DailyPlay – Portfolio Review – September 10, 2024

DailyPlay Portfolio Review

Investment Rationale

As markets await the CPI print tomorrow morning, sentiment has been mixed after a strong effort on Monday to reverse Friday’s losses. However, as economic slowdown in Asia weighs on investors, the risks are still skewed to the downside. The CPI print tomorrow could be a catalyst for a 50bps rate cut if inflation comes in cooler than expected and may provide a short term boost to bullish optimism.

Our Trades

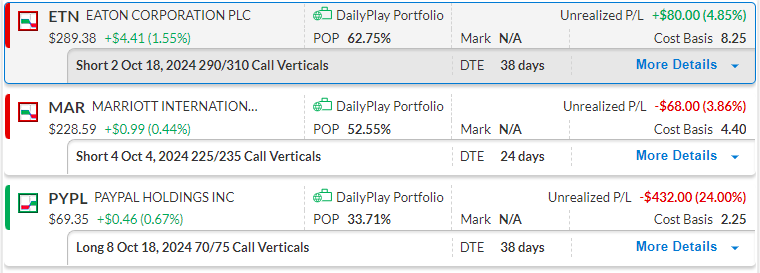

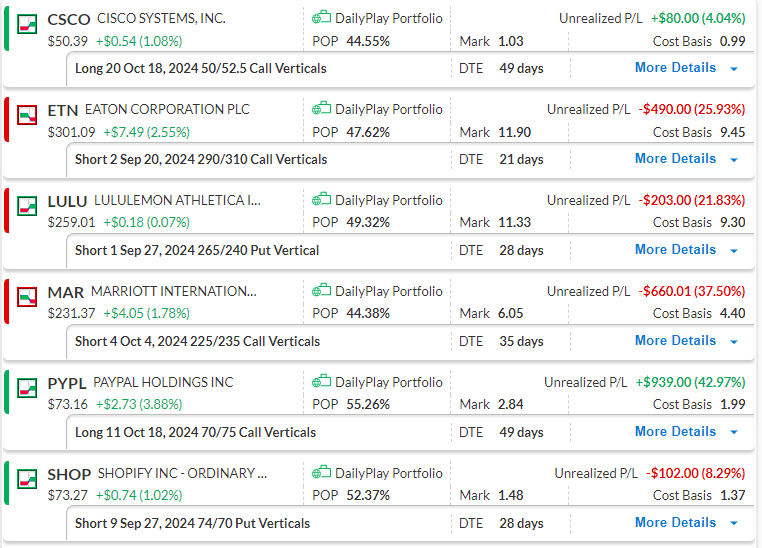

ETN – 38 DTE

Bearish Credit Spread – ETN is continuing to pull back from recent highs and our next bearish target is at around $270.

MAR – 24 DTE

Bearish Credit Spread – Recently made a lower high as MAR is trading lower, from where it is continuing the downtrend, with the next target at $210.

PYPL – 38 DTE

Bullish Debit Spread – With support holding at $69 – $70, we expect to see a continuation of the uptrend with the first upside target at $74.

$LULU, $SPY

DailyPlay – Closing Trades (LULU, SPY) – September 9, 2024

Closing Trades

- LULU- 26.34% loss: Buy to Close 1 Contract (or 100% of your Contracts) Sept 27th $265/$240 Put Vertical Spread @ $11.75 Debit. DailyPlay Portfolio: By Closing this Contract, we will pay $1,175. We initially opened this Contract on August 22 @ $9.30 Credit. Our loss, therefore, is $245.

- SPY- 90.73% gain: Sell to Close 5 Contracts (or 100% of your Contracts) Sept 20th $547/$530 Put Vertical Spreads @ $6.79 Credit. DailyPlay Portfolio: By Closing all 5 Contracts, we will receive $3,395. We initially opened these Contracts on September 5 @ $3.56 Debit. Our gain, therefore, is $1,615 which is more than 1.5% gain on our Portfolio.

