$BSX

DailyPlay – Opening Trade (BSX) Closing Trade (AMGN) – March 28, 2025

Closing Trade

- AMGN – 23% loss: Buy to Close 2 Contracts (or 100% of your Contracts) April 11 $315/$300 Put Vertical Spreads @ $7.35 Debit. DailyPlay Portfolio: By Closing both Contracts, we will be paying $1,470. We initially opened these 2 Contracts on March 21 @ $5.07 Credit. Our loss, therefore, is $228 per contract. The margin requirement per contract is $1,500 and we received a Credit of $507 per contract giving us a net margin requirement of $993. Our loss is $228 per contract which gives us a net loss of 23%.

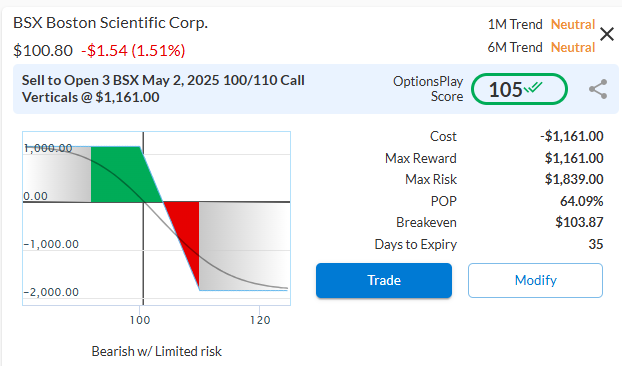

BSX Bearish Opening Trade Signal

Investment Rationale

Boston Scientific (BSX) appears overextended both technically and fundamentally, making it a compelling candidate for bearish exposure. The stock has broken below key technical levels and is now retesting resistance, presenting a high-probability downside setup. Additionally, its valuation is significantly stretched relative to industry peers, despite only marginally superior growth metrics. This combination of technical weakness and fundamental overvaluation suggests downside risk toward $90.

BSX recently broke down below a key trading range and has since rallied back to retest prior support, which is now acting as resistance. This price action presents an optimal risk/reward opportunity for bearish positioning, as failed retests of support-turned-resistance often lead to continued downside. Momentum indicators also confirm weakening price strength, reinforcing the potential for further declines. A downside target of $90 aligns with prior support levels.

BSX is trading at a premium valuation despite subpar net margins and only slightly above-average growth rates compared to its industry peers. The elevated multiple suggests significant downside risk if growth expectations falter.

- Forward PE Ratio: 35.19x vs. Industry Median 21.70x

- Expected EPS Growth: 13.65% vs. Industry Median 11.25%

- Expected Revenue Growth: 11.37% vs. Industry Median 7.73%

- Net Margins: 11.05% vs. Industry Median 17.34%

Our preference is to take a neutral to bearish outlook by harnessing options premiums through a bearish call spread – Selling to Open, BSX May 2, 2025 100/110 Call Verticall. This trade benefits from time decay and provides a favorable risk/reward profile for bearish exposure on BSX.

BSX – Daily

Trade Details

Strategy Details

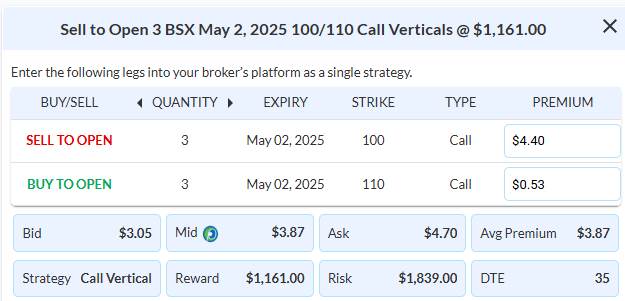

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 3 Contracts BSX May 2 $100/$110 Call Vertical Spreads @ $3.87 Credit per Contract.

Total Risk: This trade has a max risk of $1,839 (3 Contracts x $613) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $613 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue pull back from recent resistance.

