$V, $DXCM

DailyPlay – Opening Trade (V) Adjusting Trade (DXCM) – January 15, 2025

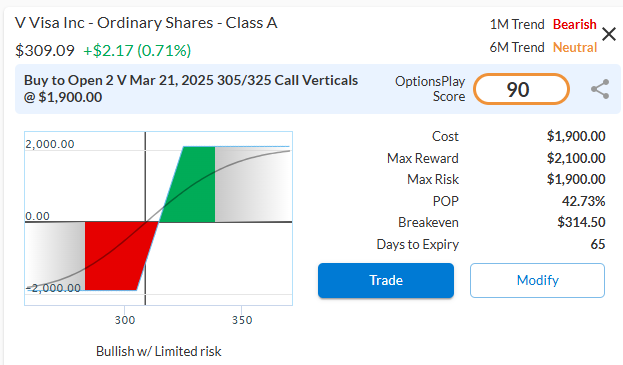

V Bullish Opening Trade Signal

Investment Rationale

Visa (V) recently broke out above its trading range with strong momentum, outperforming the S&P 500. This breakout provides an opportunity for further upside toward our $325 target. While Visa trades at a premium with a 27.48x forward P/E ratio compared to the industry average of 17.45x, its growth metrics remain competitive, including a 12.51% expected EPS growth versus 13.19% for the industry and a 9.88% expected revenue growth compared to the industry average of 8.37%. Additionally, Visa’s industry-leading profitability, highlighted by its 54.96% net margins against the industry average of 20.83%, underscores its significant upside potential. The company is expected to announce earnings after market close on Thursday, January 30.

V – Daily

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 2 V Mar 21, 2025 $305/$325 Call Vertical Spreads @ $9.50 Debit per Contract.

Total Risk: This trade has a max risk of $1,900 (2 Contracts x $950) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $950 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that is expected to continue to bounce off recent support.

1M/6M Trends: Bearish/Neutral

Relative Strength: 9/10

OptionsPlay Score: 90

Stop Loss: @ $4.75 (50% loss of premium)

View V Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

DXCM Bullish Trade Adjustment

Investment Rationale

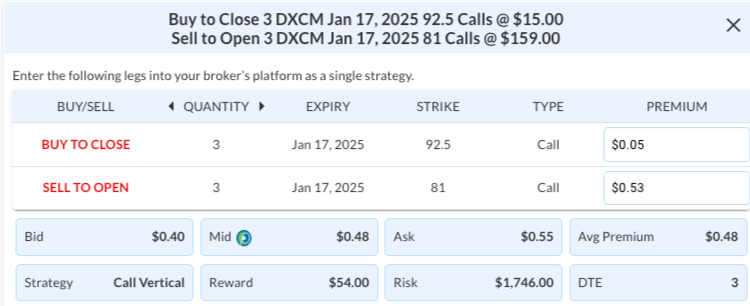

We are making a quick adjustment to the DexCom, Inc. (DXCM). Although the stock was down most of the day, it finished strong. With the options in our spread expiring this Friday and some remaining volatility premium, we will capitalize on this opportunity and position for potential upside momentum as the week concludes. Specifically, we will buy to close our short option for pennies and sell to open a new option with the same expiration, closer to the current stock price, for a meaningful net credit.

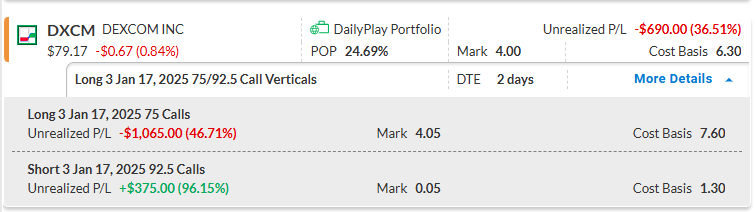

Original Position:

- Long 3 Jan 17, 2025 75 Calls

- Short 3 Jan 17, 2025 92.5 Calls

The cost basis is $6.30 per 1×1 spread. For the entire position, consisting of three spreads, the total cost basis is $1,890 ($6.30 x 3 x 100) for the current position.

Trade Details

Resulting Position after Roll/Adjustment:

- Long 3 Jan 17, 2025 75 Calls

- Short 3 Jan 17, 2025 81 Calls

With a $0.48 net credit fill for the roll, the cost basis is reduced from $6.30 to $5.82 per 1×1 spread. For the entire position, consisting of three spreads, this results in a total cost basis of $1,746 ($5.82 x 3 x 100) for the new DXCM position.

