TMUS

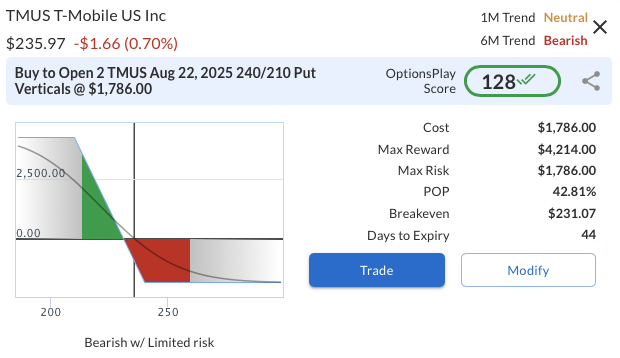

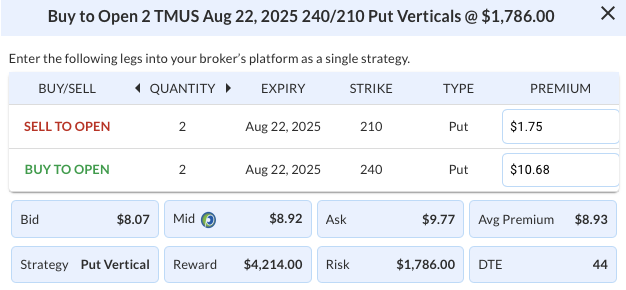

DailyPlay – Opening Trade (TMUS) – July 09, 2025

TSLA Bearish Opening Trade Signal

Investment Rationale

Investment Thesis

T-Mobile US Inc. (TMUS) presents an attractive bearish setup as it rallies within a broader downtrend, creating a potential opportunity to initiate bearish exposure with defined risk. Despite its modest growth profile, TMUS continues to trade at a substantial premium to peers, suggesting that recent strength could reverse if the market refocuses on its valuation concerns. With price action confirming technical weakness and fundamentals offering limited justification for its premium, the risk/reward favors positioning for downside continuation towards key support levels. Additionally, TMUS is scheduled to report earnings on Wednesday, July 23rd after market close, which may act as a potential catalyst for volatility in line with this bearish thesis.

Technical Analysis

TMUS has recently experienced a rally back into its $240 resistance area within a longer-term bearish trend, creating a favorable entry for trend-following shorts. Notably, today the stock crossed below its 200-day moving average at $236.08, reinforcing its medium-term technical weakness. The recent rejection near the declining 50-day moving average further confirms the bearish momentum, with the next major support sitting near $220. Relative strength remains middling, offering no evidence of bullish leadership, and instead aligning with the broader technical deterioration.

Fundamental Analysis

TMUS remains significantly overvalued relative to industry peers despite only moderately stronger growth expectations, suggesting limited fundamental support at current prices:

- Forward PE Ratio: 22.55x vs. Industry Median 10.03x

- Expected EPS Growth: 15.89% vs. Industry Median 5.56%

- Expected Revenue Growth: 5.21% vs. Industry Median 2.54%

- Net Margins: 14.41% vs. Industry Median 12.72%

Options Trade

A bearish put vertical is structured via buying the TMUS Aug 22, 2025 $240 put and selling the $210 put for a net debit of $8.93 ($893 total risk). The trade risks $893 to potentially gain $2,107 if TMUS closes below $210 at expiration.This setup results in a risk/reward ratio of approximately 1:2.4, meaning for every $1.00 of risk, the trade offers $2.40 of potential reward. This vertical spread limits risk to the premium paid, aligning with the technical breakdown, upcoming earnings catalyst, and overvaluation thesis while maintaining favorable capital efficiency.

TMUS – Daily

Trade Details

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 2 TMUS Aug 22 $240/$210 Put Vertical Spreads @ $8.93 Debit per Contract.

Total Risk: This trade has a max risk of $1,786 (2 Contract x $893) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $893 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower over the duration of this trade.

