$SQ

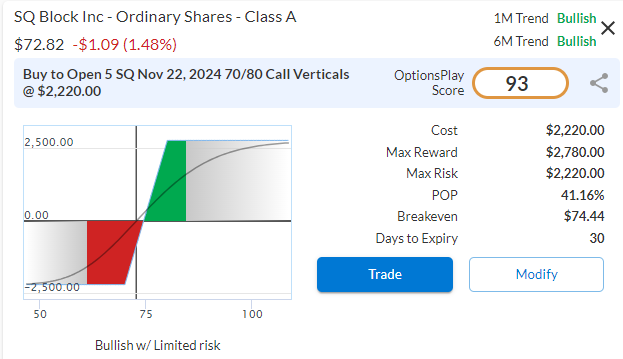

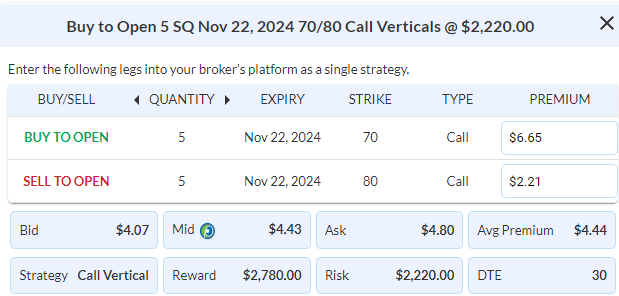

DailyPlay – Opening Trade (SQ) – October 23, 2023

SQ Bullish Opening Trade Signal

Investment Rationale

Block Inc. (SQ) has recently broken out of its trading range with strong momentum, continuing to outperform the S&P 500 and signaling potential upside toward our $80 target. Currently trading between $62.50 and $85, SQ is modestly undervalued at 16x forward earnings compared to the industry average of 27x. While its low-margin business model impacts profitability, SQ’s rapid growth suggests it could reach a more reasonable valuation of 19-20x forward earnings. With increasing investor interest, the stock shows strong growth potential. The company’s earnings are expected on November 7th, and there is a good possibility that we will remain in this position through the report.

SQ – Daily

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 5 SQ Nov 22 $70/$80 Call Vertical Spreads @ $4.44 Debit per Contract.

Total Risk: This trade has a max risk of $2,220 (5 Contracts x $444) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $444 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue its bullish trajectory.

1M/6M Trends: Bullish/Bullish

Relative Strength: 4/10

OptionsPlay Score: 93

Stop Loss: @ $2.22 (50% loss of premium)

View SQ Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View SQ Trade

$TSLA

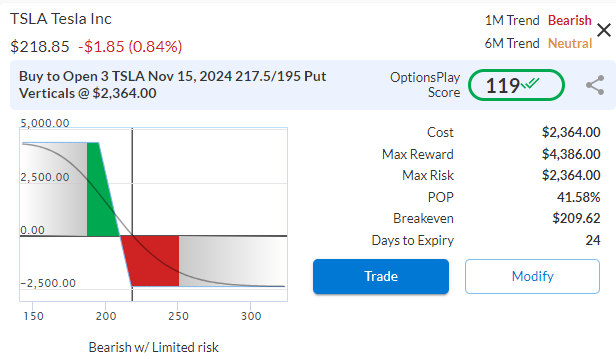

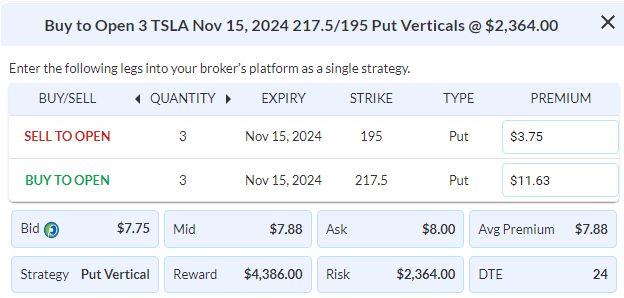

DailyPlay – Opening Trade (TSLA) – October 22, 2024

TSLA Bearish Opening Trade Signal

Investment Rationale

TSLA recently broke down from its trading range with strong momentum an underperforming the S&P 500, providing an opportunity for further downside to our $200 target. After a disappointing Robotaxi reveal, news of Waymo’s expansion, and increased competition in the EV space, TSLA’s prospects are significantly dimmed and its 70x forward earnings poses a significant risk in its valuation.

