$ABBV

DailyPlay – Opening Trade (ABBV) – February 28, 2023

ABBV Bearish Opening Trade Signal

View ABBV Trade

Strategy Details

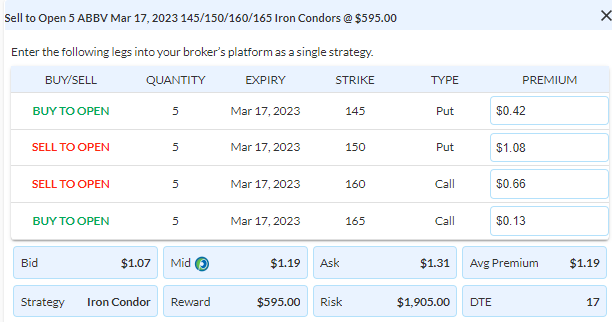

Strategy: Short Iron Condor

Direction: Bearish

Details: Sell to Open 5 Contracts Mar 17th $160/$165 Call $150/$145 Put Iron Condors @ $1.19 Credit per contract.

Total Risk: This trade has a max risk of $1,905 (5 Contracts x $381).

Counter Trend Signal: This is a stock that is currently bullish but expected to trade sideways or bearish.

1M/6M Trends: Bullish/Bullish

Technical Score: 9/10

OptionsPlay Score: 134

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

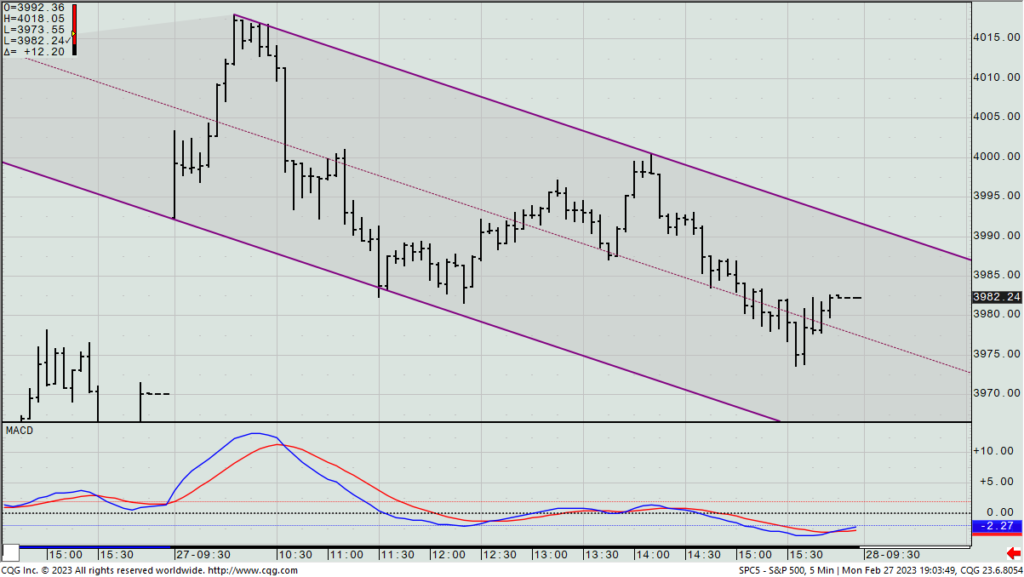

Stocks started off with nice gap opening gains yesterday, but gave back a decent chunk of them by the close, with the SPX settling at 3982, up 12 points on the day after being up almost 50 at the high of the session. Your chart and the media will report a gain, but frankly, that session wasn’t anything to write home about.

SPX – Yesterday (5 min. bars)

