$SPOT

DailyPlay – Closing Trade (JNJ) Opening Trade (SPOT) – February 13, 2023

Closing Trade

- JNJ – 102.02% Loss: Buy to Close 3 Contracts (or 100% of your remaining Contracts) March 17th $170/$165 Put Vertical Spreads @ $4.00 Debit per contract. DailyPlay Portfolio: By Closing the remaining 3 of 6 Contracts, we will be paying $1,200. We partially closed this trade on Jan 31 when we Closed 3 Contracts @ $3.54 Debit. Our average cost basis to exit this trade is therefore $3.77 Debit, and our average loss on this trade is 90.41%.

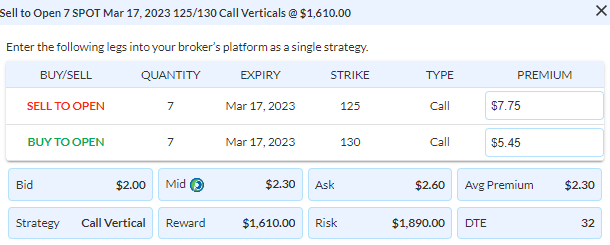

SPOT Bearish Opening Trade

View SPOT Trade

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell to Open 7 Contracts Mar 17th $125/$130 Call Vertical Spread @ $2.30 Credit per contract.

Total Risk: This trade has a max risk of $1,890 (7 Contracts x $270).

Counter Trend Signal: This is a bearish trade on a stock that is overbought and expected to retrace lower.

1M/6M Trends: Bullish/Bullish

Technical Score: 10/10

OptionsPlay Score: 107

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

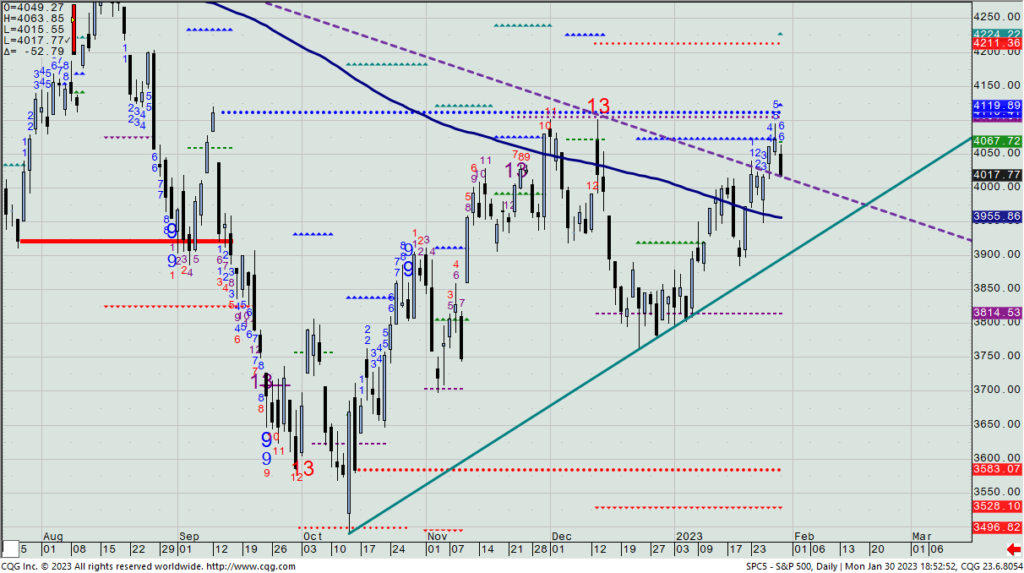

Last week I called for a stock pullback; dollar rally; and bond decline, and all three played out to start what I think are continued near-term moves in all three. The failure of the SPX at the weekly bullish Propulsion Momentum level (4148) along with the inability for the TNX to close beneath its weekly Base Line at 3.50% two weeks ago – along with the highest SPX bullish sentiment reading in over a year – were the combined catalysts for that call I made.

Looking at our open position portfolio, the only one I want to change right now is the short JNJ March 3rd $170/$165 put spread. We have 3 spreads on, and with them down 102%, let’s take them off, despite the time remaining till expiration. (I try not to have bigger than 100% losses on credit spreads.)

