$PINS

DailyPlay – Opening Trade (PINS) – May 8, 2025

PINS Bullish Opening Trade Signal

Investment Rationale

As Pinterest, Inc. (PINS) approaches its May 8 earnings release, the stock offers an attractive bullish opportunity. Improved market sentiment, recent analyst upgrades, and solid technical indicators point to near-term strength. Investor enthusiasm has returned thanks to strategic AI initiatives and partnerships, with analysts projecting further gains. Given Pinterest’s increasing relative strength, the stock is well-positioned for a defined-risk options strategy.

Price action in PINS has firmed notably in recent sessions, with improving relative strength suggesting buyers are stepping in ahead of earnings. The stock recently rebounded from key support near $25 and is now trending upward into the high $27s. The short-term setup favors continuation toward the mid-to-high $30s range, supported by a constructive base and a modest resistance gap at $32. With implied volatility elevated ahead of earnings and the expected move priced at ±13.34%, a breakout move is possible and favorably skewed to the upside given the sentiment shift.

Pinterest’s underlying fundamentals reflect accelerating performance and margin expansion, which support a bullish thesis into earnings:

- Forward PE Ratio: 24.51 vs. Industry Median 19.6

- Expected EPS Growth: 14.41% vs. Industry Median 18.30%

- Expected Revenue Growth: 51.07% vs. Industry Median 14.33%

- Net Margins: 15.25% vs. Industry Median 6.36%

While the company trades at a premium valuation, its superior revenue growth and margins justify the higher multiple, particularly as AI monetization and product innovation begin to materialize. The Street remains optimistic, with a $40 average price target implying a 46% upside from current levels.

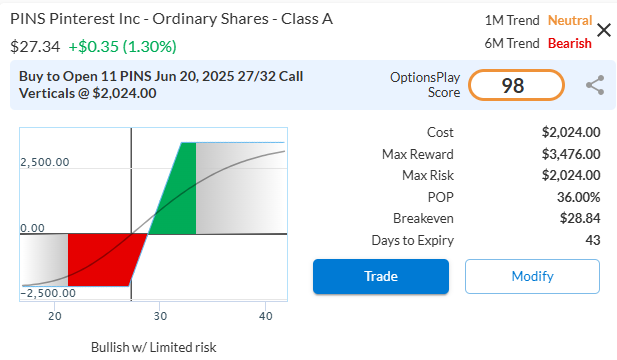

To position for a bullish outlook after earnings, consider the PINS Jun 20, 2025 27/32 call vertical for a net debit. The trade risks only the premium paid and offers a maximum profit if the stock closes at or above the short 32 strike call by expiration. With the current price near $27.34 and an implied move of ±13.34%, the spread targets realistic upside within the expected range. This structure limits downside exposure, reduces capital outlay, and helps mitigate the impact of implied volatility crush.

PINS – Daily

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 11 PINS June 20 $27/$32 Call Vertical Spreads @ $1.84 Debit per Contract.

Total Risk: This trade has a max risk of $2,024 (11 Contracts x $184) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $184 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that is expected bounce higher off recent support.

1M/6M Trends: Neutral/Bearish

Relative Strength: 3/10

OptionsPlay Score: 98

Stop Loss: @ $0.92 (50% loss of premium)

View PINS Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View PINS Trade

NVDA

DailyPlay – Trade Adjustment (NVDA) Closing Trade (INTC) – May 07, 2025

Closing Trade

- INTC – 55.81% gain: Buy to Close 17 Contracts (or 100% of your Contracts) May 30 $21/$23 Call Vertical Spreads @$0.38 Debit. DailyPlay Portfolio: By Closing both Contracts, we will receive $646. We initially opened these 17 Contracts on April 24 @ $0.86 Credit. Our gain on this trade, therefore, is $816.