Investment Rationale

As equity markets decline on the back of weaker than expected unemployment number and we have shifted out DailyPlay portfolio to gain more short exposure, it is time for us to review all long positions for opportunities to exit. Having already taking profits on our first LULU trade, let’s close out this 2nd trade at a small loss while maintaining a profit on the overall trade.

$ETN

DailyPlay – Rolling Trade (ETN) – September 6, 2024

Closing Trade

- ETN – 46.03% gain: Buy to Close 2 Contracts (or 100% of your Contracts) Sept 20th $290/$310 Call Vertical Spreads @ $5.10 Debit. DailyPlay Portfolio: By Closing both Contracts, we will pay $1,020. We opened these 2 Contracts on August 13 @ $9.45 Credit. The gain, therefore, is $870 which is almost 1% gain on our Portfolio.

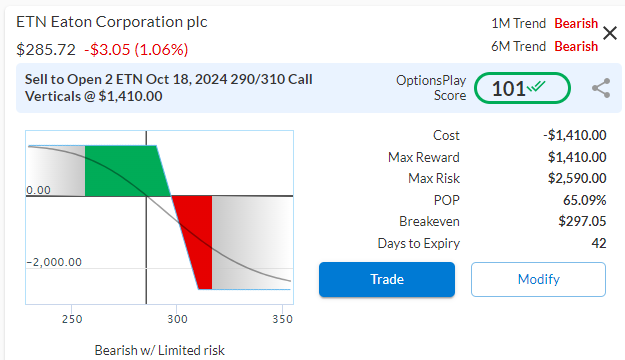

ETN Bearish Opening Trade Signal

Investment Rationale

As ETN trade reaches 2 weeks from expiration and has traded lower since we entered the trade, it’s time to take profits and roll our Sept $290/$310 Call Vertical down and out to the Oct $290/$310 Call Vertical for another @ $7.05 Credit.

By Rolling ETN we will Close the initial Trade and Open a new Trade with a later Expiry Date.

ETN – Daily

Trade Details

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 2 ETN Oct 18th $290/$310 Call Vertical Spreads $7.05 Credit per Contract.

Total Risk: This trade has a max risk of $2,590 (2 Contracts x $1,295) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $1,295 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that formed a lower high in a downtrend and is likely continuing lower.

1M/6M Trends: Bearish/Bearish

Relative Strength: 3/10

OptionsPlay Score: 101

Stop Loss: @ $14.10 Debit (100% loss to the value of premium)

View ETN Trade

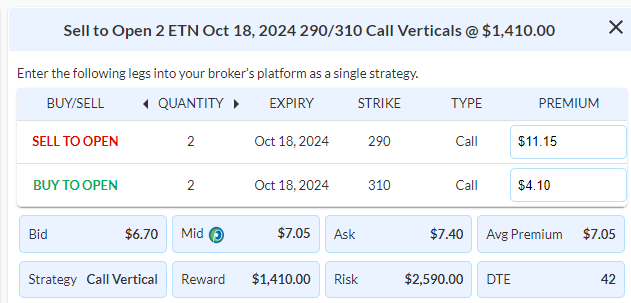

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View ETN Trade

$SPY

DailyPlay – Opening Trade (SPY) – September 5, 2024

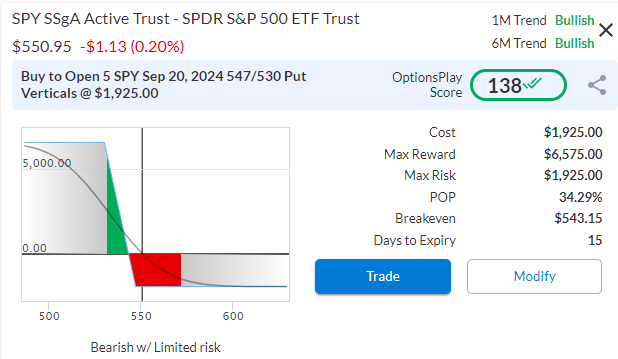

SPY Bearish Opening Trade Signal

Investment Rationale

As we head into this week’s payrolls data on Friday morning, there are signs that we could get another negative surprise, similiar to July’s numbers. JOLTs data this week came in weaker than expected and the Fed’s Survey for Aug shows a contraction in both manufacturing and services payrolls. The markets have been very sensitive and have reacted very strongly to poor jobs numbers and I believe it is worth while to put on a small hedge against further volatility at the end of this week with a put hedge on SPY.

