$GOOGL

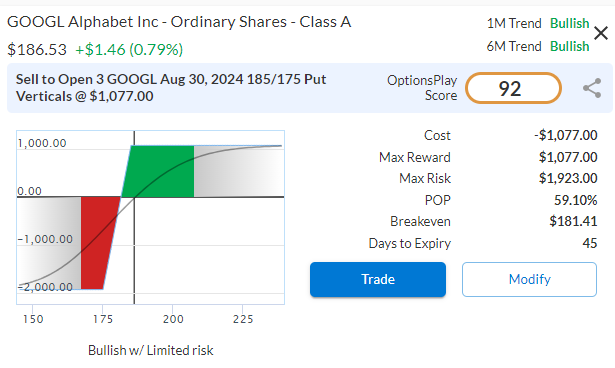

DailyPlay – Opening Trade (GOOGL) – July 16, 2024

GOOGL Bullish Opening Trade Signal

Investment Rationale

GOOGL is strategically positioned to capitalize on the growing demand for AI and cloud services, driven by its robust investments in AI technologies and the continued dominance of YouTube as a leading digital platform. The recent pullback in GOOGL’s stock price offers an attractive entry point for investors looking to gain exposure to these high-growth areas.

Technical Analysis

GOOGL has recently pulled back slightly within a strong bullish trend, creating an attractive entry point. The stock has consistently outperformed the market, and the recent dip offers a lower-risk opportunity to gain exposure. With positive momentum, the pullback provides a healthy consolidation within an overall strong bullish trend.

GOOGL – Daily

Fundamental Analysis

GOOGL trades at 24x forward earnings, which is reasonable given its strong growth prospects. The company is expected to grow EPS by 18% and revenues by 11%, significantly outpacing the average S&P 500 stock. Additionally, GOOGL boasts industry-leading net margins of 25.9%, reflecting its efficiency and profitability.

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 3 GOOGL Aug 30, 2024 $185/$175 Put Vertical Spreads @ $3.59 Credit per Contract.

Total Risk: This trade has a max risk of $1,923 (3 Contracts x $641) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $641 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is in a strong bullish trend, and expected to continue higher.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 92

Stop Loss: @ $7.18 Debit. (100% loss to the value of premium)

View GOOGL Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View GOOGL Trade

$MS

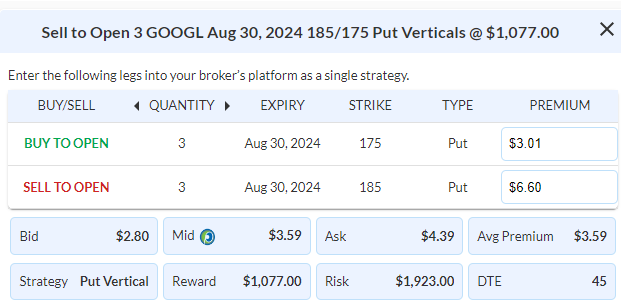

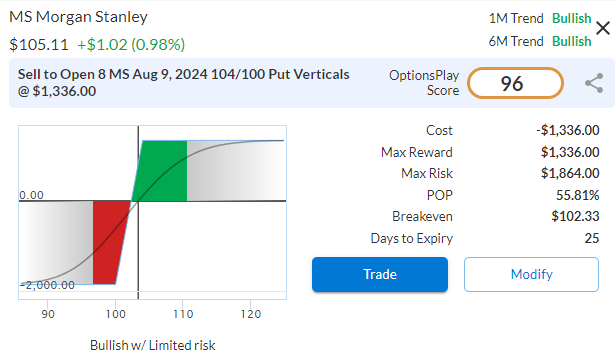

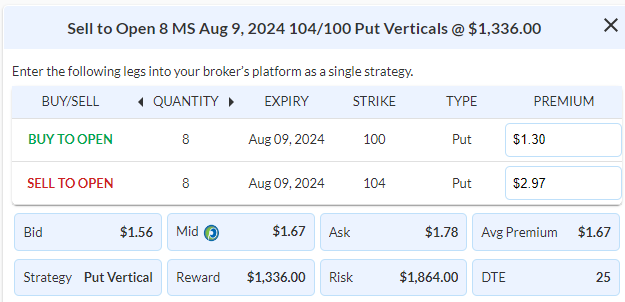

DailyPlay – Rolling Trade (MS) – July 15, 2024

Closing Trade

- MS – 42.86% gain: Buy to Close 7 Contracts (or 100% of your Contracts) August 16th $100/$95 Put Vertical Spreads @ $0.92 Debit. DailyPlay Portfolio: By Closing all 5 Contracts, we will pay $644. We opened these 7 Contracts on July 9 @ $1.61 Credit. The average gain, therefore, is $69 per contract with a total gain of $483.

