$UBER, $DHI

DailyPlay – Closing Trades (UBER, DHI) – September 25, 2024

Closing Trades

- UBER – 90% gain: Buy to Close 8 Contracts (or 100% of your Contracts) Oct 4th $69/$66 Put Vertical Spreads @ $0.05 Debit. DailyPlay Portfolio: By Closing these Contracts, we will pay $40. We initially opened these 8 Contracts on September 66 @ $0.47 Credit. Our gain, therefore, is $336.

- DHI – 20.93% loss: Sell to Close 1 Contract (or 100% of your Contracts) Oct 4th $182.50/$207.50 Rish Reversal @ $0.52 Credit. DailyPlay Portfolio: By Closing this Contract, we will receive $52. We initially opened this Contract on September 18 @ $0.43 Debit. Our loss, therefore, is $9.

- DHI – 13.41% loss: Sell to Close 1 Contract (or 100% of your Contracts) Jan 17th $170 Call @ $29.70 Credit. DailyPlay Portfolio: By Closing this Contract, we will receive $2,970. We initially opened this Contract on September 19 @ $34.30 Debit. Our loss, therefore, is $460.

Investment Rationale

Our CLX trade is staying on course with these Puts as the stock recently dropped to 161.28 (low on 9/19) from 165.95 so it might have doubled on that day. For now we are keeping these trades open as we still have 23 days left until.

We are closing our UBER trade today for $0.05 Debit. There are still 9 days left until expiry so makes sense to close for a nickel today.

DHI closed at $192.37. The stock ran up to 199.85 on the 19th and was at $195.35 when we put the trade on. I most likely would not have sold the call on that day; however, it has sadly reversed course and is now at $192.37 as of September 24. With only 9 days left for the options to expire, we can still sell the call for $0.30 at the midpoint, and I would do that. Additionally, I would buy back the short put at the midpoint price of $0.80, only because we bought the deep-in-the-money call in DHI the very next day, which gives us long exposure to DHI. It is only a 1×1 spread, so let’s close this trade and be done with it. If we hadn’t bought the long call, I would just stay the course.

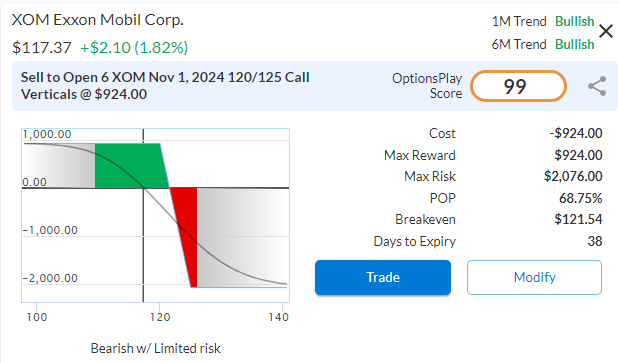

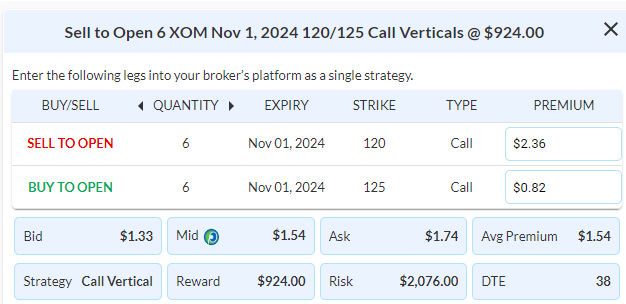

$XOM

DailyPlay – Opening Trade (XOM) – September 24, 2024

XOM Bearish Opening Trade Signal

Investment Rationale

XOM recently broke down below its trading range and has rallied back to its $117 resistance, providing an attractive risk/reward entry for bearish exposure. With revenue decline expected, EPS growth that is inline and Net margins below the industry average, XOM trades at a 13% premium relative to its industry suggesting possible downside. The stock has struggled to break out above 120. In fact, it hasn’t stayed above that level for a substantial amount of time since the end of April.

XOM – Daily

Trade Details

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 6 XOM November 1 $120/$125 Call Vertical Spreads @ $154 Credit per Contract.

