$GOOGL

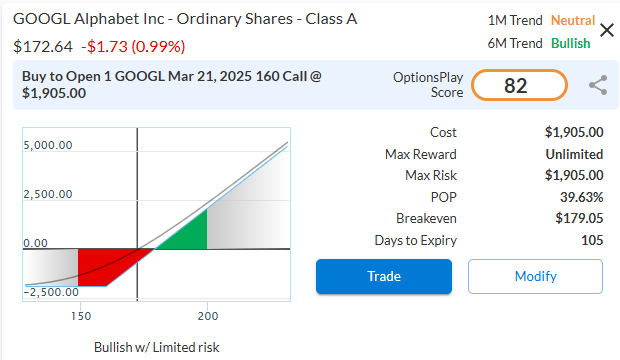

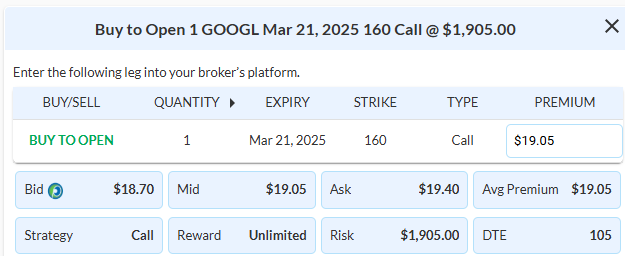

DailyPlay – Opening Trade (GOOGL) – December 6, 2024

GOOGL Bullish Opening Trade Signal

Investment Rationale

Alphabet Inc. (GOOGL) recently broke out above its $170 resistance level and pulled back to this support level, providing a strong risk/reward opportunity for adding bullish exposure.

From a fundamentals perspective, GOOGL is fair-valued, trading at a 5% discount relative to its peers. Despite this, it is expected to grow faster than its competitors and is far more profitable, suggesting substantial upside potential. GOOGL has a forward PE ratio of 19.43x compared to the industry average of 20.54x. Its expected EPS growth is 19.17%, outpacing the industry average of 11.69%. Additionally, its expected revenue growth is 12.05%, compared to the industry average of 8.18%, and its net margins are significantly higher at 27.74% versus the industry average of 13.82%.

GOOGL – Daily

Trade Details

Strategy Details

Strategy: Long Call

Direction: Bullish Call

Details: Buy to Open 1 GOOGL Mar 21, 2025 $160 Call @ $19.05 Debit per Contract.

Total Risk: This trade has a max risk of $1,905 (1 Contract x $1,905) based on a hypothetical $100,000 portfolio normally risking 2%. We suggest using 2% of your portfolio value and divide it by $1,905 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher off recent support.

1M/6M Trends: Neutral/Bullish

Relative Strength: 3/10

OptionsPlay Score: 82

Stop Loss: @ $9.53 (50% loss of premium)

View GOOGL Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View GOOGL Trade

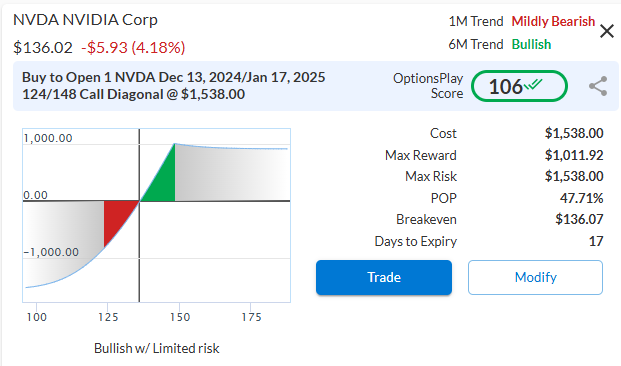

$LULU, INTC, NVDA

DailyPlay – Closing Trades (LULU, INTC) Rolling Trade (NVDA) – December 5, 2024

Closing Trades

- LULU – 196% gain: Sell to Close 3 Contracts (or 100% of your Contracts) Dec 6 $302.50/$315 Call Vertical Spreads @ $10.23 Credit. DailyPlay Portfolio: By Closing all 3 Contracts, we will receive $3,069 We initially opened these 3 Contracts on November 21 @ $3.45 Debit. Our gain on this trade, therefore, is $2,034 which is 2% gain on our total portfolio.

