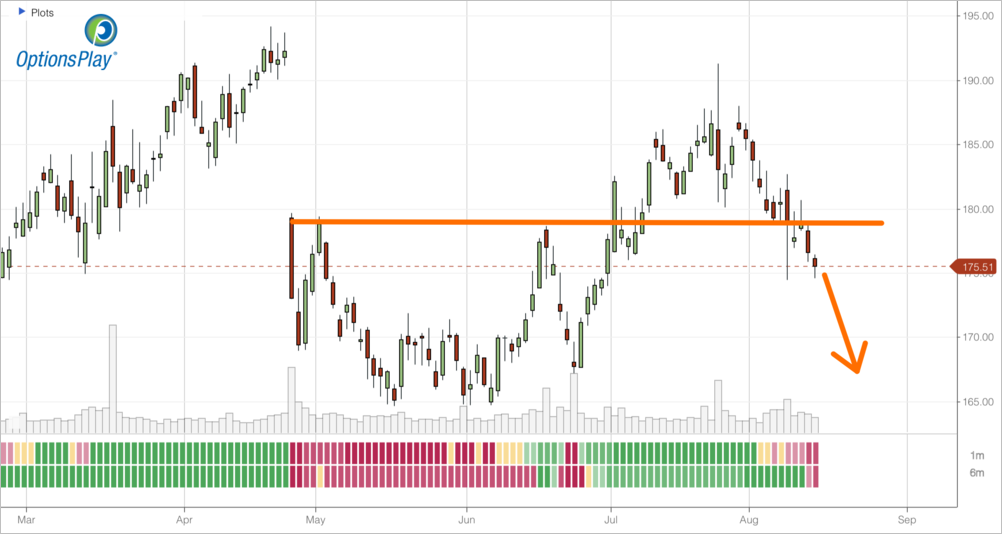

$INDA

DailyPlay – Opening Trade (INDA) Closing Trade (UPS) – August 29, 2023

Closing Trade

- UPS – 52.69% Gain: Sell to Close 4 Contracts (or 100% of your Contracts) Sept 15th $180/$165 Put Vertical Spreads @ $9.65 Credit. DailyPlay Portfolio: By Closing all 4 Contracts, we will receive $3,860. We initially opened this trade at $6.32 Debit per contract. Our average gain, therefore, is $333 per contract.

INDA Bullish Opening Trade Signal

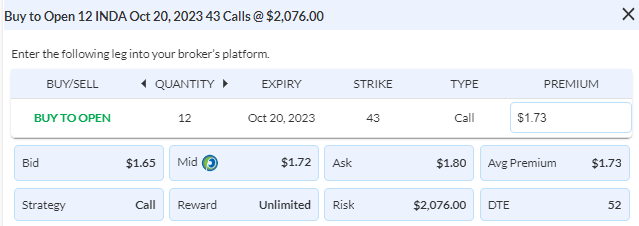

View INDA Trade

Strategy Details

Strategy: Long Call

Direction: Bullish

Details: Buy to Open 12 Contracts Oct 20th $43 Calls @ $1.72 Debit per contract.

Total Risk: This trade has a max risk of $2,076 (12 Contracts x $172) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $172 to select the # shares for your portfolio.

Trend Continuation Signal: This stock is bullish and is expected to continue higher.

1M/6M Trends: Mildly Bullish/ Bullish

Technical Score: 9/10

OptionsPlay Score: 79

Stop Loss: @ $0.85 Credit (50% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

As we see concerns out of China continue to dominate headlines and set the tone for global investors, one country that is benefiting and showing strength is India. As geopolitical tensions have shifted outsourcing capacity away from China, countries such as India and Vietnam have benefited. Looking at the INDA ETF, a breakout above its $43 resistance level and pullback to test it as support, provides an a strong risk/reward opportunity to gain upside exposure. With IV Rank at 2% and options extremely cheap, I’m going to settle for a simple call option to play for further upside in this ETF. Buy to Open Oct $43 Call @ $1.73 Debit. With a hypothetical portfolio of $100,000, I recommend risking 2% of the portfolio’s value on this trade, which is 12 Contracts for a risk of $2,076. We will set our stop loss on the entire position to 50% of the premium paid of $0.85 Credit.

