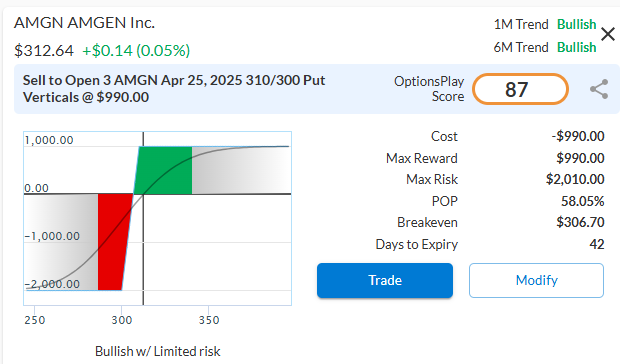

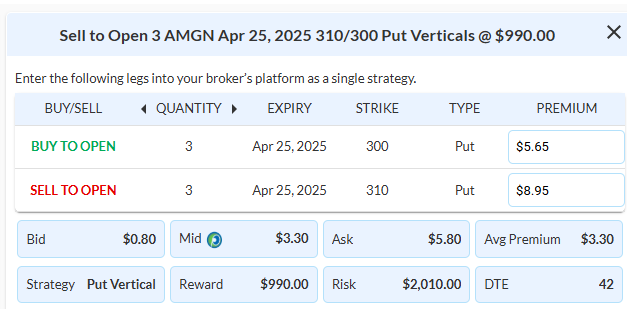

$AMGN

DailyPlay – Opening Trade (AMGN) – March 14, 2025

AMGN Bullish Opening Trade Signal

Investment Rationale

Amgen Inc. (AMGN) — A few weeks ago, we established a bullish play in AMGN. The stock recently showed strong momentum as it moved through its 200-day moving average, and we successfully closed that position for a profit. It has now pulled back from its recent high and is sitting on its 200-day moving average, which may act as a support level in the near term.

From a valuation perspective, AMGN appears moderately undervalued. It trades at a forward P/E ratio of 15.13, which is slightly above the industry average of 12.86. Although its expected EPS growth of 3.91% and expected revenue growth of 2.94% are below the industry averages of 8.61% and 7.74%, respectively, AMGN’s solid net margins of 12.24% compare well to the industry average of 13%. Recent growth trends indicate that current estimates may be too low, supporting a higher valuation.

AMGN – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 3 Contracts AMGN April 25 $310/$300 Put Vertical Spreads @ $3.30 Credit per Contract.

Total Risk: This trade has a max risk of $2,010 (3 Contracts x $670) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $670 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on an stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 7/10

OptionsPlay Score: 87

Stop Loss: @ $6.60 (100% loss to value of premium)

View AMGN Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AMGN Trade

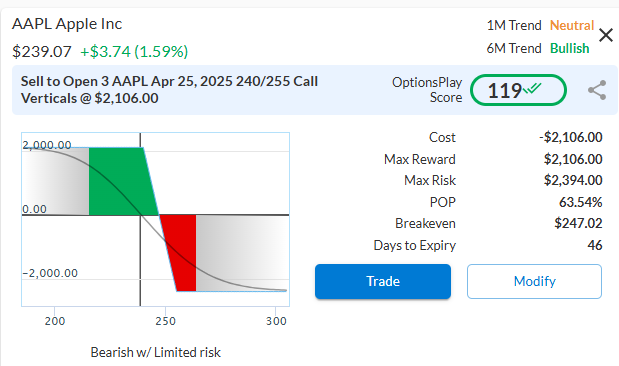

$AAP, $DAL, $V

DailyPlay – Closing Trades (AAPL, DAL, V) – March 13, 2025

Closing Trades

- AAPL – 73% gain: Buy to Close 3 Contracts (or 100% of your Contracts) April 25 $240/$255 Call Vertical Spreads @ $1.19 Debit.