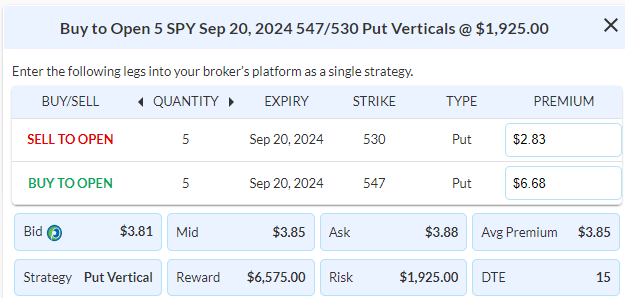

Buy Sept $547/530 Put Vertical @ $3.85 Debit, this would risk less than 1% of the ETF’s value to hedge against some short term volatility that could materialize on Friday.

SPY – Daily

Trade Details

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 5 SPY Sept 20th $547/$530 Put Vertical Spreads $3.85 Debit per Contract.

Total Risk: This trade has a max risk of $1,925 (5 Contracts x $385) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $385 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bearish trade on a stock that is expected to pull back to lower levels.

1M/6M Trends: Bullish/Bullish

Relative Strength: 7/10

OptionsPlay Score: 138

Stop Loss: @ $1.93 Credit (50% loss of premium)

View SPY Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View SPY Trade

$SHOP, $CSCO

DailyPlay – Closing Trades (SHOP, CSCO) – September 4, 2024

Closing Trade

- SHOP – 88.17% loss: Buy to Close 9 Contracts (or 100% of your Contracts) Sept 27th $74/$70 Put Vertical Spreads @ $2.58 Debit. DailyPlay Portfolio: By Closing all 9 Contracts, we will pay $2,322. We initially opened these Contracts on August 16 @ $1.37 Credit. Our loss, therefore, is $1,089.

- CSCO – 8.08% loss: Sell to Close 20 Contracts (or 100% of your Contracts) Oct 18th $50/$52.50 Call Vertical Spreads @ $0.91 Credit. DailyPlay Portfolio: By Closing all 20 Contracts, we will receive $1,820. We initially opened these Contracts on August 21 @ $0.99 Debit. Our loss, therefore, is $160.

Investment Rationale

Despite a shortened week for Labor Day, we have an outsized amount economic data due this week for the labor market. With the slowdown in manufacturing data and Fed surveys that show a continued cooling of the labor market, there is a heightened risk that non-farm payrolls on Friday will drive further market volatility. Due to this, we recommend reducing our overall long exposure in the DailyPlay portfolio for positions that have not yet reached their stop loss or take profit objective. We are going to close out our SHOP and CSCO trades as they have exposure to a slowdown in consumer spending and the overall semiconductor industry.

