$BA

DailyPlay – Opening Trade (BA) Closing Trades (ADI, CRM) Partial Closing Trades (VALE, BEAM) – August 23, 2022

Closing Trades

- ADI – 53.85% Gain: Buy to Close 1 Contract Aug 26, 2022 $165/$175 Call Verticals @ $1.80 Debit. DailyPlay Portfolio: By closing the remaining 1 of 3 Contracts, we will be paying $180. We Closed 2 of the 3 Contracts of this trade on August 2 at $6.30 Debit. Therefore, the average loss on this trade is –34.62% and the average cost basis to exit this trade is $4.80 Debit.

- CRM – 1.60% Loss: Buy to Close 1 Contract Sept 2, 2022 $175/$160 Put Verticals @ $4.45 Debit. DailyPlay Portfolio: By closing the remaining 1 of 2 Contracts, we will be paying $445. We took partial profits for this trade on August 10 at $3.57 Debit. Therefore, the average gain on this trade is 8.45% and the average cost basis to exit this trade is $4.01 Debit.

Partial Closing Trades

- VALE – 51.85% Loss: Sell to Close 25 Contracts Sept 2, 2022 $13.50/$14.50 Call Verticals @ $0.13 Credit. DailyPlay Portfolio: By closing 25 of 70 Contracts, we will be receiving $325.

- BEAM – 164.08% Gain: Sell to Close 2 Contracts Sept 16, 2022 $60/$50 Put Verticals @ $6.47 Credit. DailyPlay Portfolio: By closing the remaining 2 of 4 Contracts, we will be receiving $1,294.

BA Bearish Opening Trade Signal

View BA Trade

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish

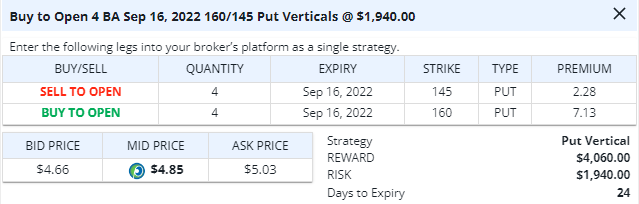

Details: Buy to Open 4 Contracts Sept 16, 2022 $160/$145 Put Verticals @ $4.85 Debit.

Total Risk: This trade has a max risk of $1,940 (4 Contracts x $485 per contract).

Counter Trend Signal: This is a Bearish trade on a stock that is experiencing a neutral trend.

1M/6M Trends: Neutral/Neutral

Technical Score: 3/10

OptionsPlay Score: 135

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

Stocks got hammered yesterday on follow-through selling from Friday’s fall, as well as an increasing belief that Fed Chair Powell will be far more clearly hawkish at his press conference this Friday from Jackson Hole. (10am ET.) The two-day drop was a hefty 200 SPX points – a rather large move of almost 5% from high to low. As I write this commentary on Monday evening, I see the S&P futures up about 20 bps., and it wouldn’t surprise me if we see some midday strength today to take some of the decline away. However, as I said in Monday’s AM webinar, I think the SPX gets to the mid- to low-4000s on this corrective down move, so I’ll still be looking to lean into charts that appear to be fading from the summer rally.