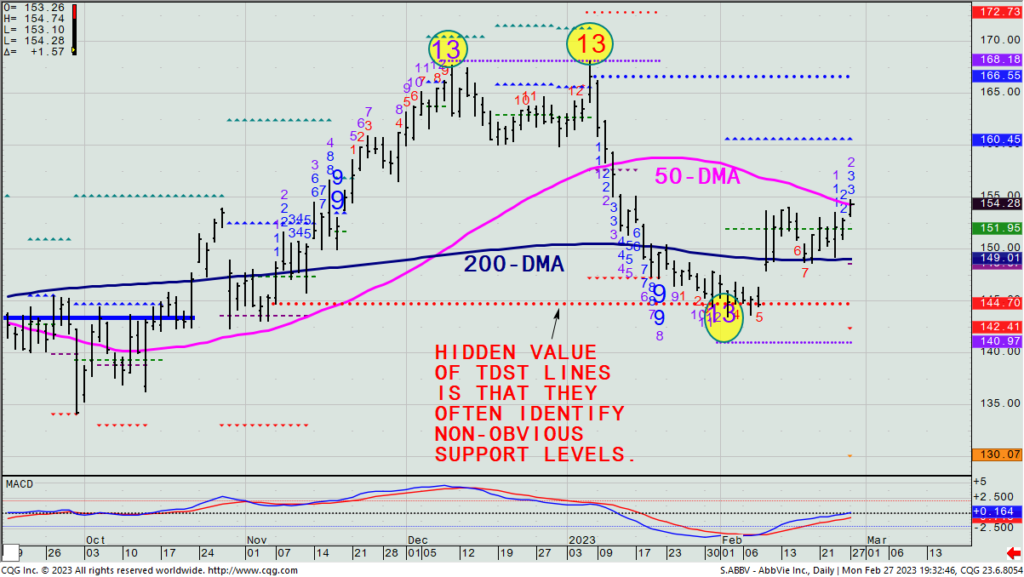

You’ll recall back in January that I gave you a bearish long put spread play in ABBV (we made nice money on it). In that idea, I had used the $145 strike as the lower strike in the spread, as I had seen TDST Line support there. We see that not only did that level hold and also get an Aggressive Combo -13 count at that same level, but it has now moved up into its 2023 mid-range and is currently bounded on its top by its 50-DMA and bottom by its 200-DMA.

ABBV – Daily

In yesterday’s weekly outlook webinar, I said that it wouldn’t surprise me to see the market churn and go somewhat sideways in the near-term. As such, let’s look to put on a bearish iron condor spread, selling the March 17th $160/$165 call spread and selling the same dated $150/$145 put spread for what on Monday’s closing mid prices netted a $1.21 credit per condor.

Our goal is to hopefully collect the premium and watch this stay inside the $150 to $160 range over the next few weeks. Earnings don’t come out till late-April, so there’s no major catalyst I am aware of during our planned holding period. (I would have gone out a few more weeks, but there is no open interest at all in those other series.)

$GLD

DailyPlay – Opening Trade (GLD) – February 27, 2023

GLD Bullish Opening Trade Signal

View GLD Trade

Strategy Details

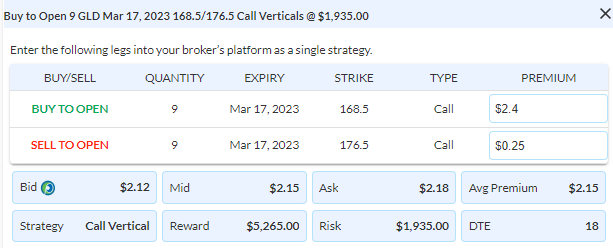

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 9 Contracts Mar 17th $168.50/$176.50 Call Vertical Spreads @ $2.15 Debit per contract.

Total Risk: This trade has a max risk of $1,935 (9 Contracts x $215).

Counter Trend Signal: This is an ETF is currently bearish and is expected to bounce higher from a level of support.

1M/6M Trends: Bearish/Neutral

Technical Score: 6/10

OptionsPlay Score: 91

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

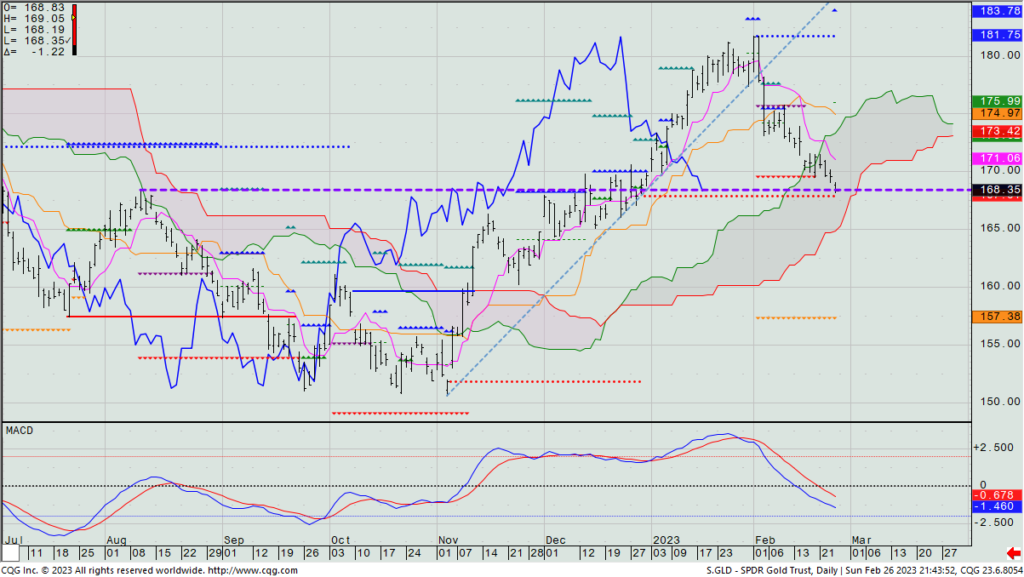

Gold has been selling off as the dollar (DXY) bounced from the 102 to 100.5 level that I called for a dollar rally to start. Now the gold futures posted a daily Setup -9 count this past Friday, and the SPDR Gold Trust ETF (GLD) is a hair from its TDST Line support and, basically right on its prior breakout level (the horizontal dashed purple colored line), now let’s look for a quick rally in gold from here.

