PEP

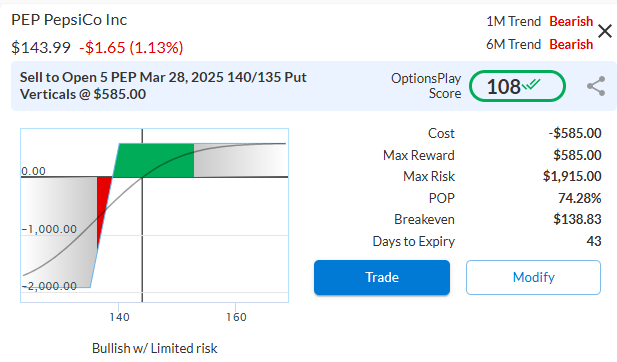

DailyPlay – Opening Trade (PEP) – February 13, 2025

PEP Bullish Opening Trade Signal

Investment Rationale

PepsiCo, Inc. (PEP) has recently reached oversold conditions and is approaching a strong support level after the company announced earnings.

PepsiCo reported mixed quarterly results, with earnings surpassing Wall Street’s expectations but revenue falling slightly short. The company posted adjusted earnings per share of $1.96, beating the consensus estimate of $1.94, while revenue came in at $27.78 billion, just below the expected $27.89 billion.

From a fundamental perspective, PEP appears modestly undervalued. Despite the revenue miss, PepsiCo posted fourth-quarter net income attributable to the company of $1.52 billion, or $1.11 per share, up from $1.3 billion, or 94 cents per share, a year earlier.

The stock trades at a forward price-to-earnings ratio of 17.29x, compared to the industry average of 19.82x, representing a discount to its peers, with growth expectations in line with the sector. While expected earnings growth is slightly below the industry average, PepsiCo continues to demonstrate strong revenue growth and solid net margins.

PEP – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 5 Contracts PEP March 28 $140/$135 Put Vertical Spreads @ $1.16 Credit per Contract.

Total Risk: This trade has a max risk of $1,915 (5 Contracts x $383) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $383 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that is expected to bounce off recent support.

1M/6M Trends: Bearish/Bearish

Relative Strength: 2/10

OptionsPlay Score: 108

Stop Loss: @ $2.32 (100% loss to value of premium)

