$DXCM, $PEP

DailyPlay – Opening Trade (DXCM) Closing Trade (PEP) – January 30, 2025

Closing Trade

- PEP – 26% gain: Sell to Close 5 Contracts (or 100% of your Contracts) Jan 31/Feb 14 $145/$150 Call Diagonal Spreads @ $5.37 Credit. DailyPlay Portfolio: By Closing all 5 Contracts, we will receive $2,685. We initially opened these 5 Contracts on Jan 23 @ $4.25 Debit. Our gain, therefore, is $560.

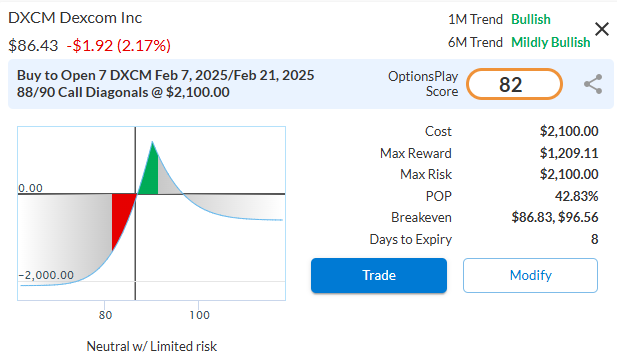

DXCM Bullish Opening Trade Signal

Investment Rationale

We are looking at DexCom, Inc. (DXCM) again. We first added it to the DailyPlay portfolio after it broke out above its trading range, and the company was initially included in the Options Play research report in early December last year.

DexCom has been outperforming the S&P 500, providing an opportunity for further upside toward our $95 target. The company is set to announce earnings after market close on Tuesday, February 13.

We view the fundamentals of DXCM as significantly undervalued. The company trades at a premium relative to its peers, but its valuation is supported by faster-than-expected growth and stronger profitability metrics.

The company has a forward P/E ratio of 44.00x compared to the industry average of 24.87x. Expected EPS growth stands at 23.12%, significantly higher than the industry average of 8.70%. Revenue is expected to grow by 13.73% compared to 6.34% for its peers. Additionally, DexCom maintains a net margin of 17.22%, exceeding the industry average of 14.13%.

DXCM – Daily

Trade Details

Strategy Details

Strategy: Long Call Diagonal Spread

Direction: Bullish Call Diagonals

Details: Buy to Open 7 Contracts DXCM Feb 7/Feb 21 $88/$90 Call Diagonal Spreads @ $3.00 Debit per Contract.

Total Risk: This trade has a max risk of $2,100 (7 Contracts x $300) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $300 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue its bullish trajectory.

1M/6M Trends: Bullish/Mildly Bullish

Relative Strength: 9/10

OptionsPlay Score: 82

Stop Loss: @ $1.50 (50% loss of premium)

View DXCM Trade

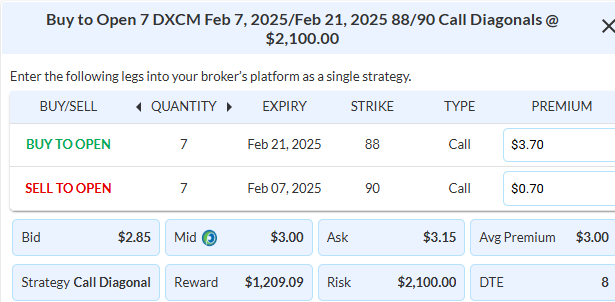

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View DXCM Trade

$UPS

DailyPlay – Opening Trade (UPS) Closing Trade (V) – January 29, 2025

Closing Trade

- V – 42% gain: Sell to Close 2 Contracts (or 100% of your Contracts) Mar 21 $305/$325 Call Vertical Spreads @ $15.97 Credit. DailyPlay Portfolio: By Closing both Contracts, we will receive $3,194. We initially opened these 2 Contracts on Jan 15 @ $11.24 Debit. Our gain, therefore, is $946 which is around 1% gain on our Portfolio.