Total Risk: This trade has a max risk of $2,076 (6 Contracts x $346) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $346 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bearish trade on a stock that is currently bullish and expected to pull back from recent highs.

1M/6M Trends: Bullish/Bullish

Relative Strength: 5/10

OptionsPlay Score: 99

Stop Loss: @ $308 (100% loss to the value of premium)

View XOM Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View XOM Trade

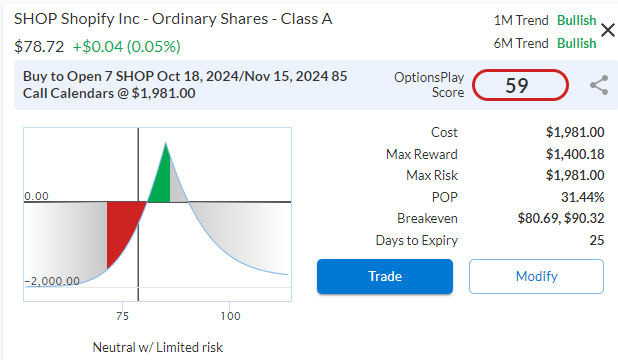

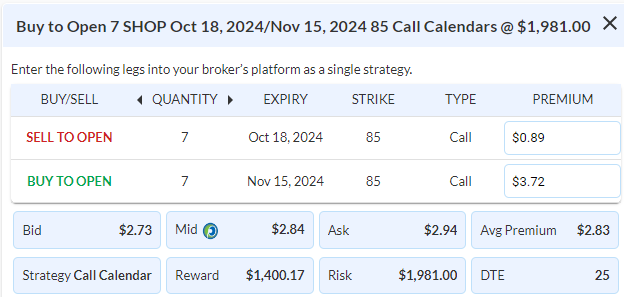

$SHOP

DailyPlay – Opening Trade (SHOP) Closing Trades (ADBE, MAR) – September 23, 2024

Closing Trades

- ADBE – 101.90% loss: Buy to Close 1 Contract (or 100% of your Contracts) Oct 25th $570/$530 Put Vertical Spread @ $29.68 Debit. DailyPlay Portfolio: By Closing this Contract, we will pay $2,968. We initially opened this Contract on September 11 @ $14.70 Credit. Our loss, therefore, is $1,498.

- MAR – 126.14% loss: Buy to Close 4 Contracts (or 100% of your Contracts) Oct 4th $225/$235 Call Vertical Spreads @ $9.95 Debit. DailyPlay Portfolio: By Closing these 4 Contracts, we will pay $3,980. We initially opened these 4 Contracts on August 27 @ $4.40 Credit. Our loss, therefore, is $555 per Contract.

SHOP Bullish Opening Trade Signal

Investment Rationale

Shopify (SHOP) recently broke out of its trading range and has since pulled back to the $67 support level, offering an attractive risk/reward opportunity for bullish exposure. With an EV-to-forward revenue ratio of 8x, in line with the industry average, Shopify’s valuation is well-supported by its significantly higher earnings per share (EPS) growth of 185% and revenue growth of 21%, compared to the industry. This makes the stock appear fairly valued. As the company is set to announce earnings in early November, we have factored this upcoming event into the selection of our option strategy.

SHOP – Daily

Trade Details

Strategy Details

Strategy: Long Call Calendar Spread

Direction: Bullish Long Call Calendar

Details: Buy to Open 7 SHOP Oct 18, 2024/Nov 15, 2024 $85 Call Calendar @ $283.00 Debit per Contract.

Total Risk: This trade has a max risk of $283 (7 Contract x $1,981) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $298 to select the # contracts for your portfolio.

Trend Continuation Signal: Momentum is bullish on SHOP following its recent breakout above the trading range, with expectations that the upward trend will continue.

1M/6M Trends: Bullish/Bullish

Relative Strength: 5/10

OptionsPlay Score: 59

Stop Loss: @ $142 (50% loss to the value of premium)

View SHOP Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View SHOP Trade

$DHI

DailyPlay – Opening Trade (DHI) – September 19, 2024

DHI Bullish Opening Trade Signal

Investment Rationale

The CME FedWatch tool indicated this week about a 50/50 chance between a 25 basis point cut and a 50 basis point cut. Rumor has it that someone eavesdropping outside the FOMC meeting overheard Chair Powell quip, “hold my beer,” as the Fed went ahead and announced their decision to cut the Fed funds rate by 50 basis points. The Federal Reserve also signaled plans for two more rate cuts later this year, followed by an additional four cuts in 2025.