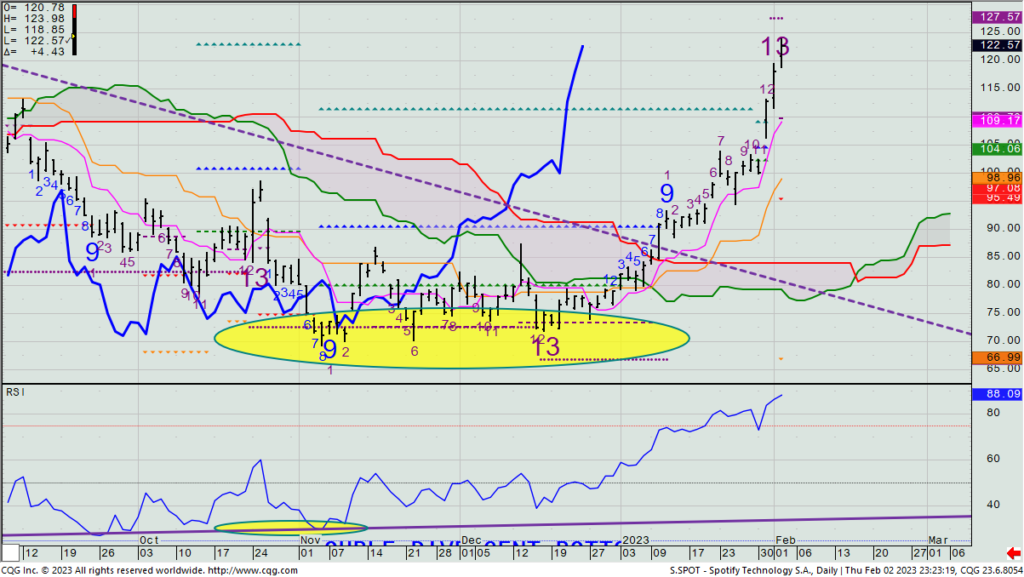

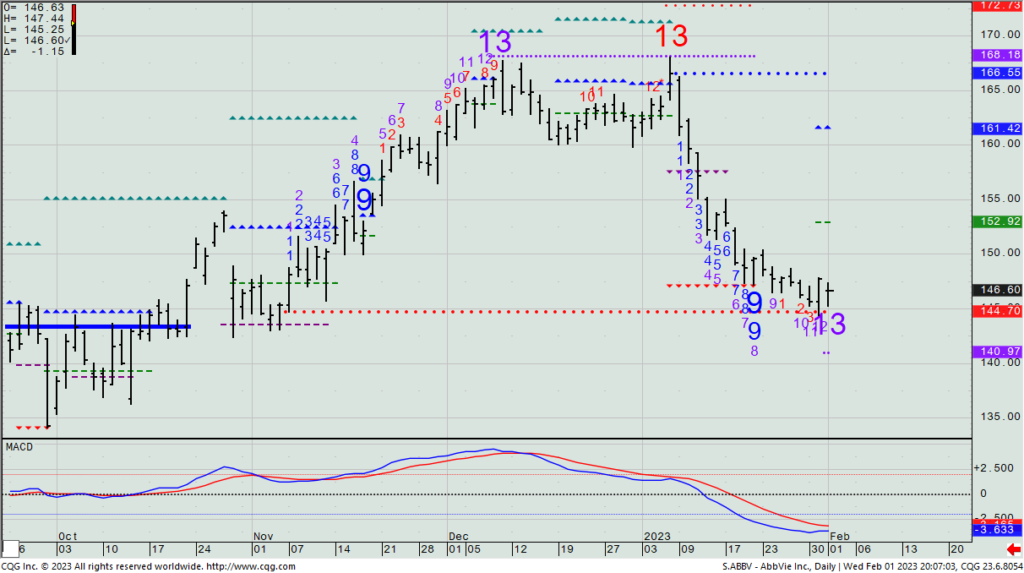

As per a new idea, we recently had a great bullish trade in SPOT. I’m thinking we can now play it in the other direction, looking for a potential 10% downmove from it failing against the August ’22 high that by chance was accompanied by both Aggressive and standard Sequential +13 signals and a very overbought MACD reading.

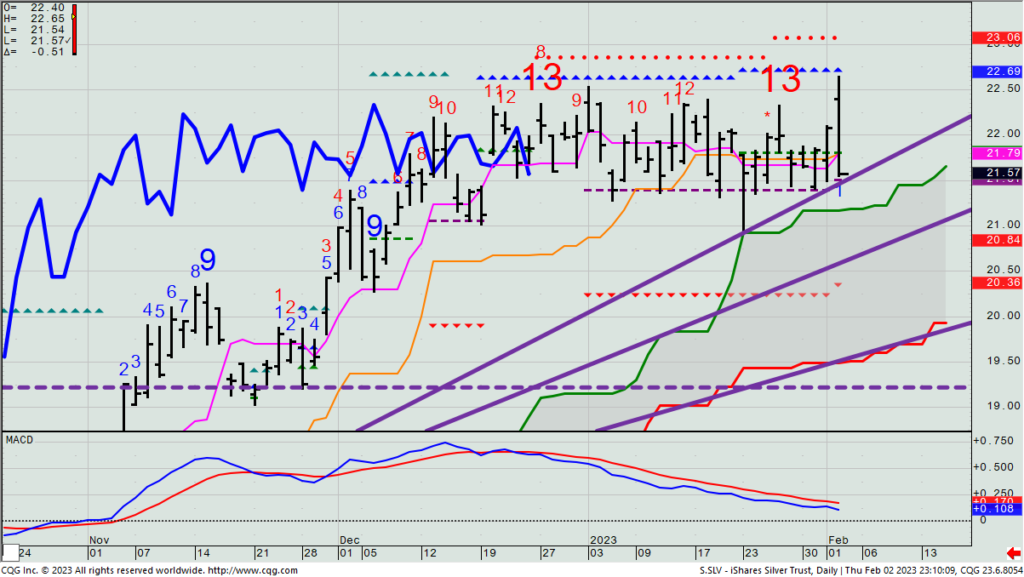

SPOT – Daily

As such, let’s look to sell some juiced-up calls by shorting the March 17th $125/$130 call spread (it closed at $2.30 mid-price on Friday, representing a 46% premium collection of the $5 strike differential).