TSLA – Daily

Trade Details

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 3 TSLA Nov 15 $217.50/$195 Put Vertical Spreads @ $7.88 Debit per Contract.

Total Risk: This trade has a max risk of $2,364 (3 Contracts x $788) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $788 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to break below recent support.

1M/6M Trends: Bearish/Neutral

Relative Strength: 10/10

OptionsPlay Score: 119

Stop Loss: @ $3.94 (50% loss of premium)

View TSLA Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View TSLA Trade

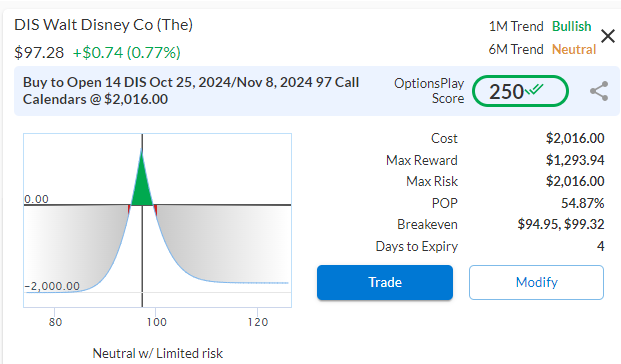

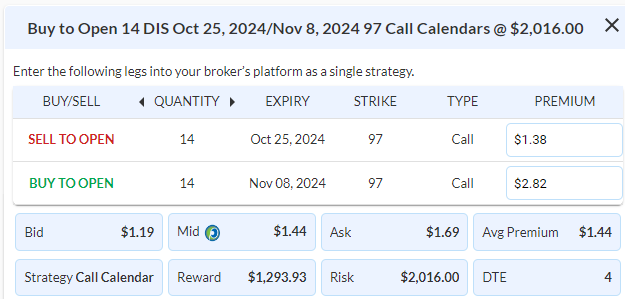

$DIS

DailyPlay – Closing Trades (AAPL, DIS) & Rolling Trade (DIS) & Portfolio Review – October 21, 2024

Closing Trades

- AAPL – 59% loss: Buy to Close 7 Contracts (or 100% of your Contracts) November 1 $225/$230 Call Vertical Spreads @ $3.77 Debit. DailyPlay Portfolio: By Closing all 7 Contracts, we will pay $2,639. We initially opened these 7 Contracts on October 8 @ $2.38 Credit. Our loss on this trade, therefore, is $139 per Contract.

- DIS – 18% gain: Sell to Close 8 Contracts (or 100% of your Contracts) Oct 25/Nov 15 $95 Call Calendars @ $2.89 Credit. DailyPlay Portfolio: By Closing all 8 Contracts, we will receive $2,312. We initially opened these 8 Contracts on October 11 @ $2.45 Debit. Our gain on this trade, therefore, is $352.

DIS Bullish Rolling/Closing & Opening Trade Signal

Investment Rationale

The Walt Disney Company (DIS): DIS recently broke out above its trading range, and we need to adjust our calendar spread. We are rolling our front-month October calls “up and out” from the $95 strike Calls to the November 8th $97 strike Calls. DIS will be reporting on November 14th, and our back-month options expire the day after the announcement.

By Rolling DIS we are Closing the existing trade and Opening a new one.