Adjusting the Trade

Use the following details to Adjust the DXCM trade on your trading platform.

PLEASE NOTE that these prices above are based on Tuesday’s closing prices.

$NVDA

DailyPlay – Adjusting Trade (NVDA) – January 14, 2025

NVDA Bullish Trade Adjustment

Investment Rationale

It has been a turbulent journey since establishing our position in NVDA. We have sold a few option contracts against the long call that expired worthless, and we now find ourselves holding a straight long call position with only a few days left until expiration. Currently, the position is at a loss. Despite this, we maintain a bullish outlook on NVDA and plan to adjust the position by rolling it out in time while keeping the same strike price. The cost basis, after multiple adjustments, stands at $14.79 net debit. We will continue to update the cost basis as we make further adjustments and will closely monitor the position’s performance.

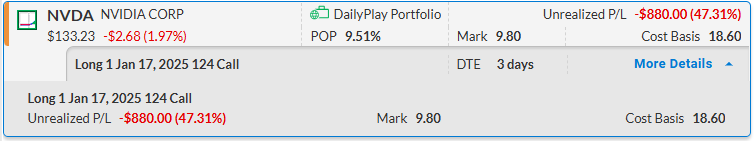

Original Position:

- Long 1 Jan 17, 2025 $124 Call

- Cost Basis after multiple adjustments is $14.79 Net Debit

Trade Details

Strategy Details

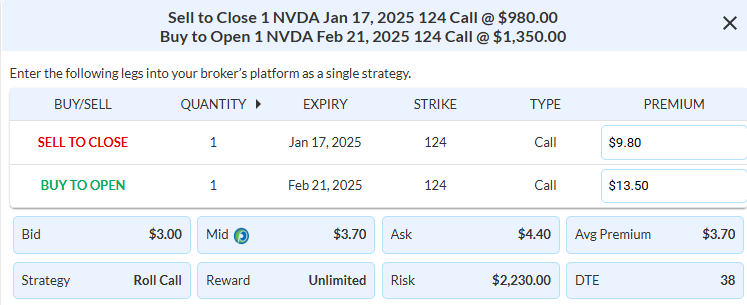

Strategy: Adjustment of a Bullish Long Call

Direction: Resulting in a new Bullish Long Call

Details: Sell to Close 1 Contract Jan 17 $124 Call and Buy to Open 1 Contract Fed 21 $124 Call @ a $3.70 net Debit, or $370 per 1×1 roll ($3.70 x 100). The total Net Debit Paid for rolling this 1 Call contract is $370. This roll establishes a new Long Call Position in NVDA.

Resulting Position after Roll/Adjustment:

- Long 1 Feb 21, 2025, $124 Call

- Based on a $3.70 net debit fill for the one contract, the cost basis would be $14.79 + $3.70, totaling $18.49 per contract or $1,849 ($18.49 x 1 x 100)

Adjusting the Trade

Use the following details to Adjust the NVDA trade on your trading platform.

PLEASE NOTE that these prices above are based on Monday’s closing prices.

