$SRE

DailyPlay – Opening Trade (SRE) – September 23, 2022

SRE Bearish Opening Trade

View SRE Trade

Strategy Details

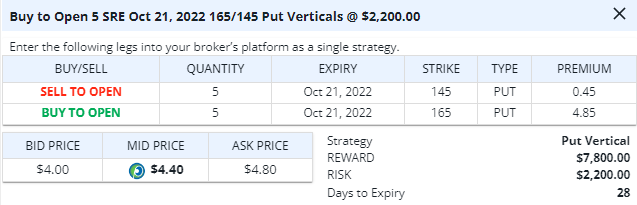

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 5 Contracts Oct. 21st $165/$145 Put Vertical Spreads @ $4.40 Debit.

Total Risk: This trade has a max risk of $2,200 (5 Contracts x $440).

Trend Continuation Signal: This is a Bearish trade on a stock that is experiencing a mildly bearish trend.

1M/6M Trends: Mildly Bearish/ Bullish

Technical Score: 9/10

OptionsPlay Score: 111

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

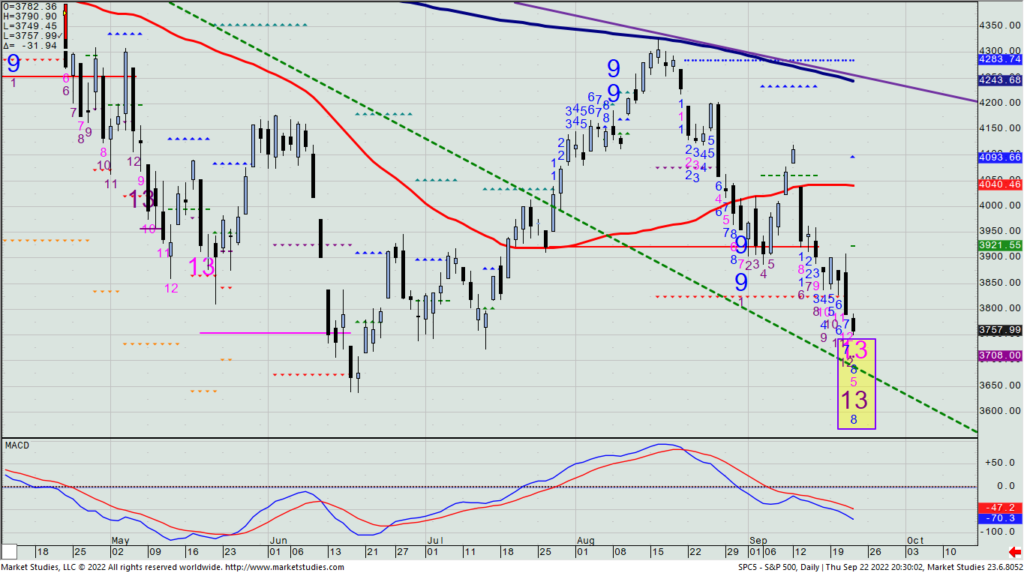

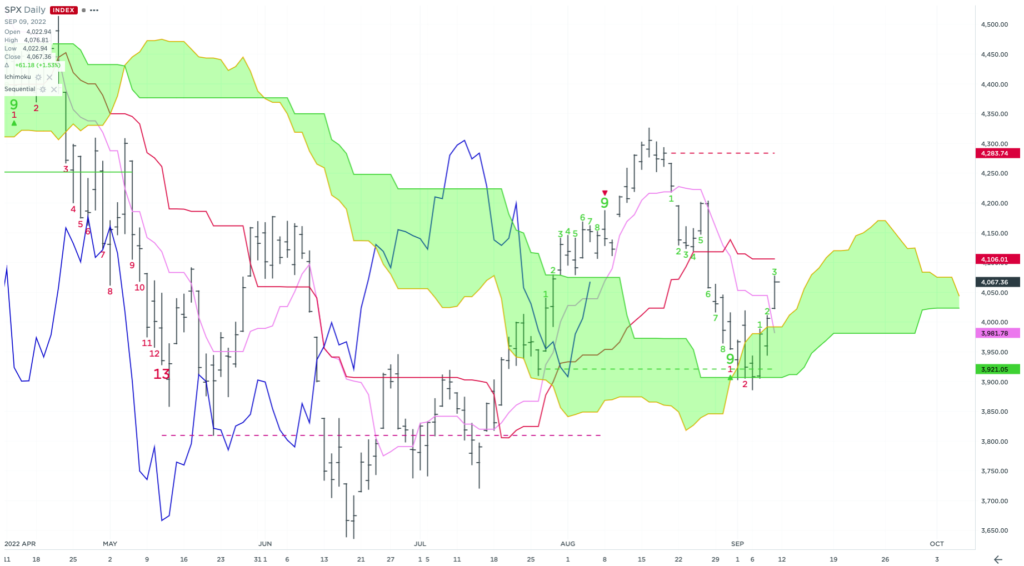

Stocks continue to tumble, as professional money managers – who know the implication of the broken weekly cloud – are heeding its signal. I remain a seller of rallies, and we might even get one next week with yesterday marking both daily Aggressive Sequential and Combo -13 signals, and today likely becoming a Setup -9 count, too. Given rather poor bullish sentiment on top of this, we could see some price pop in the coming days. (However, I believe it will be an ephemeral one.)

