$UNG

DailyPlay – Opening Trade (UNG) – January 30, 2023

UNG Bullish Opening Trades

View UNG Trade

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish

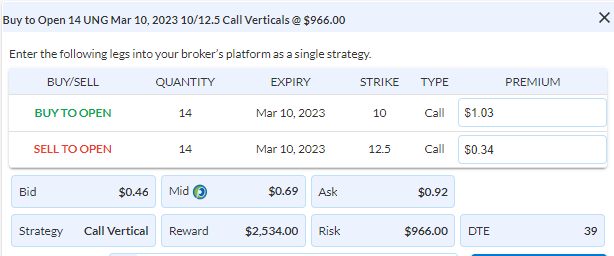

Details: Buy to Open 14 Contracts March 10th $10/$12.50 Call Vertical Spread @ $0.69 Debit per contract.

Total Risk: This trade has a max risk of $966 (14 Contracts x $69).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 1/10

OptionsPlay Score: 108

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Stocks continue their upward ways, now just a few days from the all-important Fed meeting on Wednesday. Investors will be closely watching and listening to Jay Powell’s words, both for content and tonality. This Fed statement – along with the employment report on Friday and the slew of major firms reporting earnings this week – will set the tone for how the market trades up to and even possibly through the next monthly CPI figure on Feb.14th.

I don’t expect much fireworks this week till the Wednesday announcement, so don’t look to over trade or push the envelope on trades before then. I’ll likely use tomorrow and Wednesday morn to lighten some of our bullish positions into the number.

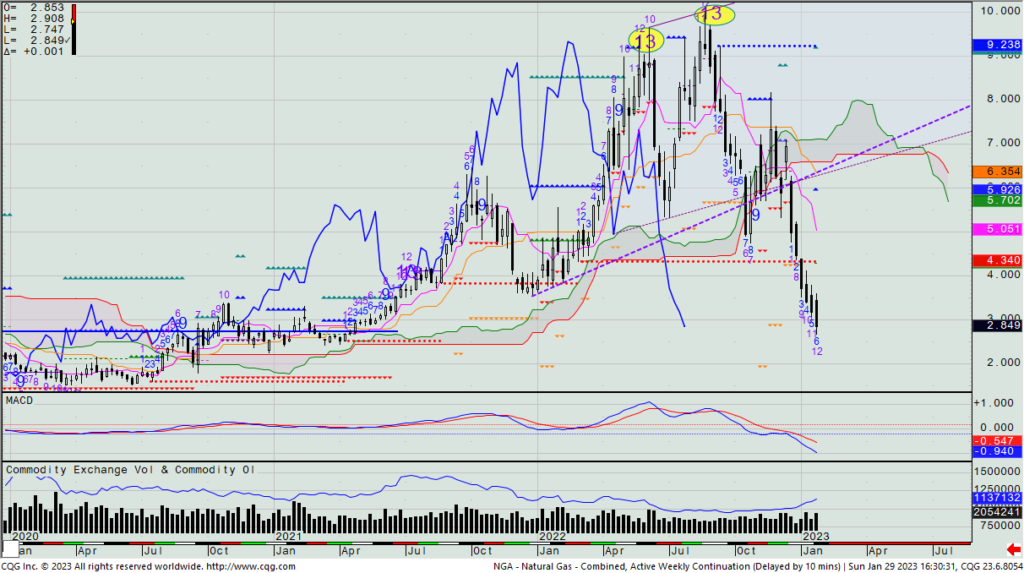

I do have a new idea for today, and because it’s in the commodity arena, I don’t expect for the Wednesday party to influence this trade. Natural gas has gotten completely obliterated in the past several months, as a way warmer than normal winter has been at hand in the US as well as commodity funds having been caught too long from 2022’s rally. (Just as an example, total snow accumulation in NYC has been less than 1” this winter, and it’s typically averaged 25” by this time of the year.) Temps here have hit 50 degrees here several times in recent weeks. Natural Gas demand has been reduced as one hasn’t needed to heat their homes to the degree as one normally would.

Natural Gas Futures – Weekly

However, this week could very well mark the first Aggressive Combo -13 signal of the entire decline, and it was this same signal that marked both major highs last year. Although the associated ETF UNG doesn’t exactly match the price movement of front-month Natgas, we can look to start building into a long position this week.