DailyPlay Portfolio: By Closing all 3 Contracts, we will be paying $357. We initially opened these 3 Contracts on March 10 @ $4.40 Credit. Our gain, therefore, is $963. - DAL – 192% gain: Sell to Close 8 Contracts (or 100% of your Contracts) April 17 $60/$50 Put Vertical Spreads @ $8.75 Credit.

DailyPlay Portfolio: By Closing all 8 Contracts, we will be receive $7,000. We initially opened these 8 Contracts on Feb 28 @ $3.00 Credit. Our gain, therefore, is $4,600. - V – 52% loss: Buy to Close 2 Contracts (or 100% of your Contracts) April 4 $350/$335 Put Vertical Spreads @ $9.68 Debit.

DailyPlay Portfolio: By Closing both Contracts, we will pay $1,936. We initially opened these 2 Contracts on Feb 25 @ $3.93 Credit. Our loss, therefore, is $1,150. The margin requirement for this trade is $1,500 and we received a Credit of $393 per contract giving us a net margin requirement of $1,107. Our loss is $575 per contract which gives us a loss of 52%.

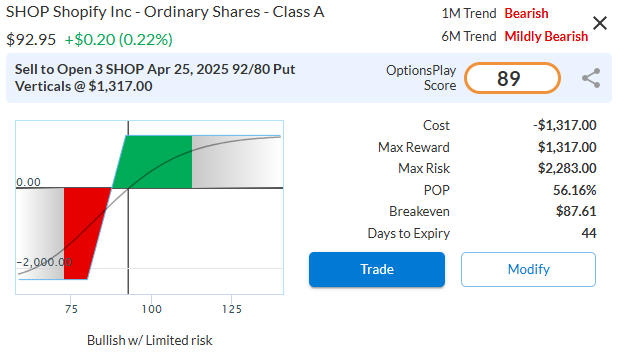

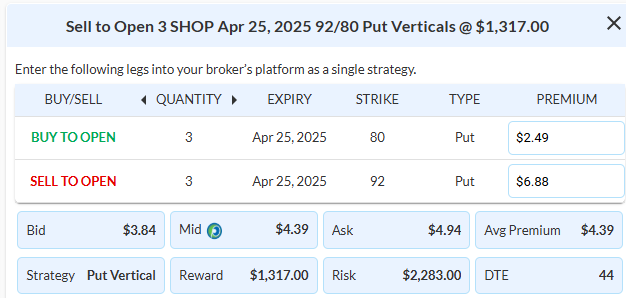

$SHOP

DailyPlay – Opening Trade (SHOP) – March 12, 2025

SHOP Bullish Opening Trade Signal

Investment Rationale

Shopify Inc. (SHOP) has been a long-standing pick in the research report and has delivered strong performance since its addition. Following a strong breakout above $90 and an extended period of sideways consolidation, the stock has now returned to the breakout level. This $90 range offers an attractive risk-reward opportunity for adding to or initiating a position.

Shopify is fundamentally modestly undervalued, with an EV to forward revenue ratio of 12x, roughly 50% higher than its peers. This valuation is supported by Shopify’s significantly stronger growth metrics, including an impressive EPS growth of 185% and revenue growth of 21%, compared to the industry averages.

Shopify’s forward PE ratio stands at 66.71x versus the industry average of 27.07x, while its expected EPS growth is 35.82% compared to 13.68% for its peers. Additionally, Shopify boasts expected revenue growth of 21.64% versus the industry average of 8.59% and maintains net margins of 23.08%, outperforming the industry average of 17.83%.

SHOP – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 3 Contracts SHOP April 25 $92/$80 Put Vertical Spreads @ $4.39 Credit per Contract.

Total Risk: This trade has a max risk of $2,283 (3 Contracts x $761) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $761 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on an stock that is expected to bounce higher off recent support.