1M/6M Trends: Neutral/Neutral

Relative Strength: 9/10

OptionsPlay Score: 105

Stop Loss: @ $7.74 (100% loss to value of premium)

View BSX Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View BSX Trade

$PDD

DailyPlay – Opening Trade (PDD) – March 27, 2025

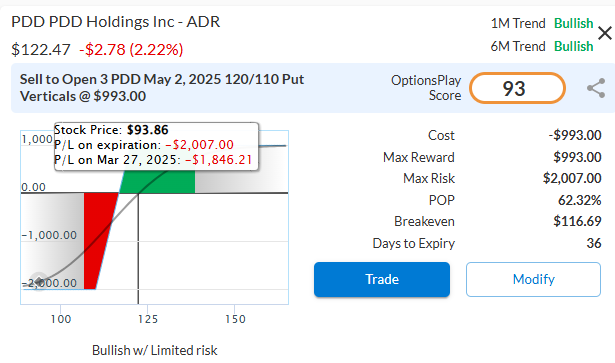

PDD Bullish Opening Trade Signal

Investment Rationale

PDD Holdings Inc. (PDD) showcases strong technical momentum, robust fundamental growth, and exceptional performance relative to its peers, solidifying our bullish perspective on the stock. Despite persistent concerns over U.S. tariffs, China has begun easing its economic approach, shifting to a “moderately loose” monetary policy and implementing measures to stimulate growth. With PDD trading at a substantial discount compared to similar companies, it remains primed for significant upside potential.

According to PDD’s chart, the stock recently broke out above its key trading range with impressive momentum, though it has since experienced a slight pullback. It continues to outperform the broader S&P 500, suggesting sustained institutional support and relative strength. Provided PDD holds above its prior breakout level, our upside target of $145 remains intact, backed by compelling price action and fundamental resilience. Despite its superior growth metrics, PDD trades at a notable discount to its industry:

- Forward P/E Ratio: 10.02x vs. Industry Median 22.47x

- Expected EPS Growth: 30.21% vs. Industry Median 9.59%

- Expected Revenue Growth: 31.26% vs. Industry Median 4.92%

- Net Margins: 29.06% vs. Industry Median 9.95%

These figures underscore PDD’s remarkable profitability and growth trajectory, reinforcing our conviction that the stock is undervalued.

To harness our bullish outlook while mitigating risk, we recommend selling the May 2, 2025, 120/110 put vertical spread for a $3.31 credit. This trade profits as long as PDD stays above $120 at expiration, offering a maximum reward of $331 per contract against a defined risk of $669. Despite the recent pullback, PDD’s breakout and strong fundamentals make this strategy an effective way to capitalize on its upward momentum while maintaining an attractive risk-reward balance.

PDD – Daily

Trade Details

Strategy Details

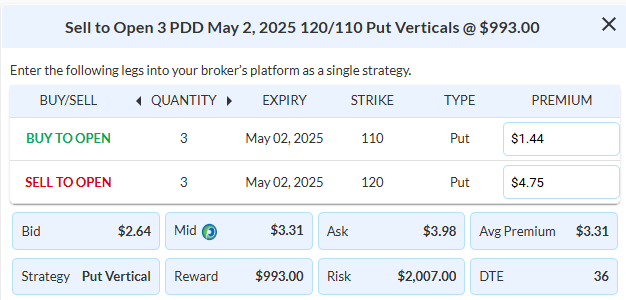

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 3 Contracts PDD May 2 $120/$110 Put Vertical Spreads @ $3.31 Credit per Contract.

Total Risk: This trade has a max risk of $2,007 (3 Contracts x $669) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $669 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher off recent support.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 93

Stop Loss: @ $13.38 (100% loss to value of premium)