I can see doing this in two separate ways, or possibly in a combination of both. Using options, you can buy a 1% position in the UNG March 10th $10/$12.5 call spread. It closed at 69 cents mid on Friday – a fairly priced 28% of the strike differential. Alternatively, you can look to buy a 1% position in the stock itself. Or thirdly, you can do a combination of both to give yourself a standard 2% bullish position.

DailyPlay Update – January 27, 2023

Investment Rationale

Buyers have been dominating January equity activity, and yesterday was no different; the SPX marked its best close since early December. Energy and Consumer Discretionary were the leading sectors, while Health Care and Staples were the worst, with the latter actually closing lower on the day.

Next Wednesday is the FOMC rate change and press conference. Bulls are thinking that they can influence the Fed and push them to halt the rate raises. I don’t think that is gonna work, nor is an equity rally what Chair Powell likely has in mind to reduce the quantitative tightening he’s in the midst of doing.

Today is a weekly option expiration, with the SPY 410 strike having the largest call open interest and the 390 strike having the largest put open interest (and twice that of the 410 calls). With the SPY having closed at $404.75 yesterday, the 410s are far closer and might possibly act as a magnet today. The second most put open interest expiring today is in the 395 strike, so that would only come into play on an approximate 100-pt. SPX decline.

As a heads up, I will probably be reducing long exposure before next Wednesday’s rate announcement, likely using Tuesday and Wednesday to do so.

$JNJ

DailyPlay – Opening Trade (JNJ) – January 26, 2023

JNJ Bullish Opening Trades

View JNJ Trade

Strategy Details

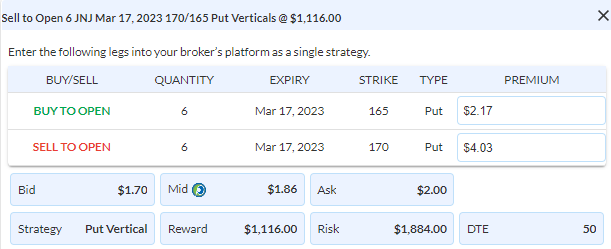

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 6 Contracts March 17th $170/$165 Put Vertical Spreads @ $1.86 Credit per contract.

Total Risk: This trade has a max risk of $1,884 (6 Contracts x $314).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 3/10

OptionsPlay Score: 92

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

Stocks started off well lower on Wednesday from MSFT and TXN forward guidance concerns. They slowly climbed back to near breakeven by 3pm, and ended up closing mixed with negligible gains and losses. Sector leadership came from Financials and Consumer Discretionary while Utilities and Industrials were the biggest losers.

