MU

DailyPlay – Opening Trade (MU) & Closing Trade (CHWY) – June 12, 2025

Closing Trade

- CHWY – 128% gain: Sell to Close 12 Contracts (or 100% of your Contracts) June 27 $46/$41 Put Vertical Spreads @ $3.74 Credit. DailyPlay Portfolio: By Closing 12 Contracts, we will be collecting $4,488. We initially opened these 12 contracts on June 10 @ $1.64 Debit. Our gain, therefore, is $2,520.

MU Bullish Opening Trade Signal

Investment Rationale

Investment Thesis

Micron Technology (MU) offers a compelling bullish setup ahead of its June 25th earnings report. The stock has recently staged a strong breakout and is gaining momentum on both technical and fundamental fronts, setting the stage for continued upside into and potentially through the earnings event. With a growing AI-driven demand cycle, improving DRAM/NAND pricing trends, and an exceptionally strong valuation profile relative to peers, MU is positioned as a leading beneficiary in the semiconductor upcycle. The upcoming report serves as a catalyst that could drive a re-rating in the stock, particularly given Micron’s historically strong post-earnings moves during upcycles.

Technical Analysis:

MU recently broke above a multi-month consolidation range, with price clearing the $100 resistance level on expanding volume and strong relative strength. The 50-day and 200-day moving averages have both turned upward, confirming a bullish trend reversal, and the stock is now trading comfortably above all major moving averages. RSI remains in bullish territory but not yet overbought, suggesting further upside potential without immediate exhaustion. If MU can hold above the $110–$112 area into earnings, the next technical target aligns with the $130 range based on the measured move from its prior base.

Fundamental Analysis:

Micron appears significantly undervalued relative to the semiconductor sector, despite leading on nearly every forward-looking metric. The company is well positioned to capitalize on AI memory demand and a recovery in memory pricing, both of which are accelerating. Its upcoming earnings report is expected to confirm this operational momentum, validating current expectations for explosive earnings growth in the coming quarters.

- Forward PE Ratio: 9.90x vs. Industry Median 22.84x

- Expected EPS Growth: 99.18% vs. Industry Median 16.50%

- Expected Revenue Growth: 22.63% vs. Industry Median 10.46%

- Net Margins: 14.92% vs. Industry Median 10.43%

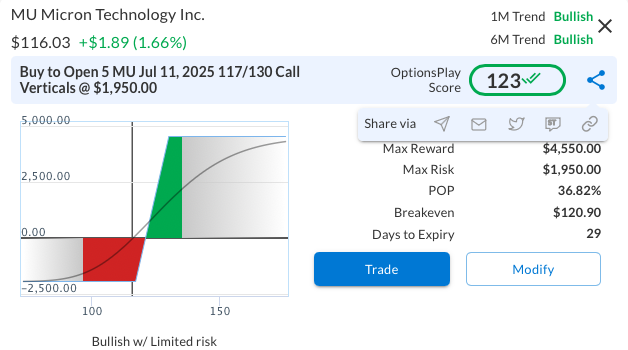

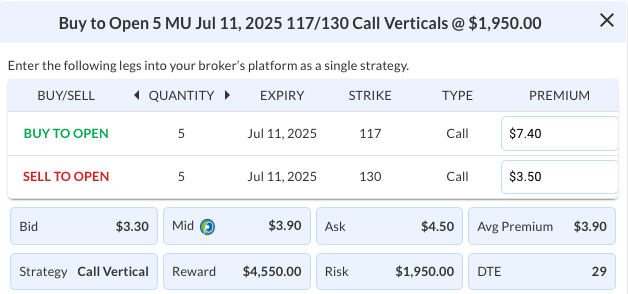

Options Trade:

To express a bullish view on MU with controlled risk into earnings, consider the July 11, 117/130 bull call vertical for a net debit. This spread’s long call sits just above current levels, offering a modest buffer while capturing potential upside if the stock rallies post-earnings. By using a vertical spread, the strategy helps neutralize the effects of an implied volatility crush after the report, delivers a favorable risk/reward ratio of over 2:1, and reduces premium outlay compared to buying calls outright, allowing you to participate in upside momentum while limiting your maximum loss to the net debit paid.

MU – Daily

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 5 MU Jul 11 117/130 Call Verticals @ $3.90 Debit per Contract.

Total Risk: This trade has a max risk of $1,950 (5 Contracts x $390) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $390 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 123

Stop Loss: @ $1.95 (50% loss of premium)

View MU Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View MU Trade

AMAT, GOOGL

DailyPlay – Closing Trades (AMAT, GOOGL) – June 11, 2025

- AMAT – 65% gain: Buy to Close 3 Contracts (or 100% of your Contracts) June 27 $165/$155 Put Vertical Spreads @ $1.34 Debit. DailyPlay Portfolio: By Closing 3 Contracts, we will be paying $402. We initially opened these 3 contracts on May 21 @ $3.85 Credit. Our gain, therefore, is $753.