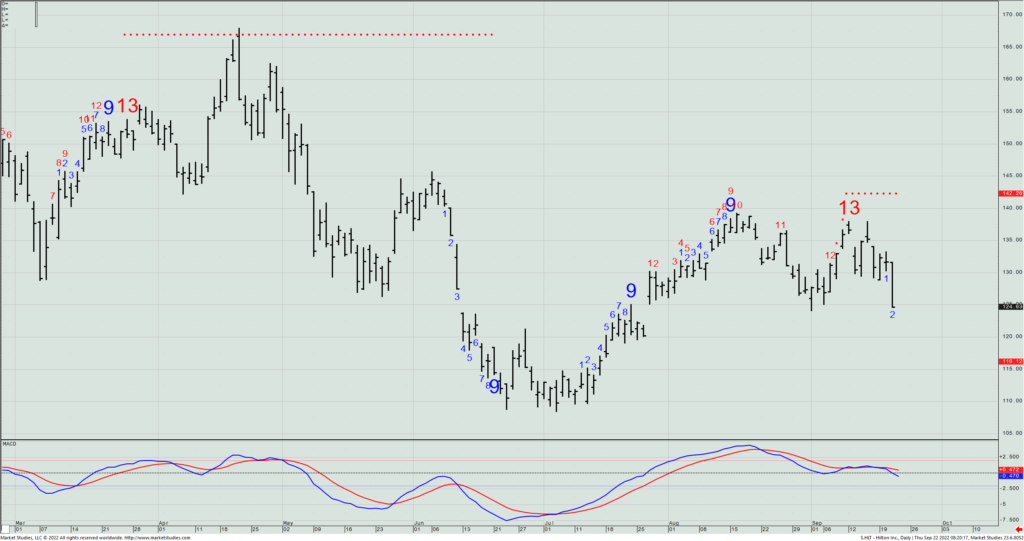

SPX – Daily

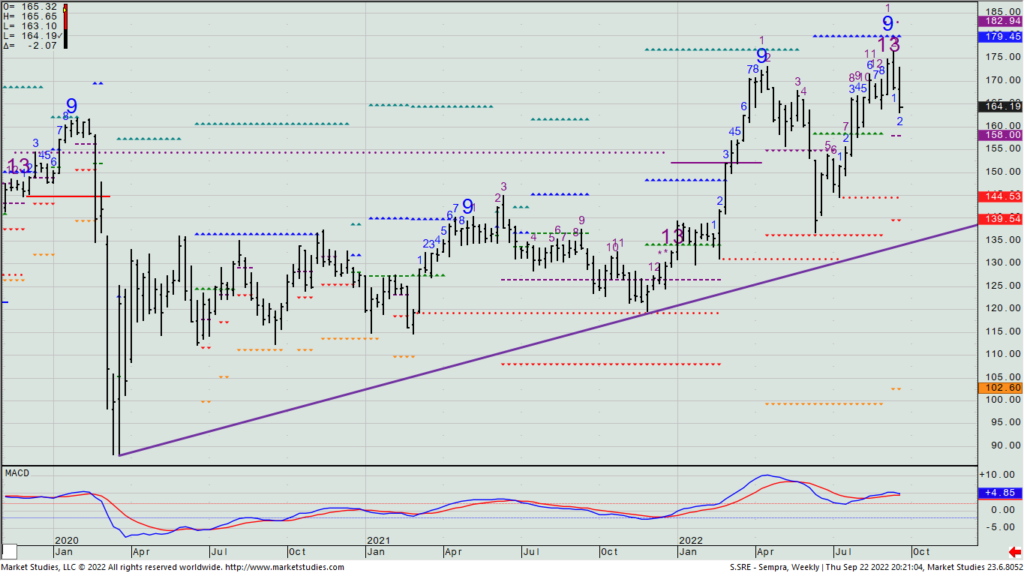

I’m looking for names to sell, and I found one that has upside exhaustion signals and is a heck of a lot closer to its 2022 high than most you’ll find. It’s Sempra Energy (SRE). As it marked a weekly +13/+9 last week, and looks like it could head decently lower relative to the upside risk of about $15, we’ll look to get long SRE Oct. 21st $165/$145 put spreads for what closed yesterday at $4.40 mid. That’s only 22% of the strike differential with the chance to make as much as $15.60, or about 3.5x our premium paid.

SRE – Weekly

$XOM, $HLT

DailyPlay – Closing Trade (XOM) Partial Closing Trade (HLT) – September 22, 2022

Closing Trade

- XOM – 92.46% Gain: Buy to Close 4 Contracts September 23, 2022 $95/$100 Call Verticals @ $0.15 Debit. DailyPlay Portfolio: By Closing the remaining 4 of the 6 Contracts, we will be paying $60.

