$ETSY

DailyPlay Update on ETSY

Please hold off on entering the DailyPlay trade on ETSY, as recommended in our DailyPlay email of today, as ESTY is about to open 5% higher today. We will inform you when the timing is right to enter this trade.

$NEM

DailyPlay – Conditional Bullish Opening Trade (NEM) – November 9, 2022

NEM Conditional Bullish Opening Trade

View NEM Trade

Strategy Details

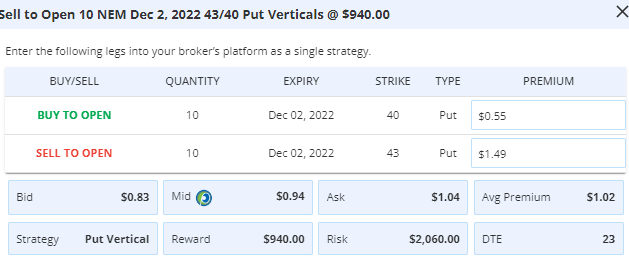

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 10 Contracts Dec. 2nd $43/$40 Put Vertical Spreads @ $0.94 Credit.

Total Risk: This trade has a max risk of $2.060 (10 Contracts x $206).

Trend Continuation Signal: This is a Bullish trade on a stock that is experiencing a neutral to bullish trend.

1M/6M Trends: Bullish/Neutral

Technical Score: 2/10

OptionsPlay Score: 90

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note that this is a CONDITIONAL trade. We will only enter the trade when the condition is met, which is IF we see a decline to $43–$42.75 anytime this week. Also note that the cost basis, premium paid, as well as the number of contracts when we open this trade will therefore be different from what we post today. This condition is only valid for this week.

Investment Rationale

Stocks edged higher into Election Day, as many think that Republicans taking at least of 1 of 2 houses (if not both) will lead to a halt to any early-discussed upcoming legislation that could put a damper on the tech and/or energy sectors. Historically, this is a favorable time for the equity market in the mid-term presidential cycle, and of course, you already know that the November to May period is a far stronger one than the May to October time frame.

I write this early enough on Tuesday night to not have any sense of how elections will pan out, or for how investors will take the results going forward. As I’ve previously said, I believe the House will be won by the Republicans, and I’m not sure about the Senate, but if I had to pick side, I’d say they also end up netting one new Senator in order to take that chamber, too. And what that basically means, is that President Biden won’t likely be able to get any new legislation passed in his final two years of his presidency.

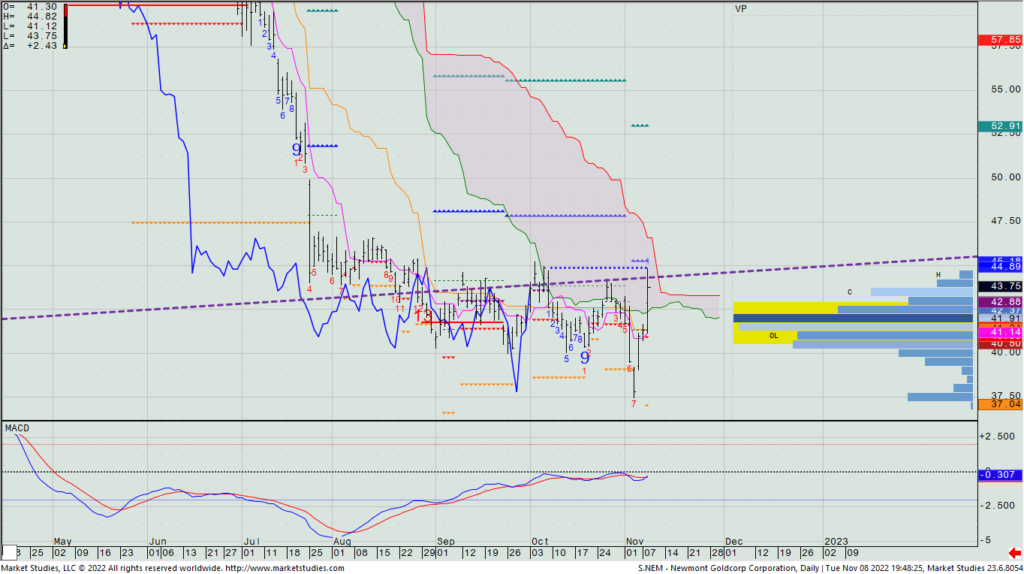

Marketwise, yesterday we saw the popular gold miner Newmont Goldcorp (NEM) continue higher to its best daily close in a month. Given the spike bottom reversal we saw in it, I think we get a move that reaches up to the Propulsion Exhaustion levels (i.e., the blue upward pointed triangle lines) at $47.73 and $48.00. I suspect we’ll have a chance this week to buy NEM on a pullback, especially with yesterday reaching the most recent TDST resistance line (the horizontal dotted blue line) at Tuesday’s high. So, if we see a decline to $43–$42.75 anytime this week, let’s look to sell a Dec. 2nd $43/$40 put spread for what the then current bid/offer mid-price is trading for.