Additionally, I wrote up a thesis for closing our UPS trade last week for a full profit, however, it was not published as a closing trade. So for those who may have missed this, we are closing the UPS trade this morning as virtually the same profit as last week.

INDA – Daily

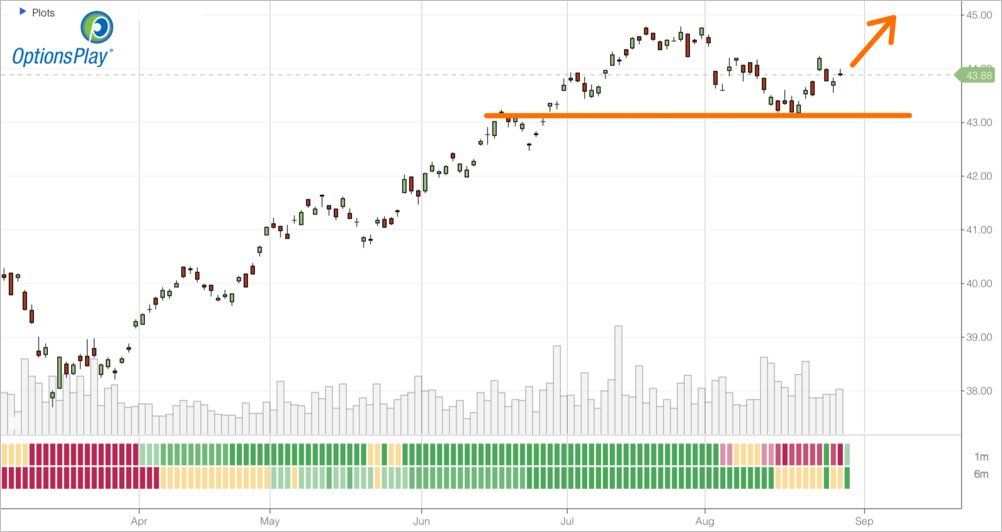

$JETS

DailyPlay – Opening Trade (JETS) – August 28, 2023

JETS Bullish Opening Trade Signal

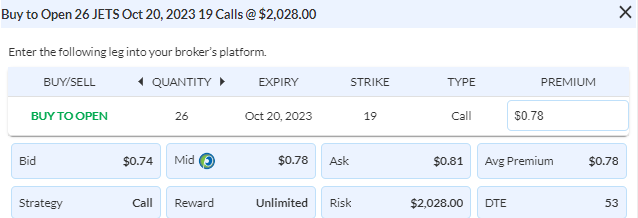

View JETS Trade

Strategy Details

Strategy: Long Call

Direction: Bullish

Details: Buy to Open 26 Contracts Oct 20th $19 Calls @ $0.78 Debit per contract.

Total Risk: This trade has a max risk of $2,028 (26 Contracts x $78) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $78 to select the # shares for your portfolio.

Counter Trend Signal: This stock is bearish but is expected to bounce higher off support.

1M/6M Trends: Bearish/Bearish

Technical Score: 4/10

OptionsPlay Score: 87

Stop Loss: @ $0.35 Credit (50% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Despite reporting record profits across the airline industry, the JETS ETF has pulled back 16% over the past month and a half on the back of contagion out of China. However, travel demand and revenue numbers in the airlines do not reflect the steep declines. I think this is an opportunity to play for a bounce with an attractive risk/reward for long exposure. With options relatively inexpensive, I’m going to use a simple call option to play for upside. Buy Oct $19 Calls @ $0.78 Debit. With a hypothetical portfolio of $100,000, I recommend risking 2% of the portfolio’s value on this trade, which is 26 Contracts for a risk of $2,028. We will set our stop loss on the entire position to 50% of the premium paid of $0.35 Credit.