Regarding yesterday’s Daily Play in D.R. Horton (DHI), the larger cut implies that mortgage rates will most likely decrease more rapidly. The stock drifted lower during the session, and our FOMO trade from yesterday is still alive and performing reasonably well. Given the Fed’s decision to cut by 50 basis points, along with the technical and fundamental outlook, we decided to build on yesterday’s trade and initiate another position in DHI for today’s trade.

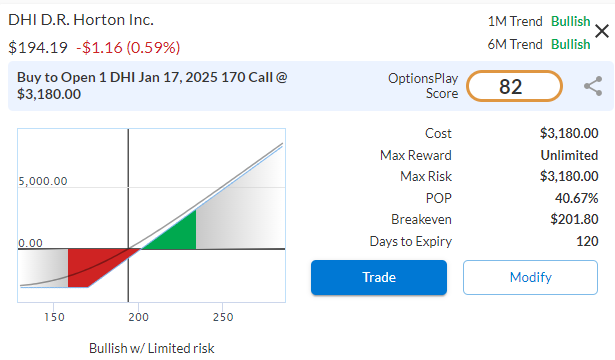

DHI – Daily

Trade Details

Strategy Details

Strategy: Long-Term Deep In-The-Money Call

Direction: Bullish Long Call

Details: Buy to Open 1 DHI Jan 17, 2025 $170 Call @ $31.80 Debit per Contract.

Total Risk: This trade has a maximum risk of $3,180. We are using the option contract as a substitute for buying 100 shares of stock. The delta of the option is 0.80, which provides a good representation of the stock price movement. The concept behind this trade is to reduce risk compared to using all the capital to purchase 100 shares of stock. This way, the risk would be limited to the price you paid for the call option, or about 16% of the cost to buy 100 shares of stock. The number of contracts to purchase would depend on your plan for the outright stock purchase. For example, if your intention was to buy 300 shares, you would buy 3 option contracts. If you were looking to buy 200 shares, you would buy 2 option contracts, and so on.

Trend Continuation Signal: A bullish trade on a stock that has broken out of its trading range with strong momentum.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 82

Stop Loss: @ $15.90 credit (50% loss of premium)

View DHI Trade

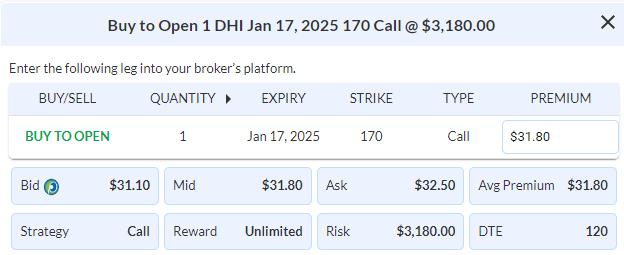

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View DHI Trade

$DHI

DailyPlay – Opening Trade (DHI) – September 18, 2024

DHI Bullish Opening Trade Signal

Investment Rationale

The Federal Reserve is poised to cut interest rates today for the first time in four years. This policy shift could significantly impact market dynamics across various sectors, but none more so than the housing industry. Lower rates reduce borrowing costs, making mortgages more affordable and potentially boosting home demand. For example, the average 30-year mortgage rate dropped to 6.2% last week, its lowest in 18 months, down from nearly 7.8%, according to Freddie Mac.

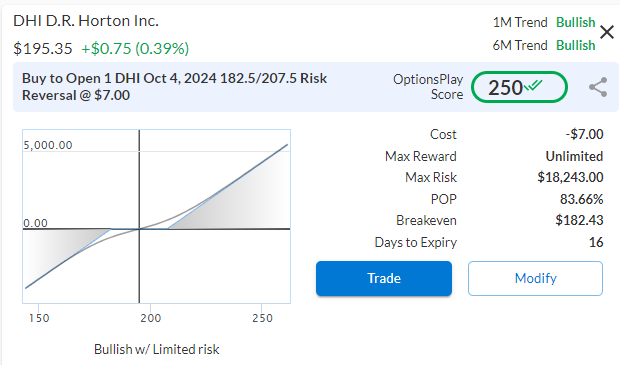

For today’s trade in DHI, industry professionals might refer to it as a Combo or Risk Reversal strategy, but we call it the “FOMO Strategy” (Fear of Missing Out). We prefer to implement this strategy in a potential “buy the rumor, sell the news” scenario, which we fear might be the case with the housing sector in general.