NEM – Daily

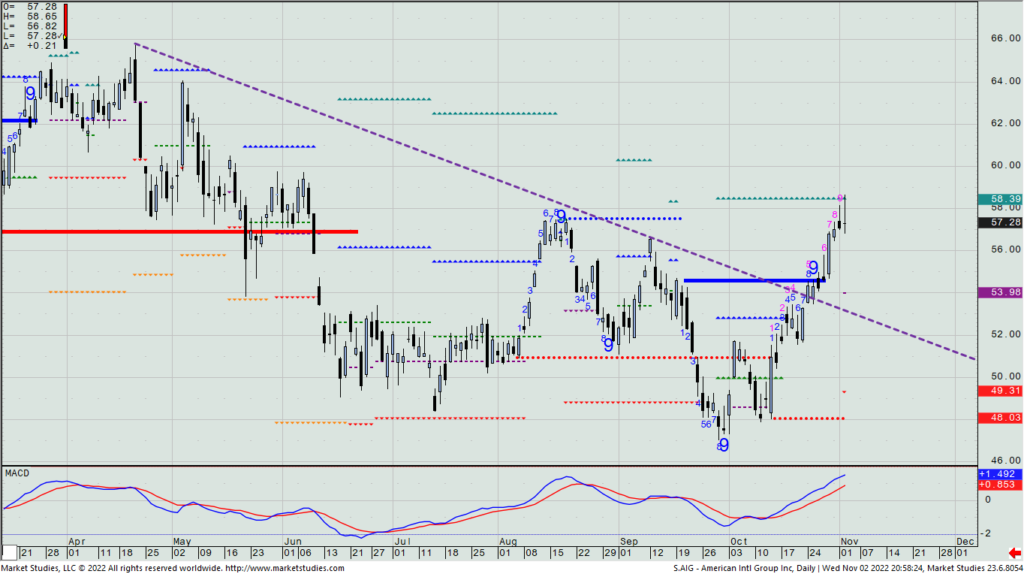

$AIG

DailyPlay – Closing Trade (AIG) – November 8, 2022

Closing Trade

- AIG-96.43% Loss: Buy to Close 6 Contracts Nov. 18 $54/$58 Call Verticals @ $1.68 Debit. DailyPlay Portfolio: By Closing the remaining 6 of 9 Contracts, we will be paying $1,512. We partially closed this trade on November 2 with 3 Contracts at a $2.42 Debit. Our average loss for this trade is therefore 78.97% and our average cost basis to exit this trade is $1.93 Debit.

Investment Rationale

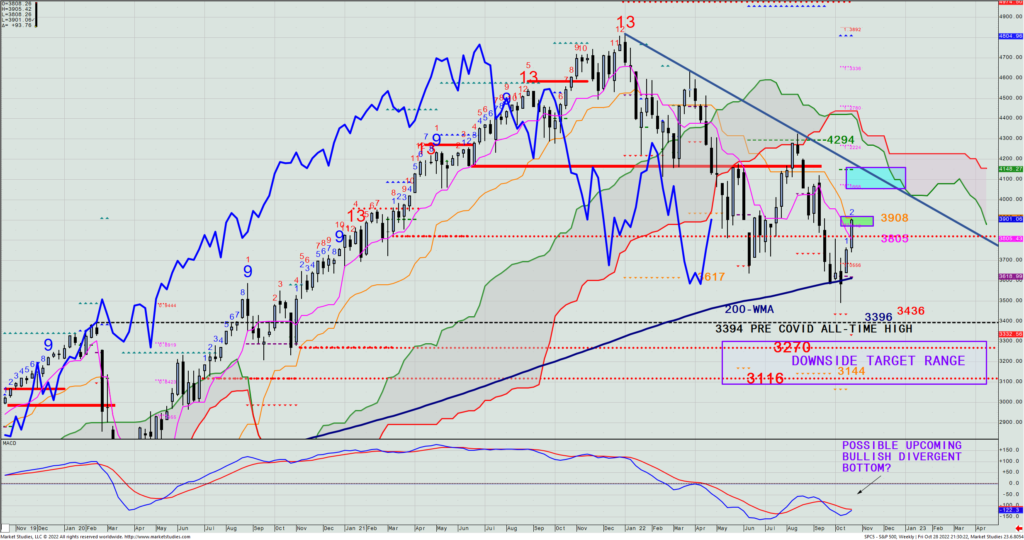

After a back and forth session, bulls took control late in the day and again pushed the market higher – just as they had on Friday. The bullish move off of a failed potential bearish Propulsion Momentum level touch (at SPX 3703 last week) continued, with the index now some 100 pts. higher than there, while also 100 pts. below last week’s high.

