$BDX

DailyPlay – Opening Trade (BDX) – August 14, 2023

BDX Bullish Opening Trade Signal

View BDX Trade

Strategy Details

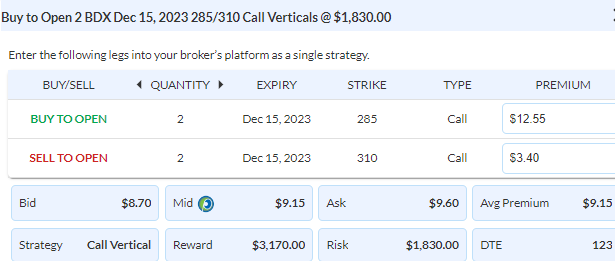

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 2 Contracts Dec 15th $285/$310 Calls Vertical Spreads @ $9.15 Debit per contract.

Total Risk: This trade has a max risk of $1,830 (2 Contracts x $915) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $915 to select the # shares for your portfolio.

Trend Continuation Signal: This stock is bullish and is expected to continue this trend.

1M/6M Trends: Bullish/Bullish

Technical Score: 9/10

OptionsPlay Score: 105

Stop Loss: @ $4.60 Credit (50% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

As the global economy slows and contagion risks rise out of China, one sector that provides defense is Healthcare, especially with an aging global population. We have recently seen Healthcare start outperforming as a sector and seek opportunities to play for a breakout. Becton Dickinson is not a household name but is a medical conglomerate providing medical devices and instruments in over 60 countries. Its double digit EPS growth and 25% margins, coupled with a 20x forward earnings provides an attractive valuation for a business that has consistently executed on high growth over the past 3 years. BDX recently broke out from its $270 resistance level on earnings and recently retested as support providing a strong risk/reward entry for further upside. I’m looking to buy a Dec $285/$310 Call Vertical @ $9.15 Debit. With a hypothetical portfolio of $100,000 I recommend adding another 2% of risk on this trade, which is 2 Contracts for $1,830 of risk. We will set a stop loss on the spread at 50% of the premium paid, $4.60 Credit.

BDX – Daily

$DIS

DailyPlay – Closing Trade (DIS) – August 11, 2023

Closing Trade

- DIS – 38.02% Loss: Buy to Close 4 Contracts (or 100% of your remaining Contracts) Sept 8th $89/$96 Call Vertical Spreads @ $3.34 Debit. DailyPlay Portfolio: By Closing all 4 Contracts, we will be paying $.1,336. We opened this trade @ $2.50 Credit which therefore gives us a loss of $84 per contract.

Investment Rationale

Now that over 90% of S&P 500 stocks have reported earnings, we saw above average EPS beats, but below average Revenue beats. More importantly, stocks that beat move on average of -0.5% and stocks that missed move on average of -2.4%, which is quite unusual. As we review our earnings plays, I no longer believe that DIS is a position worth holding onto, despite it currently only shows a small loss and has not triggered our stop loss levels. I believe in this type of environment, it is better to cut overall portfolio exposure when currently we have two thirds of our open positions that have short exposure. Close out all 4 Contracts of DIS Sept 8 $89/96 Call Verticals.

$WHR

DailyPlay – Opening Trade (WHR) – August 10, 2023

WHR Bearish Opening Trade Signal

View WHR Trade

Strategy Details

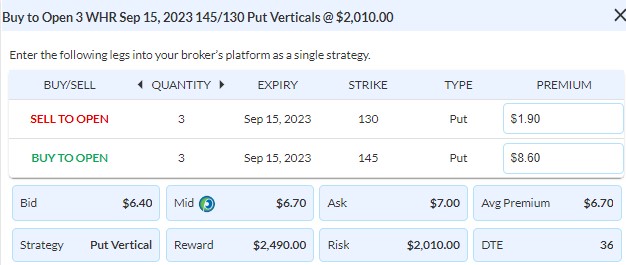

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 3 Contracts Sept 15th $145/$130 Put Vertical Spreads @ $6.70 Debit per contract.

Total Risk: This trade has a max risk of approximately $2,010 at market opening (3 Contracts x $670) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $670 to select the # shares for your portfolio.

Trend Continuation Signal: This stock is mildly bearish to bearish, and is expected to break below a level of support.