DHI – Daily

Trade Details

Strategy Details

Strategy: Risk Reversal (Short Put and Long Call)

Direction: Bullish

Details: Buy to Open 1 DHI Oct 4 $182.5/$207.5 Put/Call Risk Reversal @ $7.00 net Credit per Contract.

Total Risk: This trade has a maximum risk of $18,243. It is typically executed on a cash-secured basis, meaning you would be willing to buy 100 shares of DHI at the put strike price of $182.50 (100 x 182.50 = $18,250) and then subtract the net credit of $7, resulting in a maximum risk of $18,243.

Trend Continuation Signal: A bullish but nervous trade on a stock that has broken out of its trading range with strong momentum but could be in a potential “buy the rumor, sell the news” scenario.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 250

Stop Loss: N/A

View DHI Trade

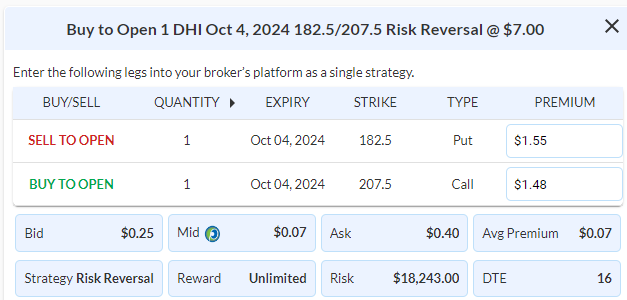

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View DHI Trade

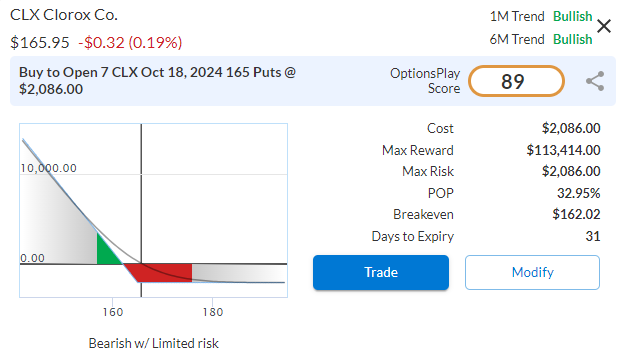

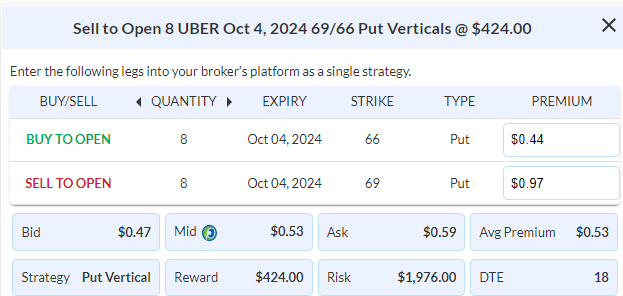

$CLX

DailyPlay – Opening Trade (CLX) – September 17, 2024

CLX Bearish Opening Trade Signal

Investment Rationale

This bearish trade was selected for CLX due to the company’s overbought conditions following the parabolic move to the upside after the strong earnings announcement on August 1st. Additionally, the stock is fundamentally overvalued, trading at a significant premium to its peers despite average growth metrics and weaker margins, which further supports the likelihood of a downturn.

CLX – Daily

Trade Details

Strategy Details

Strategy: Long Put

Direction: Bearish Put

Details: Buy to Open 7 CLX Oct 18 $165 Puts @ $2.98 Debit per share.