View PEP Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View PEP Trade

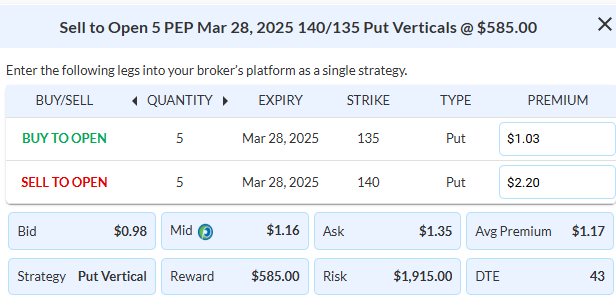

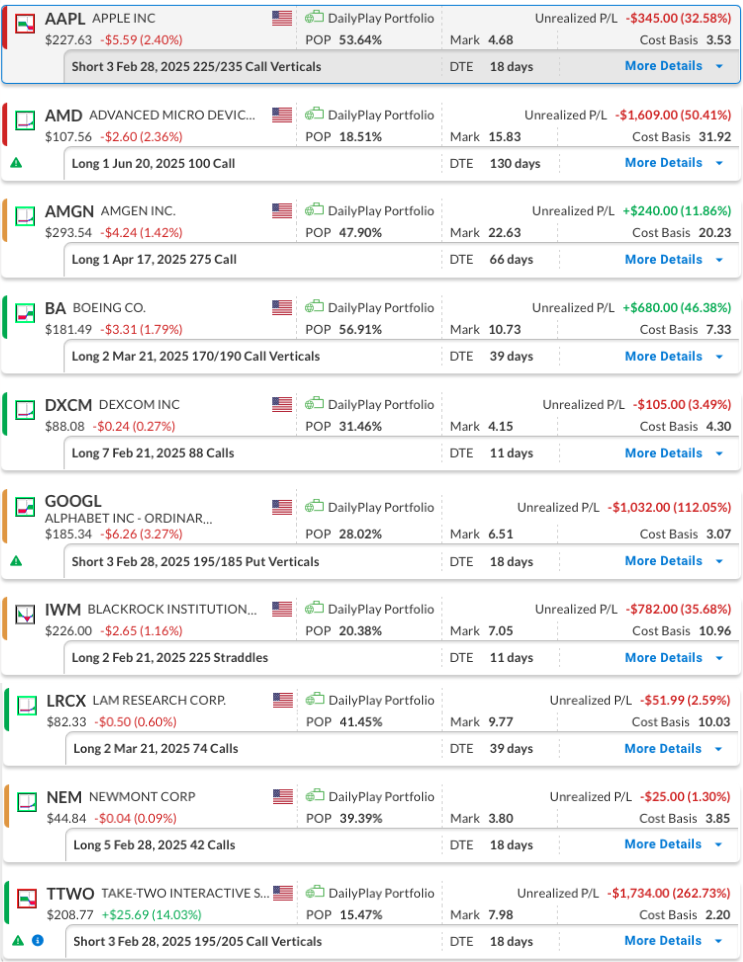

$DXCM

DailyPlay – Adjusting Trade (DXCM) Closing Trade (AAPL) – February 12, 2025

Closing Trade

- AAPL – 81% loss: Buy to Close 3 Contracts (or 100% of your Contracts) Feb 28 $225/$235 Call Vertical Spreads @ $6.40 Debit. DailyPlay Portfolio: By Closing all 3 Contracts, we will pay $1,920. We initially opened these Contracts on Jan 22 @ $3.53 Credit. Our loss, therefore, is $287 per contract.

DXCM Bullish Adjusting Trade Signal

Investment Rationale

DexCom, Inc. (DXCM) – We currently hold a long call position in the Daily Play portfolio and are selling an option to adjust the position, creating a bull call vertical spread ahead of DexCom’s earnings announcement on Thursday, February 13, after the close. Recently, our short option in the diagonal spread expired, benefiting our position by reducing the cost basis of the current long option to $3.25.

We still consider DXCM to be fundamentally undervalued despite trading at a premium relative to its peers, as its valuation is supported by stronger growth and profitability metrics. The company has a forward price-to-earnings ratio of 43.54, compared to the industry average of 24.87. Its expected earnings per share growth is 23.36%, significantly higher than the industry average of 8.70%. DexCom’s expected revenue growth stands at 13.77%, compared to 6.34% for the industry. Additionally, the company’s net margins are 17.22%, outperforming the industry average of 14.13%.

- Current Position: Long 7 Feb 21, 2025, 88 Calls

- Days to Expiration (DTE): 10 days

- Current Cost Basis: $3.25 or $2,275 total for the 7 contracts (3.25 x 7 x 100

PLEASE NOTE that these prices are based on Tuesday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Trade Details

Strategy Details

Strategy: Adjustment of a Bullish Long Call

Direction: Resulting in a new Bullish Call Vertical Spread

Details: Sell to Open 7 Contracts Feb 21 $92 Call @ a $1.75 Credit, or $1,225 ($1.75 x 7 x 100). This sale establishes a new Bull Call Vertical Spread in DXCM.

Resulting Position:

- Long: 7 Feb 21, 2025, 88 Calls

- Short: 7 Feb 21, 2025, 92 Calls

Based on a $1.75 fill for the short contract, the new cost basis is calculated as follows:

- New Cost Basis per Contract: $3.25 – $1.75 = $1.50

- Total Cost Basis for 7×7 Spread: $1,050 ($1.50 x 7 x 100)

1M/6M Trends: Bullish/Neutral

Relative Strength: 9/10

View DXCM Trade

$AMD, $BA, $TTWO

DailyPlay – Closing Trades (AMD, BA, TTWO) – February 11, 2025

Closing Trades

- AMD – 44% loss: Sell to Close 1 Contract (or 100% of your Contracts) June 20 $100 Call @ $17.63 Credit. DailyPlay Portfolio: By Closing this Contract, we will receive $1,763. We initially opened this Contract on Dec 24 @ $31.92 Debit. Our loss, therefore, is $1,429.

