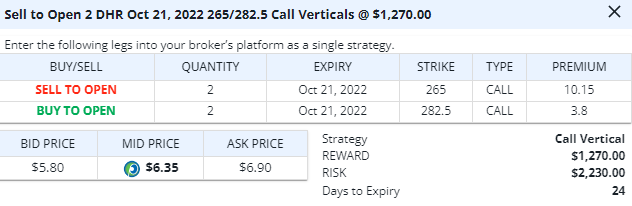

Details: Sell to Open 2 Contracts Oct. 21st $265/$282.5 Call Vertical Spreads @ $6.35 Credit.

Total Risk: This trade has a max risk of $2,230 (2 Contracts x $1,115).

Trend Continuation Signal: This is a Bearish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/ Bearish

Technical Score: 7/10

OptionsPlay Score: 101

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

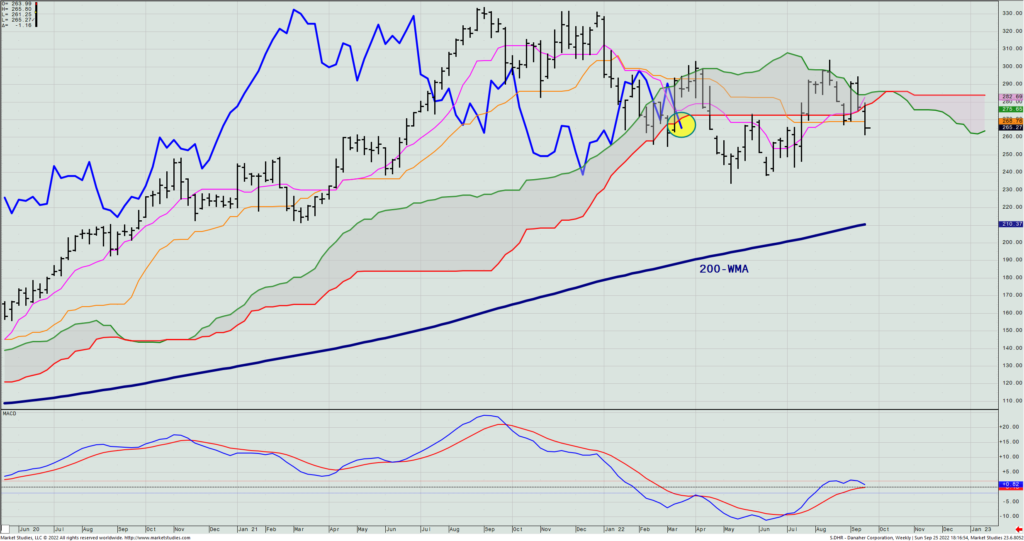

Here’s a new trade idea based almost completely upon one new key element that is different than the past. When we look at a weekly bar chart of Danaher Corp. (DHR), we see it’s been in a trading range this year, and being in the middle of that range right now gives us no particular reason to trade the name.

DHR – Weekly

But look at the same chart with the Cloud model place on it, and we see that last week the cloud’s Lagging Line broke its cloud bottom, suggesting a new leg lower is likely starting.

DHR – Weekly with Cloud Model

As such, let’s look to sell an October 21st $265/$282.5 call spread. t closed last Friday at $8.45 mid, collecting us about 38% of the strike differential. I suspect this will test and potentially breach its 2022 lowest weekly close of $238.60.