$BYND

DailyPlay – Opening Trade (BYND) – February 10, 2023

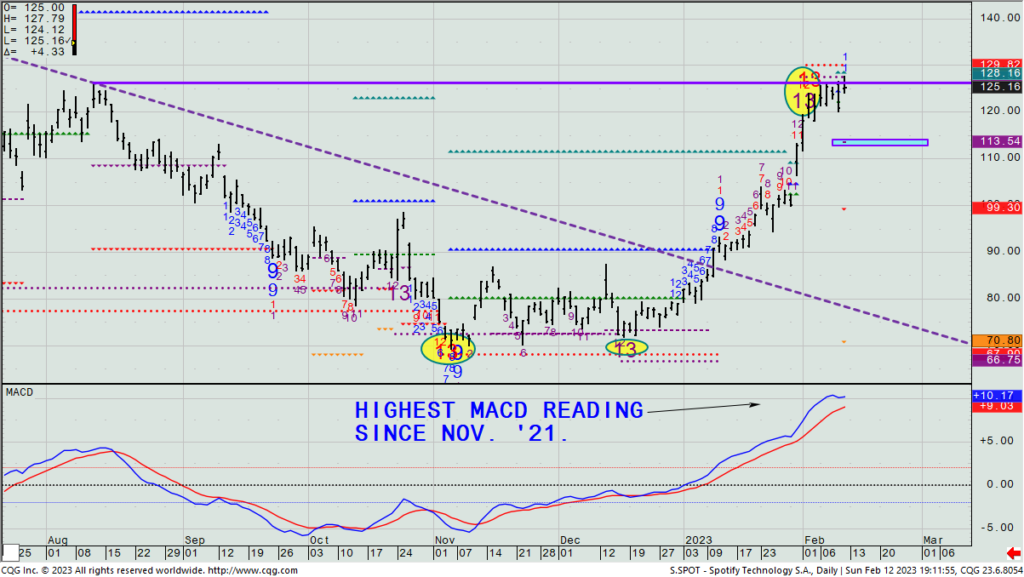

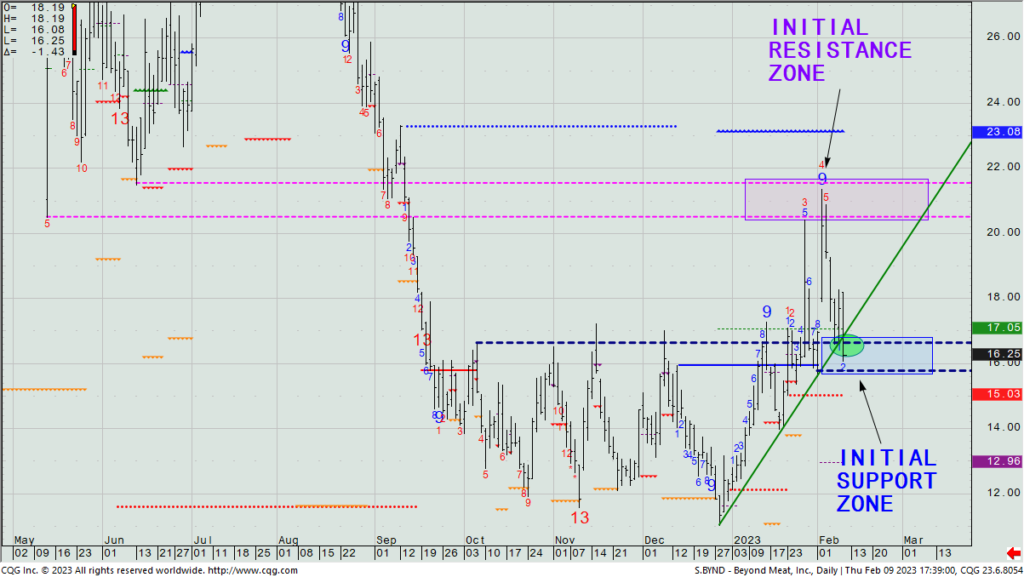

BYND Bullish Opening Trades

View BYND Trade

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 20 Contracts Mar 17th $17.50/$22.50 Call Vertical Spreads @ $0.92 Debt per contract.

Total Risk: This trade has a max risk of $1,840 (20 Contracts x $92).

Counter Trend Signal: This is a stock that is currently neutral and is expected to continue its uptrend.

1M/6M Trends: Neutral/Neutral

Technical Score: 1/10

OptionsPlay Score: 162

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Stocks gapped well higher on the open, but sold off straight and into negative territory by mid-session, and then closed well-lower and near the lows of the day. It was a telling day to me, and keeps me thinking that we’re going to see the 5% decline from the mid-4100 SPX zone that I declared early in the week. Today is Friday, with another weekly option expiration at hand.

Here’s an idea that to me appears as a low risk new long – perhaps even best as simply getting long the stock as it’s less than a $17 one. Let’s look at the below daily chart of Beyond Meat (BYND). It put in a horizontal 3.5 month base that recently broke out upside to stop on a Setup +9 count right into its first resistance area. It has now pulled back to the breakout point, which happens to coincide with its uptrend line. I can’t be sure it bottoms right here, but I’d say it’s not a bad place to get long (or minimally, start a long position).

BYND – Daily

Buying a call spread is always an option, especially in a low volatility environment like we’re now in. Looking at the March 17th $17.5/$22.5 call spread, we need to spend only about ~20% of the strike differential (but the stock is some 6% beneath the ATM strike, so a theoretical higher cost than the 20%). This is still within the realm of what we consider fairly priced, and certainly something you can consider.

Personally, I’d consider doing both a partial commitment using the above call spread, and now buying a partial position in the stock and scaling it down buying down to $15 on the rest. I look at this in terms of a medium-term holding period. Earnings are out on Feb. 23rd.

$GE

DailyPlay – Closing Trade (ABBV) Partial Closing Trade (XLF) Opening Trade (GE) – February 9, 2023

Closing Trade

- ABBV – 4.35% Gain: Buy to Close 7 Contracts (or 100% of your Contracts) Feb 10th $145/$141 Put Vertical Spreads @ $1.54 Debit.DailyPlay Portfolio: By Closing all 7 Contracts, we will be paying $1,078.

Partial Closing Trade

- XLF – 68.62% Loss: Sell to Close 3 Contracts (or 20% of your remaining Contracts) Mar 3rd $35.5/$32.5 Put Vertical Spreads @ $0.21 Credit.DailyPlay Portfolio: By Closing 3 of the remaining 17 Contracts, we will be receiving $63.

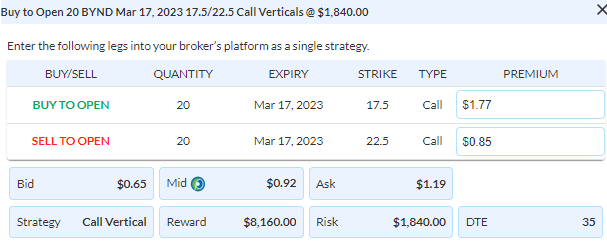

GE Bearish Opening Trades

View GE Trade

Strategy Details

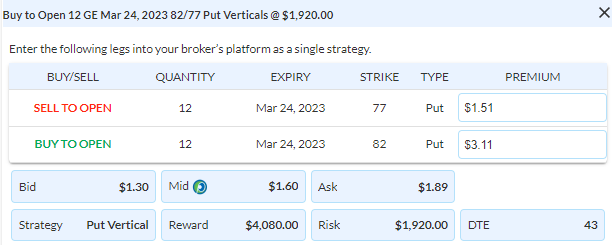

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 12 Contracts Mar 24th $83/$77 Put Vertical Spreads @ $1.60 Debt per contract.

Total Risk: This trade has a max risk of $1,900 (12 Contracts x $160).

Counter Trend Signal: This is a stock that is currently bullish and overbought, and a retracement lower is highly likely.

1M/6M Trends: Bullish/Bullish

Technical Score: 10/10

OptionsPlay Score: 136

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Investors took a little bit more realistic view of the economy and Chair Powell’s comments from Tuesday, and turned yesterday into a profit-taking day – mostly offsetting most of Tuesday’s 1.3% rally by falling 1.1% on Wednesday. GOOGL’s 7.6% decline made Communication Services the worst-performing sector, while Health Care was the best performer, with all 11 sectors down on the day.

This morning we’re going to see earnings from one of our open positions: ABBV. When we first sold the put spread, I had said we would carry it to right before today. We have until tomorrow for the Feb 10th $145/$141 put spread options to expire, but this morning’s earnings report will make this all but a binary “winner or loser” event. Just make sure you’re out of it by today’s close unless today shows a large gain.