GLD – Daily

As such, let’s look to buy the March 17th GLD $168.5/$176.5 call spread (the higher strike is right where the top of the daily cloud is for most of March). On Friday, this spread went out at $2.15 mid, and represents about a 27% cost of the strike differential – a number I can easily live with for an ATM spread.

DailyPlay Update – February 24, 2023

Investment Rationale

Quick story: On Tuesday I was in Manhattan attending a meeting at the NYSE. About 30 mins. before the start, I went to a sandwich shop nearby to the exchange to grab a quick lunch. This shop – like many other places in the city have added an extra temporary vestibule area in the wintertime outside their front doors to keep cold air from rushing into their establishments every time customers walk in or out.

I opened the outer door and quickly walked into the shop, not seeing the completely clear glass door of the shop itself. I banged into it nose and head first, which almost knocked me out, and as I tumbled to my knees slipping into la la land, my nose started gushing significant amounts of blood. I was trying to capture it in my cupped hands, but it was all over me and flowing like a river. In my semi-consciousness, while still on my knees, I knocked on the glass door for help. Three customers came out to aid me, along with a member of the staff with some napkins for the pool of blood in my hands and face.

About 20 mins. later, I stopped the bleeding in their bathroom by applying pressure to my very aching nose. When it got to the point that it wasn’t still dripping much, I saw that I had a gash across the bridge of my nose, too. So, I asked for a bandage for that, as it was still dripping blood. Eventually, I got myself in a state of being to be able to leave the establishment.

Why do I tell you this? Well, on Wednesday I had to take the day off with a massive headache and doctor appointment to make sure that I didn’t have a broken nose or need stitches. And because this event still had my body in some state of shock and pain, I realized on Thursday — while waiting for the 2pm FOMC announcement – that it had come out the prior day – the same day to which I had been AWOL from the markets.

The good news for me is that the nose isn’t broken, nor did I need stitches. But I do have one heck of a shiner under one eye, and the headache and nose ache are still very much there. Therefore, I plan on a very quiet Friday and weekend ahead. See you Monday for the weekly outlook webinar. – Rick

P.S. Getting out of the UNG trade yesterday was in no means my saying I’m now bearish natural gas. To the contrary, I continue to hold and scale down bid for more stock in my own portfolio for the long-term.

$MRNA, $COIN, $BYND, $SPOT, $GE

DailyPlay – Closing Trade (MRNA) Partial Closing Trades (COIN, BYND, SPOT, GE) – February 23, 2023

Closing Trade

- MRNA – 37.15% Loss: Buy to Close 3 Contracts (or 100% of your Contracts) Feb 24th $170/$160 Put Vertical Spreads @ $6.83 Debit. DailyPlay Portfolio: By Closing all 3 Contracts, we will be paying $2,049

Partial Closing Trades

- COIN – 29.68% Loss: Buy to Close 1 Contract (or 50% of your Contracts) Mar 10th $70/$54 Put Vertical Spread @ $9.70 Debit. DailyPlay Portfolio: By Closing 1 of 2 Contracts, we will be paying $970

- BYND – 26.09% Gain: Sell to Close 5 Contracts (or 50% of your remaining Contracts) Mar 17th $17.50/$22.50 Call Vertical Spreads @ $1.16 Credit. DailyPlay Portfolio: By Closing 5 of 10 Contracts, we will receive $580.

- SPOT – 20.00% Gain: Buy to Close 3 Contracts (or 40% of your Contracts) Mar 17th $125/$130 Call Vertical Spreads @ $1.52 Debit. DailyPlay Portfolio: By Closing 3 of 7 Contracts, we will be paying $456.

- GE – 12.50% Loss: Sell to Close 6 Contracts (or 50% of your Contracts) Mar 24th $83/$77 Put Vertical Spreads @ $1.40 Credit. DailyPlay Portfolio: By Closing 6 of the 12 Contracts, we will receive $840.

Investment Rationale

A minor mixed day for equities on Tuesday as things were pretty quiet as investors await today’s FOMC minutes. At this point, the SPX is off 4.5% from its closing 2023 high of 4180, and just ½% away from my initial call for a 5% pullback, that I could potentially even see get to an almost 8% decline from that Feb. 2nd peak price. (This has been another good example of the value of fading price trends at the right place and time. Bulls have watched an almost a 200-pt. selloff with their hands tied and like deer caught in headlights.)With the FOMC announcement this afternoon, I am not going to put out a new DP idea for today. But looking at our open positions, let’s lighten up the following names to reduce either giving back profits or potentially losing more:

- MRNA: Let’s cover 3 of 3 short Feb. 24th $170/$160 put spreads we’re down 35% on.

- COIN: Let’s cover 1 of 2 short March 2nd $70/$54 put spreads that we’re down 21% on.

- BYND: Let’s liquidate 5 of 10 long March 17th $17.5/$22.5 call spreads that we’re up 26% on.

- SPOT: Let’s cover 3 of 7 short March 17th $125/$130 call spreads that we are up 20% on.

