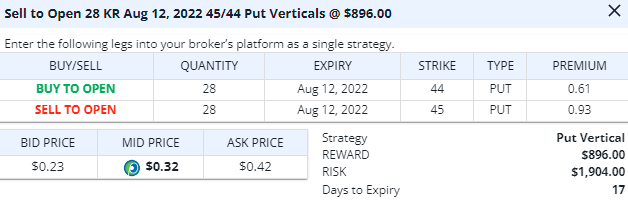

$KR

DailyPlay – Opening Trade (KR) – July 26, 2022

Bearish Opening Trade Signal

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 28 Contracts Aug 12, 2022 $45/$44 Put Verticals @ $0.32 Credit.

Total Risk: This trade has a max risk of $1,904 (28 Contracts x $68 per contract).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 5/10

OptionsPlay Score: 90

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note that we will be entering this trade later today, between 3:30 pm and 3:55 pm, as we are expecting the stock to open lower today.

Investment Rationale

With the FOMC meeting results due on Wednesday afternoon, I’m not expecting a significant market move before then, barring some brand new news coming out that can alter the game. Nonetheless, today and Wednesday still have a slew of earnings reports out that can push individual stocks to double-digit gains or losses depending upon results / guidance relative to Street expectations.

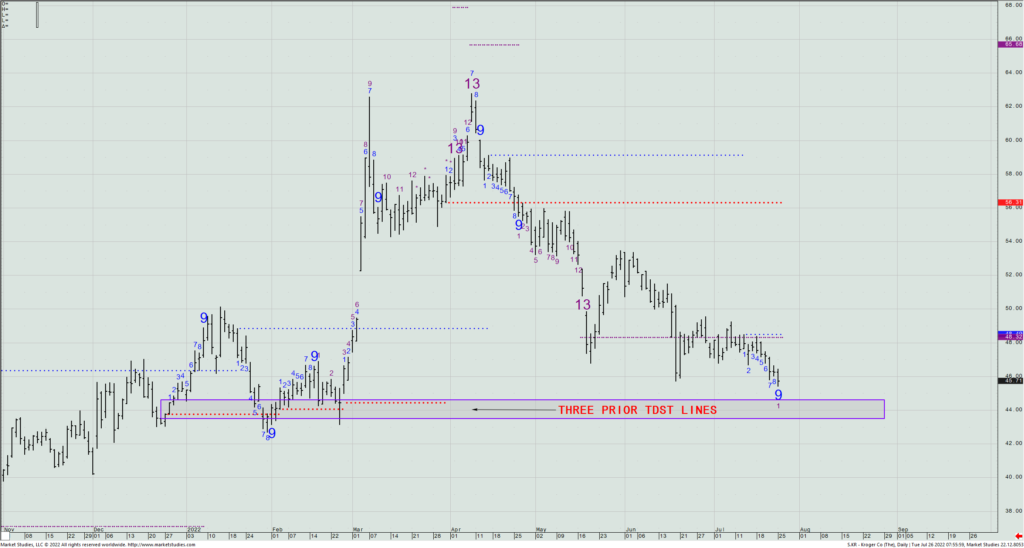

However, if you want to step into the market to do something, let’s use the likely strong weakness we will see today in Consumer Staples (after Walmart again missed their earnings report last night) to sell a short-dated August 12th Kroger (KR) $45/$44 put spread. KR reports on Aug. 12th, so we will be out of this before that report comes out. When we look at its daily chart, we see a perfected Setup -9 count from yesterday (clearly it will trade lower today, so we won’t put this trade on until late in the day today), but it is also nearing three prior daily TDST support lines all right near $44 (i.e., I know that I do not want to be long if those give way).

So, after today’s likely Staples drubbing, we’ll sell this put spread sometime between 3:30 and 3:55pm and look for this to hold into this $45-$44 support area until its earnings come out in 17 days.