MS Bullish Opening Trade Signal

Investment Rationale

After rallying nearly 8% since our initial trade in MS and rolling it already once to take profits. This position requires us to manage once again ahead of earnings tomorrow morning. I believe that it is best to take profits on our 2nd trade and reset the short put vertical again to its current price. We are rolling our MS position to the Aug 9 $104/100 Put Vertical to collect another $1.61 in credits.

We Roll this Trade by Closing the existing Trade and Opening a new one.

MS – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 8 Contracts August 9th $104/100 Put Vertical Spreads @ $1.67 Credit per Contract.

Total Risk: This trade has a max risk of $1,864 (8 Contracts x $233) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $233 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that bounced higher off support and is expected to continued higher.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 96

Stop Loss: @ $3.34 Debit. (100% loss to the value of premium)

View MS Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View MS Trade

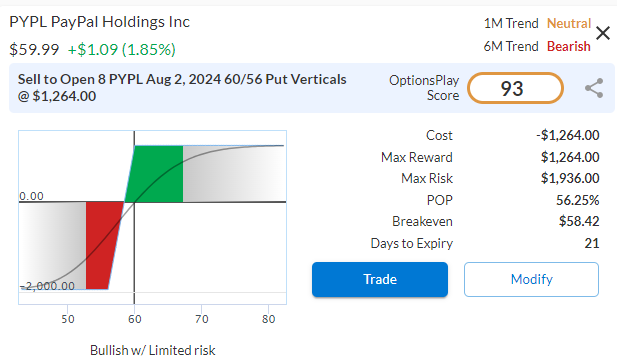

$PYPL

DailyPlay – Opening Trade (PYPL) Closing Trade (DHI) – July 12, 2024

Closing Trade

- DHI – 55.82% loss: Sell to Close 13 Contracts (or 100% of your Contracts) August 16st $140/$130 Put Vertical Spreads @ $1.65 Credit. DailyPlay Portfolio: By Closing all 13 Contracts, we will receive $2,145. We opened 8 Contracts on June 25 @ $3.10 Debit and then another 7 Contracts on July 2 @ $4.75 Debit. The average loss, therefore, is $282.

Additional PYPL Bullish Opening Trade Signal

Investment Rationale

As PYPL bounced off support at $58 our bullish thesis has been confirmed. With price moving over the $60 mark we expect to see an increase in momentum towards resistance at $68 where we will keep a close eye on this trade and its price action.

We are adding another 2% exposure to the PYPL trade and therefore opening 8 more Contracts using the same strike prices and expiry date as on June 21.

PYPL – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 8 Contracts August 2nd $60/$56 Put Vertical Spreads @ $1.58 Credit per Contract.

Total Risk: This trade has a max risk of $1,936 (8 Contracts x $242) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $242 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that found support and is expected to bounce higher.

1M/6M Trends: Neutral /Bearish

Relative Strength: 3/10

OptionsPlay Score: 93

Stop Loss: @ $3.16 Debit. (100% loss to the value of premium received)

View PYPL Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View PYPL Trade

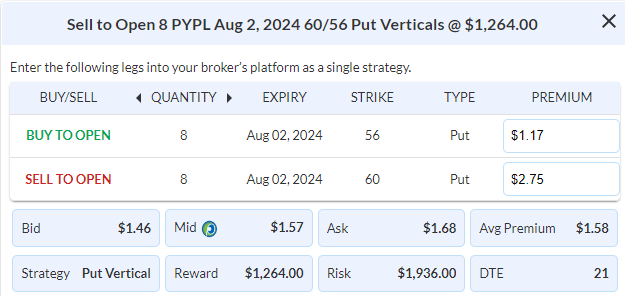

$AZN

DailyPlay – Opening Trade (AZN) – July 11, 2024

Additional AZN Bullish Opening Trade Signal

Investment Rationale

After pulling back and holding its $76 support level, AZN is starting to trend higher again and presents an opportunity for us to add another 2% of our portfolio’s exposure to this trade now that it is trading above the short strike of our Put Vertical Credit Spread.

We are adding to this position by risking another 2% of our Portfolio, using the same strike prices and expiry date.