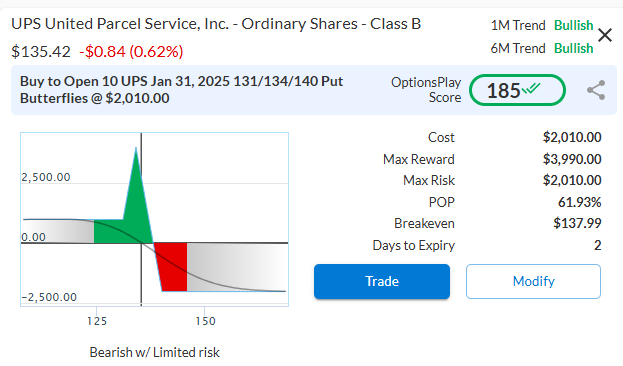

UPS Bearish Opening Trade Signal

Investment Rationale

United Parcel Service, Inc. (UPS) is set to report earnings on Thursday, January 30, before the market opens. We have a bearish outlook on the company ahead of its earnings report.

Technical indicators signal caution, as UPS approaches overbought levels, with resistance around $137. The Commodity Channel Index (CCI) above +100 and an exhausted Relative Strength Index (RSI) indicate potential weakness in the stock’s recent rally.

Fundamentally, UPS faces headwinds. While estimated EPS growth of 24.92% appears strong, it follows a three-year average decline of -12.21%, raising sustainability concerns. Revenue growth of 3.44% is modest given past struggles. Performance metrics are mixed, UPS ranks in the top 25% of its industry for YTD total return (7.39%) and EPS growth (36.92%) but faces a -33.70% decline in net income and shrinking profit margins.

Valuation concerns persist, with a P/E ratio of 20.49 exceeding its three-year average. While the 4.82% dividend yield is a bright spot, declining free cash flow and rising debt levels are red flags. Any earnings disappointment could trigger downside pressure.

UPS – Daily

Trade Details

Strategy Details

Strategy: Modified Put Butterfly Spread

Direction: Bearish Modified Put Butterfly Spread

Details: Buy to Open 10 UPS Jan 31 $131/$134/$140 Put Butterfly Spreads @ $2.01 Debit per Contract.

Total Risk: This trade has a max risk of $2,010 (10 Contracts x $201) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $201 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bearish trade on a stock that is expected to pull back from an area of resistance.

1M/6M Trends: Bullish/Bullish

Relative Strength: 8/10

OptionsPlay Score: 185

Stop Loss: @ $1.01 (50% loss of premium)