Partial Closing Trade

- HLT – 55.56% Gain: Sell to Close 4 Contracts October 21, 2022 $135/$125 Put Verticals @ $6.30 Credit. DailyPlay Portfolio: By Closing 4 of the 8 Contracts, we will be receiving $2,520.

Investment Rationale

The Fed spoke, and they found a way to still surprise investors with even a more hawkish stance, ultimately sending the see-saw post-announcement trading session into a closing dive.

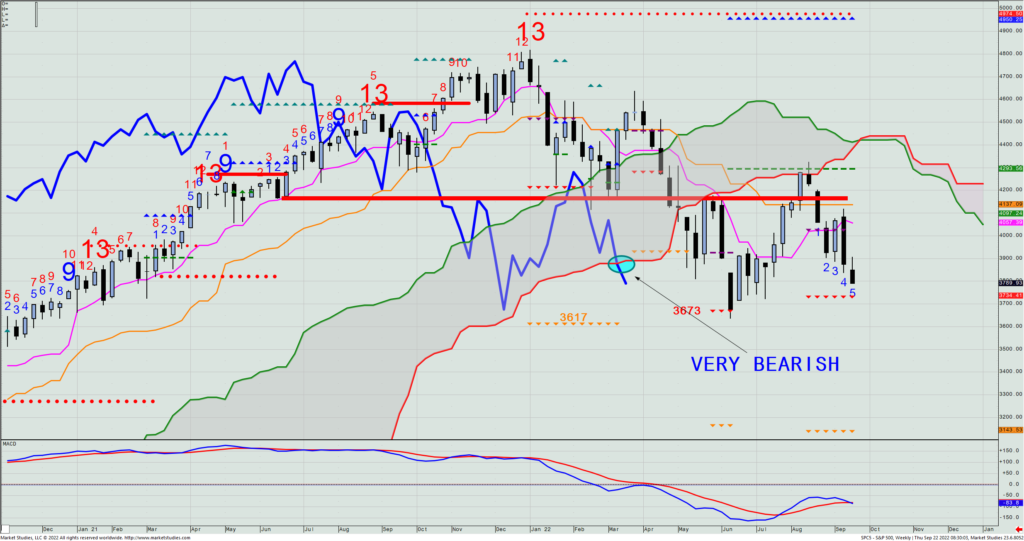

SPX 1-day 5-minute

This now puts the SPX a full 100 points beneath our key 3889 level, with only today and Friday for it to recover most of it for us to potentially not get the breakdown signal I had been looking for. Therefore, I’m going to have to think in terms of “it has broken”. Therefore, it will keep us leaning more towards buying puts and selling calls than the other way around, at least until I have a sense that there are opportunities to successfully buy.