- GE: Let’s cover 6 of 12 long $82/$77 put spreads that we are down 13% on.

It’s your choice if you want to trade these before the Fed announcement at 2pm ET, or wait till after to see the effects of the news. I tend to be conservative in my trading, so I generally lighten positions before the news, but, as always, it’s up to you and your tolerance for risk.

$UNG

DailyPlay – Closing Trade (UNG) – February 22, 2023

Closing Trade

- UNG – 115.46% Loss: Sell to Close 18 Contracts (or 100% of your Contracts) March 10th $10/$12.50 Call Vertical Spreads @ $0.09 Credit. DailyPlay Portfolio: By Closing all 18 Contracts, we will receive $162.

Investment Rationale

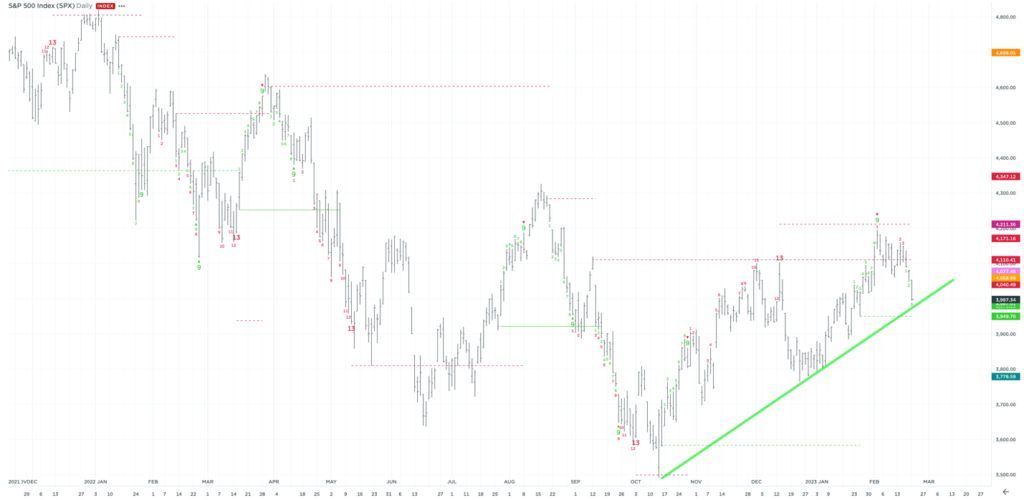

The S&P 500 fell over 80 points to below $4,000 yesterday on the back of concerns of higher interest rates. Treasuries yields rose sharply with the 10-year rising 14bps to 3.96%, as the bond market shifts to a more hawkish Fed. Our expectation is that equities will continue to remain under pressure as markets reassess how sticky inflation will likely be and what the Fed’s actions will be to bring it back to their 2% target. SPX has now within spitting distance of its trendline support. A break below trendline support and $3950 would target $3850 to the downside.

S&P 500 – Daily

As natural gas continues its decline and the inability to hold the key $8.50 level over the past few trading sessions, we would take this opportunity to cut losses on our open debit spread. As a rule of thumb with long options positions that are approaching the last 3 weeks of expiration, if the trade is not moving in the expected direction quickly, it’s better to cut losses and reassess the trading thesis and timing. We are at this point going to close out the full balance of the position of UNG and look to reestablish at lower levels and time

UNG – Weekly

$USO

DailyPlay – Opening Trade (USO) – February 21, 2023

USO Bullish Opening Trade Signal

View USO Trade

Strategy Details

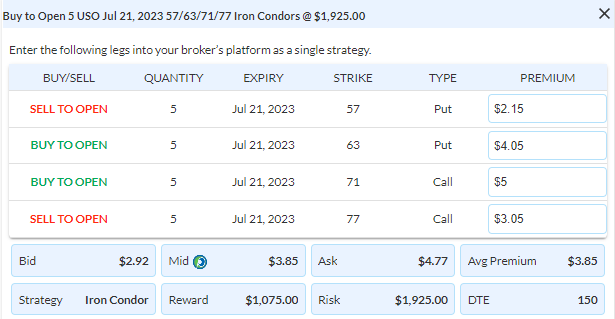

Strategy: Long Iron Condor

Direction: Bullish

Details: Buy to Open 5 Contracts Jul 21st $71/$77 $63/$57 Iron Condors @ $3.85 Debt per contract.

Total Risk: This trade has a max risk of $1,925 (5 Contracts x $385).

Counter Trend Signal: This is an ETF that is currently bearish and is expected to bounce higher.

1M/6M Trends: Bearish/Bearish

Technical Score: 3/10

OptionsPlay Score: 97

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

With markets closed yesterday, we only have how the futures traded to get a sense of what today may look like, and as I write this Monday night, I’m seeing the S&P futures down about 18 points from last Friday’s close. I continue to believe that the way to play the market is for a continued pullback, using a Friday close above SPX 4148 as the stop out of that gameplan.

