$DIS

DailyPlay – Opening Trade (DIS) – November 6, 2024

DIS Bullish Opening Trade Signal

Investment Rationale

The Walt Disney Company (DIS) stock has recently been in a very tight trading range between $95 and $97, as it appears undecided on its next direction. With earnings scheduled for November 14, this announcement could serve as the catalyst needed for an upside breakout. From a fundamental perspective, the stock appears modestly undervalued. After struggling to grow over recent quarters, DIS has reversed course, showing improvements in both revenue and EPS growth. Over the trailing twelve months (TTM), the company has posted record revenues and net income. We will look to get bullish and use call options with an expiration that extends well beyond the earnings date.

DIS – Daily

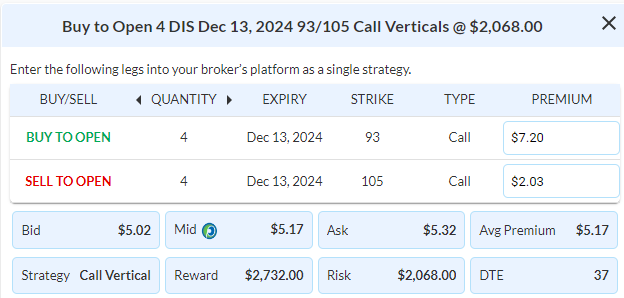

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 4 DIS Dec 16 $93/$105 Call Vertical Spreads @ $5.17 Debit per Contract.

Total Risk: This trade has a max risk of $2,068 (4 Contracts x $517) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $517 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue its bullish trajectory.

1M/6M Trends: Bullish/Neutral

Relative Strength: 3/10

OptionsPlay Score: 99

Stop Loss: @ $2.59 (50% loss of premium paid)

View DIS Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View DIS Trade

$ADBE

DailyPlay – Opening Trade (ADBE) – November 5, 2024

ADBE Bullish Opening Trade Signal

Investment Rationale

Adobe Inc. (ADBE) has recently reached oversold conditions on both daily and weekly timeframes, exhibiting signs of exhaustion that may signal a higher likelihood of a strong rally ahead. Currently modestly undervalued, ADBE trades at a discount relative to its industry, despite growth rates and profitability metrics that surpass industry averages. With a monetized AI product already generating revenue, ADBE presents strong upside potential from a valuation perspective. Additionally, the earnings date for this quarter falls in mid-December. Our expiration date extends beyond this earnings report, allowing us to hold the position through the announcement.

ADBE – Daily

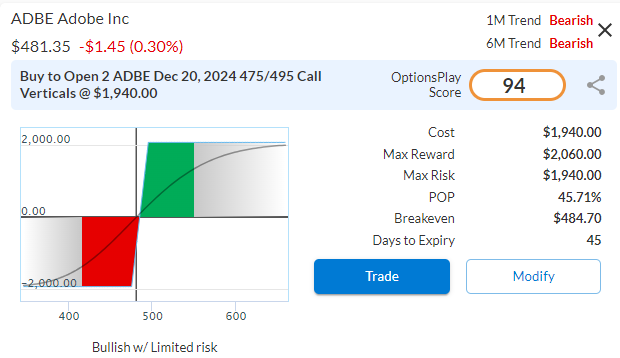

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 2 ADBE Dec 20 $475/$495 Call Vertical Spreads @ $9.70 Debit per Contract.

Total Risk: This trade has a max risk of $1,940 (2 Contracts x $970) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $970 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that is expected to bounce higher off recent lows.

1M/6M Trends: Bearish/Bearish

Relative Strength: 3/10

OptionsPlay Score: 94

Stop Loss: @ $4.85 (50% loss of premium paid)

