$AMD

DailyPlay – Opening Trade (AMD) – December 24, 2024

AMD Bullish Opening Trade Signal

Investment Rationale

Advanced Micro Devices, Inc. (AMD) has recently reached oversold conditions on both daily and weekly timeframes and is exhibiting signs of exhaustion, indicating a higher likelihood of a strong rally ahead.

The stock trades in line with the industry average, with a forward price-to-earnings (PE) ratio of 23.85x compared to the industry average of 23.54x. However, AMD is projected to grow significantly faster than its peers, with anticipated earnings-per-share (EPS) growth of 40.07%, well above the industry average of 19.62%. Similarly, its expected revenue growth is 21.61%, outpacing the industry average of 12.81%. Despite this strong growth potential, AMD’s net margins are 7.52%, falling short of the industry average of 18.77%.

AMD – Daily

Trade Details

Strategy Details

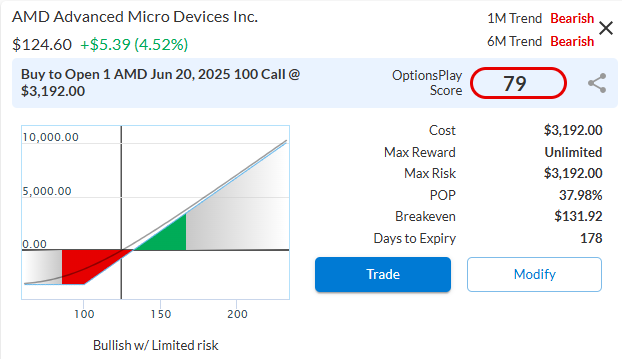

Strategy: Long Call

Direction: Bullish Long Call

Details: Buy to Open 1 AMD June 20, 2025 $100 Call @ $31.92 Debit per Contract.

Total Risk: This trade has a max risk of $3,192 (1 Contract x $31,92) based on a based on a hypothetical $100k portfolio risking 3%. We normally suggest risking only 2% but in this instance we recommend risking 3% of the value of your portfolio and divide it by $31.92 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that is expected to continue higher off recent support.

1M/6M Trends: Bearish/Bearish

Relative Strength: 2/10

OptionsPlay Score: 79

Stop Loss: @ $15.96 (50% loss of premium)

View AMD Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AMD Trade

DailyPlay – Portfolio Review – December 23, 2024

DailyPlay Portfolio Review

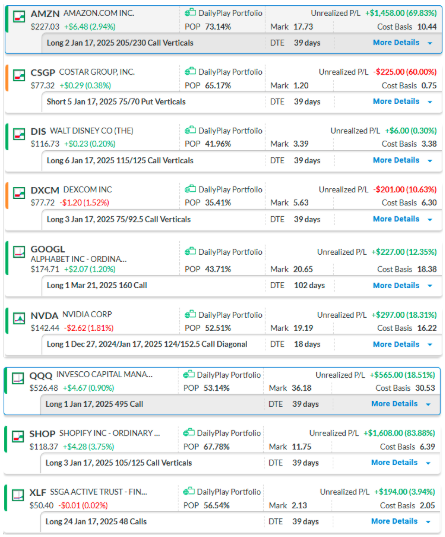

Our Trades

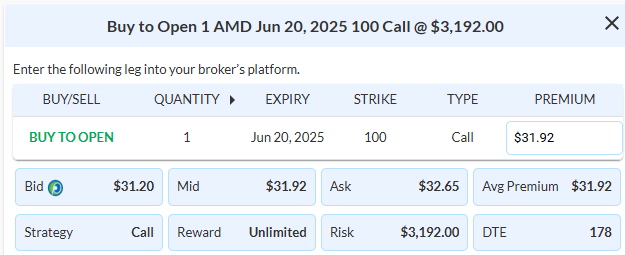

AAPL – 25 DTE

Bearish Credit Spread – Apple Inc. (AAPL) -We are down slightly on the position we recently established, and we plan to stay the course for now while keeping a close watch.

DXCM – 25 DTE

Bullish Debit Spread – DexCom, Inc. (DXCM) – The stock has solid momentum to the upside, and we have a small gain on this position. We plan to stay the course for the time being.