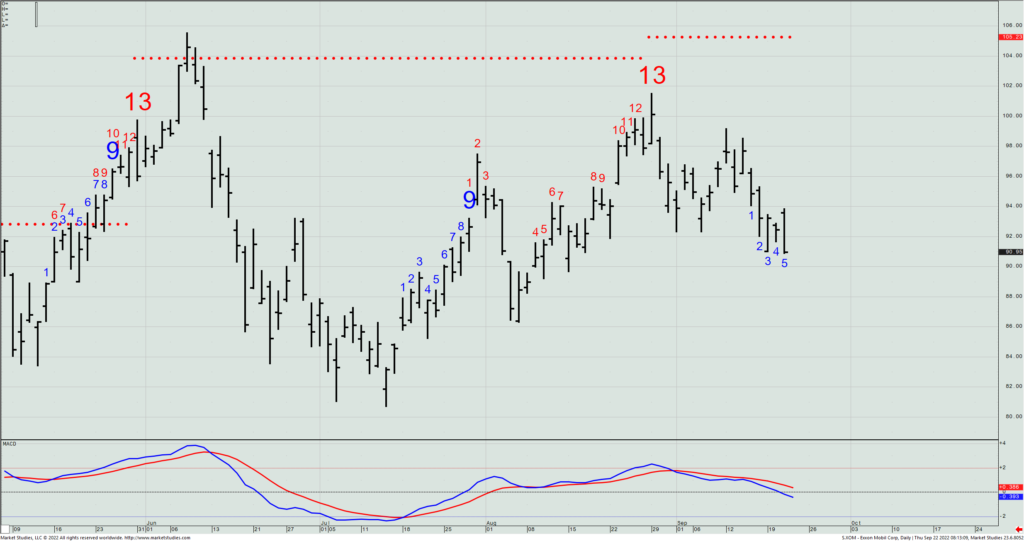

We still have on 4 of 6 short XOM $95/$100 call spreads that expire on Friday. (We took two off on Tuesday.) Make sure you exit the balance today and/or tomorrow.

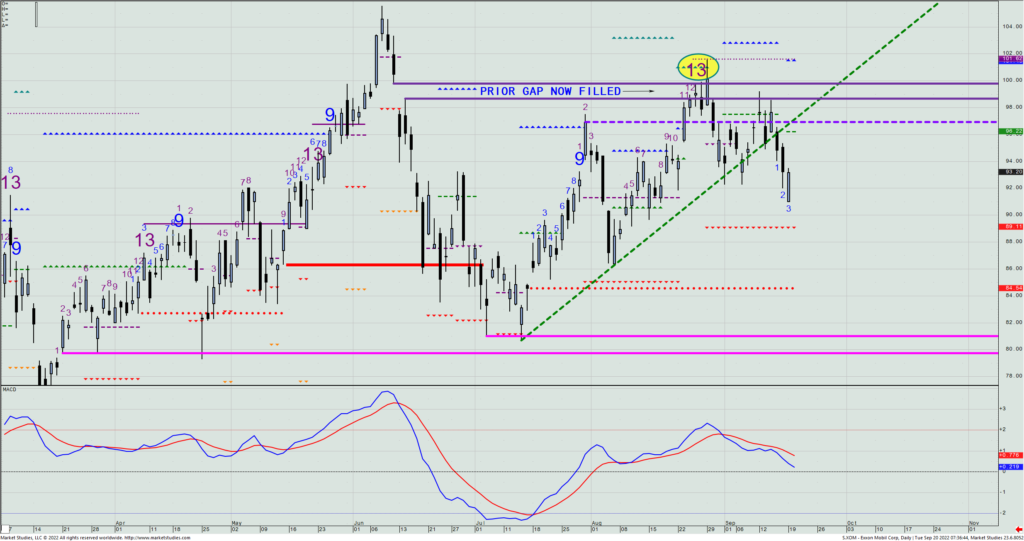

XOM – Daily

We also have on a long HLT Oct. 31 $135/$125 put spread that we are up ~56% in. We are going to take half of that off today, too.

HLT – Daily

As I’ve been saying for months, use rallies to trim your portfolios of the non-performers and names that you can also sell out of to offset taxable profitable gains you’ve had, too. I suspect that although many will look for a test of the June lows to be a place to buy, that they will more likely give way and that we won’t really get a more reliable bottom in until the SPX achieves a weekly Setup -9 count some four weeks from now.