$QQQ

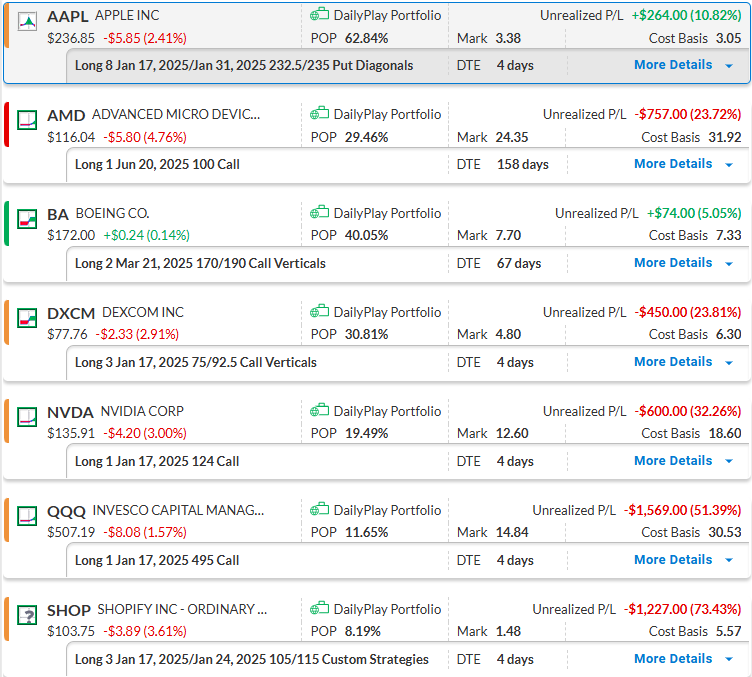

DailyPlay – Portfolio Review & Closing Trade (QQQ) – January 13, 2025

Closing Trade

- QQQ – 51% loss: Sell to Close 1 Contract (or 100% of your Contracts) Jan 17 $495 Call @ $14.85 Credit. DailyPlay Portfolio: By Closing this Contract, we will receive $1,485. We initially opened this Contract on Nov 8 @ $30.53 Debit. Our loss, therefore, is $1,568.

DailyPlay Portfolio Review

Our Trades

AAPL – 4 DTE

Bearish Diagonal Spread – Apple Inc. (AAPL) – We are slightly up on the position we recently established and plan to stay the course for now. The company is expected to announce earnings after the close on Thursday, January 30.

AMD – 158 DTE

Bullish Long Call – Advanced Micro Devices, Inc. (AMD) – While we are currently down slightly, we plan to stay the course for now, as there is still ample time remaining in the option contract. The company is expected to announce earnings after the close on Tuesday, Feb 4.

BA – 67 DTE

Bullish Debit Spread -The Boeing Company (BA) We recently established this position and plan to stay the course for now. The company is expected to announce earnings before the open on Tuesday, January 28.

DXCM – 4 DTE

Bullish Debit Spread – DexCom, Inc. (DXCM) – We will either roll the short call down to bring in additional premium, which will lower our potential maximum gain while simultaneously reducing the cost basis on our long call, or close the position outright this week.

NVDA – 4 DTE

Bullish Long Call – NVIDIA Corporation (NVDA) – We recently made a second adjustment to this position, which has lowered our loss basis on the long option contract. The short call option expired worthless, which was beneficial to the position. Expiration is quickly approaching on the long option, so we will either open a new short call position, creating a bull call vertical spread, or close the long option outright this week.

QQQ – 4 DTE

Bullish Long Call – We are closing this position today for a loss.

SHOP – 4 DTE

We’re currently down on the position but plan to hold steady for the time being. Last week, we rolled the short call down to generate additional premium. This adjustment reduced the cost basis on our long call, though it also decreased the potential maximum gain by reducing the width of the spread. Expiration is quickly approaching.

$AAPL

DailyPlay – Opening Trade (AAPL) Closing Trade (ADBE) – January 10, 2025

Closing Trade

- ADBE – 36% loss: Sell to Close 1 Contract (or 100% of your Contract) Feb 21 $425/$470 Call Vertical Spread @ $11.63 Credit. DailyPlay Portfolio: By Closing this Contract, we will receive $1,163. We initially opened this Contract on Jan 7 @ $18.23 Debit. Our loss, therefore, is $660.

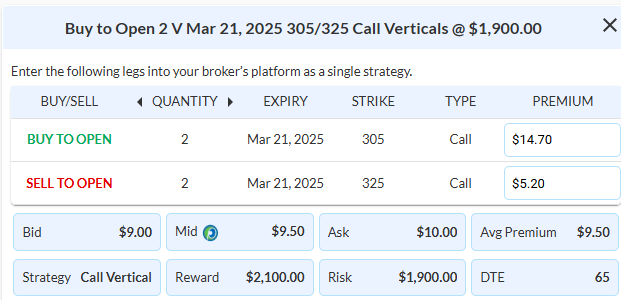

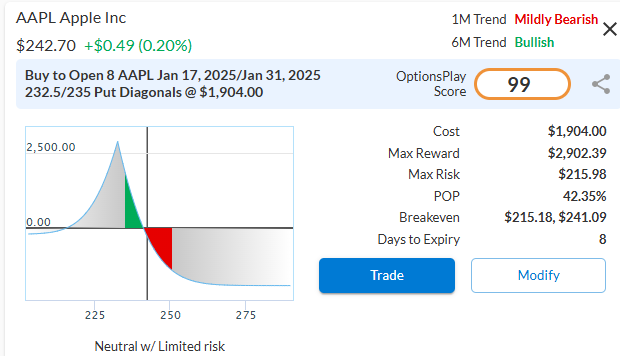

AAPL Bearish Opening Trade Signal

Investment Rationale

In light of the U.S. markets being closed on January 9, 2025, in observance of a national day of mourning for James Earl Carter, Jr., the thirty-ninth President of the United States, we will execute the following Daily Play on Apple, Inc. at the market open on Friday, January 10. This will serve as our Daily Play communication for the day, in respect and honor of his memory.