1M/6M Trends: Bearish/Mildly Bearish

Technical Score: 4/10

OptionsPlay Score: 103

Stop Loss: @ $3.35 Credit (50% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

As a reminder, the goal of our DailyPlay signals is to teach the best practices for maximizing every idea for profitability. We strive to exemplify how professional traders reach profitability through these ideas. Because even the best ideas will underperform if losses are not cut quickly and profits are taken too soon. As I review the DailyPlay portfolio there are multiple positions that one might be tempted to take profits on. WHR, UPS and LYFT are all candidates for this. However, I remind you that taking small profits is counterproductive to profitability, especially when the market has confirmed your outlook. WHR is a prime example, we were expecting a breakdown below $145 on earnings, it’s now moved in our favor and instead of taking a small profit, this presents an opportunity to potentially hit a home run if WHR declines further. I’m going to add more exposure in this position by buying more of the Sept $145/$130 Put Verticals @ $6.70 Debit. With a hypothetical portfolio of $100,000 I recommend adding another 2% of risk on this trade, which is 3 Contracts for an additional risk of $2,010. We will set a stop loss on the entire 6 open contracts at 50% of the premium paid at $3.35 Credit. This improves our Max Potential profit of $5,460 with a risk of about $1,500 if all 6 contracts are stopped out.

WHR – Daily

$DIS

DailyPlay – Opening Trade (DIS) – August 9, 2023

DIS Bearish Opening Trade Signal

View DIS Trade

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell to Open 4 Contracts Sept 8th $89/$96 Call Vertical Spreads @ $2.50 Credit per contract.

Total Risk: This trade has a max risk of approximately $1,945 at market opening (4 Contracts x $486) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $486 to select the # shares for your portfolio.

Counter Trend Signal: This stock is mildly bullish and we expect it to trade lower over the duration of this trade.

1M/6M Trends: Mildly Bullish/ Bearish

Technical Score: 2/10

OptionsPlay Score: 95

Stop Loss: @ $5.00 Debit (100% loss).

Investment Rationale

We currently have UPS and LYFT as open positions after earnings and will monitor both positions for opportunties to exit at a profit over the next few trading sessions. We will send out an update intraday if we believe that any of these positions should be closed. Looking at earnings today, DIS reports after the close. As Disney+ continues to face intense competition, subscription metrics are expected to show declining subscribers. While Parks may see some decent numbers as travel occupancy over the 1st half remains strong but DIS stock is valued more as a multiple of the subscription business rather than the parks business. DIS trades at a somewhat elevated 24x forward earnings, but expecting flat EPS growth and Disney+ declines suggests that it is still potentially overvalued. I’m looking to Sell to Open Sept 8 $89/96 Call Vertical for around $2.50 Credit (will update with pricing after the open). With a hypothetical portfolio of $100,000 we recommend risking 2% of it on this trade, which is 4 Contracts for a total risk of $2,000. We will set a stop loss on the spread at 100% of the premium.

DIS – Daily

$LYFT

DailyPlay – Opening Trade (LYFT) – August 8, 2023

LYFT Bearish Opening Trade Signal

View LYFT Trade

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 20 Contracts Sept 15th $11/$8 Put Vertical Spreads @ $1.02 Debit per contract.

Total Risk: This trade has a max risk of $2,020 (20 Contracts x $101) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $101 to select the # shares for your portfolio.

Trend Continuation Signal: This stock is mildly bearish and is expected to continue lower.

1M/6M Trends: Mildly Bearish/Mildly Bullish

Technical Score: 2/10

OptionsPlay Score: 125

Stop Loss: @ $0.56 Credit (50% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

As contagion risk out of China sours market sentiment we’re set to open lower today. However, one of our bearish earnings plays this morning is working nicely with UPS’s 2023 revenue guidance coming in nearly $4bn shy of consensus and the stock is now down over 5% pre-market. While this may seem like an obvious opportunity to take profits, I suspect that there could be further downside and will monitor price action this week on UPS to decide how long to hold onto this position.

Looking at earnings opportunities for today, LYFT reports after the close today and presents another bearish opportunity. High-valuation Tech stocks are having a tough time in this environment of 4% yields. Even earnings and revenue beats are typically not enough and many stocks continue to trade lower on the back of strong reports. While UBER had a great quarter, LYFT has likely lost further market share in the mobility space, without a Delivery business to make up for lost revenue. Additionally, just like UPS and UBER, labor costs and shortages continue to weigh on costs and margins are continuously under pressure in the transports. Trading at over 52x forward earnings, LYFT is expensive and at risk of a pullback on any soft guidance for 2023. I’m buying the Sept $11/8 Put Vertical @ $1.01 Debit. With a hypothetical portfolio of $100,000 we recommend risking 2% of it on this trade, which is 20 Contracts for a total risk of $2,020. We will set a stop loss on the spread at 50% of the premium paid, $0.50 Credit.