SPX – Weekly

DailyPlay Updates – September 21, 2022

Investment Rational

Stocks lost a percent or so yesterday, and that helped push the SPX down to 3855 – almost 1% beneath the key 3889 level we are focusing on for this and the next 3-4 Friday closes. If it weren’t for a Fed meeting today, I’d already be getting more defensive than I already am, but we do need to see what happens today to get a clearer sense of if the market is really going to break from this area or not. (My hunch is it will, and that once the lows are tested we won’t likely see the SPX get above 3820-ish.)

Should the market get a decent decline into today’s close, then we know that we will be looking to use tactical trading rallies to lean into on a fairly consistent basis, and the biggest question we’ll need to deal with is whether we are buying put spreads or selling call spreads. That will make things much easier for us and you going forward because we’ll have an even stronger market direction opinion to use consistently as the basis of our DailyPlay ideas.

If I’m right that UST 10-yr. rates are headed to 3.70% to ~3.82% — which pushes the UST 2-yr. yield to well over 4% (at its current approx. 40+ bp. differential), I can’t see how stocks can get significant traction higher. So, continue to watch rates and the dollar, for higher moves in them will likely continue to pressure equities.

No new DP idea today with the FOMC rate decision coming.

DailyPlay Updates – September 20, 2022

Investment Rationale

Stocks started to the downside yesterday, only to reverse intraday into a day of gains, with the SPX getting as low as 3947 before closing at 3900. As I mentioned in yesterday’s weekly outlook, the key level we’re focusing on is 3889 on this Friday’s close. Any significant breach of that level breaks the weekly cloud chart into a further bearish picture, and likely opens the door for a bigger decline than those simply looking for a test of the June lows would expect.

With the Fed’s next move coming tomorrow at 2pm ET (the consensus expectation is for a 75 bp. rate hike), the real focus will be on Chair Powell’s press conference words and tone. He’d likely need to make an even stauncher hawkish comment than he did from Jackson Hole last month in order to get investors even more fearful than they already are.

I’m not in the business of outguessing the Fed, but I am in the one of anticipating how investors will react to news along with how they are positioned going into it. As I told my institutional clients Sunday night, my research shows that investors have the lowest “Risk On” positioning they’ve had since the Covid meltdown in Spring 2020. That is more tactically bullish than bearish, but strategically the opposite, so keep that in mind as you play the next month or two of market swings.

We have on a short XOM $95/$100 call spread that expires Friday and is up about 62% on it. With the Fed meeting tomorrow, let’s take partial profits today by taking off 3 of the 6 spreads. Yesterday it’s closing mid price was 76 cents. (We’re short from $1.99).

XOM – Daily

$HSY, $UNG

DailyPlay – Closing Trade (HSY) Partial Closing Trade (UNG) – September 16, 2022

Closing Trade

- HSY -79.35% Gain: Buy to Close 1 Contract October 7, 2022 $230/$240 Call Vertical @ $0.82 Debit. DailyPlay Portfolio: By Closing the remaining 1 of the 3 Contracts, we will be paying $82. We took partial profits for this trade on September 12 at a $1.75 Debit. Therefore, the average gain on this trade is 63.73% and the average cost basis to exit this trade is $1.44 Debit.

Partial Closing Trade

- UNG -25.00% Gain: Buy to Close 7 Contracts October 21, 2022 $27/$24 Put Verticals @ $1.11 Debit. DailyPlay Portfolio: By Closing 7 of the 14 Contracts, we will be paying $777.

