GOOGL

DailyPlay – Opening Trade (GOOGL) & Closing Trade (MU) – June 24, 2025

Closing Trade

- MU – 50% gain: Sell to Close 5 Contracts (or 100% of your Contracts) July 11 $117/$130 Call Vertical Spreads @ $5.95 Credit. DailyPlay Portfolio: By Closing 5 Contracts, we will be collecting $2,975. Our cost basis on the trade was $1,995 Debit. Our gain, therefore, is $980.

GOOGL Bullish Opening Trade Signal

Investment Rationale

Investment Thesis:

Alphabet Inc. (GOOGL) presents an attractive bullish setup driven by a combination of technical resilience, compelling valuation, and strong business fundamentals. As one of the core pillars of digital advertising, AI infrastructure, and cloud computing, Alphabet remains well-positioned to benefit from ongoing secular trends in digital transformation and enterprise AI adoption. With earnings scheduled for July 22, we seek to capitalize on short-term price stability and potential upside while avoiding the volatility premium typically associated with earnings events. Our focus is on capturing this opportunity through a defined-risk put spread that expires before the report.

Technical Analysis:

GOOGL is undergoing a constructive pullback within a well-established bullish trend, offering a favorable setup for trend-following traders. The stock recently broke out of a multi-month consolidation and has now pulled back to retest key support near $165, which aligns with prior resistance and marks a critical retracement zone. Price action is beginning to stabilize, and GOOGL continues to hold above its rising 50-day moving average, reinforcing the strength of the longer-term uptrend. This pullback presents a compelling risk/reward opportunity, with a successful defense of the $165 level likely to set the stage for a move back toward the $175–$185 resistance range and our $185 upside target.

Fundamental Analysis:

GOOGL continues to trade at a relative discount despite its strong profitability and growth outlook, reinforcing its status as a high-quality compounder. Margins remain well above peers, driven by the efficiency of its advertising engine and growing contribution from higher-margin businesses like Google Cloud and YouTube.