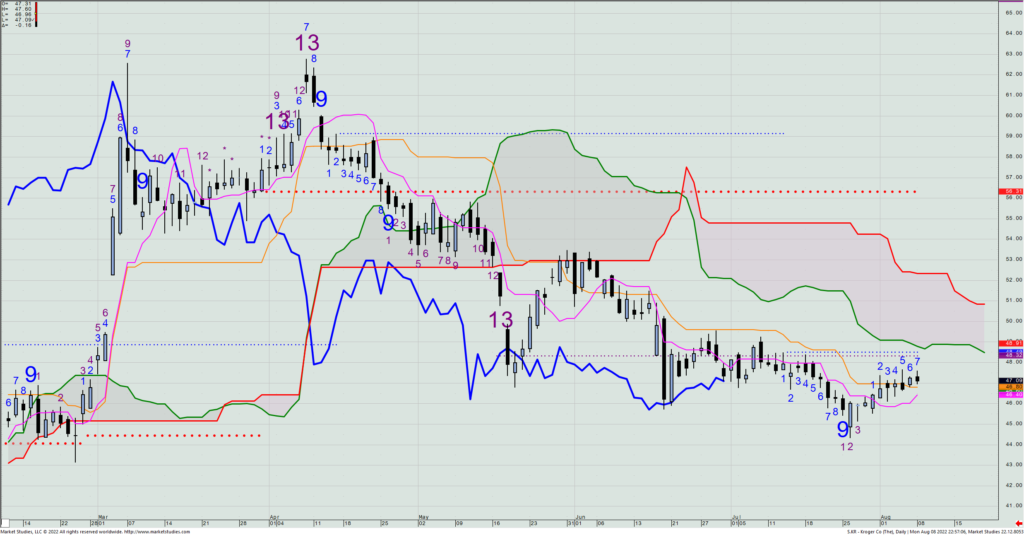

One such name is a big Daddy-O type one: it’s Boeing (BA). Its weekly chart shows a Setup +9 two weeks ago, and its daily chart now shows a bearish “island reversal” pattern upon yesterday’s gap down that offset the late-July gap higher. This after marking a daily Sequential +13 reading on the gap up, and a complete stall against a prior support level.

BA – Daily

Put these together, and we’ll look to buy a September 16th $160/$145 put spread. On Monday, that closed at $4.845, and I don’t want to buy it for any more than that (and preferably less today should we see the overall market move higher in the first half of the day).

POSITION CHANGES:

- We are short an ADI August 26th $165/$175 call spread that expires on Friday. There are now both daily and weekly support levels very close to the current price. Let’s close this out today with what showed a 54% profit as of Monday’s closing mid prices.

- We are short a CRM September 2 $175/%$160 put spread that we are at breakeven on. Let’s close that out today.

- We’re long VALE September 2 $13.5/$14.5 call spreads, and now down 52% on them. Let’s exit today 25 of the 70 spreads we have on.

- We’re still long 4 of the original 8 BEAM September 16th $60/$50 put spreads. We’re up $164% on this portion, so we’ll remove 2 of the 4 today.

$BKR

DailyPlay – Opening Trade (BKR) – August 22, 2022

Bullish Opening Trade Signal

Strategy Details

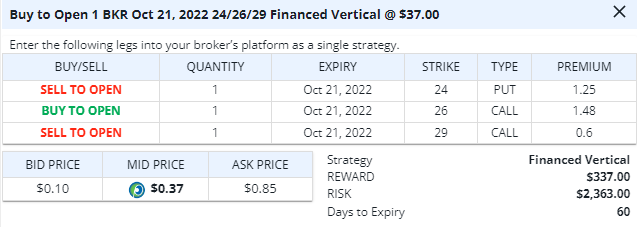

Strategy: Long Call Spread Risk Reversal

Direction: Bullish

Details: Buy to Open 1 Contract October 21, 2022 $24/$26/$29 Call Spread Risk Reversal @ $0.37 Credit.

Total Risk: This trade has a max risk of $2,363 (1 Contract x $2,363).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a neutral to bearish trend.