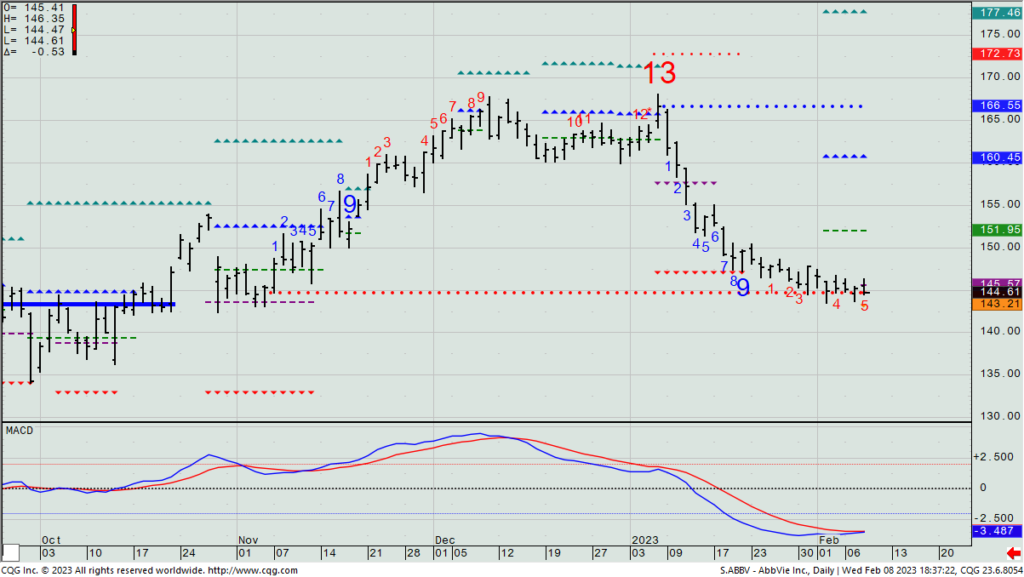

ABBV – Daily

We are also long 17 March 3rd XLF $35.5/$32.5 put spreads. We previously took off about 1/3 of the position, and today we’ll take it down 3 more spreads to bring it to 14 remaining.

There’s a lot of up and down going on in the market, but that has not made me change my view that the SPX could get a 5% pullback from the mid-4100 level. As such, I am looking for new bearish ideas, and one that pops up is revisiting a successful bearish play we had on a couple of months ago: GE. Notice on its daily chart below that there is a real rhythm to this name, peaking on Aggressive Sequential +13 signals, and then bottoming into a Setup -9 count.

GE – Daily

A recent +13 showed up last week, and I’ll again look for this to head lower in the coming weeks. Thus, we’ll look to buy a March 24th $82/$77 put spread, which went out yesterday at $1.60 mid, or 32% of the strike differential (Notice that MACD sell signals just happen to come about one week after the prior two +13 signals showed up.) As is frequently the case, I’d rather be an option seller than buyer, but selling the call spread yielded something near 20% — a level I would never sell a spread for.

$MRNA

DailyPlay – Opening Trade (MRNA) – February 8, 2023

MRNA Bullish Opening Trades

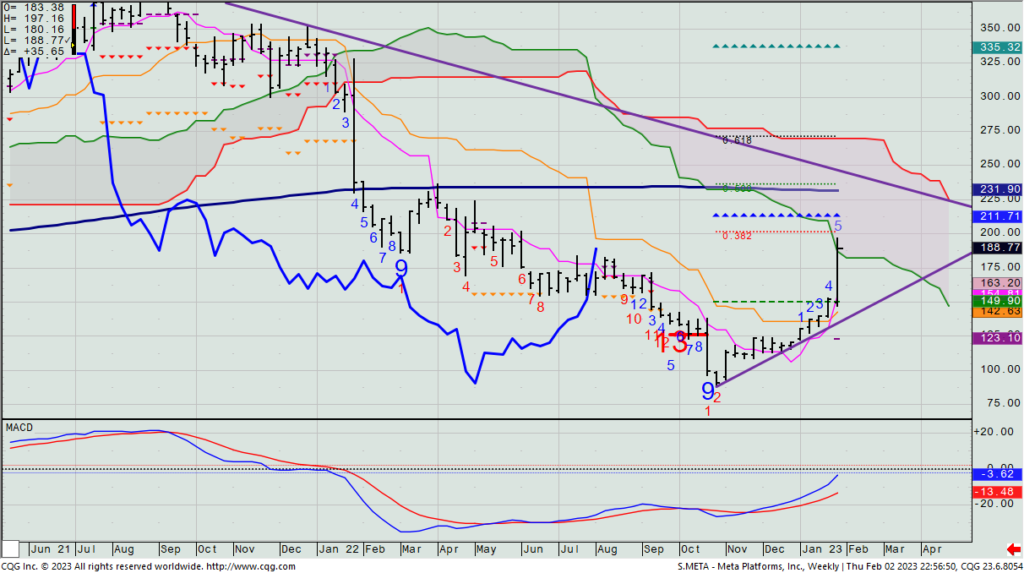

View MRNA Trade

Strategy Details

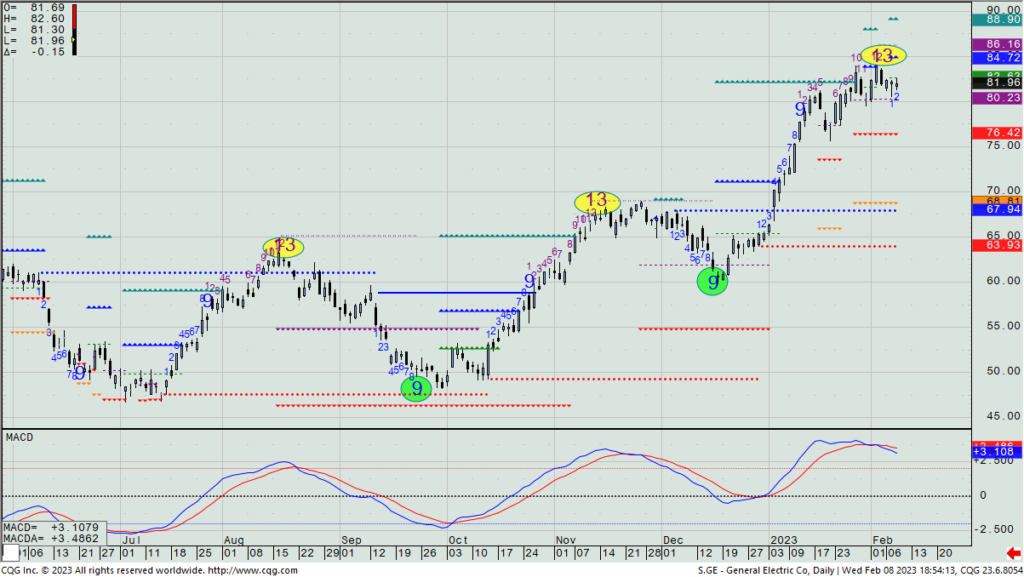

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 3 Contracts Feb 24th $170/$160 Put Vertical Spreads @ $3.70 Credit per contract.

Total Risk: This trade has a max risk of $1,890 (3 Contracts x $630).

