$AZN

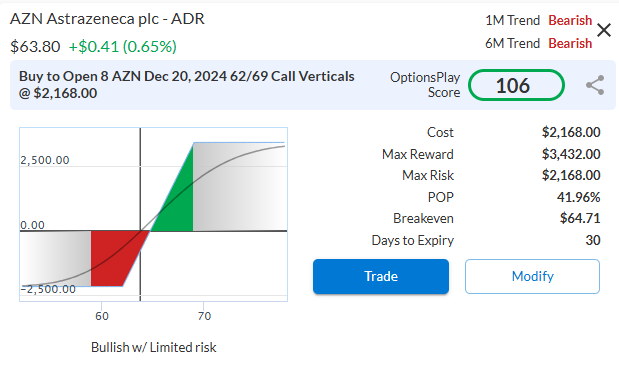

DailyPlay – Opening Trade (AZN) – November 20, 2024

AZN Bullish Opening Trade Signal

Investment Rationale

AstraZeneca PLC (AZN) is oversold on daily and weekly timeframes, signaling exhaustion and potential for a rally.

With strong EPS growth (34.56%) and net margins (12.7%), AZN trades at an 8% discount to peers, suggesting upside potential.

AZN – Daily

Trade Details

Strategy Details

Strategy: Long Call Vertical Spreads

Direction: Bullish Debit Spread

Details: Buy to Open 8 AZN Dec 20 $62/$69 Call Vertical Spreads @ $2.71 Debit per Contract.

Total Risk: This trade has a max risk of $2,168 (8 Contract x $271) based on a hypothetical $100,000 portfolio normally risking 2%. We suggest using 2% of your portfolio value and divide it by $271 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that is expected to bounce off recent support as it formed a bullish divergence.

1M/6M Trends: Bearish/Bearish

Relative Strength: 2/10

OptionsPlay Score: 106

Stop Loss: @ $1.36 (50% loss of premium paid)

View AZN Trade

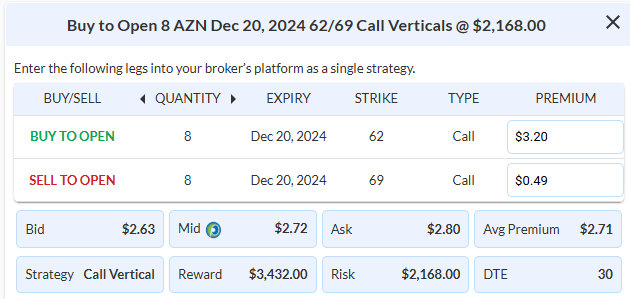

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AZN Trade

$ADI

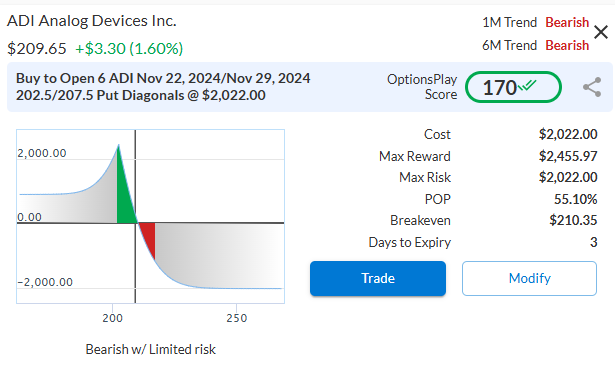

DailyPlay – Opening Trade (ADI) – November 19, 2024

ADI Bearish Opening Trade Signal

Investment Rationale

Analog Devices, Inc. (ADI) recently broke down from its trading range with strong momentum and is underperforming the S&P 500, signaling potential downside to our $200 target.

From a fundamental perspective, ADI appears overvalued relative to its peers. Despite trading at a 38% premium, its net margins (17.07%) trail the industry average (19.87%), and revenue growth (13.67%) offers limited upside as earnings continue to decline.

The company is expected to announce earnings before the market opens on Tuesday, November 26, which will be factored into our option strategy.

