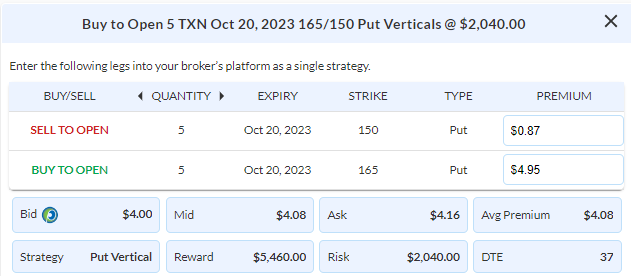

DailyPlay – Opening Trade (TXN) – September 13, 2023

TXN Bearish Opening Trade Signal

View TXN Trade

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 5 Contracts Oct 20th $165/150 Put Vertical Spread @ $4.08 Debit per contract.

Total Risk: This trade has a max risk of $2,040 (5 Contracts x $408) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $408 to select the # shares for your portfolio.

Trend Continuation Signal: This stock is bearish and expected to break below support.r.

1M/6M Trends: Bearish/Bearish

Technical Score: 8/10

OptionsPlay Score: 126

Stop Loss: @ $2.04 Credit (50% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

With housing data out of China continuing to erode, sentiment in the US equity markets are declining alongside. We are heading into today’s huge CPI print, with downside risk that inflation comes in hotter than expected. Oil and grains are examples where prices have surged in the past month and could contribute to an inflation uptick. Reviewing our DailyPlay portfolio, one position has recently confirmed our views, TXN has broken below its $165-170 trading range. I’m going to add to this position by taking the premiums that I’ve collected from the Call Vertical that we sold to buy some downside exposure. Buy Oct $165/$150 Put Vertical @ $4.08 Debit. With a hypothetical portfolio of $100,000, I recommend adding another 2% of the portfolio’s value to this trade, which is 5 Contracts for a risk of $2,040. We will set a stop loss on the put spread at 50% of the premium paid @ $2.04 Credit.

TXN – Daily

$NFLX

DailyPlay – Closing Trade (NFLX) – September 12, 2023

Closing Trade

- NFLX – 54.16% Loss: Sell to Close 2 Contracts (or 100% of your Contracts) Oct 20th $415/$360 Put Vertical Spreads @ $8.70 Credit. DailyPlay Portfolio: By Closing both Contracts, we will receive $1,740 We initially opened 1 Contract on Aug 16 @ 15.72 Debit, and then another Contract on Aug 18 @ $21.60 Debit. Our average loss, therefore, is $996 per contract.

Investment Rationale

After 3 straight quarters of revenue declines for AAPL, today’s event marks a critical moment that investors have been looking forward to. With the launch the iPhone 15, Watch and iPad updates will likely be offset by any concerns of slowdown in consumer spending and further contagion risk with China. The event will not likely result in meaningful volatility unless there are surprise announcements with VisionPro or new products. Additionally, if we look at a chart of AAPL relative to its sector XLK, we see that it has already printed a new 52-week low a few days ago. This shows poor relative strength going into the event, signaling distribution of the stock ahead of it. We are going to keep our hedge on AAPL while our NFLX position has crossed the threshold for cutting losses and warrants closing out the full position after initially breaking below our $415 support level

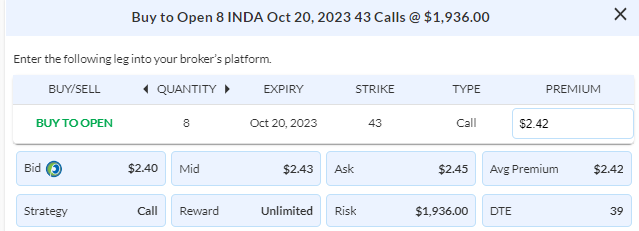

$INDA

DailyPlay – Opening Trade (INDA) – September 11, 2023

INDA Bullish Opening Trade Signal

View INDA Trade

Strategy Details

Strategy: Long Call

Direction: Bullish

Details: Buy to Open 8 Contracts Oct 20th $43 Calls @ $2.42 Debit per contract.

Total Risk: This trade has a max risk of $1,936 (8 Contracts x $242) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $242 to select the # shares for your portfolio.

Trend Continuation Signal: This stock is in a bullish trend and recently broke higher.

1M/6M Trends: Bullish/Bullish

Technical Score: 9/10

OptionsPlay Score: 81

Stop Loss: @ $1.20 Credit (50% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

As the G-20 Summit in India is wrapping up, geopolitical risks continue to rise and manufacturing capacity has seen a substantial shift towards India. Seen as more stable, friendlier to Western nations and a population growth that supports economic growth, India has seen a substantial inflow of capital investment. Our bullish India trade (INDA) has now broken out above a key resistance level of $44.75 and has room to rally to its $49 recent highs. Since our investment thesis has been proved correct with this breakout, it is now an opportunity to add some more exposure to this trade. I’m going to purchase more contracts of the Oct $43 Calls @ $2.42 Debit. With a hypothetical portfolio of $100,000, I recommend adding another 2% of the portfolio’s value to this trade, which is 8 Contracts for a risk of $1,936. We will move our stop higher on the spread at 50% of the premium of the 8 new contracts @ $1.20 Credit.