JETS – Daily

$MAR

DailyPlay – Opening Trade (MAR) – August 25, 2023

MAR Bearish Opening Trade Signal

View MAR Trade

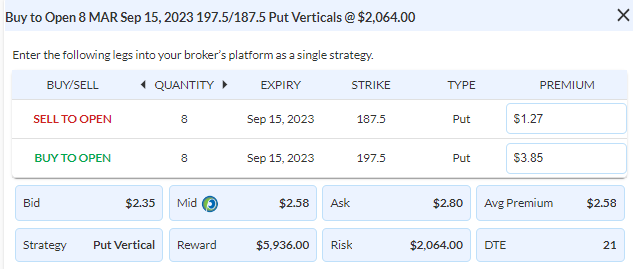

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 8 Contracts Sept 15th $197.50/$187.50 Put Vertical Spread @ $2.58 Debit per contract.

Total Risk: This trade has a max risk of $2,064 (8 Contract x $258) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $258 to select the # shares for your portfolio.

Counter Trend Signal: This stock is neutral to bullish and is expected to break below an area of support.

1M/6M Trends: Neutral/Bullish

Technical Score: 9/10

OptionsPlay Score: 145

Stop Loss: @ $1.30 Credit (50% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

With consumers spending selectively, travel has held up relatively well until now, but signs of deceleration are starting to creep in. Hotel RevPAR has meaningfully slowed across US, Europe and APAC regions. With Marriott’s global exposure, I see downside risks after its recent 52-week high print from a couple of weeks ago. The bearish trade has already started to be confirmed with a break below its key $200 support yesterday. My next downside target is $190, and a break below that would target $172. Trading at 22x next year’s earnings, while expecting only 10% EPS growth is expensive and reflects the highest valuation MAR has traded for in the past 10 years. I’m looking to potentially profit from further downside by buying the Sept $197.5/187.5 Put Vertical @ $2.58 Debit. With a hypothetical portfolio of $100,000, I recommend risking 2% of the portfolio’s value on this trade, which is 8 Contracts for a risk of $2,064. We will set our stop loss on the entire position to 50% of the premium paid of $1.30 Credit.

MAR – Daily

$AMT

DailyPlay – Opening Trade (AMT) Closing Trade (NVDA) – August 24, 2023

Closing Trade

- NVDA – 27.47% Loss: Sell to Close 1 Contract (or 100% of your Contracts) Sept 1st $445/$385 Put Vertical Spread @ $12.17 Credit. DailyPlay Portfolio: By Closing this 1 Contract, we will receive $1,217. Our loss is therefore $563 per contract. Please note that the cost basis may be slightly different when we close this position after market opening.

AMT Bullish Opening Trade Signal

View AMT Trade

Strategy Details

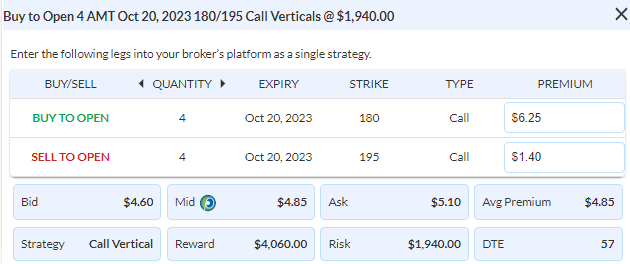

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 4 Contracts Oct 20th $180/$195 Call Vertical Spread @ $4.85 Debit per contract.

Total Risk: This trade has a max risk of $1,940 (4 Contract x $485) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $485 to select the # shares for your portfolio.

Counter Trend Signal: This stock is bearish and is expected to bounce higher off a trendline.

1M/6M Trends: Bearish/Bearish

Technical Score: 3/10

OptionsPlay Score: 110

Stop Loss: @ $2.40 Credit (50% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

It’s always difficult to face a trade where you were incorrect in the view and the trade does not go in the direction of your outlook. That certainly was the case with NVDA. It’s common when this happens to want to hold onto the losing trade, hoping that it comes back in the direction instead of crystallizing the loss. But, facing the pain and accepting a loss is an important part of building the emotional resilience to becoming a profitable trader. As much as it hurts to take a loss the very next day on this trade, we must do so in order to keep losses limited and focus our energy and efforts on our winning positions. We will be closing out the 1 contract of NVDA put spread that we have and update the price on it after the open.