1M/6M Trends: Bearish/Mildly Bearish

Relative Strength: 10/10

OptionsPlay Score: 89

Stop Loss: @ $8.78 (100% loss to value of premium)

View SHOP Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View SHOP Trade

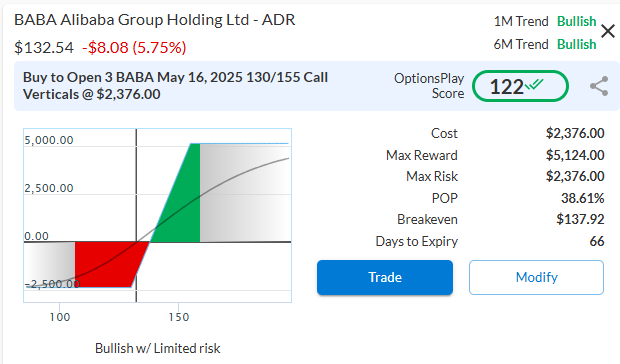

$BABA

DailyPlay – Opening Trade (BABA) – March 11, 2025

BABA Bullish Opening Trade Signal

Investment Rationale

Alibaba Group Holdings Inc. (BABA) recently emerged from a three-year bottoming pattern that began in early 2022. The stock climbed from $125 to around $140 following the breakout. Despite a pullback yesterday amid the market downturn, there remains considerable upside potential toward our $230 target. With China’s recent deregulation push, the country’s tech and AI ambitions are expected to gain momentum, potentially unlocking shareholder value.

Despite comparable growth and profitability metrics, BABA trades at a significant discount to its industry. Its forward PE ratio is 13.60 times, well below the industry average of 22.64 times. BABA’s expected EPS growth is 11.38%, compared to the industry average of 9.59%, while its expected revenue growth is 7.15% versus the industry average of 4.92%. Additionally, BABA’s net margins are 12.33%, outperforming the industry average of 9.95%

BABA – Daily

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 3 Contracts BABA May 16 $130/$155 Call Vertical Spreads @ $7.92 Debit per Contract.

Total Risk: This trade has a max risk of $2,376 (3 Contracts x $792) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $792 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on an stock that is expected to continue its bullish trajectory.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 122

Stop Loss: @ $3.96 (50% loss of premium)

View BABA Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View BABA Trade

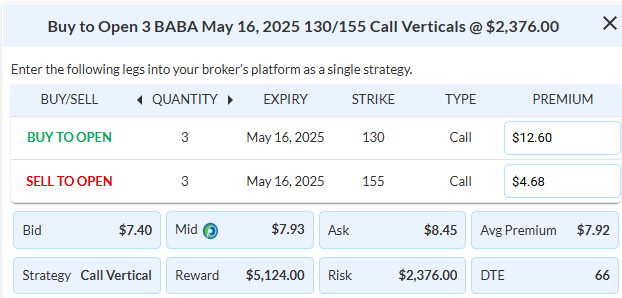

$AAPL

DailyPlay – Portfolio Review & Closing Trades (BAC, BIDU) & Opening Trade (AAPL) – March 10, 2025

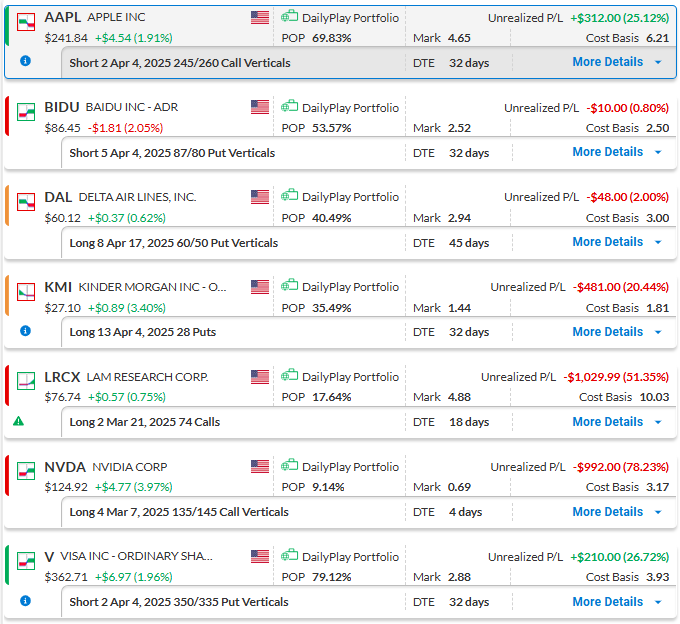

DailyPlay Portfolio Review

Our Trades

DAL – 38 DTE

Bearish Debit Spread – Delta Air Lines, Inc. (DAL) – We have a solid gain in this position and might close it out soon to capture the profit.