INDA – Daily

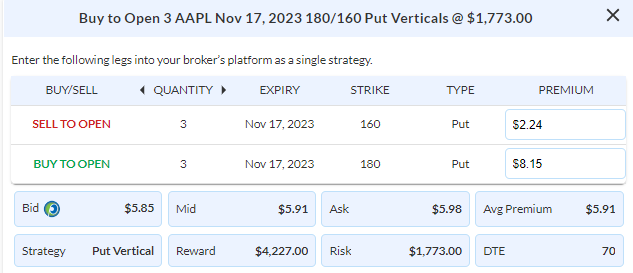

$APPL

DailyPlay – Opening Trade (APPL) – September 8, 2023

AAPL Bearish Opening Trade Signal

View AAPL Trade

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 3 Contracts Nov 17th $180/160 Put Vertical Spread @ $5.91 Debit per contract.

Total Risk: This trade has a max risk of $1,773 (3 Contracts x $591) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $591 to select the # shares for your portfolio.

Trend Continuation Signal: This stock is bearish and expected to break to lower levels.

1M/6M Trends: Bearish/Neutral

Technical Score: 9/10

OptionsPlay Score: 144

Stop Loss: @ $2.95 Credit (100% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Investment sentiment has continued to sour this week as China’s ban of iPhones for government employees threatens the largest company in the world. China accounts for over 20% of all revenue Apple (AAPL) generates and concerns over retail customers shunning Apple products as well is not yet fully baked into the valuation. Apple currently represents one of the most expensive large cap tech companies at 27x forward earnings while expecting only 9% EPS growth next year. This growth expectation also does not factor into any slowdown in demand globally, or the potential downside risks that China now represents. Since implied volatility has expanded meaningfully over the past 2 days, it’s best to trade a spread to mitigate further downside risks by buying the Nov $180/160 Put Vertical @ $5.91 Debit. With a hypothetical portfolio of $100,000, I recommend risking 2% of the portfolio’s value on this trade, which is 3 Contracts for a risk of $1,773. We will set a stop loss on the spread at 50% of the premium paid @ $2.95 Credit.

AAPL – Daily

DailyPlay – Closing Trade (JETS) – September 7, 2023

Closing Trade

- JETS – 50.55% Loss: Sell to Close 26 Contracts (or 100% of your Contracts) Oct 20th $19 Calls @ $0.45 Credit. DailyPlay Portfolio: By Closing all 26 Contracts, we will receive $1,170 We initially opened this trade @ $0.91 Debit per contract. Our average loss, therefore, is $46 per contract.

Investment Rationale

As the market digested the ISM numbers that suggested the inflation fight still has ways to go, investors had to shift expectations of Fed policy for the next FOMC meeting. The probability of another rate hike has elevated and the prospective of keeping rates higher for longer is now more likely. These sudden shifts in investor sentiment is certainly challenging to navigate and further require closing out trades that are not working quickly and focus on adding exposure to trade that are. The adjustment we are going to make to our portfolio today is closing out the JETS position which has reached the 50% stop loss level.

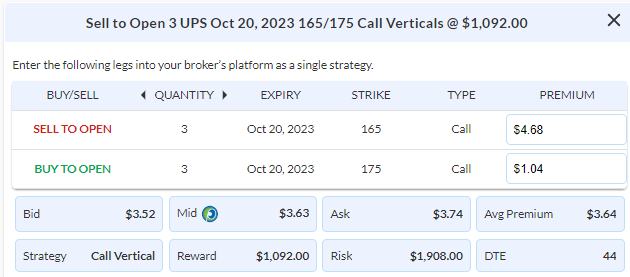

$UPS

DailyPlay – Opening Trade (UPS) Closing Trades (UPS, BDX) – September 6, 2023

Closing Trades

- UPS – 69.39% Gain: Buy to Close 7 Contracts (or 100% of your Contracts) Oct 20th $175/$180 Call Vertical Spreads @ $0.60 Debit. DailyPlay Portfolio: By Closing all 7 Contracts, we will be paying $420. We initially opened this trade @ $1.96 Credit per contract. Our average gain, therefore, is $136per contract.

- BDX – 50.51% Loss: Sell to Close 2 Contracts (or 100% of your Contracts) Dec 15th $285/$310 Call Vertical Spreads @ $4.38 Credit. DailyPlay Portfolio: By Closing all 2 Contracts, we will receive $876. We initially opened this trade @ $8.85 Debit per contract. Our average loss, therefore, is $447per contract.