$PYPL

DailyPlay – Opening Trade (PYPL) – September 3, 2024

PYPL Bullish Opening Trade Signal

Investment Rationale

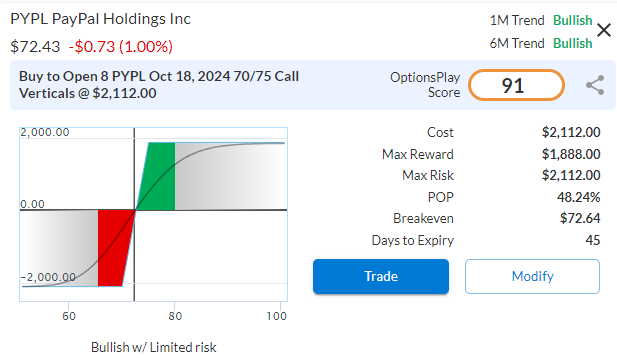

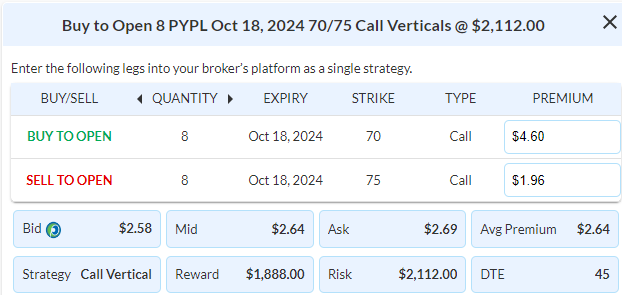

After breaking out above its $70 resistance level while outperforming the S&P 500, PYPL has now consolidated above this resistance level and offers an opportunity to add some additional exposure of 2% to seek a larger win on this trade.

PYPL – Daily

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 8 PYPL Oct 18th $70/$75 Call Vertical Spreads $2.64 Debit per Contract.

Total Risk: This trade has a max risk of $2,112 (8 Contracts x $264) based on a hypothetical $100,000 portfolio risking another 2%. We suggest using 2% of your portfolio value and divide it by $264 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue the bullish trend.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 91

Stop Loss: @ $1.32 Credit (50% loss of premium)

View PYPL Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View PYPL Trade

DailyPlay – Portfolio Review – August 30, 2024

DailyPlay Portfolio Review

Investment Rationale

Equity markets have responded positivity to the GDP numbers and the NVDA earnings, with the S&P now within spitting distance of the all-time highs. Investors will now turn to the labor market data next week to gauge the shape of overall economy. Consumer spending has been more resilient in 2024 that expected, however recent Fed data seems to show a cooling labor market, which could start to affect spending in the last quarter. We are going to take a pause from entering new positions and monitor our existing ones.

Our Trades

CSCO – 49 DTE

Bullish Debit Spread – Breakout above its key $50 resistance level is constructive for a continuation towards our $52.50 upside targets.

ETN – 21 DTE

Bearish Credit Spread – Testing $300 resistance, a breakout above would invalidate our trade thesis and warrant cutting losses on the trade.

LULU – 28 DTE

Bullish Credit Spread – Earnings report pushed the stock above $270 and should flip this to a profitable trade today.

MAR – 35 DTE

Bearish Credit Spread – Testing $234 resistance level, a breakout above would invalidate our trade thesis and warrant cutting losses on the trade.

PYPL – 49 DTE

Bullish Debit Spread – Positive momentum pushes PYPL towards our $75 target and look constructive for further upside.

SHOP – 28 DTE

Bullish Credit Spread – We’re looking for $72 support to hold and for SHOP to continue onto our $80 upside target.

$AMAT

DailyPlay – Closing Trade (AMAT) – August 29, 2024

Closing Trade

- AMAT – 41.25% gain: Buy to Close 2 Contract (or 100% of your Contracts) Oct 4th $200/$220 Call Vertical Spreads @ $5.17 Debit. DailyPlay Portfolio: By Closing both Contracts, we will pay $1,034. We initially opened this Contract on August 23 @ $8.80 Credit. Our gain, therefore, is $726.

Investment Rationale

After NVDA reported stronger than expected revenue and EPS numbers, the stock dropped about 7% after hours, but as of this morning has already pared some of those losses. Overall, the earnings report shows that demand for AI related hardware remains robust and expects that to continue into the 2nd half of this year. We are going to take this opportunity to close out our AMAT position that is currently up roughly 40% as equity markets respond positively to the report.

DailyPlay – Portfolio Review – August 28, 2024

DailyPlay Portfolio Review

Investment Rationale

With NVDA’s earnings due after the close today, there’s significant anticipation around whether the demand for AI-related hardware remains robust. We expect this report to have a significant impact on the overall direction of the market. NVDA has been at the forefront of the AI-driven market rally over the past 18 months, fueled by its leading position GPUs, essential for AI computation. However, as the market becomes increasingly sensitive to the enormous Capex required to sustain this growth, investors are seeking more clarity on when these investments will translate into substantial revenue.