View ADBE Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View ADBE Trade

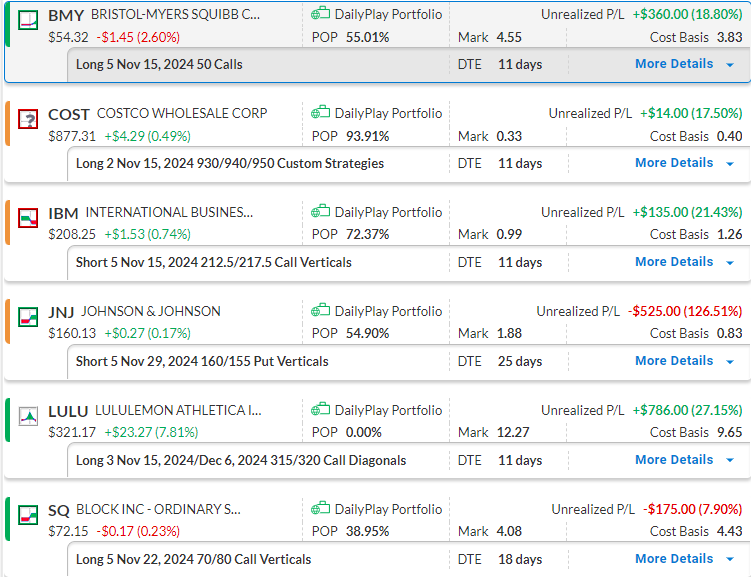

$BMY, $LULU

DailyPlay – Closing Trades (BMY, LULU) & Portfolio Review – November 4, 2024

Closing Trades

- BMY – 18.80% gain: Sell to Close 5 Contracts (or 100% of your Contracts) November 15 $50 Calls @ $4.55 Credit. DailyPlay Portfolio: By Closing all 5 Contracts, we will receive $2,275. We initially opened these 5 Contracts on October 15 @ $3.83 Debit. Our gain on this trade, therefore, is $360.

- LULU – 27.15% gain: Sell to Close 3 Contracts (or 100% of your Contracts) Nov 15/Dec 6 $315/$320 Call Diagonals @ $12.27 Credit. DailyPlay Portfolio: By Closing all 3 Contracts, we will receive $3,681. We initially opened these 3 Contracts on October 29 @ $9.65 Debit. Our gain on this trade, therefore, is $786.

DailyPlay Portfolio Review

Our Trades

BMY – 11DTE

Bullish Calls – We are closing this position today.

COST – 11 DTE

Bearish Modified Call Butterfly – We continue to hold a bearish outlook on Costco (COST) from a valuation standpoint, staying the course on the position, which is up slightly.

IBM – 11 DTE

Bearish Credit Spreads – IBM continues to indicate overbought signals, reinforcing our bearish stance. We’ll hold steady on the position, which has gained slightly.

JNJ – 25 DTE

Bullish Credit Spreads – JNJ has been volatile recently and has returned to its downside support level, which has been unfavorable for this trade, as it is also the short strike of our put vertical spread. With 26 days until expiration, we need to monitor this position closely.

LULU – 32 DTE

Bullish Call Diagonals – We are closing this position today.

SQ – 18 DTE

Bullish Debit Spread – SQ’s rapid growth suggests it could soon reach a more reasonable valuation of 19-20x forward earnings. With the company’s earnings expected on November 7th, there’s a strong chance we will hold this position through the report. We’ll stay the course on this position as the earnings date approaches.