AZN – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 13 Contracts August 16th $77.5/75 Put Vertical Spreads @ $0.96 Credit per Contract.

Total Risk: This trade has a max risk of $2,002 (13 Contracts x $154) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $154 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is trading higher and is expected to continue the uptrend.

1M/6M Trends: Bearish /Neutral

Relative Strength: 8/10

OptionsPlay Score: 95

Stop Loss: @ $1.92 Debit. (100% loss to the value of premium received)

View AZN Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AZN Trade

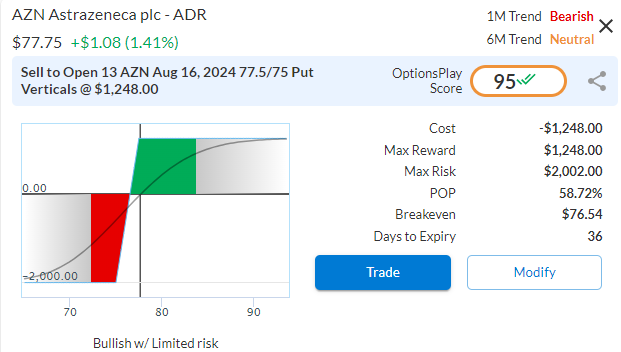

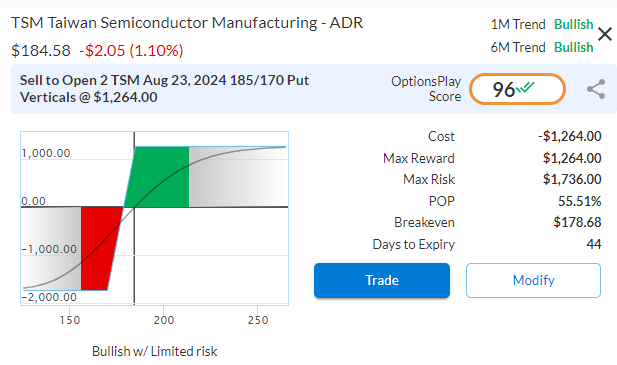

$TSM

DailyPlay – Opening Trade (TSM) – July 10, 2024

TSM Bullish Opening Trade Signal

Investment Rationale

There are very few AI-related semiconductor stocks that are trading at reasonable valuations that we can justify buying at their current levels. However, TSM is positioned for continued growth due to the semiconductor industry’s reliance on TSM’s foundries and remains attractively valued with substantial upside potential.

Technical Analysis

TSM recently made a new all-time high and broke out above a double top at $184 on higher-than-average volume, signaling strong bullish momentum. The stock has also shown impressive relative strength, consistently outperforming the overall market. And momentum recently turned positive again, supporting the case for a continuation of the bullish trend.

TSM – Daily

Fundamental Analysis

From a valuation perspective, TSM trades at a very reasonable 21x forward earnings. This is especially attractive given the company’s strong growth metrics, with expected EPS growth of 23% and revenue growth of 22%, both significantly higher than the average S&P 500 company. Additionally, TSM boasts industry leading net margins of 38%, indicating efficient operations and profitability.

Trade Details

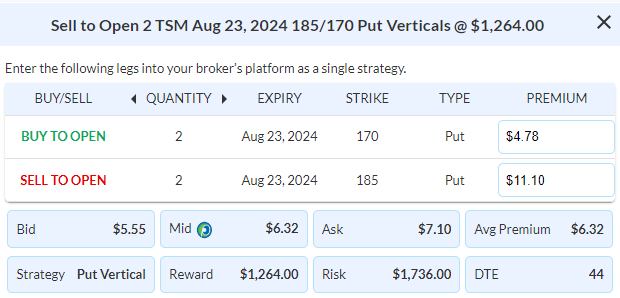

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 2 Contracts August 23rd $185/$170 Put Verticals @ $6.32 Credit per Contract.

Total Risk: This trade has a max risk of $1,736 (2 Contracts x $868) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $868 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is in a strong bullish trend.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 96

Stop Loss: @ $12.64 Debit (100% loss to the value of premium)

View TSM Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View TSM Trade

$MS

DailyPlay – Rolling Trade (MS) – July 9, 2024

Closing Trade

- MS – 37.10% gain: Buy to Close 7 Contracts (or 100% of your Contracts) August 2nd $97/$92 Put Vertical Spreads @ $1.17 Debit. DailyPlay Portfolio: By Closing all 7 Contracts, we will pay $819. We opened these 7 Contracts on June 26 @ $1.86 Credit. The average gain, therefore, is $69 per contract with a total gain of $483.