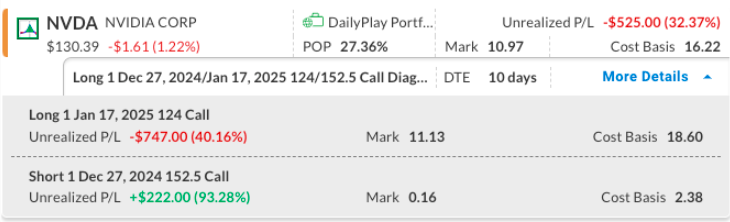

NVDA – 18 DTE

Bullish Call Diagonal Spread – NVIDIA Corporation (NVDA) – We recently rolled the short call leg of our NVDA diagonal position up and out in time, generating a small net credit. With the recent weakness in the stock’s price, we decided to roll the short option again to capture the gain on the short position and bring in additional premium. We will stay the course for now after this second adjustment to the position.

QQQ – 25 DTE

Bullish Long Call – Invesco QQQ Trust (QQQ) – The QQQ and the market have experienced a small pullback following the recent Fed meeting, and the trade is solidly profitable. With sufficient time remaining until expiration, we will maintain the position.

SHOP – 25 DTE

Bullish Debit Spread – Shopify (SHOP) – The position is profitable, and the plan is to stay the course for now.

SQ – 25 DTE

Bullish Debit Spread – Block, Inc. (SQ) – We are down on the position, watching it closely, and may need to exit soon if we don’t see signs of upside potential.

XLF – 32 DTE

Bullish Long Call – Financial Select Sector SPDR ETF (XLF) – We recently broke a downside support level and are currently facing some losses on the position. While we remain cautious about the sector, we may need to sell a call for protection. Keeping a tight watch on this trade.

$ANET, $FDX

DailyPlay – Closing Trades (ANET, FDX) – December 20, 2024

Note:

- Today we are closing ANET for a profit at market opening.

- We made the call to also close FDX at market opening as the Earnings announcement today pushed the price higher.

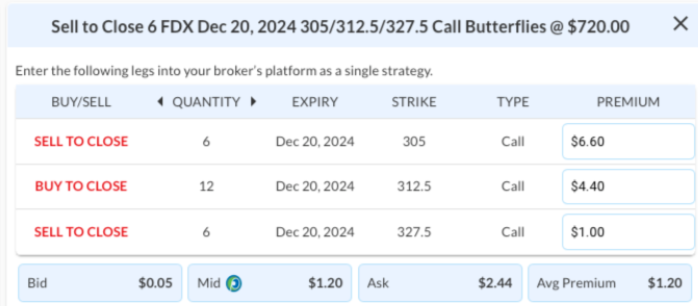

Closing Trades

- ANET – 97% gain: Sell to Close 13 Contracts (or 100% of your Contracts) Jan 3 $105/$110 Call Vertical Spreads @ $2.95 Credit. DailyPlay Portfolio: By Closing all 13 Contracts, we will receive $3,835. We initially opened these 13 Contracts on Dec 11 @ $1.50 Debit. Our gain, therefore, is $1,885.

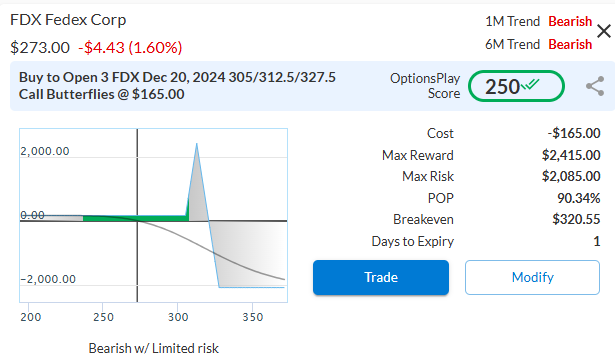

- FDX – 24% gain: Sell to Close 3 Skip-Strike Butterfly on the open (or 100% of your position) Dec 20 $305/$312.50/$327.50 Call Butterflies @ $1.20 Net Credit. DailyPlay Portfolio: By closing the position, we will receive $360 ($120 x 3). We initially opened these 3 butterflies on Dec 19 @ $0.55 Net Credit ($55 x 3 = $165). Our total proceeds, including the initial credit, are $525 ($360 + $165). Our percentage gain is calculated based on the maximum risk of the trade: Gain: $525, Maximum Risk: $2,250, Percentage Gain: 23% ($525 / $2,250).