- BA – 46% gain: Sell to Close 2 Contracts (or 100% of your Contracts) March 31 $170/$190 Call Vertical Spreads @ $10.68 Credit. DailyPlay Portfolio: By Closing both Contracts, we will receive $2,136. We initially opened these 2 Contracts on Jan 8 @ $7.33 Debit. Our gain, therefore, is $670.

- TTWO – 91% loss: Buy to Close 3 Contracts (or 100% of your Contracts) Feb 28 $195/$205 Call Vertical Spreads @ $9.28 Debit. DailyPlay Portfolio: By Closing all 3 Contracts, we will pay $1,320. We initially opened these 3 Contracts on Jan 28 @ $2.20 Credit. Our loss, therefore, is $660.

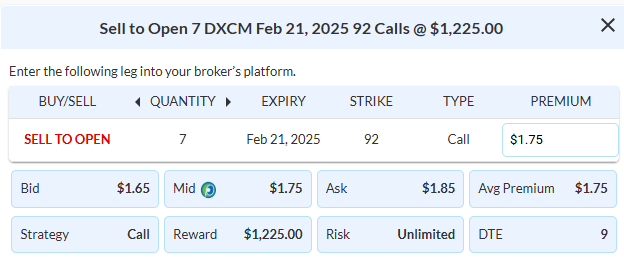

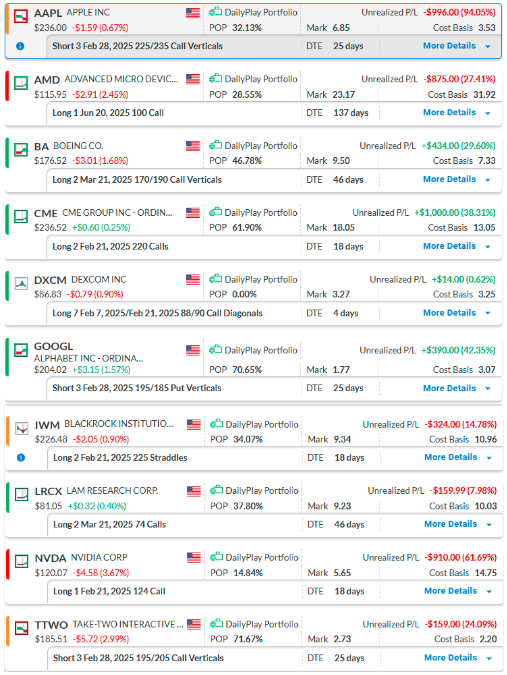

DailyPlay – Portfolio Review – February 10, 2025

DailyPlay Portfolio Review

Our Trades

AAPL – 18 DTE

Bearish Credit Spread – Apple Inc. (AAPL) – The position is at a loss, but once again, the stock showed some weakness into the close on Friday. This weakness has been helpful for the position, and with considerable time remaining until expiration, no immediate action is planned. We are maintaining a tight watch.

AMD – 130 DTE

Bullish Long Call – Advanced Micro Devices, Inc. (AMD) – The position remains down, and last week’s earnings announcement didn’t provide the boost we had hoped for. While we’re not pulling the plug just yet, we’re keeping a close watch. There’s still plenty of time until the expiration of the option, but we’re ready to move quickly if the situation calls for it.

AMGN – 66 DTE

Bullish Long Call – Amgen Inc. (AMGN) – We just established this position, and the company announced earnings this week. The stock price has been volatile since the announcement, but the position is currently showing a gain, so we plan to stay the course for now.

BA – 39 DTE

Bullish Debit Spread – The Boeing Company (BA) – We are up on this position, the stock has been range-bound since the earnings release. We still have plenty of time left in the option contracts and plan to stay the course for now.

DXCM – 11 DTE

Bullish Diagonal Spread – DexCom, Inc. (DXCM) – Our Bullish Diagonal Spread has now become a Bullish Long Call position. The shorter-term short option contract expired worthless this week, which has benefited the position, and we currently have a gain. The company is set to announce earnings after market close on Thursday, February 13, and we will need to decide on one of three actions: sell to close before earnings, hold through the earnings report as is, or sell another option contract to convert this into a bull call vertical spread ahead of the event.