KR Daily

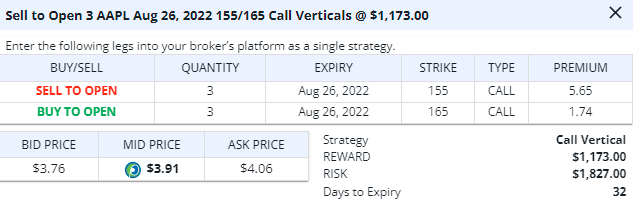

$AAPL

DailyPlay – Opening Trade (AAPL) – July 25, 2022

Bearish Opening Trade Signal

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell to Open 3 Contracts Aug 26, 2022 $155/$165 Call Verticals @ $3.91 Credit.

Total Risk: This trade has a max risk of $1,827 (3 Contracts x $609 per contract).

Counter Trend Signal: This is a Bearish trade on a stock that is experiencing a bullish trend.

1M/6M Trends: Bullish/Neutral

Technical Score: 8/10

OptionsPlay Score: 106

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

It is now time to short AAPL as we are going into earnings next week. When we look at the long-term chart of AAPL, we see a channel wherein AAPL was trading higher over the last few years. As this trend-line has been broken to the downside, we are seeing a retest of this channel. The risk/reward favors the downside as we are going into earnings. On the long-term chart, we can also see a head-and-shoulders formation. Looking at the Daily chart, we see that APPL has approached a shorter time-frame resistance level as well.

AAPL Daily

DailyPlay Updates – July 22, 2022

Another summer Friday is upon us, which means even less liquidity than the diminished bid/offer size we’ve already regularly seen for months. It’s not a good day for an institutional portfolio manager to put on a large trade.

Tech should be under strong pressure today with SNAP missing their earnings report and seeing the stock fall 25% quickly in after-hours trading, while META fell 5% in sympathy. But even if we end the week poorly, we are now seeing dip buyers, so that may balance out some bad reports’ negative effects on overall price action.