1M/6M Trends: Neutral/Bearish

Relative Strength: 6/10

OptionsPlay Score: 128

Stop Loss: @ $4.47 (50% loss of premium)

View TMUS Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View TMUS Trade

TSLA

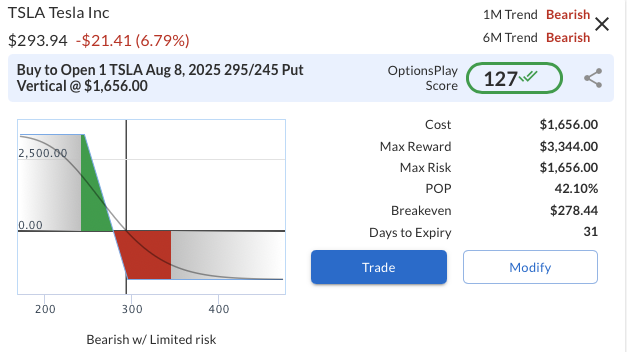

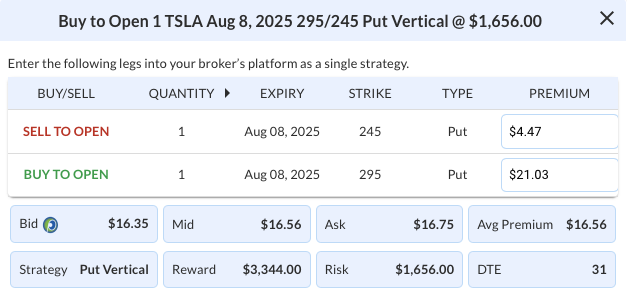

DailyPlay – Opening Trade (TSLA) – July 08, 2025

TSLA Bearish Opening Trade Signal

Investment Rationale

Investment Thesis:

Tesla Inc. (TSLA) presents a compelling bearish setup ahead of its Q2 earnings report, scheduled for Wednesday, July 23rd after market close. Despite optimism around its long-term innovation narrative, near-term price action and valuation continue to decouple from realistic fundamental support. The stock has recently failed to sustain momentum above key resistance levels, while sentiment has turned more cautious amid broader EV demand concerns and increasingly competitive market dynamics. With earnings risk approaching and limited upside catalysts, TSLA offers a tactically favorable short opportunity into the event.

Technical Analysis:

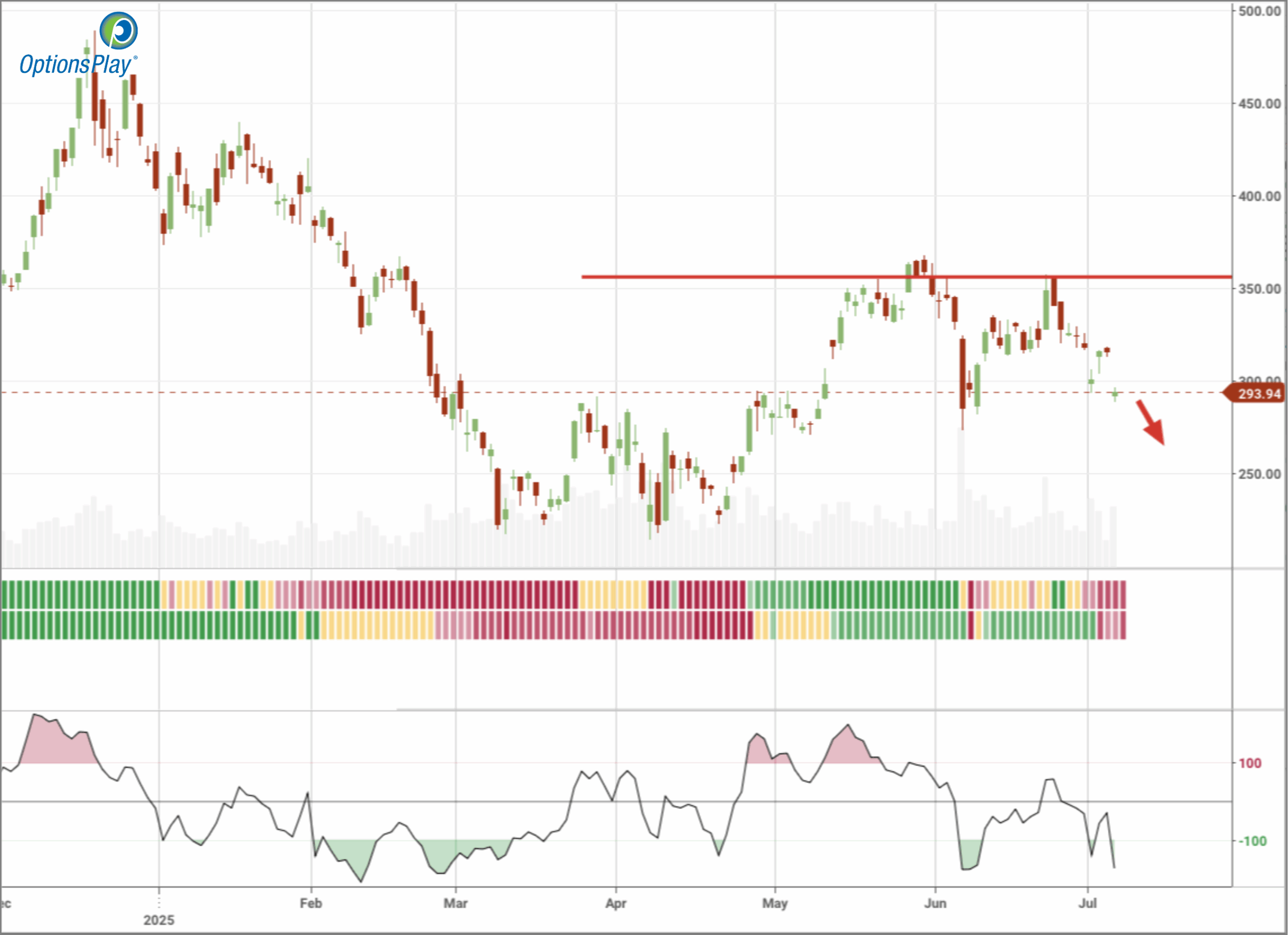

Price action in TSLA shows persistent distribution beneath the $350 resistance zone, where sellers have repeatedly capped rallies over the past year. The stock has now broken below its 50-day and 20-day moving averages, with a fresh bearish crossover developing between the short-term MAs. The rejection near $318 in early July reinforces this technical weakness, and momentum indicators like RSI have slipped toward neutral-bearish territory at 40. A breakdown below $290 confirms a lower high and opens the door toward the $250 support region, with the $180 level representing a longer-term downside target.

Fundamental Analysis:

TSLA remains fundamentally overvalued even as growth expectations compress and margins tighten under macro and competitive pressure. While Tesla’s topline metrics continue to outpace the sector, the extreme premium attached to its stock is increasingly difficult to defend.

- Forward PE Ratio: 167.38x vs. Industry Median 11.45x

- Expected EPS Growth: 17.82% vs. Industry Median 8.30%

- Expected Revenue Growth: 12.95% vs. Industry Median 3.06%

- Net Margins: 6.70% vs. Industry Median 2.71%

Options Trade:

With implied volatility elevated ahead of earnings and recent news headlines adding downside pressure, this structure offers a defined-risk way to express a bearish view. The 295/245 bear put vertical spread balances risk while providing strong convexity to the downside. The maximum potential reward of $3,344 vs. a defined risk of $1,656 delivers a favorable risk-reward ratio into a potentially volatile setup with 31 days to expiration.

TSLA – Daily

Trade Details

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 1 TSLA Aug 08 $295/$245 Put Vertical Spreads @ $16.56 Debit per Contract.

Total Risk: This trade has a max risk of $1,656 (1 Contract x $1,656) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $1,656 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower over the duration of this trade.

1M/6M Trends: Bearish/Bearish

Relative Strength: 2/10

OptionsPlay Score: 127

Stop Loss: @ $8.28 (50% loss of premium)