- GOOGL – 63% gain: Buy to Close 6 Contracts (or 100% of your Contracts) July 18 $165/$160 Put Vertical Spreads @ $0.61 Debit. DailyPlay Portfolio: By Closing 6 Contracts, we will be paying $366. We initially opened these 6 contracts on June 05 @ $1.67 Credit. Our gain, therefore, is $636.

CHWY

DailyPlay – Opening Trade (CHWY) – June 10, 2025

CHWY Bearish Opening Trade Signal

Investment Rationale

Investment Thesis:

Chewy Inc. (CHWY) has staged a notable rally ahead of its earnings announcement before the market opens on Wednesday, June 11, but the sharp bullish run appears overextended, particularly given weak underlying fundamentals and elevated valuation multiples. With the stock trading near the top of its 52-week range and relative strength at a maximum of 10/10, the potential for a short-term reversal is increasing. A bearish counter-trend setup into earnings offers a tactical opportunity to fade the recent strength, especially considering signs of waning momentum and stretched price action.

Technical Analysis

CHWY has been in a strong uptrend since mid-April, with price accelerating above the 20-day and 50-day moving averages. However, the stock has now reached a potential exhaustion point near $48, the upper end of its 52-week range. The RSI is elevated at 65, close to overbought territory, and yesterday’s sharp pullback on increased volume may mark the beginning of a corrective phase. Should selling pressure persist, key support levels to monitor include the 20-day moving average at $44.23 and the 50-day at $38.79.

Fundamental Analysis

While Chewy has benefited from improved sentiment around consumer discretionary names, its fundamentals remain relatively weak compared to industry peers:

- Forward PE Ratio: 72.37x vs. Industry Median 18.58x

- Expected EPS Growth: 0% vs. Industry Median 6.83%

- Expected Revenue Growth: 6.54% vs. Industry Median 3.62%

- Net Margins: 3.31% vs. Industry Median 6.54%

The elevated valuation multiple is difficult to justify with no earnings growth and lower margins, which increases downside risk if earnings disappoint or guidance underwhelms.

Options Trade:

To express a bearish near-term view on Chewy (CHWY), consider buying the June 27, 2025, 46/41 put vertical spread for a net debit, which yields a favorable 2.05:1 risk/reward ratio. With only 18 days until expiration and elevated implied volatility, this spread efficiently captures potential downside through or after earnings without overpaying for premium.

CHWY – Daily

Trade Details

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 12 CHWY June 27 $46/$41 Put Vertical Spreads @ $1.64 Debit per Contract.

Total Risk: This trade has a max risk of $1,968 (12 Contracts x $164) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $164 to select the # contracts for your portfolio.

Counter-Trend Signal: This is a bearish trade on a bullish stock that has started to show signs of buyer exhaustion after a strong rally and has a higher probability of a pullback on earnings.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 121

Stop Loss: @ $0.82(50% loss of premium)

View CHWY Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View CHWY Trade

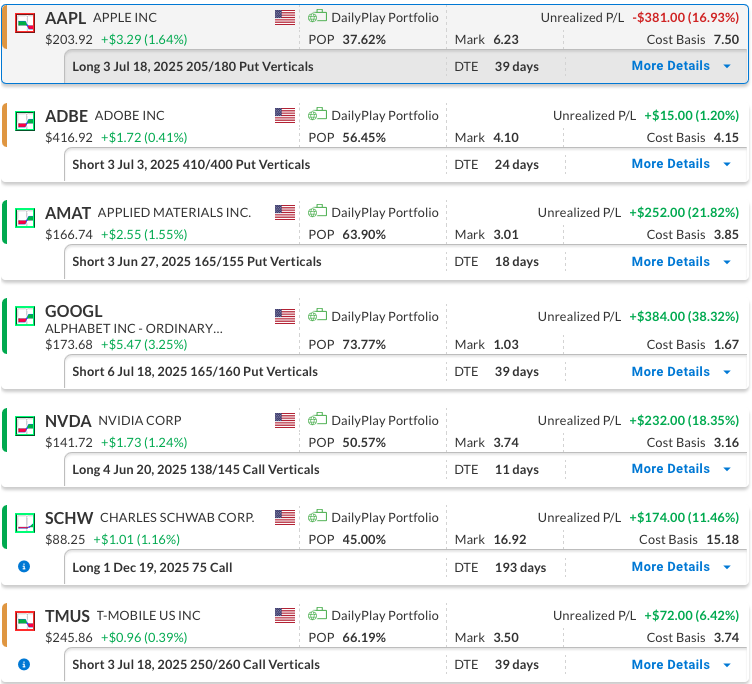

DailyPlay – Portfolio Review – June 09, 2025

DailyPlay Portfolio Review

Our Trades

AAPL – 39 DTE

Bearish Debit Spread – Apple Inc. (AAPL) – This trade has hovered around breakeven, fluctuating between modest gains and losses. Apple remains priced at a premium compared to its peers and continues to deal with unresolved concerns around the trade war and tariffs. With ample time left until expiration, we will continue to hold the position.