Looking ahead, I see an opportunity in AMT that recently traded to a new 52-week low. However, there are signs that the selloff is exhausted and near a trend reversal. As AMT made a newer low, momentum did not confirm that suggesting a bounce ahead is more likely. AMT’s consistent growth, high margins and a healthy 3.5% dividend yield makes it a lower risk buy near 52-week lows. I’m going to further reduce my risk by using a options strategy to play for the bounce. Buy to Open Oct $180/195 Call Vertical @ $4.85 Debit. With a hypothetical portfolio of $100,000, I recommend risking 2% of the portfolio’s value on this trade, which is 4 Contracts for a risk of $1,940. We will set our stop loss on the entire position to 50% of the premium paid of $2.40 Credit.

AMT – Daily

$NVDA

DailyPlay – Opening Trade (NVDA) – August 23, 2023

NVDA Bearish Opening Trade Signal

View NVDA Trade

Strategy Details

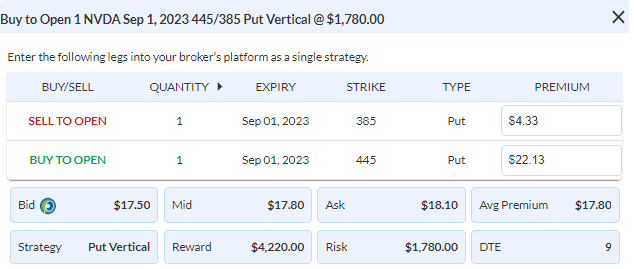

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 1 Contract Sept 1st $445/$385 Put Vertical Spread @ $17.80 Debit per contract.

Total Risk: This trade has a max risk of $1,780 (1 Contract x $1780) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $1,780 to select the # shares for your portfolio.

Counter Trend Signal: This stock is bullish and is expected to pull back to lower levels.

1M/6M Trends: Bullish/Bullish

Technical Score: 10/10

OptionsPlay Score: 126

Stop Loss: @ $8.90 Credit (50% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

My DailyPlay today will take on a higher amount of risk and is likely to be controversial with some disagreeing with my view on NVDA. NVDA reports after the close today and is expected rake in over $11b in revenue and $2.10 in EPS for the quarter. There is no doubt that NVDA is at the forefront of the AI revolution that is only in its infancy. While I believe in NVDA for the long term, there are concerns with the earnings report this quarter. There are signs from distribution partners regarding the demand of server rollouts decelerating in the previous couple of months. Also, the 10-year yield is 100bps higher compared to last quarter’s announcement, softening valuations. If we look at the chart of NVDA, it recently has failed at its $480 highs, however, I will admit that charts are not meaningful in this analysis as earnings could easily be the catalyst that breaks it higher from those levels. My overall concern is that the stock is priced to perfection after last quarter’s blowout earnings, and that we simply are trading in a different risk regime. Even if NVDA beats on earnings that doesn’t guarantee the stock breaks higher.

My trade is a short-term binary trade for earnings, that I expect to exit before the end of this week and is NOT an expression of a longer-term view on NVDA. Buy to Open Sept 1 $445/$385 Put Vertical @ $17.80. With a hypothetical portfolio of $100,000 I recommend adding another 2% of risk on this trade, which is 1 Contracts for a risk of $1,780. Due to the short-term earnings catalyst nature of this trade, we will not be setting a stop loss on this trade and manage it by tomorrow morning or Friday.