- INTC – 52% loss: Sell to Close 4 Contracts (or 100% of your Contracts) Jan 17, 2025 $21 Calls @ $2.09 Credit. DailyPlay Portfolio: By Closing all 4 Contracts, we will receive $836 We initially opened these 4 Contracts on November 12 @ $4.35 Debit. Our loss on this trade, therefore, is $904.

NVDA Bullish Rolling Trade

Investment Rationale

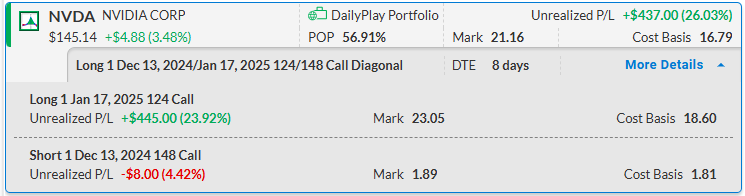

On November 26th, 2024 with the stock at $136.02, we executed a Bullish Call Diagonal Spread on NVDA. Today we will adjust this position by closing one leg and opening another leg of this Call Diagonal Spread. Below is the original trade breakdown with the individual legs listed.

- Net Debit of $16.79

- Buy to Open 1 Contract Jan 17, 2025 $124 Call @ $18.60

- Sell to Open 1 Contract Dec 13, 2024 $148 Call @ $1.81

Trade Details

Strategy Details

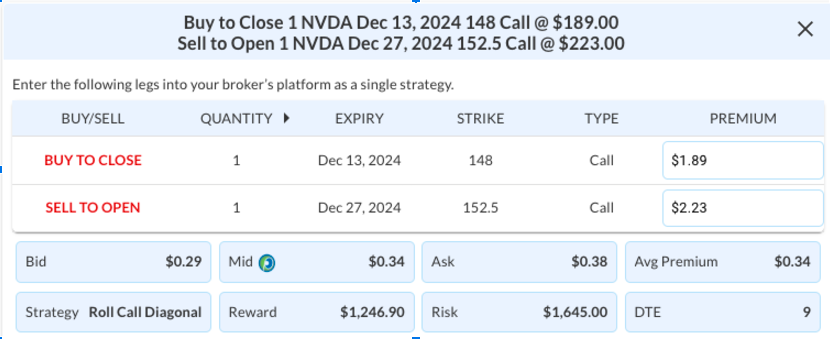

Strategy: Adjustment of a bullish Call Diagonal Spread

Direction: Resulting in a new bullish Call Diagonal Spread

Details: Buy to Close 1 Contract Dec 13 $148 Call and Sell to Open 1 Contract Dec 27 $152.50 Call @ a $0.34 net Credit, or $34 per 1×1 roll ($0.34 x 100). The total net Credit received for the single Contract is the $34. This roll establishes a new Call Calendar position in NVDA.

Original Position:

- Buy to Open 1 Contract Jan 17, 2025 $124 Call @ $18.60

- Sell to Open 1 Contract Dec 13, 2024 $148 Call @ $1.81

Resulting Position:

- Long 1 Contract Jan 17, 2025 $124 Call

- Short 1 Contract Dec 27, 2024 $152.50 Call

Adjusting the Trade

Use the following details to Adjust the NVDA trade on your trading platform.

PLEASE NOTE that these prices are based on Wednesday’s closing prices.