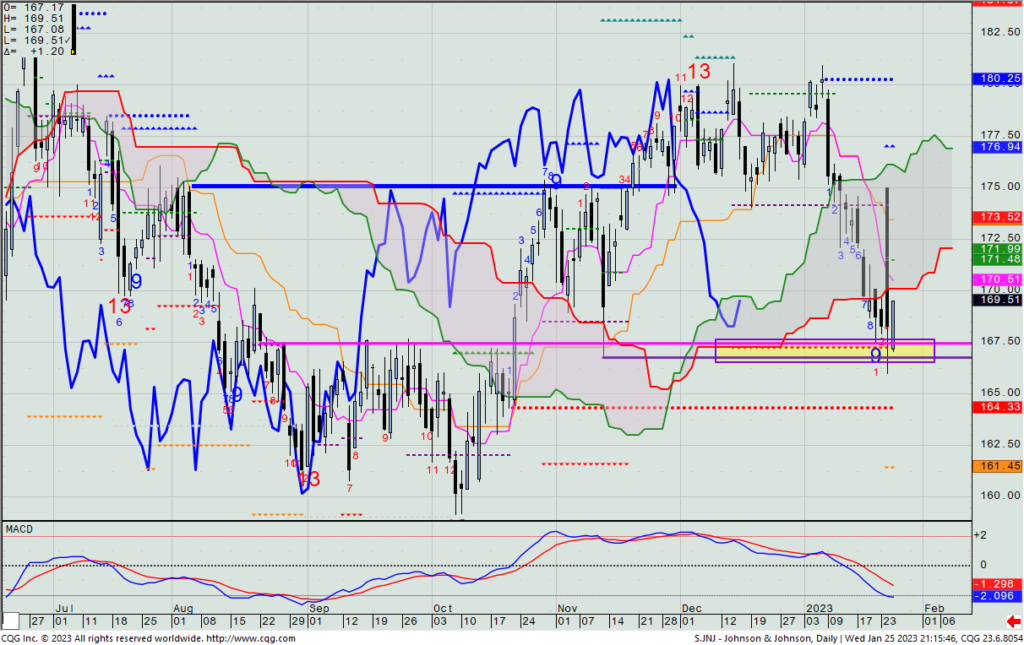

Now that earnings are out, the weekly chart of JNJ looks interesting on the long side. It has held key support (highlighted) at $167, and it was accompanied by a Setup -9, too. As such, let’s look to short the $JNJ Mar. 17th $170/$165 put spread. (Yesterday, this went out at $1.85 mid, and it represents a credit of 37% of the strike differential, and it is the only option strike combo using the ATM one that is close to being fairly priced. (Calls are silly expensive and puts are relatively cheap to sell.) Alternatively, if you are so inclined, you could consider buying the stock outright (given the very clear support level still holding.

JNJ – Daily

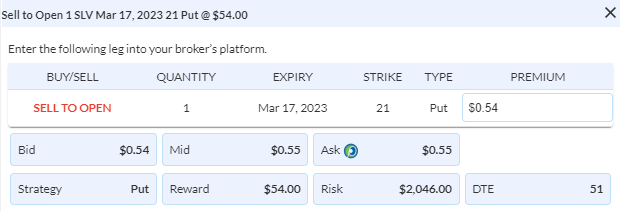

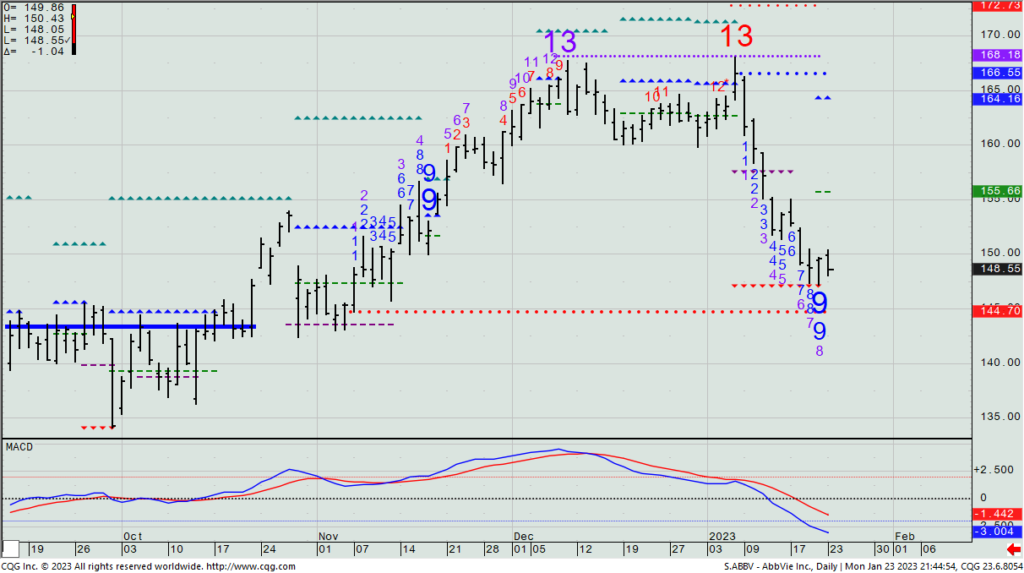

$SLV

DailyPlay – Opening Trade (SLV) – January 25, 2023

SLV Bullish Opening Trades

View SLV Trade

Strategy Details

Strategy: Cash Secured Put

Direction: Bullish

Details: Sell to Open 1 Contract March 17th $21 Cash Secured Put @ $0.55 Credit.

Total Risk: This trade has a max risk of $2,046 (1 Contract x $2,046).

Trend Continuation Signal: This is a Bullish trade on a stock that is experiencing a neutral to bullish trend.

