$TSLA

DailyPlay – Closing Trade (TSLA) – June 10, 2022

TSLA: 7.27% Gain: Buy to Close 2 Contracts June 24, 2022 $695/$675 Put Verticals @ $7.02 Debit. DailyPlay Portfolio: By Closing 2 Contracts, we will be paying $1404.

Investment Rationale

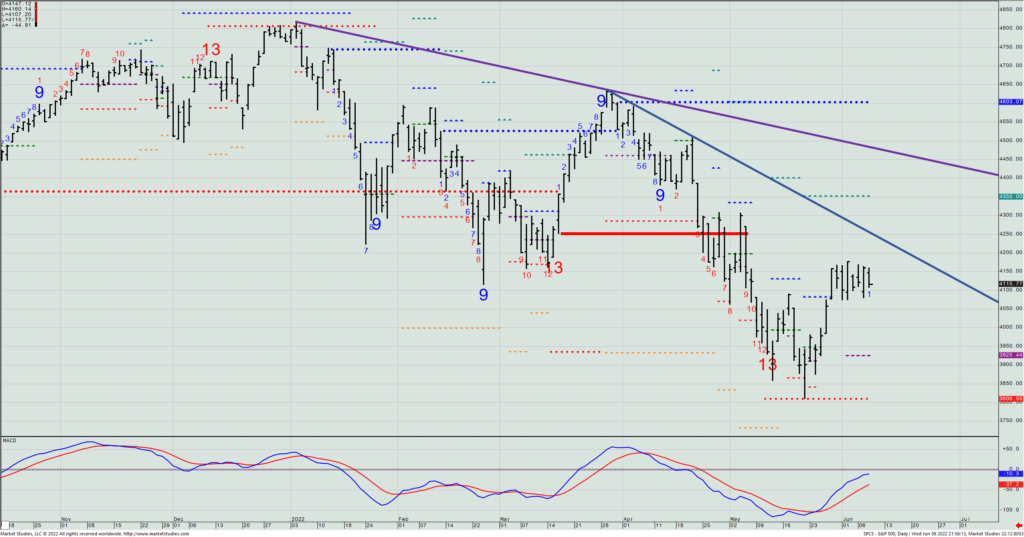

Yesterday we told you that the SPX’s 8-day sideways tight range was likely going to resolve itself by Friday’s close, and Thursday’s market drubbing seems to have answered the question of which way the market would move from the past two weeks of back and forth restrained action.

Without an immediate move back up to north of 4100 (I’m thinking by today or Monday), the picture again gets dicey for bulls, especially with the weekly cloud bottom having been right by the high the past three weeks in a row (Moreover, the weekly Conversion Line caught this week’s high, adding to the bulls’ not showing us that they have the strength to change this bearish 2022 market around.)