NVDA – Daily

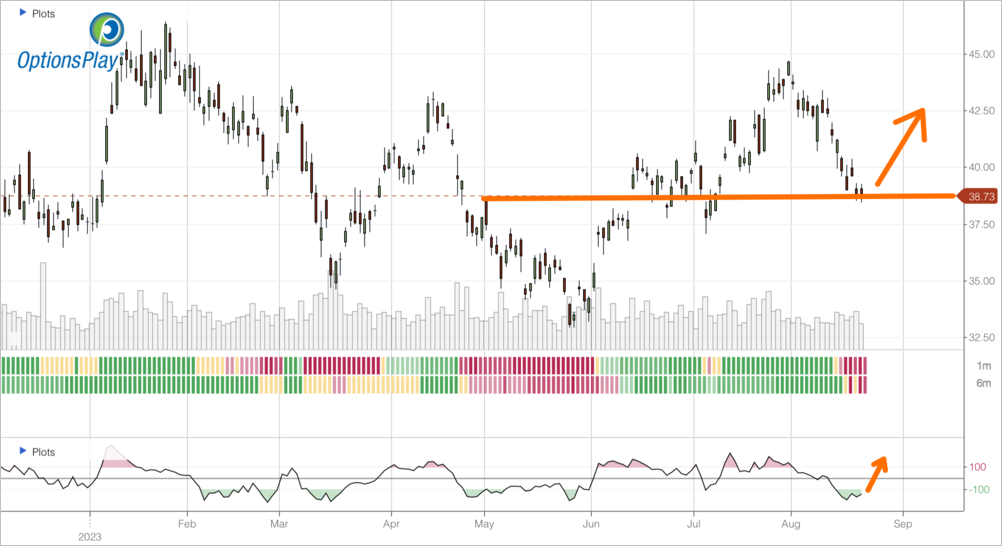

$FCX

DailyPlay – Opening Trade (FCX) – August 22, 2023

FCX Bullish Opening Trade Signal

View FCX Trade

Strategy Details

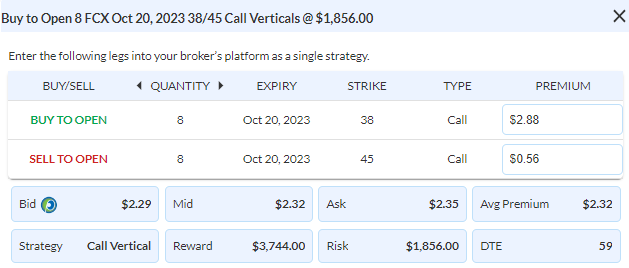

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 8 Contracts Oct 20th $38/$45 Call Vertical Spreads @ $2.32 Debit per contract.

Total Risk: This trade has a max risk of $1,856 (8 Contracts x $232) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $232 to select the # shares for your portfolio.

Counter Trend Signal: This stock is bearish and is expected to bounce higher off a level of support.

1M/6M Trends: Bearish/Bearish

Technical Score: 4/10

OptionsPlay Score: 112

Stop Loss: @ $1.15 Credit (50% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

As contagion out of China continues to cause fear in the markets, markets have retreated and trading in a sideways price action. In my opinion, it is too late to press new bearish shorts right now and establishing long positions have elevated risks of further news out of China that could sour sentiment further. I believe now is a good opportunity to take some exposure off of the table with our UPS position reaching within 1% of our downside target of $166. Let’s close out of full positions on UPS at the open today. To establish a new position at the moment, I prefer to stay in asset classes that are less correlated to equities.

During Monday’s Macro Outlook session and our Weekly Research, I mentioned that Gold has reached a support level and had bounce potential. One idea is that I want to establish a small long position in the miners. Both Gold and Copper have reached support levels recently and I believe FCX is a potential way to play for a bounce in these metals. I’m looking to buy the Oct $38/45 Call Vertical @ $2.32 Debit. With a hypothetical portfolio of $100,000 I recommend adding another 2% of risk on this trade, which is 8 Contracts for an additional risk of $1,856. We will set a stop loss at 50% of the premium paid at $1.15 Credit.

FCX – Daily

$WHR

DailyPlay – Closing Trade (WHR) – August 21, 2023

Closing Trade

- WHR – 54.24% Gain: Sell to Close 6 Contracts (or 100% of your Contracts) Sept 15th $145/$130 Put Vertical Spreads @ $9.10 Credit. DailyPlay Portfolio: By Closing all 6 Contracts, we will receive $5,460. We opened 3 contracts @ $6.70 Debit and another 3 contracts @ $5.85 Debit. Our average gain is therefore $282.50 per contract. Please note that this may be slightly different when we close this position after market opening.