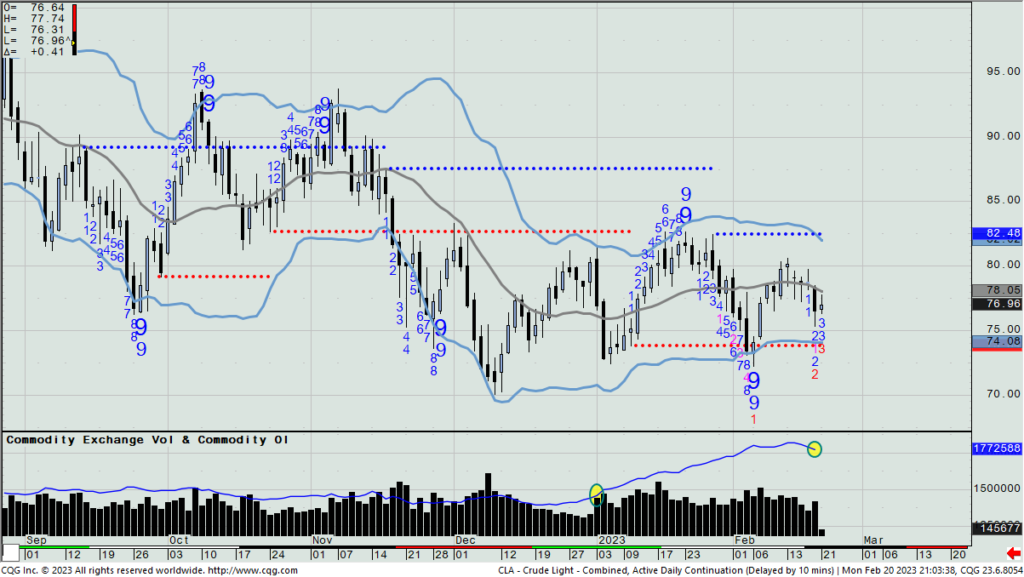

For a new idea, let’s take advantage of a flat oil market in 2023, but one that has added significant open interest since Jan. 1. (to the tune of over 330,000 contracts – a huge surge considering the market hasn’t moved since then). My experience of having traded futures markets for over 40 years would suggest to me that a large directional move is coming, as one of those two sides of recently added new longs or shorts will be on the wrong side of the move – ultimately exacerbating the move even further as the losing side will be forced to unwind their positions.

As such, I want you to consider putting on a long iron condor in the USO July 21st expiration, buying the $71/$77 call spread (it closed Friday at $1.95 mid) and buying the $63/$57 put spread (it closed Friday at $1.90 mid) for a combined cost of $3.85. I’m willing to give up the first 6% or so move in crude oil before this idea starts capturing any juice to it, but when oil really starts to move directionally, I am planning on it being far greater than a single digit percentage move.

Crude Oil – Daily

USO – Daily

$BYND

DailyPlay – Partial Closing Trade (BYND) – February 17, 2023

Partial Closing Trade

- BYND – 25.00% Gain: Sell to Close 10 Contracts (or 50% of your Contracts) Mar 17th $17.50/$22.50 Call Vertical Spreads @ $1.15 Credit. DailyPlay Portfolio: By Closing 10 of the 20 Contracts, we will receive $1,150.

Investment Rationale

The well-higher than expected PPI number yesterday never allowed the SPX to go green on the day, and then a late sell-off sent it spilling to over a 50-point loss (-1.38%) to pull the index down to 4090, its worst close since Feb. 9th. But more importantly, the chances of today closing above 4148 are greatly reduced, and thus, it makes sense to me to lighten all tactical long positions put on since the Oct. low has been made.

Within 100 pts. of yesterday’s SPX close, I see the 4050 put strike with the most open interest (~7,700 contracts) that expire today. On the call side, the largest open interest is in the 4100 strike (some 8,300 contracts) which can also go out worthless depending upon how today trades. These large open interest strikes often act as trading magnets on expiration days.

Looking at where we have some long exposure that I want to actively manage, yesterday Moderna (MRNA) got some bad news on drug trial results, sending the stock down $5. We are short the Feb. 24th $170/$160 put spread from $4.98. It went out yesterday at $3.46 mid. I’d place a buy stop back at breakeven entry to protect this from potentially turning into a loser.

We are also long 20 March 17th BYND $17.5/$22.5 call spreads from $0.92. Yesterday it closed at $1.15 on almost a 2% pullback in the stock. Let’s kick out of 10 of the 20 today to lock in what yesterday closed with a 25% gain since putting the trade on.

For now, I will stick with the several bearish trades that we have open in the portfolio.

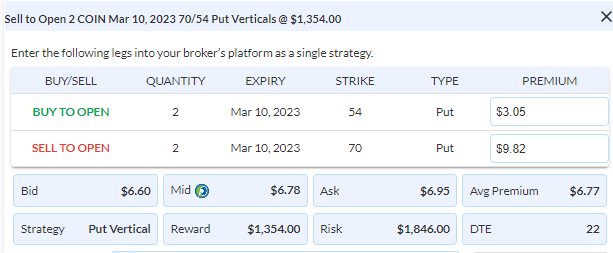

$COIN

DailyPlay – Opening Trade (COIN) – February 16, 2023

COIN Bullish Opening Trade Signal

View COIN Trade

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 2 Contracts Mar 10th $70/$54 Put Vertical Spreads @ $6.78 Credit per contract.