View UPS Trade

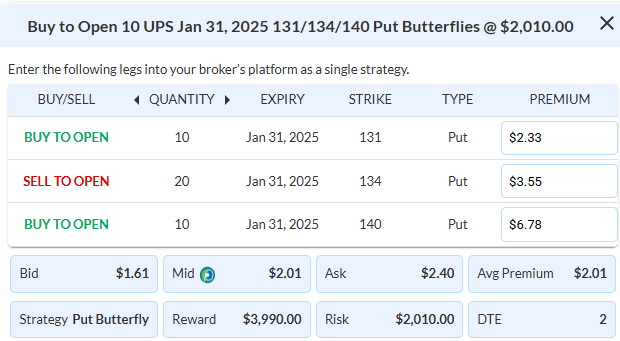

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View UPS Trade

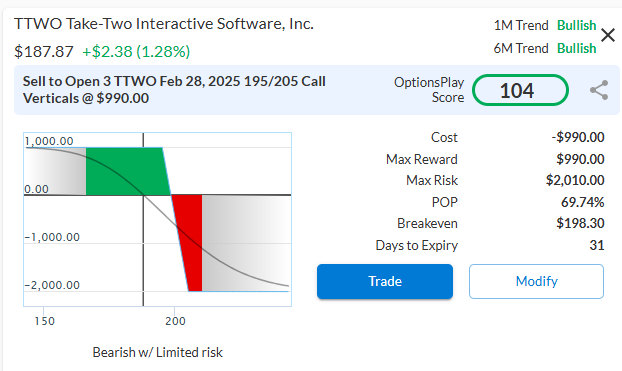

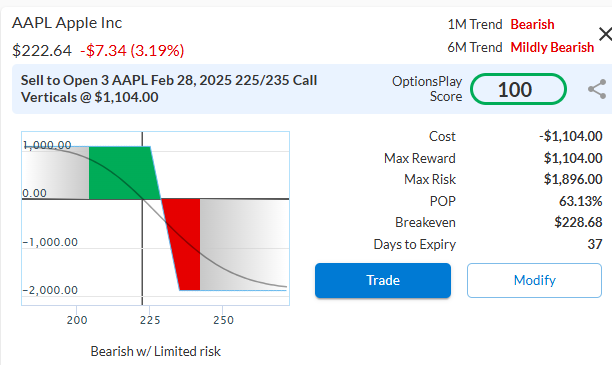

$TTWO

DailyPlay – Opening Trade (TTWO) – January 28, 2025

TTWO Bearish Opening Trade Signal

Investment Rationale

Take-Two Interactive Software, Inc. (TTWO) recently broke down from its trading range with strong momentum, underperforming the S&P 500, and presenting potential for further downside toward a $160 target. The stock appears significantly overvalued, trading at a forward P/E ratio of 23.84x, slightly above the industry average of 21.41x, with deeply negative net margins of -66.4% compared to the industry average of 17.86%. Although its expected revenue growth of 18.23% surpasses the industry average of 12.05%, the company’s projected EPS growth remains flat at 0%, far below the industry’s 19.19% average. Take-Two is scheduled to announce earnings on Thursday, February 6.

TTWO – Daily

Trade Details

Strategy Details

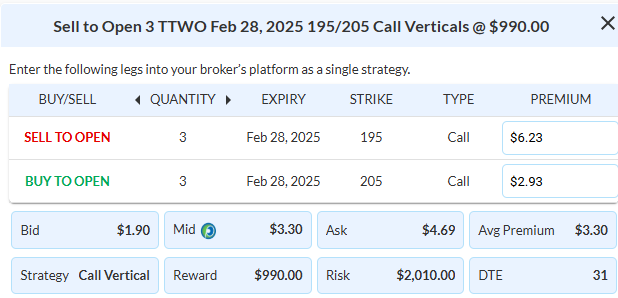

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 3 TTWO Feb 28 $195/$205 Call Vertical Spreads @ $3.30 Credit per Contract.

Total Risk: This trade has a max risk of $2,010 (3 Contracts x $670) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $670 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bearish trade on a stock that is expected to pull back from an area of resistance.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 104

Stop Loss: @ $6.60 (100% loss to value of premium)

View TTWO Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View TTWO Trade

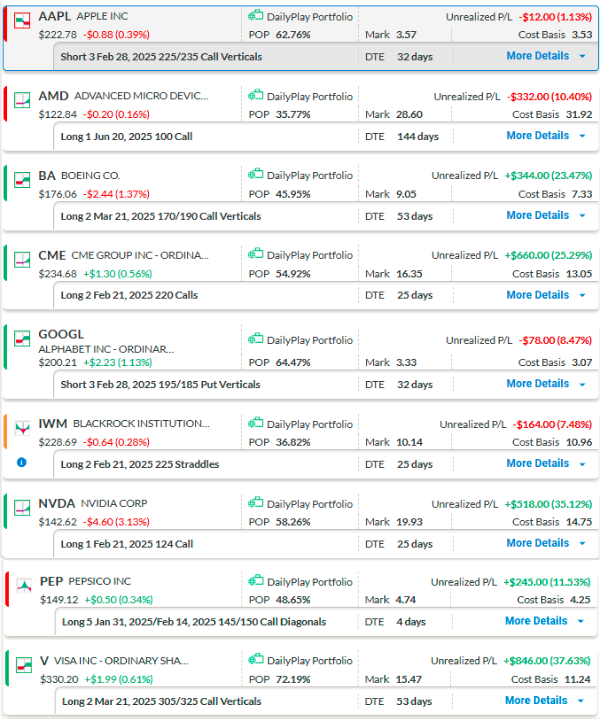

DailyPlay – Portfolio Review – January 27, 2025

DailyPlay Portfolio Review

Our Trades

AAPL – 32 DTE

Bearish Credit Spread – Apple Inc. (AAPL) – We recently established this position and plan to stay the course for now. The company is set to announce earnings after market close on Thursday, January 30.

AMD – 144 DTE

Bullish Long Call – Advanced Micro Devices, Inc. (AMD) – Although the position is currently down, we plan to stay the course for now, as there is still ample time remaining in the option contract. The company is set to announce earnings after the close on Tuesday, February 4.

BA – 53 DTE

Bullish Debit Spread – The Boeing Company (BA) – We are up on this position and plan to stay the course for now, likely riding it through the earnings report. The company is set to announce earnings before the open on Tuesday, January 28.