Investment Rationale

We plan to close our position in FedEx (FDX) on Friday, which was featured as yesterday’s daily play. Our goal for this earnings trade was to capture a net credit of $0.55, or $55, per 1x2x1 Skip-Strike Butterfly position. Following the company’s earnings announcement and the resulting after-hours market reaction, there may be an opportunity to secure an additional net credit when closing the position. That’s not a typo – we opened the trade for a net credit, and we may be able to close it for a net credit as well. The ideal scenario would be for FDX to settle at the short strike of $312.50 right at the market close on Friday.

We will update this post with the final transaction details after the market opens. This trade below was executed to close the position at the open of the market this morning.

$FDX

DailyPlay – Opening Trade (FDX) – December 19, 2024

FDX Bearish Opening Trade Signal

Investment Rationale

FedEx (FDX) – FedEx has exhibited strong bearish momentum recently, and we anticipate this trend to persist into the company’s upcoming earnings report on Thursday, Dec. 19, after the market close. Implied volatility indicates a stock price range of plus or minus $29, approximately 10% of the current stock price. For Q2 fiscal 2025, FedEx is expected to report earnings of $3.90 per share, reflecting a 2.3% year-over-year decline, with revenue projected at $22.07 billion, down 0.5%. Challenges such as demand erosion, geopolitical uncertainty, and inflation are expected to weigh heavily on results, particularly in Asia and Europe. The Express segment, FedEx’s largest, is anticipated to face volume-driven revenue declines, with an expected drop of 0.3%. FedEx’s ongoing struggles to manage demand pressures and control costs are likely to continue impacting its performance in the post-COVID business environment.

FDX – Daily

Trade Details

Strategy Details

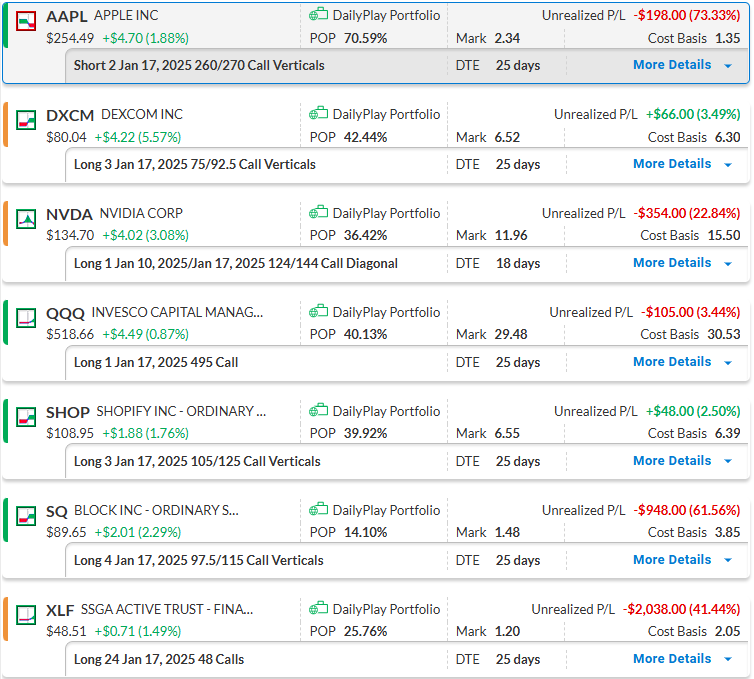

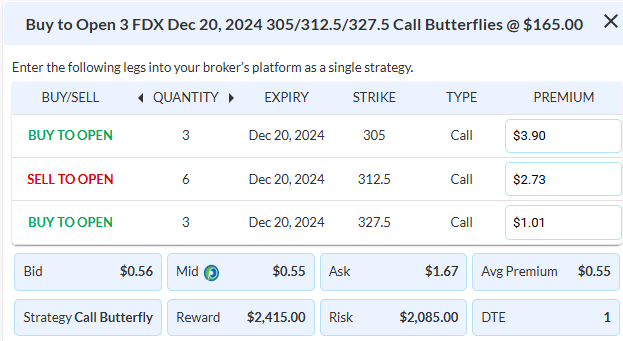

Strategy: Skip-Strike Call Butterfly

Direction: Bearish Call Butterfly

Details: Buy to Open 3 FDX Dec 20, 2024 $305/$312.50/$327.50 Call Butterflies @ $0.55 Credit per Contract. This strategy generates a Credit and not a Debit like a standard Butterfly.