Investment Rationale

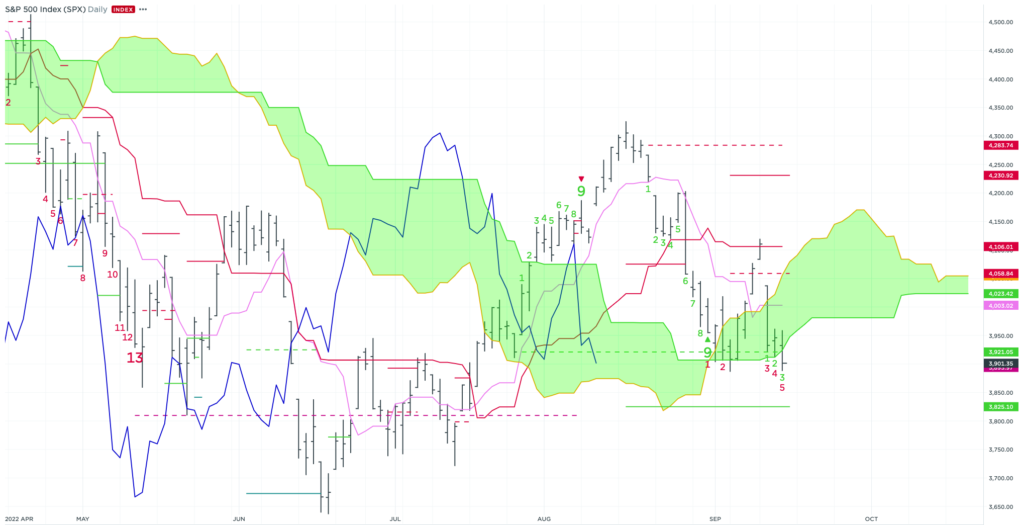

Price action for equities started with some strength which faded by the end of the day. The S&P is trading just above its $3900 level and has now broken below the daily cloud model. Our base case is for equities to continue lower unless it closes above $3950 by Friday and continues higher. As we wait for further clarify from markets going into the Fed decision next week, we take this opportunity to close out HSY which has reached the daily cloud bottom target. And we are also closing half of our UNG after Nat Gas saw a nearly 9% correction today, taking partial profits.

Close Remaining 1 Contract on HSY @ $0.82 Debit

Close Half UNG @ $1.11 Debit

S&P 500 Daily

$ARKK

DailyPlay – Opening Trade (ARKK) – September 15, 2022

ARKK Bullish Opening Trade

View ARKK Trade

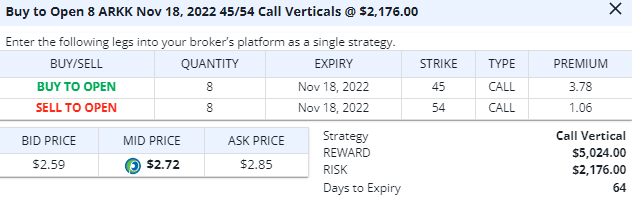

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 8 Contracts November 18, 2022 $45/$54 Call Vertical Spreads @ $2.72 Debit.

Total Risk: This trade has a max risk of $2,176 (8 Contracts x $272).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Neutral/Bearish