ADI – Daily

Trade Details

Strategy Details

Strategy: Long Put Diagonal Spread

Direction: Bearish Put Diagonal Spread

Details: Buy to Open 6 ADI Nov 22/Nov 29 $202.50/$207.50 Put Diagonal Spreads @ $3.37 Debit per Contract.

Total Risk: This trade has a max risk of $2,022 (6 Contract x $337) based on a hypothetical $100,000 portfolio normally risking 2%. We suggest using 2% of your portfolio value and divide it by $337 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue its bearish trajectory over the course of this trade.

1M/6M Trends: Bearish/Bearish

Relative Strength: 3/10

OptionsPlay Score: 170

Stop Loss: @ $1.69 (50% loss of premium paid)

View ADI Trade

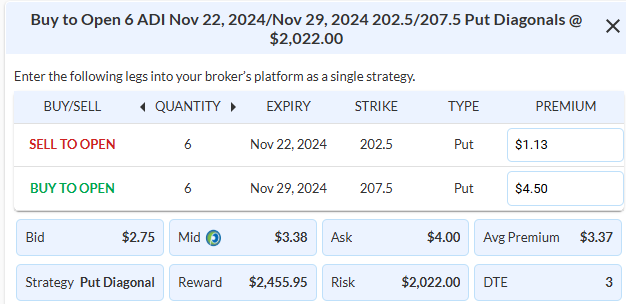

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View ADI Trade

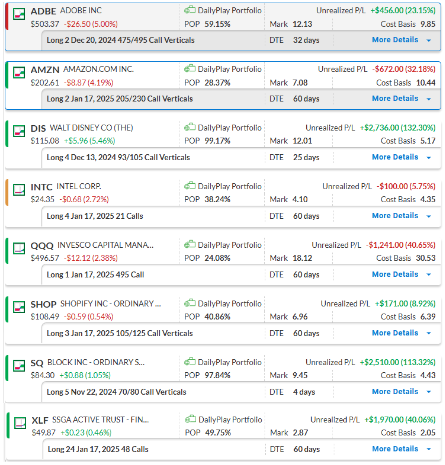

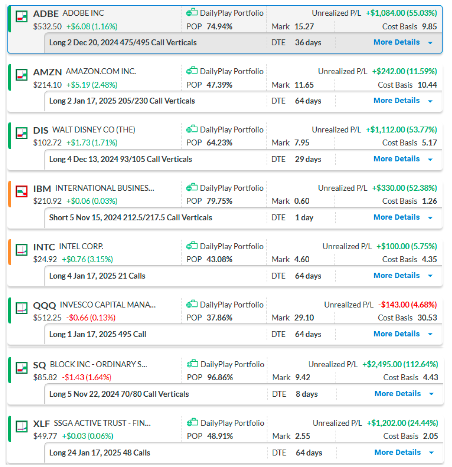

$DIS, $SQ

DailyPlay – Closing Trades (DIS, SQ) & Portfolio Review – November 18, 2024

Closing Trades

- DIS – 132% gain: Sell to Close 4 Contracts (or 100% of your Contracts) Dec 13 $93/$105 Call Vertical Spreads @ $12.01 Credit. DailyPlay Portfolio: By Closing all 4 Contracts, we will receive $4,804 We initially opened these 4 Contracts on November 6 @ $5.17 Debit. Our gain on this trade, therefore, is $2,736 which is more than 2% gain on our total portfolio.

- SQ – 113% gain: Sell to Close 5 Contracts (or 100% of your Contracts) Nov 22 $70/$80 Call Vertical Spreads @ $9.45 Credit. DailyPlay Portfolio: By Closing all 5 Contracts, we will receive $4,725 We initially opened these 5 Contracts on October 23 @ $4.43 Debit. Our gain on this trade, therefore, is $2,510 which is more than 2% gain on our total portfolio.

