$MAR

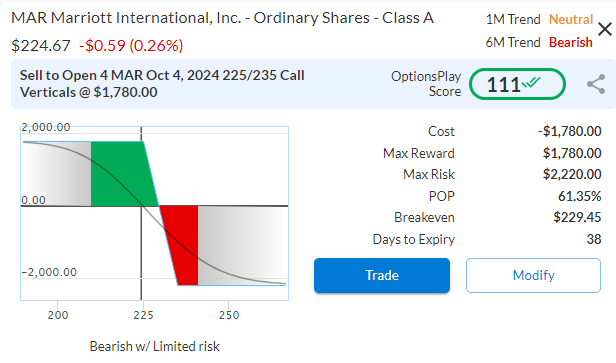

DailyPlay – Opening Trade (MAR) – August 27, 2024

MAR Bearish Opening Trade Signal

Investment Rationale

The hotel industry is facing growing headwinds as consumer spending on travel and discretionary items begins to slow. MAR has already issued softer guidance for the second half of the year. Despite being a dominant player in the hospitality industry, Marriott’s high valuation raises concerns about its ability to sustain its current stock price. This environment creates an attractive opportunity to add bearish exposure to MAR.

Technical Analysis

After breaking down below $230 support a few weeks ago, MAR has rallied back to this $230 resistance level and is now showing signs of further weakness. This is coupled with underperformance to the S&P 500 and momentum turning negative, which would target $213 initial targets to the downside with $180 extended targets.

MAR – Daily

Fundamental Analysis

If we look at the business, MAR is trading at a significantly higher valuation relative to its industry peers, at 24x forward earnings versus an 18x average. Despite this premium valuation, the company’s growth metrics are in line or slightly below industry averages, with expected EPS growth of only 6% compared to the industry average of 19%. These metrics suggest that Marriott is modestly overvalued, particularly in an environment where growth prospects are more uncertain.

Trade Details

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 4 MAR Oct 4th $225/$235 Call Vertical Spreads $4.45 Credit per Contract.

Total Risk: This trade has a max risk of $2,220 (4 Contracts x $555) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $555 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that made a lower high in a downtrend, and is expected to continue lower.

1M/6M Trends: Neutral/Bearish

Relative Strength: 3/10

OptionsPlay Score: 111

Stop Loss: @ $8.90 Debit (100% loss to the value of premium)

View MAR Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View MAR Trade

DailyPlay – Portfolio Review – August 26, 2024

DailyPlay Portfolio Review

Investment Rationale

As equities rally back towards their all-time highs, bond markets and other asset classes are confirming a risk-on environment. All eyes are on NVDA earnings this week, as AI has lead this market higher over the past 18 months and investors are keeping a close eye on CapEx spending and its future expected revenue. Any surprises to NVDA chip demand will likely have a large affect on how equities perform going forward. We are taking this time to review our DailyPlay portfolio.

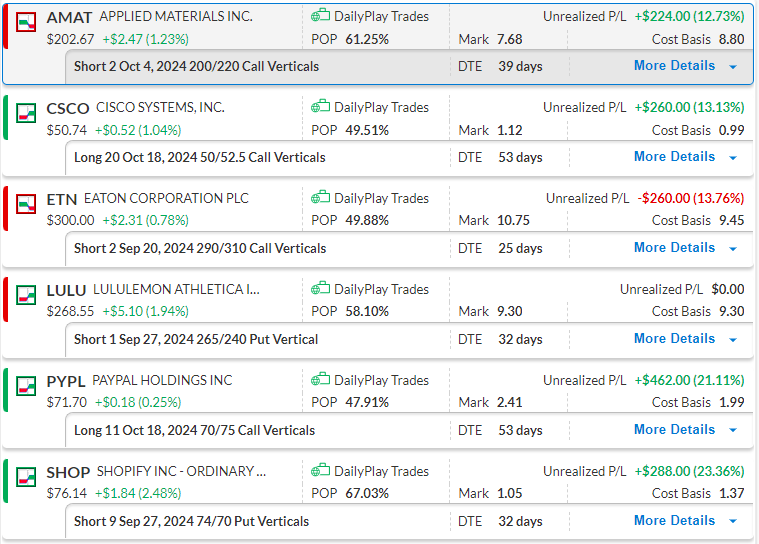

Our Trades

AMAT – 39 DTE

Bearish Credit Spread – AMAT is pulling back from a recent lower high and a break below $200 will likely target support at $190.