KMI – 25 DTE

Bearish Long Put – Kinder Morgan Inc. (KMI) – We’re seeing a slight gain since establishing this position and will maintain it for now.

GLD – 25 DTE

Bullish Credit Spread – SPDR Gold Trust (GLD) – Since opening this position, there have been no significant changes, so we plan to hold for now.

V – 32 DTE

Bullish Credit Spread – Visa Inc. (V) – Visa pulled back slightly after a period of strong momentum, and we will continue to maintain our position for now.

Closing Trades

- BAC – 70% loss: Sell to Close 10 Contracts (or 100% of your Contracts) May 16 $45/$50 Call Vertical Spreads @ $0.70 Credit. DailyPlay Portfolio: By Closing all 10 Contracts, we will be receive $700. We initially opened these 10 Contracts on March 3 @ $2.40 Credit. Our loss, therefore, is $170 per contract.

- BIDU – 54% gain: Buy to Close 5 Contracts (or 100% of your Contracts) April 4 $87/$80 Put Vertical Spreads @ $1.14 Debit.

DailyPlay Portfolio: By Closing all 5 Contracts, we will be paying $570. We initially opened these 5 Contracts on Feb 19 @ $2.50 Credit. Our gain, therefore, is $1,600.

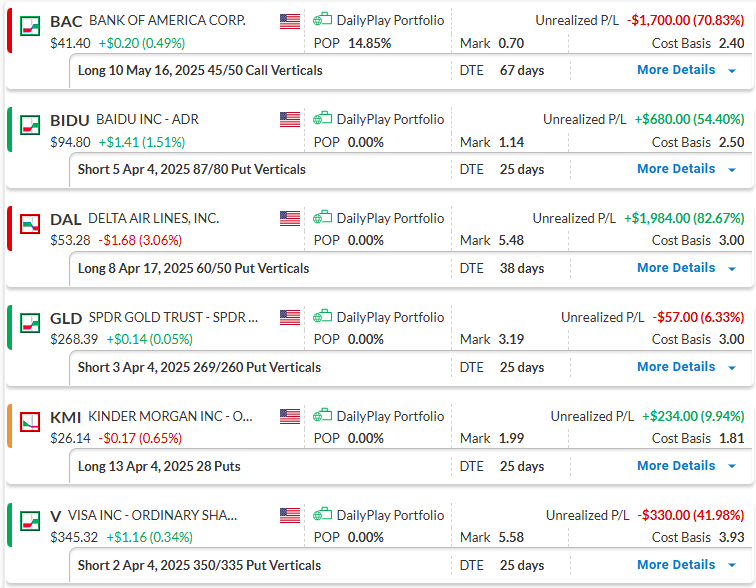

AAPL Bearish Opening Trade Signal

Investment Rationale

A couple of weeks ago, we initiated a bearish position on Apple Inc. (AAPL) using a short vertical spread, selling the Apr 4, 2025, $245/260 call vertical for a $6.20 credit. Last week, on March 6, 2025, we successfully closed this position for a profit.

Despite AAPL’s rally this week, I reiterate my strong bearish stance. The company is grappling with issues like disappointing iPhone 16 sales, competition in augmented reality, a trade war that they will find hard to avoid. Its valuation, of 33x forward earnings compares to an industry median of 20x, suggests considerable downside risks.