View PDD Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View PDD Trade

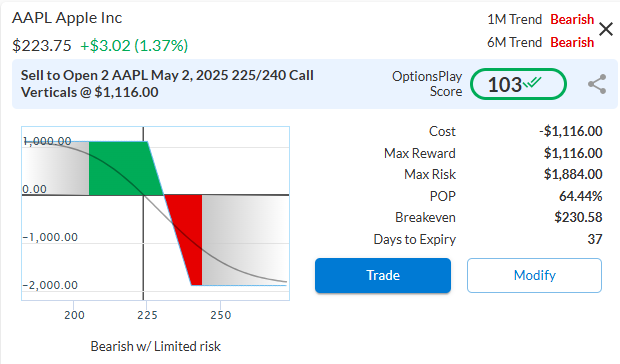

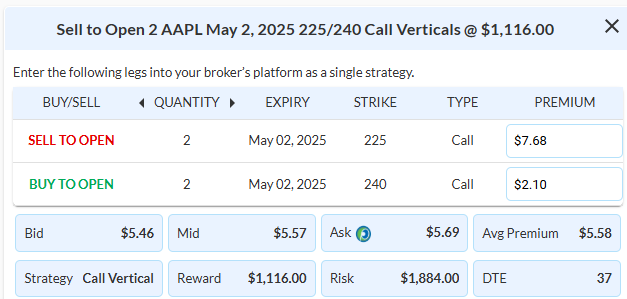

$AAPL

DailyPlay – Opening Trade (AAPL) Closing Trades (SHOP, AMGN) – March 26, 2025

Closing Trades

- SHOP – 79% gain: Buy to Close 3 Contracts (or 100% of your Contracts) April 25 $92/$80 Put Vertical Spreads @ $0.63 Debit.

DailyPlay Portfolio: By Closing all 3 Contracts, we will be paying $189. We initially opened these 3 Contracts on March 12 @ $2.95 Credit. Our gain, therefore, is $696. - AMGN – 48% loss: Buy to Close 3 Contracts (or 100% of your Contracts) April 25 $310/$300 Put Vertical Spreads @ $4.74 Debit.

DailyPlay Portfolio: By Closing all 3 Contracts, we will be paying $1,422. We initially opened these 3 Contracts on March 14 @ $3.20 Credit. Our loss, therefore, is $154 per contract.

AAPL Bearish Opening Trade Signal

Investment Rationale

As Apple Inc. (AAPL) approaches its $225 resistance level, a series of mounting challenges remains. A more selective consumer has led to disappointing iPhone 16 sales, a major component of revenue. Additionally, AAPL faces stiff competition in their singular bet on the future of augmented reality, where rivals are putting pressure on the future of Apple’s Vision Pro. Moreover, Apple’s venture into artificial intelligence has gone from bad to worse, pushing its core features that were marketed with the iPhone 16 into next year. Compounding these issues, the economic slowdown in China, a critical market for Apple, is dampening sales further. And with AAPL’s valuation trading at a 50% premium over its peers, it’s increasingly untenable given an outlook that lacks much optimism. This puts AAPL in a spot of vulnerability, suggesting that a breakout back towards recent highs is less likely.

If we look at the chart of AAPL, it has underperformed the S&P 500 since hitting a new all-time high in December and has continued to print a series of lower lows and lower highs. This suggests that as it approaches a major resistance level, the timing is optimal to add some bearish exposure where the risk/reward is attractive. Our downside target on AAPL is $200.

And if we look at the business,AAPL’s valuation is hard to justify, trading at an 50% premium relative to its peers, despite growth metrics that are only in line with the industry. While its superior profitability has historically justified a premium valuation, recent slowdown in revenues and EPS growth puts this at significant risk.

- Forward PE Ratio: 30x vs. Industry Median 20x

- Expected EPS Growth: 11% vs. Industry Median 10%

- Expected Revenue Growth: 6% vs. Industry Median 6%

- Net Margins: 24% vs. Industry Median 13%

Without an immediate catalyst on the horizon, my preference is to take a bearish to neutral outlook by harnessing options premiums by Selling an May 2, $225/240 Call Vertical @ $5.58 Credit.

AAPL – Daily

Trade Details

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 2 Contracts AAPL May 2 $225/$240 Call Vertical Spread @ $5.58 Credit per Contract.

Total Risk: This trade has a max risk of $1,884 (2 Contracts x $942) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $942 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue its bearish trajectory over the duration of this trade.

1M/6M Trends: Bearish/Bearish

Relative Strength: 4/10

OptionsPlay Score: 103

Stop Loss: @ $11.16 (100% loss to value of premium)