Technical Score: 3/10

OptionsPlay Score: 104

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

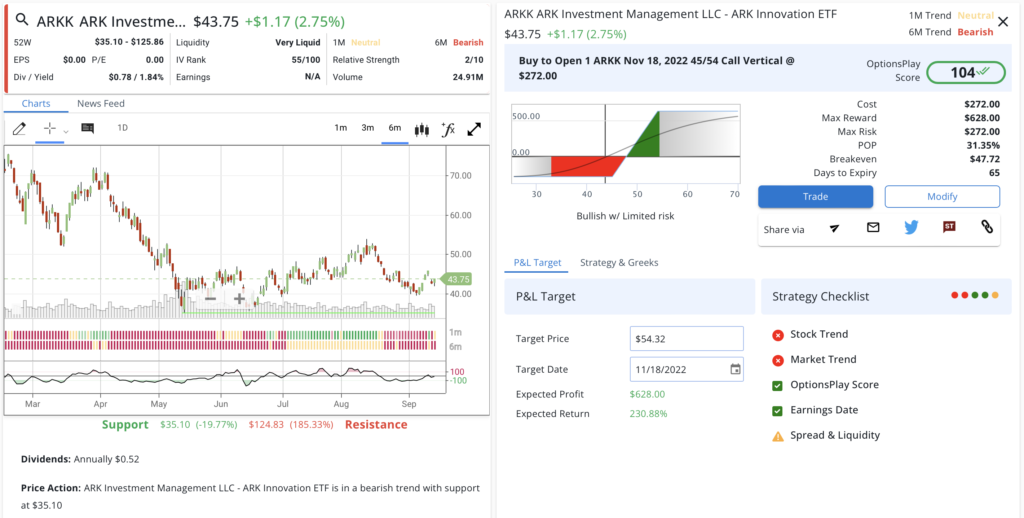

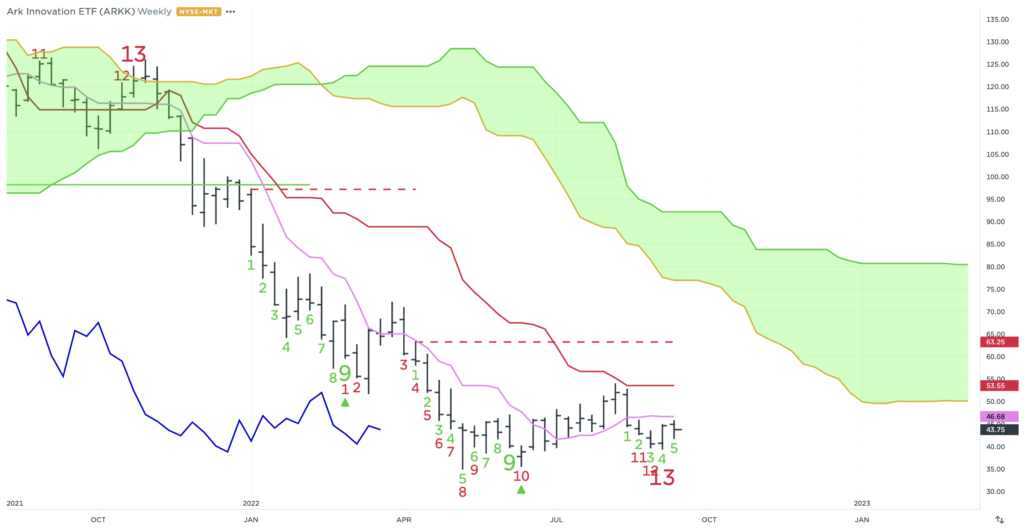

Despite the previous day’s heavy selloff, markets remained neutral today and held a major support level at the daily cloud bottom @ $3900. Despite the larger bearish backdrop, risk to rewards favor the upside at the moment unless we break below $3900, targeting $3825 to the downside. One name that has been making the news and crossed our scans last week is Cathie Wood’s ARKK. Printing a Weekly -13 Setup signals exhaustion to the downside and an opportunity to play for a bounce higher. It still sits below the weekly conversion line, but a break higher would target $54 weekly base line, roughly 20% higher. We are using this opportunity to play for a bounce in the markets with ARKK using a Call Debit Spread to reduce our overall risk in a bearish market.

Buy to Open Nov 18 $45/$54 Call Vertical @ $2.72 Debit

ARKK Trade Setup

ARKK – Weekly

$BA, $BEAM

DailyPlay – Closing Trades (BA, BEAM) – September 14, 2022

Closing Trades

- BA – 122.47% Gain: Sell to Close 2 Contracts Sept 16, 2022 $160/$145 Call Verticals @ $10.79 Credit. DailyPlay Portfolio: By Closing the remaining 2 of the 4 Contracts, we will be receiving $2,158. We took partial profits for this trade on September 6 at a $7.52 Credit. Therefore, the average gain on this trade is 88.76% and the average cost basis to exit this trade is $9.16 Credit

- BEAM – 132.65% Gain: Sell to Close 2 Contracts Sept 16, 2022 $60/$50 Put Verticals @ $5.70 Credit. DailyPlay Portfolio: By Closing the remaining 2 Contracts, we will be receiving $1,140. We took partial profits for this trade on August 18 at a $4.30 Credit, and then again on August 30 at a $5.22 Credit. Therefore, the average gain on this trade is 99.18% and the average cost basis to exit this trade is $4.88 Credit.

Investment Rationale

Equities sold off heavily yesterday with SPX down over 4% and Nasdaq over 5% on the day after a higher than expected CPI print. The Daily SPX cloud model has now retraced back into the cloud and near $3900 support, if broken, we will likely see the next support at $3825. We are taking this opportunity to close out short positions that are now profitable and near expiration.

Close remaining BA position @ $10.79 Credit.

Closing remaining BEAM position @ $5.70 Credit.

$HLT

DailyPlay – Opening Trade (HLT) – September 13, 2022

HLT Bearish Trade Idea

View HLT Trade

Strategy Details

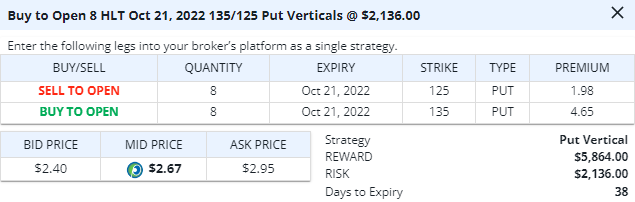

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 8 Contracts October 21, 2022 $135/$125 Put Vertical Spreads @ $2.67 Debit.