- Forward PE Ratio: 17.39x vs. Industry Median 19.15x

- Expected EPS Growth: 12.80% vs. Industry Median 12.58%

- Expected Revenue Growth: 10.46% vs. Industry Median 11.73%

- Net Margins: 30.86% vs. Industry Median 6.28%

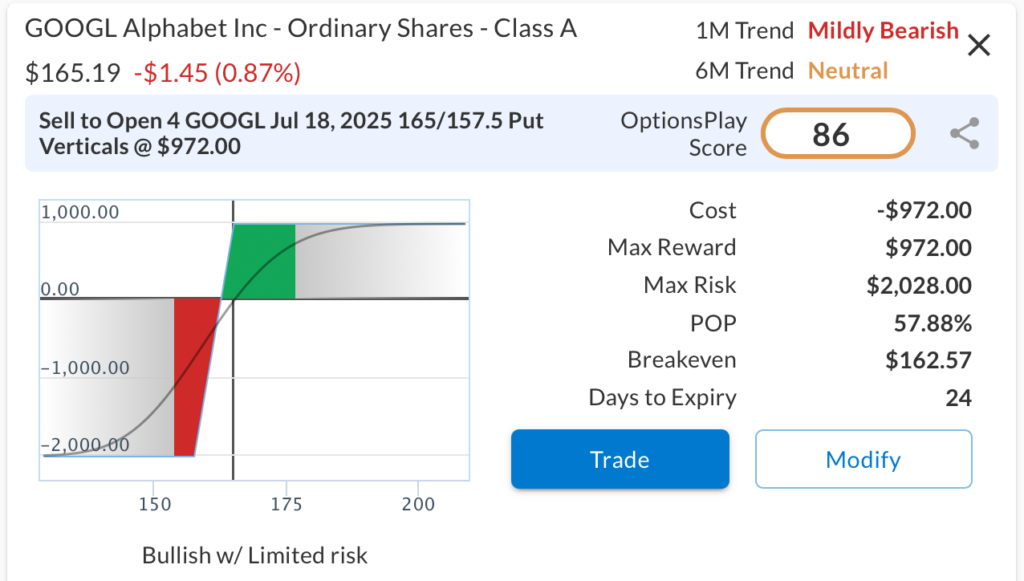

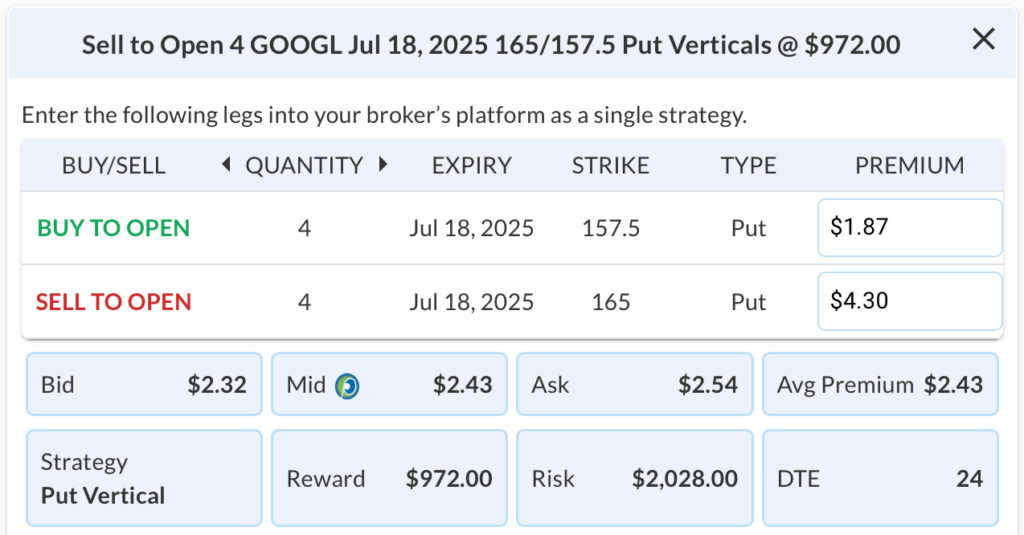

Options Trade:

To express this bullish thesis while avoiding pre-earnings volatility expansion, we suggest selling the GOOGL Jul 18, 2025 $165/$157.50 Put Vertical for a $2.43 credit. This defined-risk trade collects premium by selling the $165 put and buying the $157.50 put. Max profit is earned if GOOGL stays at or above $165. Max loss occurs below $157.50. With a solid 2 to 1 risk-reward ratio, this setup benefits from time decay and supports our view that GOOGL holds firm or trends higher in the near term.

GOOGL – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 4 GOOGL July 18 $165/$157.50 Put Verticals @ $2.43 Credit per Contract.

Total Risk: This trade has a max risk of $2,028 (4 Contracts x $507) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $507 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Mildly Bearish/Neutral

Relative Strength: 2/10

OptionsPlay Score: 86

Stop Loss: @ $4.86 Debit (100% loss to value of premium)

View GOOGL Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View GOOGL Trade

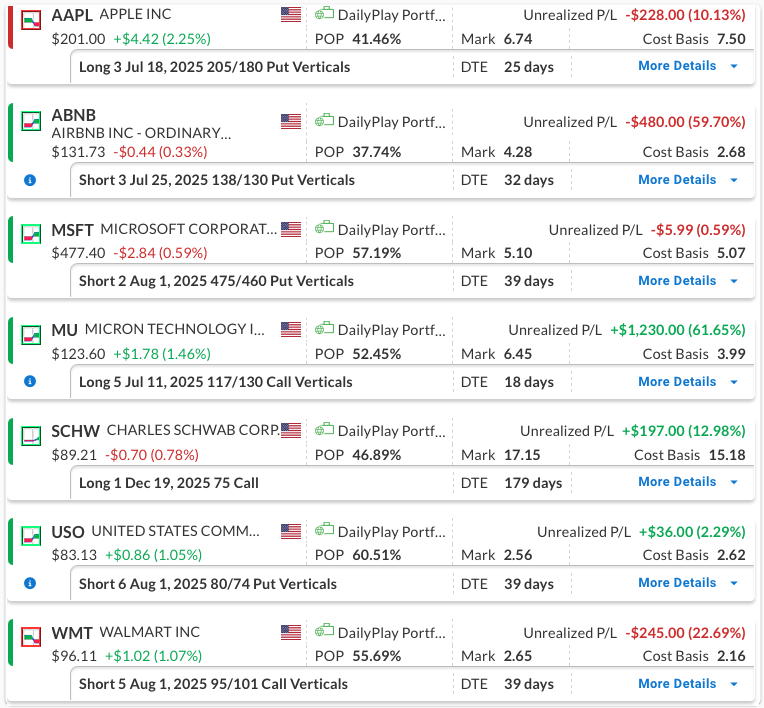

DailyPlay – Portfolio Review – June 23, 2025

DailyPlay Portfolio Review

Our Trades

AAPL – 25 DTE

This trade has hovered around breakeven, fluctuating between modest gains and losses. Apple remains priced at a premium compared to its peers and continues to deal with unresolved concerns around the trade war and tariffs. With ample time left until expiration, we will continue to hold the position.