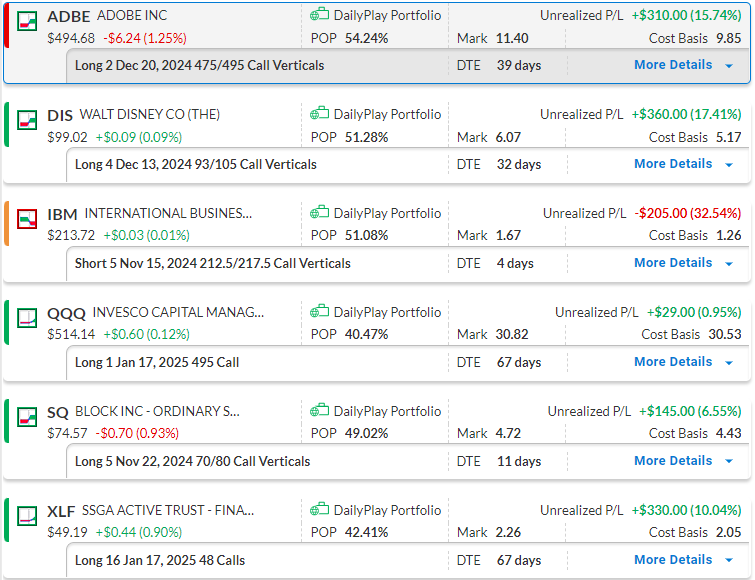

DailyPlay Portfolio Review

Our Trades

ADBE – 32 DTE

Bullish Debit Spread – Adobe Inc. (ADBE) remains volatile, recently bouncing off support at $500. The stock has struggled to break through the key resistance level at $525, but if it clears this, further upside to $550 is likely. The trade is currently profitable, and we plan to maintain our position. With an expiration date extending beyond the early December earnings report, we have the flexibility to hold through the announcement or potentially roll up the position.

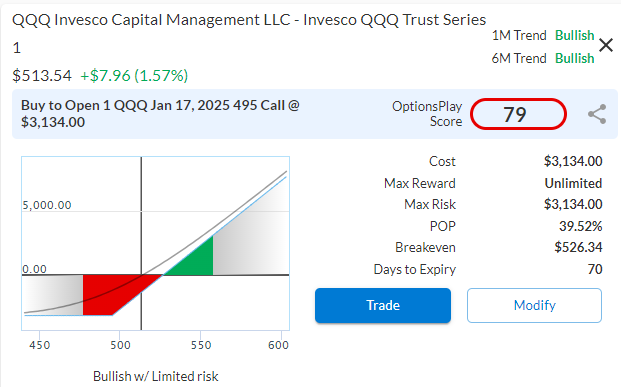

AMZN – 60 DTE

Bullish Debit Spread – Amazon.com Inc. (AMZN) recently reported strong earnings. Although the stock has experienced a pullback, we remain bullish and will continue monitoring the position closely.

DIS – 25 DTE

Bullish Debit Spread – We are closing this position for a profit today.

INTC – 60 DTE

Bullish Calls – Staying the course still presents an opportunity for further upside toward our $30 target.

QQQ – 60 DTE

Bullish Calls – We just established this position and plan to stay the course.

SHOP – 60 DTE

Bullish Debit Spread – We just established this position and plan to stay the course.

SQ – 4 DTE

Bullish Debit Spread – We are closing this position for a profit today.

XLF – 60 DTE

Bullish Calls – We recently established the long call position in the financial sector and plan to stay the course for now.