ADBE – 24 DTE

Bullish Credit Spread – Adobe Inc. (ADBE) – We started this trade not long ago and have achieved a solid short-term return. Expecting the positive trend to persist, we’re staying in the position currently.

AMAT – 18 DTE

Bullish Credit Spread – Applied Materials Inc. (AMAT) – The company’s fundamentals remain strong, even as the semiconductor sector struggles to gain upward traction. The stock built some upside momentum last week, and the position is now profitable. We plan to hold steady at this point.

GOOGL – 39 DTE

Bullish Credit Spread – Alphabet Inc. (GOOGL) – We recently entered this position and have seen a solid short-term gain. We’re expecting the upside momentum to continue, and, as a result, plan to remain in the trade for now.

NVDA – 11 DTE

Bullish Debit Spread – Nvidia Corp. (NVDA) – Nvidia delivered a strong earnings report with solid guidance, initially pushing the stock higher. However, those gains have since faded as shifting headlines continue to weigh on sentiment. The company’s fundamentals and demand outlook remain intact, so we’re holding the position for now.

SCHW – 193 DTE

Bullish Long Call – Charles Schwab Corp. (SCHW) – Our outlook remains positive, supported by strong company fundamentals and continued strength in both SCHW and the broader financial sector.

TMUS – 39 DTE

Bearish Credit Spread – T-Mobile, Inc. (TMUS) – We recently entered this position. Not much has changed since, and we plan to hold our course at this time.

TMUS

DailyPlay – Opening Trade (TMUS) – June 06, 2025

TMUS Bearish Opening Trade Signal

Investment Rationale

Investment Thesis:

T-Mobile US (TMUS) presents a compelling setup for bearish positioning as its stock struggles to sustain upward momentum amid valuation excess and technical exhaustion. While the company benefits from solid operational metrics, its premium valuation relative to peers is increasingly difficult to justify in a decelerating growth environment. The recent rally into overhead resistance levels adds to the case for a downside retracement, offering a tactical opportunity for short exposure through options.

Technical Analysis:

TMUS recently rallied off its May lows but has stalled below the $250 resistance zone, an area that coincides with the declining 50-day moving average. This level has repeatedly capped price advances since March, indicating strong supply pressure. The stock remains below both the 50-day and 20-day moving averages, reflecting short-term weakness, while relative strength continues to lag versus the broader market. With RSI hovering near neutral levels and the broader pattern forming a potential head-and-shoulders top, downside risk toward $215 appears increasingly probable.

Fundamental Analysis:

TMUS trades at a significant valuation premium despite only modest outperformance on growth and margin metrics.

- Forward PE Ratio: 22.76x vs. Industry Median 10.85x

- Expected EPS Growth: 15.59% vs. Industry Median 5.12%

- Expected Revenue Growth: 5.22% vs. Industry Median 2.29%

- Net Margins: 14.41% vs. Industry Median 12.72%

These figures show TMUS is slightly ahead of the industry on performance but drastically more expensive, suggesting overvaluation risk if growth expectations moderate.

Options Trade:

To position bearishly, consider selling the TMUS July 18, 2025, 250/260 Call Vertical. This spread profits if TMUS stays below $250 through expiration and results in a favorable reward-to-risk ratio of 0.60. This risk-defined strategy allows traders to capitalize on the resistance zone holding without needing an outright collapse, simply a rejection below the $250 ceiling.

TMUS – Daily

Trade Details

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 3 TMUS July 18 $250/$260 Call Vertical Spreads @ $3.74 Credit per Contract.

Total Risk: This trade has a max risk of $1,878 (3 Contracts x $626) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $626 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower off a recent area of resistance.

1M/6M Trends: Neutral/Neutral

Relative Strength: 5/10

OptionsPlay Score: 106

Stop Loss: @ $7.48(100% loss to value of premium)

View TMUS Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View TMUS Trade

GOOGL

DailyPlay – Opening Trade (GOOGL) & Closing Trade (MU) – June 05, 2025

Closing Trade

- MU – 85% gain: Buy to Close 3 Contracts (or 100% of your Contracts) June 20 $96/$86 Put Vertical Spreads @ $1.06 Debit. DailyPlay Portfolio: By Closing 3 Contracts, we will be paying $318. We initially opened this trade on May 30 @ $7.22 Credit. Our gain, therefore, is $1,848.

