$INDA

DailyPlay – Opening Trade (INDA) Closing Trade (INDA) – October 11, 2023

Closing Trade

INDA – 14.27% Loss: Sell to Close 20 Contracts (or 100% of your Contracts) Oct 20th $43 Calls @ $1.73 Credit. DailyPlay Portfolio: By Closing all 20 Contracts, we will receive $3.468.

INDA Bullish Opening Trade Signal

View INDA Trade

Strategy Details

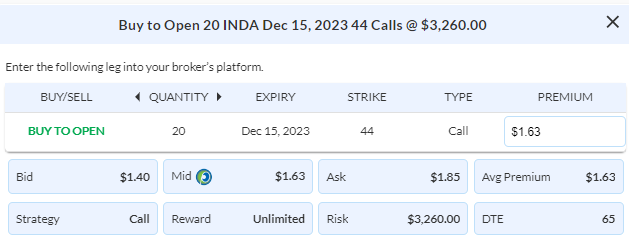

Strategy: Long Call

Direction: Bullish

Details: Buy to Open 20 Contracts Dec 15th $44 Calls @ $1.63 Debit per contract.

Total Risk: This trade has a max risk of $3,260 (20 Contracts x $163) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $163 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a Bullish trade on a stock that found support and is expected to bounce higher.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 84

Stop Loss: @ $0.75 Credit (50% loss of premium paid.)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

As our INDA position is approaches 10 days until expiration, we still believe strongly in this Macro theme of India’s outperform in Asian markets. With this it is time to roll up and out to the Dec $44 strike call. For those who are new to placing a roll order, we are effectively closing the Oct $43 Calls ($.173 Credit) that we own and buying the Dec $44 Calls ($1.63 Debit) for a net credit for $0.10. For the 20 contracts that we own this locks in a $200 credit while extending our time horizon to Dec 2023. Since this is a position that we added to after it broke out above $44, we will maintain 20 contracts of the Dec $44 Calls for an effective net price of $1.53 Debit. We will set a stop loss on the calls at around 50% of the premium paid @ $0.75 Credit.

$JPM

DailyPlay – Opening Trade (JPM) – October 10, 2023

JPM Bullish Opening Trade Signal

View JPM Trade

Strategy Details

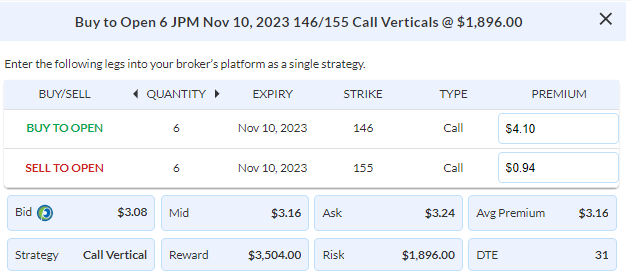

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 6 Contracts Nov 10th $146/$155 Call Vertical Spreads @ $3.16 Debit per contract.

Total Risk: This trade has a max risk of $1,896 (6 Contracts x $316) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $316 to select the # contracts for your portfolio.

Counter Trend Signal: This is a Bullish trade on a stock that found support and is expected to bounce higher.

1M/6M Trends: Bearish/Neutral

Relative Strength: 9/10

OptionsPlay Score: 98

Stop Loss: @ $1.60 Credit (50% loss of premium paid.)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

We head into another start of earnings season with the banks reporting at the end of this week. As interest rates climb, banks potentially are primed to benefit from that as interest income rise. JPM has been best positioned for the past few years as best in breed and its recent selloff to its $144 support level provides an opportunity to buy just before earnings. I’m looking for a strong earnings to potentially propel JPM towards our $155 upside target. With options premiums on the expensive side, we have to use a debit spread structure to take advantage of earnings. I’m looking to buy the Nov $146/155 Call Vertical @ $3.16 Debit. With a hypothetical portfolio of $100,000, I recommend risking 2% of the portfolio’s value to this trade, which is 6 Contracts for a risk of $1,896. We will set a stop loss on the put spread at around 50% of the premium paid @ $1.60 Credit.