CSGP

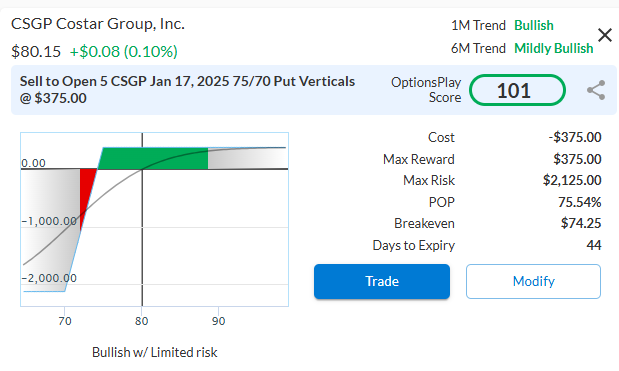

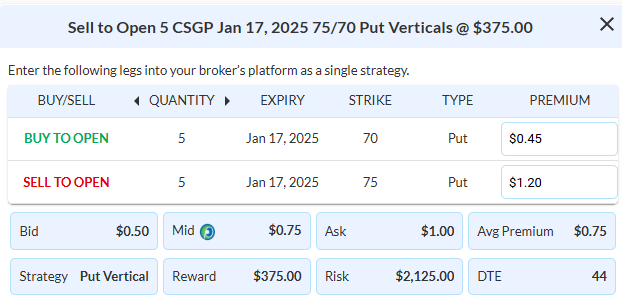

DailyPlay – Opening Trade (CSGP) – December 4, 2024

CSGP Bullish Opening Trade Signal

Investment Rationale

CoStar Group, Inc. (CSGP) recently broke out above its trading range with strong momentum, outperforming the S&P 500 and signaling potential for further upside toward our $90 target.

CoStar appears modestly undervalued, trading at a premium relative to its peers. However, this valuation is justified by its faster-than-expected growth and superior profitability metrics compared to the industry average. Specifically, CoStar has a forward price-to-earnings (PE) ratio of 72.15x versus the industry average of 29.27x. Its expected earnings per share (EPS) growth stands at an impressive 80.50%, compared to 7.32% for its peers, while expected revenue growth is 13.11% versus the industry average of 2.98%. Additionally, CoStar’s net margins of 6.58% significantly outpace the 2.68% seen across the industry.

CSGP – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 5 CSGP Jan 17 $75/$70 Put Vertical Spreads @ $0.75 Credit per Contract.

Total Risk: This trade has a max risk of $2,125 (5 Contract x $425) based on a hypothetical $100,000 portfolio normally risking 2%. We suggest using 2% of your portfolio value and divide it by $425 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher off recent support.

1M/6M Trends: Bullish/Bullish

Relative Strength: 5/10

OptionsPlay Score: 101

Stop Loss: @ $1.50 (100% loss to value of premium received)

View CSGP Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View CSGP Trade

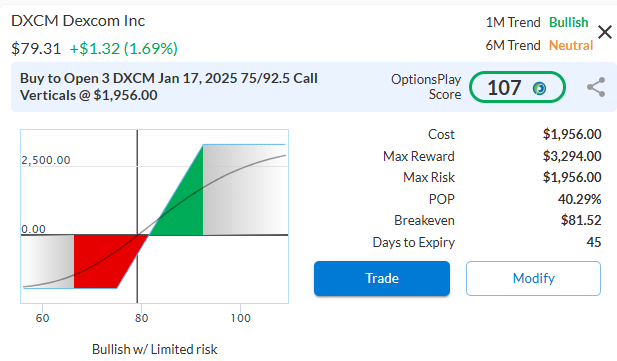

$DXCM

DailyPlay – Opening Trade (DXCM) – December 3, 2024

DXCM Bullish Opening Trade Signal

Investment Rationale

DexCom, Inc. (DXCM) recently broke out above its trading range with strong momentum, outperforming the S&P 500, and signaling potential upside to our $95 target.

The company has modestly undervalued fundamentals, trading at a forward price-to-earnings (PE) ratio of 38.31x, above the industry average of 24.87x. This premium is supported by robust growth metrics, including an expected earnings per share (EPS) growth of 23.17%, compared to the industry average of 8.70%. Additionally, DexCom’s projected revenue growth of 13.80% and net margins of 17.22% outperform peer averages of 6.34% and 14.13%, respectively, reflecting its strong competitive positioning.