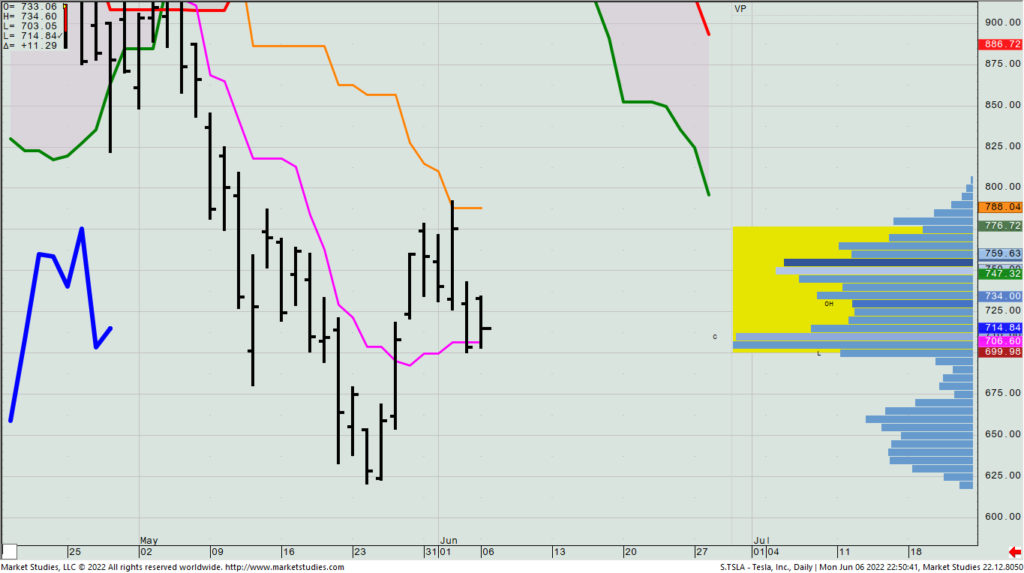

Earlier this week, we perfectly sold a June 24th TSLA $695/$675 put spread. Yesterday, that put spread was worth half of what we sold it for (giving us a 50% gain) when TSLA was at its high, which you’ll see was just near the top of its Value Area (the top of the yellow zone) that I had highlighted on Tuesday. That’s all she rode as the big market decline had this then give back all daily gains and close it right near its low of the day.

TSLA – Daily

Given the close beneath its Conversion Line and rejection of the High-Value Area, we’d be smart to cover half this trade today. If in the next few days (including today) its mid-price gets back down to the price we sold it at on Tuesday, we’ll cover the rest and kiss goodbye to what was a solid trade out of the starting gate. (A perfect example of “the market giveth and taketh”.)

P.S. Until we have the technology set up to send you intraday phone text alerts, I’ll recommend that when you see a trade make 50% in 48 hours, you take it regardless of if an alert comes out or not. This market moves too quickly to always wait for new daily updates, especially if it’s a counter-trend trade like this one was.

– Rick Bensignor

Chief Market Strategist

DailyPlay Updates – June 9, 2022

The SPX continues to toy with the 4100 level, but does continue to close above it despite several intraday breaches of it over the past two weeks. And as I’ve said before, as long as the 4020 level holds on a pullback, I still think the market could have some legs to it.

That being said, with the futures down as I write this Wednesday night, I don’t want to continue adding more long exposure (we’ve already done some this week) until the bulls prove themselves. And make no mistake about it: It is the bulls who need to prove their case; not the bears. The latter have continuously and successfully proven theirs’s all year long. It is beholden on the bulls to make us believe that this rally has more to go. I’m not in the bearish camp yet, but with price in a tight range for the past eight trading sessions, the onus is on the bulls to push prices higher. That would make the late-to-the-game bears have to cover shorts, and only when enough of them are out of the picture could we then again think of selling into strength.

Bulls will have to not only push higher now, but also keep it going to stay above 4350, for only a proper move above there would virtually eliminate the bearish argument that naysayers have effectively been able to lean on in 2022. (My guess is that if/when we got up there, we’d be more apt to be shorting names– looking for a potential failure when bears are screaming “get me out at any price” and the all too frequently interviewed on TV perma-bulls will be saying “We told you so”.

SPX – Daily

So, today, we sit back and watch to see if: A) 4100 level holds as support by the close, and B) if there is there any new sign of position stress from either the bulls or the bears. Eight days is about the maximum sideways move we’ve seen all year, so I expect a resolution to this ennui to happen by Friday’s close.

Make sure you’re buckled up and know where your closest exit door is. And thank you for flying Tumult Airlines.

– Rick Bensignor

Chief Market Strategist

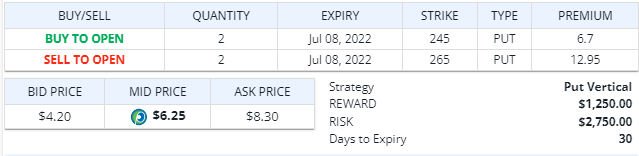

$ALGN

DailyPlay – Opening Trade (ALGN) – June 8, 2022

View ALGN Trade

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 2 Contracts July 8, 2022 $265/$245 Put @ $6.25 Credit.