1M/6M Trends: Neutral/Bullish

Technical Score: 9/10

OptionsPlay Score: N/A

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

Stocks were mixed on Tuesday with the Dow higher, but the SPX and Nasdaq were marginally lower. After the bell, we got MSFT and TXN earnings, and after initially seeing the former rally 4%, it ended up giving back all those gains, and then some, after the conference call. As I write this, the S&P futures are down 45 bps. and the NDX 75 bps.

You know that I am bullish the precious metals, and I noticed that last week the iShares Silver Trust (SLV) sold down to its weekly cloud model and immediately bounced. I think that low is a good trading low, and as such, I will propose the following to get long exposure: sell Cash Secured SLV Mar. 17th $21 Puts. Yesterday, this strike closed at $0.545 mid, meaning you’d receive a credit of $54.50 for each put you’d like to sell, with the understanding that you’d be a willing buyer of SLV if exercised. Given my belief that both gold and silver will be higher down the road, consider this as a way of getting long silver at a discounted price if exercised OR simply collecting the premium if not exercised. Notice the top of the cloud remains pretty flat for the entire first half of the year.

SLV – Weekly

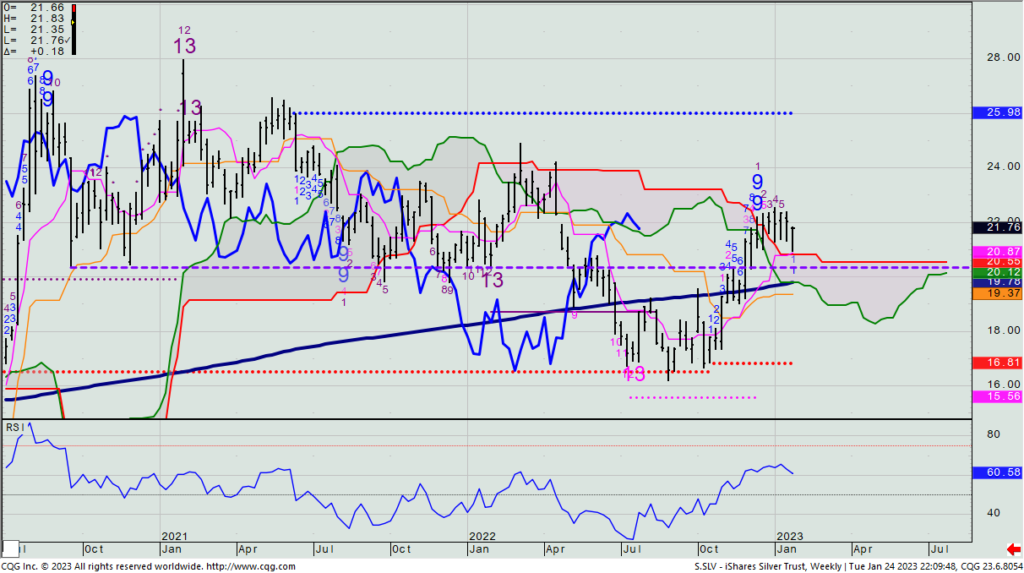

$ABBV

DailyPlay – Closing Trade (ABBV) – January 24, 2023

Closing Trade

- ABBV – 139.43% Gain: Sell to Close 1 Contract (or the remainder of your positions) Feb 17th $160/$145 Put Vertical Spreads @ $9.17 Credit. DailyPlay Portfolio: By Closing the remaining 1 Contract, we will be receiving $917. We took partial profit on this trade on Jan 13 when we Closed 3 Contracts at @6.68 Credit per Contract and then again on Jan 17 when we Closed 1 Contract at $6.28 Credit. Our average cost to exit this trade is therefore $7.10 Credit per Contract, and our average gain on this trade is 85.33%.

Investment Rationale

Stocks finally got the lift that bulls have been hoping for, pushing up and through the SPX’s major downtrend line from all-time highs. This is a good thing for longs and the general tactical bullish call we’ve had this year. Does it have more to go? Very possibly, BUT, the Fed rate hike and press conference on 2/1 could very possibly change the game, especially if the market continues to rally from now till then. Remember: The Fed does NOT want to see asset prices rallying while they are demonstrably trying to cool inflation. The higher stocks now go, the more likely we hear even more hawkish words from Jay Powell and gang on Feb. 1. (They are in their quiet period now so you will not hear anything between now and the rate announcement.)