Breakdown: The individual legs for the skip-strike butterfly are as follows

- Buy 1 Contract Dec 20 $305 Call

- Sell 2 Contracts Dec 20 $312.50 Calls

- Buy 1 Contract Dec 20 $327.50 Call

Total Risk: This trade has a max risk of $2,085 (3 Contracts x $695) based on a hypothetical $100,000 portfolio normally risking 2%. We suggest using 2% of your portfolio value and divide it by $695 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue its bearish trajectory.

1M/6M Trends: Bearish/Bearish

Relative Strength: 6/10

OptionsPlay Score: 250

Stop Loss: @ $1.10 (100% loss to value of premium received)

View FDX Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View FDX Trade

$NVDA

DailyPlay – Adjusting Trade (NVDA) – December 18, 2024

NVDA Bullish Trade Adjustment

Investment Rationale

We recently rolled the short call leg of our NVDA diagonal position up and out in time, generating a small net credit. With the recent weakness in the stock’s price, we will roll the short option again to capture the gain on the current short position and bring in additional premium by rolling down and out this time around.

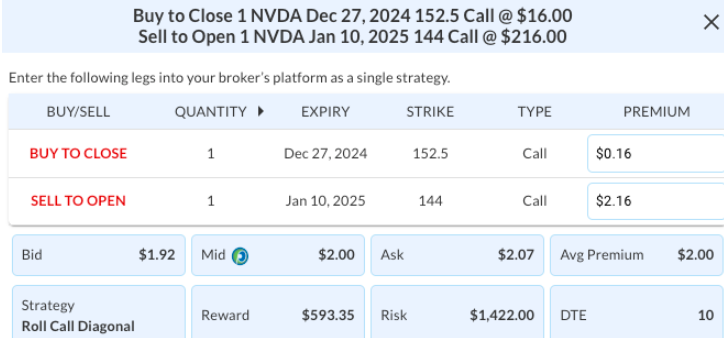

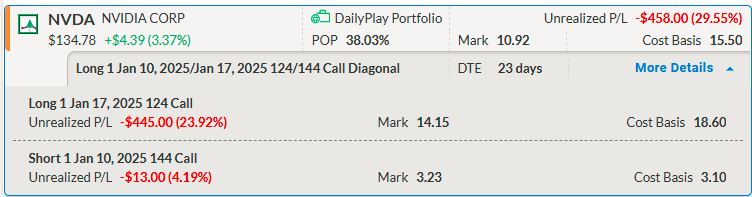

We will adjust this position by closing one leg and opening another leg of this Call Diagonal Spread. Below is the current position breakdown with the individual legs listed.

Original Position:

- Long 1 Jan 17, 2025 $124 Call

- Short 1 Dec 13, 2024 $148 Call

- Cost Basis $16.79 Net Debit

Current Position after the previous Roll/Adjustment:

- Long 1 Jan 17, 2025 $124 Call

- Short 1 Dec 27, 2024 $152.5 Call

- Cost Basis $16.22 Net Debit

Trade Details

Strategy Details

Strategy: Second Adjustment of a bullish Call Diagonal Spread

Direction: Resulting in a new bullish Call Diagonal Spread

Details: Buy to Close 1 Contract Dec 27 $152.50 Call and Sell to Open 1 Contract Jan 10 $144 Call @ a $2.00 net Credit, or $200 per 1×1 roll ($2.00 x 100). The total net Credit received for rolling this one call contract is $200. This roll establishes a new Call Diagonal position in NVDA.

Total Risk: This trade has a max risk of $1,422 (1 Contract x $1,422) based on a hypothetical $100,000 portfolio normally risking 2%. We suggest using 2% of your portfolio value and divide it by $1,422 to select the # contracts for your portfolio.