ABNB – 32 DTE

Bullish Credit Spread – Airbnb Inc. (ABNB) – We recently entered this position. The stock was down this week with the general direction of the market and we plan to hold our course at this time.

MSFT – 39 DTE

Bullish Credit Spread – Microsoft Corporation (MSFT) – The stock built some strong upside momentum last week. We have a solid gain and plan to stay the course for now.

MU – 18 DTE

Bullish Credit Spread – Micron Technology, Inc. (MU) – We have a solid gain in this position. MU had a strong week, with upside momentum continuing. The company is scheduled to report earnings on Wednesday, June 25th, after the market close. If the gain continues, we may look to close the position to capture profits without taking on the risk of the earnings report. We will be watching this position closely early in the week.

SCHW – 179 DTE

Bullish Long Call – Charles Schwab Corp. (SCHW) – Our outlook remains positive, supported by strong company fundamentals and continued strength in both SCHW and the broader financial sector.

USO – 39 DTE

Bullish Credit Spread – United States Oil Fund, LP (USO) – We recently established this position, and considering the geopolitical events that occurred over the weekend, we plan to stay the course for now.

WMT – 39 DTE

Bearish Credit Spread – Walmart Inc. (WMT) – We recently established this position and currently have a small gain. For now, we plan to stay the course.

USO

DailyPlay – Opening Trade (USO) – June 20, 2025

USO Bullish Opening Trade Signal

Investment Rationale

Investment Thesis

Rising geopolitical tensions in the Middle East are injecting a renewed risk premium into global oil markets, lifting the appeal of crude oil-linked ETFs such as the United States Oil Fund (USO). With the Strait of Hormuz under threat and oil futures reacting swiftly to headlines, USO stands to benefit as traders seek liquid instruments to express bullish crude views. While oil markets have at times decoupled from geopolitical events, the scale and persistence of current threats argue for sustained upward pressure on prices. Against this backdrop, USO offers a compelling vehicle to position for continued strength in oil.

Technical Analysis

USO has recently broken above its 50-day and 20-day moving averages, reclaiming the $82 level with strong volume confirmation. The ETF shows renewed upside momentum after a prolonged consolidation between $67 and $75, with RSI turning higher but not yet overbought—suggesting additional room to run. The next technical resistance lies around $85, while the $75 area now serves as initial support. The reclaim of the 200-day moving average earlier this quarter reinforces a bullish trend reversal and validates bullish exposure with defined risk.

Commodity Analysis

Oil prices remain sensitive to geopolitical developments, and USO’s value is closely tied to the front-month WTI crude futures it holds. As global supply risks intensify, especially via the Strait of Hormuz, traders are re-pricing crude oil with a heightened premium. USO benefits directly from this repricing dynamic as a proxy for crude.

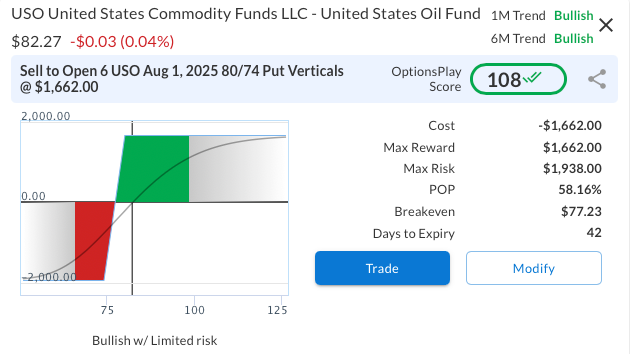

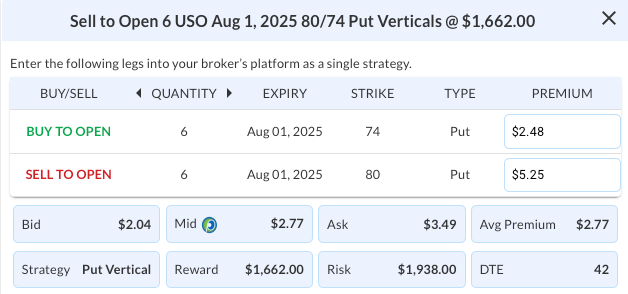

Options Trade

The trade is a bull put vertical spread, selling the USO Aug 1, 2025 $80 put and buying the $74 put for a net credit. If USO is above $80 at expiration, the maximum reward is achieved. This setup allows traders to express a bullish view without requiring a further rally—USO merely needs to hold above the short strike. The $80 level is well above technical support and reflects confidence in elevated oil prices persisting short-term due to global instability. The risk-reward ratio is 0.86, meaning for every dollar at risk, we aim to make 86 cents. A favorable volatility skew enhances the appeal of this particular trade.