Total Risk: This trade has a max risk of $1,846 (2 Contracts x $923).

Trend Continuation Signal: This stock is currently bullish and found support to continue this uptrend.

1M/6M Trends: Bullish/Bullish

Technical Score: 5/10

OptionsPlay Score: 92

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Stocks pulled off a victory on Wednesday after being down early, to mark a new closing high in the SPX for the current rally started in October. The SPX closed at 4148 – the precise level I am keying on come this Friday’s close. A close above there that gets upside follow-through next week is bullish; a failure to get above 4148 on Friday’s close keeps me playing with a defensive approach, as it will be very similar to the failure at last August’s high (which also stopped against its bullish weekly Propulsion Momentum level (highlighted in yellow-colored rectangles).

SPX – Weekly

Looking at a new idea for today, notice that until earlier this month, both price and the daily cloud’s Lagging Line (in bold blue) had been beneath the daily cloud since late 2021. Then, in early Feb. price broke out upside of both the cloud and the Lagging Line broke out above its cloud, to both pullback and hold cloud support earlier this week, before rocketing higher yesterday. To me this looks like a breakout/test/breakout to put COIN back into a bullish posture in the near-term.

COIN – Daily

As such, with premiums quite elevated in this name (the implied vol of ATM puts is running at ~150%), we can sell a March 10th $70/$54 put spread ($54 was the low earlier this week). Based upon Wednesday’s closing mid-price of $6.775 for this spread, we can collect about 42% of the strike differential – a number I can easily live with for a credit spread. Do note that earnings come out next week on the 21st, so my plan is to carry this position through the earnings report.