DXCM – Daily

Trade Details

Strategy Details

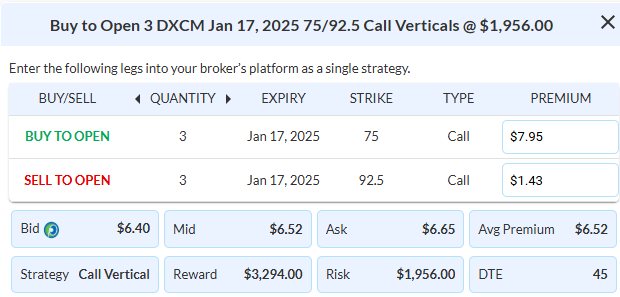

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 3 DXCM Jan 17 $75/$92.50 Vertical Spreads @ $6.52 Debit per Contract.

Total Risk: This trade has a max risk of $1,956 (3 Contract x $652) based on a hypothetical $100,000 portfolio normally risking 2%. We suggest using 2% of your portfolio value and divide it by $652 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that is expected to continue its bullish trajectory.

1M/6M Trends: Bullish/Neutral

Relative Strength: 2/10

OptionsPlay Score: 107

Stop Loss: @ $3.26 (50% loss of premium paid)

View DXCM Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View DXCM Trade

$AZN

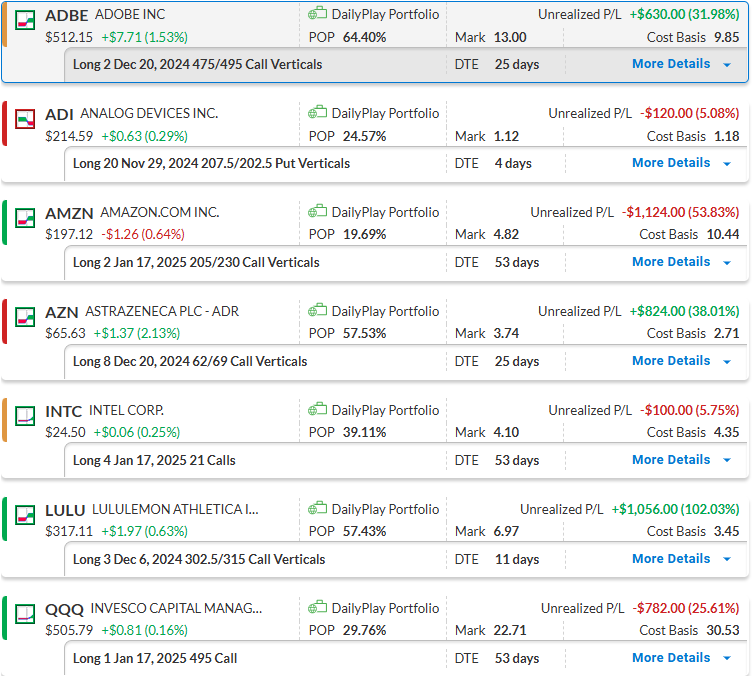

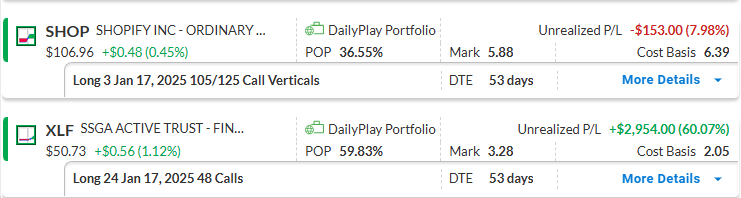

DailyPlay – Portfolio Review & Closing Trade (AZN) – December 2, 2024

Closing Trade

- AZN – 90% gain: Sell to Close 8 Contracts (or 100% of your Contracts) Dec 20 $62/$69 Call Vertical Spreads @ $5.16 Credit. DailyPlay Portfolio: By Closing all 8 Contracts, we will receive $4,128 We initially opened these 8 Contracts on November 20 @ $2.71 Debit. Our gain on this trade, therefore, is $1,960 which is almost 2% gain on our total portfolio.