DIS – Daily

Trade Details

Strategy Details

Strategy: Long Call Calendar

Direction: Bullish Call Calendars

Details: Buy to Open 14 DIS Oct 25/Nov 8 $97 Call Calendar Spreads @ $1.44 Debit per Contract.

Total Risk: This trade has a max risk of $2,016 (14 Contracts x $144) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $144 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher off recent support.

1M/6M Trends: Bullish/Neutral

Relative Strength: 2/10

OptionsPlay Score: 250

Stop Loss: @ $0.72 (50% loss of premium)

View DIS Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View DIS Trade

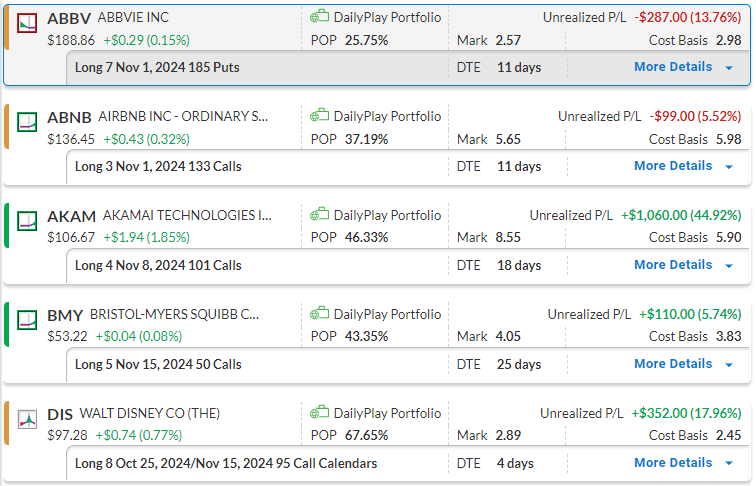

DailyPlay Portfolio Review

Our Trades

ABBV – 11 DTE

Bearish Puts – ABBV (AbbVie Inc.) drifted lower this past week. The anticipated earnings date is 10/30/24, and the gradual rise in implied volatility (IV) as earnings approach has kept our out-of-the-money November 1st put option in play. However, with only 11 days to expiration (DTE) and the stock not quite reaching the strike, it’s time to close the position.

ABNB – 11 DTE

Bullish Calls – Not much has changed with our Airbnb, Inc. (ABNB) position since we established it, apart from some initial strong momentum. With earnings scheduled for Thursday, October 30th, we are seeing a gradual increase in implied volatility (IV), which has impacted our Buy to Open 3 ABNB Nov 1st $133 Calls. Even though the stock remains stagnant, the rising IV continues to support our strategy. We plan to close the position before the earnings announcement, as we didn’t initiate the trade to take on the risk of the earnings event.

AKAM – 18 DTE

Bullish Calls – We are observing upside momentum building in Akamai Technologies (AKAM) following its recent breakout, and we currently hold a long call position, which is doing well. With 18 days to expiration (DTE) remaining and the upcoming earnings date on Thursday, November 7th, we anticipate an increase in implied volatility due to this known event, which should provide support and help justify our decision to stay the course for now.

BMY – 25 DTE

Bullish Calls – Bristol-Myers Squibb Co. (BMY) recently broke out above its trading range, and the upside momentum has continued. With the upcoming earnings announcement scheduled for before the market opens on October 31, 2024, we are observing a gradual increase in implied volatility due to this known event, which once again helps justify our decision to stay the course for now.

DIS – 4 DTE

Bullish Calendar Spreads – The Walt Disney Company (DIS): DIS recently broke out above its trading range, and we need to adjust our calendar spread. We are rolling our front-month October calls “up and out” from the $95 strike Calls to the November 8th $97 strike Calls. DIS will be reporting on November 14th, and our back-month options expire the day after the announcement.

