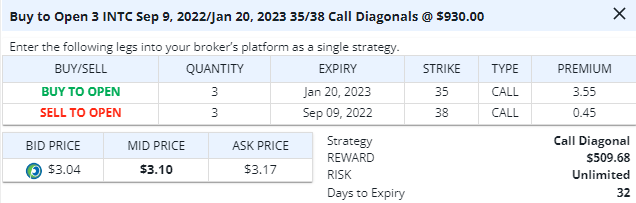

$INTC

DailyPlay – Opening Trade (INTC) – August 8, 2022

Bullish Opening Trade Signal

Strategy Details

Strategy: Long Call Diagonal Spread

Direction: Bullish

Details: Buy to Open 3 Contracts (Buy Jan 20, 2023 $35) / (Sell Sept 9, 2022 $38) Call Diagonals @ $3.10 Debit.

Total Risk: This trade has a max risk of $1,866 (3 Contracts x $622 per contract).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 2/10

OptionsPlay Score: 112

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform. Finally, the Risk for this trade is not Unlimited, but $622 per contract.

Investment Rationale

With INTC currently trading at a long-term support level of $35, we expect some market memory to come into play here. This is the price level from where INTC broke higher in 2017, and has now retraced towards. With regards to the sentiment on this stock, 26% of analysts have a BUY rating, they don’t expect EPS and revenue growth until 2024 and they have reached peak bearish sentiment. Therefore, the sentiment on the street is seen as overly bearish which leads us to take a contrarian stand on this stock. We will therefore be taking some Long exposure.

INTC – Daily

DailyPlay Update – August 5, 2022

It’s another summer Friday. Boy, do they come quickly. But to most of us, we’re glad to see the rally last that started last Wednesday when the Fed again raised rates. Despite several Fed governors telling us earlier this week that they were not done tightening – the very opposite of the supposed reason behind the equity market’s rally – they’ve continued to edge higher.

So, when you think it through, there clearly was some other reason that stocks have not sold off after the clarification of the Fed still needs to push yields higher. If it’s as simple as I suggested yesterday – that the bearish positioning was so strong that two weeks ago’s rally is pushing to a five-week high and also seeing price extend up above the weekly Conversion Line – then this rally is more than halfway done. (Bear market rallies can be vicious.) However, if it’s the real McCoy (i.e. If this is real buying largely fueled by new money coming into the market (rather than shorts bidding up stocks to cover bad positions) then any pullback to support needs to be bought.

I’m definitely in the camp of the former and think that when we see most convinced that new 2022 highs will come later this year – then, and only then, will I really play for a down move that potentially comes lethally and swiftly – for there will be few to no shorts left to cushion the decline, and few buyers to bid for stocks they already bought higher.

In the meantime, the SPX has reached an obvious resistance level in the 4150 +/- 1% area where we saw it previously break down from. Let’s see what today brings with oil still tailing off and whether there will be continued enthusiasm that inflation has peaked.

And lastly, start planning on what you will do if the market continues higher. Buy more? Thankfully sell? Or just hold (and deal with the future ups and downs at a later time)?

Though oil has finally gone our way with just a week to go before the expiration of our short Aug. 12th USO $73/$83 call spread, let’s take off one of the three contracts we have on to lock some profit. The daily chart posted a Sequential -13 on Wednesday, so better safe than sorry.

USO – Daily

Enjoy your weekend.

– Rick Bensignor

Chief Market Strategist

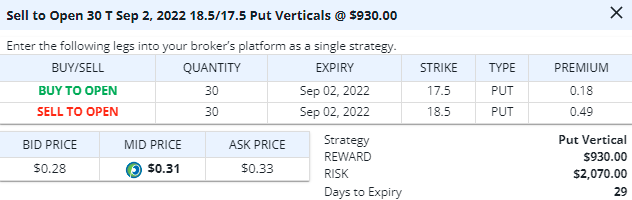

$T

DailyPlay – Opening Trade (T) – August 4, 2022

Bullish Opening Trade Signal

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 30 Contracts Sept 2, 2022 $18.50/$17.50 Put Verticals @ $0.31 Credit.

Total Risk: This trade has a max risk of $2,070 (30 Contracts x $69 per contract).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 5/10

OptionsPlay Score: 80

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

Bulls and squeezed bears continue to push stocks higher, even with Fed officials contradicting investors’ beliefs that they were “pivoting” to a more dovish view. (I told you immediately after last week’s Powell press conference that they were not, and that the Street had that interpretation wrong.) Nonetheless, the market continues to rip, and has significantly gained since the FOMC rate adjustment last Wednesday.