Total Risk: This trade has a max risk of $2,750 (2 Contracts x $1,375 per contract).

Counter Trend Signal: This is a Bullish strategy on a stock that is experiencing a bearish trend.

1M/6M Trends: Neutral/Bearish

Technical Score: 1/10

OptionsPlay Score: 87

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

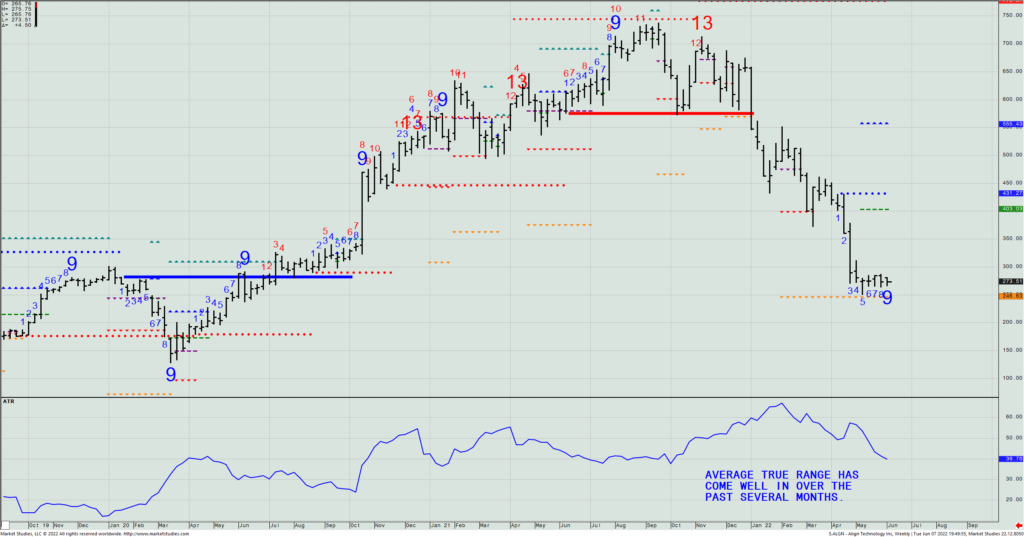

When I see a large down move in a stock – that then dramatically decreases its average trading range AND goes sideways for several price bars – it usually says to me that there is an institutional buyer quietly bidding for the name. This might very well be the case with Align Technology (ALGN). It’s had nearly four identical weekly small ranges in the past four weeks, since bottoming right by the weekly Propulsion Full Exhaustion level (~$247) a month ago – all while seeing its weekly range come into levels not seen in eight months.

Given that this week also marks a Setup -9 count – the first of the whole decline – to me, it is now both a logical time AND location to view this as a play against support. We can do that by either selling a downside put spread or buying an upside call spread, and my inclination is to do the former, as I have a very defined level that I know I don’t want to be long any longer if breached (i.e., $245). Thus, I’m willing to short a July 8th $265/$245 put spread for $6.25 (i.e., yesterday’s closing mid-prices), which represents about 31% of the strike differential.