If today weren’t Election Day – and I have no idea how results are going to affect the market tomorrow or going forward – I’d say that the bounce could potentially take the market back up to near last week’s high. And maybe it will go there anyway, but let’s see what Wednesday’s move pans out to be. Bulls are certainly feeling more emboldened, with the rough double-bottom from June and October, along with the lows made right at the 200-WMA.

So, yes, bulls have reason to believe a bottom is in. And I don’t disagree; it seems like there’s enough to think that we have one given what we’ve seen since the October low. However, note that rates have not pulled back at all, and the UST 10-yr. closed yesterday just two bps. beneath the highest close of the year. If they break to new highs and then stay above 4.3%, I think it highly unlikely that the equity market can hold up. If analyst’s lower forward earnings numbers as I expect them to need do, I think it highly unlikely that the equity market can hold up. And if inflation doesn’t materially pullback anytime soon – which I suspect it won’t – I think it unlikely that the equity market can hold up.

So, let the bulls have their fun for now. As far as I’m concerned, it remains a rally in a bear market.

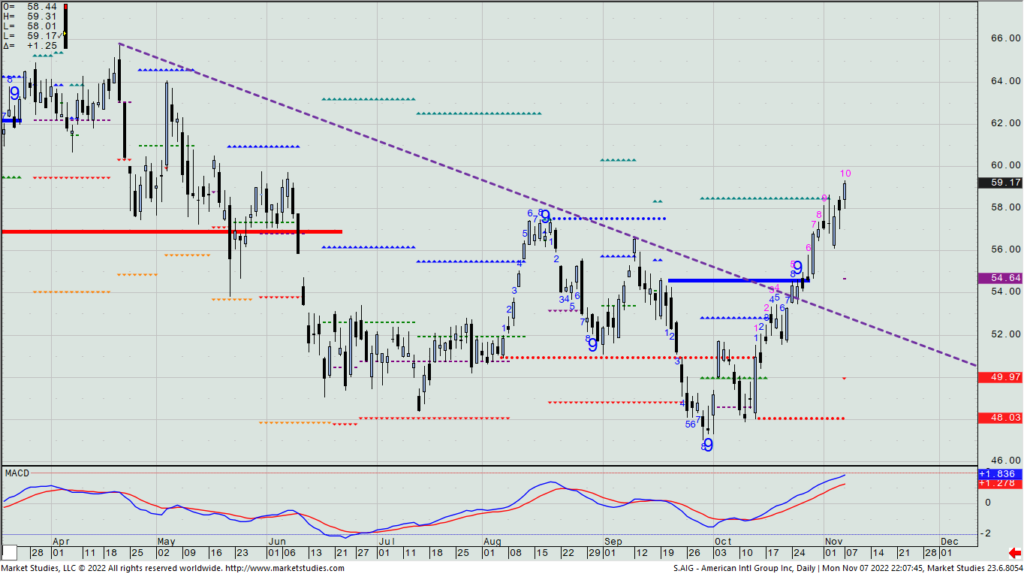

I want to exit the AIG bearish Nov. 18th $54/$58 call spread we have on, as it closed above its Propulsion Exhaustion level at $58.39 that I said I would use as the stop on this trade (as well as why I chose the $58 hedge strike in the first place).

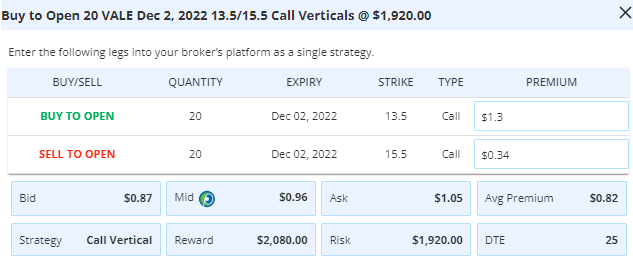

DailyPlay – Conditional Bullish Opening Trade (VALE) – November 7, 2022

VALE Conditional Bullish Opening Trade

View VALE Trade

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 20 Contracts Dec. 2nd $13.50/$15.50 Call Vertical Spread @ $0.96 Debit.

Total Risk: This trade has a max risk of $1,920 (20 Contracts x $96).

Trend Continuation Signal: This is a Bullish trade on a stock that is experiencing a bullish trend.

