$ETN

DailyPlay – Opening Trade (ETN) – August 13, 2024

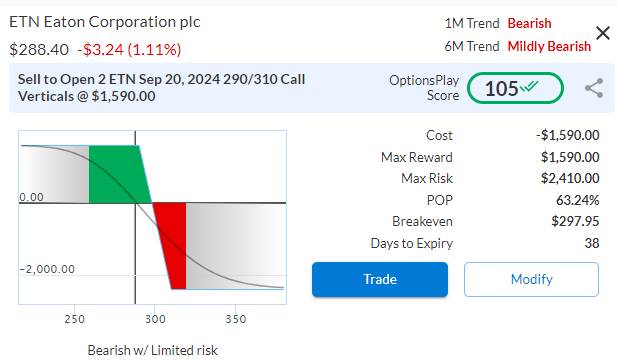

ETN Bearish Opening Trade Signal

Investment Rationale

As enthusiasm for AI-related investments begins to cool, some sectors that benefited from the initial wave of optimism are starting to face increased scrutiny. Eaton Corp (ETN), a Bearish Trade Idea on OptionsPlay today is a key player in the utilities space that powers data centers, is now showing signs of vulnerability. The company’s valuation, coupled with a recent technical breakdown, raises concerns about its ability to maintain its upward trajectory. As investors reassess their positions in light of waning AI hype, ETN is at risk of further downside, making it a candidate for a bearish trade.

Technical Analysis

Eaton Corp (ETN) has recently broken below a key support level at $300, signaling potential further downside as the stock struggles with relative underperformance against the S&P 500. The relative strength has deteriorated, and momentum have turned negative, suggesting that the selling pressure may continue.

ETN – Daily

Fundamental Analysis

ETN’s valuations appear stretched, particularly when compared to its industry peers. The stock is currently trading at 30x forward earnings which is well above the industry average of 25x. This premium valuation is difficult to justify given that Eaton’s future EPS growth of 13% and revenue growth of 8% are only marginally higher than the industry averages of 14% and 6%, respectively. Moreover, Eaton’s net margins of 15% are in line with the industry average of 14%, indicating that the company is not offering superior profitability that might warrant a higher multiple.

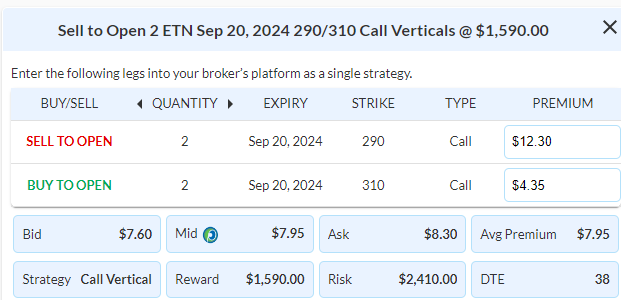

Trade Details

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 2 ETN Sept 20th $290/$310 Call Vertical Spreads $7.95 Credit per Contract.

Total Risk: This trade has a max risk of $2,410 (2 Contracts x $1,205) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $1,205 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue its bearish trend.

1M/6M Trends: Bearish/ Mildly Bearish

Relative Strength: 5/10

OptionsPlay Score: 105

Stop Loss: @ $15.90 Debit (100% loss to the value of premium)