ALGN – Weekly

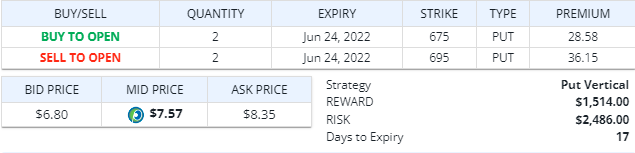

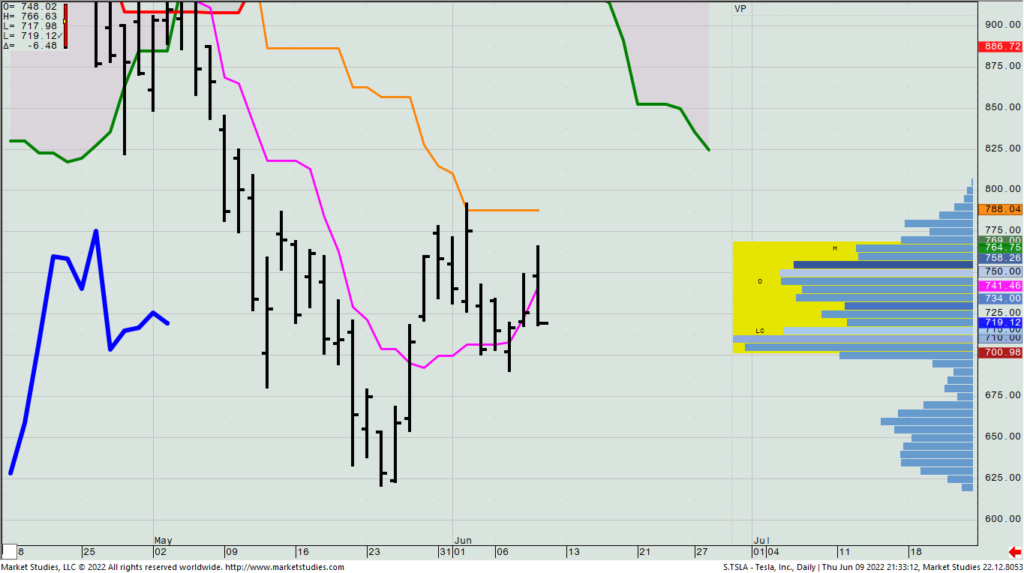

$TSLA

DailyPlay – Closing Trade (TSLA) – Opening Trade (TSLA) – June 7, 2022

Closing Trade

- TSLA: 61.07% Loss: Sell to Close 3 Contracts June 17, 2022 $620/$600 Put Verticals @ $2.55 Credit. DailyPlay Performance: By closing 3 Contracts we will be receiving $765.

View new TSLA Trade

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 2 Contract June 24, 2022 $695/$675 Put @ $7.57 Credit.

Total Risk: This trade has a max risk of $2,486 (2 Contract x $1,243 per contract).

Counter Trend Signal: This is a Bullish strategy on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 2/10

OptionsPlay Score: 89

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

Here’s a pure technical trader’s play on Tesla (TSLA), simply using the cloud model’s Conversion and Base Lines as reference points, along with the Market Profile indicator (to see where the volume has traded in its recent bottoming process).

Price rallied from its 2022 low up to its Base Line (in orange) and then fell to its Conversion Line (in pink). I think that it can hold support around the $695/$675 level, as that lower number is also where little volume has traded. Therefore, we will look to sell a June 24th $695/$675 put spread for $9.675 (based upon yesterday’s closing mid-prices). That represents about 39% of the spread differential, and gives us downside protection in case the stock gets hit more than I currently expect it will.

TSLA – Daily

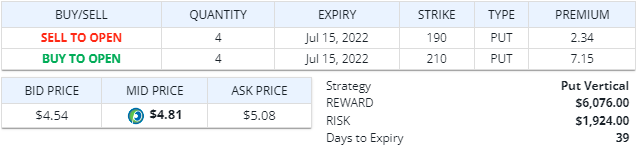

$V

DailyPlay – Opening Trade (V) – June 6, 2022

View V Trade

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 4 Contracts July 15, 2022 $210/$190 Put @ $4.81 Debit.

Total Risk: This trade has a max risk of $1,924 (4 Contracts x $481 per contract).

Counter Trend Signal: This is a Bearish strategy on a stock that is experiencing a bullish trend.