GOOGL – 18 DTE

Bullish Credit Spread – Alphabet Inc. (GOOGL) – The company announced earnings this week, and the stock price took a hit, primarily due to Alphabet’s announcement during the conference call that it plans to significantly increase spending on AI. The position is down, and we will need to monitor it closely at the start of the week.

IWM – 11 DTE

Sharp Move Straddle – iShares Russell 2000 ETF (IWM) – We are down a bit on the position. We plan to hold steady for now, keeping a close eye as time value decays with the February 21 option contract expiration approaching.

LRCX – 39 DTE

Bullish Long Call – Lam Research Corporation (LRCX) – We recently established this position and plan to stay the course for now.

NEM – 18 DTE

Bullish Long Call – Newmont Corporation (NEM) – We recently established this position and plan to stay the course for now. Be aware that there is an earnings call on Thursday February 20th which is prior to the expiration of the option contract.

TTWO – 18 DTE

Bearish Credit Spread – Take-Two Interactive Software, Inc. (TTWO) – The company announced earnings this week, and the stock price jumped, erasing the gains in the position. We will keep a close watch at the beginning of the week and stand ready to close the position if needed.

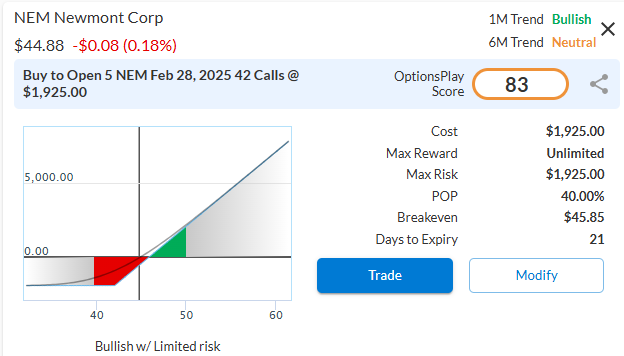

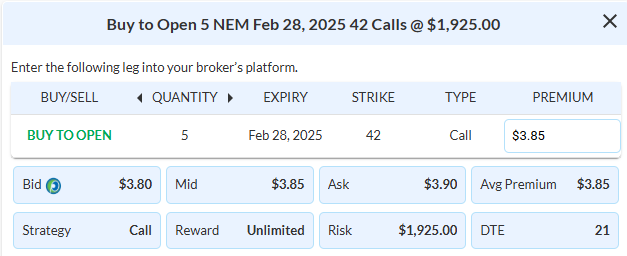

$NEM

DailyPlay – Opening Trade (NEM) – February 7, 2025

NEM Bullish Opening Trade Signal

Investment Rationale

Newmont Corporation (NEM) recently broke out above its trading range with strong momentum, outperforming the S&P 500 and presenting an opportunity for further upside toward its $56 target. From a fundamental perspective, NEM is considered moderately undervalued, trading at a price-to-sales ratio of 11.40x, compared to the industry average of 12.45x. Despite this discount, NEM is growing faster than its industry, with expected EPS growth of 38.17% versus the industry average of 22.12%, and expected revenue growth of 17.34% compared to 7.45% for the industry. While net margins currently stand at -7.14%, below the industry average of 11.17%, they have been recovering, reaching 20% over the last quarter, reinforcing NEM’s substantial upside potential. Be aware that there is an earnings call on Feb 20, 2025 which is prior to the expiration of your trade.

NEM – Daily

Trade Details

Strategy Details

Strategy: Long Call

Direction: Bullish Call

Details: Buy to Open 5 Contracts NEM Feb 28 $42 Calls @ $3.85 Debit per Contract.

Total Risk: This trade has a max risk of $1,925 (5 Contracts x $385) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $385 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher off recent support.