View AAPL Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AAPL Trade

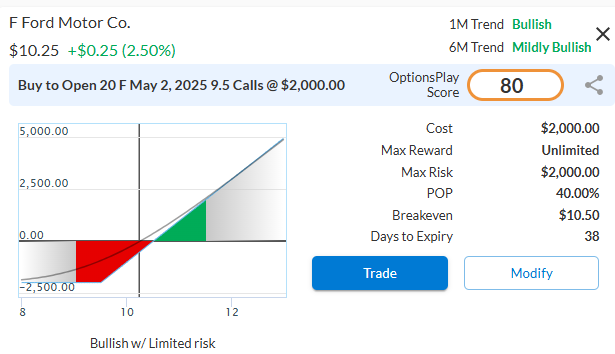

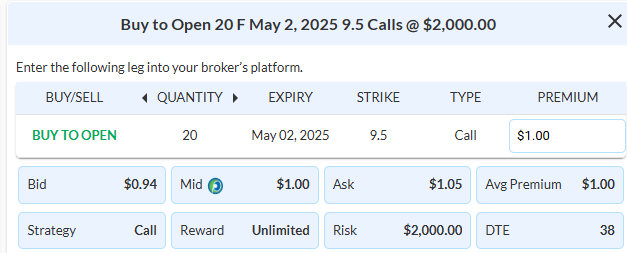

$F

DailyPlay – Opening Trade (F) – March 25, 2025

F Bullish Opening Trade Signal

Investment Rationale

Ford Motor Co. (F) is positioned for a rally as it breaks out above resistance, fueled by the recent exclusion of autos from tariffs announced on April 2, which is expected to drive a broader rally in auto stocks. This tariff relief removes a significant overhang for the sector, allowing Ford to benefit from improved cost structures and enhanced competitiveness in key markets. Ford’s focus on electric vehicles (EVs) and its strong lineup of traditional vehicles continue to resonate with consumers, while its undervalued fundamentals provide a margin of safety for investors. With the stock outperforming the S&P 500 and showing strong momentum, F is an attractive opportunity in the auto sector amidst this favorable policy shift.

The chart confirms F’s bullish setup, as the stock has broken through a key resistance level at $10 with strong momentum, outpacing the S&P 500. The breakout supported by positive volume trends indicates potential for a rally towards our $12.50 target.

Ford trades at a substantial discount to its peers despite exhibiting growth metrics that outperform its industry, suggesting there is significant upside potential.

- Forward PE Ratio: 7.62x vs. Industry Average 10.18x

- Expected EPS Growth: 11.38% vs. Industry Average 6.40%

- Expected Revenue Growth: -2.79% vs. Industry Average 2.70%

- Net Margins: 3.18% vs. Industry Average 3.53%

Bullish Thesis:

- Tariff Relief: The exclusion of autos from tariffs announced on April 2, 2025, removes a major cost burden, boosting Ford’s profitability and competitiveness, and driving a potential rally in auto stocks.

- EV and Traditional Vehicle Strength: Ford’s strategic focus on electric vehicles, alongside its strong traditional vehicle lineup, positions it to capture market share in a recovering auto sector.

Undervalued Opportunity: Trading at a significant discount to its peers with solid EPS growth, Ford offers an attractive risk-to-reward profile for investors.

F – Daily

Trade Details

Strategy Details

Strategy: Long Call

Direction: Bullish Call

Details: Buy to Open 20 Contracts Ford May 2 $9.50 Call @ $1.00 Debit per Contract.

Total Risk: This trade has a max risk of $2,000 (20 Contracts x $100) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $100 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher off recent support.

1M/6M Trends: Bullish/Mildly Bullish

Relative Strength: 7/10

OptionsPlay Score: 80

Stop Loss: @ $0.50 (50% loss of premium)