JPM – Daily

$CRWD

DailyPlay – Closing Trade (CRWD) – October 9, 2023

Closing Trade

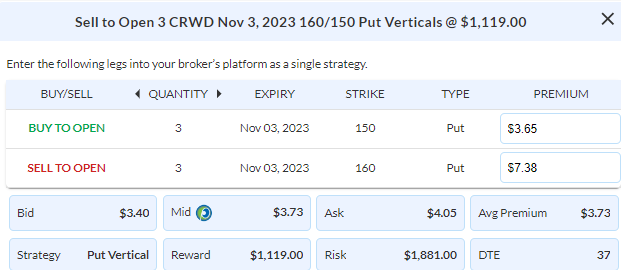

- CRWD – 70.51% Gain: Buy to Close 3 Contracts (or 100% of your Contracts) Nov 3rd $160/$150 Put Vertical Spreads @ $1.10 Debit. DailyPlay Portfolio: By Closing all 3 Contracts, we will be paying $330. We initially opened these 3 Contracts on Sept 27 @ $3.73 Credit. Our average gain, therefore, is $263 per contract.

Investment Rationale

With geopolitical tensions escalated over the weekend, we are entering today with oil prices significantly higher and equities indices lower. After a strong week last week, we will see if markets have the strength to continue higher, or rollover at these important resistance levels. Given the high degree of uncertainty and volatility expected around today’s open, we are only going to reduce exposure in our portfolio. Having collected over 70% of the max profit of our credit spread on CRWD, it is time to close out this trade at a gain and maintain the current holdings in our portfolio. This week’s CPI print and FOMC minutes will likely provide an important outlook for equities and bonds going into the November FOMC meeting.

$XOM

DailyPlay – Closing Trade – Friday Oct 6, 2023

Closing Trade

- XOM – 60.70% Loss: Sell to Close 5 Contracts (or 100% of your Contracts) Nov 17th $115/$125 Call Vertical Spreads @ $1.45 Credit. DailyPlay Portfolio: By Closing all 5 Contracts, we will receive $725. We initially opened these 5 Contracts on October 3 @ $3.69 Debit. Our average loss, therefore, is $224 per contract.

Investment Rationale

As 10-year yields hover around the 4.7%, we continue to see a case for equities to grind lower with the Nasdaq-100 holding onto a last major support level. Our base case remains that while big tech has held up, it trades at valuations that are too high in this interest rate environment. We believe that there is downside risk in this sector and maintain short positions to potentially profit from a breakdown of this major support level. However, reviewing our positions, it is unfortunate that XOM has announced an acquisition that has sent the stock down significantly, and requires us to cut losses just a few days after entering the position. However, the discipline of cutting losers quickly and keeping our sights on managing winners is the recipe for profitability in the long run. For now, we must close out our full XOM position heading into the weekend.

DailyPlay Updates – Thursday, Oct 5.

Investment Rationale

With yesterday’s bounce in equities lead by large cap tech, its easy to get sucked into the headlines and see this as a trading bottom. Let’s review where we stand on the charts. The S&P 500 remain below its key $4330 support level and maintains its bearish trend. While the QQQs have held its key $355 support level, but it needs to get above the $365 gap level for the current neutral trend to turn bullish. Our base case at the moment until these 2 resistance levels are broken is a neutral to bearish outlook, especially with 10-year yields @ 4.7%. As we review the DailyPlay portfolio, no positions are currently at a take profit or stop loss level, so we will not make any adjustments to the portfolio today.

$AAPL

DailyPlay – Opening Trade (AAPL) – October 4, 2023

AAPL Bearish Opening Trade Signal

View AAPL Trade

Strategy Details

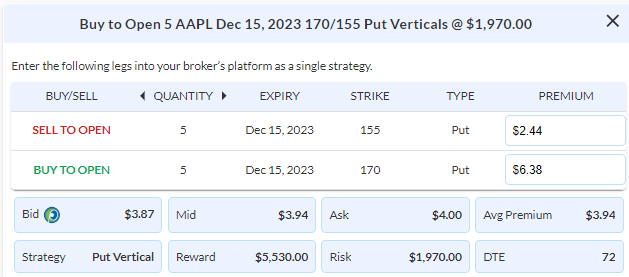

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 5 Contracts Dec 15th $170/$155 Put Vertical Spreads @ $3.94 Debit per contract.

Total Risk: This trade has a max risk of $1,970 (5 Contracts x $394) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $394 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is in a bearish trend and is expected to continue lower.

1M/6M Trends: Bearish/ Mildly Bearish

Relative Strength: 7/10

OptionsPlay Score: 145

Stop Loss: @ $2.00 Credit (50% loss of premium paid).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

With the S&P 500 firmly below the $4330 support level and 10-year yields now within spitting distance of 5%, the only market hanging on is the Nasdaq-100. I see risks building that the Nasdaq and big tech will break its support level at risk of a major pullback. We reduced our exposure last week on AAPL with the concern that markets were at a crossroads and could potentially rally in the short run. Those odds are reduced at this point and I’m advocating that we add bearish exposure in AAPL again to our portfolio. This time buying downside exposure in the form of a put spread into year end. Buy Dec $170/$155 Put Vertical @ $3.94 Debit. With a hypothetical portfolio of $100,000, I recommend risking 2% of the portfolio’s value to this trade, which is 5 Contracts for a risk of $1,970. We will set a stop loss on the put spread at around 50% of the premium paid @ $2.00 Credit.