CME – 25 DTE

Bullish Long Call – CME Group Inc. (CME) – While the position is showing a solid gain, we plan to hold steady for now, given the ample time remaining on the option contract. The company is scheduled to report earnings after the close on Wednesday, February 12.

GOOGL – 32 DTE

Bearish Credit Spread – Alphabet Inc. (GOOGL) – We recently established this position and plan to stay the course for now. The company is set to announce earnings after market close on Tuesday, February 4th.

IWM – 25 DTE

Sharp Move Straddle – iShares Russell 2000 ETF (IWM) – We are flat on the position. The ETF made a decent move up to the 230 level but bounced off resistance at that point. We plan to hold steady for now, given the ample time remaining on the option contracts.

NVDA – 25 DTE

Bullish Long Call – NVIDIA Corporation (NVDA) – We recently made a second adjustment to this position, lowering the cost basis on the long option contract. Additionally, we rolled the long call forward to extend its duration. While the position is currently showing a solid gain, we plan to hold steady for now, as there is still ample time remaining on the contract. The company is expected to report earnings on Wednesday, February 26, after the market close.

PEP – 4 DTE

Bullish Diagonal Spread – PepsiCo Inc. (PEP) – We recently established this position, which is currently profitable. The stock closed Friday near the strike price of our short option, which is favorable for the position. However, we may need to roll or close the front-month option in the diagonal spread before its expiration. The company is scheduled to report earnings on Tuesday, February 4, before the market opens.

V – 53 DTE

Bullish Debit Spread – Visa Inc. (V) – We recently established this position and are currently showing a solid gain. If the upward momentum continues, we will likely roll the long option contract to a higher strike with the same expiration, capturing a profit on the long call and reducing some risk ahead of the earnings report. The company is set to announce earnings on Thursday, January 30, after the market closes.

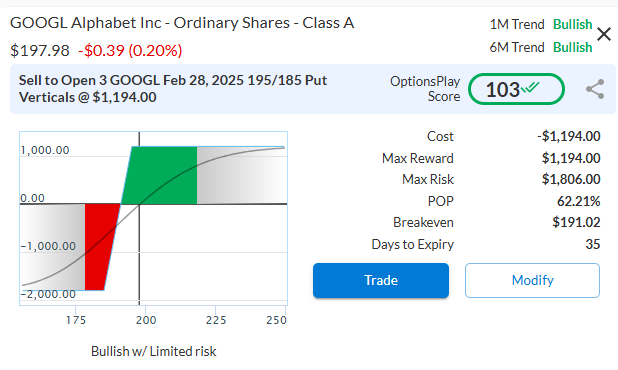

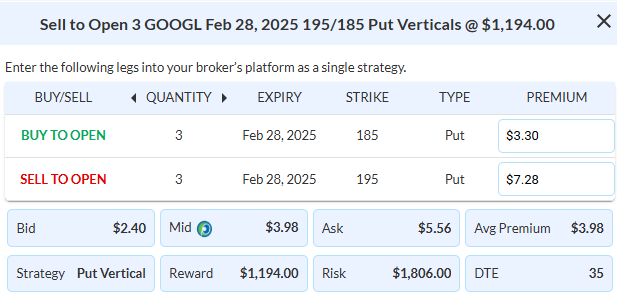

$GOOGL

DailyPlay – Opening Trade (GOOGL) – January 24, 2025

GOOGL Bullish Opening Trade Signal

Investment Rationale

Alphabet Inc. (GOOGL) recently broke out above its $190 resistance level, printing a new all-time high while outperforming the S&P 500. This suggests further upside potential on strong momentum.

GOOGL trades in line with its peers but is expected to grow faster than its competitors and is far more profitable, suggesting substantial upside potential. GOOGL has a forward P/E ratio of 21.88x, slightly above the industry average of 20.54x. However, GOOGL’s expected earnings per share (EPS) growth is 19.15%, well above the industry average of 11.69%, and its expected revenue growth is 12.02%, compared to the industry’s 8.18%. Additionally, GOOGL boasts net margins of 27.74%, far surpassing the industry average of 13.82%.

The company is expected to report earnings on Tuesday, February 4th, after market close.