Total Risk: This trade has a max risk of $2,086 (7 Contracts x $298) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $298 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bearish trade on a stock that has recently entered overbought territory, which increases the possibility of a selloff in the near future.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 89

Stop Loss: @ $1.49 Credit (50% loss of premium)

View CLX Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View CLX Trade

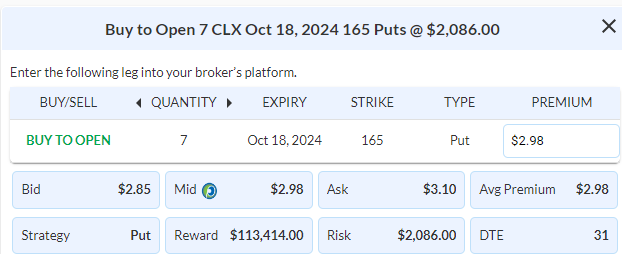

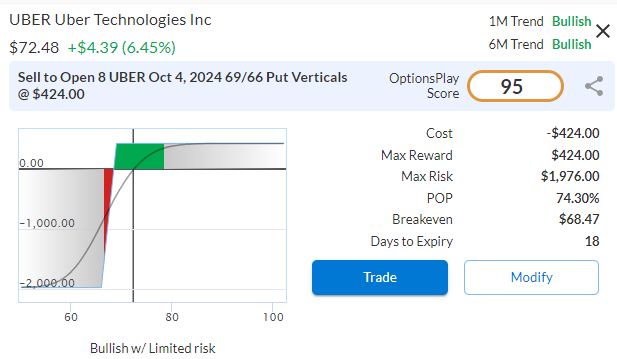

$UBER

DailyPlay – Opening Trade (UBER) – September 16, 2024

UBER Bullish Opening Trade Signal

Investment Rationale

Based on recent news, Uber Technologies gapped up at the open on Friday and closed near its high for the day. The news has slightly spiked implied volatility on short-term options, so we chose a bullish strategy that anticipates continued momentum to the upside while expecting implied volatility to realign with historical levels in the short term.

UBER – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 8 UBER Oct 4 $69/$66 Put Verticals @ $0.53 Credit per share.

Total Risk: This trade has a max risk of $1,976 (8 Contracts x $247) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $247 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock we expect to maintain its upward momentum after its recent breakout to the upside.

1M/6M Trends: Bullish/Bullish

Relative Strength: 3/10

OptionsPlay Score: 95

Stop Loss: @ $1.06 Debit (100% loss to the value of premium)

View UBER Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View UBER Trade

$ETN

DailyPlay – Closing Trade (ETN) – September 13, 2024

Closing Trade

- ETN- 41.21% loss: Buy to Close 2 Contracts (or 100% of your Contracts) Oct 18th $290/$310 Call Vertical Spreads @ $11.65 Debit. DailyPlay Portfolio: By Closing both Contracts, we will pay $2,330. We initially opened these 2 Contracts on September 6 @ $8.25 Credit. Our loss, therefore, is $340 per Contract.

Investment Rationale

With equity markets pushing higher as tech continue to lead, we must consider reducing our short exposure in the markets. One trade that we rolled was ETN after taking profits on it a couple of weeks ago, however we must reduce our exposure here as the equity markets continue to trade higher.

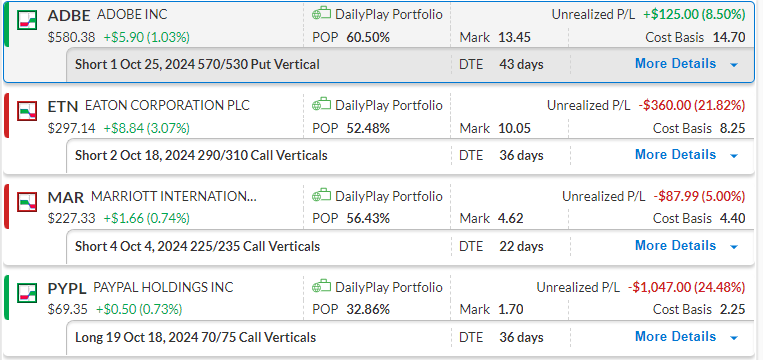

DailyPlay – Portfolio Review – September 12, 2024

DailyPlay Portfolio Review

Investment Rationale

Equity markets have shrugged off the CPI print and pricing in a 25bps cut in Sept, cementing a soft landing view of the economy. Technology has led the markets higher as OpenAI leads another equity round, valuing the company at over $150bn. This suggests that the AI race will continue to dominate equity flow for the foreseeable future as tech firms chase each other for AI dominance.