NVDA Bullish Trade Adjustment Signal

Investment Rationale

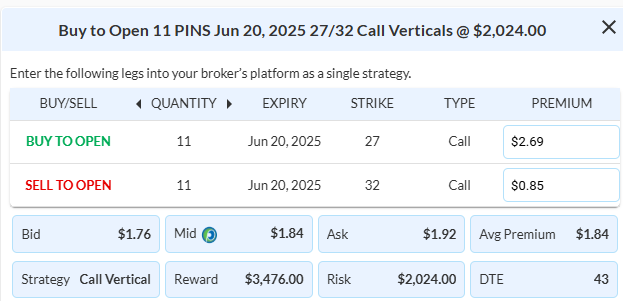

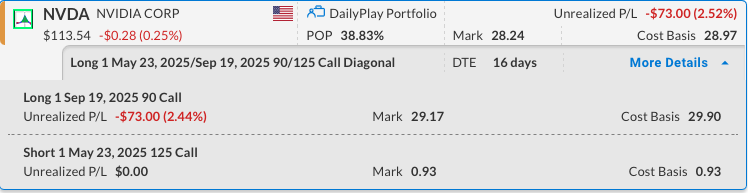

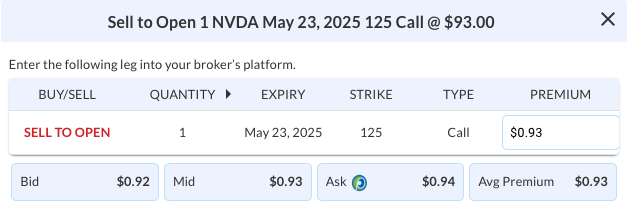

We remain bullish on NVDA due to its dominant position in AI and data center growth. Fundamentals remain strong, with exceptional earnings and revenue prospects. We continue to hold the Sep 19, 2025, $90 Strike Call and plan to sell a May 23, 2025, $125 Strike Call against it to create a diagonal spread. This trade captures short-term premium while maintaining long-term upside, aligning with a neutral to moderately bullish outlook. NVDA is set to report earnings on Wednesday, May 28, and we selected the May 23 expiration to avoid exposure to this potential catalyst.

Position after the adjustment – Bullish Diagonal Spread

Long Sep 19, 2025, $90 Strike Call

Short May 23, 2025, $125 Strike Call

NVDA – Daily

Trade Details

Strategy Details

Strategy: Selling a Call – Creating a Long Call Diagonal

Direction: Bullish Call Diagonal

Details: Sell to Open 1 Contract NVDA May 23 $125 Call @ $0.93 Credit per Contract.

Total Risk: This trade has a max risk of $2,897 ($2,990-$93). The initial cost basis of $2,990 less the premium received of $93.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Neutral

Relative Strength: 3/10

OptionsPlay Score: 90

View NVDA Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View NVDA Trade

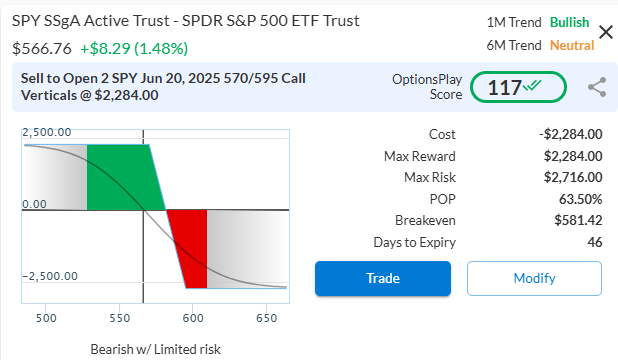

$WMT

DailyPlay – Opening Trade (WMT) & Closing Trade (GOOGL) – May 6, 2025

Closing Trade

- GOOGL – 51% gain: Sell to Close 4 Contracts (or 100% of your Contracts) May 16 $150/$165 Call Vertical Spreads @ $11.83 Credit. DailyPlay Portfolio: By Closing all 4 Contracts, we will receive $4,732. We initially opened these 4 Contracts on April 23 @ $7.80 Debit. Our gain, therefore, is $1,612.

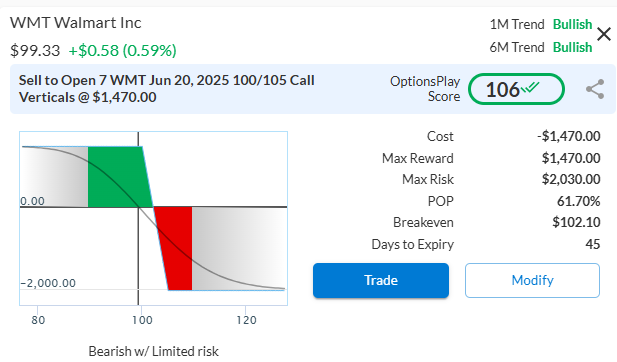

WMT Bearish Opening Trade Signal

Investment Rationale

Walmart (WMT) presents a compelling short opportunity heading into its May 15 earnings report, with valuation extended and sentiment overly optimistic after a strong recovery rally. The stock has become a market favorite for its perceived defensive positioning amid macro uncertainty, but expectations now look disconnected from potential risks. Elevated consumer stress, margin pressure, and high FY25 guidance assumptions set the stage for disappointment. With WMT trading near all-time highs, even a modest guidance miss could trigger a meaningful pullback.