1M/6M Trends: Neutral/Bearish

Technical Score: 4/10

OptionsPlay Score: 125

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

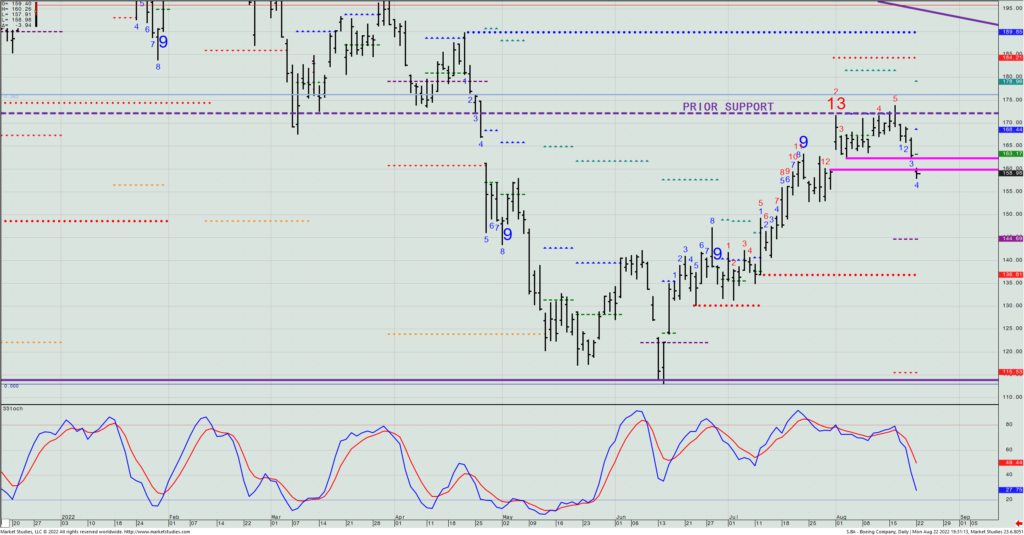

Today’s DailyPlay is Baker Hughes Company (BKR), which is currently down 40% from its all-time highs. If we look at the OIH ETF (Oil Services EFT), of which BKR is part of, we see a very clear uptrend over the last few years. OIT has pulled back towards the trendline and now we have seen a bounce higher, which is likely going to continue. When we look at the chart of BKR, we see the same clear uptrend where we pulled back to after the 40% decline, and we believe that this is where it will bounce higher and continue higher. Looking at the relative performance of BKR to OIH, we can see that BKR is trading largely on par with the ETF, we, therefore, expect both BKR and OIH to bounce higher, with BKR most probably outperforming this ETF.

BKR – Weekly

$TLT

DailyPlay – Closing Trade (TLT) – August 19, 2022

Closing Trade

- TLT -107.58% Gain: Sell to Close 3 Contracts Aug 26, 2022 $118.50/$114.50 Put Verticals @ $2.74 Credit. DailyPlay Portfolio: By closing 3 of 6 Contracts, we will be receiving $822. We Closed 6 of the 12 Contracts for this trade on August 12 at a $2.77 Credit. Therefore, the average gain on this trade was 109.1% and the average cost basis to exit this trade is $2.76 Credit.

Investment Rationale

The SPX is now but 1% beneath its 200-DMA, and I’d fully expect computer-driven funds to get even more bullish if that oft-watched level is exceeded, especially in the low volatility / high momentum environment. And that’s why I am using a whole range of SPX 4270 to 4500 to lighten my overall equity market exposure, rather than trying to pick the perfect day to sell out of an entire portfolio constructed over many years and a variety of entry points. (Honestly, that just wouldn’t make sense to do.)

Today is yet another summer Friday, which also means it’s a weekly option expiration session, too. And from what I’ve read, there are some $2 trillion of options going off the board today, so expect some real intraday swings as dealers need to unwind their positions. I wouldn’t be surprised to see the SPX gravitate toward 4300, as it has ~23,000 option contracts still open for today’s expiration, almost evenly split between calls and puts. That’s roughly more than the combined open interest of all other contracts that are +/- 50 points of 4300.

I do want to do one trade adjustment today, closing out 3 of the 6 remaining short TLT Aug. 26th $118.50/$114.50 put spread we still have of the original trade. (We previously took off 6 of the 12.) UST 10-yr. rates have again stalled at initial resistance at 2.91%, so let’s take more profit on this trade as we’re up 107% on this portion.

TLT – Daily

Additionally, Monday’s conditional DP in XLV did not get its necessary upside breakout for us to buy the

Enjoy the summer weekend.

$BEAM, $UAL, $VLX

DailyPlay – Closing Trades (BEAM, UAL) Conditional Trade (XLV) – August 18, 2022

Closing Trades

- BEAM – 75.51% Gain: Sell to Close 4 Contracts Sept 16, 2022 $60/$50 Put Verticals @ $4.30 Credit. DailyPlay Portfolio: By closing 4 of the 8 Contracts, we will be receiving $1,720.

- UAL – 61.39% Loss: Buy to Close 3 Contracts Aug 19, 2022 $38/$47 Call Verticals @ $1.17 Debit. DailyPlay Portfolio: By closing the remaining 3 of 6 Contracts, we will be paying $351. We Closed 3 of the 6 Contracts for this trade on July 27 at a $0.98 Debit. Therefore, the average loss on this trade was -64.53% and the average cost basis to exit this trade is $1.08 Debit.

Conditional Trade

- XLV – On August 16th we published a Conditional Trade for XLV. As XLV did not meet the Condition, we are canceling this DailyPlay trade.

Investment Rationale

We finally saw some profit-taking yesterday in the market as some major earnings reports disappointed vs. expectations. I do believe we’ll be seeing more of these disappointments as time goes forward into the fall, and it is just one of the reasons that I think the risk now to buying stocks is higher than the potential likely reward.