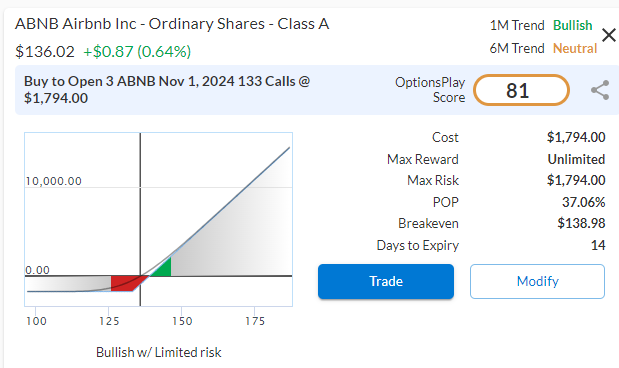

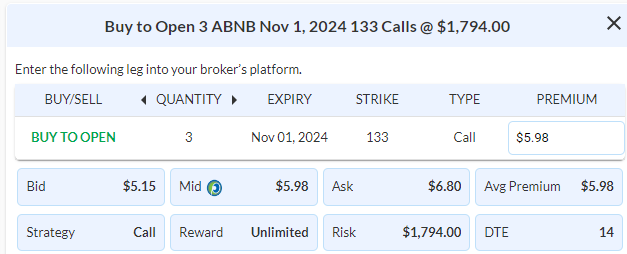

$ABNB

DailyPlay – Closing Trade (META) Opening Trade (ABNB) – October 18, 2024

Closing Trade

META – 79% loss: Sell to Close 4 Contracts (or 100% of your Contracts) October 18 $585/$600/$610 Call Butterfly Spreads @ $0.87 Credit. DailyPlay Portfolio: By Closing all 4 Contracts, we will receive $480. We initially opened these 24 Contracts on October 10 @ $4.18 Debit. Our loss on this trade, therefore, is $331 per Contract.

ABNB Bullish Opening Trade Signal

Investment Rationale

Airbnb, Inc. (ABNB) recently broke out above its trading range with strong momentum, outperforming the S&P 500 and presenting further upside potential toward our $145 target. While ABNB trades at a premium compared to its peers, it is expected to deliver faster top and bottom-line growth, and it remains significantly more profitable, making it modestly undervalued. With earnings scheduled for Thursday, October 30th, we will incorporate the anticipated increase in implied volatility from this event into our strategy selection.

ABNB – Daily

Trade Details

Strategy Details

Strategy: Long Call

Direction: Bullish Calls

Details: Buy to Open 3 ABNB Nov 1st $133 Calls @ $5.98 Debit per Contract.

Total Risk: This trade has a max risk of $1,794 (3 Contracts x $598) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $598 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher off recent support.

1M/6M Trends: Bullish/Neutral

Relative Strength: 3/10

OptionsPlay Score: 81

Stop Loss: @ $2.99 (50% loss of premium)

View ABNB Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View ABNB Trade

$MMM

DailyPlay – Closing Trade (MMM) – October 17, 2024

Closing Trade

- MMM – 84% loss: Sell to Close 24 Contracts (or 100% of your Contracts) October 18 $135/$131 Put Vertical Spreads @ $0.20 Credit. DailyPlay Portfolio: By Closing all 24 Contracts, we will receive $480. We initially opened these 24 Contracts on October 1 @ $1.25 Debit. Our loss on this trade, therefore, is $105 per Contract.

Investment Rationale

As we approach expiration MMM has rallied above our $135 resistance level and warrants closing out this trade just before expiration.