View ETN Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View ETN Trade

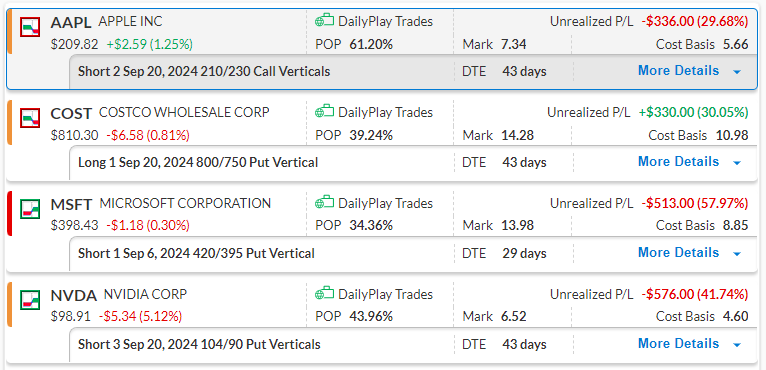

DailyPlay – Portfolio Review – August 12, 2024

DailyPlay Portfolio Review

Our Trades

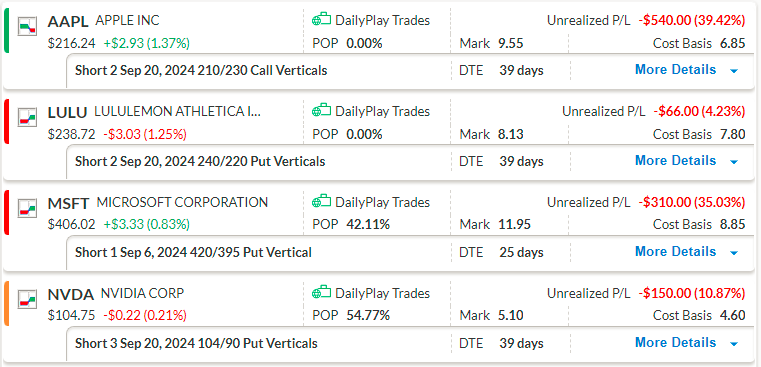

AAPL – 39 DTE

Bearish Credit Spread – AAPL has broken above its key $210 resistance and generated a buy signal today, if we do not see a meaningful pullback over the next few trading sessions, we will look to close out this trade.

LULU – 39 DTE

Bullish Credit Spread – Bounced off support at $230 with the next upside target at around $260.

MSFT – 25 DTE

Bullish Credit Spread – Bounced off support at $390 and broke out above $400, indicating that further upside is likely. The next upside target is at around $425.

NVDA – 39 DTE

Bullish Credit Spread – Bounced off support at $95 and broke out above $100, indicating that further upside is likely. The next upside target is at around $115.

$LULU

DailyPlay – Opening Trade (LULU) Closing Trade (COST) – August 9, 2024

Closing Trade

- COST – 32.60% loss: Sell to Close 1 Contract (or 100% of your Contracts) Sept 20th $800/$750 Put Vertical Spreads @ $7.40 Credit. DailyPlay Portfolio: By Closing this Contract, we will receive $740. We initially opened this Contract on Aug 2 @ $10.98 Debit. Our loss, therefore is $358.

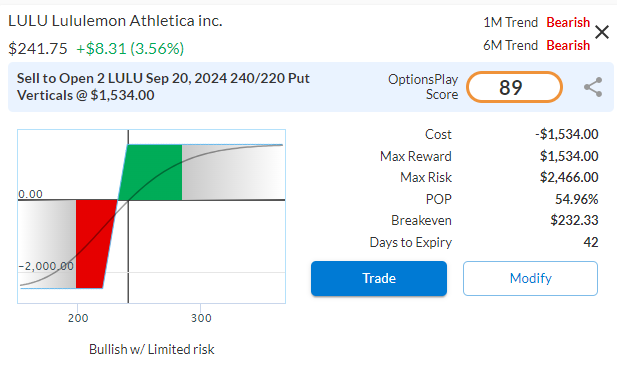

LULU Bullish Opening Trade Signal

Investment Rationale

The recent selloff has pushed Lululemon Athletica Inc. (LULU) to a new multi-year low, but now it looks oversold and ready for a bounce. The charts confirm that sellers are exhausted, while the fundamentals are more than compelling. With improving technical and fundamental outlooks, LULU presents an attractive risk to reward for long exposure.

Technical Analysis

LULU’s 50% decline has pushed the stock’s price to its 2020 levels and has reached it’s most oversold condition in its stock history. This suggests that sellers are exhausted and now has the potential to reverse higher. The initial upside target would be the bottom of its trading range from May 2020 to July 2024 of $280.

LULU – Daily

Fundamental Analysis

Trading now at 15.7x forward earnings a 24% discount to its industry despite expecting to grow EPS inline with its industry of 10-11% and expecting revenue growth that is double its industry. Additionally, LULU operates more efficiently than its peers with a 16% net margins vs 11.5% industry average. This puts LULU in a rare classification of strong growth retailer that trades at a significant discount to the market and its peers and provides an attractive investment opportunity.

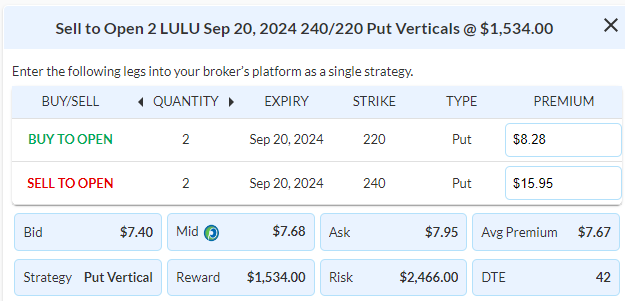

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 2 LULU Sept 20th $240/$220 Put Vertical Spreads $7.67 Credit per Contract.

Total Risk: This trade has a max risk of $2,466 (2 Contracts x $1,233) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $1,233 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that is expected to bounce higher off support.