CSCO – 53 DTE

Bullish Debit Spread – Following a break above $50 CSCO is continuing higher. The next key level is at around $54.

ETN – 25 DTE

Bearish Credit Spread – Resistance at $300 remains intact and a break lower is likely following, with the next area of support at around $275.

LULU – 32 DTE

Bullish Credit Spread – Following a bounce off support at $250 LULU continues to grind higher, likely targeting a key level at around $295.

PYPL – 53 DTE

Bullish Debit Spread – We will keep a close eye on this trade as we see possible consolidation at this price level. A break above $73 is needed to warrant keeping this position.

SHOP – 32 DTE

Bullish Credit Spread – SHOP remains in a strong bullish trend with the next key level being at $80.

$AMAT

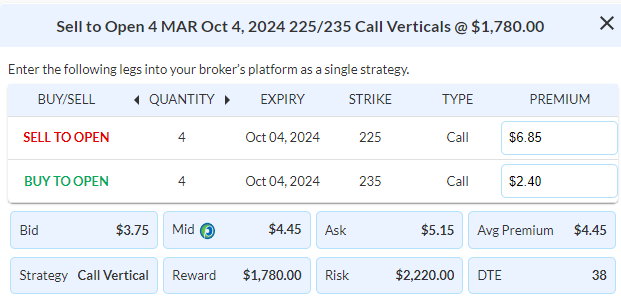

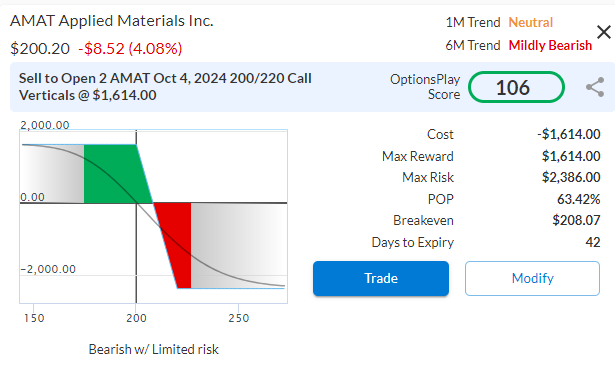

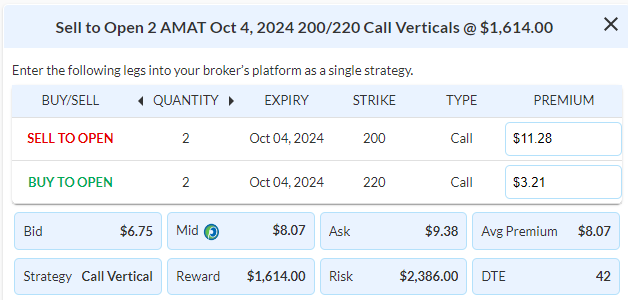

DailyPlay – Opening Trade (AMAT) – August 23, 2024

AMAT Bearish Opening Trade Signal

Investment Rationale

AMAT is facing headwinds as the broader semiconductor sector faces mounting pressure. The AI-driven rally that previously bolstered semiconductor stocks appears to be losing momentum, with concerns about high valuations and potential supply chain disruptions. As a key player in semiconductor manufacturing equipment, AMAT is vulnerable to these sector-wide challenges.

Technical Analysis

AMAT recently failed to break above the $215 resistance level, a critical area that has now been reaffirmed as resistance. The rejection at this level suggests that the stock’s upward momentum is slowing. The price action indicates a potential downside towards the $175 level, the next significant support.