1M/6M Trends: Bullish/Mildly Bullish

Technical Score: 9/10

OptionsPlay Score: 148

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

Our bearish trade idea for today is Visa Inc. (V) which is displaying some downside risk when one considers the current consumer spending and consumer confidence slowdown. From a technical perspective, V has experienced a long term underperformance relative to the market, which we expect to resume after a brief rebound. Price is also forming lower higher on the weekly timeframe while holding the $190 support. We have seen a slight slowdown in momentum in recent days which could indicate the end of the current rebound and potential reversal lower.

UAA, NVDA, AXP, NFLX, ARKK

DailyPlay – Closing Trade (UAA) – Taking Partial Profits (NVDA, AXP, NFLX, ARKK) – June 3, 2022

Closing Trade

- UAA: 82.50% Gain:Buy to Close 2 Contracts June 24, 2022 $9 Cash Secured Puts @ $0.07 Debit. DailyPlay Portfolio: By Closing 2 Contracts, we will be paying $14.

Taking Partial Profits

- NVDA: 49.80% Gain: Buy to Close 1 Contract June 17, 2022 &182.5/&167.5 Put Verticals @ $2.57 Debit. DailyPlay Portfolio: By Closing 1 of the 2 Contracts, we will be paying $257.

- AXP: 58.15% Gain: Buy to Close 3 Contracts June 24, 2022 $160/$150 Put Verticals @ $1.36 Debit. DailyPlay Portfolio: By Closing 2 of the 3 Contracts, we will be paying $272.

- NFLX: 61.09% Gain: Buy to Close 1 Contract July 15, 2022 $170/$190 Put Verticals @ $4.55 Debit. DailyPlay Portfolio: By Closing 1 of the 2 Contracts, we will be paying $455.

- ARKK: 65.15% Gain: Buy to Close 10 Contracts June 24, 2022 $41/$39 Put Verticals @ $0.46 Debit. DailyPlay Portfolio: By Closing 10 of the 20 Contracts, we will be paying $460.

$NVDA

DailyPlay – Opening Trade (NVDA) – June 2, 2022

View NVDA Trade

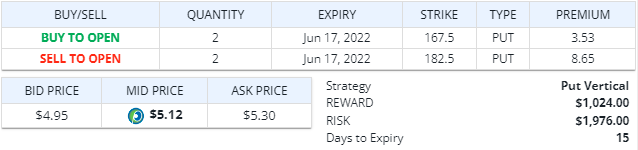

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 2 Contracts June 17, 2022 $182.5/$167.5 Short Put Vertical Spreads @ $5.12 Credit.

Total Risk: This trade has a max risk of $1,976 (2 contracts x $988 per contract).

Counter Trend Signal: This is a Bullish strategy on a stock that is experiencing a bearish trend.

1M/6M Trends: Neutral/Bearish

Technical Score: 2/10

OptionsPlay Score: 86

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

First and foremost, the SPX is seeing some buying into the zone (4130—4020) I said need to hold on a pullback after last week’s 6%+ rally. Yesterday’s low reached 4074 – roughly halfway down into that zone before seeing the close at 4101.

So, if I look at a name that may have also bottomed last week and is now holding onto support in between that low and where it is now trading, I come across the very actively traded NVIDIA Corp. (NVDA). Its chart shows a daily -13 bottom downside exhaustion signal that then rallied and yesterday’s low ($181.22) held above its bearish Propulsion Momentum level ($179.92). That’s potentially bullish, so let’s play for this to continue higher to test the nearest Propulsion Exhaustion level at $197.15.

Let’s sell a short-dated June 17 $182.5/$167.5 put spread for a $5.13 credit, taking in about 34% of the strike differential, based upon yesterday’s closing mid-prices. When/if the price reaches the above target near $197, I can already tell you that we’ll want to remove half the position.

NVDA – Daily

$MET, $CVX, ARKK

DailyPlay – Closing Trades (MET, CVX) Trade Adjustment (ARKK) – June 1, 2022

Taking Profits

- $MET 89.84% Gain: Buy to Close 12 June 3, 2022 $69/$72 Call Verticals @ $0.13 Debit. DailyPlay Portfolio: By buying 12 Contracts we will pay $156.