AAPL – Daily

$XOM

DailyPlay – Opening Trade (XOM) – October 3, 2023

XOM Bullish Opening Trade Signal

View XOM Trade

Strategy Details

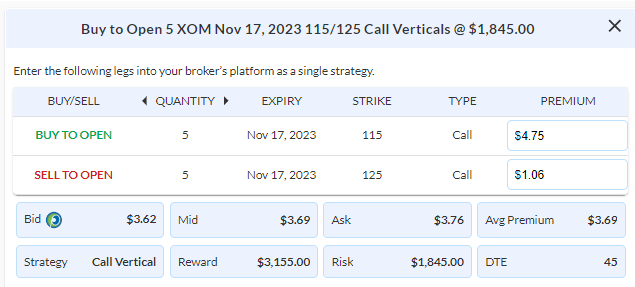

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 5 Contracts Nov 17th $115/$125 Call Vertical Spreads @ $3.69 Debit per contract.

Total Risk: This trade has a max risk of $1,845 (5 Contracts x $369) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $369 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to break out higher.

1M/6M Trends: Neutral/Bullish

Technical Score: 8/10

OptionsPlay Score: 105

Stop Loss: @ $2.00 Credit (50% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

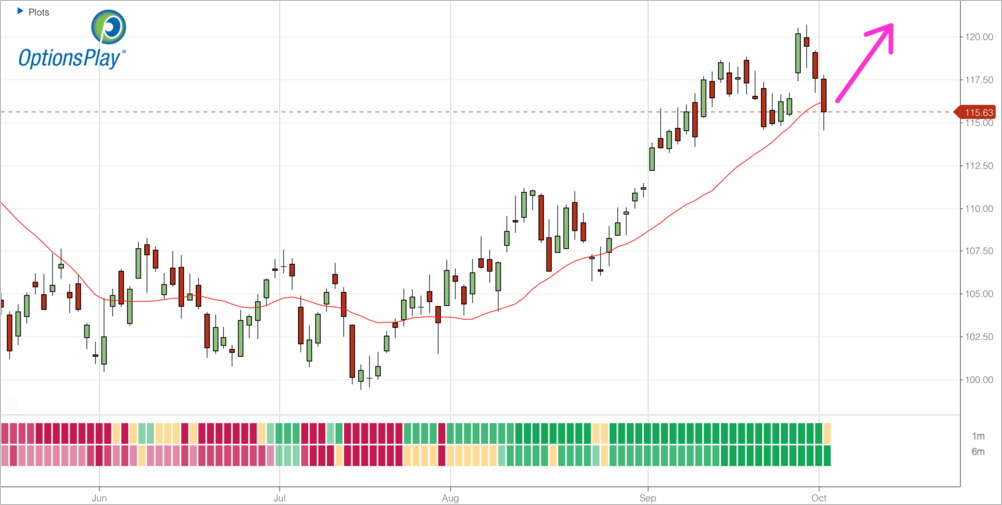

Investment Rationale

A recent pullback in oil prices has presented an opportunity to seek long exposure in energy stocks where the risk/reward ratio is more favorable. XOM currently is knocking on an all-time high triple top of $120 and the recent pullback to its 21D moving average of $155 provides an entry point to play for a potential breakout higher. With oil prices finding support around the $88 level, look for energy stocks to also find stabilization at these levels and potentially start trading higher if oil prices continue to spike. I’m looking to buy the Nov $115/$125 Call Vertical @ $3.69 Debit. With a hypothetical portfolio of $100,000, I recommend risking 2% of the portfolio’s value to this trade, which is 5 Contracts for a risk of $1,975. We will set a stop loss on the put spread at around 50% of the premium paid @ $2.00 Credit.