AMAT – Daily

Fundamental Analysis

While AMAT has strong profitability metrics, its growth rates are significant lower than the industry and the broader semiconductor industry is facing a potential headwind for the AI trade that had previously driven the sector’s gains. Trading at 23x forward earnings, AMAT’s valuation is risky given the growing uncertainties surrounding future revenues.

Trade Details

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 2 AMAT Oct 4th $200/$220 Call Vertical Spreads $8.07 Credit per Contract.

Total Risk: This trade has a max risk of $2,386 (2 Contracts x $1,193) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $1,193 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that made a lower high in a downtrend.

1M/6M Trends: Neutral/ Mildly Bearish

Relative Strength: 4/10

OptionsPlay Score: 106

Stop Loss: @ $16.14 Debit (100% loss to the value of premium)

View AMAT Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AMAT Trade

$LULU

DailyPlay – Rolling Trade (LULU) – August 22, 2024

Closing Trade

- LULU – 49.23% gain: Buy to Close 2 Contracts (or 100% of your Contracts) Sept 20th $240/$220 Put Vertical Spreads @ $3.96 Debit. DailyPlay Portfolio: By Closing both Contracts, we will pay $792. We opened these 2 Contracts on August 9 @ $8.12 Credit. The gain, therefore, is $832 which is almost 1% gain on our Portfolio.

LULU Bullish Opening Trade Signal

Investment Rationale

As LULU trades higher on the back of better than expected consumer spending data, it has reached a take profit level. We are going to adjust this position by rolling it up and out to the Sept 27 $260/$240 Put Vertical @ $6.93 Credit. We are looking to continue this upward momentum and targeting $295 to the upside.

By Rolling LULU we will Close the initial trade and Open a new trade with different strikes and expiry date.

LULU – Daily

Trade Details

Strategy Details

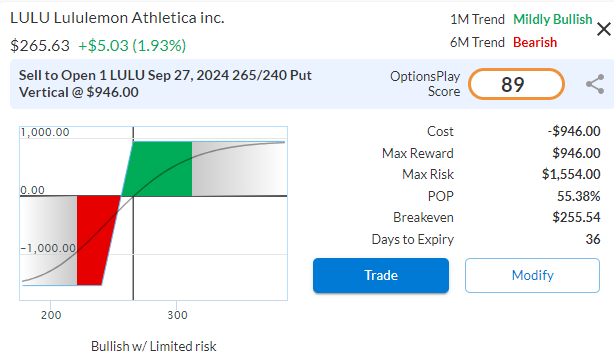

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 1 LULU Sept 27th $265/$240 Put Vertical Spread $9.46 Credit per Contract.

Total Risk: This trade has a max risk of $1,554 (1 Contract x $1,554) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $1,554 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is in a strong bullish trend and expected to continue higher.

1M/6M Trends: Mildly Bullish/Bearish

Relative Strength: 1/10

OptionsPlay Score: 89

Stop Loss: @ $18.92 Debit (100% loss to the value of premium)

View LULU Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View LULU Trade

$CSCO

DailyPlay – Opening Trade (CSCO) – August 21, 2024

CSCO Bullish Opening Trade Signal

Investment Rationale

As CSCO works through reinventing itself and shifting away from its core business of selling network hardware, there are some signs that investors are starting to pay attention. Despite revenues declining for the 3rd straight quarter and cost cutting, there are signs that brighter days are ahead for CSCO and worth considering for adding some bullish exposure.

Technical Analysis

Having been on a downtrend since Sept of last year, CSCO’s recent gap higher has broken the bearish trendline. It recently gapped higher on earnings and is now starting to breakout above its $50 resistance level, which would open up $53 gap fill and $54 upside targets.

CSCO – Daily

Fundamental Analysis

With its recent partnership with NVDA and focus on AI, CSCO’s shift into cybersecurity and software will allow it to trade a higher multiple. Currently at 20x forward earnings, its at a discount to its peer, due to its slower than expected growth, but that is expected to pickup over the next few quarters with margin expansion. This translates to some upside potential in its valuation.