View F Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View F Trade

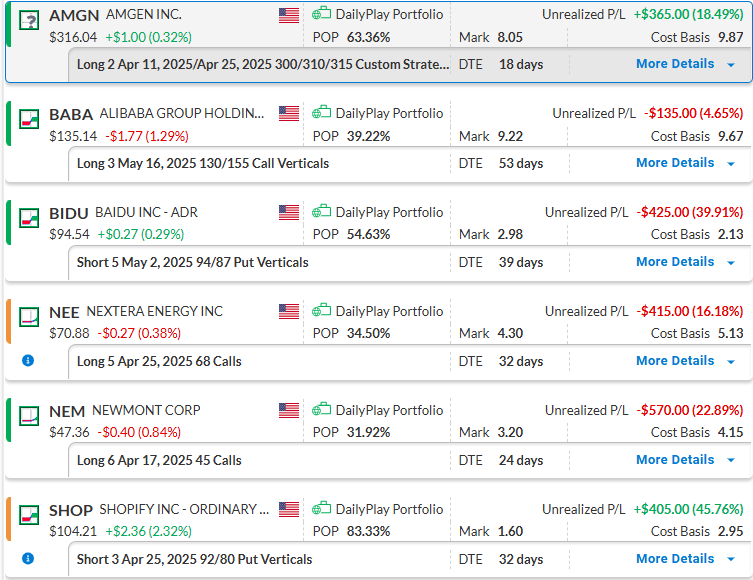

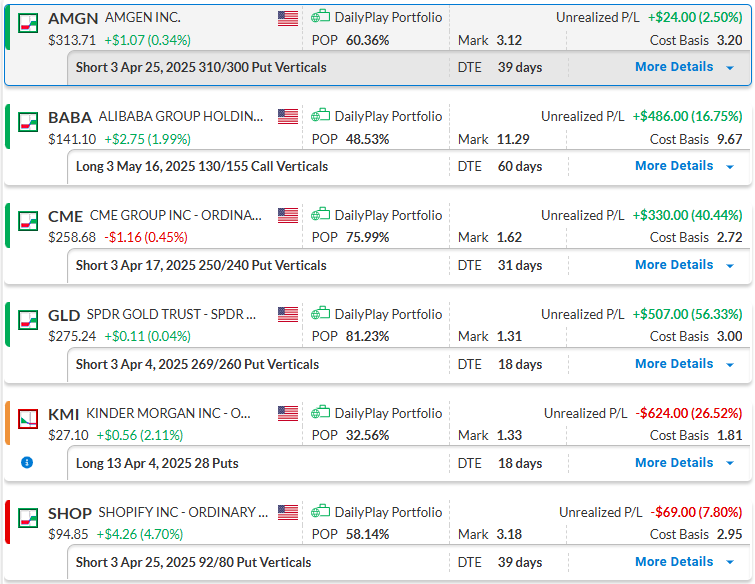

DailyPlay – Portfolio Review – March 24, 2025

DailyPlay Portfolio Review

Our Trades

AMGN – 18 DTE

Bullish Credit Spread – Amgen Inc – This position was established recently and is profitable. We plan to hold steady for now.

BABA – 53 DTE

Bullish Debit Spread – Alibaba Group Holding Ltd. – This position was recently opened and is currently experiencing a minimal loss. We plan to hold steady for now.

BIDU – 39 DTE

Bullish Credit Spread – Baidu, Inc. (BIDU) – We recently established this position, and it’s currently underwater. For now, we plan to hold steady.

NEE – 32 DTE

Bullish Long Call – NextEra Energy, Inc. (NEE) – We established this position recently, and it’s currently at a loss. For now, we’ll hold steady.

NEM – 24 DTE

Bullish Long Call – Newmont Corporation (NEM) – This position was established recently and is at a loss. We’re holding firm for the time being.

SHOP – 32 DTE

Bullish Credit Spread – Shopify Inc. – We’ve recently established this position and are seeing profits. We’ll keep a close eye on it this week and may close it when the timing’s right.

$AMGN

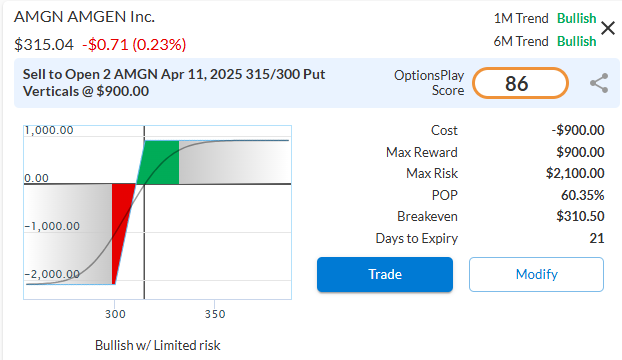

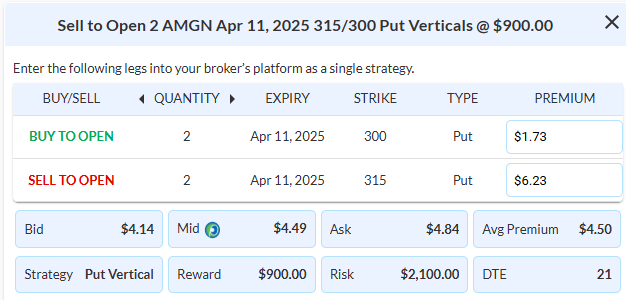

DailyPlay – Opening Trade (AMGN) – March 21, 2025

AMGN Bullish Opening Trade Signal

Investment Rationale

Amgen Inc. (AMGN) – Last month, we initiated a position on AMGN via a long call. On February 25, we closed that position for a profit. The momentum continued to the upside but has now pulled back, and we are looking at a credit spread to take a bullish stance this time around.