Apple Inc. (AAPL) has recently reached overbought conditions on both daily and weekly timeframes, exhibiting signs of exhaustion that suggest a higher likelihood of a strong selloff ahead. Fundamentally, AAPL appears significantly overvalued, trading at an 86% premium relative to its peers. While its net margins of 23.97% exceed the industry average of 8.40%, justifying a premium valuation, the recent decline in these margins introduces significant downside risks. AAPL’s forward PE ratio of 33.86x is considerably higher than the industry average of 17.89x. Additionally, its expected EPS growth of 11.41% and revenue growth of 6.91% are only marginally different from the industry averages of 13.93% and 6.50%, respectively. The company is expected to announce earnings after the close on Thursday, January 30, 2025, which will be factored into the option strategy chosen for today’s play.

AAPL – Daily

Trade Details

Strategy Details

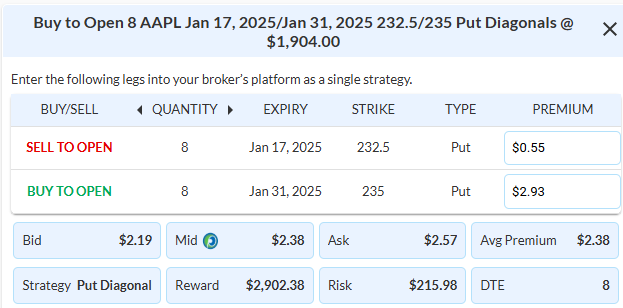

Strategy: Long Put Diagonal Spread

Direction: Bearish Put Diagonal Spread

Details: Buy to Open 8 Contracts AAPL Jan 17/Jan 31 $232.50/$235 Put Diagonal Spreads @ $2.38 Debit per Contract.

Total Risk: This trade has a max risk of $1,904 (8 Contracts x $238) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $238 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue to pull back from recent highs.

1M/6M Trends: Mildly Bearish/Bullish

Relative Strength: 7/10

OptionsPlay Score: 99

Stop Loss: @ $1.19 (50% loss of premium)

View AAPL Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices, with consideration given to the market holiday in honor of President Carter. Should the underlying move significantly during pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AAPL Trade

$AAPL

DailyPlay – Opening Trade (AAPL) – January 9, 2025

AAPL Bearish Opening Trade Signal

Investment Rationale

Apple Inc. (AAPL) has recently reached overbought conditions on both daily and weekly timeframes, exhibiting signs of exhaustion that suggest a higher likelihood of a strong selloff ahead. Fundamentally, AAPL appears significantly overvalued, trading at an 86% premium relative to its peers. While its net margins of 23.97% exceed the industry average of 8.40%, justifying a premium valuation, the recent decline in these margins introduces significant downside risks. AAPL’s forward PE ratio of 33.86x is considerably higher than the industry average of 17.89x. Additionally, its expected EPS growth of 11.41% and revenue growth of 6.91% are only marginally different from the industry averages of 13.93% and 6.50%, respectively. The company is expected to announce earnings after the close on Thursday, January 30, 2025, which will be factored into the option strategy chosen for today’s play.

AAPL – Daily

Trade Details

Strategy Details

Strategy: Long Put Diagonal Spread

Direction: Bearish Put Diagonal Spread

Details: Buy to Open 8 Contracts AAPL Jan 17/Jan 31 $232.50/$235 Put Diagonal Spreads @ $2.38 Debit per Contract.

Total Risk: This trade has a max risk of $1,904 (8 Contracts x $238) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $238 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue to pull back from recent highs.