1M/6M Trends: Bearish/Bearish

Relative Strength: 1/10

OptionsPlay Score: 89

Stop Loss: @ $15.34 Debit (100% loss to the value of premium)

View LULU Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View LULU Trade

DailyPlay – Portfolio Review – August 8, 2024

DailyPlay Portfolio Review

Investment Rationale

Investors are nervously awaiting the jobless claims numbers this morning, as softness in the labor market and uptick in unemployment last week sent markets reeling lower. Further surprises in Jobless Claims this morning could shift sentiment back towards the bearish side and retest the $5120 lows on the S&P 500. We will take a step back from adding new exposure until we have better clarity to the health of the US labor market.

Our Trades

AAPL – 43 DTE

Bearish Credit Spread – The $210 resistance level has held so far, we are looking for the stock to start turning lower from this level, a breakout above $210 would warrant cutting losses.

COST – 43 DTE

Bearish Debit Spread – The breakdown below its key $840 support level, targets $715 to the downside and remains within our bearish thesis.

MSFT – 29 DTE

Bullish Credit Spread – Remains oversold and we are looking for a bounce back towards its $415 resistance level.

NVDA – 43 DTE

Bullish Credit Spread – We expect volatility to remain elevated over the next few weeks but valuations and levels remain attractive for long exposure.

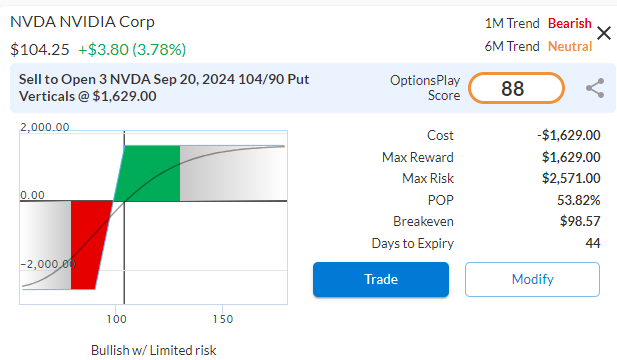

$NVDA

DailyPlay – Opening Trade (NVDA) – August 7, 2024

NVDA Bullish Opening Trade Signal

Investment Rationale

The recent volatility in markets have sent growth stocks significantly lower and some of the best performing stocks are now trading at compelling valuations. NVDA fits this category where lower interest rates, combined with the multiple contraction over the past 4 weeks, have pulled it back to levels that warrant a potential investment. Additionally, elevated options premiums can be harnessed for an additional opportunity to potentially acquire the stock at a valuation that is over 35% lower than where it was at the peak.

Technical Analysis

If we review the chart of NVDA, it recently broke out from a major resistance level at $97 in late May on earnings, and after rallying to its $140 all-time highs, it has pulled back to this support level yesterday. This presents an attractive risk/reward for a long entry. The selloff also has started to show levels of exhaustion where lower lows in price are no longer confirmed by momentum, suggesting a possible trend reversal.

NVDA – Daily

Fundamental Analysis

Looking at the fundamentals, NVDA trades at a 41x forward earnings, which is a 48% premium to its industry, but is expected to grow EPS and Revenues at more than double the pace of its peers. It’s margins also stand out as industry leading in the semiconductor space. This means that the recent multiple contraction provides investors a rare opportunity to buy NVDA at a much more attractive valuation.

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 3 NVDA Sept 20th $104/$90 Put Vertical Spreads $5.43 Credit per Contract.

Total Risk: This trade has a max risk of $2,571 (3 Contracts x $857) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $857 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that is expected to bounce higher off support.

1M/6M Trends: Bearish/Neutral

Relative Strength: 10/10

OptionsPlay Score: 88

Stop Loss: @ $10.86 Debit (100% loss to the value of premium)