Current Position:

- Long 1 Jan 17, 2025 124 Call

- Short 1 Dec 27, 2024 152.5 Call

Resulting Position after Roll/Adjustment:

- Long 1 Jan 17, 2025 $124 Call

- Short 1 Jan 10, 2025 $144 Call

- Cost Basis $14.22 Net Debit ($16.22 Debit brought forward – $2.00 Credit received)

Adjusting the Trade

Use the following details to Adjust the NVDA trade on your trading platform.

PLEASE NOTE that these prices above are based on Tuesday’s closing prices.

Below is the position following today’s Adjustment Trade:

$AMZN, CSGP

DailyPlay – Closing Trades (AMZN, CSGP) – December 17, 2024

- AMZN – 95% gain: Sell to Close 2 Contracts (or 100% of your Contracts) Jan 17 $205/$230 Call Vertical Spreads @ $20.38 Credit. DailyPlay Portfolio: By Closing both Contracts, we will receive $4,076. We initially opened these 2 Contracts on Nov 13 @ $10.44 Debit. Our gain, therefore, is $1,988.

- CSGP – 117% loss: Buy to Close 5 Contracts (or 100% of your Contracts) Jan 17 $75/$70 Put Vertical Spreads @ $1.63 Debit. DailyPlay Portfolio: By Closing all 5 Contracts, we will pay $815. We initially opened these 5 Contracts on Dec 4 @ $0.75 Credit. Our loss, therefore, is $88 per Contract.

$AAPL

DailyPlay – Opening Trade (AAPL) – December 13, 2024

AAPL Bearish Opening Trade Signal

Investment Rationale

Apple Inc. (AAPL) has recently entered overbought territory on both daily and weekly timeframes, exhibiting signs of exhaustion that suggest an increased likelihood of a significant selloff.

Currently, AAPL trades at a forward price-to-earnings (P/E) ratio of 33.34x, a substantial premium compared to the industry average of 17.89x. However, this valuation is not supported by its growth metrics. AAPL’s expected earnings-per-share (EPS) growth of 11.49% falls below the industry average of 13.93%, and its anticipated revenue growth of 6.89% is only marginally higher than the industry average of 6.50%. Although AAPL’s net margins of 23.97% far exceed the industry average of 8.40%, the recent decline in these margins heightens downside risks.

AAPL – Daily

Trade Details

Strategy Details

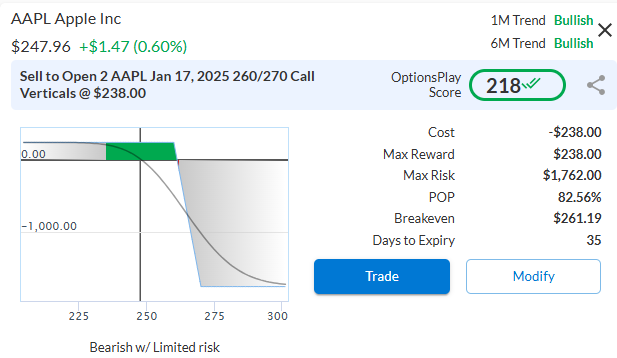

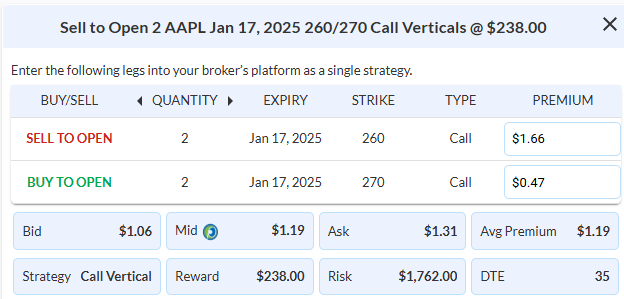

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 2 AAPL Jan 17, 2025 $260/$270 Call Vertical Spreads @ $1.19 Credit per Contract.

Total Risk: This trade has a max risk of $1,762 (2 Contracts x $881) based on a hypothetical $100,000 portfolio normally risking 2%. We suggest using 2% of your portfolio value and divide it by $881 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bearish trade on a stock that is expected to pull back from recent highs to lower support.