1M/6M Trends: Mildly Bearish/Bullish

Relative Strength: 7/10

OptionsPlay Score: 99

Stop Loss: @ $1.19 (50% loss of premium)

View AAPL Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AAPL Trade

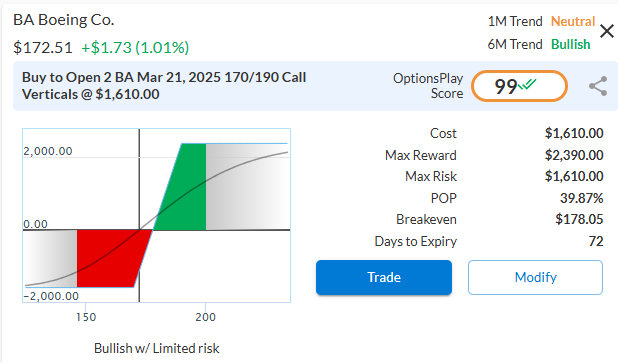

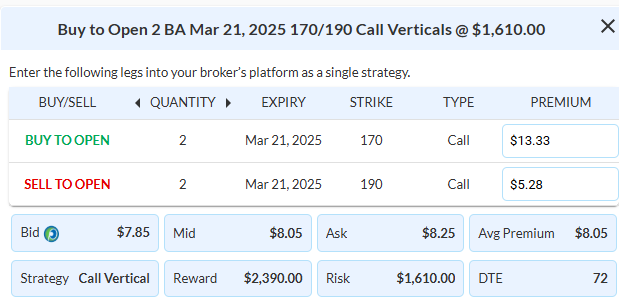

$BA

DailyPlay – Opening Trade (BA) – January 8, 2025

BA Bullish Opening Trade Signal

Investment Rationale

The Boeing Company (BA) recently broke out above its trading range with strong momentum, outperforming the S&P 500, and presenting an opportunity for further upside to our $190 target. From a fundamental perspective, BA appears moderately undervalued. The company trades at 1.45x price-to-sales, significantly below the industry average of 1.81x, despite its faster-than-expected revenue growth rate of 9.77%, compared to the industry average of 6.45%. Additionally, Boeing’s expected EPS growth is projected at 34.5%, far surpassing the industry average of 12.27%. While BA is currently operating with net margins of -10.9%, compared to the industry average of 7.10%, its recovery trajectory suggests substantial upside potential as it moves out of a net loss in 2025.

BA – Daily

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 2 BA Mar 21, 2025 $170/$190 Call Vertical Spreads @ $8.05 Debit per Contract.

Total Risk: This trade has a max risk of $1,610 (2 Contracts x $1,610) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $1,610 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue its bullish trajectory.

1M/6M Trends: Neutral/Bullish

Relative Strength: 5/10

OptionsPlay Score: 99

Stop Loss: @ $4.03 (50% loss of premium)

View BA Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View BA Trade

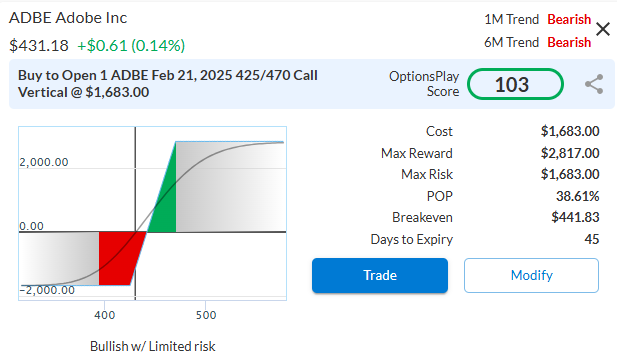

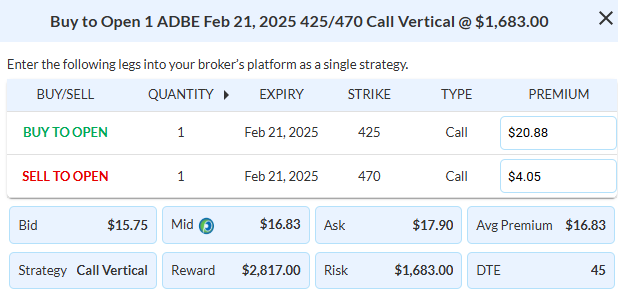

$ADBE

DailyPlay – Opening Trade (ADBE) – January 7, 2025

ADBE Bullish Opening Trade Signal

Investment Rationale

Adobe Inc. (ADBE) has recently entered oversold territory on both daily and weekly timeframes, showing signs of exhaustion that suggest a strong rally could be on the horizon, with a target price of $540.