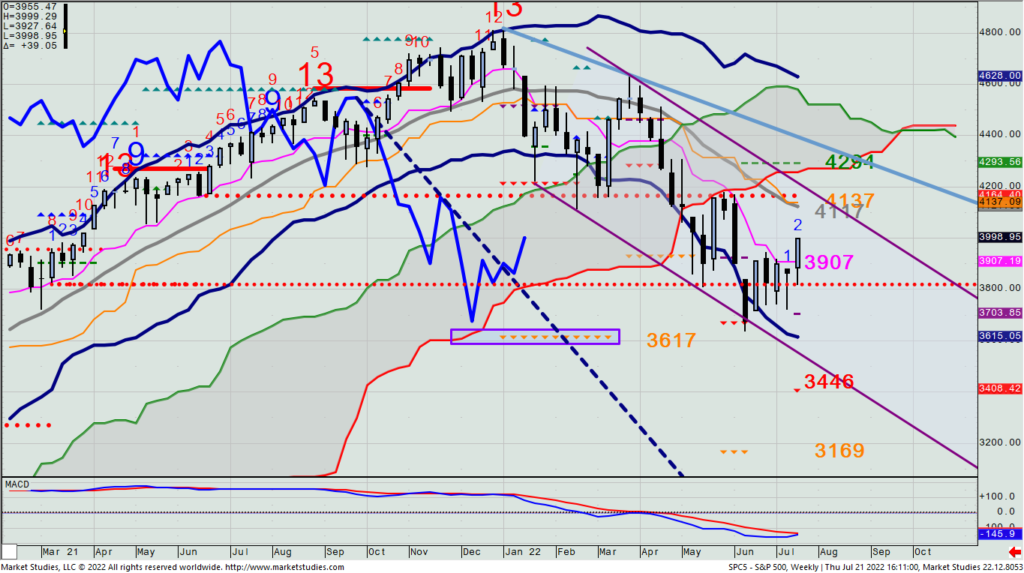

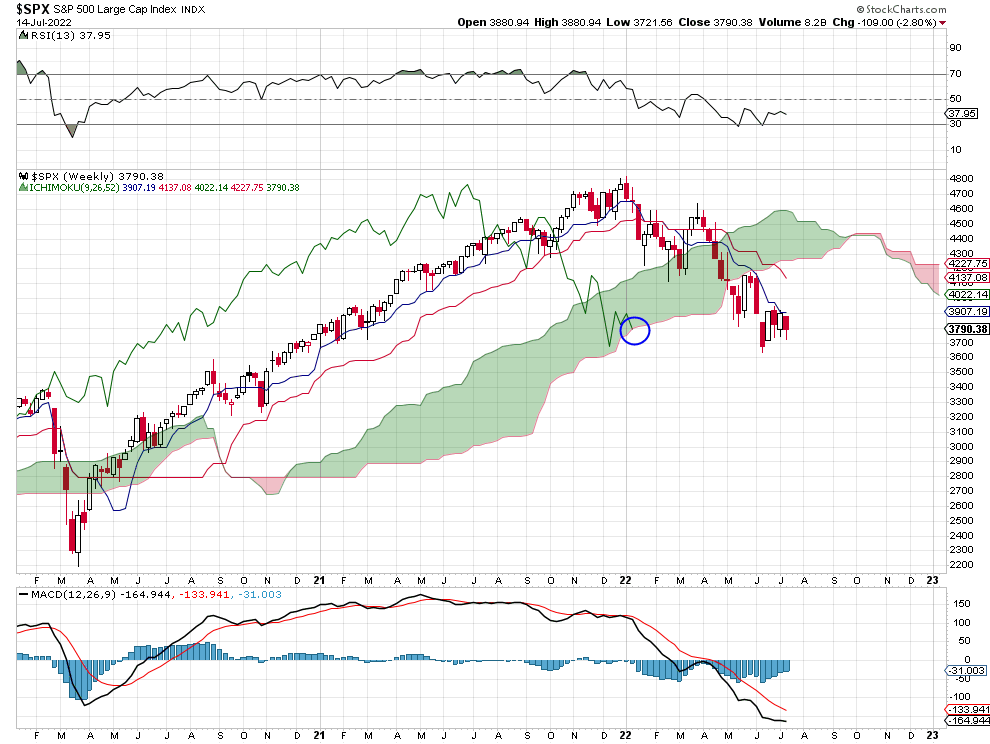

In the bigger picture, the SPX’s weekly cloud’s Lagging Line continues to be the most reliable indicator of SPX direction, and while it still remains above the bottom of its cloud, there is a near-term bullish bias. But I will tell you – well in advance of it potentially happening – that I still will be looking to sell into market strength (probably in the 4200—4300 level). And maybe even in a large way. I am not at all convinced that the 2022 low at 3637 stays the low this year.

SPX – Weekly

I think the macro picture is still a major issue, and that this current rally is more about over-zealous bearish positioning at the wrong time (meaning too much selling had come in since the low was made. The shorts need to get squeezed out before the market can likely take another leg lower.)

Also, keep an eye on the US Dollar. It is stalling against a monthly TDST Line at 107.31 that it has already gone above and back below on an intra-month basis. If the greenback fades, stocks get a tailwind for its rally, as dollar strength in 2022 continues to hamper equity price advancement.

Enjoy your weekend.

– Rick Bensignor

Chief Market Strategist

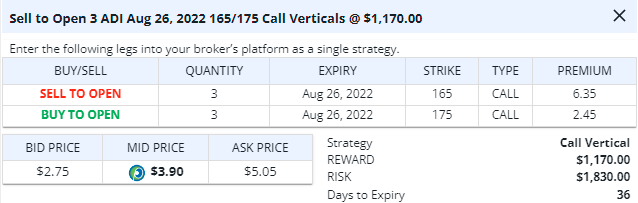

$ADI

DailyPlay – Opening Trade (ADI) Closing Trade (JNJ) Partial Closing Trade (DAL) – July 21, 2022

Closing Trade

JNJ – 54.90% Loss: Sell to Close 3 Contracts Sept 16, 2022 $175/$190 Call Verticals @ $2.81 Credit. DailyPlay Portfolio: By closing all 3 Contracts, we will be receiving $843.

Partial Closing Trade

DAL – 71.70% Gain: Sell to Close 6 Contracts Aug 19, 2022 $30/$35 Call Verticals @ $2.73 Credit. DailyPlay Portfolio: By closing 6 of the 12 Contracts, we will be receiving $1,638.

Bearish Opening Trade Signal

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell to Open 3 Contracts Aug 26, 2022 $165/$175 Call Verticals @ $3.90 Credit.