Yesterday we put on a bearish put spread in BEAM, and with the stock having sold off 6.3% on Tuesday, the trade is already up some 75%. That’s a heck of a good one-day return, and as such, I’m going to suggest we take 4 of our 8 contracts off today to lock in the solid gain.

BEAM – Daily

Additionally, Monday’s conditional DP in XLV did not get its necessary upside breakout for us to buy the call spread. I am officially canceling the idea.

BEAM

DailyPlay – Opening Trade (BEAM) Closing Trades (AAPL, HD) – August 17, 2022

Closing Trades

AAPL – 144.90% Loss: Buy to Close 3 Contracts Aug 26, 2022 $155/$165 Call Verticals @ $9.60 Debit. DailyPlay Portfolio: By closing all 3 Contracts, we will be paying $2,880.

HD – 60.19% Loss: Sell to Close 3 Contracts Sept 16, 2022 $310/$285 Put Verticals @ $2.52 Credit. DailyPlay Portfolio: By closing all 3 Contracts, we will be receiving $756.

Bearish Opening Trade Signal

View BEAM Trade

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish

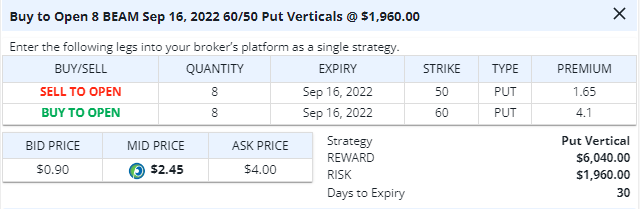

Details: Buy to Open 8 Contracts Sept 16, 2022 $60/$50 Put Verticals @ $2.45 Debit.

Total Risk: his trade has a max risk of $1,960 (8 Contracts x $245 per contract).

Counter Trend Signal: This is a Bearish trade on a stock that is experiencing a neutral to bullish trend.

1M/6M Trends: Neutral/Bullish

Technical Score: 3/10

OptionsPlay Score: 157

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

Another up day for stocks, as the bulls can’t seemingly get their hands on enough shares to keep them satiated; they just come back each day for more. And we’re really happy about that, as we’ve been bullish the market since July and have been capturing the upmove. That being said, you know that I am very gingerly starting to get less bullish over time, and will be using the following month or so to reduce my equity exposure, using a combination of selling covered calls, shorting futures, shorting SPY and/or QQQ, and simply selling out of certain of my personal holdings as I see individual names reach targets that I am happy to say “au revoir” to after having held many of them for years.

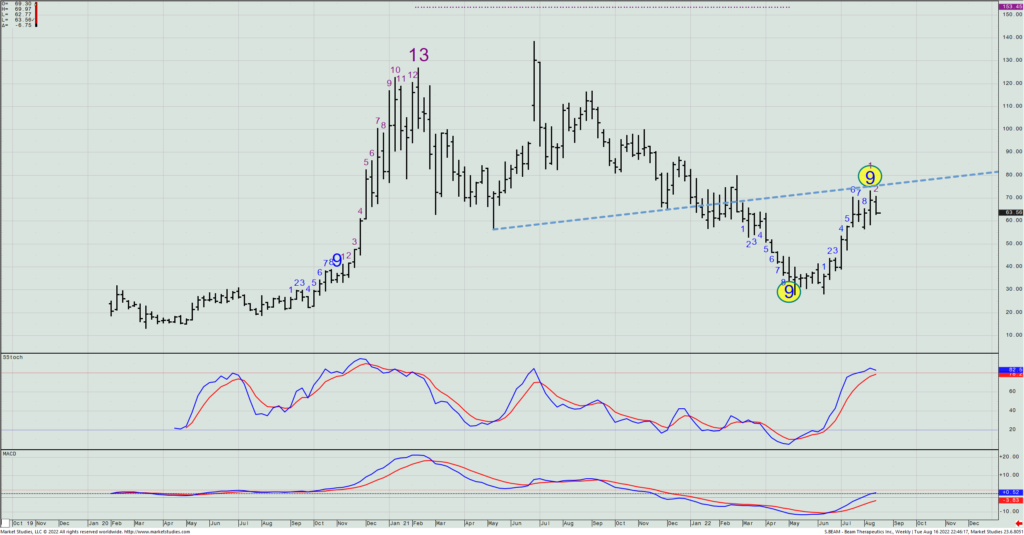

For a new trading idea for today, let’s look at one of the top 10 weighted holdings in Cathy Woods’ ARKK fund, Beam Therapeutics (BEAM). The name has less than three years of price history, and like many names in her flagship fund, was decimated earlier this year, but rebounded nicely since its bottom in May. But here’s the thing about its recent price action: it has gone nowhere in the past month while the market has zoomed upward.