Fundamentally, AMGN is moderately undervalued, trading in line with its industry median. However, recent growth suggests that estimates may be too low, supporting a higher valuation. AMGN has a forward P/E ratio of 15.28x compared to the industry average of 12.86x. Expected EPS growth for AMGN is 3.91% versus 8.61% for the industry, while expected revenue growth stands at 2.94% compared to the industry average of 7.74%. Net margins for AMGN are 12.24%, slightly below the industry average of 13%.

AMGN – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 2 Contracts AMGN April 11 $315/$300 Put Vertical Spreads @ $4.50 Credit per Contract.

Total Risk: This trade has a max risk of $2,100 (2 Contracts x $450) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $450 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue its bullish trajectory over the duration of this trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 6/10

OptionsPlay Score: 86

Stop Loss: @ $9.00 (100% loss to value of premium)

View AMGN Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AMGN Trade

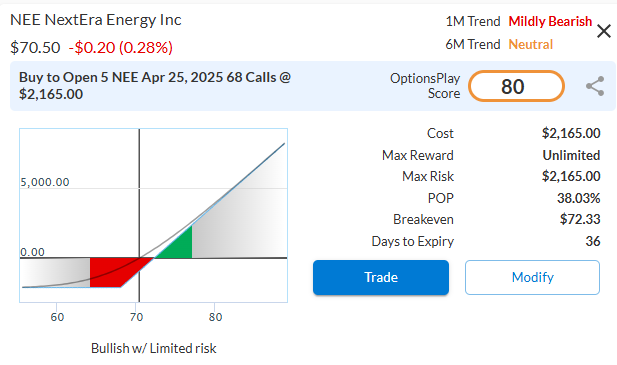

$NEE

DailyPlay – Opening Trade (NEE) – March 20, 2025

NEE Bullish Opening Trade Signal

Investment Rationale

NextEra Energy, Inc. (NEE) recently broke out above resistance while outperforming the S&P 500, suggesting further upside toward a target of $85.

Fundamentally, NEE is moderately undervalued, trades in line with its peers, and is expected to grow at a faster pace while offering superior profitability metrics. NEE has a forward P/E ratio of 19.15x compared to the industry average of 19.14x. Its expected EPS growth is 8.32%, versus the industry average of 7.65%, and its expected revenue growth is 10.95% compared to 4.39% for the industry. NEE also boasts net margins of 28.06%, significantly higher than the industry average of 14.17%.

NEE – Daily

Trade Details

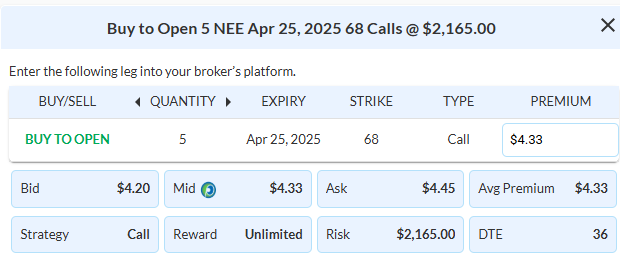

Strategy Details

Strategy: Long Call

Direction: Bullish Call

Details: Buy to Open 5 Contracts NEE April 25 $68 Calls @ $4.33 Debit per Contract.

Total Risk: This trade has a max risk of $2,165 (5 Contracts x $433) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $433 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher off recent support.

1M/6M Trends: Mildly Bearish/Neutral

Relative Strength: 3/10

OptionsPlay Score: 80

Stop Loss: @ $2.17 (50% loss of premium)

View NEE Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View NEE Trade

$CME, $KMI

DailyPlay – Closing Trades (CME, KMI) – March 19, 2025

- CME – 86% gain: Buy to Close 3 Contracts (or 100% of your Contracts) April 17 $250/$240 Put Vertical Spreads @ $0.39 Debit.