USO – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 6 USO Aug 01 $80/$74 Put Verticals @ $2.77 Credit per Contract.

Total Risk: This trade has a max risk of $1,938 (6 Contracts x $323) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $323 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 108

Stop Loss: @ $5.54 (100% loss to value of premium)

View USO Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View USO Trade

WMT

DailyPlay – Opening Trade (WMT) & Closing Trade (ADBE) – June 18, 2025

Closing Trade

- ADBE – 112% loss: Buy to Close 3 Contracts (or 100% of your Contracts) July 03 $410/$400 Put Vertical Spreads @ $8.80 Debit.

DailyPlay Portfolio: By Closing 3 Contracts, we will be paying $2,640. We initially opened these 3 contracts on June 04 @ $4.15 Credit. Our loss, therefore, is $465 per contract.

WMT Bearish Opening Trade Signal

Investment Rationale

Investment Thesis:

Walmart (WMT) appears increasingly vulnerable to downside pressure following a rejection at key technical resistance and signs of overvaluation relative to its industry peers. While the retail giant continues to benefit from its defensive profile, current valuation levels and modest growth metrics do not support the prevailing premium. In a market environment increasingly sensitive to valuation and earnings quality, WMT may underperform as investors reassess risk-adjusted expectations heading into Q3. With weakening momentum and limited upside catalysts, a bearish stance is justified as the stock struggles to hold key support.

Technical Analysis:

WMT was recently rejected at the $100 level, a significant area of resistance that has capped price rallies since late 2024. The stock has since broken below its 20-day moving average and is hovering just above the 50-day, with price action showing a potential transition from consolidation to a new downtrend. The RSI sits around neutral territory, but the lack of strong buying support on recent pullbacks suggests diminishing bullish conviction. A breakdown below $91 would likely accelerate downside momentum toward its longer-term moving averages and volume support levels.

Fundamental Analysis:

Walmart trades at a meaningful valuation premium despite performance metrics that are largely in line with industry averages. This disconnect highlights the risk of multiple compression should market sentiment deteriorate or growth expectations reset lower.

- Forward PE Ratio: 36.23x vs. Industry Median 17.96x

- Expected EPS Growth: 8.99% vs. Industry Median 9.02%

- Expected Revenue Growth: 4.19% vs. Industry Median 4.98%

- Net Margins: 2.75% vs. Industry Median 2.36%

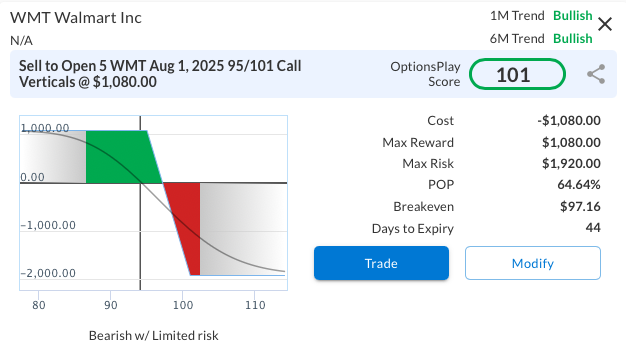

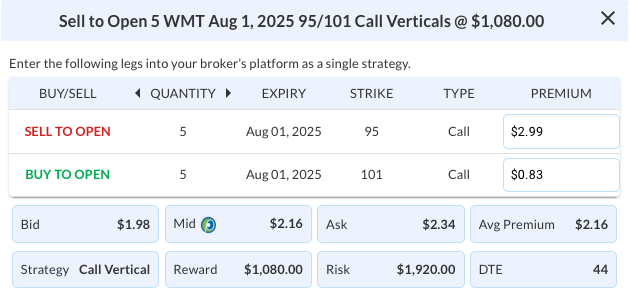

Options Trade:

Sell the WMT Aug 1, 2025, 95/101 bear call vertical spread for a net credit. This bearish position reaches maximum profit if WMT closes below $95 at expiration. The structure presents an attractive 0.56 risk/reward profile and benefits from both time decay and bearish price action. With shares currently near $94.25, the spread is strategically placed just above resistance, offering a high-probability setup if WMT continues to stall or weaken.

WMT – Daily

Trade Details

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 5 WMT Aug 01 $95/$101 Call Vertical Spreads @ $2.16 Credit per Contract.

Total Risk: This trade has a max risk of $1,920 (5 Contracts x $384) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $384 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower over the duration of this trade.