GOOGL Bullish Opening Trade Signal

Investment Rationale

Investment Thesis

Alphabet Inc. (GOOGL) presents an attractive bullish opportunity as it benefits from resilient advertising demand, continued AI integration across its product suite, and strong operating leverage from its cloud and search businesses. Despite broader macro headwinds and competitive pressure in the tech sector, GOOGL remains well-positioned as a secular compounder. The stock offers a favorable valuation relative to peers while maintaining superior profitability, making it a compelling candidate for a defined-risk bullish strategy heading into Q3.

Technical Analysis

GOOGL has surpassed its 50-day moving average of $161.91, now at $168.05, and is consolidating below the 200-day moving average of $172.90, a critical resistance. It bounced from about $158.91 in early May, higher than April’s $140.53 low, showing bullish trends. RSI at 54.03 indicates potential for appreciation. Breaking above $172.90 with volume could lead to a new upward leg.

Fundamental Analysis

Alphabet’s financial metrics continue to reflect operational strength despite slightly lagging growth expectations:

- Forward PE Ratio: 17.55x vs. Industry Median 17.8x

- Expected EPS Growth: 12.81% vs. Industry Median 13.42%

- Expected Revenue Growth: 10.46% vs. Industry Median 11.73%

- Net Margins: 30.86% vs. Industry Median 6.28%

While revenue and EPS growth forecasts are modestly below median levels, GOOGL’s dominant margin profile underscores its cash flow strength and pricing power. The company’s AI strategy, efficiency initiatives, and leadership in digital advertising continue to support long-term margin expansion.

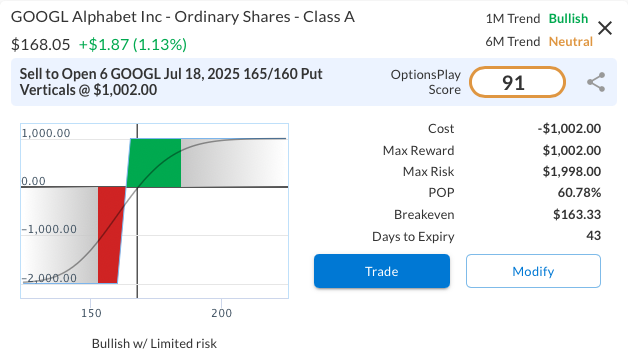

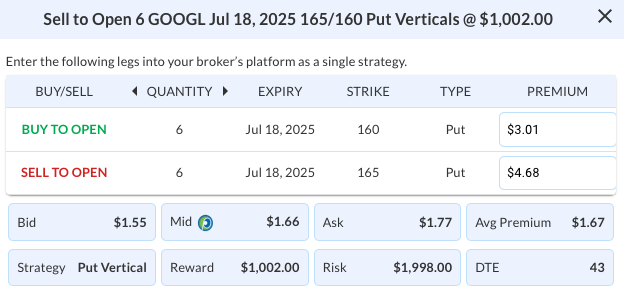

Options Trade

A defined-risk bullish position can be established using the GOOGL Jul 18, 2025 165/160 bull put vertical. The trade generates a profit if GOOGL closes above $165 at expiration, offering a 50.2% return on risk. It capitalizes on time decay and stable to moderately bullish price action, making it well-suited for a consolidation phase within an overall constructive technical setup.

GOOGL – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 6 GOOGL July 18 $165/$160 Put Vertical Spreads @ $1.67 Credit per Contract.

Total Risk: This trade has a max risk of $1,998 (6 Contracts x $333) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $333 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Neutral

Relative Strength: 5/10

OptionsPlay Score: 91

Stop Loss: @ $3.34 (100% loss to value of premium)