UPS Bearish Opening Trade Signal

View UPS Trade

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell to Open 3 Contracts Oct 20th $165/$175 Call Vertical Spreads @ $3.64 Credit per contract.

Total Risk: This trade has a max risk of $1,908 (3 Contracts x $636) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $636 to select the # shares for your portfolio.

Trend Continuation Signal: This stock is bearish and expected to break to lower levels.

1M/6M Trends: Bearish/Bearish

Technical Score: 3/10

OptionsPlay Score: 101

Stop Loss: @ $7.25 Debit (100% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

With the S&P 500 failing at a key resistance level this week at $4550, there are growing risks that we will revisit $4340 support levels as September is seasonally a weak month. Reviewing our open positions there are a few that require managing. Firstly we should cut losses on BDX, which simply has not propelled to new all-time highs with time decay working against us. It’s reached a 50% loss and requires closing. JETS is also on watch for closing but not yet at the 50% mark so we will keep a close eye on that position. The only other position that is near stop loss that I’m choosing not to close at the moment is NFLX. It has recently set up what looks like a head & shoulders top and I’m looking for that to potentially confirm over the next few trading sessions.

UPS on the other hand has reached a take profit level and broken below a major support of $165. It is now time to roll this position by taking profits on our Oct $175/$185 Call Vertical @ $0.60 Debit and sell an Oct $165/$175 Call Vertical @ $3.64 Credit. With a hypothetical portfolio of $100,000, I recommend risking 2% of the portfolio’s value on this trade, which is 3 Contracts for a risk of $1,908. We will set a stop loss on the spread at 100% of the premium collected @ $7.25 Debit.

UPS – Daily

$TXN

DailyPlay – Opening Trade (TXN) – September 5, 2023

TXN Bearish Opening Trade Signal

View TXN Trade

Strategy Details

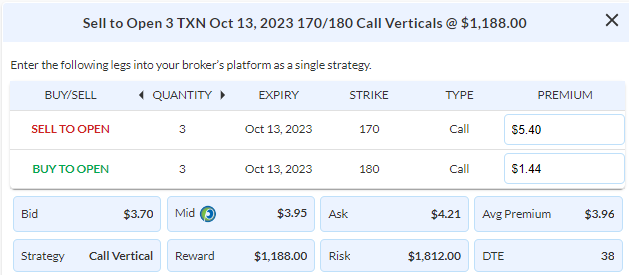

Strategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell to Open 3 Contracts Oct 13th $170/$180 Call Vertical Spreads @ $3.96 Credit per contract.

Total Risk: This trade has a max risk of $1,821 (3 Contracts x $607) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $607 to select the # shares for your portfolio.

Trend Continuation Signal: This stock is neutral to bearish and expected to break lower.

1M/6M Trends: Neutral/Bearish

Technical Score: 5/10

OptionsPlay Score: 103

Stop Loss: @ $8.00 Debit (100% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

As semiconductors lose relative ground to the S&P 500 over the past few weeks, non-specialized fabricators such as Texas Instruments are pressured more as demand slows globally. TXN is expected to earn nearly 21% less than last year, yet continues to trade at 22x forward earnings. Additionally, semiconductors for autos remain one of the few categories where demand remains resilient, yet TXN is showing signs of losing market share to its peers ADI and NXPI. With the stock failing to break out from its $165-170 trading range alongside the rest of the market, I expect TXN to trade sideways to lower from here and warrants selling a Call Spread to potentially take advantage of this outlook. Sell Oct 13 $170/$180 Call Vertical @ $3.96 Credit. With a hypothetical portfolio of $100,000, I recommend risking 2% of the portfolio’s value on this trade, which is 3 Contracts for a risk of $1,812. We will set a stop loss on the spread at 100% of the premium collected, $8.00 Debit.

TXN – Daily

$BIDU

DailyPlay – Opening Trade (BIDU) – September 1, 2023

BIDU Bullish Opening Trade Signal

View BIDU Trade

Strategy Details

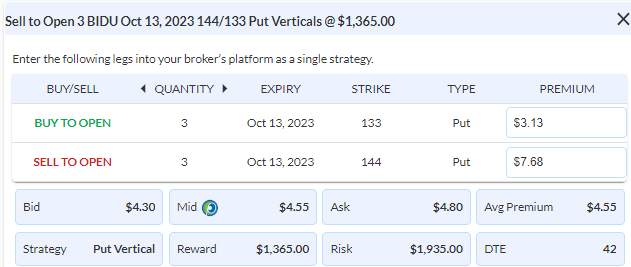

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 3 Contracts Oct 13th $144/$134 Put Vertical Spreads @ $4.25 Credit per contract.