XOM – Daily

$MSFT

DailyPlay – Opening Trade (MSFT) – October 2, 2023

MSTF Bearish Opening Trade Signal

View MSFT Trade

Strategy Details

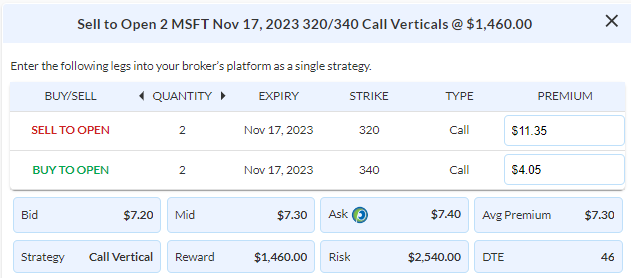

Strategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell to Open 2 Contracts Nov 17th $320/$340 Call Vertical Spreads @ $7.30 Credit per contract.

Total Risk: This trade has a max risk of $2,540 (2 Contracts x $1,270) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $1,270 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is in a bearish trend.

1M/6M Trends: Bearish/Neutral

Technical Score: 8/10

OptionsPlay Score: 102

Stop Loss: @ $14.60 Debit (100% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Markets are breathing a sigh of relief after a government shutdown was averted over the weekend and futures markets are rallying as a result. However, equities remain currently below major support levels and requires a decisive rally to break back above them to maintain a neutral view. Our base case remains that rallies are opportunities to sell into and establish new bearish positions. With 10-year rates now pushing 4.6%, high-valuation stocks that have seen strong multiple expansion without strong revenue and EPS growth are at risk of pulling back. Especially ones that rallied on the back of the AI hype.

MSFT sits at the intersection of this crossroad and recently broke below a major support at $320 with elevated implied volatilities. I’m looking to establish a neutral/bearish trade by selling the Nov $320/$340 Call Vertical @ $7.30 Credit. With a hypothetical portfolio of $100,000, I recommend risking 2% of the portfolio’s value to this trade, which is 2 Contracts for a risk of $2,540. We will set a stop loss on the put spread at 100% of the premium collected @ $14.60 Debit.

MSFT – Daily

$TXN

DailyPlay – Closing Trade (TXN) – September 28, 2023

Closing Trade

- TXN – 33.28% Gain: Sell to Close 9 Contracts (or 100% of your Contracts) Oct 20th $165/$150 Put Vertical Spreads @ $6.51 Credit. DailyPlay Portfolio: By Closing all 9 Contracts, we will receive $5,859. We initially opened 5 Contracts on Sept 13 @ $4.08 Debit and then on another 4 Contracts on Sept 26 @ $5.89 Debit. Our average gain, therefore, is $163 per contract.

Investment Rationale

The underlying market continues to be driven by bonds, as 10-year yields hit a new 10-year high we continue to target 5.2% to the upside. In this environment, we are bearish on equities, however markets are quite oversold and showing signs of exhaustion on this selloff. This increases the probability of a bounce from here and we are going to take this opportunity to reduce some bearish exposure and take profits. If markets bounce we will look to add to bearish exposure where the risk/reward is more favorable. Look to take profits on the full TXN position as price action is showing exhaustion to the downside.

$CRWD

DailyPlay – Opening Trade (CRWD) – September 27, 2023

CRWD Bullish Opening Trade Signal

View CRWD Trade

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 3 Contracts Nov 3rd $160/$150 Put Vertical Spreads @ $3.73 Credit per contract.tract.

Total Risk: This trade has a max risk of $1,881 (3 Contracts x $627) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $627 to select the # shares for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher.

1M/6M Trends: Neutral/Bullish

Technical Score: 10/10

OptionsPlay Score: 90

Stop Loss: @ $7.50 Debit (100% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

The bond market selloff has started to reach oversold and exhausted levels that suggest we are in for a bounce. The question is how far? With 10-year yields now firmly above 4.3%, in my opinion, we may see a shallow bounce in equities and bonds, but the economic headwinds remain. Higher oil prices are denting consumer confidence, and higher rates are pushing equity valuations lower. The real risk is if the bond market has to reprice its current expectations of rate cuts by next year. In that scenario, equity markets will have to sell off further to account for higher rates for longer. While I expect a bounce over the next few trading sessions, I believe that bounce is an opportunity to seek further downside exposure rather than a buying opportunity.

To play for a short-term tactical bounce, I’m choosing to favor profitable, high-margin momentum plays such as CRWD. Cybersecurity remains one of the fastest-growing industries within software as geopolitical tensions rise. With its recent pullback to its $160 support level, I’m looking to sell the Nov 3 $160/$150 Put Vertical @ $3.73 Credit. With a hypothetical portfolio of $100,000, I recommend risking 2% of the portfolio’s value to this trade, which is 3 Contracts for a risk of $1,881. We will set a stop loss on the put spread at 100% of the premium collected @ $7.50 Debit.

CRWD – Daily