WMT has stalled below the $100 level after a persistent rally off its March lows, with the stock now pushing into overbought territory across both daily and weekly charts. Momentum is fading, as seen in a developing bearish RSI divergence, and price action is losing steam. Long-term resistance near $105 remains intact, while a post-earnings break below $95–$96 could open the door to accelerated downside toward the $70 zone, a prior support area and measured move target.

Walmart’s valuation is notably rich compared to peers, despite relatively modest growth metrics and thin margins. The market is pricing in flawless execution at a time when consumers are stretched and cost pressures remain high. Any stumble in FY25 guidance could force a sharp re-rating.

- Forward PE Ratio: 37.78x vs. Industry Median 16.95x

- Expected EPS Growth: 9.75% vs. Industry Median 9.63%

- Expected Revenue Growth: 4.23% vs. Industry Median 4.98%

- Net Margins: 2.85% vs. Industry Median 2.40%

Sell the WMT Jun 20, 2025 $100/$105 Call Vertical for a net credit. This bearish call spread profits if WMT stays below $100, aligning with the thesis that the stock may stall or fade post-earnings.

WMT – Daily

Trade Details

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 7 WMT June 20 $100/$105 Call Vertical Spreads @ $2.10 Credit per Contract.

Total Risk: This trade has a max risk of $2,030 (7 Contracts x $290) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $290 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bearish trade on an instrument that is expected to continue lower over the duration of this trade, off recent resistance.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 106

Stop Loss: @ $4.20 (100% loss to value of premium)

View WMT Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View WMT Trade

$SPY

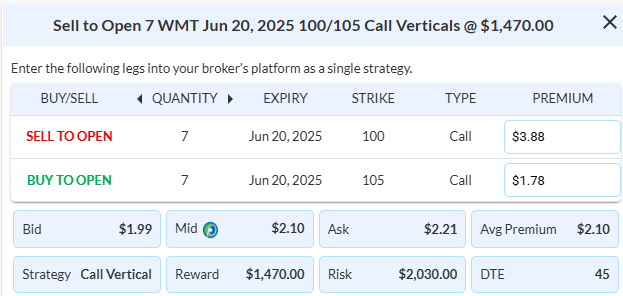

DailyPlay – Portfolio Review & Opening Trade (SPY) – May 5, 2025

DailyPlay Portfolio Review

Our Trades

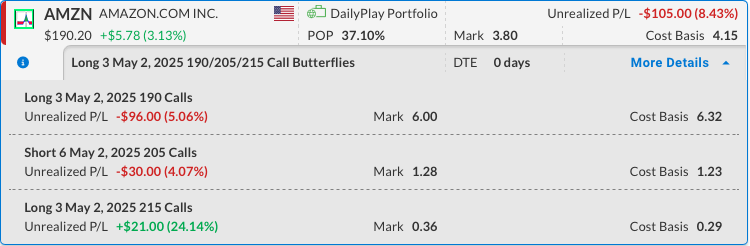

AMZN – 4 DTE

Bullish Long Call Butterflies – Amazon Inc. (AMZN) – The stock showed little movement after the company reported earnings, remaining on its current course for now. AMZN showed little movement after the company reported earnings, and we are staying the course for now.

GOOGL – 11 DTE

Bullish Debit Spread – Alphabet Inc. (GOOGL) – Since GOOGL’s recent earnings announcement, the company’s stock has shown bullish momentum. We are profitable on the position and intend to stay the course for now.

INTC – 25 DTE

Bearish Credit Spread – Intel Corporation (INTC) – Intel’s recent earnings release led to weakness in the stock. We are in a profitable position and intend to stay the course for now.

JPM – 25 DTE

Bearish Credit Spread – JPMorgan Chase & Co. (JPM) – After announcing earnings, JPM’s stock initially leaned bearish but has since bounced back. We are currently down on the position and plan to stay the course for now, but have a very short leash.

NVDA – 137 DTE

Bullish Long Call – NVIDIA Corp. (NVDA) – Following the news-driven decline, NVDA participated in the upside momentum the market showed this week. We remain bullish on NVDA given its strong fundamentals. In the short term, we may look to sell call premium to capitalize on elevated volatility. The company is not scheduled to report earnings until Wednesday, May 28.

PAYC – 11 DTE

Bullish Credit Spread – Paycom Software Inc (PAYC) – Since establishing this position, not much has happened and we are currently up slightly, but the common stock is set to report earnings on Wednesday, May 7th after the market close, and we will most likely hold the position through earnings.