1M/6M Trends: Bullish/Mildly Bullish

Technical Score: 7/10

OptionsPlay Score: 95

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note that this is a CONDITIONAL trade. We will only enter the trade when the condition is met, which is IF the stock pulls back to the $13.75 – $13.50 area. Also note that the cost basis, premium paid, as well as the number of contracts when we open this trade will therefore be different from what we post today. This condition is only valid for this week.

Investment Rationale

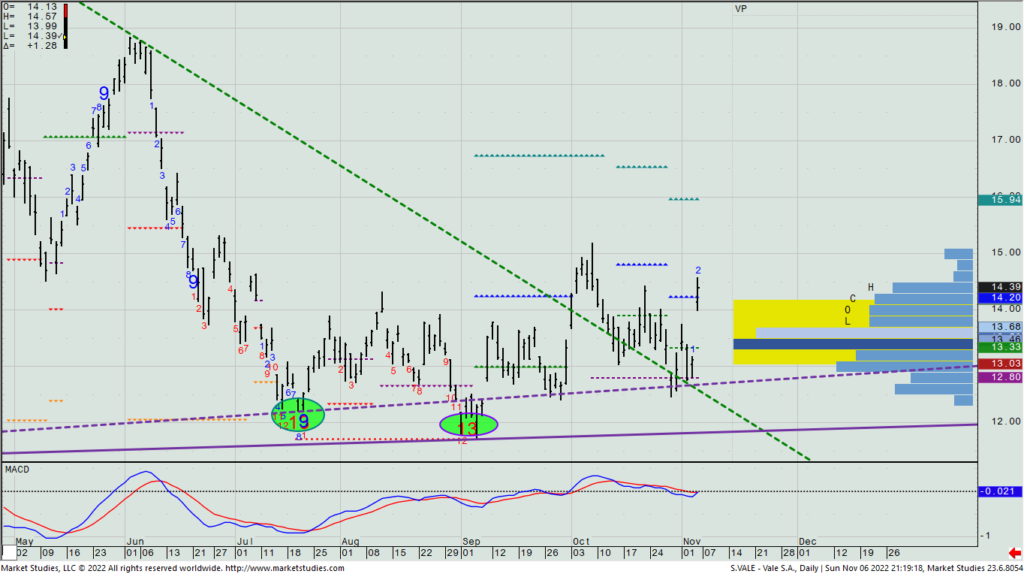

Equities had a good Friday rally, but still had a horrible week. What had a good Friday and a good week were metals stocks, as dollar weakness and prior non-breakdowns in gold and copper finally took a toll on those recently positioned short.

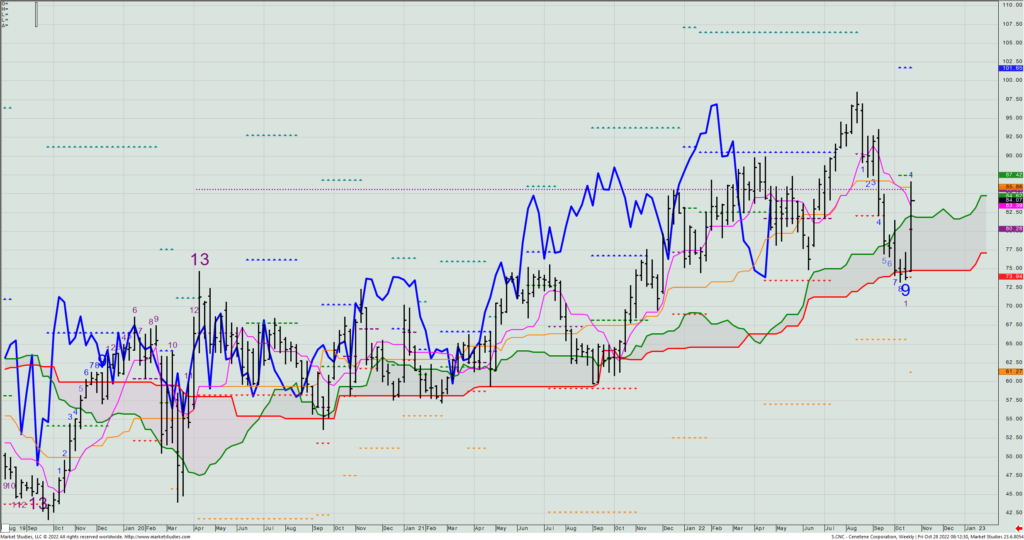

One name that I like in the copper space is VALE. It has side-by-side daily Sequential -13s in July and September and last week came back down to bounce on its uptrend line (in purple) and also backfilled against the downtrend line (in green) that it had broken out above in early-October.