MS Bullish Opening Trade Signal

Investment Rationale

As Morgan Stanley bounces off our $97 support level based on our trade thesis and has now broken above its $100 resistance level, it’s time to roll out Put Credit Spread and lock in some profits and look for further upside from earnings. We’ll close our Aug 2 $97/92 Put Vertical and roll it out to the Aug $100/95 Put Vertical @ $0.98 Net Credit ($2.15 – $1.17). This would lock in about $1.00 per share worth or profits while continuing to seek bullish exposure in MS.

We Roll this Trade by Closing the existing Trade and Opening a new one.

MS – Daily

Trade Details

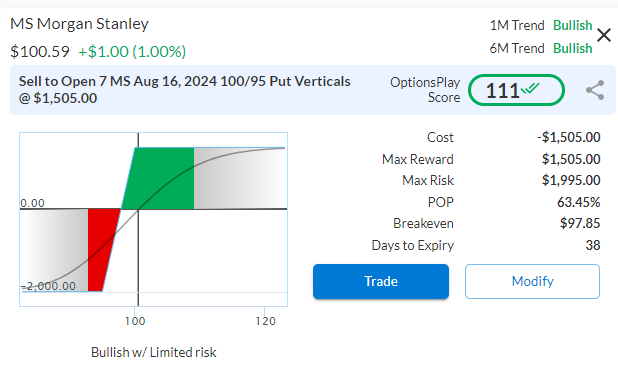

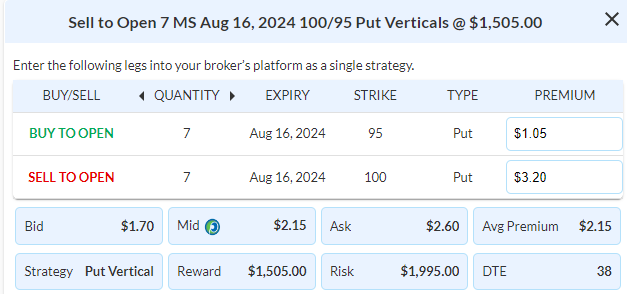

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 7 Contracts August 16th $100/$95 Put Vertical Spreads @ $2.15 Credit per Contract.

Total Risk: This trade has a max risk of $1,995 (7 Contracts x $285) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $285 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that bounced higher off support and is expected to continued higher.

1M/6M Trends: Bullish/Bullish

Relative Strength: 8/10

OptionsPlay Score: 111

Stop Loss: @ $4.30 Debit. (100% loss to the value of premium)