Total Risk: This trade has a max risk of $2,136 (8 Contracts x $267).

Counter Trend Signal: This is a Bearish trade on a stock that is experiencing a mildly bullish trend.

1M/6M Trends: Bullish/Mildly Bullish

Technical Score: 6/10

OptionsPlay Score: 150

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

As the equity market continues a grind higher into resistance levels, we are starting to take a look at bearish opportunities in consumer names that are showing signs of exhaustion and underperformance. HLT has been a name that has stuck out with an unreasonably premium valuation relative to its peers, while starting to shows signs of exhaustion after a near 30% rally from the June lows. Additionally, it is trading up against the weekly cloud bottom and base line which converge at $138 forming a strong level of resistance. Coupled with the Daily Setup +13 count that we printed on yesterday, I’m looking for a reversal lower back towards the $120’s.

Buy to Open HLT Oct 21 $135/$125 Put Vertical @ $2.68 Debit.

HLT – Weekly

$HSY, $XLF, $NEM

DailyPlay – Closing Trades (HSY, XLF, NEM) – September 12, 2022

Closing Trades

- HSY – 55.92% Gain: Buy to Close 2 Contracts October 7, 2022 $230/$240 Call Vertical Spreads @ $1.75 Debit. DailyPlay Portfolio: By Closing 2 of the 3 Contracts, we will be paying $350.

- XLF – 85.29% Gain: Buy to Close 30 Contracts September 16, 2022 $33/$32 Put Vertical Spreads @ $0.05 Debit. DailyPlay Portfolio: By Closing all 30 Contracts, we will be paying $150.

- NEM – 86.96% Loss: Sell to Close 6 Contracts Sept 16, 2022 $45/$50 Call Verticals @ $0.21 Credit. DailyPlay Portfolio: By Closing the remaining 6 of the 12 Contracts, we will be receiving $126. We took partial profits for this trade on September 2 at a $0.14 Credit. Therefore, the average loss on this trade is 89.13% and the average cost basis to exit this trade is $0.18 Credit.

Investment Rationale

After a small rally last week, markets will likely continue higher to test the major resistance area of $4106-$4283 with opportunities to seek bearish exposure on any further strength. Gold and Bonds remain just above a major support level and Bitcoin near a major resistance level. Look for breaks of these key levels in the coming weeks for large potential opportunities. We are using this time to reduce long exposure and take profits on short positions that are near take profit levels.

SPX – Daily

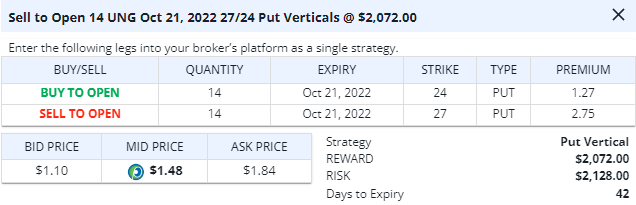

$UNG

DailyPlay – Opening Trade (UNG) – September 9, 2022

View UNG Trade

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 14 Contracts October 21, 2022 $27/$24 Put Vertical Spreads @ $1.48 Credit.

Total Risk: This trade has a max risk of $2,128 (14 Contracts x $152).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a mildly bearish trend.

1M/6M Trends: Mildly Bearish/Bullish

Technical Score: 1010

OptionsPlay Score: 108

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

Before the market open on Monday, Rick laid out a bearish tactical case for Natural Gas given the excessive bullishness from traders despite a bullish longer-term view. With Natural gas now over 21% lower in 2 weeks and 12% in the past 4 trading sessions, I see an opportunity to play for a neutral bounce. This also coincides with a -9 Setup on the Daily Chart and the Daily Cloud top acting as a level of support for natural gas. Additionally, the elevated implied volatility on this selloff provides an opportunity to harvest volatility by selling a Put Vertical for nearly 50% of the vertical width.

Sell to Open Oct 21 $27/$24 Put Vertical @ $1.48 Credit.

UNG – Daily