Counter Trend Signal: This is a stock that is currently bearish and oversold, with a strong potential for a quick bounce higher.

1M/6M Trends: Bearish/Neutral

Technical Score: 3/10

OptionsPlay Score: 88

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Powell’s comments first sent the market higher, than that 50 point SPX gain turned into a 20 point loss, all to see another big rally to close the day up 53 points and a 1.3% gain. In the end, the Fed Chair’s comments were not enough to dissuade buyers from again bidding up stocks. The SPX did close on its highest level of the entire post-Oct. low rally, and did end the day at 4164, a quarter-percent above the 50% retracement up to the whole 2022 decline.

With the VIX at the low end of where it’s traded in the past year, I’m often seeing calls priced expensively and puts priced cheaply, making buying a call spread or selling a put spread less than an ideal way to put on a bullish bet. Nonetheless, we need to play within the context of what the market gives us.

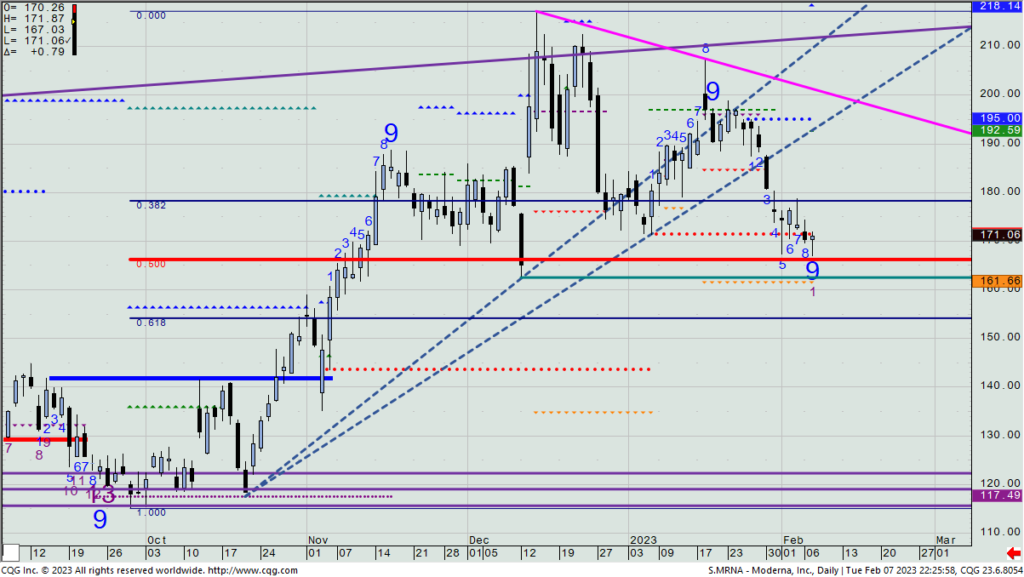

Let’s look at the daily chart of Moderna (MRNA), which yesterday posted a daily Setup -9 count into its general support area and cloud bottom. It reports earnings on Feb. 23rd, just over two weeks from now. With the overall market holding up, let’s look for this to find some support around here. As such, let’s look to sell a Feb. 24th $170/$160 credit spread today. It went out yesterday at $3.70 mid, representing a credit of 37% of the strike differential – a mostly fair price for the spread (though a bit less than I’d typically like to receive as premium). The $170/$180 call spread costs $4.25, or ~43% of the strike differential – well too expensive to consider.

MRNA – Daily

$SLV

DailyPlay – Conditional Opening Trade (SLV) – February 7, 2023

SLV Conditional Bullish Opening Trades

View SLV Trade

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish

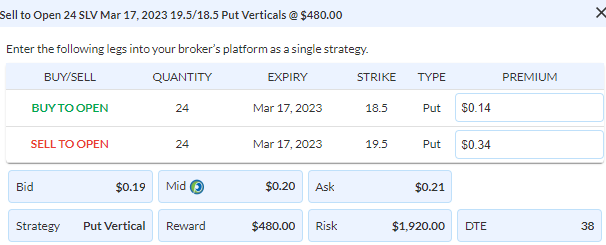

Details: Sell to Open 24 Contracts Mar 17th $19.50/$18.50 Put Vertical Spread @ $0.20 Credit per contract.

Total Risk: This trade has a max risk of $1,920 (24 Contracts x $80).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Neutral

Technical Score: 5/10

OptionsPlay Score: 96

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that this is a Conditional trade. The condition that has to be met, before you enter this bullish trade is if the price moves to $19.75 anytime in the next week. Therefore, the price for this trade will be different than what we are showing here, which is only acting as a guideline.

Investment Rationale

Yesterday, stocks started, as I expected, with as much as a 5% pullback, with the SPX having topped last week at its weekly bullish Propulsion Momentum level of 4148 (i.e., the same indicator that it failed at on the August high last summer). Though there are still earnings reports out every day, these names don’t really have market-moving impact (meaning that this week’s reports are more likely to generate individual stock movement, but unlikely to impact the overall market like when names like Apple, Google, or Microsoft report). Thus, other factors – including the dollar and bond yields – will more likely effect the overall stock market direction than anything else until the Feb. 14th CPI figure next Tuesday. (Fed Chair Powell does speak today at 12:40pm ET, so let’s see if he walks back any of his non-hawkish talk from last week.)

Here’s a new trade – and returning to an idea we recently had and fortunately got out of it just in time. I like silver over the medium term, but just last Friday exited a bullish trade to avoid the sell-off we’ve seen since. I have looked at where support now lies in the SPDR Silver Trust, and it appears that its lowest uptrend line coincides with the bottom of the cloud for the rest of the week.

SLV – Daily

Right now (to get a sense of what we might expect to collect on a credit spread) the current March 17th ATM/$1 OTM put spread ($20.5/$19.5) takes in a credit of 39% of the $1 strike differential. I’m not looking to put this bullish idea on now, but IF SLV reaches $19.75. That coincides with the cloud bottom (and highlighted in the green box), anytime in the next week, we’ll then look to sell the March 17th $19.50/$18.50 put spread at what is the then-current bid/offer mid-price.

If your portfolio allows it, I think you should also consider buying SLV shares outright down there for a full medium-term expected holding timeframe.

$TLT

DailyPlay – Closing Trade (TLT) – February 6, 2023

Closing Trade

- TLT – 97.84% Gain: Buy to Close 1 Contract (or 100% of your remaining Contracts) Feb 17th $100/$95 Put Vertical Spread @ $0.04 Debit. DailyPlay Portfolio: By Closing the remaining 1 Contract, we will be paying $4. We partially closed this trade on Jan 9 when we closed 2 Contracts at $0.66 Debit, then on Jan 17 when we closed 1 Contract at $0.39 Debit, on Jan 31 we closed 1 Contract at $0.16 Debit. Our average cost basis for this trade is therefore $0.38 Debit and our average gain on this trade is 79.35%.