1M/6M Trends: Bullish/Bullish

Relative Strength: 8/10

OptionsPlay Score: 218

Stop Loss: @ $2.38 (100% loss to value of premium received)

View AAPL Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AAPL Trade

$ANET

DailyPlay – Opening Trade (ANET) – December 11, 2024

ANET Bullish Opening Trade Signal

Investment Rationale

Arista Networks (ANET) recently broke above its $105 resistance level, signaling strong momentum and potential for further gains toward our $115 target. Despite trading at a forward PE ratio of 44x, higher than peers, Arista justifies this premium with impressive net margins of 40.29%, far exceeding the industry average of 8.23%. Additionally, EPS and revenue growth projections of 17.54% and 18.29% surpass the industry averages of 14.13% and 6.5%. Trading at a 38% discount to peers, Arista presents significant upside potential given its superior profitability and growth.

ANET – Daily

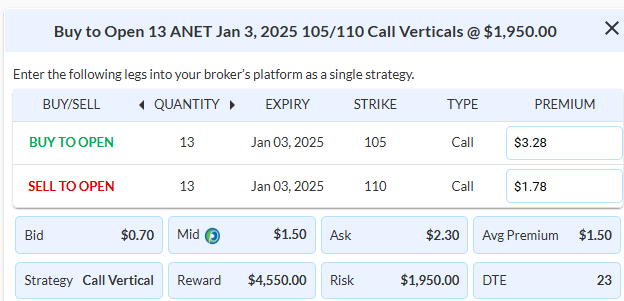

Trade Details

Strategy Details

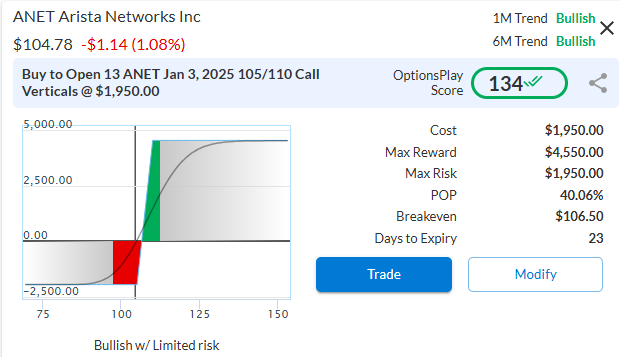

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 13 ANET Jan 3, 2025 $105/$110 Call Vertical Spreads @ $1.50 Debit per Contract.

Total Risk: This trade has a max risk of $1,950 (13 Contracts x $150) based on a hypothetical $100,000 portfolio normally risking 2%. We suggest using 2% of your portfolio value and divide it by $150 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher off recent support.

1M/6M Trends: Bullish/Bullish

Relative Strength: 5/10

OptionsPlay Score: 134

Stop Loss: @ $0.75 (50% loss of premium)

View ANET Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View ANET Trade

$GOOGL

DailyPlay – Adjusting Trade (GOOGL) – December 10, 2024

GOOGL Bullish Trade Adjustment

Investment Rationale

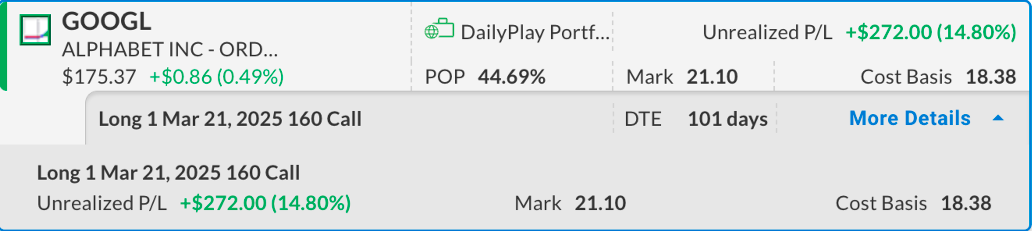

Alphabet Inc. (GOOGL) recently broke out above its $170 resistance level, and we maintain an upside target near its most recent high in the $190 area. This breakout provides a strong risk/reward opportunity for adding bullish exposure. Based on this outlook, we purchased a long call option on December 6th for the Daily Play portfolio when the stock was at 172.64.