- $CVX 155.43% Gain: Sell to Close 2 June 3, 2022 $160/$170 Call Verticals @ $9.17 Credit. On May 17, we closed 4 contracts of this position for $7.43 credit. This results in an average close price of $8.01 credit. DailyPlay Portfolio: By selling 2 Contracts we will receive $1,834.

Adjustment Trade

$ARKK Trade Adjustment – 70.59% Unrealized Gain. Roll June 10, $39/$37 Short Put Verticals to June 24, $41/$39 Short Put Verticals to collect more premium:

- Buy to close June 10, $39/$37 Short Put Verticals @ $0.30 Debit (originally opened at $1.02 credit = $0.72 profit)

- Sell to open June 24, $41/$39 Short Put Verticals @ $0.60 Credit

- This results in an increased premium for the ARKK Short Put Vertical Trade to $1.32 ($0.60 + $0.72)

Investment Rationale

We have two open trades that expire on Friday, both of which are large gains. Let’s look to close them out to avoid dealing with any expiration issues.

The first is our short MET June 3rd $69/$72 call spread. We’re up about 90% on the trade, and with the stock having closed at $67.39 on Tuesday, let’s not take the chance that we get exercised on the $69 strike should the stock see a 2% gain over the next few days. So, let’s unwind that spread today. It closed yesterday at $0.15 mid-price (and we’re short from $1.28).

The other is a long CVX June 3rd $160/$170 spread. We paid $3.59 for it and yesterday it closed at $9.20 mid. We had previously taken off half for a large gain, and today we’ll take off the balance.

Lastly, we’re going to roll up our short ARKK June 10th $39/$37 put spread, by taking that off today (we’re short at $1.02 and yesterday it closed at $0.30 mid), and roll that up to a short June 24th $41/$39 put spread (collecting $0.60 based on yesterday’s mid-closing price.)

ARKK – Weekly

$NFLX

DailyPlay – Opening Trade (NFLX) – May 31, 2022

View NFLX Trade

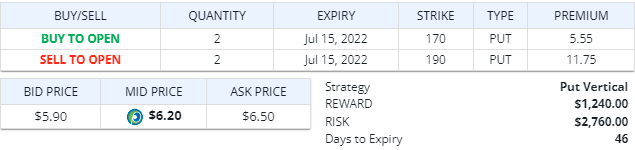

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 2 Contracts July 15, 2022 $170/$190 Put Verticals @ $6.20 Credit.

Total Risk: This trade has a max risk of $2,760 (2 Contracts x $1,380 per contract).

Counter Trend Signal: This is a Bullish strategy on a stock that is experiencing a bearish trend.

1M/6M Trends: Neutral/Bearish

Technical Score: 1/10

OptionsPlay Score: 85

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

With Netflix Inc. (NFLX) being a dominant player in online streaming, this is a pivotal moment, as it is currently trading at 75% lower than its peak. By looking at the long-term chart since its IPO, NFLX has traded in a well-defined channel, and it is now trading towards the bottom of this channel, from where it is now starting to bounce higher off the $170 level. The first major resistance level is only at the $240 level. As NFLX is currently trading at around 15 to 16 times next year’s earnings, this stock is well-priced and it is a good place to start buying at this level.