GOOGL – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 3 GOOGL Feb 28 $195/$185 Put Vertical Spreads @ $3.98 Credit per Contract.

Total Risk: This trade has a max risk of $1,806 (3 Contracts x $602) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $602 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue its bullish trend.

1M/6M Trends: Bullish/Bullish

Relative Strength: 8/10

OptionsPlay Score: 103

Stop Loss: @ $7.96 (100% loss to value of premium)

View GOOGL Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View GOOGL Trade

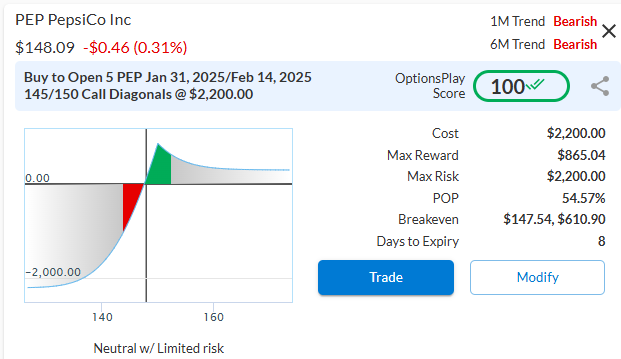

$PEP

DailyPlay – Opening Trade (PEP) – January 23, 2025

PEP Bullish Opening Trade Signal

Investment Rationale

PepsiCo, Inc. (PEP) has recently reached oversold conditions on both daily and weekly timeframes, indicating a potential for a strong rally ahead.

From a fundamental perspective, PEP appears modestly undervalued. The stock trades at a forward price-to-earnings ratio of 17.29x, compared to the industry average of 19.82x, representing a discount to its industry, with growth expectations in line with the sector. Although expected earnings growth is slightly below the industry average, PepsiCo’s revenue growth and net margins remain strong. The stock also offers an attractive dividend yield, providing value for income-seeking investors. The company is set to report earnings on Tuesday, February 4, before the market opens.

PEP – Daily

Trade Details

Strategy Details

Strategy: Long Call Diagonal Spread

Direction: Bullish Call Diagonal Spread

Details: Buy to Open 5 PEP Jan 31/Feb 14 $145/$150 Call Diagonal Spreads @ $4.40 Debit per Contract.

Total Risk: This trade has a max risk of $2,200 (5 Contracts x $440) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $440 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that is expected to bounce off recent support after being oversold.

1M/6M Trends: Bearish/Bearish

Relative Strength: 3/10

OptionsPlay Score: 100

Stop Loss: @ $2.20 (50% loss of premium)

View PEP Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View PEP Trade

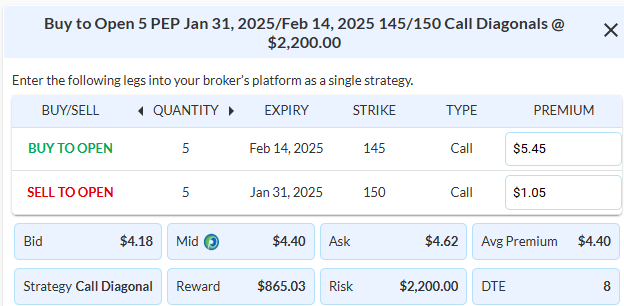

$AAPL

DailyPlay – Opening Trade (AAPL) – January 22, 2025

AAPL Bearish Opening Trade Signal

Investment Rationale

Apple Inc. (AAPL) has recently reached overbought conditions on both daily and weekly timeframes, exhibiting signs of exhaustion that suggest a strong selloff may be ahead. Fundamentally, AAPL appears significantly overvalued, trading at a forward PE ratio of 32.91x, an 86% premium compared to the industry average of 17.89x. While its net margins of 23.97% are significantly higher than the industry average of 8.40%, justifying some level of premium valuation, the recent decline in its net margins highlights notable downside risks. Additionally, AAPL’s expected EPS growth of 11.42% falls below the industry average of 13.93%, and its expected revenue growth of 6.91% is only slightly above the industry average of 6.50%, further emphasizing its overvaluation concerns. Be aware that there is an earnings call on Jan 30, which is prior to the expiration date of this trade.

AAPL – Daily

Trade Details

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 3 AAPL Feb 28, 2025 $225/$235 Call Vertical Spreads @ $3.68 Credit per Contract.