View NVDA Trade

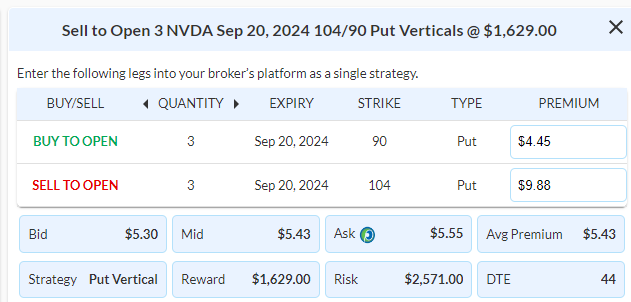

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View NVDA Trade

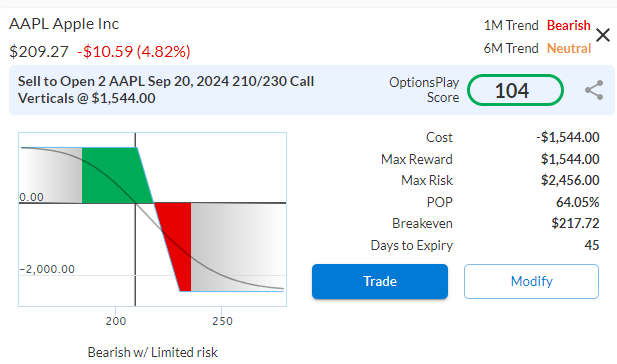

$AAPL

DailyPlay – Opening Trade (AAPL) – August 6, 2024

AAPL Bearish Opening Trade Signal

Investment Rationale

With the VIX’s extreme reading yesterday, our view is that markets will likely find a trading bottom over the next few weeks, however for volatility to stick around. Yesterday’s price action where all 11 sectors were in the red suggests that the panic selling may be overdone but to still potentially expect downside even if there are pockets of optimism over the next few trading weeks. We believe it is better to take a neutral to bearish approach by collecting premium selling options. For this trade we will use AAPL as a proxy for the overall market and tech sector.

Technical Analysis

AAPL’s intraday bounce yesterday took it just shy of its key $210 resistance level, we are looking for a potential reversal lower from this important resistance. Our downside target is $197 initially but as low as $175 (gap fill level) if panic selling does take over again.

AAPL – Daily

Fundamental Analysis

AAPL remains on our overvalued list at 28x forward earnings (33% premium to its industry) while expecting EPS growth of only 10% vs. 14.2% for the industry. And revenue growth of only 5.4% vs. 8.7% for its industry. The only metric that AAPL excels at is its Net Margins of 26.4% vs. only 12.5% for its industry. However, a 33% premium valuation is hard to swallow when growth rates are substantially lower than its peers, even if it is more profitable.

Trade Details

Strategy Details

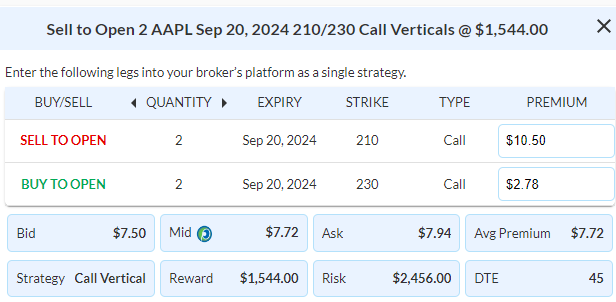

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 2 AAPL Sept 20th $210/$230 Call Vertical Spreads $7.72 Credit per Contract.

Total Risk: This trade has a max risk of $2,456 (2 Contracts x $1,228) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $1,228 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that recently turned bearish and is expected to continue lower.

1M/6M Trends: Bearish/Neutral

Relative Strength: 7/10

OptionsPlay Score: 104

Stop Loss: @ $15.44 Debit (100% loss to the value of premium)

View AAPL Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AAPL Trade

$GOOGL, OIH

DailyPlay – Closing Trades (GOOGL, OIH) – August 5, 2024

Investment Rationale

As markets melt down over the past few trading sessions, we must close out a few trades that are at its stop loss levels which are GOOGL and OIH.

Closing Trades

- GOOGL – 143.40% loss: Buy to Close 3 Contracts (or 100% of your Contracts) August 30th $185/$175 Put Vertical Spreads @ $8.30 Debit.

DailyPlay Portfolio: By Closing all 3 Contracts, we will be paying $2,490. We initially opened these 3 Contracts on July 16 @ $3.41 Credit. Our average loss, therefore is $489 per Contract. - OIH – 91.13% loss: Buy to Close 2 Contracts (or 100% of your Contracts) September 16th $330/$312.50 Put Vertical Spreads @ $11.85 Debit.

DailyPlay Portfolio: By Closing both Contracts, we will be paying $2,370. We initially opened these 2 Contracts on June 30 @ $6.20 Credit. Our average loss, therefore is $565 per Contract.