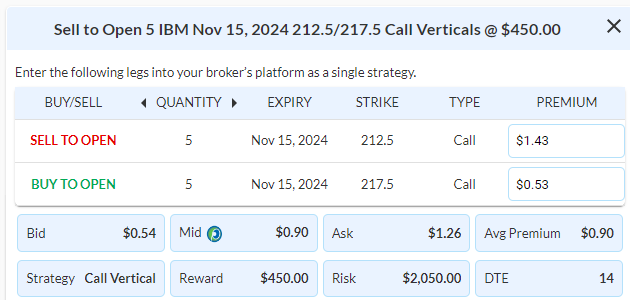

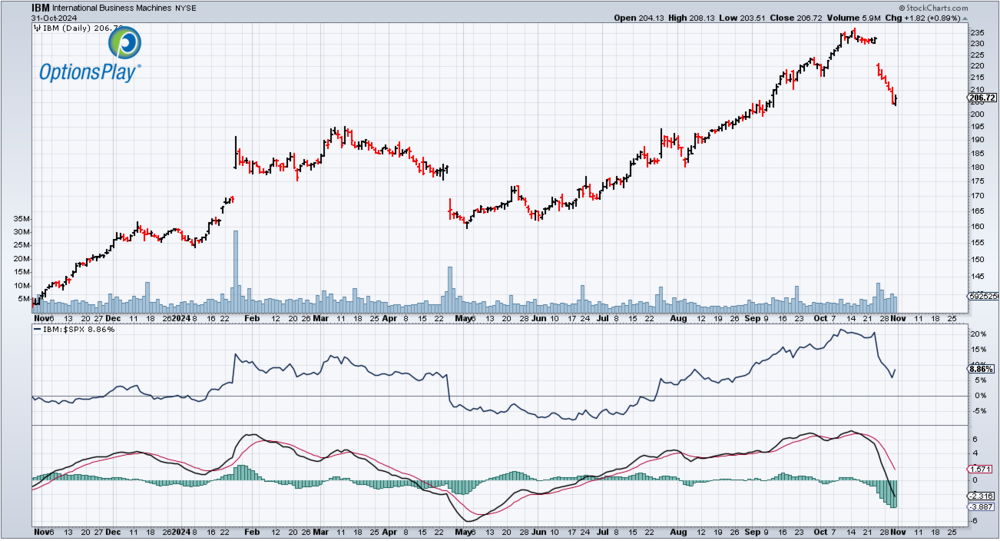

$IBM

DailyPlay – Opening Trade (IBM) – November 1, 2024

IBM Bearish Opening Trade Signal

Investment Rationale

IBM shows overbought signals, suggesting a likely selloff. Although its valuation aligns with industry averages, IBM is overvalued due to slower growth prospects and similar profitability. Key metrics reveal IBM’s lower expected growth in EPS and revenue, highlighting potential downside risks.

IBM – Daily

Trade Details

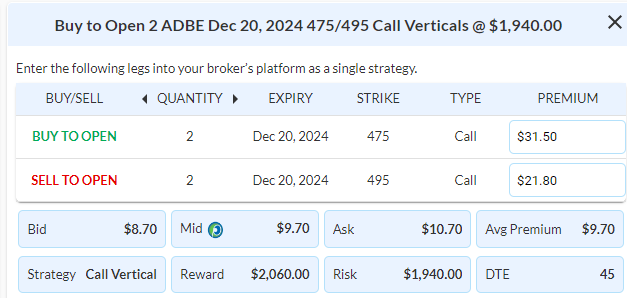

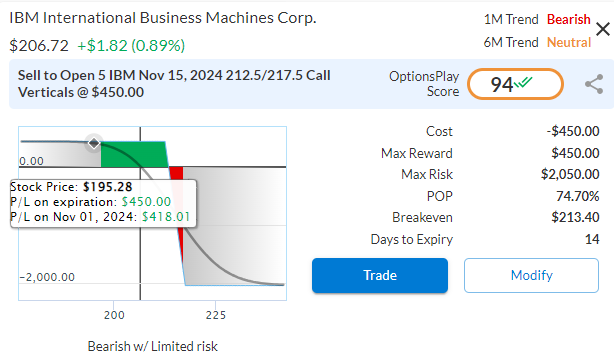

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 5 IBM Nov 15 $212.50/$217.50 Call Vertical Spreads @ $0.90 Credit per Contract.

Total Risk: This trade has a max risk of $2,050 (5 Contracts x $410) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $410 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower from recent highs.

1M/6M Trends: Bearish/Neutral

Relative Strength: 9/10

OptionsPlay Score: 94

Stop Loss: @ $1.80 (100% loss to value of premium)