Looking at the weekly chart, we see a Setup -9 one week before this year’s low, and now an opposite Setup +9 one week before its recent high last week. This makes it a significant underperformer this summer, and a candidate for lower prices on any corporate-specific negative news or just the whole market coming off.

BEAM – Weekly

The daily chart shows an Aggressive Sequential -13 one day before this year’s low, and a +13 one day after the rally’s high (just a few days ago).

BEAM – Daily

Put this data altogether, and we have a reason to now be bearish the name. As such, we are going to buy a BEAM September 16th $60/$50 put spread for $2.45 (based on Tuesday’s closing mid prices). The cost represents just 25% of the strike differential (but realize that it is also out of the money by ~ $3.50).

$HD

DailyPlay – Opening Trade (HD) – August 15, 2022

Bullish Opening Trade Signal

View HD Trade

Strategy Details

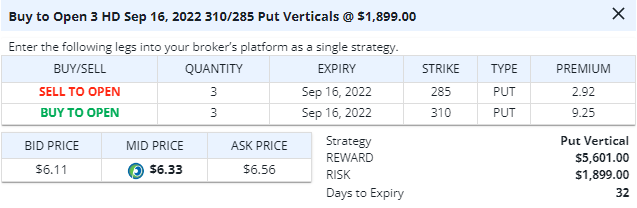

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 3 Contracts Sept 16, 2022 $310/$285 Put Verticals @ $6.33 Debit.

Total Risk: This trade has a max risk of $1,899 (3 Contracts x $633 per contract).

Counter Trend Signal: This is a Bearish trade on a stock that is experiencing a bullish trend.

1M/6M Trends: Bullish/ Mildly Bullish

Technical Score: 4/10

OptionsPlay Score: 125

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

Today’s DailyPlay trade is Home Depot (HD). We have seen a fair amount of decrease in the construction industry, which we expect to reflect in the earnings for HD this week. The stock has already declined by 30% since its peak, and lately, it had a significant bounce higher, but it is currently trading at a key level of $315. This level used to be a key support level, which has now turned into a key resistance level. When we look at the Relative Performance chart, we can see that HD is aiming toward the downside relative to its sector, which is an indication that fewer buyers are stepping in and that some buyers are getting out of their positions. The Home Construction numbers for June were lower than expected and we, therefore, believe that HD will trend lower after the earnings announcements this week. Finally, HD is currently trading at about 18 X next year’s earnings which are above the average of 14 X compared to its main competitor’s lows.

HD – Daily

$TLT

DailyPlay – Partial Closing Trade (TLT) – August 12, 2022

Partial Closing Trade

TLT -109.85% Gain: Sell to Close 6 Contracts Aug 26, 2022 $118.50/$114.50 Put Verticals @ $2.77 Credit. DailyPlay Portfolio: By closing 6 of 12 Contracts, we will be receiving $1,662