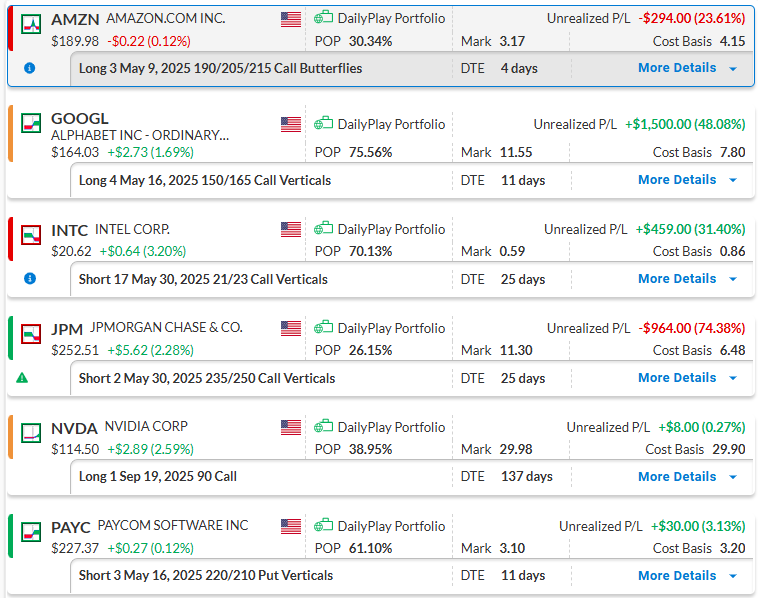

SPY Bearish Opening Trade Signal

Investment Rationale

Investment Thesis

After a strong run, the U.S. equity markets appear to be approaching exhaustion, with SPY trading near potential resistance in the $560–$570 range. While the longer-term trend remains intact, short-term momentum is clearly decelerating, suggesting the risk-reward skews negatively at current levels. Multiple macro and market signals—including rising jobless claims, deteriorating consumer credit health, and early signs of renewed supply-side pressures—point to a likely pause or pullback in the near term. This backdrop sets the stage for a tactically bearish position, ideally structured to benefit from stagnation or mild downside.

Market Timing

SPY has erased the losses from the tariff tantrum, but the recent price action shows signs of exhaustion. The ETF is approaching a critical resistance level at $570, which coincides with prior zones of consolidation. Unless SPY decisively breaks above this zone with volume, the path of least resistance favors consolidation or a retracement.

Economic Analysis

Equity valuations remains above long term averages which are at risk with a weakening growth outlook. Additionally, increasing initial jobless claims, rising credit card delinquencies, and unresolved supply chain risks—especially related to China—pose tangible downside catalysts. Even if geopolitical and tariff issues resolve quickly, the lag in supply chain normalization could result in temporary shocks and margin compression across sectors.

Options Trade

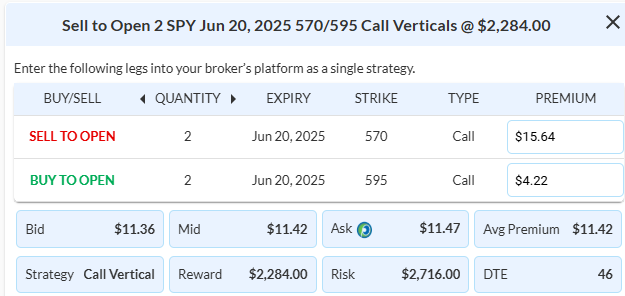

To express a neutral-to-bearish view with defined risk, consider initiating a short call vertical in SPY:

Sell the SPY Jun 20, 2025 $570/$595 Call Vetical @ $11.42 Credit

This trade has a probability of profit of approximately 63.5%, making it attractive for traders expecting SPY to stall or pull back below $570 over the next 30-40 days. The 25-point width allows room for a controlled upside move while benefiting from time decay and resistance holding near current levels.

SPY – Daily

Trade Details

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 2 SPY June 20 $570/$595 Call Vertical Spreads @ $11.42 Credit per Contract.

Total Risk: This trade has a max risk of $2,716 (2 Contracts x $1,358) based on a hypothetical $100k portfolio risking 1%. We suggest risking only 1% of the value of your portfolio and divide it by $1,358 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bearish trade on an instrument that is expected to continue lower over the duration of this trade.