View IBM Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View IBM Trade

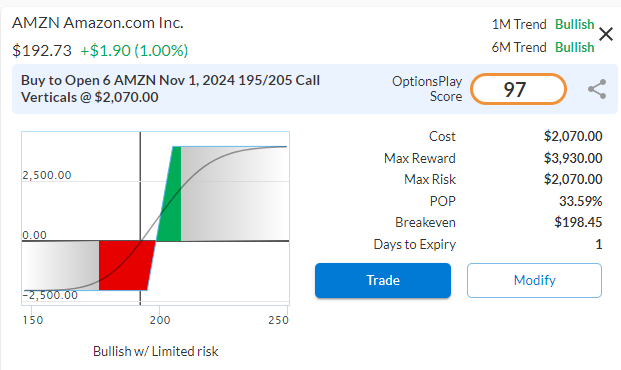

$AMZN

DailyPlay – Opening Trade (AMZN) – October 31, 2024

AMZN Bullish Opening Trade Signal

Investment Rationale

Amazon.com, Inc. (AMZN) demonstrates robust earnings growth and profitability, underscoring its strength in e-commerce, with significant revenue and market share. The stock is trending upward, and while Amazon isn’t always central in AI discussions, AWS and its AI capabilities contribute substantially to profitability. Recently, Amazon announced it has been working behind the scenes on ‘Project Amelia,’ an AI tool for third-party sellers that optimizes decision-making, attracts sellers, and supports revenue growth, which should positively impact AMZN’s bottom line.

Amazon announces earnings after market close on Halloween, Thursday the 31st. We plan to explore a speculative trade around this event, hoping the conference call won’t spook the market but instead drives the stock higher based on its AI initiatives.

AMZN – Daily

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 6 AMZN Nov 1 $195/$205 Call Vertical Spreads @ $3.45 Debit per Contract.

Total Risk: This trade has a max risk of $2,070 (6 Contracts x $345) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $345 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher off recent support.

1M/6M Trends: Bullish/Bullish

Relative Strength: 6/10

OptionsPlay Score: 97

Stop Loss: @ $1.73 (50% loss of premium)

View AMZN Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AMZN Trade

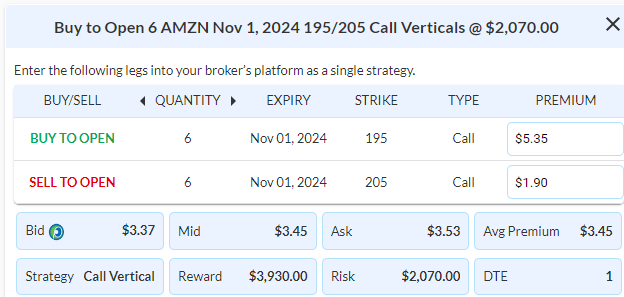

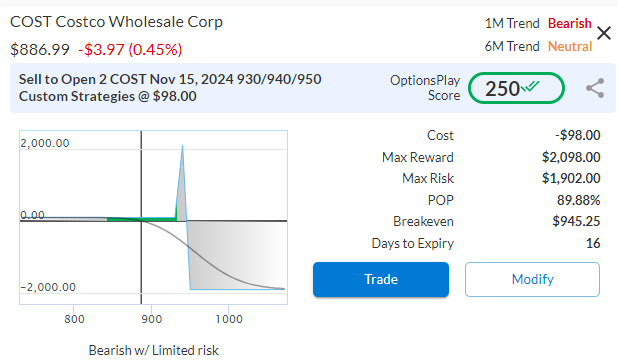

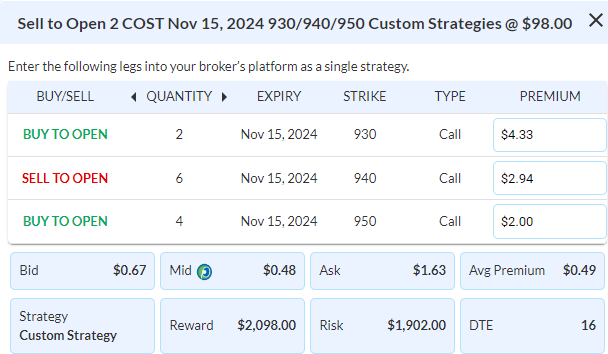

$COST

DailyPlay – Opening Trade (COST) – October 30, 2024

COST Bearish Opening Trade Signal

Investment Rationale

Costco Wholesale Corporation (COST) recently broke down from its trading range with strong momentum, underperforming the S&P 500 and signaling further downside potential toward our $800 target. Costco is Significantly Overvalued and trades at more than twice the valuation of its peers, despite growth and profitability metrics that are only average within the industry, highlighting considerable downside risks.