Something is amiss, given that the “No, we’re not done” statements didn’t undo the rally. In theory, it should have more than Tuesday’s one-day decline. Which means one very important thing to me: Bearish positioning was so strong that not even bad news can get the market down enough to give the shorts an out, leading me to think that we still need to do more upside squeezing before the market can actually fall again

Today, I’m looking at putting on a bullish play in a beaten down, unloved name: AT&T (T). Its weekly chart shows it still holding above its uptrend line; support from prior highs; and, by chance, now also shows its first daily Sequential -13 downside exhaustion signal of the year.

- You could simply choose to buy the stock outright.

- You could choose to buy a call spread.

- You could choose to sell an at-the-money or slightly in-the-money put

- You could choose to sell a put spread.

I’m not going to lay out each and every one of those idea’s trade parameters, but I’ll simply lay out selling a September 2nd $18.50/$17.50 put spread for what yesterday closed at $0.305. You’re collecting ~31% of the strike differential, and if exercised you’re essentially buying the stock at about $18.20, a bit lower than it is now.

T – Daily

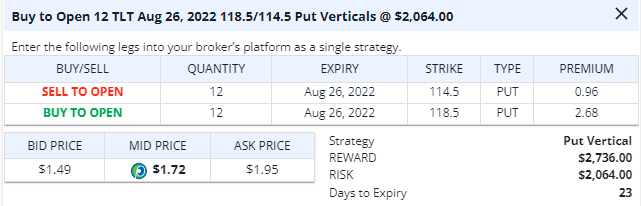

$TLT

DailyPlay – Opening Trade (TLT) – August 3, 2022

Bearish Opening Trade Signal

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 12 Contracts Aug 26, 2022 $118.50/$114.50 Put Verticals @ $1.72 Debit.

Total Risk: This trade has a max risk of $2,064 (12 Contracts x $172 per contract).

Counter Trend Signal: This is a Bearish trade on a stock that is experiencing a bullish trend.

1M/6M Trends: Bullish/Neutral

Technical Score: 4/10

OptionsPlay Score: 107

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please Note that this is a CONDITIONAL TRADE. See the Condition below. The strike prices, premiums, and OptionsPlay Score will therefore be slightly different when the condition is met, and we enter this trade.

Investment Rationale

I’ve recently been telling you that the TLT needs to get Friday closes above $119.42 to potentially create a bigger breakout to $130+. But yesterday’s multiple Fed governor statements that the Fed is “not” done raising rates – something I’ve been saying since last week – along with the UST 10yr. bouncing on the weekly Base Line at 2.58% (to yesterday’s close at 2.74%), makes me think that rates will actually head towards 3% in the near term. If so, we will look to fade the 6-week-long TLT rally.

THE CONDITIONAL TRADE: IF the TLT trades (anytime today or during the rest of this week) up to $118.50 to $119.00, we’ll then look to buy an August 26th $118.50/$114.50 put vertical at the then current mid-price of the spread, playing for the TLT to lose value to break its uptrend line and sell down into the $114 area.