LYFT – Daily

$EEM

DailyPlay – Opening Trade (EEM) – August 7, 2023

EEM Bullish Opening Trade Signal

View EEM Trade

Strategy Details

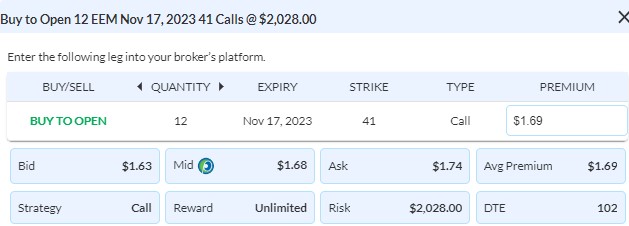

Strategy: Long Call

Direction: Bullish

Details: Buy to Open 12 Contracts Nov 17th $41 Calls @ $1.68 Debit per contract.

Total Risk: This trade has a max risk of $2,028 (12 Contracts x $169) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $169 to select the # shares for your portfolio.

Trend Continuation Signal: This stock has been neutral to bearish and is expected to break downwards.

1M/6M Trends: Neutral/Bullish

Technical Score: 6/10

OptionsPlay Score: 81

Stop Loss: @ $0.84 Credit (50% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Read this week’s Macro Weekly Research to start your trading week.

With the biggest week of earnings season behind us, we’ve closed many of our earnings plays and currently have only a few open positions. As we start to wrap up earnings season I’d like to add some longer-term exposure in our portfolio based on emerging trends in the market. One that recently caught my eye is Emerging Markets. Emerging Markets is one of the “risk-on” area that could benefit from an improving global economic outlook. EEM recently broke out from a 2 year bearish trendline and presents a strong bullish risk/reward. I’m looking out to Nov and purchasing the $41 Calls @ $1.69 Debit. With a hypothetical portfolio of $100,000 we recommend risking 2% of it on this trade, which is 12 Contracts for a total risk of $2,028. Set a stop loss on the call when losses exceed 50% of the premium paid, at about $0.85 Credit.

EEM – Daily

$UPS

DailyPlay – Opening Trade (UPS) – August 4, 2023

UPS Bearish Opening Trade Signal

View UPS Trade

Strategy Details

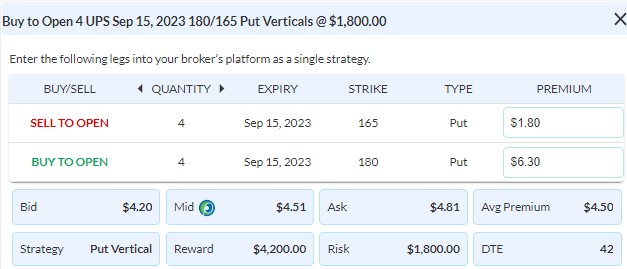

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 4 Contracts Sept 15th $180/$165 Put Vertical Spreads @ $4.51 Debit per contract.

Total Risk: This trade has a max risk of $1,800 (4 Contracts x $450) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $450 to select the # shares for your portfolio.

Trend Continuation Signal: This stock is neutral to bearish and is expected to continue lower.

1M/6M Trends: Neutral/Bearish

Technical Score: 5/10

OptionsPlay Score: 119

Stop Loss: @ $2.25 Debit (50% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

AAPL and AMZN earnings yesterday showed that consumers remained resilient but showed signs of deceleration. One stock that is sensitive to lower shipping volumes and higher fuel costs is UPS. Reporting earnings next week, UPS is currently trading within a range, but the relative performance to its sector XLI is poor and new 52w lows, suggesting possible weakness going into earnings. With a union deal last week, UPS avoids a strike but adds substantial wage costs and will likely further erode margins. Couple the negative EPS and revenue growth with lower margins, UPS earnings is at risk of coming in on the lighter end. With this, I see an opportunity to seek bearish exposure going into earnings next week I’m looking to buy the Sept $180/165 Put Vertical @ $4.50 Debit. With a hypothetical portfolio of $100,000 we recommend risking 2% of it on this trade, which is 4 Contracts for a total risk of $1,800. Set a stop loss on the spread when losses exceed 50% of the premium paid, at about $2.25 Credit.

UPS – Daily

DailyPlay Updates – August 3, 2023

Trading earnings comes with binary risks and PYPL is a trade that simply did not work out as expected. In such cases, it is important to cut losses immediately and salvage any premiums possible for the next opportunity. PYPL released earnings in line with expectations but investors were not impressed with it and the stock is down nearly 7% pre-market. We will update the pricing for closing the full position after today’s open. For today, all eyes are focused on AAPL and AMZN earnings this afternoon which will likely set the tone for tech stocks and its AI lead rally for the rest of the earnings season. Additionally, markets seem to have shrugged off any concerns of systemic risk from Fitch’s downgrade yesterday so we will monitor the situation closely this week and refrain from adding any new positions today.