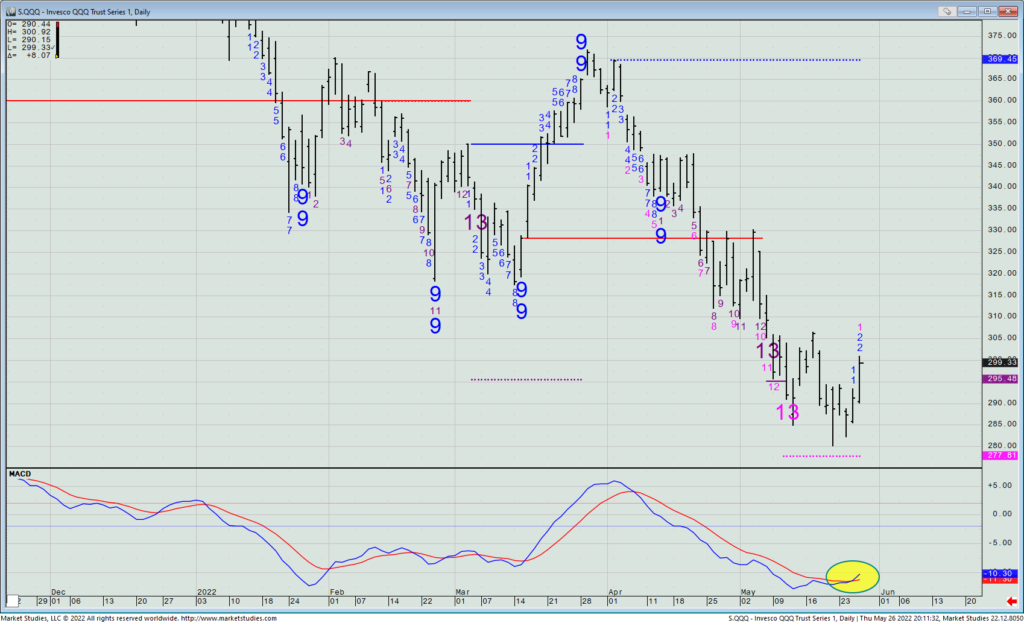

$QQQ

DailyPlay – Opening Trade (QQQ) – May 27, 2022

Special Notice

This is a conditional trade idea and the trade should not be taken immediately. Please read the Investment Rationale for more information on this trade. Also, keep in mind that the Credit received, the Max Risk, the Max Reward, as well as the OptionsPlay Score, will be different than what you see in this email, as we are waiting for the price to move more favorably before we enter the trade.

View QQQ Trade

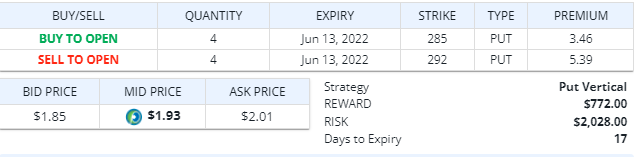

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 4 Contracts June 13 $292/$285 Put Vertical @ $1.93 Credit.

Total Risk: This trade has a max risk of $2,028 (4 contracts x $507 per contract). As this is a conditional order, the number of Contracts could change depending on the Total Risk at the time of opening the trade. We will base the numbers of Contracts on roughly $2,000 of Risk.

Counter Trend Signal: This is a Bullish strategy on an ETF that is experiencing bearish 1M and 6M trends.

1M/6M Trends: Bearish/Bearish

Technical Score: 4/10

OptionsPlay Score: 91

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

Yesterday saw a strong market rally after NVDA turned itself around after falling sharply after Wednesday’s post-close earnings report/guidance call. The SPX rallied 2%; the NDX 2.8%; and the talking heads on TV are back into bullish mode. Do they have a case?

Well, yes, they do. We’ve been waiting to see if the QQQ weekly cloud model’s Lagging Line was going to hold above its cloud bottom – something it’s been playing with for three weeks. Barring a major down-move today, that support near QQQ $287 is holding, and thus, we will lean bullishly near-term. That being said, I am not going to chase after the up-move on a Friday going into a three-day holiday weekend.

But I am willing to put on a bullish Short Put Spread IF we see the Qs trade down today to ~$295. If we see that, then we’ll look to enter a short June 13th $292/$285 put spread for what on Thursday went out at $1.93. (That credit should be a little higher if/when we’re able to put this on.) That represents about 28% of the strike differential, and gives us downside protection in case new lows come into play.

QQQ – Daily