Total Risk: This trade has a max risk of $1,830 (3 Contracts x $610 per contract).

Counter Trend Signal: This is a Bearish trade on a stock that is experiencing a bullish trend.

1M/6M Trends: Bullish/Mildly Bullish

Technical Score: 9/10

OptionsPlay Score: 107

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

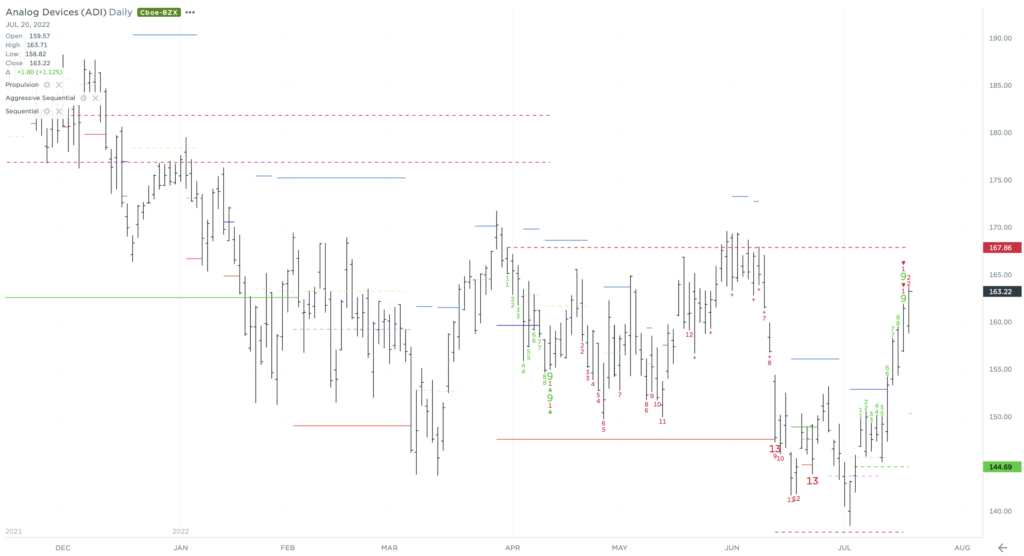

We have seen an incredible amount of strength from semis these past couple of weeks as the market finds a temporary bottom. However, that does not change the overall underperformance of the sector and my preference is to seek short exposure on this strength. There is one name that jumps out as a potential opportunity to fade this strength. I’m looking at Analog Devices (ADI) which printed a daily +9 count.

Additionally, we are approaching a prior resistance area around $167.50, which also corresponds with the weekly cloud bottom. To fade this rally, I’m going to sell a call credit spread, using the Aug 26 $165/175 Call Vertical for a $3.90 Credit (39% of vertical width).

ADI – Daily

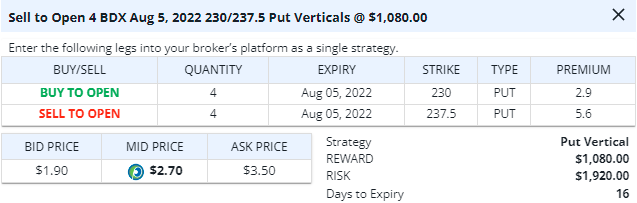

$BDX

DailyPlay – Opening Trade (BDX) – July 20, 2022

Bullish Opening Trade Signal

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 4 Contracts Aug 5, 2022 $237.5/$230 Put Verticals @ $2.70 Credit.

Total Risk: This trade has a max risk of $1,869 (3 Contracts x $623 per contract).

Counter Trend Signal: This trade has a max risk of $1,920 (4 Contracts x $480 per contract).

1M/6M Trends: Bearish/Bearish

Technical Score: 7/10

OptionsPlay Score: 89

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

JNJ had a break above the $150 level in early 2020, and ever since it traded in an upward channel. When

Yesterday’s rally was a big one, with the SPX up 2.75%, and the NDX up even more. Indeed, bulls are trying to make a stand, and along with my call on Monday to be near-term bullish, getting in Monday on what ended up being a down day gave us good entry for what happened yesterday. Will it continue? I think for now, yes. (But I still will keep it within the context of an ongoing bear, but one that presented a buying opportunity.)