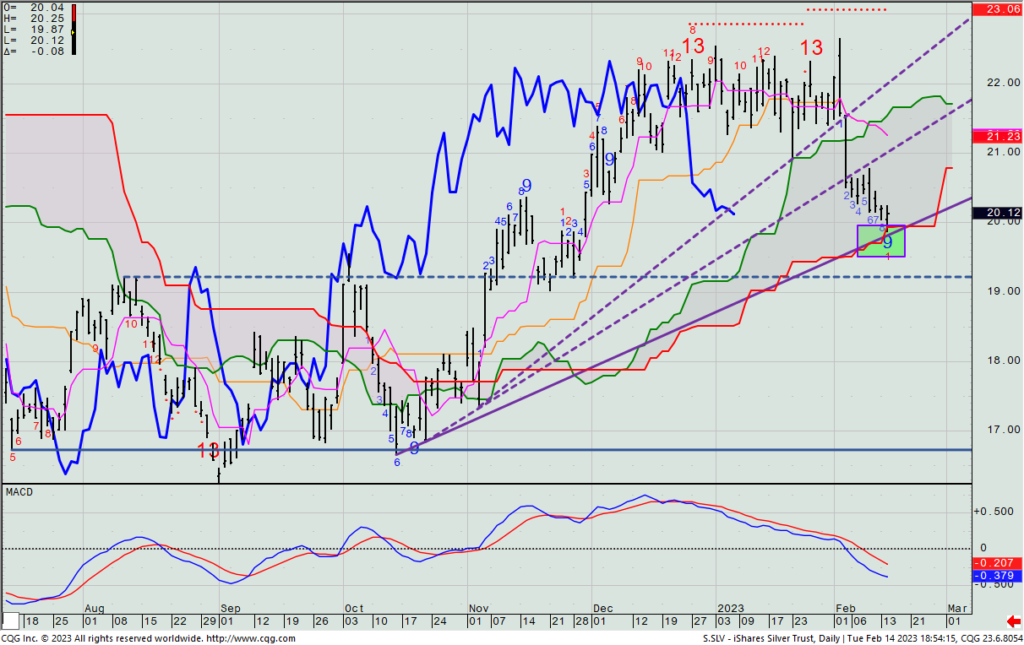

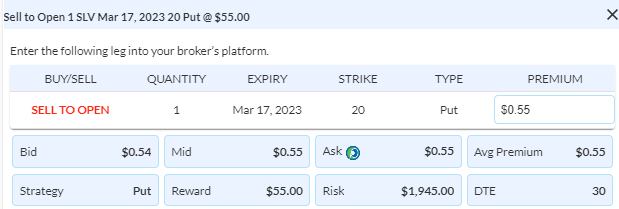

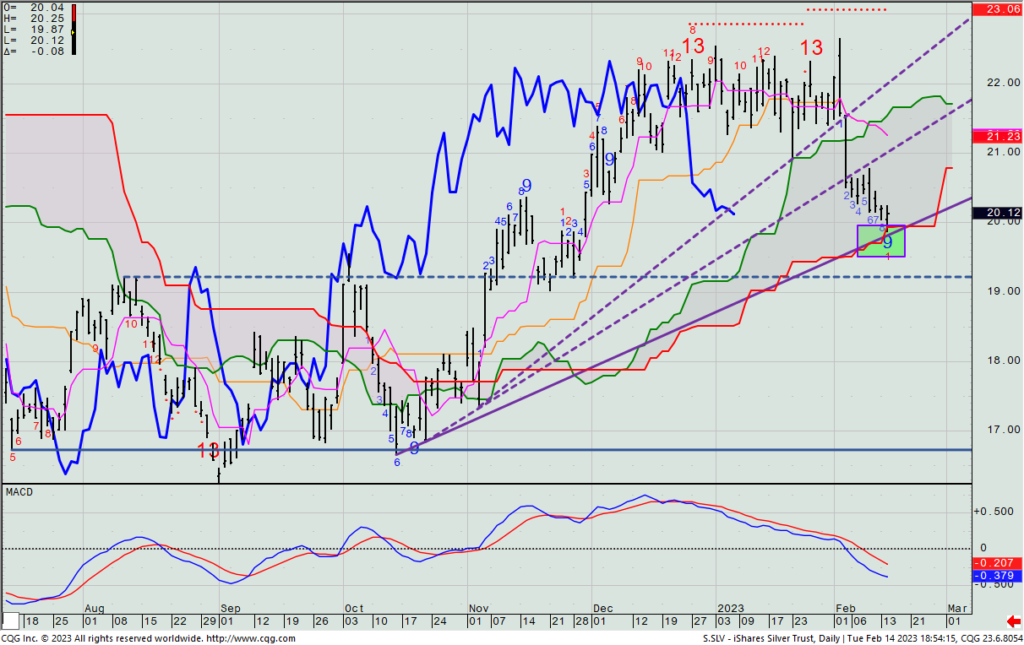

$SLV

DailyPlay – Opening Trade (SLV) – February 15, 2023

SLV Bullish Opening Trade Signal

View SLV Trade

Strategy Details

Strategy: Cash Secured Put

Direction: Bullish

Details: Sell to Open 1 Contract Mar 17th $20 Cash Secured Put @ $0.55 Credit per contract.

Total Risk: This trade has a max risk of $1,945 (1 Contract x $1945).

Counter Trend Signal: This ETF is currently neutral to bearish and is expected to resume an uptrend.

1M/6M Trends: Bearish/Neutral

Technical Score: 6/10

OptionsPlay Score: N/A

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

There was a ton of movement in the markets after the CPI number came out, but when all was said at the end of the day, we saw the SPX virtually flat on the day – not particularly helping us get a better clue on whether or not the bulls can push this up and through the key 4148 level by Friday’s close. What is still evident, though, is that this bullish weekly Propulsion Momentum level has not yet been properly breached, and as such, I will stay with my near-term call for a market pullback from this mid-4100 area.

Recall last week my desire to buy the iShares Silver Trust if it sold down to the uptrend line and cloud bottom area I had highlighted. Well, it got there yesterday while also marking a daily Setup -9 count – upping the odds that the timing is right to be bullish now, too.

SLV – Daily

As such, let’s look to put on a bullish play by either A) selling a single March 17th $20 cash-secured put. It closed at $0.545 mid-yesterday and gives you the chance to collect the premium if not exercised, or lets you get long SLV closer to $19.45 if exercised, or B) simply buying the SLV for the approximate $2000 that 100 shares would cost you.

Choice A makes you have the $2000 cash in your account, and you run the risk that silver sharply rallies and you’re not involved (other than collecting the ~$545). In this case, you’re also covered down to $19.45 before you lose money.

Choice B makes you lay out the ~$2000 right away, and you either make or lose – penny for penny – what silver makes or loses. But it does gives you unlimited profit potential if silver materially rallies, whereas Choice A maxes out your return at ~$545.

$CRWD

DailyPlay – Closing Trade (XLF) Opening Trade (CWRD) – February 14, 2023

Closing Trade

- XLF – 74.50% Loss: Sell to Close 7 Contracts (or 50% of your Contracts) Mar 3rd $35.5/$32.5 Put Vertical Spreads @ $0.17 Credit per contract.DailyPlay Portfolio: By Closing 7 of the remaining 14 Contracts, we will be receiving $119.

CRWD Bullish Opening Trade Signal

View CRWD Trade

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 1 Contract Mar 10th $94/$130 Call Vertical Spread @ $17.81 Debit per contract.

Total Risk: his trade has a max risk of $1,781 (1 Contract x $1,781).

Trend Continuation Signal: This is a bullish trade on a stock that has recently turned bullish.