Total Risk: This trade has a max risk of $1,725 (3 Contracts x $575) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $575 to select the # shares for your portfolio.

Trend Continuation Signal: This stock is bullish and expected to make new highs.

1M/6M Trends: Bullish/Bullish

Technical Score: 4/10

OptionsPlay Score: 94

Stop Loss: @ $8.00 Debit (100% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on the previous day’s closing price and we’re estimating that it will likely fill around $3.80 at the open.

Investment Rationale

As data out of China continues to stagnate, and the government rolls out stimulus across a wide swath of the economy, there may be contrarian opportunities in this market. The Chinese government just approved the first AI Chatbot for public consumption, and BIDU looks like an interesting setup. BIDU has spent the last nearly 2 years forming a bottoming inverse head & shoulders formation that has a neckline of $160, which would be an immediate upside target. With a breakout potential into the $220’s. While I don’t think we’re ready to get ahead of ourselves, I think now is a low-risk opportunity to acquire a small position in BIDU and see if an AI lead rally will materialize. I’m looking to sell the Oct 13 $144/$134 Put Vertical @ $4.25 Credit (I expect that this will likely trade around $3.80 at the open since BIDU is already up about 1% pre-market). With a hypothetical portfolio of $100,000, I recommend risking 2% of the portfolio’s value on this trade, which is 3 Contracts for a risk of $1,725. We will set a stop loss on the spread at 100% of the premium collected, $8.00 Debit.

BIDU – Daily

$UPS

DailyPlay – Opening Trade (UPS) – August 31, 2023

UPS Bearish Opening Trade Signal

View UPS Trade

Strategy Details

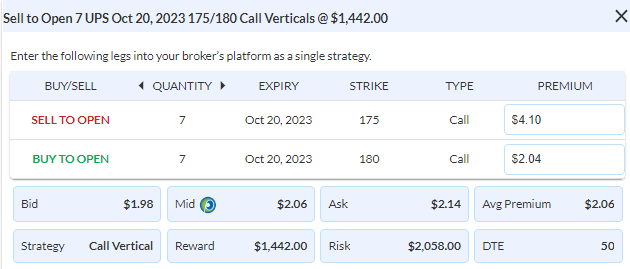

Strategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell to Open 7 Contracts Oct 20th $175/$180 Call Vertical Spreads @ $2.06 Credit per contract.

Total Risk: This trade has a max risk of $2,058 (7 Contracts x $294) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $294 to select the # shares for your portfolio.

Trend Continuation Signal: This stock is bearish and expected to continue lower.

1M/6M Trends: Bearish/Bearish

Technical Score: 4/10

OptionsPlay Score: 108

Stop Loss: @ $4.15 Debit (100% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

As we seek new opportunities in a sideways market, one idea that has generated profits for us recently has presented a new entry opportunity. Using the Credit Spread Trade Ideas scanner on the OptionsPlay platform, UPS generated a new Bearish Call Vertical trade opportunity, collecting over 40% of the vertical width by selling the Oct $175/$180 Call Vertical @ $2.06 Credit. The small rally off the $166 lows presents another opportunity to play for another leg lower on UPS. Its recent approval to lift driver wages during times of slowing shipping volumes and increased competition from Amazon suggests the risks are to the downside. With a hypothetical portfolio of $100,000, I recommend risking 2% of the portfolio’s value on this trade, which is 7 Contracts for a risk of $2,058. We will set a stop loss on the spread at 100% of the premium collected, $4.15 Debit.

UPS – Daily

$MAR

DailyPlay – Closing Trade (MAR) – August 30, 2023

Closing Trade

- MAR – 68.81% Loss: Sell to Close 8 Contracts (or 100% of your Contracts) Sept 15th $197.50/$187.50 Put Vertical Spreads @ $0.68 Credit. DailyPlay Portfolio: By Closing all 8 Contracts, we will receive $544. We initially opened this trade @ $2.58 Debit per contract. Our average loss, therefore, is $190 per contract.

Investment Rationale

Market sentiment has made a 180 as the S&P 500 breaks above the key $4450 resistance level on the back of weaker JOLTs data. Bond traders have moved expectations of rate cuts forward from July to June of 2024, ahead of the Fed’s forecast and 10-year yields have responded by tumbling to 4.1%. However, I’m not confident that we’re out of the woods yet. I still believe that there are opportunities to add some downside exposure as we rally but at the moment, we have to review one of our open positions that have reached a stop loss level. MAR has rallied back above its key $200 resistance level and the options have lost more than 50% of the premium paid and it’s time to close this trade out at a loss. We have a good amount of long exposure and now only NFLX for short exposure. Depending on how markets respond this week, we will look to potentially allocate more capital to bearish exposure and start taking profits on our long positions.