Despite its recent underperformance, ADBE remains one of the most profitable AI software investments. Currently trading at a forward P/E ratio of 21.79x compared to the industry average of 27.85x, Adobe offers a substantial discount relative to its peers and the broader market. While its expected EPS growth of 12.13% is slightly below the industry average of 13.90%, its expected revenue growth of 9.76% exceeds the industry average of 9.30%. Additionally, Adobe’s net margins of 25.85% significantly outpace the industry average of 17.70%, highlighting its strong profitability and competitive positioning. These factors underscore its appeal as a compelling upside opportunity.

ADBE – Daily

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 1 ADBE Feb 21, 2025 $425/$470 Call Vertical Spread @ $16.83 Debit per Contract.

Total Risk: This trade has a max risk of $1,683 (1 Contract x $1,683) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $1,683 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that is expected to continue higher off recent support.

1M/6M Trends: Bearish/Bearish

Relative Strength: 1/10

OptionsPlay Score: 103

Stop Loss: @ $8.42 (50% loss of premium)

View ADBE Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View ADBE Trade

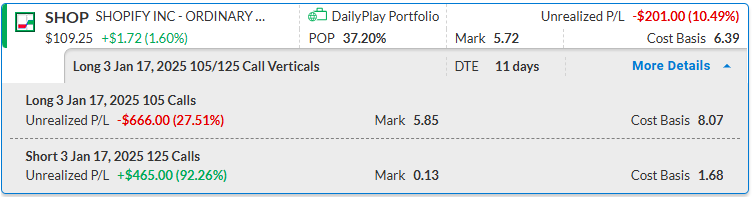

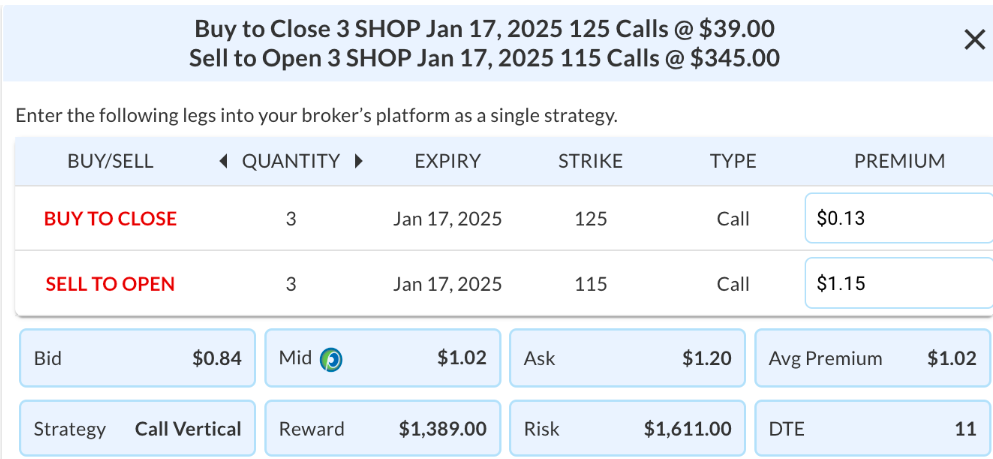

$SHOP

DailyPlay – Adjusting Trade (SHOP) – January 6, 2025

SHOP Bullish Trade Adjustment

Investment Rationale

Shopify (SHOP) – We are maintaining our bullish outlook following the gap move higher to a new 52-week high a little while back and continue to hold a longer-term target of $140. After a recent pullback in the stock’s price, we will roll the short option of our long call vertical spread to capture the gain on the current short position and bring in additional premium, as the expiration date is quickly approaching (11 DTE).

We will adjust this position by closing the short leg and selling to open another leg with a lower strike price but the same expiration, for a net credit to the position. This adjustment will lower our cost basis but at the detriment of reducing our maximum potential profit if the upside momentum from yesterday continues. Below is the current position breakdown with the individual legs listed.