View GOOGL Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View GOOGL Trade

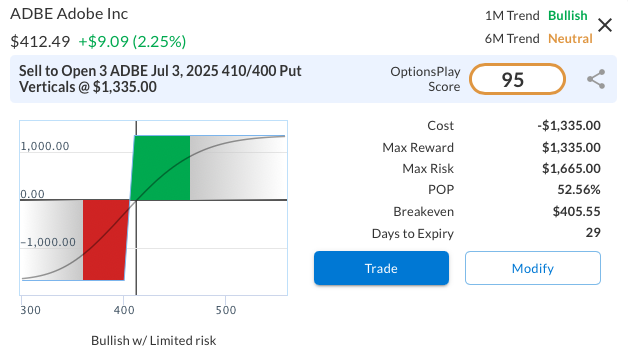

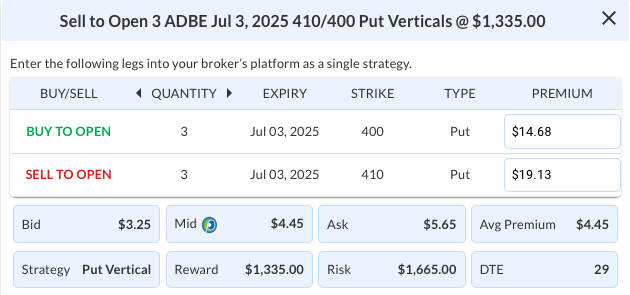

ADBE

DailyPlay – Opening Trade (ADBE) & Closing Trade (ZM) – June 04, 2025

Closing Trade

- ZM – 58% loss: Sell to Close 3 Contracts (or 100% of your Contracts) June 13 $80/$90 Call Vertical Spreads @ $1.97 Credit.

DailyPlay Portfolio: By Closing 3 Contracts, we will be collecting $591. We adjusted this trade on May 20 and added $399 Credit bringing the total cost down to $1,410. Our loss, therefore, is $273 per contract.

ADBE Bullish Opening Trade Signal

Investment Rationale

Adobe Inc. (ADBE) presents a compelling bullish setup ahead of its upcoming earnings on June 12th. With shares recently regaining upward momentum and trading at a discount to peers despite comparable growth expectations, the stock is poised to outperform. Adobe remains a leader in creative and digital media software, and its subscription-based business model offers earnings visibility and margin stability. Heading into earnings, the risk/reward dynamic favors the bulls, particularly as the stock has started to outperform major indices like the S&P 500.

Technical Analysis:

ADBE recently broke out of a multi-month consolidation range, supported by accelerating momentum and strengthening relative performance. The stock’s rebound from key support, coupled with alignment above short-term moving averages and a rising RSI, points to continued upside potential. A decisive move above $415.70 would confirm a bullish trend reversal, though traders should remain cautious of overhead resistance at the 200-day moving average.

Fundamental Analysis:

Adobe is modestly undervalued relative to its peers, offering both growth and profitability at a discount. Despite industry headwinds in software valuations, Adobe’s consistent margin leadership and solid revenue growth underpin the bullish thesis:

- Forward PE Ratio: 20.02x vs. Industry Median 27.72x

- Expected EPS Growth: 11.83% vs. Industry Median 11.48%

- Expected Revenue Growth: 9.56% vs. Industry Median 9.36%

- Net Margins: 30.64% vs. Industry Median 9.80%

Options Trade:

A bull put vertical spread using the ADBE Jul 3, 2025 $410/$400 offers a compelling risk-defined opportunity ahead of earnings. The trade’s max profit can be achieved if ADBE holds above $410 at expiration. The strategy’s 0.80:1 reward-to-risk ratio is solid, especially given the higher probability of profit typically associated with bull put spreads. However, the June 12 earnings event introduces uncertainty that traders must manage within their position sizing and risk framework.

ADBE – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 3 ADBE July 03 $410/$400 Put Vertical Spreads @ $4.45 Credit per Contract.

Total Risk: This trade has a max risk of $1,665 (3 Contracts x $555) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $555 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Neutral

Relative Strength: 3/10

OptionsPlay Score: 95

Stop Loss: @ $8.90 (100% loss to value of premium)