Long 1 GOOGL Mar 21, 2025 $160 Call @ $18.38 Debit per Contract.

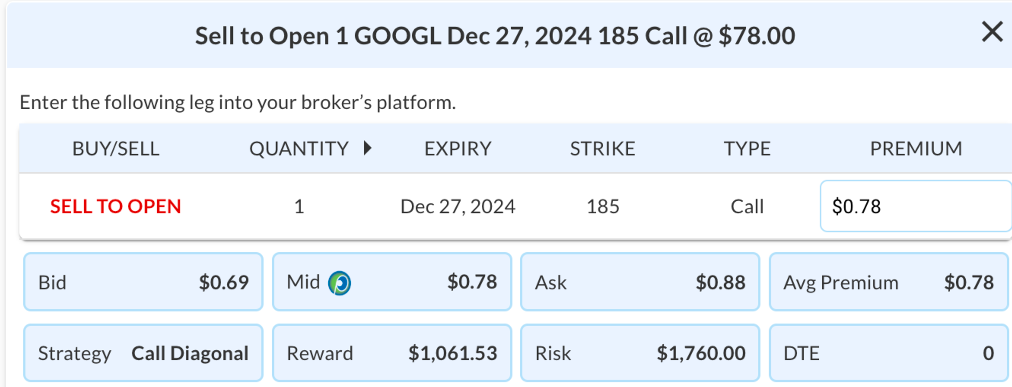

This position is profitable, and we believe the time is right to sell a near-term call to offset some of the time premium paid for the long call with the March 21st expiration.

Sell to Open 1 GOOGL Dec 27, 2024 $185 Call @ $0.78 Credit per Contract

Trade Details

Strategy Details

Strategy: Adjustment of a bullish Call

Direction: Resulting in a new bullish Call Diagonal Spread

Details: Sell to Open 1 GOOGL Dec 27, 2024 $185 Call @ $0.78 Credit per Contract

Total Risk: This trade has a max risk of $1,760 (1 Contract x $1,760) based on a hypothetical $100,000 portfolio normally risking 2%. We suggest using 2% of your portfolio value and divide it by $1,760 to select the # contracts for your portfolio.

Original Position:

- Long 1 GOOGL Mar 21, 2025 $160 Call @ $18.38 Debit per Contract.

Resulting Position:

- Long 1 GOOGL Mar 21, 2025 $160 Call @ $18.38 Debit per Contract

- Short 1 GOOGL Dec 27, 2024 $185 Call @ $0.78 Credit per Contract

- The net Debit for the new position is $17.60

Adjusting the Trade

Use the following details to Adjust the GOOGL trade on your trading platform.

PLEASE NOTE that these prices are based on Monday’s closing prices.

DailyPlay – Portfolio Review – December 9, 2024

DailyPlay Portfolio Review

Our Trades

AMZN – 39 DTE

Bullish Debit Spread – Amazon.com Inc. (AMZN) recently demonstrated strong upward momentum, rebounding from a resistance level near 207 and approaching the short strike of our call vertical spread. This aligns with our bullish outlook, so we will maintain the current position.

CSGP – 39 DTE

Bullish Credit Spread – We just established this position and plan to stay the course.

DIS – 39 DTE

Bullish Calls – We have a small gain currently and plan to stay the course for now.

DXCM – 39 DTE

Bullish Debit Spread – We just established this position and plan to stay the course.

GOOGL – 102 DTE

Bullish Calls – We just established this position and plan to stay the course.

NVDA – 18 DTE

Bullish Call Diagonal Spread – We recently rolled the short call leg of our NVDA diagonal position up and out in time, generating a small net credit. The long call leg is performing well, and the new higher strike price of the short call option provides additional upside potential for the long call if the bullish momentum continues.

QQQ – 39 DTE

Bullish Calls – The QQQ has demonstrated recent upside momentum, and the trade is now profitable. With sufficient time remaining until expiration, we will maintain the position.

SHOP – 39 DTE

Bullish Debit Spread – The position is profitable, and the plan is to stay the course for now.

XLF – 39 DTE

Bullish Calls – We have a small profit in our long call position in the financial sector and see more potential upside. Therefore, we will stay the course for now.