1M/6M Trends: Bearish/Neutral

Relative Strength: 4/10

OptionsPlay Score: 101

Stop Loss: @ $4.32 (100% loss to value of premium)

View WMT Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View WMT Trade

MSFT

DailyPlay – Opening Trade (MSFT) & Closing Trade (NVDA) – June 17, 2025

Closing Trade

- NVDA – 60% gain: Sell to Close 4 Contracts (or 100% of your Contracts) June 20 $138/$145 Call Vertical Spreads @ $5.39 Credit. DailyPlay Portfolio: By Closing 4 Contracts, we will be collecting $2,156. We adjusted the 4 short calls June 03 reducing our cost basis to $1,348 Debit. Our gain, therefore, is $808.

MSFT Bullish Opening Trade Signal

Investment Rationale

Investment Thesis

Microsoft stands out as both offense and defense among mega-cap tech stocks. Its core enterprise business is highly resilient, shielding it from consumer-driven macro headwinds and making it a stable defensive play amid market volatility. On offense, Azure remains the fastest-growing hyperscaler, with 35 percent revenue growth and a significant AI contribution, well ahead of AWS and Google Cloud. Microsoft’s deep AI integration, powered by OpenAI, positions it squarely at the forefront of the next technology wave. With a dominant footprint across cloud, productivity, and developer ecosystems, MSFT is well positioned to deliver durable long-term growth while providing downside protection.

Technical Analysis

MSFT recently broke out cleanly above 420 resistance and has since accelerated to new all-time highs near 480, maintaining a strong, orderly uptrend. Price is firmly above all major moving averages, with the 20-day EMA providing steady support. While RSI is extended, it is not diverging, indicating ongoing trend strength rather than exhaustion. Relative strength ranks high at 9 out of 10, and volume confirms conviction behind the move. With strong momentum in place, MSFT looks poised to push toward the 520 area in the near term.

Fundamental Analysis

Microsoft’s premium valuation is supported by best-in-class fundamentals and strategic leadership in AI and cloud infrastructure. Its scale, fortress balance sheet, and high-margin software model uniquely combine growth and defensiveness.

- Forward PE Ratio: 31.48x vs. Industry Median 27.72x

- Expected EPS Growth: 14.24% vs. Industry Median 11.48%

- Expected Revenue Growth: 13.87% vs. Industry Median 9.36%

- Net Margins: 35.79% vs. Industry Median 9.80%

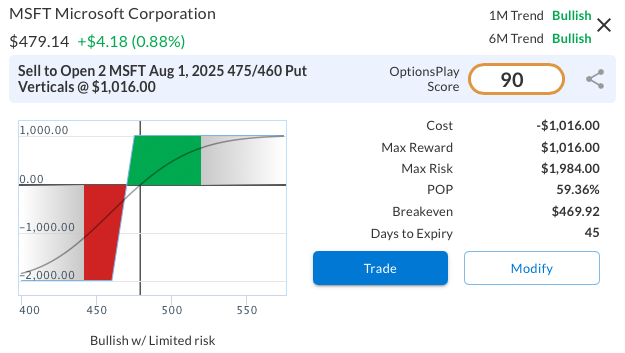

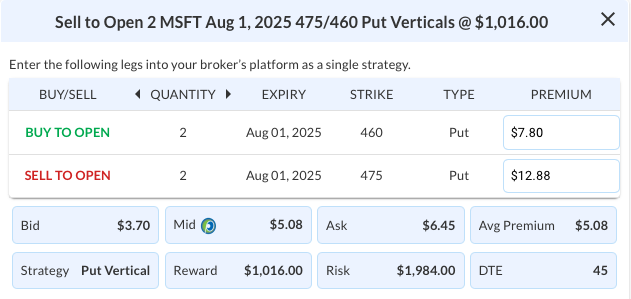

Options Trade

To establish a bullish position with defined risk, sell the MSFT Aug 1, 2025, 475/460 put vertical spread for a net credit. This bull put vertical spread achieves maximum profit if MSFT closes above $475 at expiration, offering a high-probability, risk-controlled strategy. With a risk/reward ratio of 0.51, this trade aims to earn $0.51 for every $1.00 risked, making it an attractive option for bullish investors seeking a high-probability strategy to complement their optimistic outlook on MSFT.

MSFT – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 2 MSFT Aug 01 $475/$460 Put Verticals @ $5.08 Credit per Contract.