View ADBE Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View ADBE Trade

NVDA

DailyPlay – Adjusting Trade (NVDA) – June 03, 2025

NVDA Bullish Trade Adjustment Signal

Investment Rationale

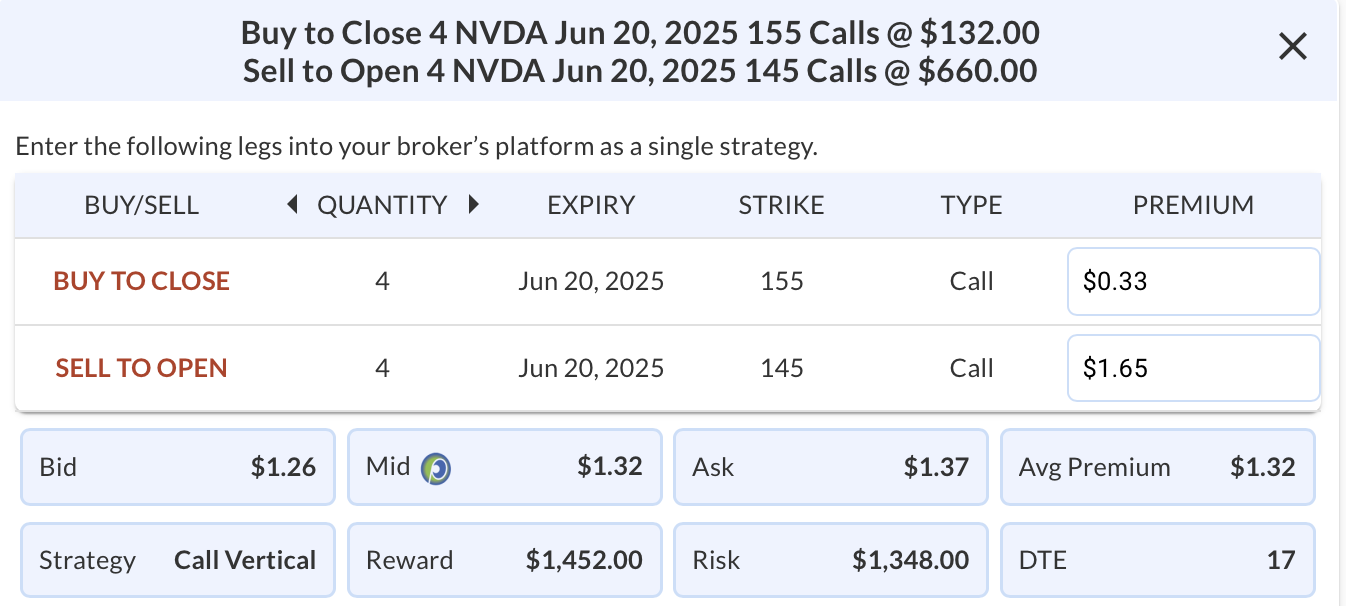

Adjustment Rationale:

We remain bullish on NVIDIA Corp. (NVDA) and continue to hold four NVDA June 20, 2025, 138/155 bull call vertical spreads in the Daily Play portfolio. NVDA recently announced earnings. The company’s strong earnings and guidance initially drove the stock higher, though the rally has stalled amid shifting market headlines. While the fundamentals remain strong and demand for semiconductor chips is solid, the position is currently at a slight loss. With the earnings catalyst behind us, we are reducing risk by rolling the short 155 calls down to the 145 strike, same expiration, collecting a net credit on the adjustment.