View TSLA Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View TSLA Trade

DailyPlay – Portfolio Review – July 07, 2025

DailyPlay Portfolio Review

Our Trades

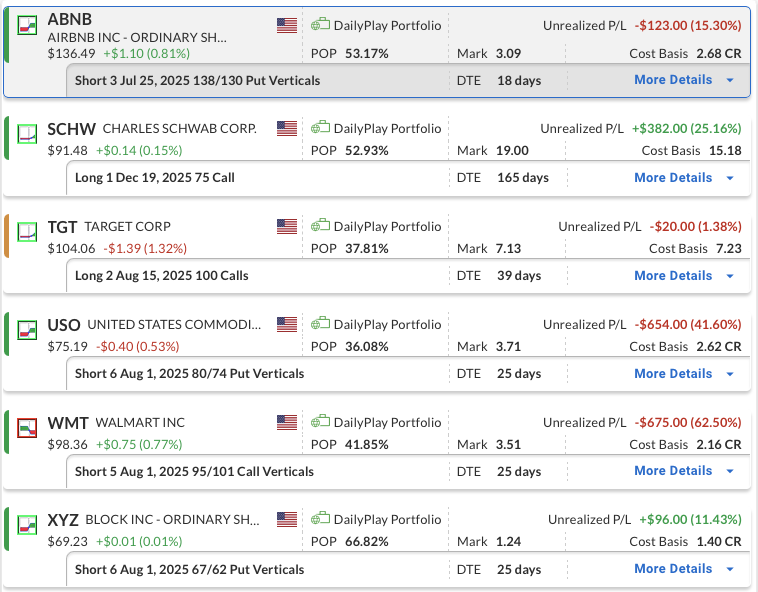

ABNB – 18 DTE

Bullish Credit Spread – Airbnb Inc. (ABNB) – The position is slightly down, as the stock broke out to the upside from its range and is now trading above its 200-day moving average, generating upside momentum. We plan to stay the course for now.

SCHW – 165 DTE

Bullish Long Call – Charles Schwab Corp. (SCHW) – Our outlook remains positive, supported by strong company fundamentals and continued strength in both SCHW and the broader financial sector.

TGT – 39 DTE

Bullish Long Call – Target Corporation (TGT) – We recently established this position and have a slight profit. We will stay the course for now, as the setup remains intact and the potential for additional upside is still in play.

USO – 25 DTE

Bullish Credit Spread – United States Oil Fund, LP (USO) – The position is down at the moment, and we’re keeping a close eye on oil prices leading into the OPEC International Seminar on July 9th and 10th, a key event that could move the market. With plenty of time left until expiration, we intend to stay the course.

WMT – 25 DTE

Bearish Credit Spread – Walmart Inc. (WMT) – The position is currently down, as the stock has remained range-bound. The bottom of the channel, near the 95 level, is an important downside support level that needs to break to generate momentum. At this stage, we plan to hold steady.

XYZ – 25 DTE

Block is trading above its 20-day and 50-day moving averages and is now testing the 200-day level near $71. The stock’s bullish trend remains intact, supported by steady volume and neutral RSI. We plan to stay the course for now.

MU, AAPL

DailyPlay – Closing Trade (MU, AAPL) – July 03, 2025

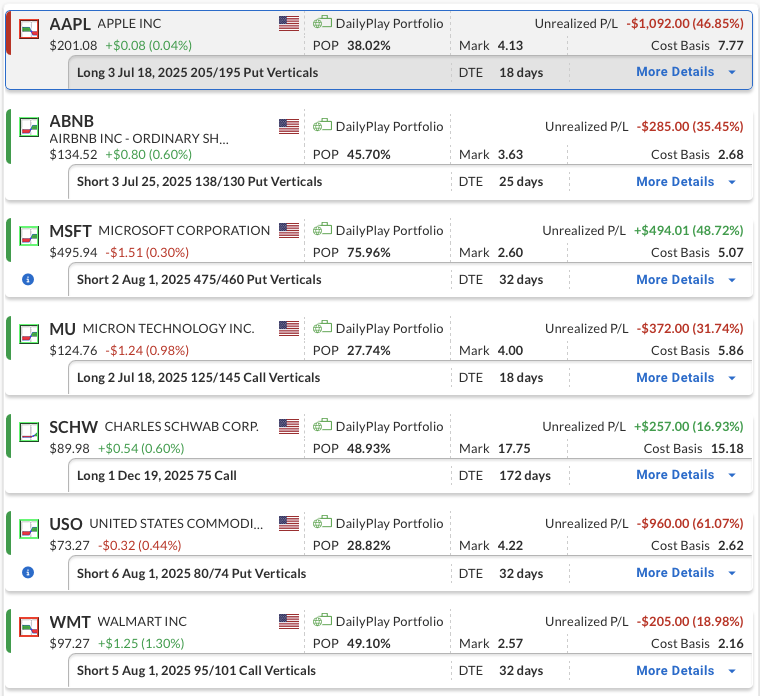

MU – 61% loss: Sell to Close 2 Contracts (or 100% of your Contracts) July 18 $125/$145 Call Vertical Spreads @ $2.30 Credit.

DailyPlay Portfolio: By Closing 2 Contracts, we will be collecting $460. We initially opened these 2 contracts on June 25 @ $5.86 Debit. Our loss, therefore, is $356 per contract.

AAPL – 78% loss: Sell to Close 3 Contracts (or 100% of your Contracts) July 18 $205/$195 Put Vertical Spreads @ $1.15 Credit.