COST – Daily

Trade Details

Strategy Details

Strategy: Modified Call Butterfly

Direction: Bearish Modified Call Butterfly

Details: Sell to Open 2 COST Nov 15 $930/$940/$950 Modified Call Butterflies @ $0.49 Credit per Contract. Please carefully consider the amount of Contracts for each leg of this spread, which is (Buy 1x$930 Call) & (Sell 3x$940 Calls) & (Buy 2x$950 Calls) per Contract. Refer to Entering the Trade, right at the bottom where we opened 2 Contracts.

Total Risk: This trade has a max risk of $1,902 (2 Contracts x $951) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $951 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is underperforming and is expected to continue lower.

1M/6M Trends: Bearish/Neutral

Relative Strength: 9/10

OptionsPlay Score: 250

Stop Loss: @ $0.98 (100% loss to value of premium received)

View COST Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View COST Trade

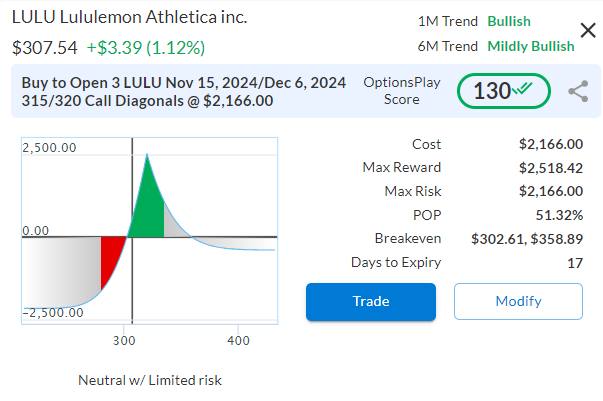

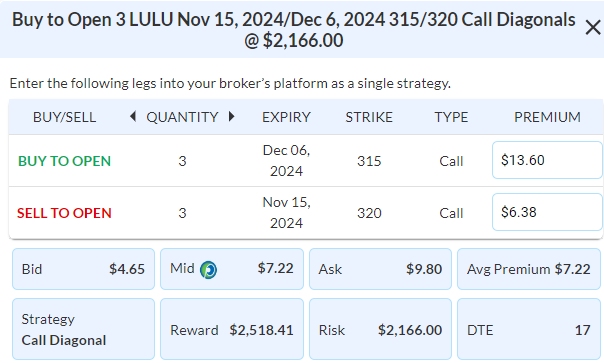

$LULU

DailyPlay – Opening Trade (LULU) – October 29, 2024

LULU Bullish Opening Trade Signal

Investment Rationale

Lululemon Athletica Inc. (LULU) recently broke out above its trading range with strong momentum, outperforming the S&P 500 and signaling potential upside toward our $320 target. LULU trades at a 10% discount to its peers, with projected revenue growth nearly twice the industry average and significantly higher profitability. Its forward P/E ratio stands at 20.37x, compared to the industry average of 22.05x. The company’s earnings announcement is anticipated in the first week of December.

LULU – Daily

Trade Details

Strategy Details

Strategy: Long Call Diagonals

Direction: Bullish Call Diagonals

Details: Buy to Open 3 LULU Nov 15/Dec 6 $315/$320 Call Diagonals @ $7.22 Debit per Contract.

Total Risk: This trade has a max risk of $2,166 (5 Contracts x $722) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $722 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue its bullish trajectory.

1M/6M Trends: Bullish/Mildly Bullish

Relative Strength: 3/10

OptionsPlay Score: 130

Stop Loss: @ $3.61 (50% loss of premium)

View LULU Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View LULU Trade

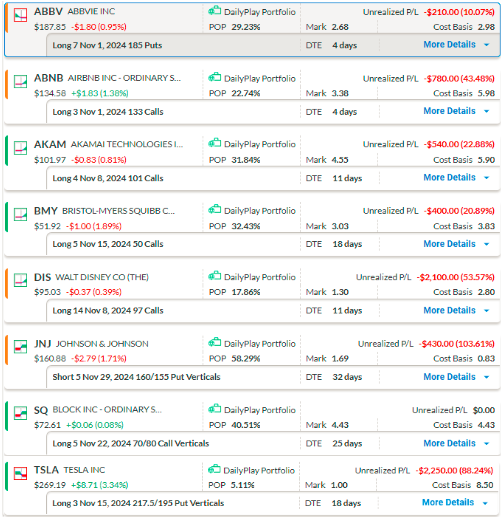

$ABBV, $ABNB, $AKAM, $DIS, $TSLA

DailyPlay – Closing Trade (ABBV, ABNB, AKAM, DIS, TSLA) & Portfolio Review – October 28, 2024