Investment Rationale

Stocks sold off on Friday as the large jobs numbers don’t gel with the Fed’s goal of slowing the economy. Technically, the SPX reached above the 4148 bullish weekly Propulsion Momentum level last week but then closed beneath there. Along with several other things I’m looking (i.e., bullish sentiment having reached as high as 66% bulls last Thursday; UST 10-yr. bond rates again having held above the weekly 3.50% Base Line level after being under 3.4% a day earlier; the and DXY marking a new low last week before rallying sharply on Friday above its downtrend line), I’m looking for the recent rally in the SPX to give back as much as 5% in the near-term to target ~3900 to 3850.

I want to exit our last remaining TLT short Feb. 17th $100/$95 put spread today, up 98%.

We will stay short the ABBV put spread because I think that Health Care stocks will hold up better during this possible decline (as will any classic defensive sector). Our UNG short is against us, but I think the almost 5 weeks we have till expiration should be enough time for natgas to see a decent trading bounce take place.

$SLV, $SPOT

DailyPlay – Closing Trades (SLV, SPOT) – February 3, 2023

Closing Trades

- SLV – 3.64% Gain: Buy to Close 1 Contract (or 100% of your remaining contracts) March 17th $21 Cash Secured Put @ $0.53 Debit. DailyPlay Portfolio: By Closing the 1 Contract, we will be paying $53.

- SPOT – 200.63% Gain: Sell to Close 1 Contract (or 100% of your remaining contracts) Feb 17th $90/$110 Call Vertical Spread @ $19.00 Credit. DailyPlay Portfolio: By Closing the remaining 1 of 3 Contracts, we will be receiving $1900. We Partially Closed this trade on Jan 18 at $6.45 Credit and then again on Jan 31 at $9.72 Credit. Our average cost basis to exit this trade is therefore $11.72 Credit, and our average gain is 85.5%.

Investment Rationale

Equities again moved higher on Thursday after the huge META report and Zuckerberg comments. However, S&P futures are down about 50 bps. as I write this late night after several large cap names reported earnings.

Today is another weekly options expiration, including a position we have open in the Feb.3rd short META $123/$113 put spread. The last spread we have on will go out with the full 100% capture of the premium received, and we did nicely on this one. (Many of you who listen to my Option Play webinars know that I personally bought META on the day it made the secular low last year. Under $89. I sold half yesterday precisely $100 above my entry point, as there is some potential resistance up here from the weekly cloud chart; the 38% Fibo retracement level at $201; and then the Propulsion Exhaustion level at ~$212. I choose not to be a pig.)

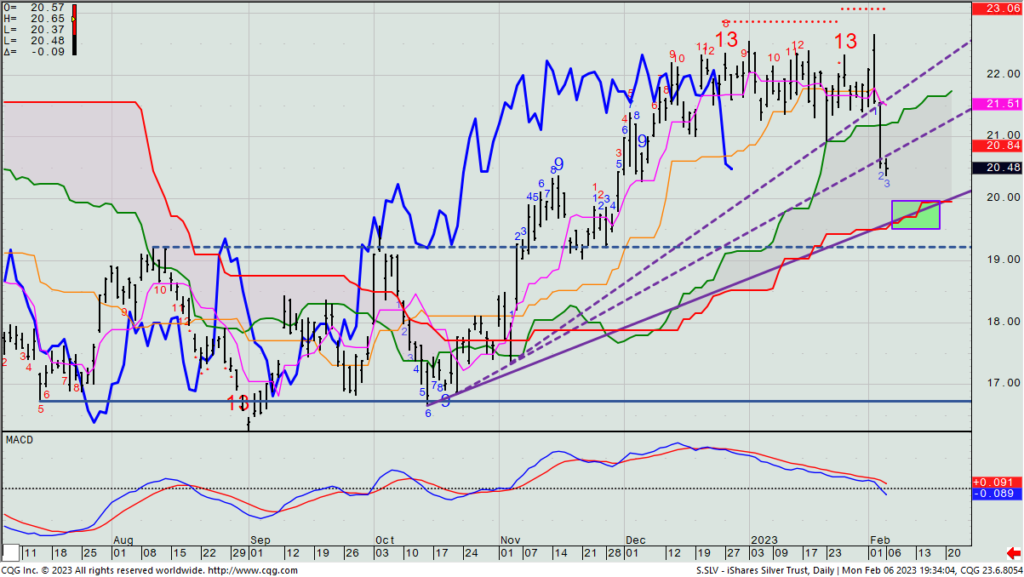

META – Weekly

Yesterday, the price of silver jumped > $1 (~4%) before giving back everything to close unchanged on the day. The SLV ETF closed down about 50 cents (~2.5%) and is now pennies beneath where we first put on the March 17th short $21 put spread. Despite the SLV’s trendline still holding as support, I’m not loving its price action, so I am going to recommend we get out today, and look for another opportunity to be bullish this or gold in coming weeks at a better price.

SLV – Daily

Let’s also now remove the SPOT Feb. 17th $90/$110 call spread we have on. We are up 200% on the last spread and it’s facing resistance on both the daily and weekly charts.

SPOT – Daily

$ABBV

DailyPlay – Opening Trade (ABBV) – February 2, 2023

ABBV Bullish Opening Trades

View ABBV Trade

Strategy Details

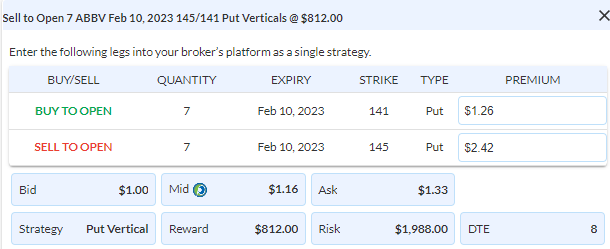

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 7 Contracts Feb 10th $145/$141 Put Vertical Spreads @ $1.16 Credit per contract.

Total Risk: This trade has a max risk of $1,988 (7 Contracts x $284).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 3/10

OptionsPlay Score: 88

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on yesterday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

The Fed spoke, and it wasn’t that they particularly said bullish comments to make the market turnaround from a 1% loss to over a 1% gain. But it was the lack of any semblance of remarks similar to what Powell said in August at the Jackson Hole meeting that gave bears reason to cover shorts and bulls to put some money to work. (I still hear from trading desks that the bulk of buying is coming from shorts covering than it is from real new money coming in. They say that mutual fund PMs are still net sellers into this strength.) That should give you some reason not to be overzealous.