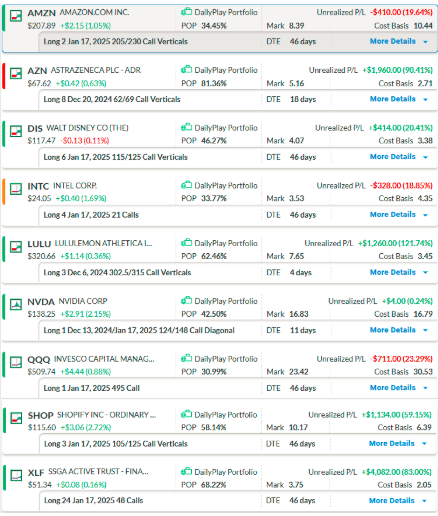

DailyPlay Portfolio Review

Our Trades

AMZN – 46 DTE

Bullish Debit Spread – Since Amazon.com Inc. (AMZN) reported earnings, the stock has experienced wild price swings but has remained range-bound. It is currently at a resistance level around 207. We remain bullish and will continue monitoring the position closely.

AZN – 18 DTE

Bullish Debit Spread – We are closing this position today for a profit.

DIS – 46 DTE

Bullish Debit Spread – We just established this position and plan to stay the course.

INTC – 46 DTE

Bullish Debit Spread – We are currently down on the trade, but with ample time remaining until expiration, we will stay the course. The position still presents an opportunity for further upside toward our $30 target.

LULU – 4 DTE

Bullish Debit Spread – The stock has reached our upside target and is trading five points above our short call strike at the 320 level, giving us a decent profit on the trade. However, the company is expected to announce earnings on Thursday, December 5th, after the close. The implied volatility of our short option has surged, and now theta is our best friend. We will monitor the position closely, allowing theta decay to help with the position, and will most likely close it before the earnings announcement to avoid the risks the announcement may bring.

NVDA – 11 DTE

Bullish Call Diagonal Spread – We just established this position and plan to stay the course.

QQQ – 46 DTE

Bullish Calls – We are currently down on the trade, but with ample time remaining until expiration, we will stay the course.

SHOP – 46 DTE

Bullish Debit Spread – The position is profitable, and the plan is to stay the course for now.

XLF – 46 DTE

Bullish Calls – We have a profit in our long call position in the financial sector and see more potential upside. Therefore, we will stay the course for now.

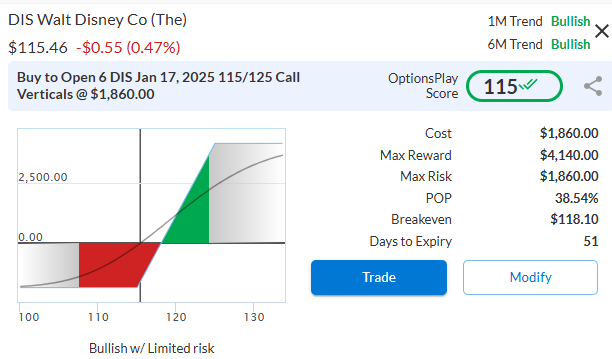

$DIS

DailyPlay – Opening Trade (DIS) – November 27, 2024

DIS Bullish Opening Trade Signal

Investment Rationale

The Walt Disney Company (DIS) recently filled its $114 gap, reaching our prior target, and is now targeting its 52-week high near $125. DIS has turned around its revenue and EPS growth, achieving record TTM revenues and net income.

Since breaking out above $96 and completing a bottoming formation, Disney has demonstrated a solid recovery. While it trades at a slight premium to the industry, its growth and profitability are outpacing its peers in the space.