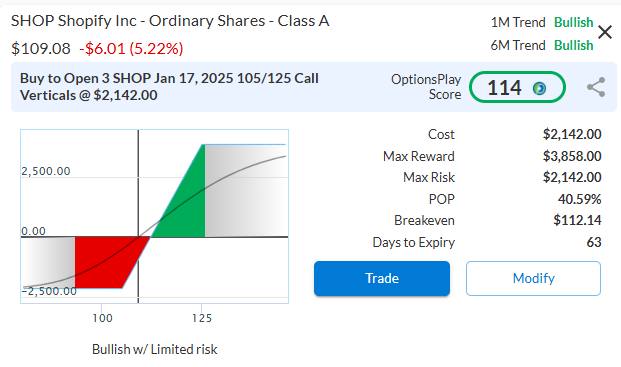

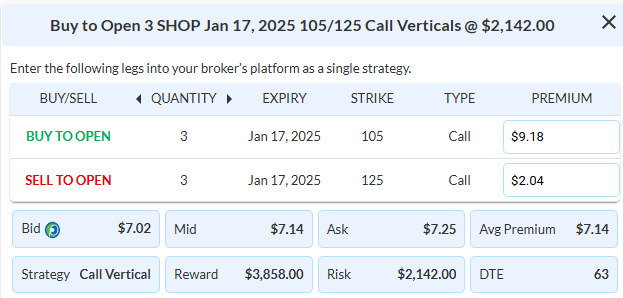

$SHOP

DailyPlay – Opening Trade (SHOP) – November 15, 2024

SHOP Bullish Opening Trade Signal

Investment Rationale

Shopify (SHOP) stock surged by 25% following the announcement of better-than-expected earnings and an optimistic forecast for the holiday season. We recently executed a bullish long calendar trade in SHOP ahead of the earnings report. The company’s strong financial performance has fueled significant upside momentum, boosting investor confidence. Shopify’s revenue growth exceeded analyst expectations, indicating continued momentum as the holiday shopping season approaches. Consequently, we are considering a longer-term bullish strategy as we head into the year’s end.

SHOP – Daily

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 3 SHOP Jan 17 $105/$125 Call Vertical Spreads @ $7.14 Debit per Contract.

Total Risk: This trade has a max risk of $2,142 (3 Contract x $714) based on a hypothetical $100,000 portfolio normally risking 2%. We suggest using 2% of your portfolio value and divide it by $714 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to bounce higher off recent support.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 114

Stop Loss: @ $3.57 (50% loss of premium paid)

View SHOP Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View SHOP Trade

DailyPlay – Portfolio Review – November 14, 2024

DailyPlay Portfolio Review

Our Trades

ADBE – 36 DTE

Bullish Debit Spread – With a strong bounce off support at $500, ADBE is currently testing a key area at $525. Further upside is likely with the next target at $550.

AMZN – 64 DTE

Bearish Call Butterfly – AMZN broke out above its trading range with strong momentum and is now pulling back from recent highs. We will keep a close eye on this position.

DIS – 29 DTE

Bullish Debit Spread – Dis gapped higher from support at $100 toward the $110 area. Our bullish thesis on this trade remains in place.

IBM – 1 DTE

Bearish Credit Spread – This trade expires tomorrow while we are having some gains on our side.

INTC – 64 DTE

Bullish Calls – INTC pulled back to support at around $24, from where it is trading higher. The next upside target is at around $29.

QQQ – 64 DTE

Bullish Calls – QQQ is pulling back from recent highs with the $500 level as an area of support. We will keep a close eye on this position.

SQ – 8 DTE

Bullish Debit Spread – SQ experienced strong bullish momentum as it gain almost 20% in a few days. Further upside is likely after some consolidation and with 8 days left until expiration, we will keep this position open.

XLF – 64 DTE

Bullish Calls – XLF is currently grinding higher after it gapped to the upside. A break above the $50 psychological barrier could indicate continued upside.