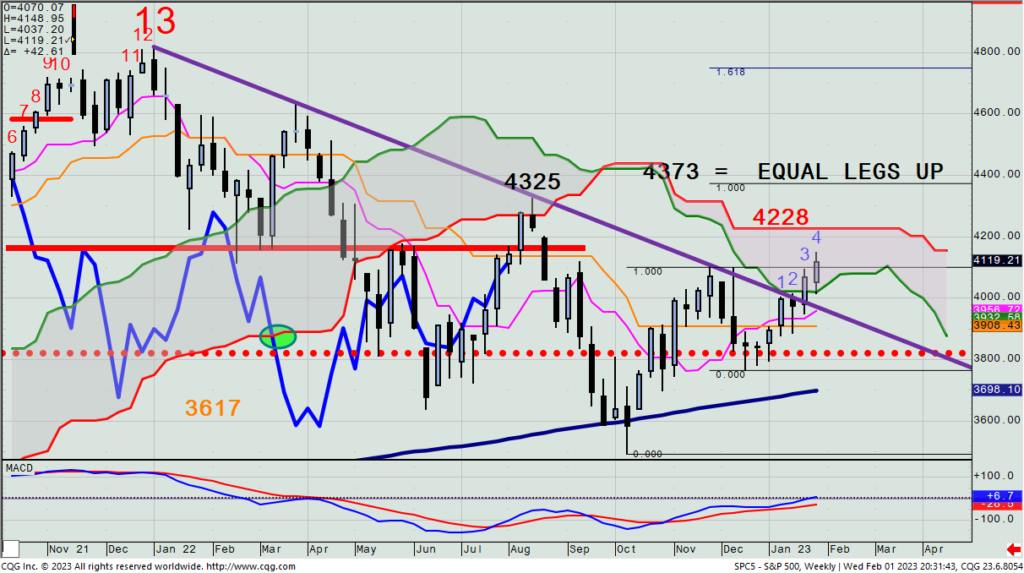

I can make the case that there’s still more upside to go, and we possibly see the SPX test the weekly cloud high at 4228, or even the August high near 4325. If it gets above the latter, I will likely start selling stocks again, as that move would almost assuredly drag out all previous shorts (i.e., actually increasing the odds that the upmove won’t have much more to go).

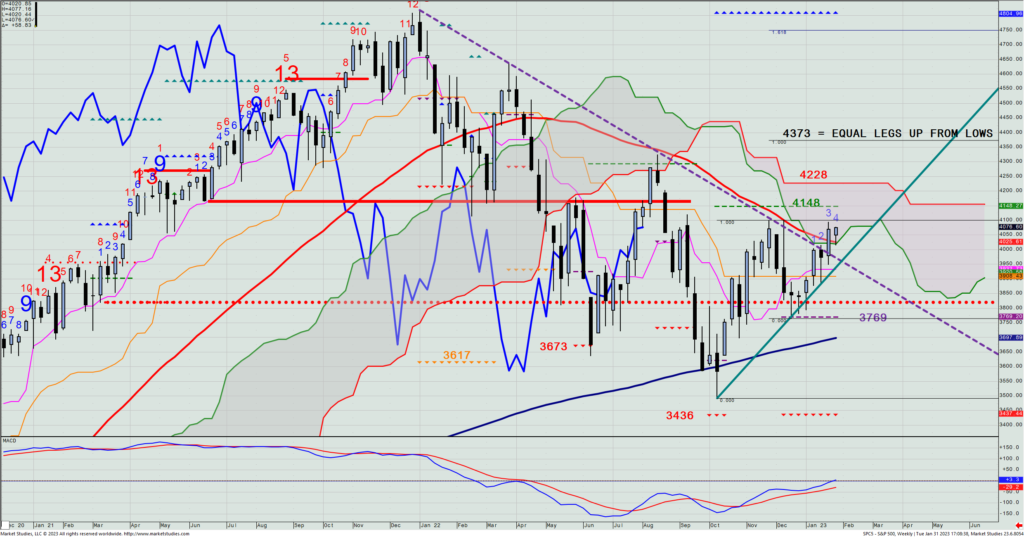

SPX – Weekly

Here’s an idea for a new trade that is very tactical in nature, and is playing that between now and earnings on the morning of Feb. 9th (giving us a max. of 6 days to hold the position (unless it surprisingly materially rallies between now and then, which would then potentially give us a reason to hold through the earnings report).

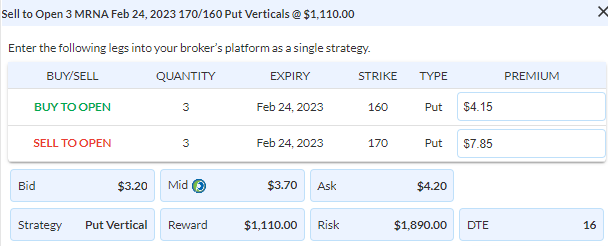

Let’s look at the daily chart of ABBV, a stock that we recently made very good money on when we were long a $160/$145 put spread. With it continually holding right around that $145 support level and then yesterday marking an Aggressive Combo -13 signal, I’d think that this will not materially decline before that 2/9 report, giving us the chance to make some money by collecting downside premium.

ABBV – Daily

As such, let’s look to sell a Feb. 10th $145/$141 put spread. It’s slightly out of the money, and only collects 29% of the spread differential ($1.165 as of yesterday’s closing mid price). Though this is not what I’d normally be willing to accept on a credit put spread, buying calls could easily see time pass to not accomplish the goal of us making money. (BTW- the $146/$152.50 call spread cost 39+ percent, so they’re definitely no bargain, either.)

DailyPlay Updates – February 1, 2023

Buyers came right back in on Tuesday, negating Monday’s decline after some earnings numbers gave them enthusiasm. For us, that was mostly a good thing, as all off yesterday’s Daily Play ideas were to lighten exposure either yesterday or today before the Fed’s announcements.

Today is both a key earnings day; economic reports day; and, of course, the all-important FOMC rate announcement and press conference. This should easily set the stage for the near-term market movement – certainly through the Feb. 14th CPI figure – but very possibly well beyond. As a habit, I typically lighten all trading exposure into such a key potentially large market moving event. (In fact, here’s the link to a video I just created yesterday for my own In The Know Trader YouTube channel that addresses how to handle this very issue: https://youtu.be/RwoSTXjsZNc. I really suggest you watch it.)