I found a chart that looks like a good risk/reward idea to put on a bullish play, as it has continually shown support at a level that goes back 16 months and has been tested many times. Let’s look at Becton Dickenson (BDX), a health care name in a favored sector that I am substantially overweight in my In The Know Trader’s 7:11 report. It has played in and around the mid-$230s on all lows going back to March 2021.

BDX – Daily

With the daily Setup -9 count showing up on Monday in this same mid-$230s zone, let’s look to sell an August 5th $237.5/$230 put spread. (It’s mid prices closed on Tuesday at $2.70.) They report on August 4th, so we will only be holding this a short period, but it gives us a bit of extra premium because the expiration is the day after next their earnings release. Barring a market meltdown, I’d think this will hold in here going into their quarterly numbers in 17 days.

$ACN

DailyPlay – Partial Closing Trade (ACN) – July 19, 2022

Partial Closing Trade

- ACN: 63.16% Loss: Buy to Close 2 Contracts July 29, 2022 $280/$270 Put Verticals @ $3.80 Debit. DailyPlay Portfolio: By closing 2 of the 3 Contracts, we will be paying $760.

Investment Rationale

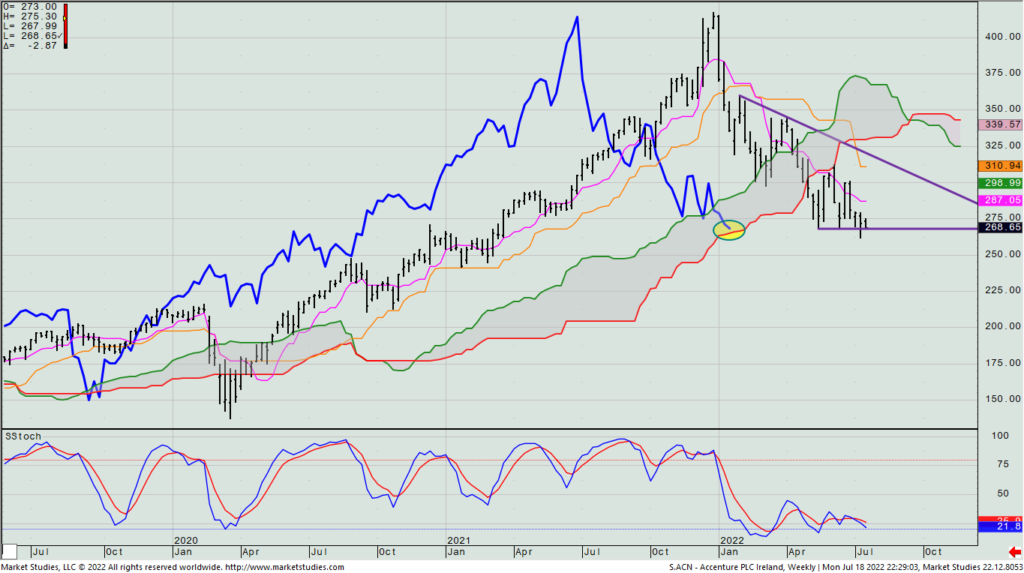

Last week we talked about potentially reducing exposure in our short ACN July 29th $280/$270 put spread, as it had lost 50%+ of its value. At the time, I said we could also wait to see where last Friday closed in order to see if the cloud’s Lagging Line was going to hold or break its cloud support level.

As we head into Tuesday’s action, the weekly cloud model has still held support where it needs to, but the option has lost time value and its price hasn’t rallied, and our expiration date is just 11 days away.

So, if you haven’t already sold half yet, do so today.

ACN – Weekly

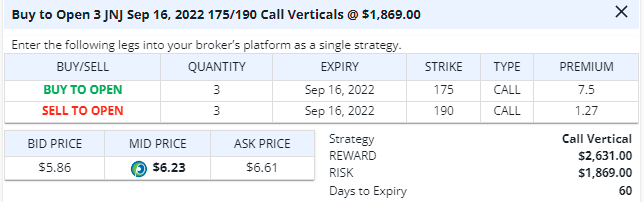

$JNJ

DailyPlay – Opening Trade (JNJ) – July 18

Bullish Opening Trade Signal

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 3 Contracts Sept 16, 2022 $175/$190 Call Verticals @ $6.23 Debit.