1M/6M Trends: Bullish/Neutral

Relative Strength: 6/10

OptionsPlay Score: 117

Stop Loss: @ $22.84 (100% loss to value of premium)

View SPY Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Friday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View SPY Trade

MSFT

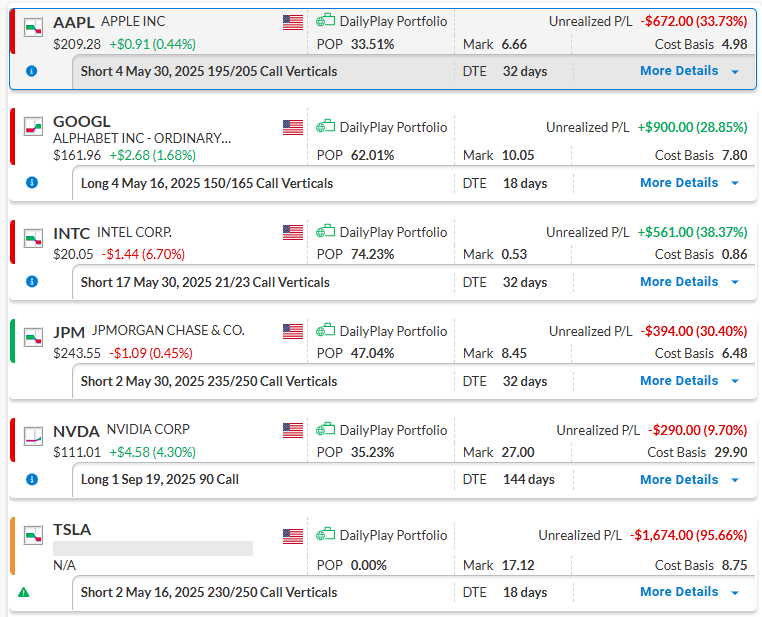

DailyPlay – Closing Trade (MSFT) & Portfolio Review (AAPL, AMZN) – May 02, 2025

Closing Trades

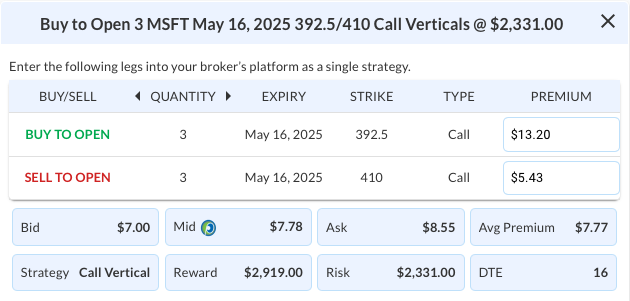

- MSFT – 95.24% gain: Sell to Close 3 Contracts (or 100% of your Contracts) May 16 $392.5/$410 Call Vertical Spreads @ $15.17 Credit.

DailyPlay Portfolio: By Closing all 3 Contracts, we will receive $4,551. We initially opened these 3 Contracts on April 30 @ $7.77 Debit. Our gain, therefore, is $2,220.

DailyPlay Portfolio Review

Our Trades

After Apple and Amazon released their earnings, we’re closing our option positions today, with only one day left until expiration.

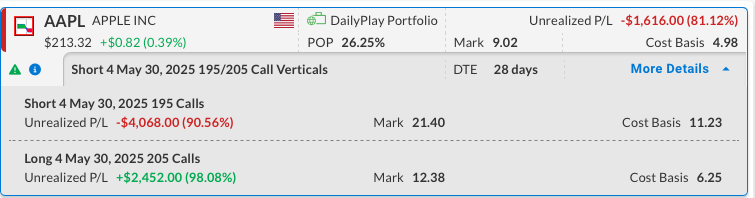

AAPL – 28 DTE

Apple’s stock is expected to open lower, which benefits our Short 195/205 Call Vertical. Each point below the key 205 level improves the position, which is currently near its maximum loss. The maximum risk is limited to 10 points (the width between the strike prices of the spread), offering an attractive risk-reward opportunity if the stock continues to drop. To avoid auto-exercise or assignment notices, and any unwanted stock transactions, be sure to close the position before the market closes today.

AMZN – 0 DTE

Post-earnings, Amazon’s stock is down after hours, which is not favorable for our current bullish Long 190/205/215 Open-Wing Call Butterfly. This position benefits if the stock rallies above the 190 strike. With minimal risk in holding through the day, it may be worth watching the position to see if it can bounce back. However, if any options move in the money, close the position before trading ends to avoid auto-exercise or assignment notices, preventing unwanted stock transactions.