DIS – Daily

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 6 DIS Jan 17 $115/$125 Vertical Spreads @ $3.10 Debit per Contract.

Total Risk: This trade has a max risk of $1,860 (6 Contract x $310) based on a hypothetical $100,000 portfolio normally risking 2%. We suggest using 2% of your portfolio value and divide it by $310 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue its bullish trajectory.

1M/6M Trends: Bullish/Bullish

Relative Strength: 8/10

OptionsPlay Score: 115

Stop Loss: @ $1.55 (50% loss of premium paid)

View DIS Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View DIS Trade

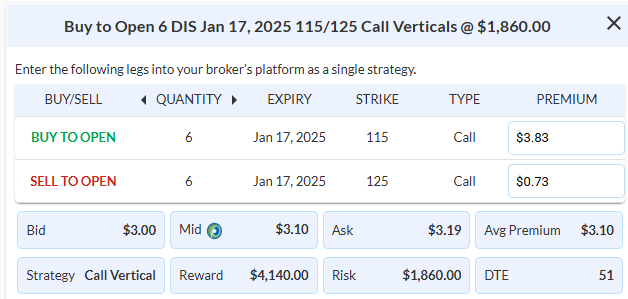

$NVDA

DailyPlay – Opening Trade (NVDA) & Closing Trade (ADBE) – November 26, 2024

Closing Trade

- ADBE – 41% gain: Sell to Close 2 Contracts (or 100% of your Contracts) Dec 20 $475/$495 Call Vertical Spreads @ $13.90 Credit. DailyPlay Portfolio: By Closing both Contracts, we will receive $2,780. We initially opened these 2 Contracts on November 5 @ $9.85 Debit. Our gain on this trade, therefore, is $810.

NVDA Bullish Opening Trade Signal

Investment Rationale

NVIDIA Corp (NVDA) recently broke out above its $135 resistance level and has since pulled back to a support level, presenting an attractive risk/reward setup for bullish positions.

While trading at a premium with a forward P/E ratio of 33.26x versus the industry average of 19.76x, NVIDIA boasts superior metrics, including expected EPS growth of 63.85%, revenue growth of 56.04%, and net margins of 55.69%. These figures underscore its significant upside potential despite the higher valuation.

NVDA – Daily

Trade Details

Strategy Details

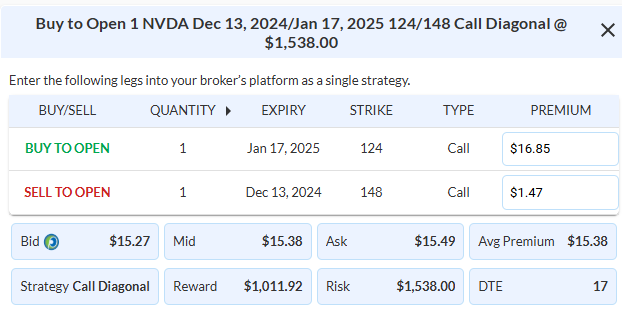

Strategy: Long Call Diagonal Spread

Direction: Bullish Call Diagonal Spread

Details: Buy to Open 1 NVDA Dec 13/Jan 17 $124/$148 Call Diagonal Spread @ $15.38 Debit per Contract.

Total Risk: This trade has a max risk of $1,538 (1 Contract x $1,538) based on a hypothetical $100,000 portfolio normally risking 2%. We suggest using 2% of your portfolio value and divide it by $1,538 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to bounce off recent support.

1M/6M Trends: Mildly Bearish/ Bullish

Relative Strength: 7/10

OptionsPlay Score: 106

Stop Loss: @ $7.69 (50% loss of premium paid)

View NVDA Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View NVDA Trade

DailyPlay – Portfolio Review – November 25, 2024

DailyPlay Portfolio Review

Our Trades

ADBE – 25 DTE

Bullish Debit Spread – Adobe Inc. (ADBE) remains volatile, recently bouncing strongly off the $500 support level. The $525 resistance has been a struggle. The trade is currently profitable. With an expiration beyond the December earnings report, we have the option to close, hold, or potentially roll up the position.