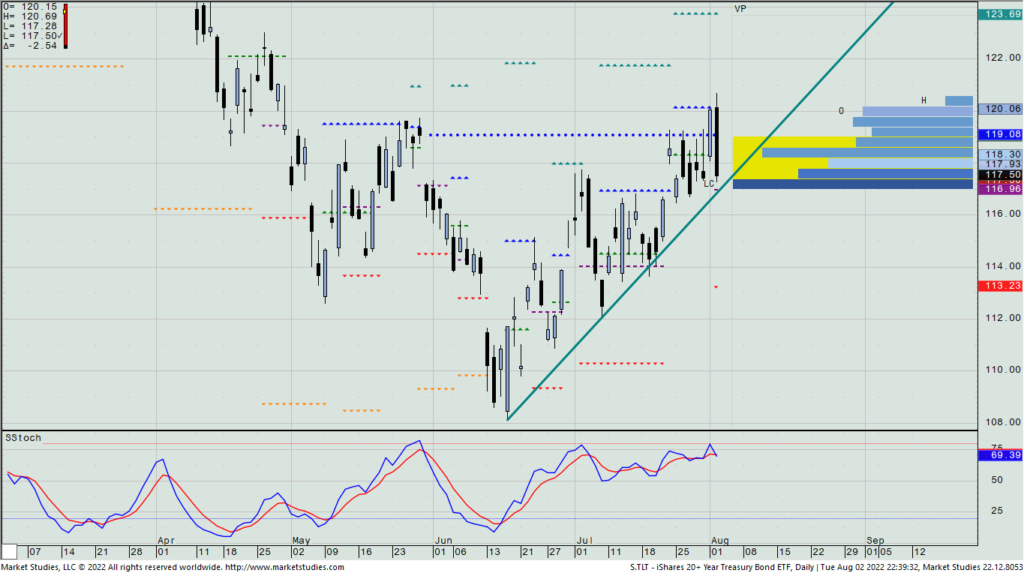

TLT – Daily

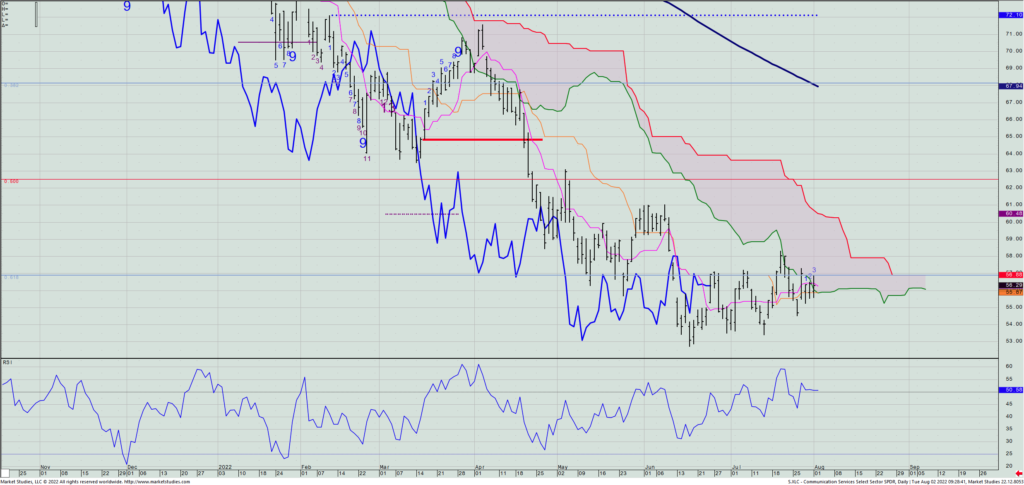

$BDX, $VRTX, $ADI, $DAL, $XLC

DailyPlay – Partial Closing Trades (BDX, VRTX, ADI) Closing Trades (DAL, XLC) – August 2, 2022

Partial Closing Trades

- BDX – 57.41% Gain: Buy to Close 2 Contracts Aug 5, 2022 $237.5/$230 Put Verticals @ $1.15 Debit. DailyPlay Portfolio: By closing 2 of 4 Contracts, we will be paying $230.

- VRTX – 71.71% Gain: Buy to Close 1 Contract Aug 19, 2022 $290/$310 Call Verticals @ $2.15 Debit. DailyPlay Portfolio: By closing 1 of 2 Contracts, we will be paying $215.

- ADI – 61.54% Loss: Buy to Close 2 Contracts Aug 26, 2022 $165/$175 Call Verticals @ $6.30 Debit. DailyPlay Portfolio: By closing 2 of 3 Contracts, we will be paying $1,260.

Closing Trades

- DAL – 53.46% Gain: Sell to Close 6 Contracts Aug 19, 2022 $30/$35 Call Verticals @ $2.44 Credit. DailyPlay Portfolio: By closing the remaining 6 of the 12 Contracts, we will be receiving $2,928. We took partial profits for this trade on July 21 at a $2.73 Credit. Therefore, the average gain on this trade was 62.58 % and the average cost basis to exit this trade is $2.59 Credit.

- XLC – 31.67% Loss: Buy to Close 5 Contracts Aug 5, 2022 $55/$61 Call Verticals @ $2.37 Debit. DailyPlay Portfolio: By closing all of the 15 Contracts, we will be paying $1,185. Note: this was a conditional trade that was closed for a profit at 10am this morning, when the condition described below was met.

Investment Rationale

Equities saw a mild sell-off yesterday, and not something unexpected by me given that Friday’s rally closed right on resistance levels in both the SPY and QQQ. Was this but a one-day decline, or will we see some more? I suspect we’ll see a bit more before another more significant rally occurs over the coming weeks leading into the Jackson Hole meeting that investors will keenly focus on later this month. Between now and then, earnings and interest rates will most likely be the day-to-day driving force behind the market’s moves.

With just 4 trading days to go to expiration of our short August 5th BDX $237.50/$230 put spread, and the stock has closed at $244.71 yesterday, I see a daily Setup +9 count that also shows an overbought MACD move, along with the past 5 days in a row of roughly the same high. That is surely enough for me to take off 2 of the 4 contracts we have on this morning (generally, I don’t usually trade options before 9:50am ET earliest to get past less savvy retail investors’ orders). Moreover, should today also head into the last 20 mins. of trading at a price beneath Friday’s low of $242.02, then we’ll also kick out the remaining 2 contracts by the close.