Total Risk: This trade has a max risk of $1,984 (2 Contracts x $992) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $992 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 90

Stop Loss: @ $10.16 (100% loss to value of premium)

View MSFT Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View MSFT Trade

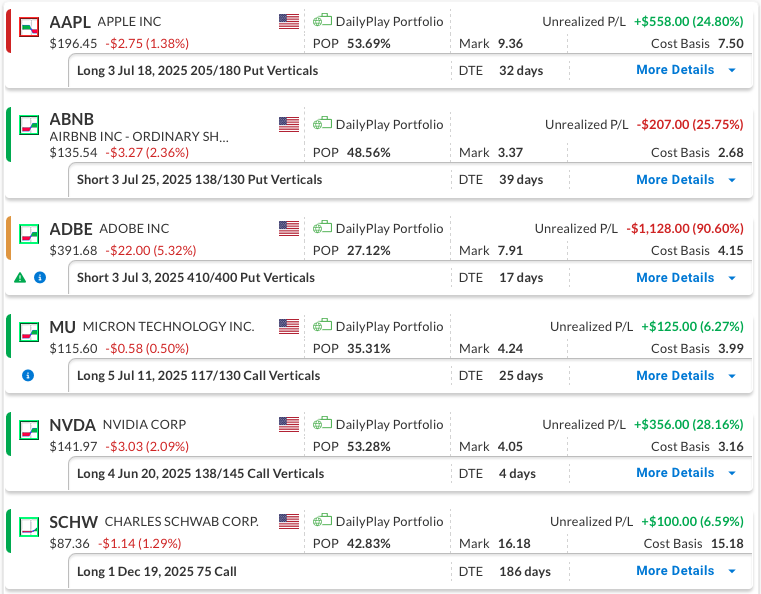

DailyPlay – Portfolio Review – June 16, 2025

DailyPlay Portfolio Review

Our Trades

AAPL – 32 DTE

Bearish Debit Spread – Apple Inc. (AAPL) – Apple’s stock showed weakness last week, with signs of modest downside pressure emerging. AAPL still trades at a premium to its peers, and ongoing concerns about tariffs and trade dynamics remain a factor. With sufficient time until expiration, we are holding the position to allow the trade thesis to continue to play out.

ABNB – 39 DTE

Bullish Credit Spread – Airbnb Inc. (ABNB) – We recently entered this position. The stock was down this week with the general direction of the market and we plan to hold our course at this time.

ADBE – 17 DTE

Bullish Credit Spread – Adobe Inc. (ADBE) – Adobe’s Q2 results met expectations with a modest beat and upward guidance revision. However, investor sentiment turned cautious, sending the stock down 5.32% post-announcement, bringing it close to our max loss. We believe the underlying fundamentals remain favorable and are maintaining the trade following earnings. While the stock’s reaction warrants attention, we continue to see enough strength to justify holding the position, though we’ll monitor the trend closely.

MU – 25 DTE

Bullish Credit Spread – Micron Technology, Inc. (MU) – We recently entered this position. The stock had a solid week despite a challenging overall market, and we plan to hold our course at this time. The company is set to report earnings on Wednesday, June 25th, after market close.

NVDA – 4 DTE

Bullish Debit Spread – Nvidia Corp. (NVDA) – Since the earnings announcement, this trade has hovered near breakeven, fluctuating between small gains and losses. With NVDA showing some weakness last week and expiration approaching quickly, we’re likely to close the position early this week to manage risk effectively.

SCHW – 186 DTE

Bullish Long Call – Charles Schwab Corp. (SCHW) – Our outlook remains positive, supported by strong company fundamentals and continued strength in both SCHW and the broader financial sector.

ABNB

DailyPlay – Opening Trade (ABNB) & Closing Trade (TMUS) – June 13, 2025

Closing Trade

- TMUS – 82% gain: Buy to Close 3 Contracts (or 100% of your Contracts) July 18 $250/$260 Call Vertical Spreads @ $0.69 Debit. DailyPlay Portfolio: By Closing 3 Contracts, we will be paying $207. We initially opened these 3 contracts on June 06 @ $3.74 Credit. Our gain, therefore, is $915.

ABNB Bullish Opening Trade Signal

Investment Rationale

Investment Thesis

Airbnb Inc. (ABNB) remains a standout in the Travel & Leisure sector, leveraging its capital-light model, global brand recognition, and operational efficiency to drive consistent growth. As the platform transitions from early-stage volatility into sustained profitability, it benefits from durable secular trends in alternative lodging and post-pandemic travel normalization. With a business model that scales efficiently and a healthy balance of margin expansion and top-line growth, ABNB is well-positioned to command a valuation premium. This backdrop supports a constructive outlook and justifies bullish positioning into the summer travel season.

Technical Analysis

ABNB has reasserted its bullish posture following a clean breakout above its 200-day moving average at $134.76, now acting as firm support. The recent advance to $138.81, accompanied by a +0.75% gain on strong volume, reflects renewed momentum and buyer conviction. The 50-day moving average continues to trend higher, reinforcing a structurally sound uptrend. With an RSI of 41.01, the stock is far from overbought, suggesting ample room for upside extension. These technical signals collectively point to a favorable risk/reward setup for bullish exposure above the $138 level.