ADI – 4 DTE

Bearish Debit Spread – This week, we bought to close the 202.50 Nov 22nd option for a few cents and rolled into a short Nov 29th put at the same strike. This adjustment captured a significant amount of implied volatility premium in the Nov 29th put ahead of earnings, positioning us in a long put vertical spread for the announcement on Tuesday, November 26th. Watch closely and be ready to close on the morning of the announcement.

AMZN – 53 DTE

Bullish Debit Spread – Amazon.com Inc. (AMZN) recently reported strong earnings. Although the stock has experienced a pullback, we remain bullish and will continue holding the position as the holiday shopping season gets underway.

AZN – 25 DTE

Bullish Debit Spread – AZN stock is building momentum to the upside, gaining 4% last week. We will stay the course.

INTC – 53 DTE

Bullish Calls – Staying the course with Intel (INTC) has the possibility for further upside, with our target set at $30 for the stock.

LULU – 11 DTE

Bullish Debit Spread – We currently have a nice profit, as the stock is above our short strike in the bull call vertical spread. While we could close the position soon, time decay works in our favor, but an increase in implied volatility is a concern with the company’s earnings announcement scheduled for December 5th.

QQQ – 53 DTE

Bullish Calls – We still have 54 DTE and plan to stay the course, as this is a longer-term outlook we have on this ETF.

SHOP – 53 DTE

Bullish Debit Spread – Shopify (SHOP) – We are down on this position, but we plan to stay the course for now.

XLF – 53 DTE

Bullish Calls – Financial Select Sector SPDR ETF (XLF) – We established a long call position in the financial sector and plan to stay the course for now.

$ADI

DailyPlay – Rolling Trade (ADI) – November 22, 2024

Closing Trade

- ADI – 33% loss: Sell to Close 6 Contracts (or 100% of your Contracts) Nov 22/Nov 29 $202.50/$207.50 Put Diagonal Spreads @ $2.82 Credit. DailyPlay Portfolio: By Closing all 6 Contract, we will receive $1,692. We opened these 6 Contract on November 19 @ $4.25 Debit. As we are Rolling ADI, we will open a new position to generate a Net Credit of $1.85.

ADI Bearish Opening Trade Signal

Investment Rationale

Analog Devices, Inc. (ADI) recently broke down from its trading range with strong momentum and is underperforming the S&P 500. Our downside target is the $200 support level on the chart.

From a fundamental perspective, ADI appears overvalued compared to its peers. The company is scheduled to announce earnings before the market opens on Tuesday, November 26th, and the stock has experienced a recent uptick.

With the stock at $209.65, we executed a bearish put diagonal spread: so we will make 1.13 – .08 = 1.05 on the 202.5 put to start.

- Buy 1 Nov 29th Put 207.50 (10 DTE) @ $4.50

- Sell 1 Nov 22nd Put 202.50 (3 DTE) @ $1.13

Net debit for the spread: $3.37 as of Thursday’s close, the stock was at $213.96, leaving the Nov 22nd 202.50 strike put out-of-the-money (OTM). We plan to close this option contract for a few cents and roll into a Nov 29th put with the same strike. This adjustment will capture a significant implied volatility (IV) premium due to the upcoming earnings report and position us in a long put vertical spread that we can hold through the announcement.

As we are Rolling ADI, we are therefore closing the original trade and open a new position to generate a Net Credit of $1.85.