$COST

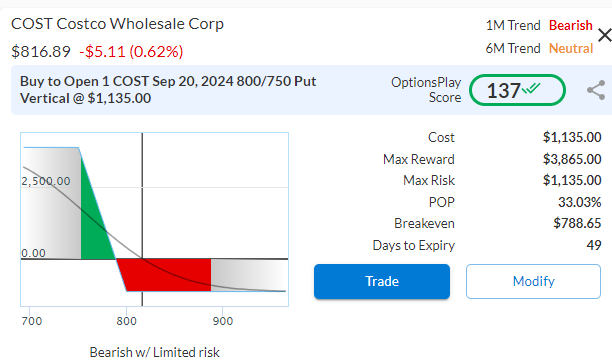

DailyPlay – Opening Trade (COST) – August 2, 2024

COST Bearish Opening Trade Signal

Investment Rationale

Consumers sentiment and trends have been deteriorating and retailers that trade at rich valuations are vulnerable to a bigger decline. Given the current market conditions and sector underperformance, Costco’s valuation appears unsustainable. The retail and consumer discretionary sectors have been lagging, and Costco’s high valuation makes it vulnerable to further declines if growth expectations are not met.

Technical Analysis

Recently, the stock broke below a crucial support level at $840, coupled by deteriorating relative strength compared to the S&P 500. And momentum has turned negative signaling the start of a bearish trend. The overall technical outlook suggests a risk of continued underperformance.

COST – Daily

Fundamental Analysis

COST trades at 46 forward earnings, which is more than 100% higher than the industry average of 22. Despite this premium valuation, Costco’s growth metrics are not exceptionally superior to its industry peers. The expected EPS growth rate for the next 3-5 years is 11%, with expected revenue growth rate is 7%. These are only marginally better than the industry averages of 9% EPS growth and 4% revenue growth. Furthermore, Costco’s net margin of 3% is comparable to the industry average of 2%. The high valuation coupled with relatively thin margins, indicates that investors are paying a premium for the “cult” that is Costco.

Trade Details

Strategy Details

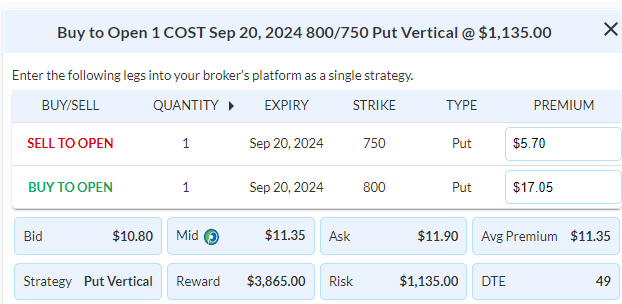

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 1 COST Sept 20th $800/$750 Put Vertical Spreads @ $11.35 Debit per Contract.

Total Risk: This trade has a max risk of $1,135 (1 Contract x $1,135) based on a hypothetical $100,000 portfolio risking 1%. We suggest using 1% of your portfolio value and divide it by $1,135 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that recently turned bearish and is expected to continue lower.

1M/6M Trends: Bearish/Neutral

Relative Strength: 7/10

OptionsPlay Score: 137

Stop Loss: @ $5.68 Credit (50% loss of premium)

View COST Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View COST Trade

$PYPL

DailyPlay – Closing Trade (PYPL) – August 1, 2024

Investment Rationale

With PYPL reporting better than expected earnings, we have now earned more than 98% of the total max gain of the trade. Let’s therefore close this trade today.

Closing Trades

- PYPL – 98.71% gain: Buy to Close 16 Contracts (or 100% of your Contracts) Aug 2nd $60/$56 Put Vertical Spreads @ $0.02 Debit.

DailyPlay Portfolio: By Closing all 16 Contracts, we will be paying $32. We initially opened 8 Contracts on June 21 @ $1.57 Credit and then another 8 Contracts on July 12 @ $1.54 Credit. Our average gain, therefore is $153.50 per Contract with a total gain of $2,456 which is a 2.5% gain on our Portfolio.

$AZN, $MS

DailyPlay – Closing Trades (AZN, MS) – July 31, 2024

Investment Rationale

After reporting better than expected earnings, we have now earned more than 95% of the total max gain of the trade. Let’s close out this trade for a win and continue to monitor our other positions for potential exit opportunities in AZN and MS.

Closing Trades

- AZN – 8.38% gain: Buy to Close 26 Contracts (or 100% of your Contracts) Aug 16th $77.50/$75 Put Vertical Spreads @ $0.82 Debit.

DailyPlay Portfolio: By Closing all 26 Contracts, we will be paying $2,132. We initially opened 13 Contracts on July 1 @ $0.83 Credit and then another 13 Contracts on July 11 @ $0.96 Credit. Our gain, therefore is $195. - MS – 14.79% loss: Buy to Close 8 Contracts (or 100% of your Contracts) Aug 9th $104/$100 Put Vertical Spreads @ $1.63 Debit.

DailyPlay Portfolio: By Closing all 8 Contracts, we will be paying $1,304. We initially opened these 8 Contracts on July 15 @ $1.43 Credit. Our average loss, therefore, is $20 per contract.