Trade Details

Strategy Details

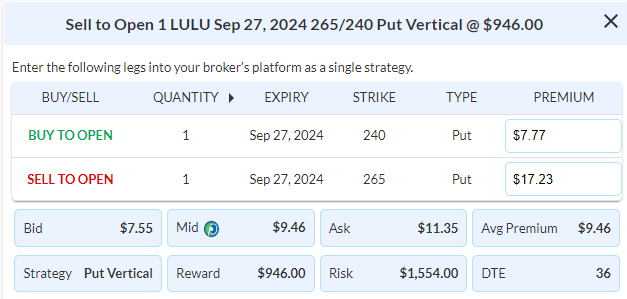

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 20 CSCO Oct 18th $50/$52.50 Call Vertical Spreads $1.01 Debit per Contract.

Total Risk: This trade has a max risk of $2,020 (20 Contracts x $101) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $101 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is in a strong bullish trend and expected to continue higher.

1M/6M Trends: Bullish/Bullish

Relative Strength: 7/10

OptionsPlay Score: 107

Stop Loss: @ $0.51 Debit (50% loss of premium)

View CSCO Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View CSCO Trade

$PYPL

DailyPlay – Opening Trade (PYPL) – August 20, 2024

PYPL Bullish Opening Trade Signal

Investment Rationale

We have taken a bullish stance on PYPL since April, and taking profits on trades earlier this month on earnings. PYPL has now triggered another bullish signal for a massive breakout higher and presents another buying opportunity for investors.

Technical Analysis

PYPL has formed a bottoming formation between $55 and $68 for the past year and just broke out above the $68 resistance level yesterday. Additionally, it has outperformed the market over the past 2 months on the breakout which is a good confirmation signal for the breakout.

PYPL – Daily

Fundamental Analysis

PYPL trades at 15x forward earnings, a 25% discount to the market despite averaging nearly 15% EPS growth over the past few years and improving operating margins of over 16%. Especially when analysts expect 13% EPS growth over the next few years. With very little debt and strong cash flows, the risks are low investing in PYPL at these valuations and reflect significant upside potential.

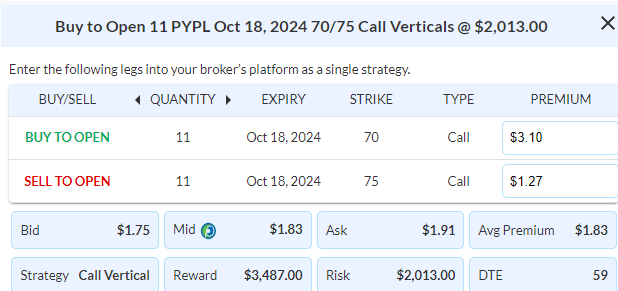

Trade Details

Strategy Details

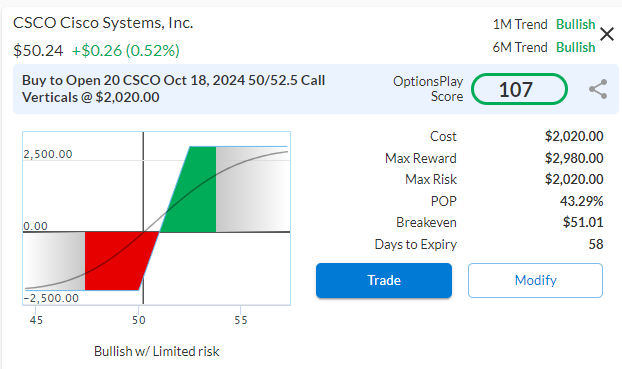

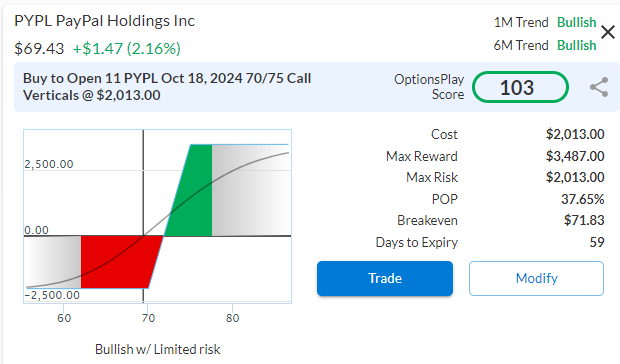

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 11 PYPL Oct 18th $70/$75 Call Vertical Spreads $1.83 Debit per Contract.