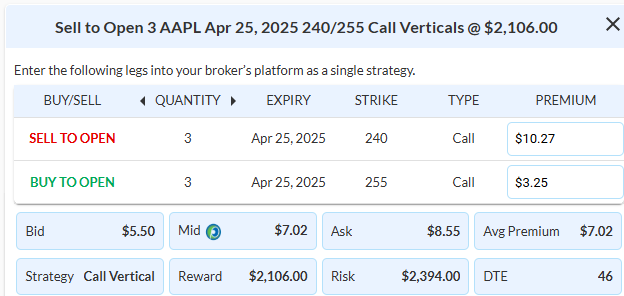

Given this outlook, I’m proposing a new bearish position using another short vertical call spread. Selling the AAPL Apr 25, 2025, $240/255 call vertical for a $7.02 credit. The maximum profit is $702 if AAPL stays below $240 at expiration, with a breakeven at $247.02 and a maximum risk of $798.

AAPL – Daily

Trade Details

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 3 Contracts AAPL April 25 $240/$255 Call Vertical Spreads @ $7.02 Credit per Contract.

Total Risk: This trade has a max risk of $2,394 (3 Contracts x $798) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $798 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on an stock that is expected to continue lower off recent resistance.

1M/6M Trends: Neutral/Bullish

Relative Strength: 8/10

OptionsPlay Score: 119

Stop Loss: @ $14.04 (100% loss to value of premium)

View AAPL Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Friday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AAPL Trade

$CME

DailyPlay – Opening Trade (CME) – March 7, 2025

CME Bullish Opening Trade Signal

Investment Rationale

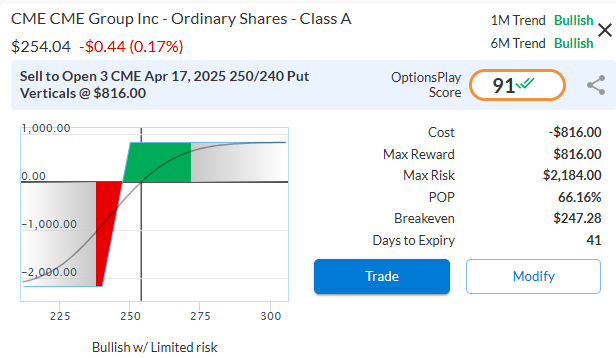

CME Group Inc. (CME) recently broke out of its trading range with strong upside momentum, briefly reaching an all-time high, and is now consolidating following a short pullback from its peak. We believe the stock will retest that recent high and likely break through to the upside.

From a fundamental perspective, CME appears moderately undervalued. While its valuations are in line with the industry, it demonstrates far greater profitability. The company’s net margins exceed 55%, suggesting substantial upside potential. CME currently trades at a forward price-to-earnings ratio of 22.06, compared to the industry average of 17.45. Expected earnings per share growth for CME is 4.93%, while the industry average is higher at 13.19%. However, CME’s expected revenue growth stands at 5.42%, compared to the industry average of 8.37%. Most notably, CME’s net margins are an impressive 57.34%, far surpassing the industry average of 20.83%.

CME – Daily

Trade Details

Strategy Details

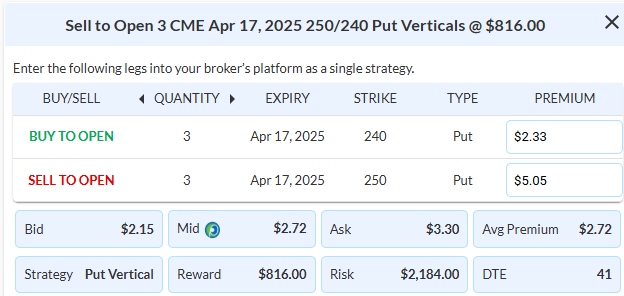

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 3 Contracts CME April 17 $250/$240 Put Vertical Spreads @ $2.72 Credit per Contract.