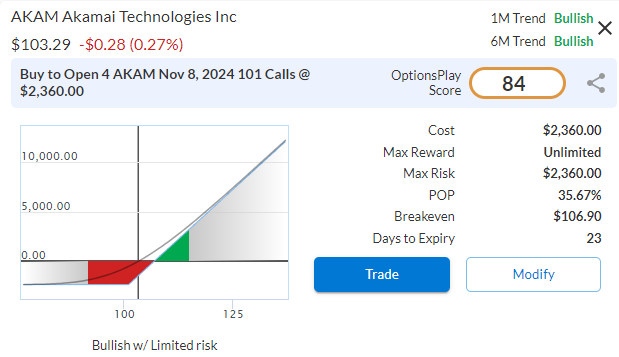

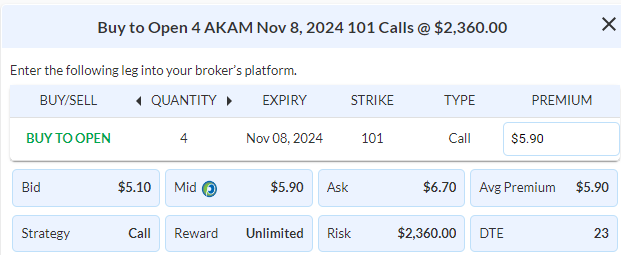

$AKAM

DailyPlay – Opening Trade (AKAM) – October 16, 2024

AKAM Bullish Opening Trade Signal

Investment Rationale

Akamai Technologies (AKAM) recently broke out above its $102.50 resistance level, with a potential target of $125. The chart shows a long period of underperformance, followed by a bottoming formation, and now it appears to be breaking out. While often overlooked, Akamai’s edge computing servers are well-suited for AI applications, offering faster service and enhanced security. Despite trading at a discount, Akamai’s technology could play a crucial role in AI deployment, potentially driving future revenue growth. With the upcoming Earnings Date on Thursday November 7th, we will use the potential implied volatility increase caused by this known event in our strategy choice.

AKAM – Daily

Trade Details

Strategy Details

Strategy: Long Call

Direction: Bullish Calls

Details: Buy to Open 4 AKAM Nov 8 $101 Calls @ $5.90 Debit per Contract.

Total Risk: This trade has a max risk of $2,360 (4 Contracts x $590) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $590 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher off recent support.

1M/6M Trends: Bullish/Bullish

Relative Strength: 5/10

OptionsPlay Score: 84

Stop Loss: @ $2.95 (50% loss of premium)

View AKAM Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AKAM Trade

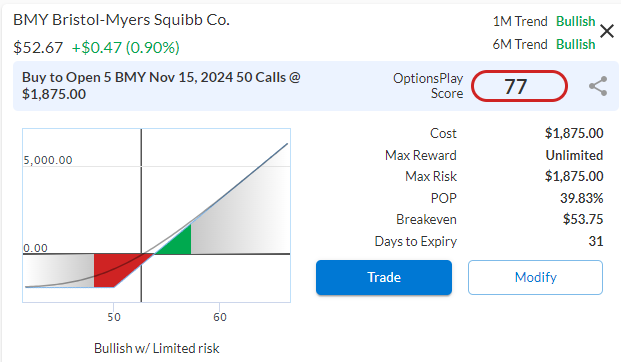

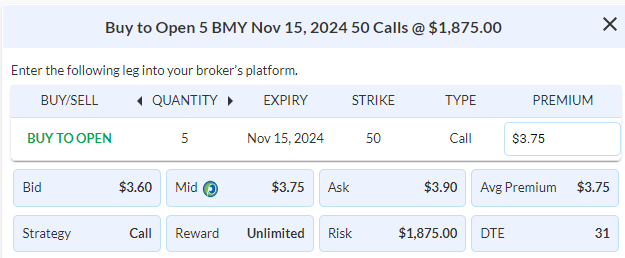

$BMY

DailyPlay – Opening Trade (BMY) – October 15, 2024

BMY Bullish Opening Trade Signal

Investment Rationale

Bristol-Myers Squibb Co. (BMY) recently broke out above its trading range with strong momentum, outperforming the S&P 500 and presenting a promising upside toward our $60 target. The stock has strengthened by turning former resistance levels into support. We view the recent selloff as a compelling buying opportunity, as BMY currently trades at a significant discount to its peers. Emerging from a period of net losses, BMY is expected to return to profitability by 2025, positioning the stock for further gains and bringing it more in line with its industry. With the upcoming earnings announcement before the open on October 31, 2024, we will factor this event into our strategy selection.