Adjustment Trade

Days to Expiration (DTE): 17

Buy to Close 4 NVDA Jun 20, 2025 155 Calls @ $0.33

Sell to Open 4 NVDA Jun 20, 2025 145 Calls @ $1.65

Mid: $1.32

Average Premium Received: $1.32 net credit

or $528 (400 x $1.32) for the adjustment trade

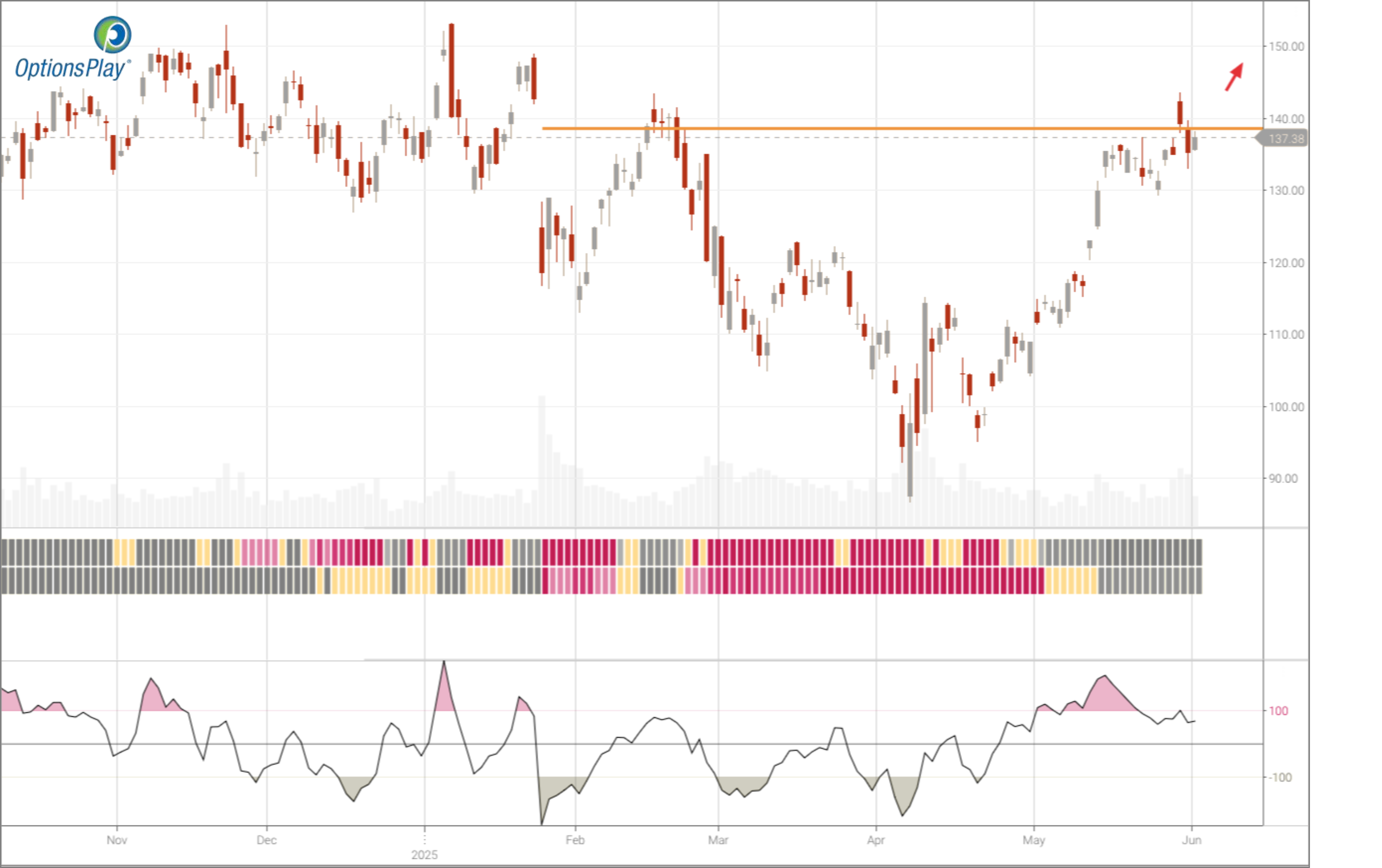

NVDA – Daily

Trade Details

Strategy Details

Strategy: Rolling a Short Call option down in strike

Direction: Resulting in a new Bullish Call Vertical Spread

Details: Buy to Close 4 NVDA Jun 20, 2025 155 Calls and Sell to Open 4 NVDA Jun 20, 2025 145 Calls @ $1.32

Total Risk: The resulting position has a maximum risk of $1,348 (1,876 – 528), calculated as the initial cost basis of the four spreads purchased ($1,876) minus the premium received from the adjustment ($528).

Trend Continuation Signal: This is a bullish trade on a stock that is expected to break out above its current trading range.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

Stop Loss: @ $1.69(50% loss of premium)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

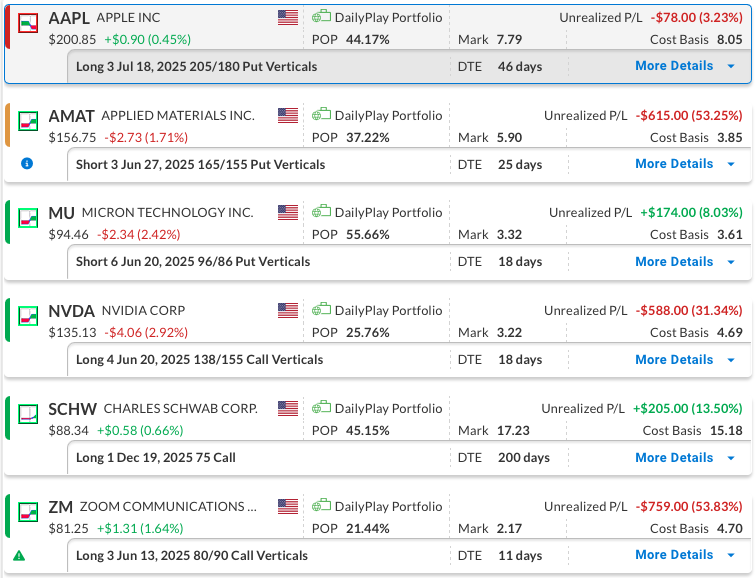

DailyPlay – Portfolio Review – June 02, 2025

DailyPlay Portfolio Review

Our Trades

AAPL – 46 DTE

Bearish Debit Spread – Apple Inc. (AAPL) – This trade has hovered around breakeven, fluctuating between modest gains and losses. Apple remains priced at a premium compared to its peers and continues to deal with unresolved concerns around the trade war and tariffs. With ample time left until expiration, we will continue to hold the position.

AMAT – 25 DTE

Bullish Credit Spread – Applied Materials Inc. (AMAT) – The company’s fundamentals remain strong, even as the semiconductor sector struggles to gain upward traction. The position is down, but we plan to hold steady at this point.

MU – 18 DTE

Bullish Credit Spread – Micron Technology Inc. (MU) – Our recently opened position shows a small profit at this stage. With Micron benefiting from growing demand for memory products and a solid outlook in semiconductor supply chains, we remain committed to holding the trade.