Total Risk: This trade has a max risk of $1,869 (3 Contracts x $623 per contract).

Trend Continuation Signal: This is a Bullish trade on a stock that is experiencing a bullish trend.

1M/6M Trends: Bullish/Bullish

Technical Score: 10/10

OptionsPlay Score: 97

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

JNJ had a break above the $150 level in early 2020, and ever since it traded in an upward channel. When we look at the performance of JNJ relative to the Health Care Sector we notice that it has underperformed to this sector since 2008. Over the past few weeks, this has changed and JNJ is now outperforming the Health Care Sector, with a breakout higher. With earnings coming up this week, this is a positive signal to consider. The Options Market is implying larger earnings than before at +/- 2.8% versus the +/- 2.2% over the last 8 quarters.

JNJ Daily

$V, $BIIB

DailyPlay – Closing Trades – July 15, 2022

Closing Trades

- V: 8.32% Loss: Sell to Close 2 Contracts July 15, 2022 $210/$190 Put Verticals @ $4.41 Credit. DailyPlay Portfolio: By closing the remaining 2 of the 4 Contracts, we will be receiving $882. We took partial profits for this trade on June 21 at a $13.42 Credit Therefore, the average gain on this trade was 85.34 % and the average cost basis to exit this trade is $8.92 Credit.

- BIIB: 70.30% Loss: Sell to Close 3 Contracts July 15, 2022 $215/$225 CallVerticals @ $0.98 Credit. DailyPlay Portfolio: By closing the remaining 3 of the 6 Contracts, we will be receiving $294. We took partial profits for this trade on July 12 at a $2.80 Credit. Therefore, the average loss on this trade was 42.73% and the average cost basis to exit this trade is $1.89 Credit.

Investment Rationale

Going into today, the weekly SPX’s Lagging Line is right by its associated cloud bottom. It’s why, in my eyes, yesterday saw a fairly dramatic rally from what were the intraday lows. Bulls are trying to defend this line, for those of them who know this indicator also know that a real breach of that cloud bottom could quickly start another leg lower.

As such, I am not going to try to guess which way the market is going to trade today, but I do very much suspect that within a few days to a week or two, we will know which way the overall market is likely to trade through Labor Day.

SPX – Weekly

We have two open option spread positions that expire today that we need action on. First, there’s a long Visa (V) $210/$190 put spread that had the stock close at $205.91 on Thursday. You want to exit that trade today unless you plan on exercising your option to short the stock at $210.

Secondly, we are long a BIIB $215/$225 call spread. The stock closed yesterday at $214.27. This could trade either way today, but if you are sure that you want to avoid exercising the $215 strike if it closes above there today, you’ll also want to exit this before today’s close.

We also have on two other long call spreads that will go out worthless today (META and GLD) that we need do nothing with but lick our wounds.

Lastly, our short July 29th ACN $280/$270 put spread is now down over 50%. Those of you who typically exit half the trade when that occurs could do so today. (Personally, I’d prefer to see where the SPX closed today, because if its weekly cloud model holds as explained above, next week could be a decent up move, putting this spread back in contention.) It’s completely up to you.

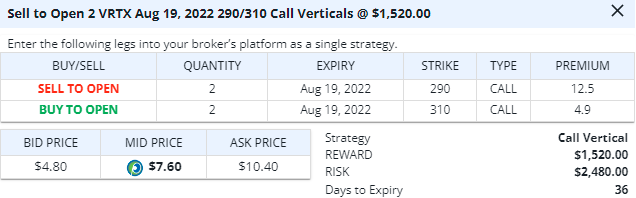

$VRTX

DailyPlay – Opening Trade (VRTX) – July 14, 2022

Bearish Opening Trade Signal

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell to Open 2 Contracts Aug 19, 2022 $290/$310 Call Verticals @ $7.60 Credit.

Total Risk: This trade has a max risk of $2,480 (2 Contracts x $1,240 per contract).