DailyPlay Portfolio: By Closing all 3 Contracts, we will be paying $117. We initially opened these 3 Contracts on March 7 @ $2.72 Credit. Our gain, therefore, is $699. - KMI – 50% loss: Sell to Close 13 Contracts (or 100% of your Contracts) April 4 $28 Puts @ $0.90 Credit.

DailyPlay Portfolio: By Closing all 13 Contracts, we will receive $1,170. We initially opened these 13 Contracts on Feb 20 @ $1.81 Debit. Our loss, therefore, is $91 per contract.

$NEM

DailyPlay – Opening Trade (NEM) Closing Trade (GLD) – March 18, 2025

Closing Trade

- GLD – 68% gain: Buy to Close 3 Contracts (or 100% of your Contracts) April 4 $269/$260 Put Vertical Spreads @ $0.97 Debit. DailyPlay Portfolio: By Closing all 3 Contracts, we will be paying $291. We initially opened these 3 Contracts on March 5 @ $3.00 Credit. Our gain, therefore, is $609.

NEM Bullish Opening Trade Signal

Investment Rationale

Newmont Corporation (NEM) – Following the company’s February 20, 2025, earnings report, the stock fell 12%, then consolidated before stabilizing and rebounding near its pre-earnings price. The closing price on the day of the earnings report, $48.09, is now acting as resistance. Our upside target for the stock is $56 if this level is broken. Recent record highs in gold prices may have bolstered NEM’s recovery, supporting its upward momentum.

Fundamentally, NEM appears moderately undervalued, trading at a forward price-to-earnings (P/E) ratio of 12.36, slightly below the industry median of 12.45. While its expected EPS growth is lower at 7.33% compared to the industry’s 22.12%, NEM’s net margins have recently improved to 17.92%, outperforming the industry average of 11.17%. Despite modest revenue growth of 1.69% versus the industry’s 7.45%, its improved margins and attractive valuation suggest meaningful upside potential.

NEM – Daily

Trade Details

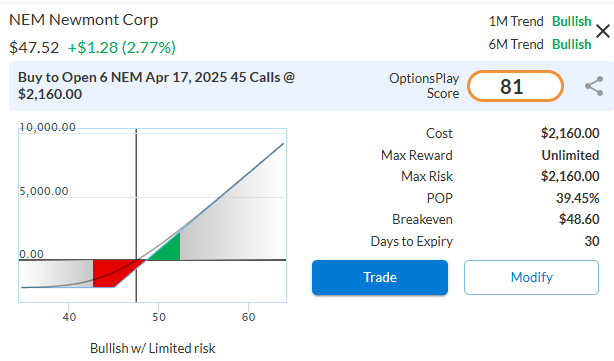

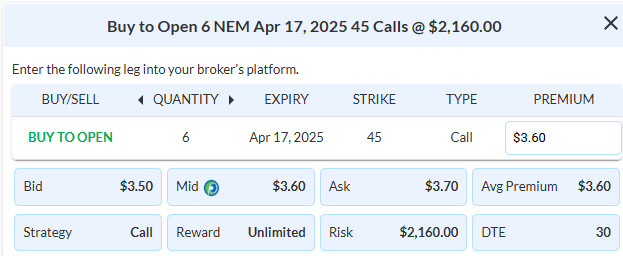

Strategy Details

Strategy: Long Call

Direction: Bullish Call

Details: Buy to Open 6 Contracts NEM April 17 $45 Calls @ $3.60 Debit per Contract.

Total Risk: This trade has a max risk of $2,160 (6 Contracts x $360) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $360 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher off recent support.

1M/6M Trends: Bullish/Bullish

Relative Strength: 4/10

OptionsPlay Score: 81

Stop Loss: @ $1.80 (50% loss of premium)

View NEM Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View NEM Trade

$BIDU

DailyPlay – Portfolio Review & Opening Trade (BIDU) – March 17, 2025

DailyPlay Portfolio Review

Our Trades

AMGN – 39 DTE

Bullish Credit Spread – Amgen Inc – This position was established recently and is slightly profitable. We plan to hold steady for now.

BABA – 60 DTE

Bullish Debit Spread – Alibaba Group Holding Ltd – This position was established recently and is currently profitable. We plan to hold steady for now.

CME – 31 DTE

Bullish Credit Spread – CME Group Inc – We have a solid gain in this position and might close it out soon to capture the profit.