1M/6M Trends: Bullish/Neutral

Relative Strength: 5/10

OptionsPlay Score: 83

Stop Loss: @ $1.93 (50% loss of premium)

View NEM Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View NEM Trade

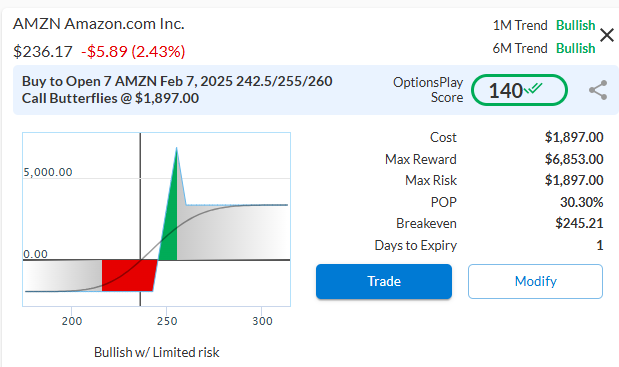

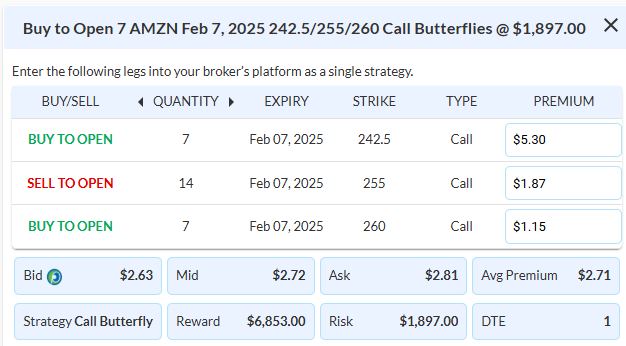

$AMZN

DailyPlay – Opening Trade (AMZN) – February 6, 2025

AMZN Bullish Opening Trade Signal

Investment Rationale

Amazon.com, Inc. (AMZN) maintains its e-commerce leadership, driven by advancements in cloud computing and AI. Strong earnings reinforce its market dominance, with Amazon Web Services (AWS) playing a key role in profitability. While other companies dominate AI headlines, Amazon’s steady progress—such as “Project Amelia”—enhances its ecosystem. This AI tool assists third-party sellers in optimizing performance, potentially boosting Amazon’s revenue. Recent earnings reports from cloud providers highlighted capacity challenges, pressuring stock prices, including AMZN’s. However, Amazon’s ability to navigate these issues could set it apart. Investors await its earnings report for further confirmation of its momentum. A highly speculative 0DTE options strategy will be explored, targeting a potential price increase following earnings.

AMZN – Daily

Trade Details

Strategy Details

Strategy: Modified Call Butterfly Spread

Direction: Bullish Modified Call Butterfly Spread

Details: Buy to Open 7 Contracts AMZN Feb 7 $242.50/$255/$260 Call Butterfly @ $2.71 Debit per Contract.

Total Risk: This trade has a max risk of $1,897 (7 Contracts x $271) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $271 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue its bullish trajectory.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 140

Stop Loss: @ $1.36 (50% loss of premium)

View AMZN Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AMZN Trade

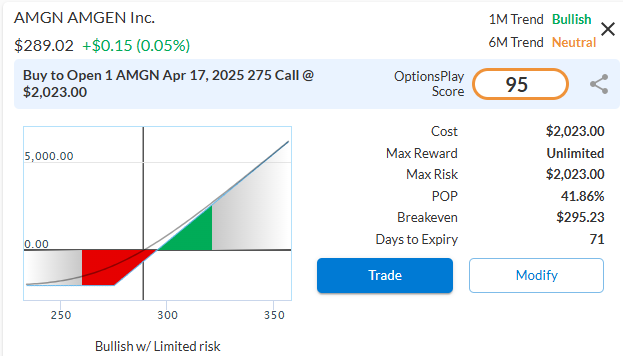

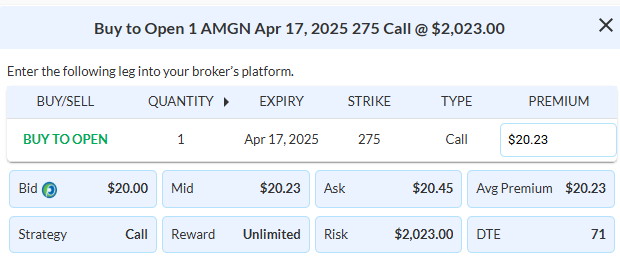

$AMGN

DailyPlay – Opening Trade (AMGN) – February 5, 2025

AMGN Bullish Opening Trade Signal

Investment Rationale

Amgen Inc. (AMGN) recently broke out above its resistance level of $280 while outperforming the S&P 500, suggesting further upside on strong momentum.