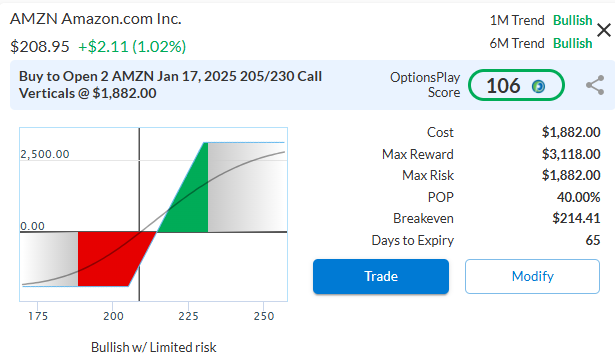

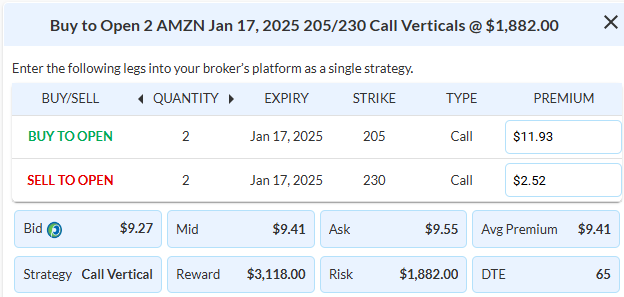

$AMZN

DailyPlay – Opening Trade (AMZN) – November 13, 2024

AMZN Bullish Opening Trade Signal

Investment Rationale

Amazon.com Inc. (AMZN) recently reported a strong third-quarter profit of $17.4 billion, surpassing expectations with an 11% operating margin, a notable improvement from last year. The company highlighted momentum in both its retail and Amazon Web Services (AWS) segments. With AI initiatives like ‘Project Amelia’ supporting third-party sellers, AMZN is well-positioned for continued growth. The stock has recently reached new all-time highs, breaking out of its trading range with strong momentum. Having been featured in a speculative Daily Play before earnings, we are now considering a longer-term trade as the holiday season approaches.

AMZN – Daily

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 2 AMZN Jan 17 $205/$230 Call Vertical Spreads @ $9.41 Debit per Contract.

Total Risk: This trade has a max risk of $1,882 (2 Contract x $941) based on a hypothetical $100,000 portfolio normally risking 2%. We suggest using 2% of your portfolio value and divide it by $941 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to bounce higher off recent support.

1M/6M Trends: Bullish/Bullish

Relative Strength: 6/10

OptionsPlay Score: 106

Stop Loss: @ $4.71 (50% loss of premium paid)

View AMZN Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AMZN Trade

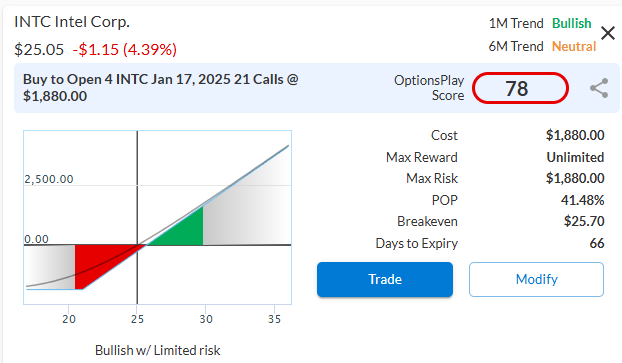

$INTC

DailyPlay – Opening Trade (INTC) – November 12, 2024

INTC Bullish Opening Trade Signal

Investment Rationale

Intel Corporation (INTC) recently broke out above its trading range with strong momentum and is outperforming the S&P 500, presenting an opportunity for further upside toward our $30 target. The company is modestly undervalued, and with its focus on cost-cutting and successfully navigating restructuring and impairment expenses, the outlook is becoming more optimistic due to operational improvements. As INTC continues to reduce costs and move past these restructuring and impairment challenges, the future looks promising, with operating margins returning to normal and revenue expectations being consistently exceeded.

INTC – Daily

Trade Details

Strategy Details

Strategy: Long Call

Direction: Bullish Calls

Details: Buy to Open 4 INTC Jan 17 $21 Call @ $4.70 Debit per Contract.

Total Risk: This trade has a max risk of $1,880 (4 Contract x $470) based on a hypothetical $100,000 portfolio normally risking 2%. We suggest using 2% of your portfolio value and divide it by $470 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to bounce higher off recent support.

1M/6M Trends: Bullish/Neutral

Relative Strength: 3/10

OptionsPlay Score: 78

Stop Loss: @ $2.35 (50% loss of premium paid)

View INTC Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View INTC Trade

$COST, $JNJ, VIX

DailyPlay – Closing Trades (COST, JNJ, VIX) & Portfolio Review – November 11, 2024

Closing Trades

- COST – 100% loss: Buy to Close 2 Contracts (or 100% of your Contracts) Nov 15 $930/$940/$950 Modified Call Butterflies @ $3.63 Debit. DailyPlay Portfolio: By Closing both Contracts, we will pay $646. We initially opened these 2 Contracts on October 30 @ $0.40 Credit. Our loss on this trade, therefore, is $283 per Contract.