$VALE

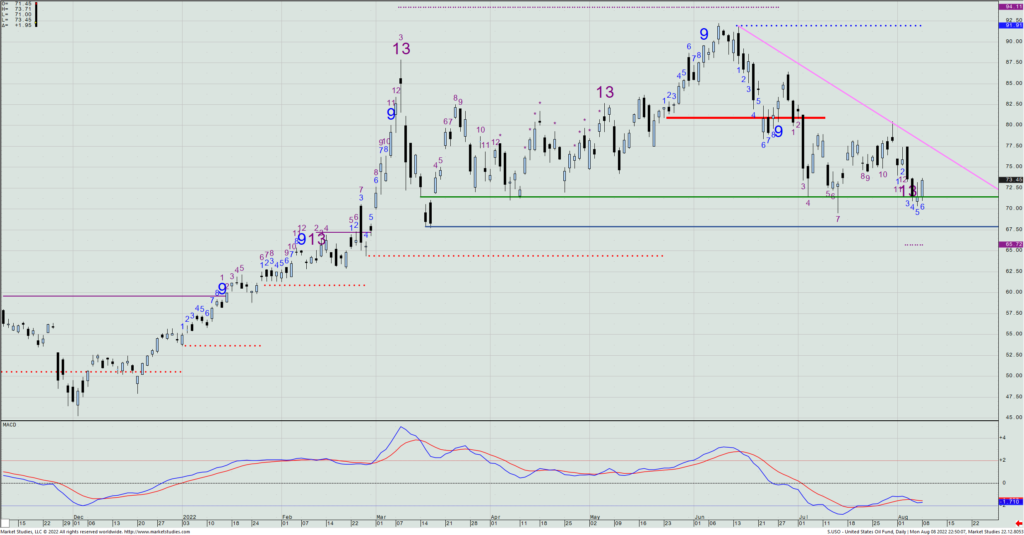

DailyPlay – Opening Trade (VALE) Closing Trade (USO) – August 11, 2022

Closing Trades

USO -40.00% Gain: Buy to Close 1 Contract Aug 12, 2022 $73/$83 Call Verticals @ $1.83 Debit. DailyPlay Portfolio: By closing the remaining 1 of 3 Contracts, we will be paying $183. We took partial profits for this trade on August 5 and then again on August 9. Therefore, the average gain on this trade is roughly 42% and the average cost basis to exit this trade is $1.76 Debit.

Bullish Opening Trade Signal

Strategy Details

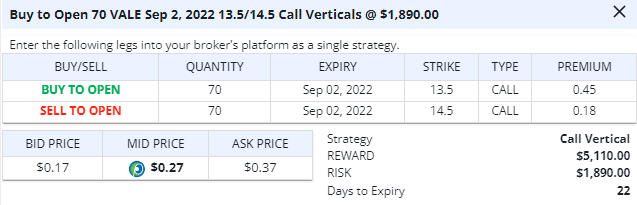

Strategy: Long Call Vertical Spread

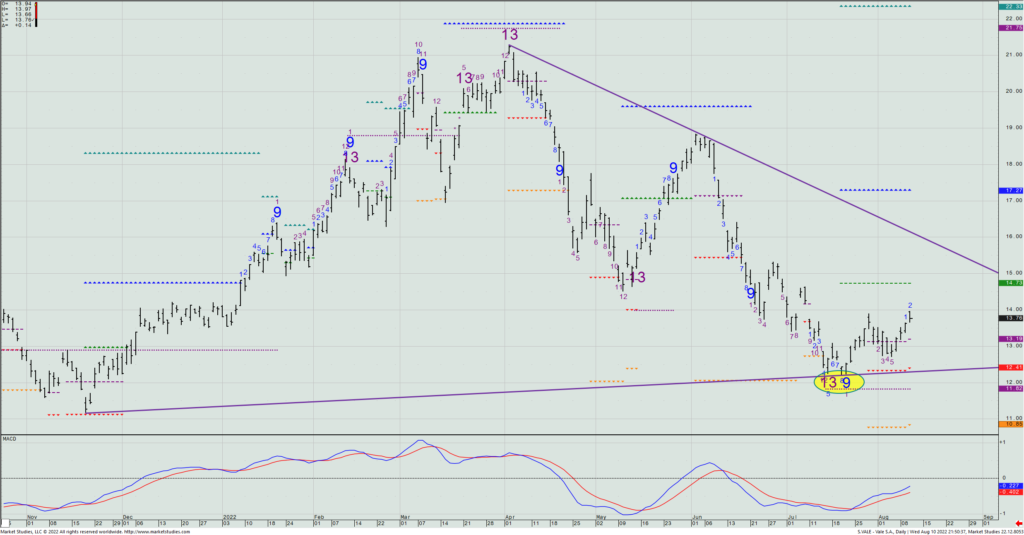

Direction: Bullish

Details: Buy to Open 70 Contracts Sept 2, 2022 $13.50/$14.50 Call Verticals @ $0.27 Debit.

Total Risk: This trade has a max risk of $1,890 (70 Contracts x $27 per contract).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a mildly bullish to bearish trend.