AMGN is modestly undervalued fundamentally, trading in line with its industry median. However, recent growth suggests that estimates may be too low, supporting a higher valuation. The stock has a forward P/E ratio of 13.67, compared to the industry average of 12.86. Expected EPS growth for AMGN is 4.70%, while the industry average is higher at 8.61%. Expected revenue growth stands at 7.20%, compared to the industry average of 4.74%. Net margins for AMGN are 13%, matching the industry average.

The company announced earnings on Tuesday, beating estimates on both the top and bottom lines. Amgen benefited from an 11% year-over-year increase in product sales during the quarter. Despite a solid report, the stock price is showing weakness in after-hours trading.

AMGN – Daily

Trade Details

Strategy Details

Strategy: Long Call

Direction: Bullish Call

Details: Buy to Open 1 Contract AMGN April 17 $275 Call @ $20.23 Debit per Contract.

Total Risk: This trade has a max risk of $2,023 (1 Contracts x $2,023) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $2,023 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to bounce higher off recent support.

1M/6M Trends: Bullish/Neutral

Relative Strength: 5/10

OptionsPlay Score: 95

Stop Loss: @ $10.12 (50% loss of premium)

View AMGN Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AMGN Trade

$CME, $NVDA

DailyPlay – Closing Trades (CME, NVDA) – February 4, 2025

Closing Trades

- CME – 63% gain: Sell to Close 3 Contracts (or 100% of your Contracts) Feb 21 $220 Calls @ $21.25 Credit. DailyPlay Portfolio: By Closing all 3 Contracts, we will receive $6,375. We initially opened these 3 Contracts on Jan 16 @ $13.05 Debit. Our gain, therefore, is $2,460.

- NVDA – 76% loss: Sell to Close 1 Contract (or 100% of your Contracts) Feb 21 $124 Call @ $3.50 Credit. DailyPlay Portfolio: By Closing this Contract, we will receive $350. We initially opened this position on Dec 18 @ $15.50 Debit and we rolled it thereafter to give us a cost basis of $18.49. Our loss after the roll, is therefore $1,499.

DailyPlay – Portfolio Review – February 3, 2025

DailyPlay Portfolio Review

Our Trades

AAPL – 25 DTE

Bearish Credit Spread – Apple Inc. (AAPL) – The position is at a loss following last week’s earnings announcement, but the stock showed some weakness into the close on Friday and in the overnight session. This after-hours weakness in the stock would be helpful for the position, and we still have considerable time remaining until expiration, so no immediate action is planned, and we are maintaining a tight watch.

AMD – 137 DTE

Bullish Long Call – Advanced Micro Devices, Inc. (AMD) – Although the position is currently down, we plan to stay the course for now, as there is still ample time remaining in the option contract. The company is set to announce earnings after the close on Tuesday, February 4.

BA – 46 DTE

Bullish Debit Spread – The Boeing Company (BA) – We are up on this position, and the company announced earnings last week. The stock has been range-bound since the earnings release. We still have plenty of time left in the option contracts and plan to stay the course for now.

CME – 18 DTE

Bullish Long Call – CME Group Inc. (CME) – While the position is showing a solid gain, we plan to hold steady for now, given the ample time remaining on the option contract. The company is scheduled to report earnings after the close on Wednesday, February 12.

DXCM – 4 DTE

Bullish Diagonal Spread – DexCom, Inc. (DXCM) – We recently established this position and plan to stay the course for now. The company is set to announce earnings after market close on Thursday, February 13th.

GOOGL – 25 DTE

Bullish Credit Spread – Alphabet Inc. (GOOGL) – We have a gain on this position. The company is set to announce earnings after market close on Tuesday, February 4th, so we have a decision to make before the earnings: close and take the profit or ride it through the earnings and take on the risks involved with the company event.

IWM – 18 DTE

Sharp Move Straddle – iShares Russell 2000 ETF (IWM) – We are down a bit on the position. We plan to hold steady for now, keeping a close eye as time value decays with the February 21 option contract expiration approaching.