View MS Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View MS Trade

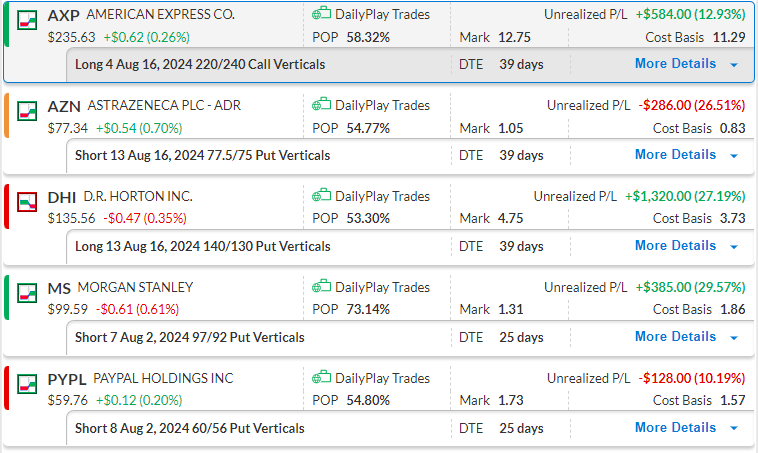

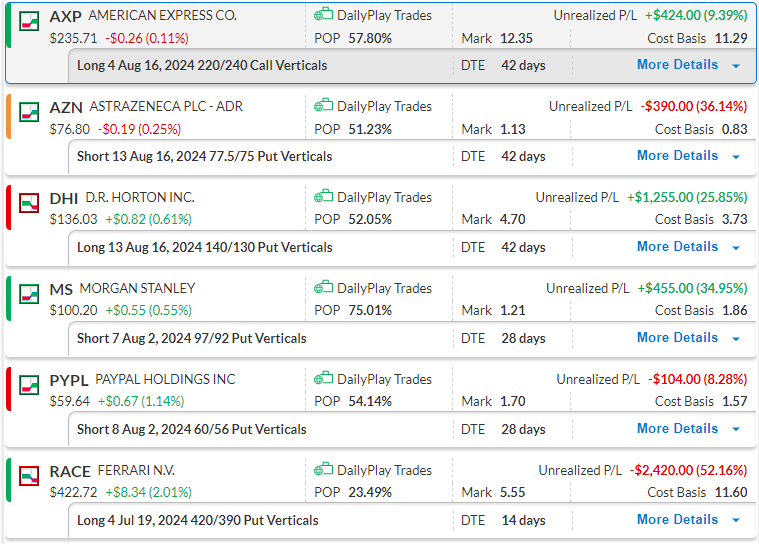

DailyPlay – Portfolio Review – July 8, 2024

DailyPlay Portfolio Review

Investment Rationale

As we resume trading after a shortened week, let’s review our current positions that we hold.

Our Trades

AXP – 39 DTE

Bullish Debit Spread – The last week added gains to AXP as it bounced higher from support at $230. This uptrend will likely resume this week, after the previous short trading week.

AZN – 39 DTE

Bullish Credit Spread – Recent bounce brings the stock just above our short strike and look for time decay to start showing profits on this position.

DHI – 39DTE

Bearish Debit Spread – The breakdown below the key $140 support level targets our $125 downside targets.

MS – 25 DTE

Bullish Credit Spread – MS is currently at a critical resistance at $100. We will keep a close eye on this trade to see how price reacts.

PYPL – 25 DTE

Bullish Credit Spread – PYPL continued its bounced higher over the last few trading days and a move above $61 will likely lead to further upside.

DailyPlay – Portfolio Review & Closing Trade (RACE) – July 5, 2024

Closing Trade

- RACE – 52.16% loss: Sell to Close 4 Contracts (or 100% of your Contracts) July 19th $420/$390 Put Vertical Spreads @ $5.55 Credit. DailyPlay Portfolio: By Closing all 4 Contracts, we will receive $2,200. We opened 2 Contracts on May 21 @ $9.95 Debit and then another 2 Contracts on May 29 @ $13.35 Debit. The average loss, therefore, is $610.

DailyPlay Portfolio Review

Investment Rationale

With Non-Farm payrolls due today and a thin day of trading, we will simply monitor how the markets respond to the jobs report. The only position that requires managing is RACE, as it triggers a 50% stop loss level. We’re going to close that trade today and provide a review of all the DailyPlay positions.

Our Trades

AXP – 42 DTE

Bullish Debit Spread – The last week added gains to AXP as it bounced higher from support at $230. The next upside target is at $240.

AZN – 42 DTE

Bullish Credit Spread – AZN continued to pull back from recent highs and we expect to see a bounce from support at $75 to warrant keeping this position open.

DHI – 42 DTE

Bearish Debit Spread – Had a confirmed break below a key area of support at $140. With this level holding as resistance our next downside target is $130.

MS – 28 DTE

Bullish Credit Spread – MS has been trading higher this week, with price at a critical resistance at $100. We will keep a close eye on this trade to see how price reacts.

PYPL – 28 DTE

Bullish Credit Spread – The lat two days added gains to PYPL as it bounced higher off support at $58. We will keep a close eye on this position as we need a break above $61 over the next few trading days to confirm momentum.