BMY – Daily

Trade Details

Strategy Details

Strategy: Long Call

Direction: Bullish Calls

Details: Buy to Open 5 BMY Nov 15 $50 Calls @ $3.75 Debit per Contract.

Total Risk: This trade has a max risk of $1,875 (5 Contracts x $375) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $375 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher off recent support.

1M/6M Trends: Bullish/Bullish

Relative Strength: 7/10

OptionsPlay Score: 77

Stop Loss: @ $1.88 (50% loss of premium)

View BMY Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View BMY Trade

$RACE

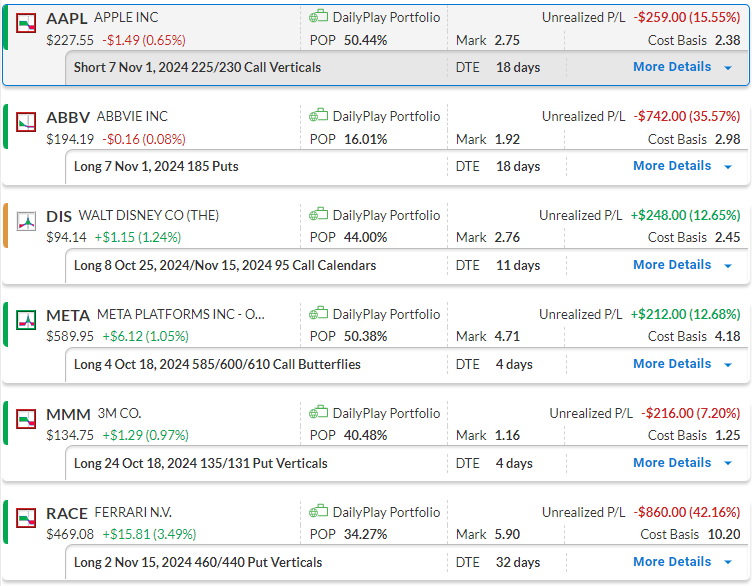

DailyPlay – Closing Trade (RACE), Portfolio Review – October 14, 2024

Closing Trade

RACE – 42.16% loss: Sell to Close 2 Contracts (or 100% of your Contracts) November 15 $460/$440 Put Vertical Spreads @ $5.90 Credit. DailyPlay Portfolio: By Closing both Contracts, we will receive $1,180. We initially opened these 2 Contracts on October 7 @ $10.20 Debit. Our loss on this trade, therefore, is $430 per Contract.

Investment Rationale

We are Closing this position today based on recent news that might influence the stock price. Recent news: JPMorgan upgraded Ferrarri (RACE) from Neutral to Overweight and massively upgraded its price target from $385 to $525 per share. Analysts cited such attributes as Ferrarri’s unit volume growth, discipline, and innovation as drivers for the upgrade and price target boost.

DailyPlay Portfolio Review

Our Trades

AAPL – 18 DTE

Bearish Credit Spread – In Apple Inc. (AAPL) we recently rolled our credit spread position out and down to the November 1 $225/$230 call vertical to collect another $2.08 in credit. The trend is still bearish, and we are staying the course while remaining aware that the company is anticipated to announce earnings on October 31st.

ABBV – 18 DTE

Bearish Puts – ABBV (AbbVie Inc.) is still holding below its $195 support and maintains downside potential as it continues to underperform relative to the market. The anticipated earnings date is 10/30/24, and the gradual increase in implied volatility (IV) as earnings approach has kept our out-of-the-money (OTM) put alive in this trade. However, the position is on a short leash this week. If the stock closes above $195 or does not start drifting downward, we will close the position and move on from our long puts.