LRCX – 46 DTE

Bullish Long Call – Lam Research Corporation (LRCX) – We recently established this position after the company announced earnings last week and plan to stay the course for now.

NVDA – 18 DTE

Bullish Long Call – NVIDIA Corporation (NVDA) – Several adjustments have been made to the initial position in NVDA. The position’s PnL has been volatile, and while we are currently down, we will remain in the position for now and evaluate the next steps. The company is scheduled to report earnings on Wednesday, February 26, after the market closes.

TTWO – 25 DTE

Bearish Credit Spread – Take-Two Interactive Software, Inc. (TTWO) – We have a small gain on this position. The company is set to announce earnings after market close on Thursday, February 6th, so we have a decision to make before the earnings: close and take the profit or ride it through the earnings and take on the risks involved with the company event.

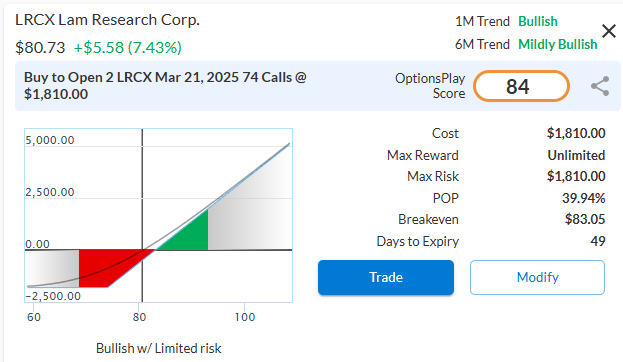

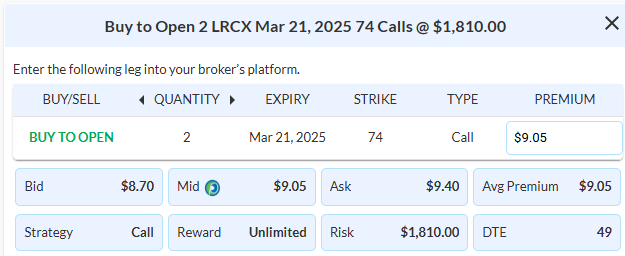

$LRCX, $UPS

DailyPlay – Opening Trade (LRCX) Closing Trade (UPS) – January 31, 2025

Closing Trade

- UPS – 30% gain: Sell to Close 10 Contracts (or 100% of your Contracts) Jan 31 $131/$134/$140 Put Butterflies @ $2.95 Credit. DailyPlay Portfolio: By Closing all 10 Contracts, we will receive $2,950. We initially opened these 10 Contracts on Jan 29 @ $2.27 Debit. Our gain, therefore, is $680. The posted closing price for the trade represents the most likely scenario as the market closes today. To exit the trade, a limit order will be placed at the $2.95 price.

LRCX Bullish Opening Trade Signal

Investment Rationale

Lam Research Corporation (LRCX) recently broke out above its trading range with strong momentum, outperforming the S&P 500 and providing an opportunity for further upside to our $105 target.

LRCX appears moderately undervalued despite trading in line with industry valuations, given its stronger growth and profitability. It has a price-to-sales ratio of 21.22x vs. the industry’s 23.02x, with expected EPS growth of 17.86% (industry: 16.62%) and revenue growth of 12.22% (industry: 8.73%). Its 26.02% net margin also outperforms the industry’s 19.87%. Yesterday Lam Research posted adjusted EPS of $0.91 on $4.38 billion in revenue, beating expectations, and projects $4.65 billion next quarter. Shares rose over 5% post-earnings.

LRCX – Daily

Trade Details

Strategy Details

Strategy: Long Call

Direction: Bullish Call

Details: Buy to Open 2 Contracts LRCX Mar 21 $74 Calls @ $9.05 Debit per Contract.

Total Risk: This trade has a max risk of $1,810 (2 Contracts x $905) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $905 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue its bullish trajectory.

1M/6M Trends: Bullish/Mildly Bullish

Relative Strength: 3/10

OptionsPlay Score: 84

Stop Loss: @ $4.53 (50% loss of premium)

View LRCX Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.