As such, let’s look to buy a VALE Dec. 2nd $13.50/$15.50 call spread anytime this week IF the stock pulls back to the $13.75 – $13.50 area. Then, and only then, will we look to buy that spread at the then current mid-price.

VALE – Daily

DailyPlay Update – November 3, 2022

Fed Chairman Powell did exactly what I expected he would: Raise rates by 75 bps. and continue his hawkish stance to fighting inflation. I saw nor heard anything bullish for stocks in his press conference. Period. End of my statement.

In my opinion, stock investors have very little to look forward to between now and year’s end, and barring an exogenous event (like Putin unexpectedly ending the war, or keeling over, or something as unlikely as that), stocks will likely slide this year to make new 2022 lows – even in the face of the well-known seasonally-favorable period that we are now in.

I suspect that this week’s SPX high of 3912 (which was just 4 pts. above the weekly cloud model’s Base Line of 3908) was the top of Wave 4 of Wave III down from all-time highs. That suggests not only a high likelihood of new lows, but also that the bigger market move has well more downside to go before all is said and done. (This also means that it is still not too late to be exiting long stock positions – whether they be winners or losers.)

Looking into yesterday’s price action, I see two areas I’d like to use to sell into rallies: One is in the SPY $377 to $379 area; the other from ~ $381.50 to ~$383.50.

As far as our portfolio’s positions, I want to look to exit all tactical longs I’ve recently given you (that all expire no later than Nov. 18th.) We’ve already taken a good amount of them off, but let’s not get stubborn about exiting the rest. You can do all today; some today and some tomorrow; or all tomorrow. Your choice. But I do recommend being out of these bullish spreads by tomorrow’s close, as I will likely exclusively be looking to be a seller in the immediate future.

As mentioned in Wednesday afternoon’s monthly Q&A webinar, we will stay short the AIG call spread, using a close (or two, your choice) above $58.39 as our reason to exit the bearish trade.

AIG – Daily

$SPY, $AIG, $CNC, $UNP

DailyPlay – Partial Closing Trades (SPY, AIG, CNC, UNP) – November 2, 2022

Partial Closing Trade

- SPY – 76.00% Gain: Buy to Close 1 Contract Nov. 9th $365/$361 Put Vertical @ $0.36 Debit. DailyPlay Portfolio: By Closing 1 of the remaining 3 Contracts, we will be paying $36.

- AIG – 44.05% Loss: Buy to Close 3 Contracts Nov. 18 $54/$58 Call Verticals @ $2.42 Debit. DailyPlay Portfolio: By Closing 3 of the 9 Contracts, we will be paying $726.

- CNC – 94.74% Gain: Buy to Close 4 Contracts Nov. 18th $75/$72.50 Put Verticals @ $0.05 Debit. DailyPlay Portfolio: By Closing 4 of the 8 Contracts, we will be paying $20.

- UNP – 2.38% Gain: Sell to Close 1 Contract Nov. 18 $197.50/212.50 Call Verticals @ $4.30 Credit. DailyPlay Portfolio: By Closing 1 of the 4 Contracts, we will be receiving $430.

Investment Rationale

I don’t know if you joined me or not, but yesterday I shorted the SPX (I used futures) when the SPX traded 3908, the weekly cloud model’s Base Line that I had labeled as the first meaningful resistance of the current rally from 2022 lows. It yielded about a 50-point gain on the day, which I was happy to take as we go into today’s FOMC announcement (with one major Wall Street firm expecting a MASSIVE move to take place between 2pm ET and today’s close — they just have no idea which direction it will be).

Today brings significant risk to all investors across the major asset classes. I have been steady in my call that the Fed will do a 75 bp. raise in rates. Bulls are expecting only a 50 bp. hike and a softer, kinder Fed. I say they can in no way afford to take their foot off the pedal – upcoming elections or not. For once, I think they will actually do the right thing and keep to their stated goal of reducing inflation – helping to unwind the prior large, easy-money environment they allowed for well too long that caused this mess in the first place.

In my continuous attempt to protect you and do what I think is the best course of action, I am not going to suggest putting on a new position today. (And based upon yesterday’s fairly tight range after the market made its morning drop, we’d not be alone in waiting to see what the Fed is going to do.) I’d expect a fairly tight range for most of today’s trading until the 2pm announcement. After that, it could be a free-for-all – in either direction.

I do want to reduce some of our holdings that expire within 17 days, as we have several of them. Some are gains, some losses. It doesn’t matter to me. Given the possible huge move coming from the Fed news today, let’s just cut overall exposure:

- We’re short 3 SPY Nov. 9th $365/$361 call spreads, up 76%. Let’s take one off this morning.