NVDA – 18 DTE

Bullish Debit Spread – Nvidia Corp. (NVDA) – Nvidia delivered a strong earnings report with solid guidance, initially pushing the stock higher. However, those gains have since faded as shifting headlines continue to weigh on sentiment. The company’s fundamentals and demand outlook remain intact, so we’re holding the position for now.

SCHW – 200 DTE

Bullish Long Call – Charles Schwab Corp. (SCHW) – Our outlook remains positive, supported by strong company fundamentals and continued strength in both SCHW and the broader financial sector.

ZM – 11 DTE

Bullish Debit Spread – Zoom Communications Inc. (ZM) – In the last earnings report, Zoom beat estimates on both revenue and profit. Despite the solid results, the stock moved lower following the announcement. We finally saw some encouraging bullish movement at the end of last week and will remain in the trade for now, though time to expiration is quickly running out.

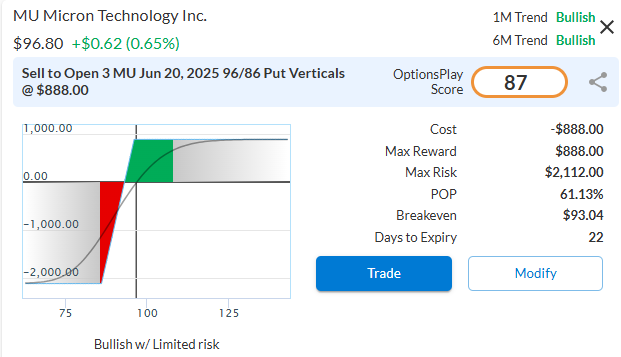

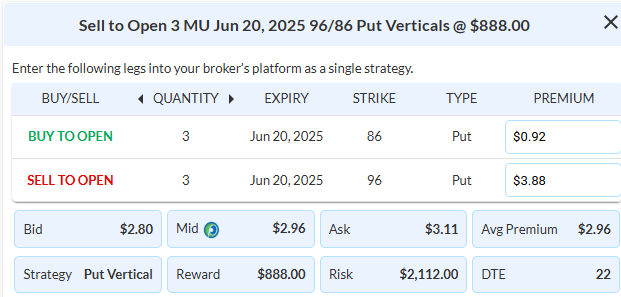

$MU

DailyPlay – Opening Trade (MU) – May 30, 2025

MU Bullish Opening Trade Signal

Investment Rationale

Investment Thesis

Micron Technology (MU) presents a compelling bullish opportunity as it continues to benefit from favorable macro trends in AI-driven memory demand and an improving semiconductor cycle. With earnings scheduled for June 25, 2025, we view the pre-earnings window as an ideal setup for a defined-risk, high-probability options play. The company has recently broken above key technical levels, signaling strong bullish momentum ahead of the catalyst. By selecting an options expiration date that precedes the earnings event, we aim to capitalize on the current trend while avoiding binary risk tied to the report.

Technical Analysis

MU has recently broken out of a multi-month consolidation zone, surging above its 200-day moving average near $92, now establishing that level as new support. The stock has reclaimed both its 20-day and 50-day moving averages, which are now trending upward and aligned in a bullish stack. Relative strength is notable, with MU outperforming the S&P 500 and the broader semiconductor sector. With the stock trading near $96.80, its momentum remains strong, and the path toward the $100 upside target appears technically achievable over time.

Fundamental Analysis

Micron trades at a considerable valuation discount while demonstrating superior growth and profitability metrics compared to its peers. This valuation gap combined with strong forward growth expectations reinforces the bullish case, particularly ahead of a potentially upbeat earnings report.

- Forward PE Ratio: 8.58x vs. Industry Median 22.84x

- Expected EPS Growth: 96.81% vs. Industry Median 16.50%

- Expected Revenue Growth: 22.31% vs. Industry Median 10.46%

- Net Margins: 14.92% vs. Industry Median 10.43%

Options Trade

Sell to open the MU June 20, 2025, 96/86 put vertical for a net credit of $2.96. This bull put spread profits if MU stays above $96 through expiration, offering a maximum reward of $296 with a defined risk of $704. With just 22 days until expiration and earnings scheduled for June 25, after the trade expires, this setup expresses a bullish view while avoiding earnings risk. The structure offers a high-probability trade setup with a decent risk/reward.

MU – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 3 MU June 20 $96/$86 Put Vertical Spreads @ $2.96 Credit per Contract.

Total Risk: This trade has a max risk of $2,112 (3 Contracts x $704) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $704 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to break out above its current trading range.

1M/6M Trends: Bullish/Bullish

Relative Strength: 8/10

OptionsPlay Score: 87

Stop Loss: @ $5.92 (100% loss to value of premium)

View MU Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.