Total Risk: This trade has a max risk of $1,896 (3 Contracts x $632) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $632 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue its bearish trend.

1M/6M Trends: Bearish/Mildly Bearish

Relative Strength: 3/10

OptionsPlay Score: 100

Stop Loss: @ $7.36 (100% loss to value of premium)

View AAPL Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AAPL Trade

DailyPlay – Portfolio Review – January 21, 2025

DailyPlay Portfolio Review

Our Trades

AMD – 150 DTE

Bullish Long Call – Advanced Micro Devices, Inc. (AMD) – Although the position is currently down, we plan to stay the course for now, as there is still ample time remaining in the option contract. The company is expected to announce earnings after the close on Tuesday, February 4.

BA – 59 DTE

Bullish Debit Spread – The Boeing Company (BA) – We recently established this position and plan to stay the course for now. The company is expected to announce earnings before the open on Tuesday, January 28.

CME – 31 DTE

Bullish Long Call – CME Group Inc. (CME) – Although the position is currently showing a slight gain, we plan to stay the course for now, as there is still ample time remaining in the option contract. The company is expected to announce earnings after the close on Wednesday, February 12.

IWM – 31 DTE

Sharp Move Straddle – iShares Russell 2000 ETF (IWM) – We recently established this position and plan to stay the course for now.

NVDA – 31 DTE

Bullish Long Call – NVIDIA Corporation (NVDA) – We recently made a second adjustment to this position, reducing our cost basis on the long option contract. We then rolled the long call forward to extend its duration and plan to stay the course for now. NVIDIA is scheduled to announce earnings after the market close on Wednesday, February 26.

V – 59 DTE

Bullish Debit Spread – Visa Inc. (V) – We recently established this position and have a small gain; we plan to stay the course for now. The company is expected to announce earnings after market close on Thursday, January 30, 2025.

$IWM

DailyPlay – Opening Trade (IWM) Closing Trades (AAPL, DXCM) – January 17, 2025

Closing Trades

- AAPL – 66% gain: Sell to Close 8 Contracts (or 100% of your Contracts) Jan 17/Jan 31 $232.50/$235 Put Diagonal Spreads @ $5.07 Credit.

DailyPlay Portfolio: By Closing all 8 Contracts, we will receive $4,056. We initially opened this trade on Jan 9, 2025 @ $3.05. Our gain, therefore, is $1,616. - DXCM – 1% gain: Sell to Close 3 Contracts (or 100% of your Contracts) Jan 17 $75/$81 Call Vertical Spreads @ $5.90 Credit.

DailyPlay Portfolio: By Closing all 3 Contracts, we will receive $1,770. We initially opened this trade on Dec 3, 2024 @ $6.30 and then rolled it Jan 15 @ $0.48 Credit to give us a net Credit of $5.95. Our gain therefore is $15.

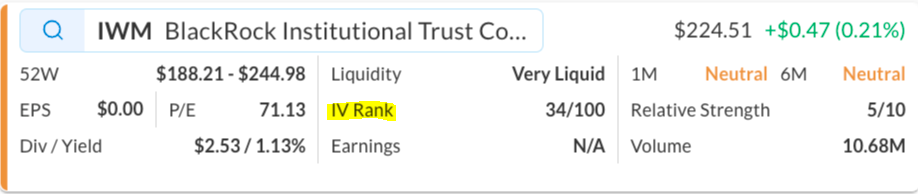

IWM Bullish Opening Trade Signal

Investment Rationale

The Daily Play today is a long straddle in the IWM. The rationale for considering this strategy in the Russell 2000 Small Cap Index, using the IWM ETF, is straightforward. Recently, the ETF has been trading within a tight range. Small-cap stocks are particularly sensitive to interest rate fluctuations, and inflation disproportionately affects them.

With the presidential inauguration on Monday and the transition of power, speculation is mounting, especially regarding tariffs, tax policy, spending, and debt management. Additionally, there’s uncertainty about how the Federal Reserve will evolve under the Trump administration.

We expect significant headlines in the coming days, though it’s unclear whether markets will react positively or negatively. This environment makes a long straddle appealing, as it positions for potential sharp moves in either direction.