Fundamental Analysis

ABNB continues to outpace industry peers on key financial metrics, reinforcing the quality of its growth profile:

- Forward PE Ratio: 33.01x vs. Industry Median 17.30x

- Expected EPS Growth: 11.25% vs. Industry Median 10.91%

- Expected Revenue Growth: 9.24% vs. Industry Median 5.11%

- Net Margins: 22.60% vs. Industry Median 9.90%

Options Trade

To capitalize on the bullish setup, consider selling the Jul 25, 2025 $138/$130 put vertical for a net credit. offering a risk/reward ratio just under 1:2. The position profits if ABNB remains above $138 through expiration, which aligns with technical support and ongoing fundamental strength. With 43 days to expiry, this spread provides an efficient way to express a bullish thesis while maintaining downside protection in a well-structured risk envelope.

ABNB – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 3 ABNB Jul 25 138/130 Put Verticals @ $2.68 Credit per Contract.

Total Risk: This trade has a max risk of $1,596 (3 Contracts x $532) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $532 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 5/10

OptionsPlay Score: 86

Stop Loss: @ $5.36 (100% loss to value of premium)

View ABNB Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View ABNB Trade

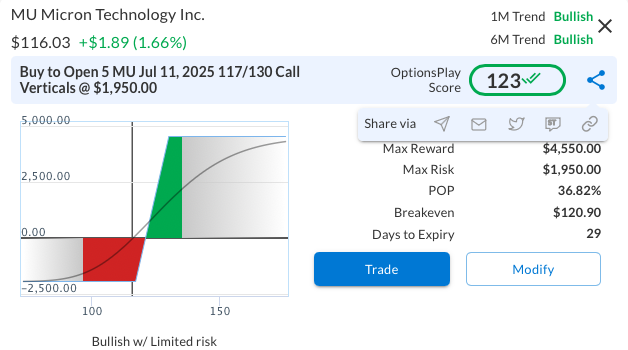

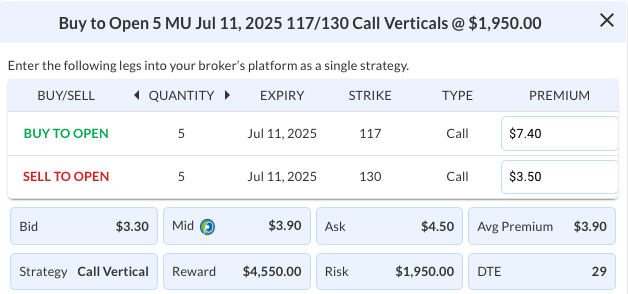

MU

DailyPlay – Opening Trade (MU) & Closing Trade (CHWY) – June 12, 2025

Closing Trade

- CHWY – 128% gain: Sell to Close 12 Contracts (or 100% of your Contracts) June 27 $46/$41 Put Vertical Spreads @ $3.74 Credit. DailyPlay Portfolio: By Closing 12 Contracts, we will be collecting $4,488. We initially opened these 12 contracts on June 10 @ $1.64 Debit. Our gain, therefore, is $2,520.

MU Bullish Opening Trade Signal

Investment Rationale

Investment Thesis

Micron Technology (MU) offers a compelling bullish setup ahead of its June 25th earnings report. The stock has recently staged a strong breakout and is gaining momentum on both technical and fundamental fronts, setting the stage for continued upside into and potentially through the earnings event. With a growing AI-driven demand cycle, improving DRAM/NAND pricing trends, and an exceptionally strong valuation profile relative to peers, MU is positioned as a leading beneficiary in the semiconductor upcycle. The upcoming report serves as a catalyst that could drive a re-rating in the stock, particularly given Micron’s historically strong post-earnings moves during upcycles.

Technical Analysis:

MU recently broke above a multi-month consolidation range, with price clearing the $100 resistance level on expanding volume and strong relative strength. The 50-day and 200-day moving averages have both turned upward, confirming a bullish trend reversal, and the stock is now trading comfortably above all major moving averages. RSI remains in bullish territory but not yet overbought, suggesting further upside potential without immediate exhaustion. If MU can hold above the $110–$112 area into earnings, the next technical target aligns with the $130 range based on the measured move from its prior base.

Fundamental Analysis:

Micron appears significantly undervalued relative to the semiconductor sector, despite leading on nearly every forward-looking metric. The company is well positioned to capitalize on AI memory demand and a recovery in memory pricing, both of which are accelerating. Its upcoming earnings report is expected to confirm this operational momentum, validating current expectations for explosive earnings growth in the coming quarters.