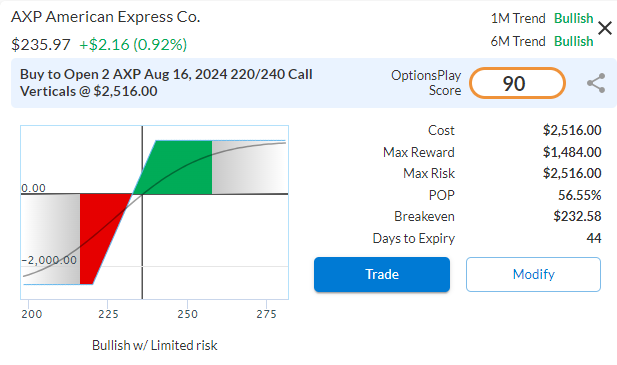

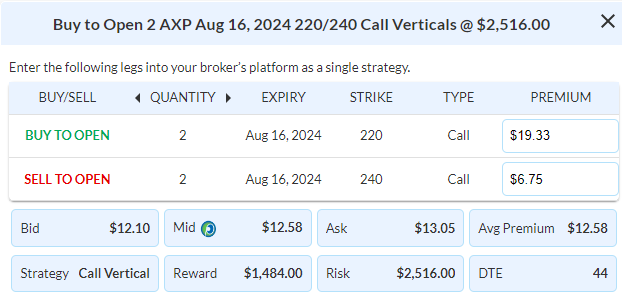

$AXP

DailyPlay – Opening Trade (AXP) – July 3, 2024

Additional AXP Bullish Opening Trade Signal

Investment Rationale

As we head into the July 4th holiday, we expect Friday to be a light trading day, despite Non-Farm payrolls coming out at 8:30AM. Our AXP position is progressing well towards our $240 target and we can add another 2% (roughly 2.5% today) of our portfolio’s exposure to this position and attempt to hit a home run with this trade. We will update you with any potential closing trades on Friday but will not be opening any new positions.

We are adding another 2% exposure to the AXP trade and therefore opening 2 more Contracts using the same strike prices and expiry date as on June 18.

AXP – Daily

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 2 Contracts August 16th $220/$240 Call Verticals @ $12.58 Debit per Contract.

Total Risk: This trade has a max risk of $2,516 (2 Contracts x $1,258) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $1,258 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is bouncing higher off support.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 90

Stop Loss: @ $6.29 Credit (50% loss of premium)

View AXP Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AXP Trade

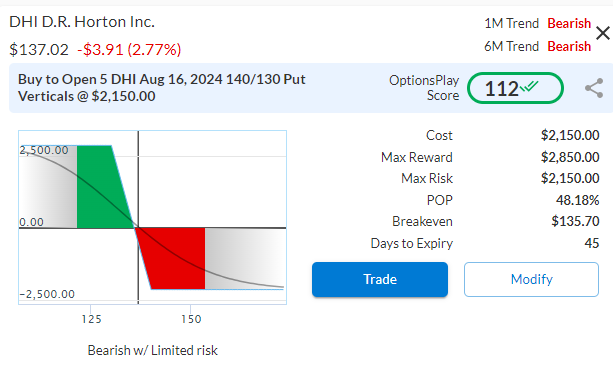

$DHI

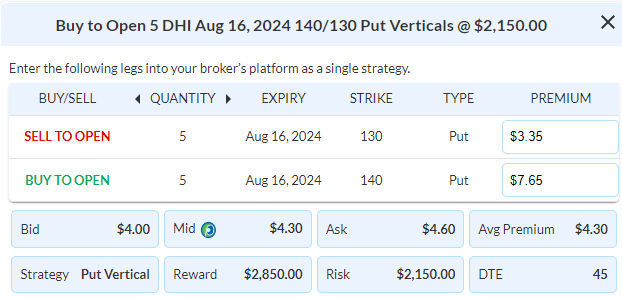

DailyPlay – Opening Trade (DHI) Closing Trade (LIN) – July 2, 2024

Closing Trade

- LIN – 58.82% gain: Buy to Close 2 Contracts (or 100% of your Contracts) July 19th $435/$450 Call Vertical Spreads @ $2.80 Debit. DailyPlay Portfolio: By Closing both Contracts, we will pay $560. We opened these 2 Contracts on June 14 @ $6.80 Credit. The gain, therefore, is $800. This translates to a gain of 0.8% on our Portfolio.

Additional DHI Bearish Opening Trade Signal

Investment Rationale

As home builders continue to underperform, home builders such as D.R. Horton continue to be under pressure and DHI just broke below the key $140 support level that we were expecting. We are going to take this opportunity to add another 2% of our portfolio’s exposure to this position as we target $125 to the downside. Additionally, LIN reached out $425 target price intraday yesterday and has triggered our take profit level, so we are going to take this opportunity to close that out for a profit.

We are adding another 2% exposure to the DHI trade and therefore opening 5 more Contracts using the same strike prices and expiry date as on June 25.

DHI – Daily

Trade Details

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 5 Contracts August 16th $140/$130 Put Vertical Spreads @ $4.30 Debit per Contract.

Total Risk: This trade has a max risk of $2,150 (5 Contracts x $430) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $430 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that broke below an area of support.

1M/6M Trends: Bearish/Bearish

Relative Strength: 3/10

OptionsPlay Score: 112

Stop Loss: @ $2.15 Credit. (50% loss of premium)

View DHI Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.