$PYPL

DailyPlay – Opening Trade (PYPL) Closing Trades (CAT, AMD) – August 2, 2023

Closing Trades

- CAT – 138.20% Gain: Sell to Close 3 Contracts (or 100% of your Contracts) Sept 15th $260/$280 Call Vertical Spreads @ $16.15 Credit. DailyPlay Portfolio: We opened this trade at $ 6.78 Debit, giving us a gain of $937 per contract.

- AMD – 30.33% Loss: Sell to Close 5 Contracts (or 100% of your Contracts) Aug 25th $110 Puts @ $3.33 Credit. DailyPlay Portfolio: We opened this trade at $ 4.78 Debit, giving us a loss of $145 per contract.

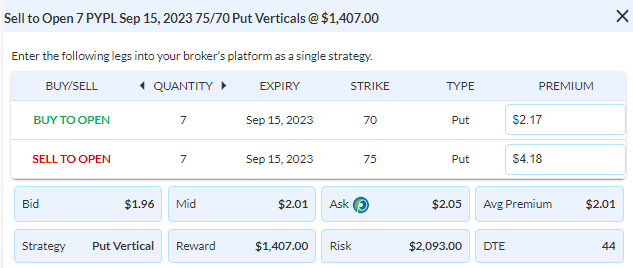

PYPL Bullish Opening Trade Signal

View PYPL Trade

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 7 Contracts Sept 25th $75/$70 Put Vertical Spreads @ $2.01 Credit per contract.

Total Risk: This trade has a max risk of $2,093 (7 Contracts x $299) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $299 to select the # shares for your portfolio.

Trend Continuation Signal: This stock is bullish and is expected to break out above a trendline.

1M/6M Trends: Bullish/Bullish

Technical Score: 5/10

OptionsPlay Score: 94

Stop Loss: @ $4.02 Debit (100% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Going into today’s session, we have 2 open positions that need managing, CAT and AMD. CAT reported stronger than expected earnings and rallied above the $280 short strike on our vertical, an opportunity to take profits. By closing out the 3 Contracts of our Sept $260/280 Call Vertical @ $16.15 Credit we realized a 138% gain or $2,800 in profits. We also need to close out all contracts of our AMD trade as it reported better than expected earnings. We will update the pricing after the open.

Looking towards this evening’s earnings, PYPL stands out as an opportunity to take bullish exposure. After declining 75% over the past two years, PYPL is now trading at an attractive 14x forward earnings despite expecting 20% and 15% EPS growth for this year and next year. Additionally, the chart has finally started to breakout from a bearish trendline over the past year. With IV Rank currently at 51% we see an opportunity to Sell to Open the Sept $75/70 Put Vertical @ $2.01 Credit (40% of width). With a hypothetical portfolio of $100,000 we recommend risking 2% of it on this trade, which is 7 Contracts for a total risk of $2,093. Set a stop loss on the spread when losses exceed 100% of the premium collected, at about $4.00 Debit.

PYPL – Daily

$TMUS

DailyPlay – Closing Trade (TMUS) – August 1, 2023

Closing Trade

- TMUS – 43.53% Loss: Sell to Close 7 Contracts (or 100% of your Contracts) August 18th $140/$150 Call Vertical Spreads @ $5.48 Credit. And, Sell to Close 4 Contracts (or 100% of your Contracts) Sept 15th $140/$155 Call Vertical Spreads @ $5.48 Credit. DailyPlay Portfolio: With an average cost basis of $9.71 Debit, our loss on this trade is, therefore an average of $423 per contract.

Investment Rationale

With more than 50% of S&P 500 companies reported earnings so far, 80% have beat on EPS while only 64% on Revenue. Stocks that beat on earnings moved on average of 0.2% lower after the report while stocks that missed move on average of 0.7% lower. As we continue to monitor for opportunities during earnings season, we must review our portfolio and cut any underperforming trades. TMUS was one that we added further exposure to after breaking out above its $140 resistance level, but has since traded back into the range. It has now triggered our stops loss levels that we have set and it’s time to cut this loss. While this may hurt to see a winning trade turn back into a loss, we have to remember that it’s more important to stick with our trading plan. Cutting losses quickly and adding to winning positions provides us with the opportunity to hit home runs and remain profitable in our portfolios. What is far worse for your portfolio’s long-term performance is taking a small profit because you didn’t follow your own trading plan. I’m looking to close both the 7 Contracts of Aug $140/$150 Call Vertical @ $1.44 Credit and the 4 Contracts of Sept $140/155 Call Vertical. We will also keep an eye on CAT after it reports with potential adjustments to that trade after the open.