Total Risk: This trade has a max risk of $2,184 (3 Contracts x $728) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $728 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on an stock that is expected to continue its bullish trajectory.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 91

Stop Loss: @ $5.44 (100% loss to value of premium)

View CME Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View CME Trade

$AAPL

DailyPlay – Closing Trade (AAPL) – March 6, 2025

Closing Trade

- AAPL – 53% gain: Buy to Close 2 Contracts (or 100% of your Contracts) April 4 $245/$260 Call Vertical Spreads @ $2.89 Debit.

DailyPlay Portfolio: By Closing both Contracts, we will be paying $578. We initially opened these 2 Contracts on Feb 24 @ $6.21 Credit. Our gain, therefore, is $664.

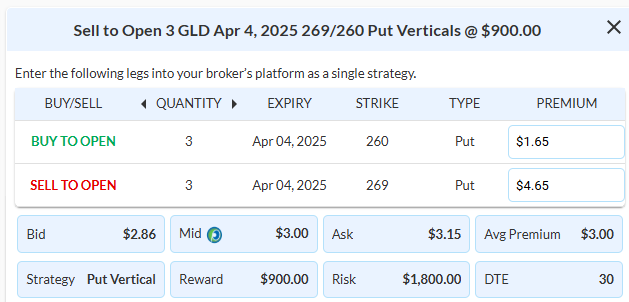

$GLD

DailyPlay – Opening Trade (GLD) – March 5, 2025

GLD Bullish Opening Trade Signal

Investment Rationale

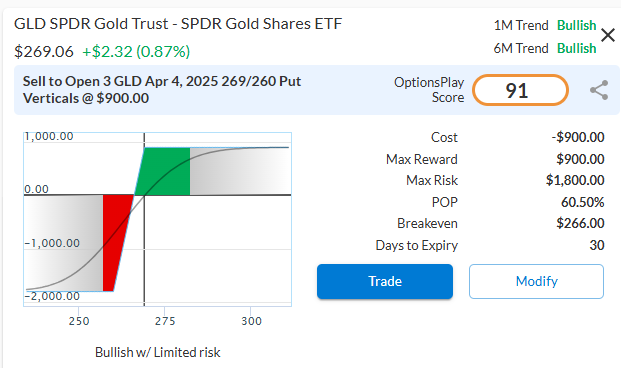

Gold prices have recently reached new highs, driven by macroeconomic, geopolitical, and market-specific factors, reinforcing their role as a safe-haven asset. After nearing the 3000 level, gold futures pulled back to key support at the mid-October high before rebounding with strong momentum. SPDR Gold Shares ETF (GLD) followed suit, bouncing near 261, with upside momentum suggesting a potential retest of the most recent high in GLD of 272.32. Meanwhile, the CBOE Volatility Index (VIX) has remained elevated near the upper end of its range, holding around 20 for an extended period, implying that market concerns are unlikely to fade in the near term.

GLD – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 3 Contracts GLD April 4 $269/$260 Put Vertical Spreads @ $3.00 Credit per Contract.

Total Risk: This trade has a max risk of $1,800 (3 Contracts x $600) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $600 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on an ETF that is expected to continue its bullish trajectory.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 91

Stop Loss: @ $6.00 (100% loss to value of premium)

View GLD Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View GLD Trade

$LRCX

DailyPlay – Closing Trade (LRCX) – March 4, 2025

Closing Trade

- LRCX – 55% loss: Sell to Close 2 Contracts (or 100% of your Contracts) March 21 $74 Calls @ $4.43 Credit.

DailyPlay Portfolio: By Closing both Contracts, we will receive $886. We initially opened these 2 Contracts on Jan 31 @ $10.03. Our loss on this trade is therefore $560 per Contract.

$BAC

DailyPlay – Portfolio Review & Opening Trade (BAC) – March 3, 2025

DailyPlay Portfolio Review

Our Trades

AAPL – 32 DTE

Bearish Credit Spread – Apple Inc. (AAPL) – This position was established recently and is profitable. We plan to hold steady for now.

BIDU – 32 DTE

Bullish Credit Spread – Baidu, Inc. (BIDU) – Since opening this position, there have been no significant changes, so we plan to hold for now.