AMZN

DailyPlay – Opening Trade (AMZN) – May 01, 2025

AMZN Bullish Opening Trade Signal

Investment Rationale

Amazon (AMZN) presents a compelling bullish setup heading into its Q1 2025 earnings report scheduled for Thursday, May 1st after the close. With improving consumer sentiment, easing logistics costs, and a robust rebound in cloud spending, Amazon is positioned to surprise to the upside—particularly in its high-margin AWS segment. Market participants appear overly cautious after a steep drawdown from February highs, creating an asymmetric risk-reward opportunity for a short-term upside move. A high-probability technical setup combined with strong fundamental tailwinds makes AMZN a timely bullish play into earnings.

AMZN’s technical setup heading into today’s earnings report shows signs of improving short-term momentum. The stock is trading above its 20-day moving average of $184.17, suggesting some upward pressure in the near term. The MACD has crossed above its signal line and continues to rise, pointing to a shift in momentum. The RSI has moved higher but remains below overbought territory, which leaves room for potential upside. Volume has declined during the recent consolidation, which may indicate reduced selling interest. The stock is currently approaching resistance near $188. A close above this level would be an encouraging development and could set up a move toward $200, an area that aligns with the 200-day moving average. While the stock remains below some longer-term trend levels, the recent technical action leans positive and may support further gains if momentum continues to build.

Amazon continues to demonstrate fundamental strength even amid macro challenges, supported by its sticky Prime user base and enterprise-leading AWS platform. While the retail segment may face inflation-related pressures, its ability to undercut prices and streamline logistics remains a core advantage. AWS, which now accounts for the majority of operating income, is expected to provide stability and earnings visibility going forward.

- Forward PE Ratio: 29.76 vs. Industry Median 18.08

- Expected EPS Growth: 17.40% vs. Industry Median 7.91%

- Expected Revenue Growth: 9.57% vs. Industry Median 3.61%

- Net Margins: 9.25% vs. Industry Median 6.97%

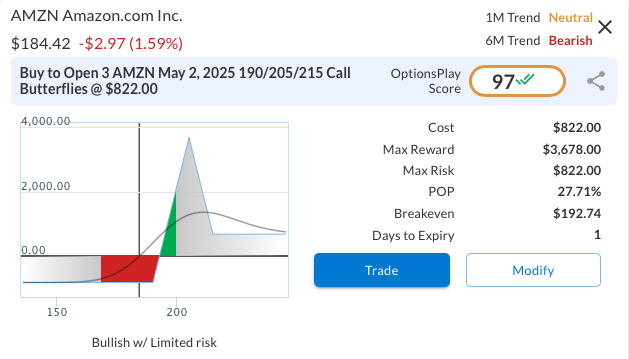

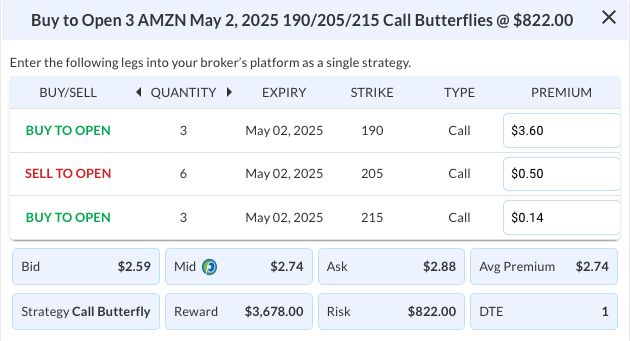

To express a bullish view on AMZN into earnings with limited risk, consider the May 2, 2025 190/205/215 open-wing call butterfly for a net debit. The trade performs best if AMZN moves toward $205 by Friday’s expiration, offering a 4.5:1 reward-to-risk ratio. It can also do reasonably well if AMZN closes above $215, since the open-wing structure allows for some upside flexibility.

AMZN – Daily

Trade Details

Strategy Details

Strategy: Open Wing Call Butterfly

Direction: Bullish Open Wing Call Butterfly

Details: Buy to Open 3 AMZN May 2 $190/$205/$215 Call Butterfly @ $2.74 Debit per Contract.

Total Risk: This trade has a max risk of $822 (3 Contracts x $274) based on a hypothetical $100k portfolio risking 1%. We suggest risking only 1% of the value of your portfolio and divide it by $274 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that is expected to break through from an area of resistance.