DailyPlay Portfolio: By Closing 3 Contracts, we will be collecting $345. We adjusted the 3 short puts on June 26 reducing our cost basis to $1,590 Debit. Our loss, therefore, is $415 per contract.

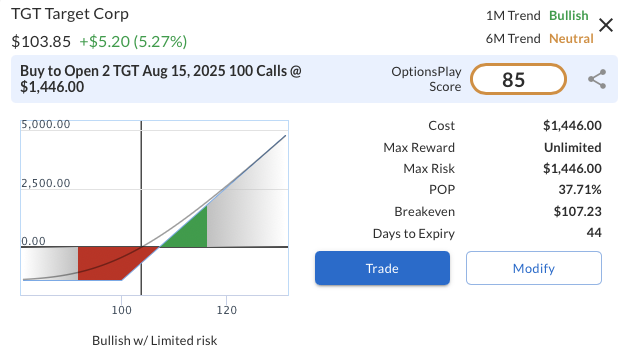

TGT

DailyPlay – Opening Trade (TGT) – July 02, 2025

TGT Bullish Opening Trade Signal

Investment Rationale

Investment Thesis:

Target Corp. (TGT) appears to be at a potential inflection point following a multi-year drawdown, offering an attractive setup for investors seeking value with upside optionality. Despite being down more than 50% from its highs, the stock has recently shown signs of stabilization and regained critical levels, suggesting improving sentiment. In a defensive retail space where peers trade at rich valuations and compressing margins, Target stands out with its attractive earnings multiple, strong dividend yield, and industry-leading profitability. As macro pressures from tariffs and inflation persist, TGT’s lean cost structure and disciplined capital return profile offer an edge in a risk-conscious market.

Technical Analysis:

TGT has broken out above the key $100 psychological level after months of basing, supported by rising short-term moving averages and strengthening volume trends. The price action now shows early trend development, with the stock pressing against the $104 level and attracting momentum buyers. RSI at 64 indicates building upside pressure without entering overbought territory, while the upward-sloping 20-day and 50-day MAs reflect a short-term shift in trend. The setup favors a move toward the $120–130 resistance zone, offering an asymmetric opportunity for early entry before broader confirmation.

Fundamental Analysis:

TGT trades at a substantial discount to its peers despite growth expectations that are in line and net margins that beat more than 75% of its peers.

- Forward PE Ratio: 13.49x vs. Industry Median 18.09x

- Expected EPS Growth: 9.22% vs. Industry Median 8.99%

- Expected Revenue Growth: 1.15% vs. Industry Median 5.26%

- Net Margins: 3.95% vs. Industry Median 2.29%

Options Trade:

After the breakout, we are considering Buy to Open 1 TGT Aug 15, 2025 $100 Call @ $723. This long call strategy provides upside exposure with defined risk, controlling 100 shares for just 7% of the stock’s price. The $100 strike is now slightly in-the-money, aligning with the recent technical breakout and capturing further upside toward the $120–130 resistance zone. The maximum risk is the $723 premium paid, while the potential reward exceeds 3:1 if shares approach $130, offering a leveraged way to play a continued recovery in TGT.

TGT – Daily

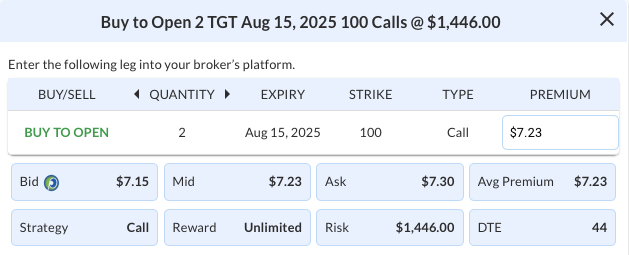

Trade Details

Strategy Details

Strategy: Long Call

Direction: Bullish Call

Details: Buy to Open 2 TGT Aug 15 $100 Call @ $7.23 Debit per Contract.