1M/6M Trends: Mildly Bullish/Bearish

Technical Score: 3/10

OptionsPlay Score: 171

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

Stocks zoomed higher again on Wednesday, fueled by what investors took as a softened inflation outlook. The SPX crossed above 4200, and is getting closer to the area (4270+) where I will likely start to fade the rally. We’re starting to see a real shift higher in bullish sentiment, and the more I hear people say, “You can’t be short”, the more I will look to find the places that we can be. Fading moves takes patience, so I haven’t been in a hurry to do that. In fact, I’ve consistently said that there was more upside likely coming – and it has. Thus, things are looking like they are playing out the way I was anticipating they would. We’ll see if today’s PPI report leads to more buying.

Turning towards our short USO $73/$83 that expires tomorrow, yesterday’s oil inventory report was a well higher stockpile build than expected, and oil should have had a decent selloff. However, it got dragged higher by “Risk-On” buyers, and the corresponding USO ETF closed at $74.32. Make sure you close out the last contract we still have on sometime today.

USO – Daily

I’m also looking to get into a long VALE Sept. 2nd $13.5/$14.5 call spread. If we’re going to see a final squeeze on the shorts in beaten-down names (this is a copper-related one), then this should also see an upward thrust that takes out the naysayers. This spread costs $0.27 (so 27% of the spread differential), and is already in-the-money by 26 cents, so I look at it as a relatively cheap option to play for that upside over the next three-plus weeks.

VALE – Daily

$NEM

DailyPlay – Opening Trade (NEM) Closing Trades (UBER, VRTX) Partial Closing Trade (CRM) – August 10, 2022

Closing Trades

- UBER – 98.39% Gain: Buy to Close 1 Contract Aug 19, 2022 $22.50 Put @ $0.02 Debit. DailyPlay Portfolio: By closing 1 Contract, we will be paying $2. Initially, we only opened 1 Contract, which we are now closing.

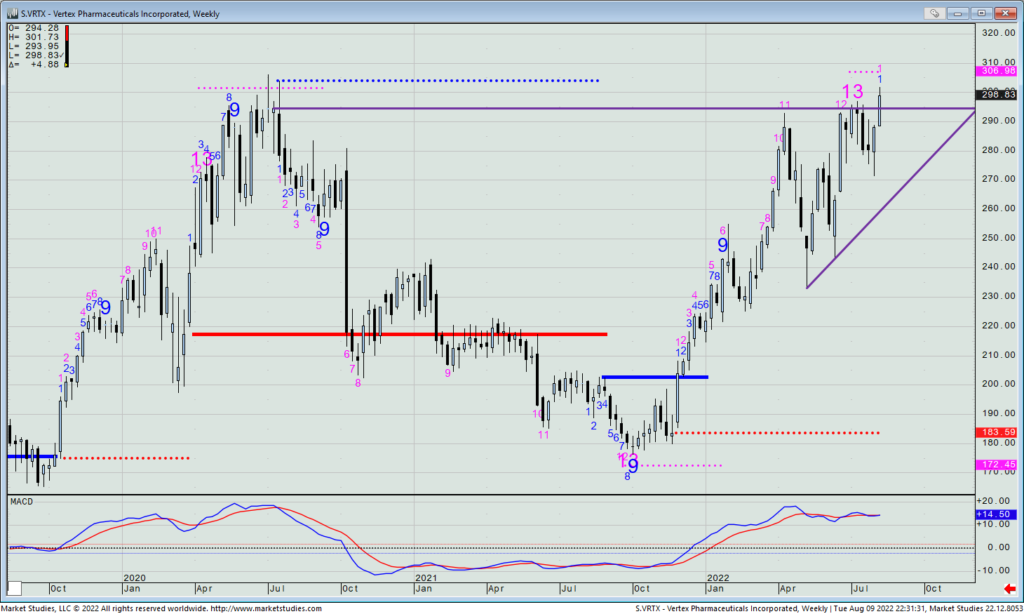

- VRTX – 24.61% Loss: Buy to Close 1 Contract Aug 19, 2022 $290/$310 Call Verticals @ $9.47 Debit. DailyPlay Portfolio: By closing the remaining 1 of 2 Contracts, we will be paying $947. We took partial profits for this trade on August 2 at a $2.73 Debit. Therefore, the average gain on this trade is 23.55 % and the average cost basis to exit this trade is $5.81 Debit.