BDX – Daily

We’re also short an August 5th XLC $55/$61 call spread, so we’re running out of time for this to work. The stock closed yesterday at $56.29, so we’re well within striking distance of the $55 becoming out of the money for the call buyer by then. But with little time left, let’s put a bid in at the same $1.80 we originally shorted it for to potentially wash the trade in the next day or two. If we don’t get filled, we’ll exit on Thursday to avoid being exercised.

XLC – Daily

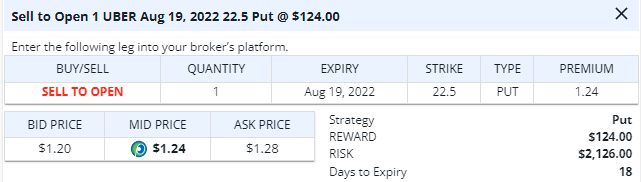

$UBER

DailyPlay – Opening Trade (UBER) – August 1, 2022

Bullish Opening Trade Signal

Strategy Deta

Strategy: Short Put

Direction: Bullish

Details: Sell to Open 1 Contract Aug 19, 2022 $22.50 Put @ $124 Credit.

Total Risk: This trade has a max risk of $2,130 (1 Contract x $2,130 per contract).

Trend Continuation Signal: This is a Bullish trade on a stock that is experiencing a bullish trend.

1M/6M Trends: Bullish/Neutral

Technical Score: 2/10

OptionsPlay Score: N/A

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

By looking at the UBER chart, we can see a primary downtrend since February 2021. Over the last few months, we saw a bottom coming in as an inverted head-and-shoulders formed, and this targets about $28 to the upside which we could see on the earnings catalyst. Another factor to consider for a bullish trade is the comparison between UBER and its biggest rival, LYFT. LYFT’s revenue growth has been half of what we see in UBER. More interesting is the rich Implied Volatility as we are going into earnings. Right now the market is implying a +- 12% move versus the historical average of only +- 5.3% over the last 8 quarters. What we will be doing is to harvest this Implied Volatility by Selling a naked Put option.

UBER Daily

$TAN, $DE

DailyPlay Partial Closing Trade (TAN) Closing Trade (DE) July 29, 2022

Partial Closing Trade

- TAN -69.31% Gain: Buy to Close 1 Contract Aug 5, 2022 $70.50/$61 Put Verticals @ $0.85 Debit. DailyPlay Portfolio: By closing 1 of 3 Contracts, we will be paying $85.

Closing Trade

- DE -99.46% Loss: Buy to Close 2 Contracts Aug 12, 2022 $295/$315 Call Verticals @ $18.35 Debit. DailyPlay Portfolio: By closing 2 of the 2 Contracts, we will be paying $3,670.

Investment Rationale

We’ve just reviewed all open DP positions in our morning webinar. Two charts make me want to adjust positioning:

We are short 3 TAN Aug. 12th $70.5/$61 put spread. With the stock now on a daily +13 and against the stop-out level from a prior +13, let’s take one of the three spreads off today to lock in a 90% profit on that contract.

TAN – Daily

We are short 2 Aug. 12th DE $295/$315 call spread. We’ve lost the same amount equal to the premium we collected, and there’s less than a 10% chance this comes back to work out. Thus, let’s just take our loss before it gets worse and exit this spread today.

DE – Daily

DailyPlay Update – July 29, 2022

Investors have looked extremely favorably at Fed Chair Powell’s remarks from his press conference earlier this week, and have continued on a rampant buying spree to add a 1.2% SPX gain yesterday onto Wednesday’s over 2% gain. With Amazon and Apple providing good numbers after yesterday’s close, I see S&P futures already up near 4100 as I write this Thursday evening. That’s some 450 pts. (or about 12.5%) higher than the intraday low marked just six weeks ago.

Though I strongly believe that this rally will lead to an upcoming solid selling opportunity, for now, it’s another summer Friday and let’s look to see if today finishes strong or sees profit-taking.

Enjoy your weekend.