Total Risk: This trade has a max risk of $1,446 (2 Contracts x $723) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $723 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Neutral

Relative Strength: 2/10

OptionsPlay Score: 85

Stop Loss: @ $3.62 (50% loss of premium)

View TGT Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View TGT Trade

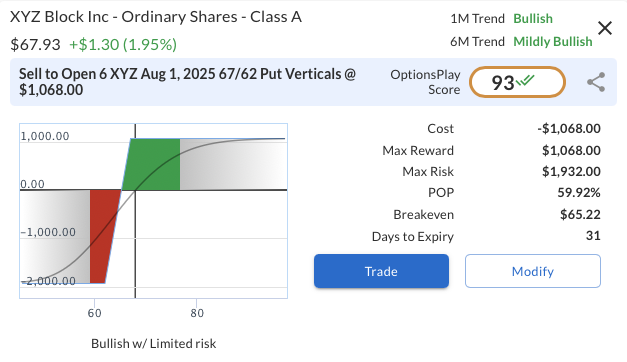

XYZ

DailyPlay – Opening Trade (XYZ) & Closing Trade (MSFT) – July 01, 2025

Closing Trade

- MSFT – 52% gain: Buy to Close 2 Contracts (or 100% of your Contracts) Aug 01 $475/$460 Put Vertical Spreads @ $2.45 Debit. DailyPlay Portfolio: By Closing 2 Contracts, we will be paying $490. We initially opened these 2 contracts on June 17 @ $5.07 Credit. Our gain, therefore, is $524.

XYZ Bullish Opening Trade Signal

Investment Rationale

Investment Thesis:

Block Inc. (XYZ) presents a timely bullish setup, supported by strong recent price action and an attractive valuation. With earnings scheduled for August 7, 2025, traders have an opportunity to position ahead of the event without taking on direct earnings risk. Momentum has continued to build, and as the stock outperforms the broader market, our $85 upside target remains in focus. Our options strategy is designed to capture this strength while avoiding earnings-related volatility.

Technical Analysis:

XYZ recently broke out above multi-month consolidation with sustained accumulation and a constructive pattern of higher lows and higher highs. The stock has reclaimed both the 20-day and 50-day moving averages and is now pushing toward the 200-day at $71.32, which marks the next key resistance level. Relative strength continues to improve, and with volume building and RSI trending higher, the price action supports a bullish continuation setup. The $62 level marks solid support, aligning with the breakout base and prior resistance zone from late May.

Fundamental Analysis:

XYZ trades at a discount relative to its industry while boasting growth and profitability metrics that exceed its sector peers. The valuation gap, coupled with strong earnings and revenue projections, signals potential for multiple expansion and continued investor re-rating.

- Forward PE Ratio: 14.65x vs. Industry Median 26.35x

- Expected EPS Growth: 23.90% vs. Industry Median 11.69%

- Expected Revenue Growth: 11.39% vs. Industry Median 9.38%

- Net Margins: 10.93% vs. Industry Median 8.59%

Options Trade:

To capitalize on the bullish setup while avoiding earnings risk, we recommend selling a short-dated put vertical: Sell to Open 1 XYZ Aug 1, 2025 67/62 Put Vertical @ $1.78. This trade collects a net credit of $1.78 ($178) with a defined risk of $3.22 ($322), yielding a potential 55% return on risk if XYZ stays above $67 through expiration. With 31 days to expiry, the setup benefits from time decay and technical support near $62, while avoiding the Aug 7 earnings event altogether.

XYZ – Daily

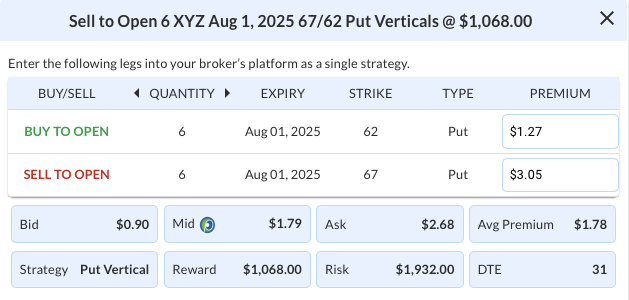

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 6 XYZ Aug 01 $67/$62 Put Vertical Spreads @ $1.78 Credit per Contract.

Total Risk: This trade has a max risk of $1,932 (6 Contracts x $322) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $322 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Mildly Bullish

Relative Strength: 2/10

OptionsPlay Score: 93

Stop Loss: @ $3.56 (100% loss to value of premium)

View XYZ Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View XYZ Trade

DailyPlay – Portfolio Review – June 30, 2025

DailyPlay Portfolio Review

Our Trades

AAPL – 18 DTE

Bearish Debit Spread – Apple Inc. (AAPL) – The trade has seen limited movement, fluctuating just above and below breakeven. Apple’s valuation remains elevated compared to its peers, while trade and tariff concerns persist. We made an adjustment last week to reduce the cost basis, decreasing overall risk and giving the bearish outlook more time to materialize.