Partial Closing Trade

- CRM -18.49% Gain: Buy to Close 1 Contract Sept 2, 2022 $175/$160 Put Verticals @ $3.57 Debit. DailyPlay Portfolio: By closing 1 of the 2 Contracts, we will be paying $357.

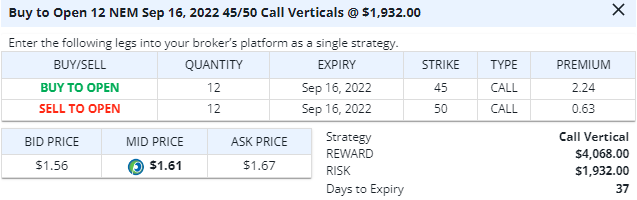

Bullish Opening Trade Signal

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 12 Contracts Sept 16, 2022 $45/$50 Call Verticals @ $1.61 Debit.

Total Risk: This trade has a max risk of $1,932 (12 Contracts x $161 per contract).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 2/10

OptionsPlay Score: 118

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

Stocks took a minor breather yesterday as tech names were hit hardest after Micron disappointed investors. The SPX is still up against general resistance in the 4150 neighborhood, and less bullish traders are taking some profits on recent purchases.

For today’s DP, I noticed that Newmont Goldcorp (NEM) now has a weekly Setup -9 count that is also in the vicinity of its 6-yr. uptrend line from the secular lows in late-2015. As such, and with the VIX near its lows for most of this year, we’ll look to buy a NEM Sept. 16th $45/$50 call spread. Yesterday, this went out at $1.92, and has a very reasonable cost of just 26% of the strike differential.

If the VIX had been nearer 30 (than the current sub-22), I’d really prefer to play this by selling a $45/$37.5 put spread, but there’s just no juice in selling most options right now.

NEM – Weekly

We’re also short two CRM Sept. 2nd $175/$160 put spreads. The stock has stalled right at resistance and yesterday broke beneath its near-term uptrend line. Let’s remove one of those two contracts today.

CRM – Daily

Let’s also close out our short UBER August 19th $22.5 put. We’ve taken out almost the entire value of what we collected (~98%) and with a Setup +9 count against prior TDST resistance, there’s just no reason not to run with what we already have made.

UBER – Daily

Lastly, let’s close out of our short 1 contract of the VRTX August 19th $290/$310 call spread. We’re down about 25%, but with it having reported earnings last week and beaten estimates, we run the risk that this goes up to that $310 area. (When I can, I like taking small losses.)

VRTX – Weekly

$USO, $KR

DailyPlay – Partial Closing Trades (USO, KR) – August 9, 2022

Partial Closing Trades

- USO – 44.26% Gain: Buy to Close 1 Contract Aug 12, 2022 $73/$83 Call Verticals @ $1.70 Debit. DailyPlay Portfolio: By closing 1 of the 3 Contracts, we will be paying $170. We closed the 1st of 3 contracts on August 5th and have 1 contract remaining.

- KR – 83.87% Gain: Buy to Close 28 Contracts Aug 12, 2022 $45/$44 Put Verticals @ $0.05 Debit. DailyPlay Portfolio: By closing all 28 Contracts, we will be paying $140.

Investment Rationale

Monday saw but a 12 bps. loss for the SPX, despite some lousy earnings reports out that, could have made for a far worse loss than the 5 pt. drop. So, again, we are seeing a market get bearish news, but not sell-off. That usually means that there is still more upside room to go, as trapped shorts from lower levels are simply not given a chance to get out anything near breakeven. Short squeezes can be and are often vicious.

Today we will take off one of the two remaining USO short $73/$83 spread contracts we have that expire this Friday. Last week we took off the first of three, and with the USO going out on Monday at $73.54, it’s just too close to the $73 strike to do much else with it. (As a reminder, every Wednesday at 10:30am ET the oil market gets the weekly API inventory report. It’s basically the biggest news driver for the oil market each week.) So, tomorrow’s number will determine if that last contract we have on will be a winner or loser. (If you are not comfortable in taking that “gamble” to play that news, then feel free to exit the trade today. We’ve made money in it.)

USO – Daily

We’re also short an August 5th XLC $55/$61 call spread, so we’re running out of time for this to work. The We also have a short KR $45/$44 put spread that expires Friday, with 28 contracts on. With that position up 84% with just a few days to go, let’s take off 10 of the contracts today.

KR – Daily