– Rick Bensignor

Chief Market Strategist

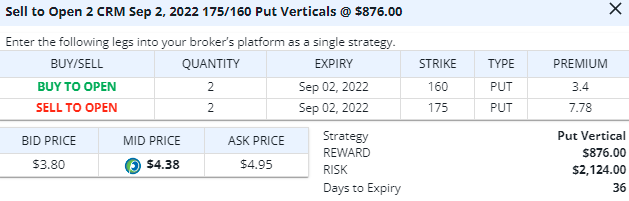

$CRM

DailyPlay – Opening Trade (CRM) – July 28, 2022

Bullish Opening Trade Signal

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 2 Contracts Sept 2, 2022 $175/$160 Put Verticals @ $4.38 Credit.

Total Risk: This trade has a max risk of $2,124 (2 Contracts x $1,062 per contract).

Trend Continuation Signal: This is a Bullish trade on a stock that is experiencing a bullish trend.

1M/6M Trends: Bullish/Neutral

Technical Score: 4/10

OptionsPlay Score: 87

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

The FED has spoken, and although they raised rates by the expected 75 bps., investors were pleased with what Chairman Powell said to ease fears that the economy is not in trouble, moving ever more so dovish-ly as his press conference went on. By the day’s end, the SPX added 2.6% and the Nasdaq a whopping 4%.

As I said in an interview on Tuesday with IG TV in Europe (here’s the link: https://www.ig.com/uk/market-insight-articles/beat-the-street–pre-us-market-open-live-show-220726)

To me, the more the market now rallies, the more the Fed will feel comfortable raising rates later this year. And as such, it would imply that stocks can eventually fall under the pressure of those higher rates, which would also likely lead to more layoffs and the consumer having a more difficult time paying for things than they even have now. If that were to come along with gas prices getting back over $5 – and possibly heading even higher than that (it recently reached over $10/gallon equivalent in the UK) – the Fall could see “The Fall” in equity prices that make new 2022 lows.

But in the meantime, I have been near-term bullish, having suggested that the SPX’s four weeks in a row with roughly the same low (starting the week after the 2022 low was made) was enough to start a move higher – along with now a second week in a row closing above the weekly cloud model’s Conversion Line (another piece of the puzzle I said would be needed to improve the bullish picture).

As such, let’s look to sell a Salesforce (CRM) Sept. 2nd $175/$160 put spread (yesterday the mid- price closed at $4.38). This gives us some breathing room if we see some pullback from Wednesday’s large gains (the stock closed at $180.30), but I’m thinking this could run up to its Base Line (in orange), currently near $194+.

CRM – Weekly

$ACN, $DE, UAL

DailyPlay – Closing Trade (ACN) Partial Closing Trades (DE, UAL) – July 27, 2022

Closing Trade

- ACN -60.53% Gain: Buy to Close 1 Contract July 29, 2022 $280/$270 Put Verticals @ $1.50 Debit. DailyPlay Portfolio: By closing the remaining 1 of 2 Contracts, we will be paying $150. We took partial profits for this trade on July 19 at a $3.80 Debit. Therefore, the average loss on this trade was –1.32% and the average cost basis to exit this trade is $2.65 Debit.

Partial Closing Trades

- DE – 65.76% Loss: Buy to Close 1 Contract Aug 12, 2022 $295/$315 Call Verticals @ $15.25 Debit. DailyPlay Portfolio: By closing 1 of the 2 Contracts, we will be paying $1,552.

- UAL – 67.66% Loss: Buy to Close 3 Contracts Aug 19, 2022 $38/$47 Call Verticals @ $0.98 Debit. DailyPlay Portfolio: By closing 3 of the 6 Contracts, we will be paying $294.

Investment Rationale

Right off the bat, today is Fed Day, so we will not be putting on a new trade today: it would be a complete crap-shoot of which way to play the market’s reaction to whatever news comes from both the 2pm FOMC release, as well as Chairman Powell’s remarks at the 2:30pm press conference. Thanks, but no thanks.

However, we do have some positions on that we can make adjustments to. Let’s start with our short ACN July 29 $280/$270 put spread. This expires in three days, and the stock closed on Tuesday at $285.18. We only have 1 contract on, so let’s take our ~60% profit on it and be out before Fed time.

Secondly, we have on a short DE $295/$315 call spread expiring in 17 days. Price is above the upper strike (i.e., the “hedge” level) and we’re down more than 50% on it. So, let’s remove 1 of the 2 spread contracts we have today.

Lastly, we’re long a UAL August 19th $38/$47 call spread. The stock closed at $35.34 yesterday, and we’re down 68% on it. If after the 2 pm Fed news the stocks is trading (or trades) below this week’s low of $35.19, sell out of 3 of the 6 spreads we are long.

The market is pricing in a 75 bp. raise in rates today. I’d think it would come in at that level, but even if it does, it’s all about the language/tone of the statement, as well as what Powell says afterward that players will most key off of.