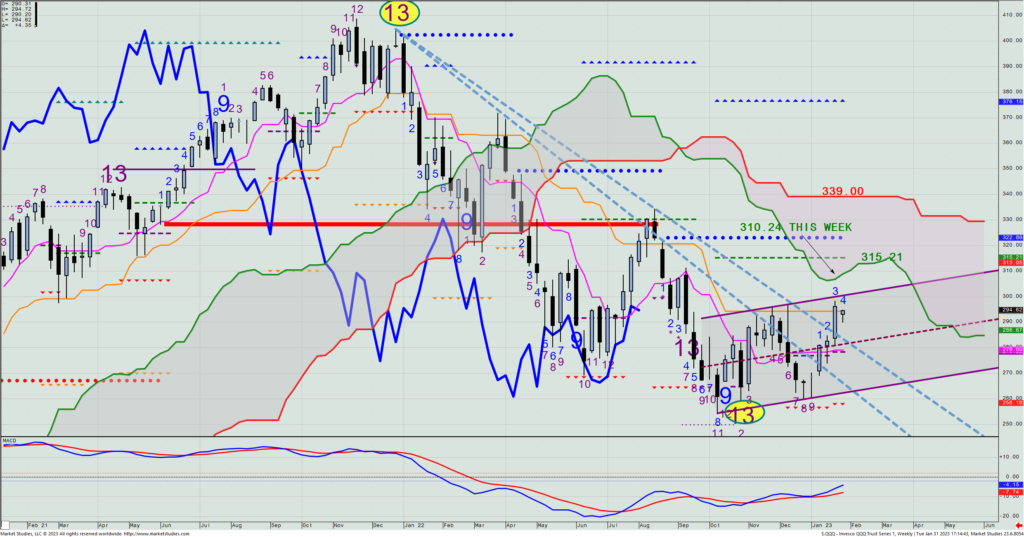

Here’s the look at both the weekly SPX and QQQ charts. They certainly have a much better look than we’ve seen in a while, but they both have overhead resistance to deal with to improve its medium-term picture. I remain in the camp that this year might very well be one that really messes with investors’ heads (for that matter, traders’, too) by which when you’re finally convinced that the market must be headed higher, it’s in the 9th inning of the rally. And when and if you’re convinced that selling is the right thing to do because the market has broken down, it could very well also be in the 9th inning of that decline. It may, actually, end up becoming the perfect year for counter-trend trading. We’ll have a better clue by week’s end.

SPX – Weekly

QQQ – Weekly

$META, $TLT, $SPOT, $XLF, $JNJ

DailyPlay – Partial Closing Trades (META, TLT, SPOT, XLF, JNJ) – January 31, 2023

Partial Closing Trades

- META – 87.90% Gain: Buy to Close 1 Contract (or 50% of your remaining Contracts) Feb 3rd $123/$113 Put Vertical Spread @ $0.45 Debit. DailyPlay Portfolio: By Closing 1 of the remaining 2 Contracts, we will be paying $45.

- TLT – 91.35% Gain: Buy to Close 1 Contract (or 50% of your remaining Contracts) Feb 17th $100/$95 Put Vertical Spread @ $0.16 Debit. DailyPlay Portfolio: By Closing 1 of the remaining 2 Contracts, we will be paying $16.

- SPOT – 53.80% Gain: Sell to Close 1 Contract (or 50% of your remaining Contracts) Feb 17th $90/$110 Call Vertical Spread @ $9.72 Credit. DailyPlay Portfolio: By Closing 1 of the remaining 2 Contracts, we will be receiving $972.

- XLF – 38.74% Loss: Sell to Close 9 Contracts (or a third of your remaining Contracts) Mar 3rd $35.5/$32.5 Put Vertical Spreads @ $0.41 Credit. DailyPlay Portfolio: By Closing 9 of the 26 Contracts, we will be receiving $369.

- JNJ – 78.79% Loss: Buy to Close 3 Contracts (or 50% of your remaining Contracts) Mar 17th $170/$165 Put Vertical Spreads @ $3.54 Debit. DailyPlay Portfolio: By Closing 3 of the 6 Contracts, we will be paying $1,062.

Investment Rationale

Profit-taking was clearly at play yesterday, as traders were locking in profits from the recent run-up before Wednesday’s FOMC announcement. For one of the very few times this year (or maybe even the first; I’m not sure), Staples led daily sector performance. (They were actually higher yesterday – the only sector up on the day while the SPX lost 1.3%.)

As I mentioned in Monday’s weekly outlook webinar, I am not looking to put on new equity positions before we see what transpires on Wednesday after the Fed press conference. Doing so would not only suggest that I can guesstimate what the Fed will say, but then also how investors will react to his press conference words and tone. That’s more than I care to prognosticate with my own money – let alone yours.

But yesterday’s decline does show how easily the market can come off when it wants to. Bulls aren’t going to buy more until they feel that it’s the right zone to do so. I don’t think it’s likely as easy as it just seeing a pullback to the broken downtrend line, for it that’s all it is, then yesterday already achieved that objective.

SPX – Daily

Now, an up-close today above Friday’s close that gets follow-through on Wednesday is potentially another bullish signal that would next target over 4200. Or a down close today that sees a close above last Friday’s high on Wednesday and follow-through on Thursday, also targets that same move to north of 4200 (though a possible Setup +9 count on Thursday could call for a pause and refresh first.

Let’s update some positions:

- META: We are still short 2 Feb 3rd $123/$113 put spread. They report tomorrow after the close. Let’s take one spread off either today or tomorrow (pre-Fed) and we’ll let the last one go through earnings, as we have a large cushion before being exercised.

- TLT: We’re still short 2 Feb. 17th $100/$95 put spreads, up 91%. Let’s get out of one of these today or tomorrow (pre-Fed) as 10-yr. rates continue to hold key support at the weekly Base Line (which this week has moved up to 3.50% (from 3.43%)

- SPOT: We’re still long 2 Feb 17th $90/$110 call spreads, up 54%. Let’s get out of one of these today or tomorrow (pre-Fed).

- XLF: We’re long 26 Mar. 3rd $35.5/$32.5 put spreads, down 29%. Let’s exit 9 of those today or tomorrow (pre-Fed).

- JNJ: We’re short 6 Mar. 17th $170/$165 put spreads. Yesterday’s news with a court not letting JNJ send some 38K talc-related lawsuits into a special bankruptcy situation sent the stock into a tailspin, breaking major support. Our position plunged to a 78% loss in a flash. I have no choice but to sell out of half of these now. JNJ’s intention to appeal this will very not likely be back in court before this expiration date. Now it’s about managing the loss.