Total Risk: This trade has a max risk of $2,013 (11 Contracts x $183) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $183 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that bounced off support and is in a strong bullish trend.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 103

Stop Loss: @ $0.92 Credit (50% loss of premium)

View PYPL Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View PYPL Trade

$MSFT

DailyPlay – Closing Trade (MSFT) – August 19, 2024

Closing Trade

- MSFT – 27.57% gain: Buy to Close 1 Contract (or 100% of your Contracts) Sept 6th $420/$395 Put Vertical Spreads @ $6.41 Debit. DailyPlay Portfolio: By Closing this Contract, we will pay $641. We initially opened this Contract on July 26 @ $8.85 Credit. Our gain, therefore, is $244.

Investment Rationale

As short term momentum starts to roll over off the back of a strong rally over the past two weeks, technology stocks are at risk of a pullback if equity markets start to retest recent lows. With 18 days left, our MSFT position requires managing and we are going to take profits on this trade today as MSFT lagged behind the market on its rebound.

$SHOP

DailyPlay – Opening Trade (SHOP) Closing Trade (AAPL) – August 16, 2024

Closing Trade

- AAPL – 99.56% loss: Buy to Close 2 Contracts (or 100% of your Contracts) Sept 20th $210/$230 Call Vertical Spreads @ $13.67 Debit.

DailyPlay Portfolio: By Closing both Contracts, we will pay $2,734. We initially opened these 2 Contracts on Aug 6 @ $5.66 Credit. Our average loss, therefore, is $801 per Contract.

Investment Rationale

With the S&P 500 breaking out above a key resistance level at $5,450, we must adjust our positioning to shift with the more bullish tone. This includes closing out the short AAPL position and keeping ETN on a short leash. On the other hand today’s retail sales numbers have provided a significant boost to our LULU and MSFT position and look for opportunities to take profits by early next week.

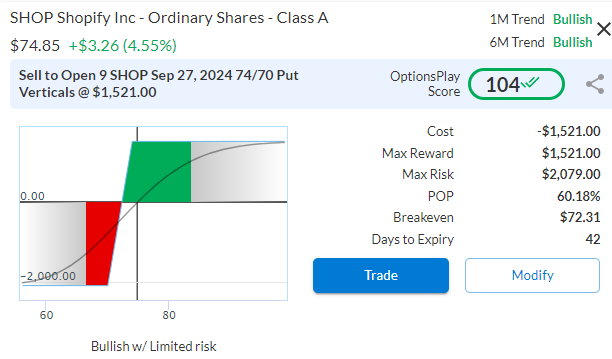

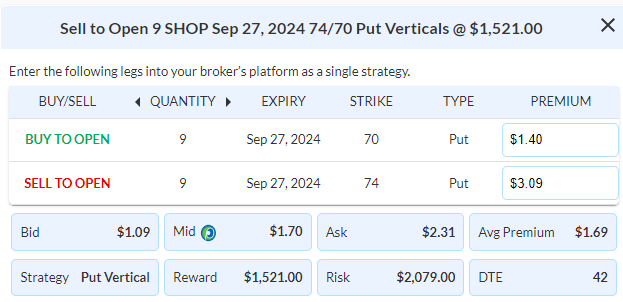

SHOP Bullish Opening Trade Signal

Investment Rationale

As AMZN continues to erode the rights of sellers on their platform, SHOP has benefited from this overall trend and presents a compelling opportunity driven by strong earnings momentum and favorable fundamentals. The stock has recently seen significant upward momentum, pushing it above a recent resistance level and targets the highs from earlier in the year.

Technical Analysis

The recent earnings momentum has catapulted SHOP higher, breaking above its $70 resistance level and 200-day moving average, a key area that now serves as support. Our immediate upside target is $80 on this breakout.