1M/6M Trends: Neutral/Bearish

Relative Strength: 5/10

OptionsPlay Score: 97

Stop Loss: @ $1.37 (50% loss of premium)

View AMZN Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AMZN Trade

MSFT

DailyPlay – Opening Trade (MSFT) – April 30, 2025

MSFT Bullish Opening Trade Signal

Investment Rationale

We’re bullish on Microsoft (MSFT) heading into its earnings report today, Wednesday, April 30th, after the market close. As one of the most systemically important software providers globally, Microsoft offers a rare blend of stability, innovation, and growth — attributes that are especially valuable in today’s uncertain macro backdrop. The company’s strong positioning in AI, cloud infrastructure, and enterprise software makes it well-leveraged to outperform as sentiment improves and investors re-engage with high-quality tech.

Recent price action in MSFT points to improving technical strength. The stock bounced off $375 support and has moved back above its 20-day moving average, indicating short-term bullish sentiment. Resistance near $400 remains a key hurdle, and a breakout above that level, aided by strong earnings, would confirm further upside potential. Momentum indicators are supportive, with the MACD flashing a bullish crossover and relative strength versus the Nasdaq trending upward over the past week.

Microsoft’s business model and financial profile remain robust despite macroeconomic headwinds. The company’s software-centric operations provide stability, while AI and cloud adoption trends continue to support forward growth:

- Forward PE Ratio: 26.34x vs. Industry Median 26.17x

- Expected EPS Growth: 13.95% vs. Industry Median 12.54%

- Expected Revenue Growth: 13.63% vs. Industry Median 6.87%

- Net Margins: 35.43% vs. Industry Median 10.19%

To position for a possible bullish move after earnings with defined risk, consider the May 16, 392.5/410 call vertical spread for a net debit. This spread offers a max reward if MSFT closes above $410 by the May 16th expiration. The trade targets a moderate upside move through the $400 level, aligning with technical resistance and anticipated post-earnings momentum. With 17 days to expiry, the structure provides a near-term catalyst-driven opportunity while mitigating downside with limited capital at risk.

MSFT – Daily

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 3 Contracts MSFT May 16 $392.5/$410 Call Vertical Spreads @ $7.77 Debit per Contract.

Total Risk: This trade has a max risk of $2,331 (3 Contracts x $777) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $777 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher off recent support.

1M/6M Trends: Bullish/Neutral

Relative Strength: 5/10

OptionsPlay Score: 90

Stop Loss: @ $3.89 (50% loss of premium)

View MSFT Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View MSFT Trade

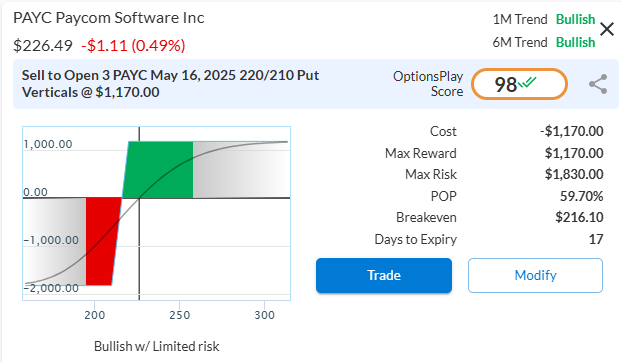

$PAYC

DailyPlay -Opening Trade (PAYC) – April 29, 2025

PAYC Bullish Opening Trade Signal

Investment Rationale

Paycom Software Inc. (PAYC) presents a compelling bullish setup heading into its Q1 earnings report, scheduled for May 7, 2025. The stock has recently broken out of a multi-month consolidation pattern with increasing volume and strong momentum, signaling renewed investor confidence. PAYC’s leadership in human capital management solutions, coupled with healthy operating margins and an improving macro backdrop for enterprise software spending, provides a favorable backdrop for continued upside. The upcoming earnings event could serve as a catalyst, especially if management delivers upside surprises or raises guidance amid stabilization in enterprise demand.

PAYC has recently cleared resistance near the $220 level, confirming a breakout from its multi-month trading range. This move is supported by rising volume and strong relative strength versus the S&P 500, indicating institutional accumulation. The breakout targets a measured move toward $270, with interim resistance at $242. The stock remains well-supported above its 20-day and 50-day moving averages, and momentum indicators continue to trend positively. Overall, the technical structure favors a continuation higher, particularly if earnings provide a tailwind.

While PAYC trades near parity with industry valuation multiples, its margin superiority offers a key edge as software investors increasingly focus on profitability and efficiency. The company’s ability to convert top-line growth into robust earnings, along with stable recurring revenues from its cloud-based platform, supports the case for multiple expansion.