Counter Trend Signal: This is a Bearish trade on a stock that is experiencing a bullish trend.

1M/6M Trends: Bullish/Bullish

Technical Score: 10/10

OptionsPlay Score: 103

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

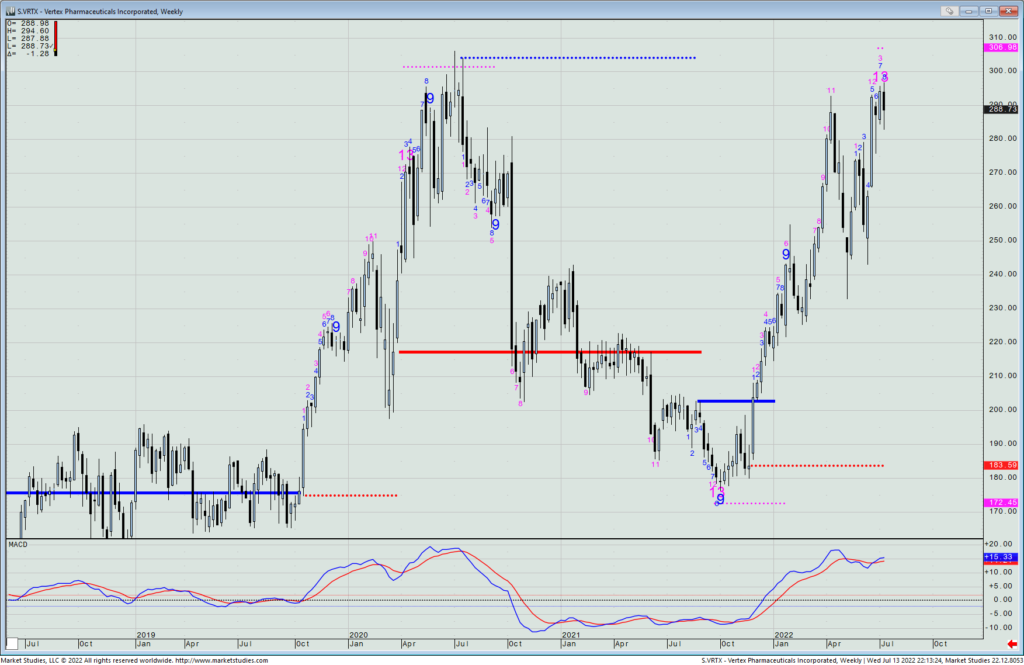

It’s not too easy finding stocks close to all-time highs these days, but when I find one that is testing those highs, and is accompanied by a weekly Combo +13 and a Setup +8, to me it’s likely worth fading – especially given my belief that stocks will likely come off further this year.

So, let’s look at the weekly chart of Vertex Pharmaceuticals (VRTX). Given the above DeMark counts and the stock very much in close proximity to its all-time high, I’d like to short an August 19th $290/$310 call spread. This gives us time to collect some theta while it plays in this area, as well as time to trade off as the summer progresses.

Based upon last night’s closing mid-price, we’d be collecting $7.60, or about 43% of the strike differential.