Investment Rationale

With 3 bearish positions in our DailyPlay portfolio that have double the initial exposure and only 1 bullish position, it is time to consider reducing some of the size on the bearish side. While I believe there is still further downside risks, it is time to take exposure off the table for a more balanced portfolio. Both UPS and WHR are within a few percentage points of our downside targets so I’m going to choose to take profits on our WHR trade and let the UPS trade continue to run. I’ll be closing out the full position of WHR this morning after the open.

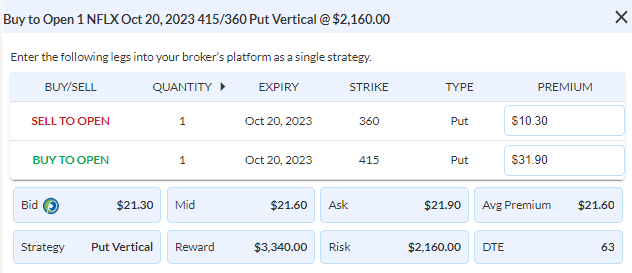

$NFLX

DailyPlay – Opening Trade (NFLX) – August 18, 2023

NFLX Bearish Opening Trade Signal

View NFLX Trade

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 1 Contract Oct 20th $415/$360 Put Vertical Spread @ $21.60 Debit per contract.

Total Risk: This trade has a max risk of $2,160 (1 Contract x $2,160) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $2,160 to select the # shares for your portfolio.

Trend Continuation Signal: This stock is bearish to neutral and is expected to break below a level of support.

1M/6M Trends: Bearish/Neutral

Technical Score: 9/10

OptionsPlay Score: 120

Stop Loss: @ $9.35 Credit (50% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

We quickly received confirmation of our head & shoulders neckline break on NFLX after just 2 trading sessions. If you missed out on the initial trade to play for the breakdown, now is another lower risk opportunity to get into the trade. For those who did jump in on the first trade, here is an opportunity to turn a small win into a potentially much larger win by adding further exposure in the position. I’m looking to Buy the Oct $415/$360 Put Vertical @ $21.60. With a hypothetical portfolio of $100,000 this would be 1 Contract for a total risk of $2,160 and bring our average cost on the 2 contracts to $18.67. I would also raise our stops to 50% of the average premium for $9.35 Credit. Our mandate with any trade is to cut losses quickly when an idea doesn’t work out and keep losses small, and reach our goal of being profitable by adding exposure in winning positions to potentially hit home runs. We currently have 3 open positions where we’ve added to it as it’s proven out to be correct, UPS, WHR and now NFLX. If even 2 our of these 3 trades reach our final targets, the total gains on these trades will add up to the largest month of profits we’ve had in the DailyPlay portfolio this year. Happy Trading and have a wonderful weekend!

NFLX – Daily

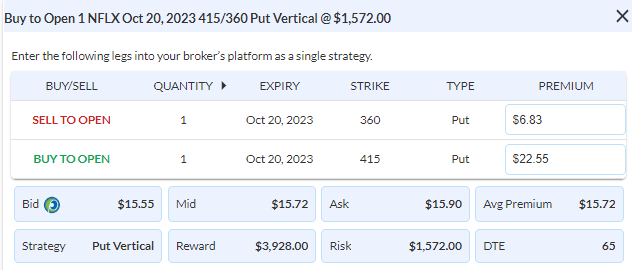

$NFLX

DailyPlay – Opening Trade (NFLX) – August 16, 2023

NFLX Bearish Opening Trade Signal

View NFLX Trade

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 1 Contract Oct 20th $415/$360 Put Vertical Spread @ $15.72 Debit per contract.

Total Risk: This trade has a max risk of $1,572 (1 Contract x $1,572) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $1,572 to select the # shares for your portfolio.

Trend Continuation Signal: This stock is bearish to neutral and is expected to break below a level of support.

1M/6M Trends: Bearish/Neutral

Technical Score: 9/10

OptionsPlay Score: 136

Stop Loss: @ $7.90 Credit (50% loss).