- Forward PE Ratio: 26.21x vs. Industry Median 26.17x

- Expected EPS Growth: 10.37% vs. Industry Median 12.54%

- Expected Revenue Growth: 9.48% vs. Industry Median 9.67%

- Net Margins: 26.66% vs. Industry Median 10.19%

A bullish put vertical spread using the May 16, 2025 expiry is well-positioned to capture near-term strength while limiting downside risk. The trade involves selling the 220 strike put and buying the 210 strike put for a net credit. This strategy benefits from PAYC holding above $220 through expiration, a level that now acts as support following the recent breakout. With only 17 days to expiry, the setup offers a favorable risk/reward ratio of approximately 0.64 and aligns well with the anticipated post-earnings upside momentum.

PAYC – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 3 Contracts PAYC May 16 $220/$210 Put Vertical Spreads @ $3.90 Credit per Contract.

Total Risk: This trade has a max risk of $1,830 (3 Contracts x $610) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $610 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher off recent support.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 98

Stop Loss: @ $7.80 (100% loss to value of premium)

View PAYC Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View PAYC Trade

$TSLA

DailyPlay – Portfolio Review & Closing Trade (TSLA) – April 28, 2025

Closing Trade

- TSLA – 95% loss: Buy to Close 2 Contracts (or 100% of your Contracts) May 16 $230/$250 Call Vertical Spreads @ $17.12 Debit.

DailyPlay Portfolio: By Closing both Contracts, we will be paying $3,424. We initially opened these 2 Contracts on April 22 @ $8.75 Debit. Our loss, therefore, is $837 per contract.

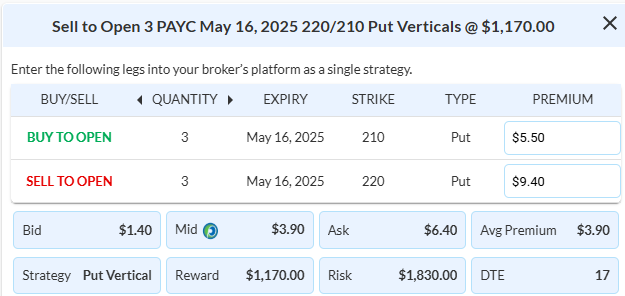

DailyPlay Portfolio Review

Our Trades

AAPL – 32 DTE

Bearish Credit Spread – Apple Inc. (AAPL) – Apple continues to face growing pressure from global economic concerns and heightened U.S.–China tensions. With this position recently established, we will maintain our current stance. The company is set to report earnings on Thursday, May 1, after the market close.

GOOGL – 18 DTE

Bullish Debit Spread – Alphabet Inc. (GOOGL) – GOOGL recently announced earnings, and the company’s stock has shown some bullish momentum after the report. We are profitable on the position and intend to stay the course for now.

INTC – 32 DTE

Bearish Credit Spread – Intel Corporation (INTC) – Intel’s recent earnings release led to weakness in the stock. We are in a profitable position and intend to stay the course for now.

JPM – 32 DTE

Bearish Credit Spread – JPMorgan Chase & Co. (JPM) – After announcing earnings, JPM’s stock initially leaned bearish but has since bounced back. We are currently down on the position and plan to stay the course for now.

NVDA – 144 DTE

Bullish Long Call – NVIDIA Corp. (NVDA) – Following the news-driven decline, NVDA participated in the upside momentum the market showed this week. We remain bullish on NVDA given its strong fundamentals. In the short term, we may look to sell call premium to capitalize on elevated volatility. The company is not scheduled to report earnings until Wednesday, May 28.

TSLA – 18 DTE

Bearish Debit Spread – Tesla, Inc. (TSLA) – We are closing this position today.

$BAC, $MSI

DailyPlay – Closing Trades (BAC, MSI) – April 25, 2025

Closing Trades

- BAC – 78% gain: Sell to Close 11 Contracts (or 100% of your Contracts) May 16 $36/$41 Call Vertical Spreads @ $3.36 Credit.

DailyPlay Portfolio: By Closing all 11 Contracts, we will receive $3,696. We initially opened these 11 Contracts on April 11 @ $1.89 Debit. Our gain, therefore, is $1,617. - MSI – 51% loss: Sell to Close 2 Contracts (or 100% of your Contracts) May 16 $410/$380 Put Vertical Spreads @ $4.30 Credit.

DailyPlay Portfolio: By Closing both Contracts, we will receive $860. We initially opened these 2 Contracts on April 8 @ $8.65 Debit. Our loss, therefore, is $435 per contract.