ABNB – 25 DTE

Bullish Credit Spread – Airbnb Inc. (ABNB) – The position is currently down, as the stock has remained range-bound. A breakout above the $135 level is needed to generate upside momentum. With the stock trading near the upper end of its range, we plan to stay the course for now.

MSFT – 32 DTE

Bullish Credit Spread – Microsoft Corporation (MSFT) – The stock continues to show strong upside momentum, trading well above its 20-day, 50-day, and 200-day moving averages. With a solid gain in place, we intend to maintain our current position.

MU – 18 DTE

Bullish Credit Spread, Micron Technology, Inc. (MU), Micron (MU) released earnings last week. Prior to the report, we took some profits on a MU bull call vertical spread and repositioned accordingly. Despite solid results and guidance, the stock pulled back. We continue to hold a bullish outlook and will maintain the adjusted position.

SCHW – 172 DTE

Bullish Long Call – Charles Schwab Corp. (SCHW) – Our outlook remains positive, supported by strong company fundamentals and continued strength in both SCHW and the broader financial sector.

USO – 32 DTE

Bullish Credit Spread, United States Oil Fund, LP (USO), The position is currently down, and we’re closely monitoring oil prices ahead of the OPEC International Seminar on July 9th, a key event that will most likely impact the market.

WMT – 32 DTE

Bearish Credit Spread – Walmart Inc. (WMT) – We’re currently down slightly on this position. At this stage, we plan to hold steady.

GOOGL

DailyPlay – Closing Trade (GOOGL) – June 27, 2025

- GOOGL – 64% gain: Buy to Close 4 Contracts (or 100% of your Contracts) July 18 $165/$157.5 Put Vertical Spreads @ $0.88 Debit. DailyPlay Portfolio: By Closing 4 Contracts, we will be paying $352. We initially opened these 4 contracts on June 24 @ $2.43 Credit. Our gain, therefore, is $620.

AAPL

DailyPlay – Adjusting Trade (AAPL) – June 26, 2025

AAPL Bearish Trade Adjustment Signal

Investment Rationale

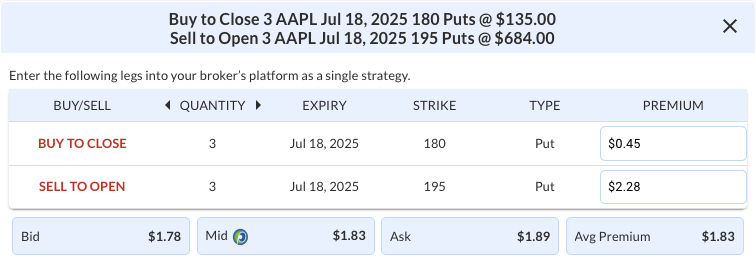

Adjustment Rationale:

Our bearish stance on Apple, Inc. (AAPL) remains intact, and we are holding 3 AAPL Jul 18, 2025 205/180 Bear Put Vertical Spreads within the Daily Play portfolio. Apple’s valuation continues to outpace peers, while unresolved trade and tariff risks persist. With the initial trade now at the halfway point to expiration, we’re managing risk by rolling the short 180 put up to the 195 strike, same expiration, for a net credit. Closing the position is also a viable alternative, but the roll effectively keeps the bearish idea in play and reduces the max risk of the position.

Adjustment Trade

Days to Expiration (DTE): 22

Buy to Close: 3 AAPL Jul 18, 2025 180 Puts @ $0.45

Sell to Open: 3 AAPL Jul 18, 2025 195 Puts @ $2.28

Mid: $1.83

Average Premium Received: $1.83 net credit

or $549 (300 x $1.83) for the adjustment trade

AAPL – Daily

Trade Details

Strategy Details

Strategy: Rolling a Short Put option up in strike

Direction: Resulting in a new Bearish Debit Spread

Details: Buy to Close 3 AAPL July 18 $180 Puts and Sell to Open 3 AAPL July 18 $195 Puts @ $1.83

Total Risk: The resulting position has a maximum risk of $1701 (2250 – 549), calculated as the initial cost basis of the 3 spreads purchased ($2250) minus the premium received from the adjustment ($549).