SHOP – Daily

Fundamental Analysis

Despite a slight premium, SHOP’s growth metrics far outpace those of its software peers. With an EV to Forward Revenue ratio of 10x compared to the industry average of 8x, Shopify’s valuation is justified by its expected EPS growth of 185% and revenue growth of 21%, both of which are significantly higher than industry averages. Shopify is well-positioned to capitalize on its growth potential without compromising profitability as margins are inline with the industry. Despite IV Rank of only 5%, the skew currently favors selling a bullish credit spread on SHOP.

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 9 SHOP Sept 27th $74/$70 Put Vertical Spreads $1.69 Credit per Contract.

Total Risk: This trade has a max risk of $2,079 (9 Contracts x $231) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $231 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that bounced off support and is expected to continue higher.

1M/6M Trends: Bullish/Bullish

Relative Strength: 4/10

OptionsPlay Score: 104

Stop Loss: @ $3.38 Debit (100% loss to the value of premium)

View SHOP Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View SHOP Trade

$NVDA

DailyPlay – Closing Trade (NVDA) – August 15, 2024

Closing Trade

- NVDA – 49.% gain: Buy to Close 3 Contracts (or 100% of your Contracts) Sept 20th $104/$90 Put Vertical Spreads @ $2.33 Debit. DailyPlay Portfolio: By Closing this Contract, we will pay $699. We initially opened these 3 Contracts on Aug 7 @ $4.60 Credit. Our gain, therefore, is $227 per Contract with a total gain of $681.

Investment Rationale

The inflation print this week largely came inline with expectations which cements a rate cut in Sept. Markets are pricing in 25bps of cuts in Sept and markets have reacted positively. As it continues to grind higher we have reached a take profit level on our NVDA trade and we are going to close that out today.

DailyPlay – Portfolio Review – August 14, 2024

DailyPlay Portfolio Review

Investment Rationale

With investors awaiting the CPI print this morning, we are going to hold off on adding any additional positions to the DailyPlay portfolio until we have more clarity as to the full picture of inflation and digest how the Fed will likely approach the September meeting.

Our Trades

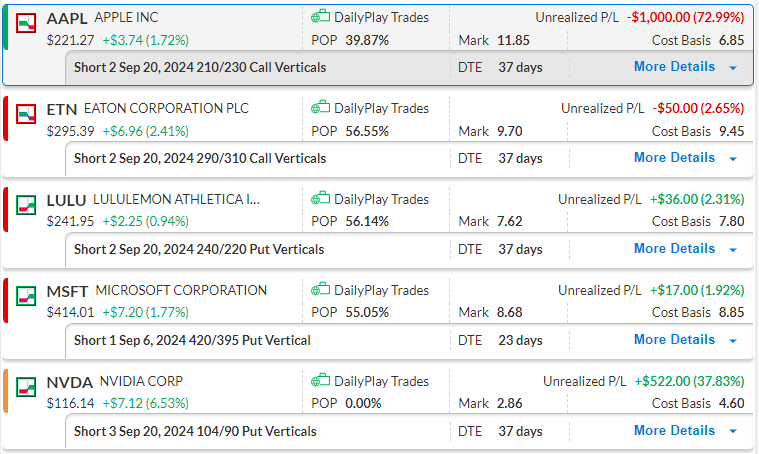

AAPL – 37 DTE

Bearish Credit Spread – AAPL is currently trading above a level of resistance and a break below $220 is needed to warrant keeping this trade. We will therefore keep a close eye on this trade over the next few days.

ETN – 37 DTE

Bearish Credit Spread – ETN is trading at an area of resistance between $297 and $300 and a pullback to lower levels is therefore likely.

LULU – 37 DTE

Bullish Credit Spread – Bounced off support at $230 and further upside is likely if price breaks above the $250 level.

MSFT – 23 DTE

Bullish Credit Spread – Bounced higher off support at $400 with the next upside target at $430.

NVDA – 37 DTE

Bullish Credit Spread – NVDA had a strong bounce off support at $100 and further upside seems likely, targeting $130 and then $140.