DAL – 45 DTE

Bearish Debit Spread – Delta Air Lines, Inc. (DAL) – We recently established this position and plan to stay the course for now.

KMI – 32 DTE

Bearish Long Put – Kinder Morgan Inc. (KMI) – Since establishing this position, we are slightly down. We plan to hold steady for now.

LRCX – 18 DTE

Bullish Long Call – Lam Research Corporation (LRCX) – This position is at a loss, and with expiration only weeks away, it’s time to either sell a call to create a bull call spread or close it outright. We’ll closely monitor it early in the week.

NVDA – 4 DTE

NVDA delivered a strong earnings beat last week, but market headlines overshadowed the results. With expiration approaching, the position is still down, though Friday’s momentum was encouraging, and we hope it continues, offering an opportunity to recover some value.

V – 32 DTE

Visa’s strong upward momentum continues. We’re profitable and maintaining our position for now.

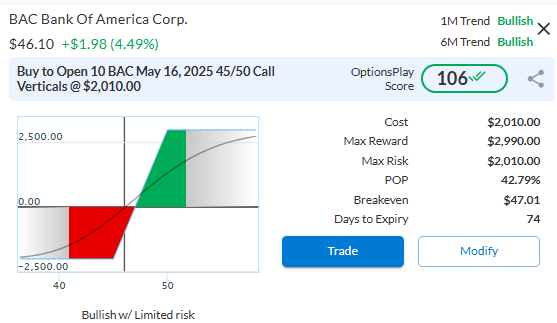

BAC Bullish Opening Trade Signal

Investment Rationale

The financial sector is experiencing favorable tailwinds, with interest rates enhancing net interest margins for major banks like BAC. Bank of America (BAC) is presenting a bullish opportunity as it bounces off support, setting the stage for potential breakout to all-time highs. Additionally, BAC’s balance sheet and diversified revenue streams position it to capitalize on improving regulatory environment and increased lending activity. Trading at an attractive valuation with solid growth metrics, BAC is poised to benefit from these macro trends, making it an appealing investment within the financial sector.

The chart confirms BAC’s bullish setup, as the stock recently bounced off its $43 support and is now approaching the $48 double top. A breakout above this level could propel BAC to our $55 upside target.

Fundamentals: Attractively Valued

BAC trades at a slight discount to its industry, with growth and profitability metrics that highlight its potential for outperformance. The bank’s strong fundamentals and favorable macro environment bolster its investment case.

- PB Ratio: 1.29x vs. Industry Average 1.37x

- EPS Growth: 15.29% vs. Industry Average 13.83%

- Revenue Growth: 5.80% vs. Industry Average 5.28%

- Net Margins: 26.63% vs. Industry Average 24.02%

Bullish Thesis:

- Favorable Interest Rate Environment: Interest rates are boosting BAC’s net interest margins, a key driver of profitability for the bank.

- Strong Balance Sheet: BAC’s diversified revenue streams and solid capital position provide resilience and growth potential in a recovering economy.

- Increased Lending Activity: Improving domestic regulatory conditions are driving higher loan demand, benefiting BAC’s core banking operations.

BAC – Daily

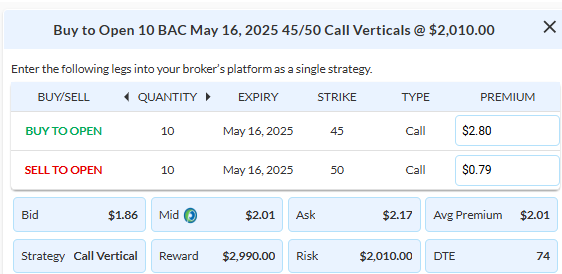

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 10 Contracts BAC May 16 $45/$50 Call Vertical Spreads @ $2.01 Debit per Contract.

Total Risk: This trade has a max risk of $2,010 (10 Contracts x $201) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $201 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher off recent support.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 106

Stop Loss: @ $1.01 (50% loss of premium)

View BAC Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Friday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.