- JNJ – 100% loss: Buy to Close 5 Contracts (or 100% of your Contracts) Nov 29 $160/$155 Put Vertical Spreads @ $3.56 Debit. DailyPlay Portfolio: By Closing all 5 Contracts, we will pay $1,780 We initially opened these 5 Contracts on October 24 @ $0.83 Debit. Our loss on this trade, therefore, is $273 per Contract.

- VIX – 41% gain: Sell to Close 12 Contracts (or 100% of your Contracts) VIX Nov 20 $19/$16 Put Vertical Spreads @ $2.65 Credit DailyPlay Portfolio: By Closing all 12 Contracts, we will receive $3,180 We initially opened these 12 Contracts on October 25 @ $1.57 Debit. Our gain on this trade, therefore, is $1,296 which is more than 1% gain on our total portfolio.

DailyPlay Portfolio Review

Our Trades

ADBE – 39 DTE

Bullish Debit Spread – Adobe Inc. (ADBE) has recently entered oversold territory and remains volatile, but it has started to build some upside momentum. We are currently profitable on the trade and plan to maintain our position. Our expiration date extends beyond the upcoming earnings report in early December, giving us the flexibility to hold the position through the announcement if we choose to.

COST – 4 DTE

Bearish Call Butterfly – This position is an interesting case. We intended for the stock to decline in price and for all the options to expire worthless, allowing us to capture the $0.40 net credit received when establishing the 1x3x2 butterfly position. The hedge provided by the long call vertical spread in the butterfly helped mitigate some risk. If the move to the middle strike (940) had occurred closer to the expiration date, the trade would have been notably profitable. At this point, it’s all about time decay, and if the stock were to remain around the 940 strike until expiration, it would become profitable because of theta decay. However, given the bullish momentum of the overall market, closing this position is warranted. We are closing this position today.

DIS – 32 DTE

Bullish Debit Spread – The Walt Disney Company (DIS) was lifted by the overall bullish market and has broken out of its previous trading range. We hope this upward trend continues as the company’s earnings date approaches, with earnings scheduled for November 14. We will maintain our current position for now.

IBM – 4 DTE

Bearish Credit Spread – We’re closely monitoring this bearish IBM position, which is currently at a loss. While there’s some weakness on the chart, expiration is quickly approaching, and we may need to close the position early in the week.

JNJ – 18 DTE

Bullish Credit Spread – Johnson & Johnson (JNJ) has broken through its downside support level in a strong bullish market environment. It has fallen to the long strike of our short put vertical spread (155), so it’s time to close the position and take the loss at this stage. We are closing this position today.

QQQ – 67 DTE

Bullish Calls – Invesco QQQ Trust (QQQ) – The conclusion of an election cycle often provides market clarity, reducing volatility and boosting investor confidence. We just established this position and plan to stay the course.

SQ – 11 DTE

Bullish Debit Spread – Block Inc. (SQ) announced earnings on November 7th. The stock opened lower after the announcement but finished with solid upside momentum by the close. We have a gain in the position and will stay the course for now.

XLF – 67 DTE

Bullish Debit Spread – Financial Select Sector SPDR ETF (XLF) – This position is part of our post-election cycle strategy. We’ve just established the long call position in the financial sector and plan to stay the course for now.

VIX – 8 DTE

Bullish Debit Spread – We are closing this position today.