Currently, the implied volatility rank (IV rank) on the platform is 34/100, indicating that volatility is at the lower end of the range. This suggests it’s not a bad entry point for buying options. Option traders use IV rank to determine whether implied volatility is high or low based on the past year’s data. High IV may indicate a selling opportunity, while low IV may suggest a buying opportunity.

At 34/100, IV is on the lower end, as 50/100 represents the midpoint. Once the strategy is established, an increase in implied volatility is ideal, as it raises the value of both options and suggests a greater likelihood of a price swing.

IWM – Daily

Trade Details

Strategy Details

Strategy: Long Straddle

Direction: Sharp Move Straddle

Details: Buy to Open 2 IWM Feb 21, 2025 $225 Straddles @ $10.85 Debit per Contract.

Total Risk: This trade has a max risk of $2,170 (2 Contracts x $1,085) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $1,085 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue its long-term bullish trajectory.

1M/6M Trends: Neutral/Neutral

Relative Strength: 5/10

OptionsPlay Score: 56

Stop Loss: @ $5.39 (50% loss of premium)

View IWM Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View IWM Trade

$CME, $SHOP

DailyPlay – Opening Trade (CME) Closing Trade (SHOP) – January 16, 2025

Closing Trade

- SHOP – 85% loss: Sell to Close 3 Contracts (or 100% of your Contracts) Jan 17 $105/$115 Call Vertical Spreads @ $0.83 Credit.

DailyPlay Portfolio: By Closing all 3 Contracts, we will receive $249. We initially opened this trade on Nov 15, 2024 @ $6.39 and then rolled it Jan 6 @ $2.29 Credit. Our loss therefore is $981.

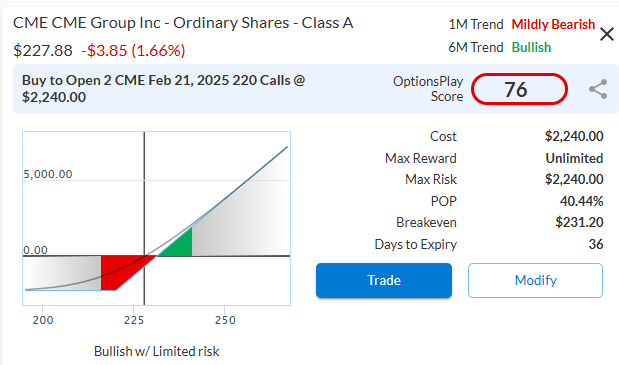

CME Bullish Opening Trade Signal

Investment Rationale

CME Group Inc. (CME) recently broke out above its trading range with strong momentum and is outperforming the S&P 500, creating an opportunity for further upside to our target of $250.

From a fundamental perspective, CME appears moderately undervalued. While its valuations are in line with the industry, CME demonstrates far greater profitability. The company’s net margins exceed 55%, suggesting substantial upside potential.

CME currently trades at a forward price-to-earnings (PE) ratio of 22.06, compared to the industry average of 17.45. Expected earnings per share (EPS) growth for CME is 4.93%, while the industry average is higher at 13.19%. However, CME’s expected revenue growth stands at 5.42%, compared to the industry average of 8.37%. Most notably, CME’s net margins are an impressive 57.34%, far surpassing the industry average of 20.83%. The company is anticipated to report earnings on February 12, 2025, before the market opens.

CME – Daily

Trade Details

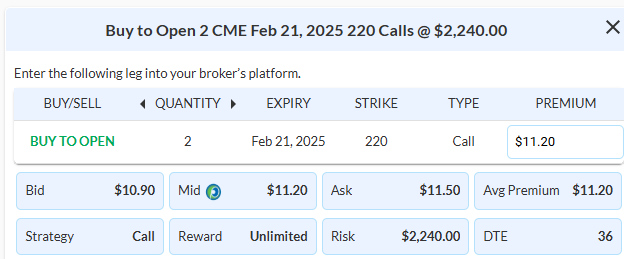

Strategy Details

Strategy: Long Call

Direction: Bullish Call

Details: Buy to Open 2 CME Feb 21, 2025 $220 Calls @ $11.20 Debit per Contract.

Total Risk: This trade has a max risk of $2,240 (2 Contracts x $1,120) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $1,1200 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue its bullish trajectory.

1M/6M Trends: Mildly Bearish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 76

Stop Loss: @ $5.60 (50% loss of premium)

View CME Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.