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower off a recent area of resistance.

1M/6M Trends: Neutral/Bearish

Relative Strength: 2/10

Stop Loss: @ $2.84(50% loss of premium)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

MU

DailyPlay – Opening Trade (MU) – June 25, 2025

MU Bullish Opening Trade Signal

Investment Rationale

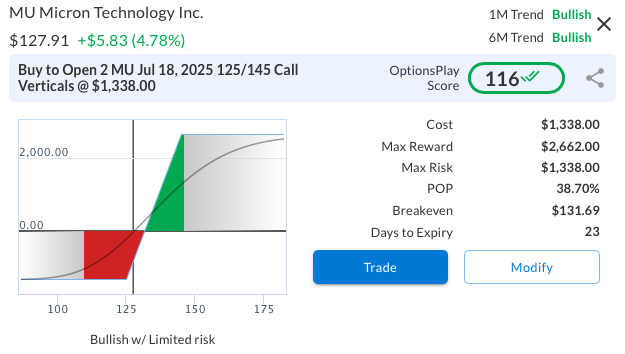

Investment Thesis

Micron Technology (MU) presents a high-conviction bullish setup heading into its earnings report today, Wednesday June 25th, with the options market pricing an 8.11% expected move. Micron is mentioned in the earnings navigator section at the end of this week’s trade ideas research report, reflecting its prominence as a top earnings catalyst this week. The stock is benefitting from a powerful convergence of secular tailwinds and earnings momentum, particularly tied to the AI-driven demand for high-performance memory. As one of the best-positioned plays in the DRAM and NAND recovery cycle, MU stands to outperform in the second half of 2025. A strong earnings beat and guide could drive further institutional accumulation, especially given its deep relative valuation discount and surging growth profile. The setup is attractive both as a short-term catalyst trade and a longer-term structural long.

Technical Analysis:

MU has decisively broken out above the $110 resistance zone and is now trading at multi-year highs, closing at $127.91. Price action remains bullish, supported by a steepening trendline that has developed since April. The stock is trading well above its 20-, 50-, and 200-day moving averages, all of which are trending higher. Volume trends also indicate accumulation, adding conviction to the breakout ahead of earnings. One potential concern is the RSI, which has reached 83, suggesting the stock may be approaching overbought territory. However, there is still some opportunity for further upside if the earnings report is perceived positively by the market, with our upside target at $135.

Fundamental Analysis:

Micron remains one of the most attractive names in the semiconductor space on a valuation-adjusted growth basis, with AI tailwinds accelerating demand for next-gen memory products. Industry dynamics are improving, and Micron is expected to deliver a notable earnings inflection as pricing recovers.

- Forward PE Ratio: 11.73x vs. Industry Median 22.84x

- Expected EPS Growth: 99.92% vs. Industry Median 16.50%

- Expected Revenue Growth: 22.73% vs. Industry Median 10.46%

- Net Margins: 14.92% vs. Industry Median 10.43%

Options Trade:

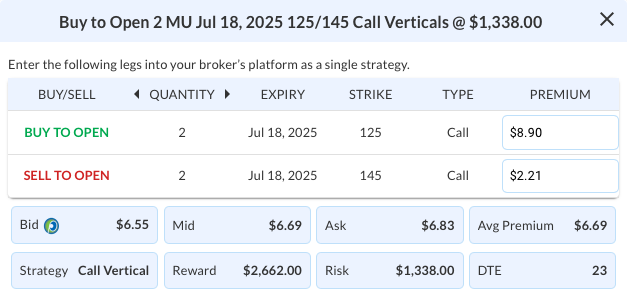

A bullish call vertical is favored into earnings: Buy the MU Jul 18, 2025 125/145 Call Spread for $6.69. This trade risks $669 to potentially make $1,331 (2.0x reward-to-risk ratio) if MU closes above $145 by expiration. With 24 days to expiry, this structure captures the earnings event while capping downside versus outright calls. The 125 strike sits just in-the-money, while the 145 target aligns with a post-earnings extension consistent with the implied move and current momentum. This trade expresses a directional bullish view while maintaining defined risk.

MU – Daily

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 2 MU July 18 $125/$145 Call Vertical Spreads @ $6.69 Debit per Contract.

Total Risk: This trade has a max risk of $1,338 (2 Contracts x $669) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $669 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 116

Stop Loss: @ $3.35 (50% loss of premium)

View MU Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.