- Forward PE Ratio: 9.90x vs. Industry Median 22.84x

- Expected EPS Growth: 99.18% vs. Industry Median 16.50%

- Expected Revenue Growth: 22.63% vs. Industry Median 10.46%

- Net Margins: 14.92% vs. Industry Median 10.43%

Options Trade:

To express a bullish view on MU with controlled risk into earnings, consider the July 11, 117/130 bull call vertical for a net debit. This spread’s long call sits just above current levels, offering a modest buffer while capturing potential upside if the stock rallies post-earnings. By using a vertical spread, the strategy helps neutralize the effects of an implied volatility crush after the report, delivers a favorable risk/reward ratio of over 2:1, and reduces premium outlay compared to buying calls outright, allowing you to participate in upside momentum while limiting your maximum loss to the net debit paid.

MU – Daily

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 5 MU Jul 11 117/130 Call Verticals @ $3.90 Debit per Contract.

Total Risk: This trade has a max risk of $1,950 (5 Contracts x $390) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $390 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 123

Stop Loss: @ $1.95 (50% loss of premium)

View MU Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View MU Trade

AMAT, GOOGL

DailyPlay – Closing Trades (AMAT, GOOGL) – June 11, 2025

- AMAT – 65% gain: Buy to Close 3 Contracts (or 100% of your Contracts) June 27 $165/$155 Put Vertical Spreads @ $1.34 Debit. DailyPlay Portfolio: By Closing 3 Contracts, we will be paying $402. We initially opened these 3 contracts on May 21 @ $3.85 Credit. Our gain, therefore, is $753.

- GOOGL – 63% gain: Buy to Close 6 Contracts (or 100% of your Contracts) July 18 $165/$160 Put Vertical Spreads @ $0.61 Debit. DailyPlay Portfolio: By Closing 6 Contracts, we will be paying $366. We initially opened these 6 contracts on June 05 @ $1.67 Credit. Our gain, therefore, is $636.

CHWY

DailyPlay – Opening Trade (CHWY) – June 10, 2025

CHWY Bearish Opening Trade Signal

Investment Rationale

Investment Thesis:

Chewy Inc. (CHWY) has staged a notable rally ahead of its earnings announcement before the market opens on Wednesday, June 11, but the sharp bullish run appears overextended, particularly given weak underlying fundamentals and elevated valuation multiples. With the stock trading near the top of its 52-week range and relative strength at a maximum of 10/10, the potential for a short-term reversal is increasing. A bearish counter-trend setup into earnings offers a tactical opportunity to fade the recent strength, especially considering signs of waning momentum and stretched price action.

Technical Analysis

CHWY has been in a strong uptrend since mid-April, with price accelerating above the 20-day and 50-day moving averages. However, the stock has now reached a potential exhaustion point near $48, the upper end of its 52-week range. The RSI is elevated at 65, close to overbought territory, and yesterday’s sharp pullback on increased volume may mark the beginning of a corrective phase. Should selling pressure persist, key support levels to monitor include the 20-day moving average at $44.23 and the 50-day at $38.79.

Fundamental Analysis

While Chewy has benefited from improved sentiment around consumer discretionary names, its fundamentals remain relatively weak compared to industry peers:

- Forward PE Ratio: 72.37x vs. Industry Median 18.58x

- Expected EPS Growth: 0% vs. Industry Median 6.83%

- Expected Revenue Growth: 6.54% vs. Industry Median 3.62%

- Net Margins: 3.31% vs. Industry Median 6.54%

The elevated valuation multiple is difficult to justify with no earnings growth and lower margins, which increases downside risk if earnings disappoint or guidance underwhelms.

Options Trade:

To express a bearish near-term view on Chewy (CHWY), consider buying the June 27, 2025, 46/41 put vertical spread for a net debit, which yields a favorable 2.05:1 risk/reward ratio. With only 18 days until expiration and elevated implied volatility, this spread efficiently captures potential downside through or after earnings without overpaying for premium.

CHWY – Daily

Trade Details

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 12 CHWY June 27 $46/$41 Put Vertical Spreads @ $1.64 Debit per Contract.

Total Risk: This trade has a max risk of $1,968 (12 Contracts x $164) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $164 to select the # contracts for your portfolio.

Counter-Trend Signal: This is a bearish trade on a bullish stock that has started to show signs of buyer exhaustion after a strong rally and has a higher probability of a pullback on earnings.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 121

Stop Loss: @ $0.82(50% loss of premium)

View CHWY Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.