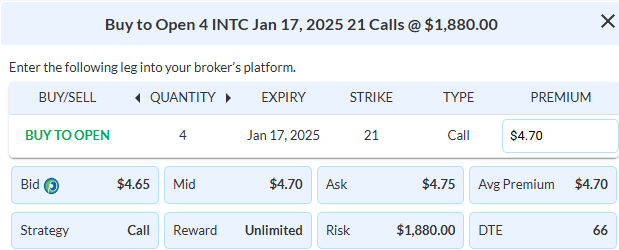

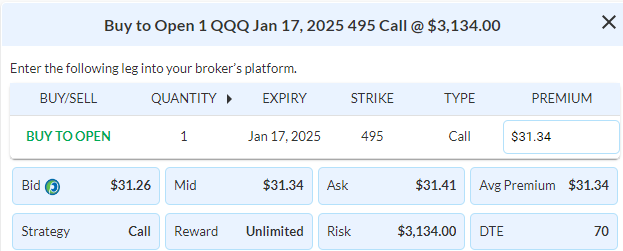

$QQQ

DailyPlay – Opening Trade (QQQ) – November 8, 2024

QQQ Bullish Opening Trade Signal

Investment Rationale

Invesco QQQ Trust (QQQ) – The conclusion of an election cycle often provides market clarity, reducing volatility and boosting investor confidence. Our post-election strategy began with the purchase of a bearish long put spread on the VIX index (DailyPlay – Opening Trade (VIX) – October 25, 2024), anticipating a decrease in volatility. Next, we bought in-the-money calls on the XLF, the financial ETF. Looking ahead, the tech sector creates global value by improving efficiency and addressing challenges across various industries. QQQ stocks are well-positioned to drive these outcomes, supporting continued growth and gains.

QQQ – Daily

Trade Details

Strategy Details

Strategy: Long Call

Direction: Bullish Calls

Details: Buy to Open 1 QQQ Jan 17 $495 Call @ $31.34 Debit per Contract.

Total Risk: This trade has a max risk of $3,134 (1 Contract x $3,134) based on a hypothetical $100,000 portfolio normally risking 2% (3% in today’s case). We suggest using 2% of your portfolio value and divide it by $3,134 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue its bullish trajectory.

1M/6M Trends: Bullish/Bullish

Relative Strength: 8/10

OptionsPlay Score: 79

Stop Loss: @ $15.67 (50% loss of premium paid)

View QQQ Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View QQQ Trade

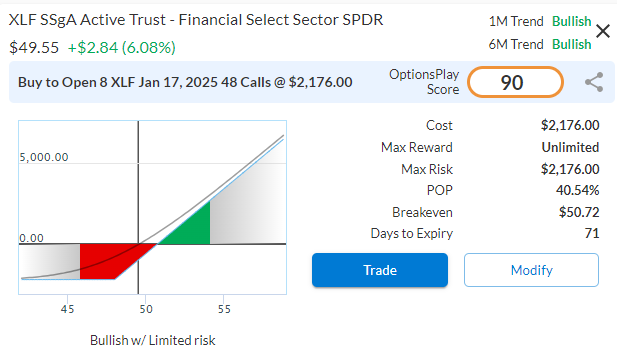

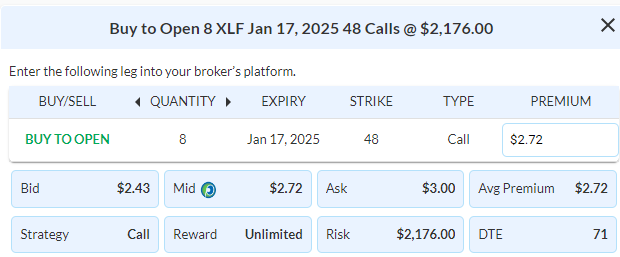

$XLF

DailyPlay – Opening Trade (XLF) – November 7, 2024

XLF Bullish Opening Trade Signal

Investment Rationale

Financial Select Sector SPDR ETF (XLF) – The conclusion of an election cycle often brings clarity to the market and reduces volatility, boosting investor confidence. Our after the election strategy began with the purchase of a bearish long put spread on the VIX index (DailyPlay – Opening Trade (VIX) – October 25, 2024), anticipating that volatility would decrease following the election. The next step is to position in select market sectors during the post-election optimism, which coincides with the holiday season. If interest rates remain favorable, policies support growth, and the economy continues to expand, the financial sector appears promising. Despite a 31% increase in the XLF this year, financial stocks remain undervalued, trading at a 25% discount to the S&P 500. This suggests potential for continued growth, as investor allocations to financials are at their lowest since 2010.

XLF – Daily

Trade Details

Strategy Details

Strategy: Long Call

Direction: Bullish Calls

Details: Buy to Open 8 XLF Jan 17 $48 Calls @ $2.72 Debit per Contract.

Total Risk: This trade has a max risk of $2,176 (8 Contracts x $272) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $272 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue its bullish trajectory.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 90

Stop Loss: @ $1.36 (50% loss of premium paid)

View XLF Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.