GLD – 18 DTE

Bullish Credit Spread – SPDR Gold Trust – The bullish trend in gold is gathering force once more. The position remains profitable, and we will hold steady for now.

KMI – 18 DTE

Bearish Long Put – Kinder Morgan Inc – Since establishing this position, we have a small loss, and with expiration approaching, the position will be under close watch.

SHOP – 39 DTE

Bullish Credit Spread – Shopify Inc – This position was recently established, and we are slightly down. We plan to hold steady for now.

BIDU Bullish Opening Trade Signal

Investment Rationale

As a trade war with China escalates, Baidu Inc. (BIDU) stands out as an opportunity to gain exposure to a global leader in AI at a compelling valuation, with reduced risks from tariffs. As China’s leading search engine, BIDU has evolved into a powerhouse in AI innovation, with initiatives like the Ernie Bot chatbot, Baidu AI Cloud, and autonomous driving projects gaining significant traction. These efforts position BIDU to capitalize on China’s aggressive push to compete globally in AI, supported by recent deregulation that is unlocking value for Chinese tech firms. Trading at a significant discount to its industry, BIDU offers an attractive risk to reward for investors seeking exposure to the AI revolution with a long-term growth horizon.

If we examine the chart, BIDU made a new 52-week low at the beginning of 2025 which started to show exhaustion from sellers. Since then, the stock has made a series of higher highs and higher lows, suggesting that the multi-year downtrend is potentially starting to reverse in the other direction. Lastly, the recent pullback and bounce off its $84 confirms this directional shift with an upside target of $150.

Looking at the business, BIDU trades at a significant discount to its industry, despite EPS growth and profitability metrics that are in line with or exceed industry averages. China’s deregulatory push and BIDU’s leadership in AI further enhance its investment case.

- Forward PE Ratio: 9.1x vs. Industry Average 20.9x

- Expected EPS Growth: 13% vs. Industry Average 14%

- Net Margins: 18% vs. Industry Average 8%

BIDU’s AI Leadership:

- AI Leadership: BIDU’s AI initiatives, including the Ernie Bot 4.5 and Ernie X1 leading frontier models that compete with ChatGPT.

- Deregulatory Tailwinds: China’s recent relaxation of tech regulations is unlocking value for BIDU, allowing it to focus on innovation and growth.

- Investment in AI Ecosystem: BIDU’s $145M venture capital fund for AI startups and up to $2B investment in biotech highlights its commitment to expanding its AI and tech footprint.

BIDU – Daily

Trade Details

Strategy Details

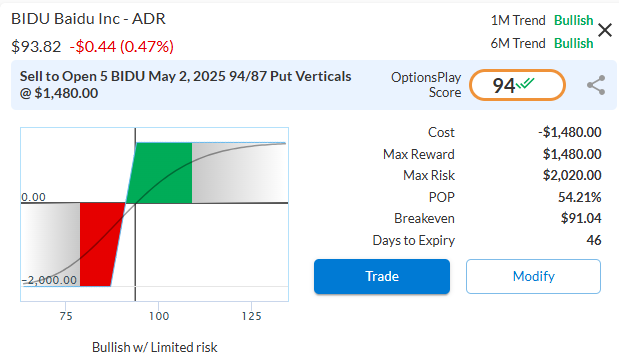

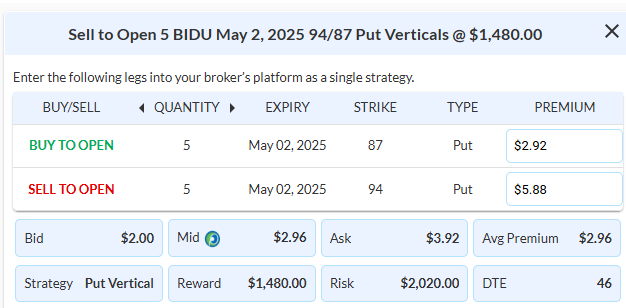

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 5 Contracts BIDU May 2 $94/$87 Put Vertical Spreads @ $2.96 Credit per Contract.

Total Risk: This trade has a max risk of $2,020 (5 Contracts x $404) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $404 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on an stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 94

Stop Loss: @ $5.92 (100% loss to value of premium)

View BIDU Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View BIDU Trade

Your trial has expired!

Please visit the page below to begin your membership now

Start My Membership