VRTX – Weekly

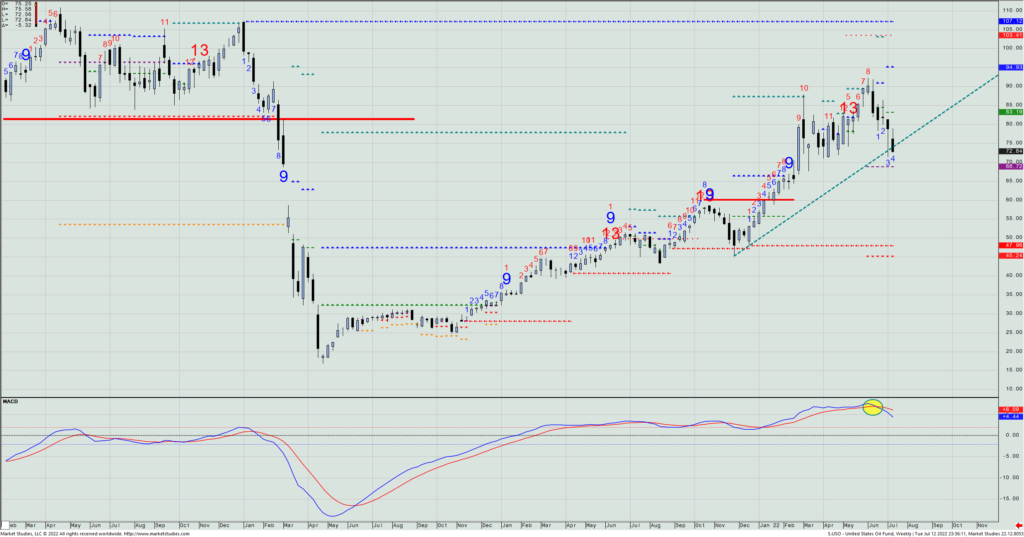

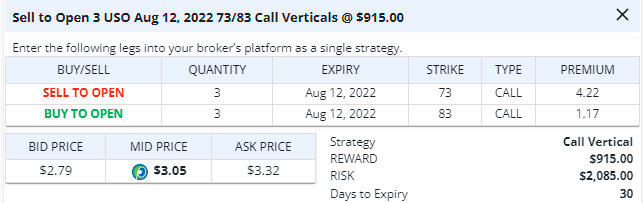

$USO

DailyPlay – Opening Trade (USO) – July 13, 2022

Bearish Opening Trade Signal

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell to Open 3 Contracts Aug 12, 2022 $73/$83 Call Verticals @ $3.05 Credit.

Total Risk: This trade has a max risk of $2085 (3 Contracts x $695 per contract).

Trend Continuation Signal: This is a Bearish trade on an ETF that is experiencing a bearish trend.

1M/6M Trends: Bearish/Mildly Bearish

Technical Score: 10/10

OptionsPlay Score: 94

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

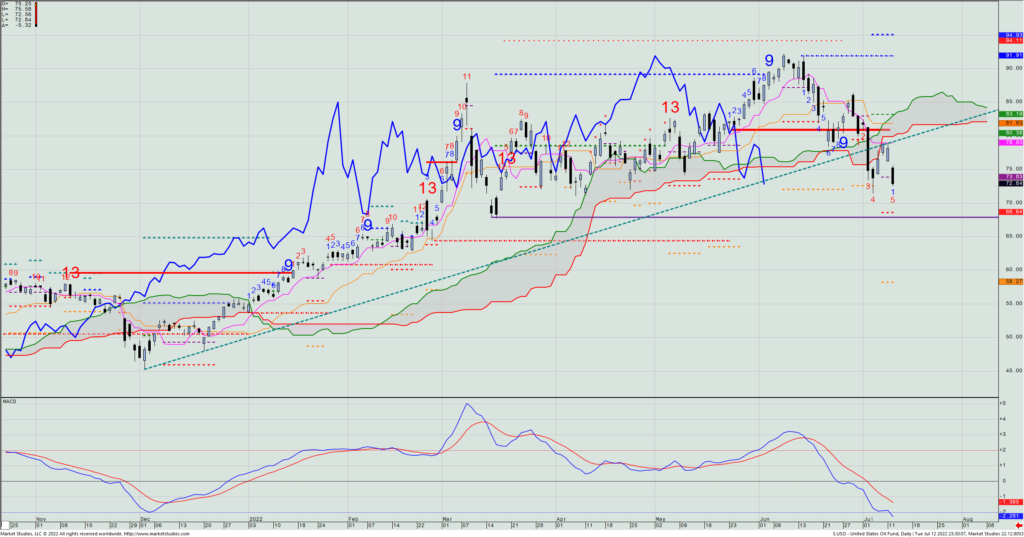

Investment Rationale

In my view, oil has broken its key support and should head lower over the coming weeks. As such, let’s look to short a USO Aug 12th $73/$83 call spread for what closed yesterday at $3.08 mid. That’s approx. 31% of the spread differential, and with the daily and weekly cloud charts breaking down, I expect that we will see oil complete a daily Sequential -13 count – something it hasn’t done since its bottom in late-October 2020.

USO – Daily

EUSO – Weekly