1M/6M Trends: Bullish/Neutral

Technical Score: 2/10

OptionsPlay Score: 94

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Stocks rallied ahead of today’s key CPI report (out an hour before the NYSE opens), so we’ll at least see investors’ initial reaction to the number based on how the futures trade right after 8:30am ET. The consensus Y-O-Y inflation rate is expected to be 6.2%, with core inflation expected to be 5.5%. Bulls expect these numbers to come in as expected or better, but if they are higher, look for an immediate decline that I’d expect to continue down several percent over the balance of the week. I’ll focus on where the SPX is on Friday’s close: above 4148 will likely lead to a higher market over the next several weeks; lower than 4148 keeps me thinking the market is heading lower in the near term.

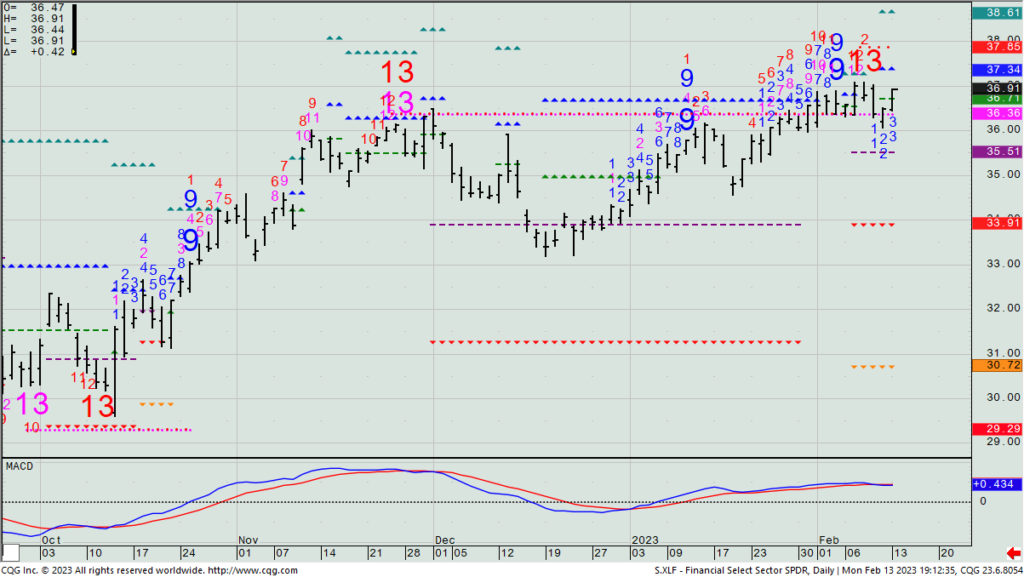

As per open positions, if today’s CPI pushes stocks higher, then we have to lower our bearish exposure on the long XLF March 3rd $35.5/$32.5 put spread we have on by removing half of the 14 spreads we have remaining.

XLF – Daily

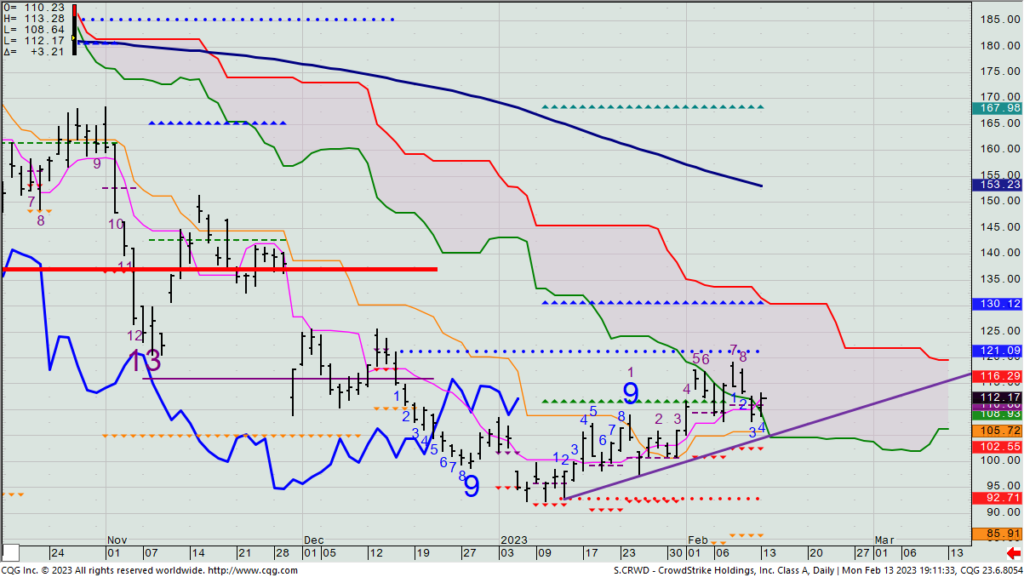

For a new trade idea, I do like the very badly beaten-down name, CrowdStrike Holdings (CRWD). This sold off some 70% from its all-time high, and is considered one of the premier cybersecurity names out there.

CRWD – Daily

Let’s look to buy a position in the March 10th $94/$130 call spread (It closed yesterday at $17.81 mid).

Your only choice to make is whether or not to put this on in relation to the CPI number and whether you think the overall market is now headed higher or not.