Closing Trades

- ABBV – 10.07% loss: Sell to Close 7 Contracts (or 100% of your Contracts) November 1 $185 Puts @ $2.68 Credit. DailyPlay Portfolio: By Closing all 7 Contracts, we will receive $1,876. We initially opened these 7 Contracts on September 27 @ $2.98 Debit. Our loss on this trade, therefore, is $30 per Contract.

- ABNB – 43.48% loss: Sell to Close 3 Contracts (or 100% of your Contracts) November 1 $133 Calls @ $3.38 Credit. DailyPlay Portfolio: By Closing all 3 Contracts, we will receive $1,014. We initially opened these 3 Contracts on October 18 @ $6.38 Debit. Our loss on this trade, therefore, is $300 per Contract.

- AKAM – 22.88% loss: Sell to Close 4 Contracts (or 100% of your Contracts) November 8 $101 Calls @ $4.55 Credit. DailyPlay Portfolio: By Closing all 4 Contracts, we will receive $1,820. We initially opened these 4 Contracts on October 16 @ $5.90 Debit. Our loss on this trade, therefore, is $135 per Contract.

- DIS – 53.57% loss: Sell to Close 14 Contracts (or 100% of your Contracts) November 8 $97 Calls @ $1.30 Credit. DailyPlay Portfolio: By Closing all 14 Contracts, we will receive $1,820. We initially opened these 14 Contracts on October 21 @ $1.64 Debit. Our loss on this trade, therefore, is $34 per Contract.

- TSLA – 88.28% loss: Sell to Close 3 Contracts (or 100% of your Contracts) November 15 $217.50/$195 Put Vertical Spreads @ $1.00 Credit. DailyPlay Portfolio: By Closing all 3 Contracts, we will receive $300. We initially opened these 3 Contracts on October 22 @ $8.50 Debit. Our loss on this trade, therefore, is $750 per Contract.

DailyPlay Portfolio Review

Our Trades

ABBV – 4 DTE

Bearish Puts – ABBV (AbbVie Inc.) drifted lower this past week. The anticipated earnings date is 10/30/24, and the gradual rise in implied volatility (IV) as earnings approach has kept our out-of-the-money November 1st put option in play. However, with only 4 days to expiration (DTE) and the stock not quite reaching the strike, it’s time to close the position. We are closing this position today.

ABNB – 4 DTE

Bullish Calls – Not much has changed with our Airbnb, Inc. (ABNB) position since we established it, aside from some initial strong momentum. With earnings scheduled for Thursday, October 30, we’re seeing a gradual increase in implied volatility (IV), which has provided some support to our Buy to Open 3 ABNB Nov 1 $133 Calls, though the stock remains stagnant. With only four days to expiration (DTE) and earnings right around the corner, it’s time to close the position. We are closing this position today.

AKAM – 11 DTE

Bullish Calls – The stock has reversed course, and our long call position is not performing well. With 11 days to expiration (DTE) remaining and earnings scheduled for Thursday, November 7, it’s time to close the position. We are closing this position today.

BMY – 18 DTE

Bullish Calls – Bristol-Myers Squibb Co. (BMY) recently broke out above its trading range and has since stalled, but we’ll keep a close eye on this position. With the upcoming earnings announcement scheduled before the market opens on October 31, 2024, we’re observing a gradual increase in implied volatility, which supports our decision to stay the course for now.

DIS – 11 DTE

Bullish Calls – We rolled this trade a week ago and due to a change in the market direction. We are closing this position today.

JNJ – 32 DTE

Bullish Credit Spread – Johnson & Johnson (JNJ) stock price is trading around the short strike of our put vertical spread. We’ll stay the course for now but will adjust or close in the near term if necessary.

SQ – 25 DTE

Bullish Debit Spread – Block Inc. (SQ) The company’s earnings are expected on November 7th, and there is a good possibility that we will remain in this position through the report.