- We’re short 9 AIG Nov. 18th $54/$58 call spreads, down 44%. Let’s take 3 off this morning.

- We’re short 3 CNC Nov. 18th $75/$72.5 put spreads, up 95%. Let’s take 1 off this morning.

- We’re long 4 UNP Nov. 18th $197.50/$212.50 call spreads, up 2%. Let’s take 1 off this morning.

I have absolutely no idea what is going to transpire later today. So, it makes sense to reduce holdings because whatever analysis got us into the trades originally may not have any meaning come later today. I’d rather be safe than sorry.

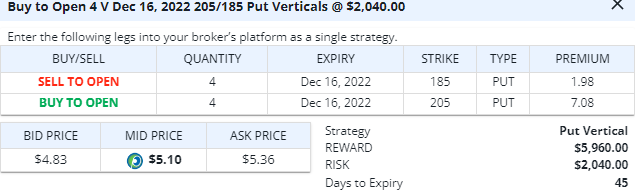

$V

DailyPlay – Opening Trade (V) – November 1, 2022

V Bearish Opening Trade

View V Trade

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 4 Contracts Dec. 16 $205/185 Put Vertical Spreads @ $5.10 Debit.

Total Risk: This trade has a max risk of $2,040 (4 Contracts x $510).

Counter Trend Signal: This is a Bearish trade on a stock that is experiencing a bullish trend.

1M/6M Trends: Bullish/Bullish

Technical Score: 9/10

OptionsPlay Score: 141

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

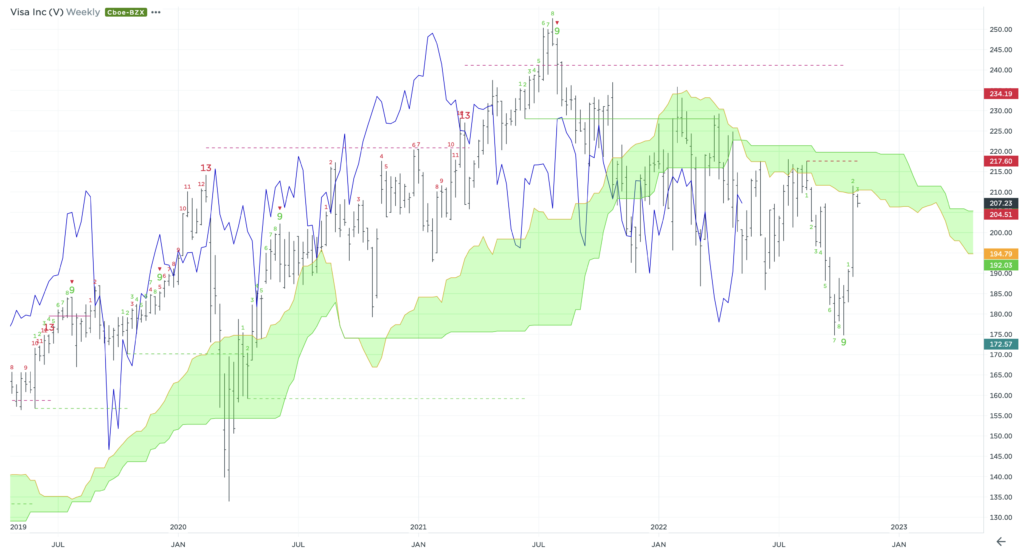

I’ve been keeping an eye on Visa after taking a short position earlier this year, and I see a similar setup after earnings last week. Despite reporting “strong” earnings that beat analyst expectations, raising dividends and authorizing $12B in share buybacks, the stock has rallied up to two major resistance levels. I see this post earnings rally as an opportunity to seek short exposure on Visa rather than a reason to be a buyer.

There is no doubt that Visa is the dominate player in a world shifting to all digital, but the economic headwinds and the rich valuations are concerning. Trading at a 50% premium to the market (25x next year’s earnings) in an economic slowdown and expecting only 10% EPS growth next year is simply too high in my opinion. Couple this with the stock trading up against the Weekly Cloud bottom and its 16-month bearish trendline aligns the timing with my fundamental view. I’m using this opportunity to buy a Put Spread on Visa expiring in December to target a $185 target and cutting losses if we see Visa breaks above the trendline and weekly cloud model.

Buy to Open V Dec $205/$185 @ $5.10 Debit

Visa – Weekly

$SPY, $CNC, $SMH

DailyPlay – Partial Closing Trades (SPY, CNC, SMH) – October 31, 2022

Partial Closing Trade

- SPY – 80.67% Gain: Buy to Close 3 Contracts Nov. 9th $365/$361 Put Verticals @ $0.29 Debit. DailyPlay Portfolio: By Closing 3 of the remaining 6 Contracts, we will be paying $87.