ADI – Daily

Trade Details

Strategy Details

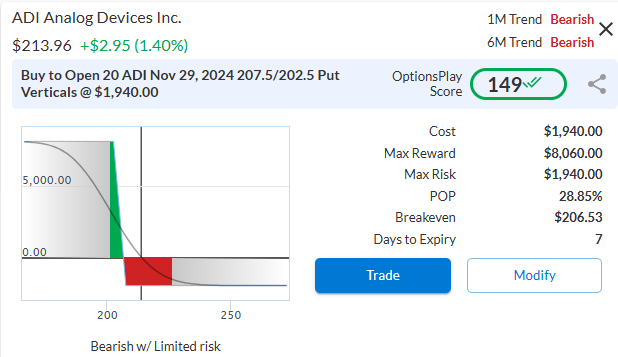

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 20 ADI Nov 29 $207.50/$202.50 Put Vertical Spreads @ $0.97 Debit per Contract. With the $2.82 Credit that we receive when closing the original trade, we will generate a Net Credit of $1.85 ($2.82 – $0.97).

Total Risk: This trade has a max risk of $1,940 (20 Contract x $97) based on a hypothetical $100,000 portfolio normally risking 2%. We suggest using 2% of your portfolio value and divide it by $97 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue its bearish trajectory over the course of this trade.

1M/6M Trends: Bearish/Bearish

Relative Strength: 3/10

OptionsPlay Score: 149

Stop Loss: @ $0.49 (50% loss of premium paid)

View ADI Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View ADI Trade

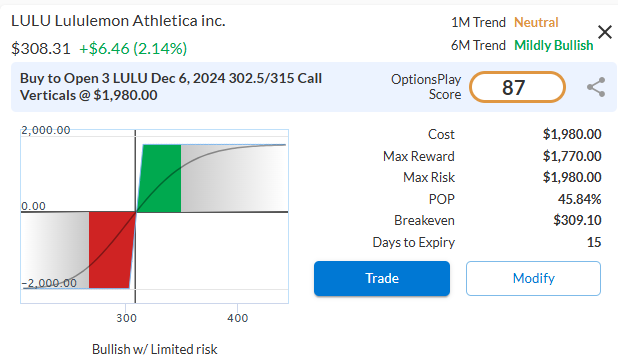

$LULU

DailyPlay – Opening Trade (LULU) – November 21, 2024

LULU Bullish Opening Trade Signal

Investment Rationale

Lululemon Athletica Inc. (LULU) has recently broken out above its trading range with strong momentum, outperforming the S&P 500, creating an opportunity for further upside toward our $320 target. Despite trading at a 10% discount compared to its peers, LULU is poised to grow revenues at nearly double the industry average while maintaining significantly higher profitability, with a forward P/E ratio of 21.44x, expected EPS and revenue growth of 8.15% and 8.07%, respectively, and net margins of 16.34%. In comparison, the industry average has a forward P/E of 22.05x, expected revenue growth of 4.91%, and net margins of 9.82%. The company’s earnings announcement is expected on December 5th.

LULU – Daily

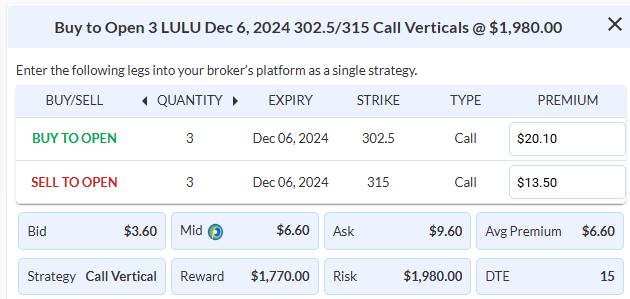

Trade Details

Strategy Details

Strategy: Long Call Vertical Spreads

Direction: Bullish Debit Spread

Details: Buy to Open 3 LULU Dec 6 $302.50/$315 Call Vertical Spreads @ $6.60 Debit per Contract.

Total Risk: This trade has a max risk of $1,980 (3 Contract x $660) based on a hypothetical $100,000 portfolio normally risking 2%. We suggest using 2% of your portfolio value and divide it by $660 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that is expected to bounce off recent support.

1M/6M Trends: Neutral/Mildly Bullish

Relative Strength: 6/10

OptionsPlay Score: 87

Stop Loss: @ $3.30 (50% loss of premium paid)

View LULU Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.