TSLA – 18 DTE

Bearish Debit Spread – Tesla, Inc. (TSLA) gapped up after the company’s earnings report, and since we were bearish on the trade, it’s time to close the position. We are closing this position today.

$VIX

DailyPlay – Opening Trade (VIX) – October 25, 2024

VIX Bearish Opening Trade Signal

Investment Rationale

The market has been on quite a ride since early August, with the SPX hitting three new highs: first in mid-August, then mid-September, and now mid-October. Each time, it has pulled back slightly, only to rally again, as if on “buy-the-dip” autopilot. Since the significant downturn in August, the SPX has formed a distinct wedge pattern, indicating uncertainty about its next direction. Meanwhile, the VIX is reminding us that it’s election season. There is considerable buzz about institutions positioning themselves for either a Trump or Harris victory, along with speculation about what rising bond yields might signal for the upcoming election. However, this chatter hasn’t yet shaken up the broader indexes. Until the election results are final, the VIX appears determined to maintain its grip on the market, showing no signs of allowing the market to run free.

Given this outlook, we speculate that the VIX will drift lower after the election results are in. To capitalize on this, we will implement a bearish Long Put Vertical Spread strategy using puts in the VIX index.

VIX – Daily

Trade Details

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 12 VIX Nov 20 $19/$16 Put Vertical Spreads @ $1.57 Debit per Contract.

Total Risk: This trade has a max risk of $1,884 (12 Contracts x $157) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $157 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on an instrument that is expected to trade lower over the duration of this trade.

1M/6M Trends: Neutral/Neutral

Stop Loss: @ $0.79 (50% loss of premium)

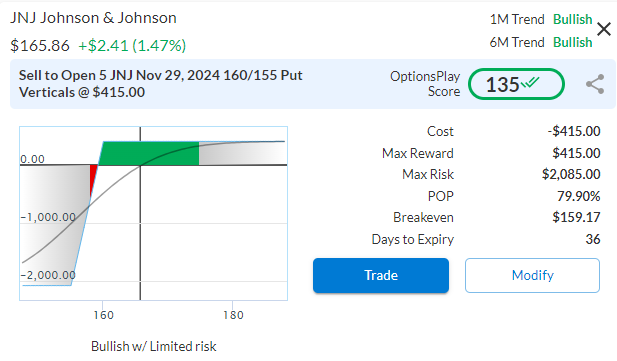

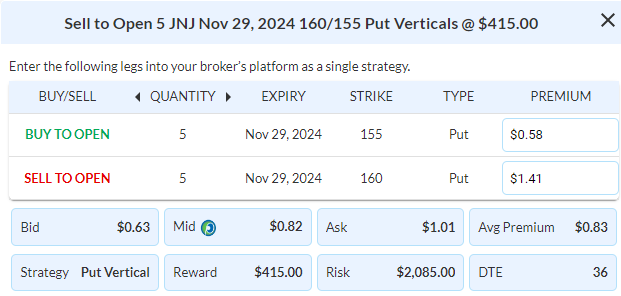

$JNJ

DailyPlay – Opening Trade (JNJ) – October 24, 2024

JNJ Bullish Opening Trade Signal

Investment Rationale

Johnson & Johnson (JNJ) rebounded from its $160 support level after breaking above resistance, indicating potential to reach its $170 target. The stock has climbed to around $165, about halfway to that goal. While JNJ is expected to grow slightly slower than the industry average, its superior profitability, including higher net margins, justifies its premium valuation relative to peers. This strong profitability is a key factor supporting the stock’s potential for further upside. In this marketplace, we’re looking at a neutral-to-bullish put vertical spread or a bull put spread, a less aggressive approach that allows us to sell some of the general market volatility.

JNJ – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 5 JNJ Nov 29 $160/$155 Put Vertical Spreads @ $0.83 Credit per Contract.

Total Risk: This trade has a max risk of $2,085 (5 Contracts x $417) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $417 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to break higher off recent support.

1M/6M Trends: Bullish/Bullish

Relative Strength: 8/10

OptionsPlay Score: 135

Stop Loss: @ $1.66 (100% loss to the value of premium received)

View JNJ Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.