- CNC – 89.47% Gain: Buy to Close 3 Contracts Nov. 18th $75/$72.50 Put Verticals @ $0.10 Debit. DailyPlay Portfolio: By Closing 3 of the remaining 8 Contracts, we will be paying $30.

- SMH – 65.15% Gain: Buy to Close 2 Contracts Nov. 18th $176/$168 Put Verticals @ $1.07 Debit. DailyPlay Portfolio: By Closing 2 of the 4 Contracts, we will be paying $214.

Investment Rationale

I am in Orlando, FL today, speaking at the Money Show conference. Tony will be hosting the 8:45am weekly Technical Market Outlook in my place, and will be sharing with you my thoughts on the market, including that my belief that the SPX will hold up through next Tuesday’s Election Day, with a pullback going no lower than 3680 from the current 3901.

However, the SPX is also right up against its first real resistance level at 3908 – the weekly Base Line from the cloud model. It would not surprise me to see a pullback today (and I am writing this on Saturday afternoon, so I have no idea how futures are going to open and trade on Sunday night).

SPX – Weekly

As I mentioned on this past Friday’s Daily Play open trade position webinar, I said I would likely take some profits today in bullish plays we have on. To that end, let’s look to do the following:

- We are short 6 SPY Nov. 9th $365/$361 put spreads that expire a week from Wednesday (the day after Election Day). We are up 81% on them so far; let’s take off 3 today.

- We have 8 of 12 short CNC Nov. 18th $75/$72.5 put spreads remaining, having lifted 4 of them on Friday. We are now up 89% on the balance. Let’s take another 3 off today, leaving us with a balance of 5 spreads.

- We are short 4 SMH Nov. 18th $176/$168 put spreads. We’re up 65% on them. Let’s take 2 off today.

$APPL, $CNC

DailyPlay – Closing Trade (APPL) Partial Closing Trade (CNC) – October 28, 2022

Closing Trade

- APPL -1.72% Gain: Buy to Close 1 Contract Nov. 11th $145/$157.5 Call Vertical @ $4.57 Debit. DailyPlay Portfolio: By Closing the 1 Contract, we will be paying $457.

Partial Closing Trade

- CNC -81.05% Gain: Buy to Close 4 Contracts Nov. 18th $75/$72.50 Put Verticals @ $0.18 Debit. DailyPlay Portfolio: By Closing 4 of the 12 Contracts, we will be paying $72.

Investment Rationale

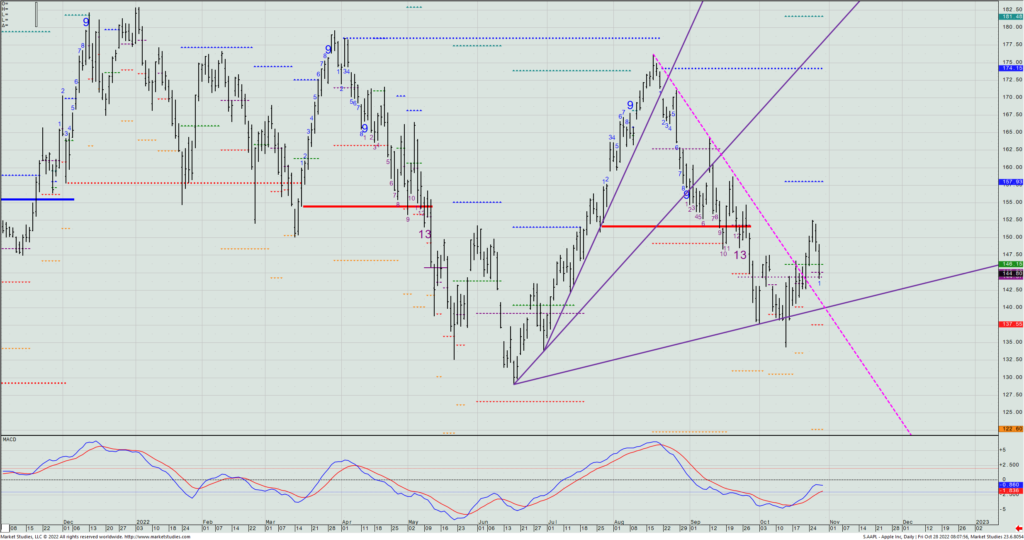

Most big tech names continue to come under heavy pressure after earnings, with Amazon falling as much as 20% yesterday before recouping about a third of it going into this morning’s action. AAPL dropped over $5 too before recovering and is now about $1 higher than yesterday’s close. Today, we get over 1150 new earnings reports in the US, so keep a close eye on your portfolio because that means there’s a good chance that many names you own are involved.