Our Trades

ADBE – 43 DTE

Bullish Credit Spread – ADBE made some gains yesterday and is currently trading above a key area of support of $580, indicating that further upside is likely.

ETN – 36 DTE

Bearish Credit Spread – With resistance at $300 holding, ETN remains setup for bearish momentum with $275 as the first target.

MAR – 22 DTE

Bearish Credit Spread – As MAR continue to trade lower off a recent high, we expect to see further downside with $215 being the first target.

PYPL – 36 DTE

Bullish Debit Spread – Support is holding above $68 and a continuation of the uptrend remain likely.

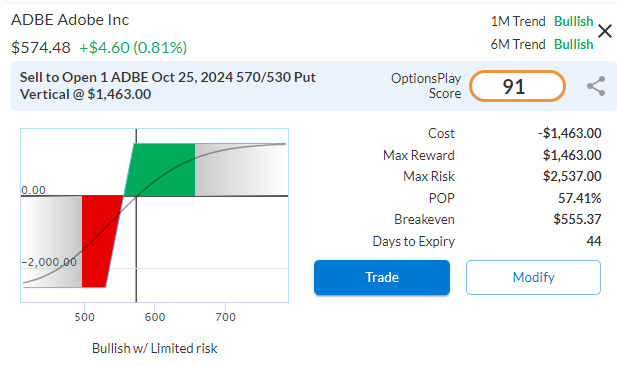

$ADBE

DailyPlay – Opening Trade (ADBE) – September 11, 2024

ADBE Bullish Opening Trade Signal

Investment Rationale

We’ve taken a bullish stance on ADBE for the past 2 quarters and with earnings later today, we are taking another stab at a bullish position going into earnings. As investors become more sensitive to the size of CapEx spending by tech firms to chase AI dominance, Adobe (ADBE) stands out as it already generates revenue from their AI models. Having shown strong performance over the past two quarters, particularly with its integration of AI-powered tools for content creators. With earnings on deck after the close today, this continued demand for Adobe’s AI tools positions the company for further growth, especially as digital content creation becomes prominent across industries.

Technical Analysis

ADBE is trading just above its $570 support/resistance zone. ADBE has tested this level multiple times over the past year, and a break above this resistance could signal a potential rally towards the $640 price target — which represents a historical high. If earnings surprise to the upside, we expect the stock to break out above $570 and continue its upward trend.

ADBE – Daily

Fundamental Analysis

ADBE remains a highly profitable company with an industry leading net margin of 25%. While its forward P/E ratio of 28 is elevated compared to industry peers, the company’s growth projections help justify the premium valuation. With expected EPS growth of 14%and revenue growth of 11%, Adobe maintain its leadership in the software industry. This is further supported by strong profitability metrics, such as a gross margin of 88%, that continue to outshine industry averages.

Trade Details

Strategy Details

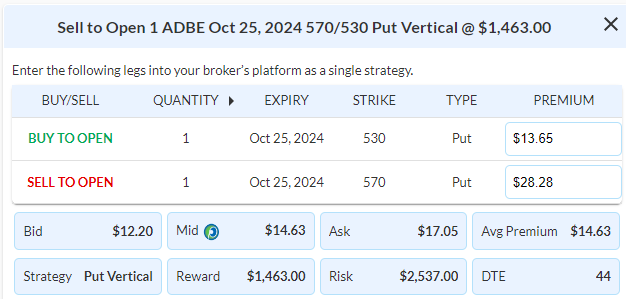

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 1 ADBE Oct 25th $570/$530 Put Vertical Spread $14.63 Credit per Contract.

Total Risk: This trade has a max risk of $2,537 (1 Contract x $2,537) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $2,537 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to break out to the upside.

1M/6M Trends: Bullish/Bullish

Relative Strength: 5/10

OptionsPlay Score: 91

Stop Loss: @ $29.26 Debit (100% loss to the value of premium)

View ADBE Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.