DIS – 11 DTE

Bullish Calendar Spreads – After struggling to grow in recent quarters, DIS has reversed course, showing improvements in both revenue and EPS growth. With the company set to report on November 14th, this known event plays a significant role in our strategy. Ideally, we’d like the stock to slow its roll, or we may have to roll the short-term option contracts up and out. The bullish move this week is positive for our position, but with a strike at $95, we don’t want the stock to move too quickly above our strike. It’s not a bad problem to have, but we may need to adjust sooner rather than later if the bullish trend continues.

META – 4 DTE

Bullish Call Butterflies – Meta has been volatile recently but is currently within the wings of our modified butterfly, giving us a smidgen of a gain. We still think the stock can retest the $600 level, but with the expiration date approaching this Friday, the position will be interesting to watch as it reflects every stock price tick until then. We need to monitor this position closely.

MMM – 4 DTE

Bearish Debit Spread – 3M Company (MMM) is still lingering in overbought territory, with expiration fast approaching this Friday. We currently have a small gain on the position, but this is another one we need to keep a close eye on.

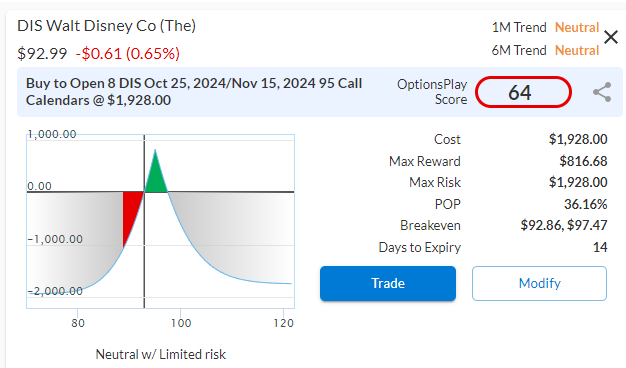

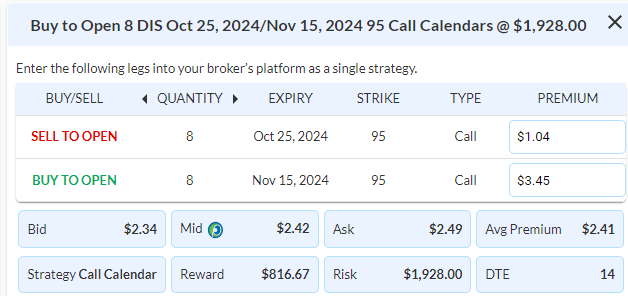

$DIS

DailyPlay – Opening Trade (DIS) – October 11, 2024

DIS Bullish Opening Trade Signal

Investment Rationale

Casting a line to do some bottom fishing in The Walt Disney Company (DIS): DIS recently broke out above its trading range and has since pulled back to the $92 support level, offering an attractive risk/reward entry for bullish exposure. From a fundamentals perspective, the stock appears modestly undervalued. After struggling to grow over the past few quarters, DIS has reversed course, showing improvements in both revenue and EPS growth. For the trailing twelve months (TTM), the company has posted record revenues and net income. Also, ’tis the season for earnings announcements, and DIS will be reporting on November 14th—this event will be factored into our strategy selection.

DIS – Daily

Trade Details

Strategy Details

Strategy: Long Call Calendar Spread

Direction: Bullish Calendar Spread

Details: Buy to Open 8 DIS Oct 25/Nov 15 $95 Call Calendar Spreads @ $2.41 Debit per Contract.

Total Risk: This trade has a max risk of $1,928 (8 Contracts x $241) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $241 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher off recent support.