We’ve been waiting for AAPL’s earnings to come out to cover our short Nov. 19th $145/$157.5 call spread. Now that they have, and the stock is still basically just where it was when we put this trade on, we will remove it today, as there’s no particular advantage to still holding it.

AAPL – Daily

Let’s also take off 4 of the 12 CNC short CNC Nov. 18th $75/$72.5 put spreads.

CNC – Weekly

$UNP

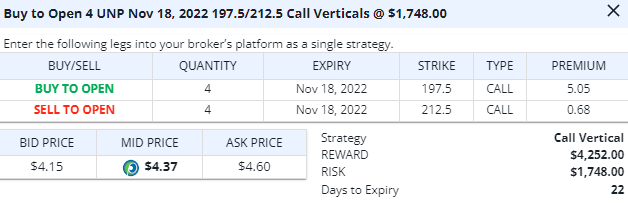

DailyPlay – Opening Trade (UNP) – October 27, 2022

UNP Bullish Opening Trade

View UNP Trade

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 4 Contracts Nov. 18 $197.50/212.50 Call Vertical Spreads @ $4.37 Debit.

Total Risk: This trade has a max risk of $1,748 (4 Contracts x $437).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 3/10

OptionsPlay Score: 93

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

Investors had a weak dollar and strengthening bonds to give a positive spin to yesterday’s price action, but MSFT and Alphabet earnings reports/guidance more than offset those potential tailwinds. We’ve still got AMZN, AAPL, MA, MRK, MCD, TMUS, and Samsung and Shell earnings reports today, and other big cap names coming shortly to see if I’m right that stocks can hold up into (and possibly beyond) Election Day.

You’ll see that we completely removed commodity-related shorts (e.g., NEE and SLV) as I’ve anticipated dollar weakness which is playing out. And I’ve recently only been only playing bullish stock positions (until yesterday’s short play in AiG), as I was bullish from mid-October into elections on 11/08. I’m trying not to be too committed to either direction right now, but playing with near-term ideas while trying not to be prognosticating out several months. Lots of things are going on – both here and abroad – to keep me from stubbornly sitting with positions that just aren’t working.

A new idea for today is to look to get long UNP Nov. 18th $197.5/$2.125 call spreads. Firstly, they reported earnings last week, so that’s not an issue we need to deal with over the next month. Secondly, the chart shows an Aggressive Sequential -13 signal on the lowest close day of the year (last week), and it’s been straight up since then. This spread closed yesterday at $4.38 mid, and is about $1.75 OTM to the lower call strike we’d be buying, making the current 29% differential paid between strikes theoretically cost a bit more because of the OTM strike. (I had actually preferred to sell the $195/$185 put spread, but they collect only 30% of the strike differential – making them priced far too cheaply for me to want to be a seller of them.)

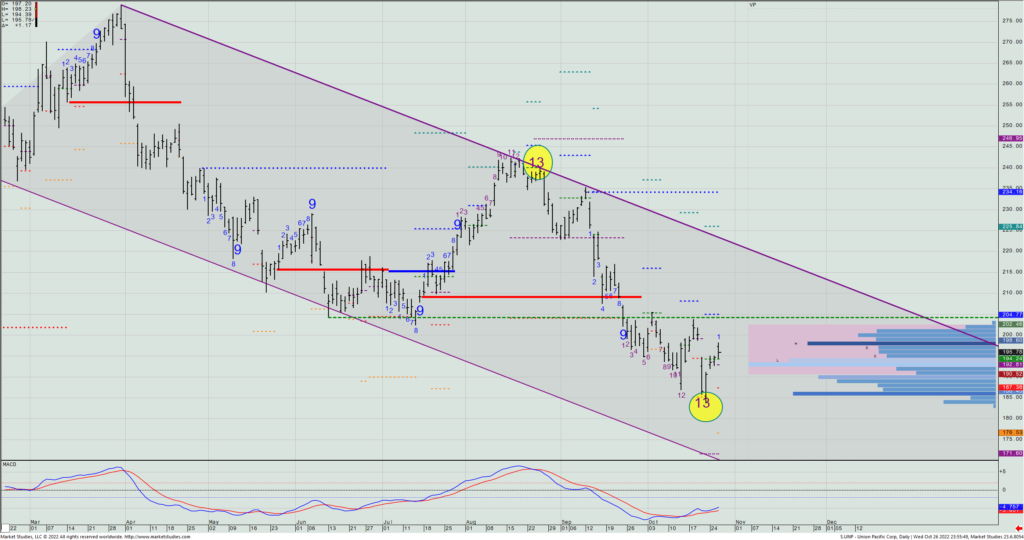

UNP – Daily