Our Trades

AMAT – 37 DTE

Bearish Credit Spread – AMAT broke below the $200 level which solidifies our bearish thesis on this trade.

CSCO – 51 DTE

Bullish Debit Spread – As CSCO is trading above the $50 mark, we expect to see the next target to be between $52.50 and $54.

ETN – 23 DTE

Bearish Credit Spread – Recent rejection off the $300 resistance is a good confirmation of our bearish thesis on this trade and further downside is expected to the $275 support level.

LULU – 30 DTE

Bullish Credit Spread – LULU continues to grind higher with the next target of $295 and $320 to the upside.

MAR – 37 DTE

Bearish Credit Spread – Continues to trade around an area of resistance of $225 from where a break lower is expected with the first downside target at $215.

PYPL – 51 DTE

Bullish Debit Spread – Continues to consolidate above the $70 support level which supports our bullish thesis.

SHOP – 30 DTE

Bullish Credit Spread – Breakout above $70 remains constructive for our bullish thesis and our upside target remains at $80.

$MAR

DailyPlay – Opening Trade (MAR) – August 27, 2024

MAR Bearish Opening Trade Signal

Investment Rationale

The hotel industry is facing growing headwinds as consumer spending on travel and discretionary items begins to slow. MAR has already issued softer guidance for the second half of the year. Despite being a dominant player in the hospitality industry, Marriott’s high valuation raises concerns about its ability to sustain its current stock price. This environment creates an attractive opportunity to add bearish exposure to MAR.

Technical Analysis

After breaking down below $230 support a few weeks ago, MAR has rallied back to this $230 resistance level and is now showing signs of further weakness. This is coupled with underperformance to the S&P 500 and momentum turning negative, which would target $213 initial targets to the downside with $180 extended targets.

MAR – Daily

Fundamental Analysis

If we look at the business, MAR is trading at a significantly higher valuation relative to its industry peers, at 24x forward earnings versus an 18x average. Despite this premium valuation, the company’s growth metrics are in line or slightly below industry averages, with expected EPS growth of only 6% compared to the industry average of 19%. These metrics suggest that Marriott is modestly overvalued, particularly in an environment where growth prospects are more uncertain.

Trade Details

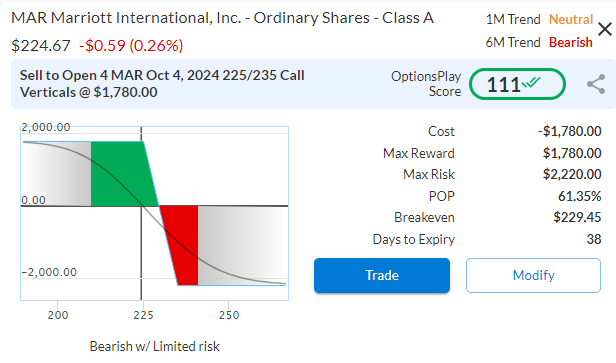

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 4 MAR Oct 4th $225/$235 Call Vertical Spreads $4.45 Credit per Contract.

Total Risk: This trade has a max risk of $2,220 (4 Contracts x $555) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $555 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that made a lower high in a downtrend, and is expected to continue lower.

1M/6M Trends: Neutral/Bearish

Relative Strength: 3/10

OptionsPlay Score: 111

Stop Loss: @ $8.90 Debit (100% loss to the value of premium)

View MAR Trade

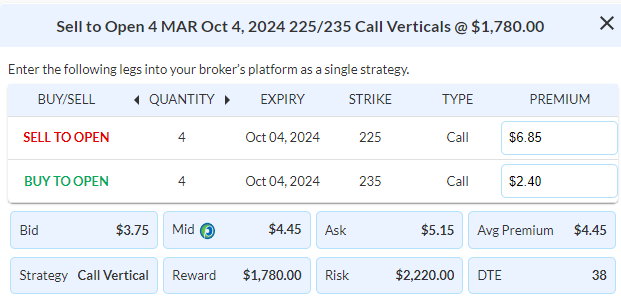

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.