1M/6M Trends: Neutral/Neutral

Relative Strength: 2/10

OptionsPlay Score: 64

Stop Loss: @ $1.22 (50% loss of premium)

View DIS Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View DIS Trade

$META

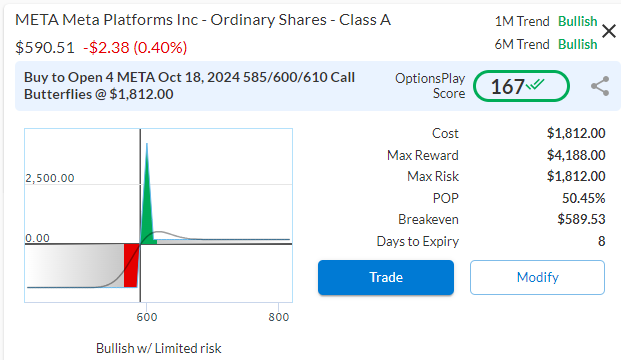

DailyPlay – Opening Trade (META) – October 10, 2024

META Bullish Opening Trade Signal

Investment Rationale

Although META is currently overvalued, it trades at a discount relative to its industry peers and is expected to achieve faster growth in both revenue and earnings going forward. Additionally, its higher profitability suggests further upside potential. Recently, META broke out of its trading range, reaching our target of $600 before pulling back slightly ahead of its highly anticipated earnings report at the end of the month. We expect the stock to retest the $600 level before the earnings announcement, and as part of our strategy, we will employ option contracts expiring prior to the report.

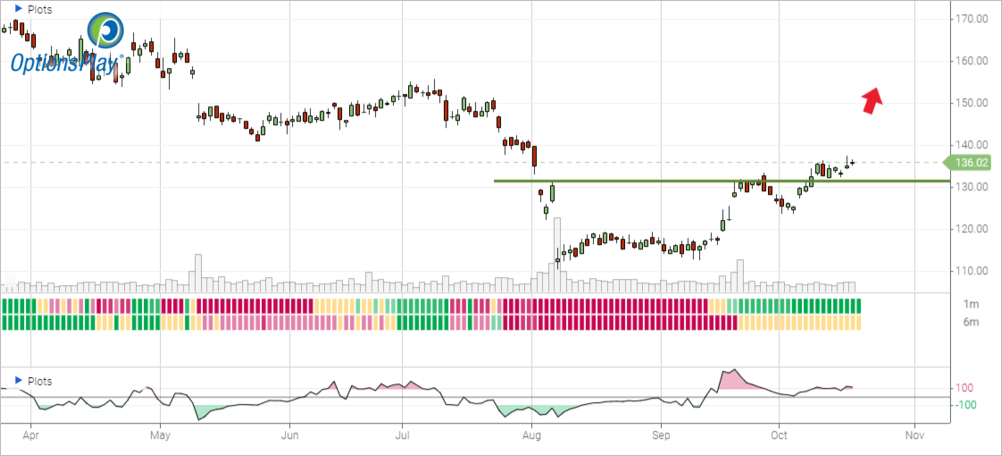

META – Daily

Trade Details

Strategy Details

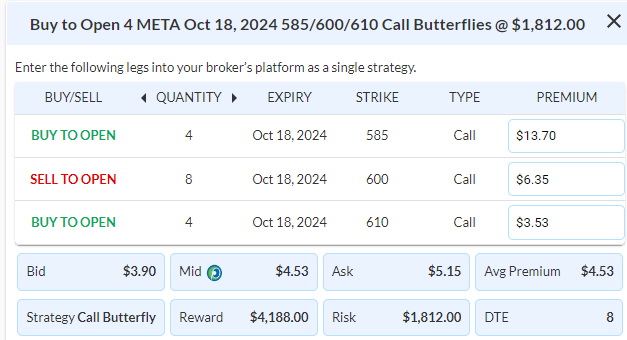

Strategy: Long Call Butterfly

Direction: Bullish Call Butterfly

Details: Buy to Open 4 META October 18 $585/$600/$610 Call Butterflies @ $4.53 Debit per Contract.

Total Risk: This trade has a max risk of $1,812 (4 Contracts x $453) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $453 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 167

Stop Loss: @ $2.27 (50% loss of premium)

View META Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.