Original Position:

- Long 3 Jan 17, 2025 $105 Calls

- Short 3 Jan 17, 2025 $125 Calls

- Cost Basis $6.39 Net Debit

Trade Details

Strategy Details

Strategy: Adjustment of a bullish Call Vertical Spread

Direction: Resulting in a new bullish Call Vertical Spread

Details: Buy to Close 3 Contracts Jan 17, 2025 $125 Call and Sell to Open 3 Contracts Jan 17, 2025 $115 Call @ 1.06 net Credit, or $106 per 1×1 roll ($1.06 x 100). The total net Credit received for rolling these 3 call contracts is $318 ($1.06 x 100 x 3) This roll establishes a new Bullish Call Vertical Spread.

Resulting Position after Roll/Adjustment:

- Long 3 Jan 17, 2025 $105 Call

- Short 3 Jan 17, 2025 $115 Call

- Cost Basis $5.37 Net Debit

Adjusting the Trade

Use the following details to Adjust the SHOP trade on your trading platform.

PLEASE NOTE that these prices above are based on Friday’s closing prices.

$AAPL, $XLF

DailyPlay – Portfolio Review & Closing Trades (AAPL, XLF) – January 3, 2025

Closing Trades

- AAPL – 90% gain: Buy to Close 2 Contracts (or 100% of your Contracts) Jan 17 $260/$270 Call Vertical Spreads @ $0.14 Debit. DailyPlay Portfolio: By Closing both Contracts, we will pay $28. We initially opened these 2 Contracts on Dec 13 @ $1.50 Credit. Our gain, therefore, is $272.

- XLF – 58% loss: Sell to Close 8 Contracts (or 100% of your Contracts) Jan 17 $48 Calls @ $0.86 Credit. DailyPlay Portfolio: By Closing all 8 Contracts, we will receive $688. We initially opened these 8 Contracts on Nov 11 @ $2.05 Debit. Our loss, therefore, is $119 per contract.

DailyPlay Portfolio Review

Our Trades

AAPL – 14 DTE

Bearish Credit Spread – We are closing this position today for a profit.

AMD – 168 DTE

Bullish Long Calls – Advanced Micro Devices, Inc. (AMD) – We recently established this position. While we are currently down slightly, we plan to stay the course for now, as there is still ample time remaining in the option contract.

DXCM – 14 DTE

Bullish Debit Spread – DexCom, Inc. (DXCM) – We still maintain our bullish forecast on the stock, so we plan to stay the course for the time being. We may roll the short call down to bring in additional premium, which will lower our potential maximum gain while simultaneously reducing the cost basis on our long call.

NVDA – 7 DTE

Bullish Call Diagonal Spread – NVIDIA Corporation (NVDA) – We recently made a second adjustment to this position, which has lowered our loss basis on the long option contract. For now, we will stay the course after this adjustment, as the short option contract has just 8 days until its expiration date.

QQQ – 14 DTE

Bullish Long Call – The QQQ and the market, in general, have experienced a pullback, it seems someone closed the damper in the chimney on the so-called Santa Claus rally between Christmas and New Year’s Day. With the new year now upon us, we will maintain the position and may sell a call this week as a hedge if we see a bounce in the market. This move would help lower the cost basis on our long call option contracts.

SHOP – 14 DTE

Bullish Debit Spread – Shopify (SHOP) – We maintain our bullish outlook and plan to stay the course for now. We may consider rolling the short call down to bring in additional premium. This adjustment would reduce the cost basis on our long call while lowering the potential maximum gain.

XLF – 14 DTE

Bullish Long Call – We are closing this position today for a loss.

$SQ

DailyPlay – Closing Trade (SQ) – December 27, 2024

Season’s Greetings: DailyPlay Update

With the holidays in full swing, we want to share a quick update on our DailyPlays. Throughout this time, we’ll continue to monitor our DailyPlay Portfolio to ensure we stay on track. While we may make adjustments or sell certain positions if warranted, we won’t be adding any new positions between the Christmas holiday and New Year’s Day.

Today, we’ll be closing our position in SQ, as it has hit our stop-loss threshold.

May your holiday season be merry and bright, and here’s to a successful year ahead!

Warmest Regards,

Brian Overby

OptionsPlay Senior Options Strategist

Closing Trade

- SQ – 61% loss: Sell to Close 4 Contracts (or 100% of your Contracts) Jan 17 $97.50/$115 Call Vertical Spreads @ $1.49 Credit. DailyPlay Portfolio: By Closing all 4 Contracts, we will receive $596. We initially opened these 4 Contracts on Dec 12 @ $3.85 Debit. Our loss, therefore, is $236 per contract.