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

As contagion risks continues to heat up after an emergency rate cut by the PBOC and further defaults emerge, we see further downside to the S&P. After breaking below its key $4450 support level, we are now targeting $4,100 to the downside after VIX rises above the 16% handle. In a market where 10-year yields top 4% again , we scan for stocks trading at rich valuations with EPS growth metrics that are on the lower end to take short exposure in. NFLX is again the a target on my bearish list trading at over 35x forward earnings, while expecting to grow EPS by roughly 19% this year. While the valuation is not ridiculous, a combination of a competitive streaming landscape and virtually no product innovation presents a risk to its valuation as markets selloff. If we review the chart, after breaking out above its $415 resistance, it’s recently completed a head & shoulder formation with trends turning bearish in the past week. While this has not broken yet, the risk is a pullback to its $315 level, nearly 25% lower. This is an opportunity to take a small short position and looking for a break lower in the next few weeks. If NFLX breaks below the $415 level, we would add further exposure to potentially profit from a move down to the $315 target. Buy to Open Oct $415/$360 Put Vertical @ $15.72 Debit. With a hypothetical portfolio of $100,000 I recommend adding another 2% of risk on this trade, which is 1 Contract for a total risk of $1,572. We will set a stop loss on the spread at 50% of the premium paid, $7.90 Credit.

NFLX – Daily

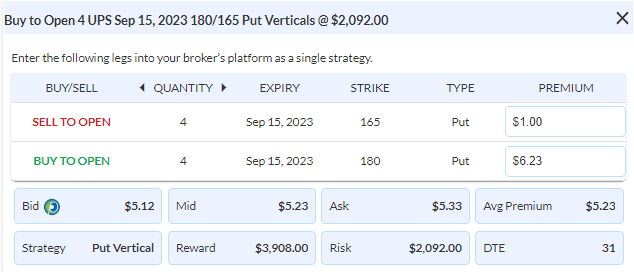

$UPS

DailyPlay – Opening Trade (UPS) Closing Trade (LYFT) – August 15, 2023

Closing Trade

- LYFT – 53.06% Loss: Sell to Close 20 Contracts (or 100% of your remaining Contracts) Sept 15th $11/$8 Put Vertical Spreads @ $0.46 Credit. DailyPlay Portfolio: By Closing all 20 Contracts, we will receive $920. We opened this trade @ $1.02 Debit which therefore gives us a loss of $56 per contract.

UPS Bearish Opening Trade Signal

View UPS Trade

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 4 Contracts Sept 15th $180/$165 Put Vertical Spreads @ $5.23 Debit per contract.ct.

Total Risk: This trade has a max risk of $2,092 (4 Contracts x $523) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $523 to select the # shares for your portfolio.

Trend Continuation Signal: This stock is in a bearish trend and is expected to continue this trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 4/10

OptionsPlay Score: 134

Stop Loss: @ $2.60 Credit (50% loss)..

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Our goal with the DailyPlay trading signals is to show you how to trade ideas for profitability. This entails two primary rules that we must stay 100% disciplined in, cutting losses quickly and adding exposure when a trade starts to work in our favor to potentially hit home runs. Today, we get to exercise both disciplines with LYFT and UPS. When a trade such as LYFT does not go in the direction that we expect, instead of holding and hoping it turns back into a profit, it is far better to take a small loss, accept it and move on. Moreover, with our UPS position, the market has proven our initial outlook correct. Instead of taking a small profit, we will add more exposure to the trade. This may be counter to what you want to do, but the road to profitability requires us to take bigger bets at times, and it’s when the market proves our outlook to be correct, that we have the best shot of hitting home runs. We are going to add to our UPS short position by adding another 2% of our portfolio’s value to the trade. Buy Sept $180/165 Put Verticals @ $5.23 Debit. With a hypothetical portfolio of $100,000, adding another 2% of risk on this trade would be 4 Contracts for an additional $2,092 of risk. We will move our stop loss on the entire position to 50% of the premium paid, $2.60 Credit.

UPS – Daily