We’re still long one ABBV Feb 17th $160/$145 put spread that we’ve played very well. Any daily close that’s now above the close from four days prior (so today, if above $149.20, last Wednesday’s close) going into the close, we will exit the remaining position. The stock has made a daily Setup -9 count right at its daily Propulsion Exhaustion level.

ABBV – Daily

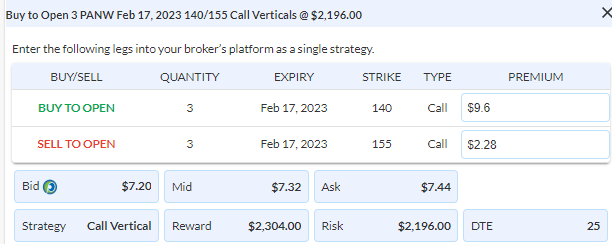

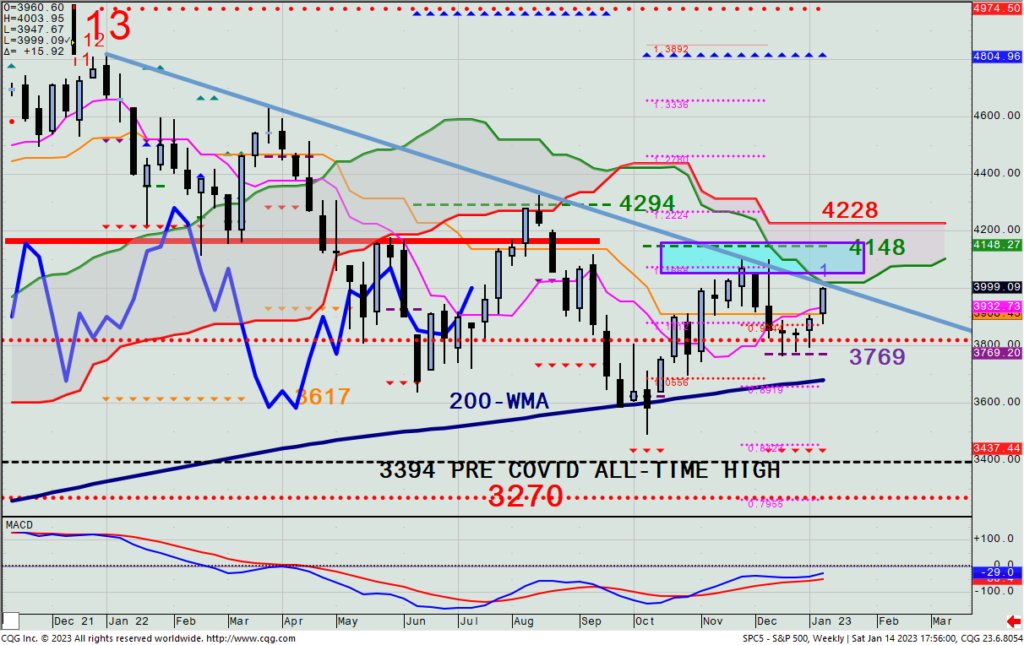

$PANW

DailyPlay – Conditional Opening Trade (PANW) – January 23, 2023

PANW Conditional Bullish Opening Trades

View PANW Trade

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 3 Contracts Feb 17th $140/$155 Call Vertical Spread @ $7.32 Debit per contract.

Total Risk: This trade has a max risk of $2,196 (3 Contracts x $732).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a neutral to bearish trend.

1M/6M Trends: Neutral/Bearish

Technical Score: 2/10

OptionsPlay Score: 91

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that this is a Conditional trade. The condition that has to be met, before you enter this bullish trade is if we see any minor pullback to the $140 area. Therefore, the price for this trade will be different than what we are showing here, which is only acting as a guideline.

Investment Rationale

Stocks surged on Friday but again, the SPX closed just beneath its major downtrend line. What a hurdle that has been for bulls to be able to push above. Meanwhile, UST 10yr. yields again held support at its weekly Base Line at 3.42%. To me, that is still the key level to use to determine if rates hold or break further down to 3%. As per a new trade idea for today, I’m looking at Palo Alto Networks, a premier name in the cybersecurity space. Like so many other tech stocks, the past year+ has been painful for stockholders.

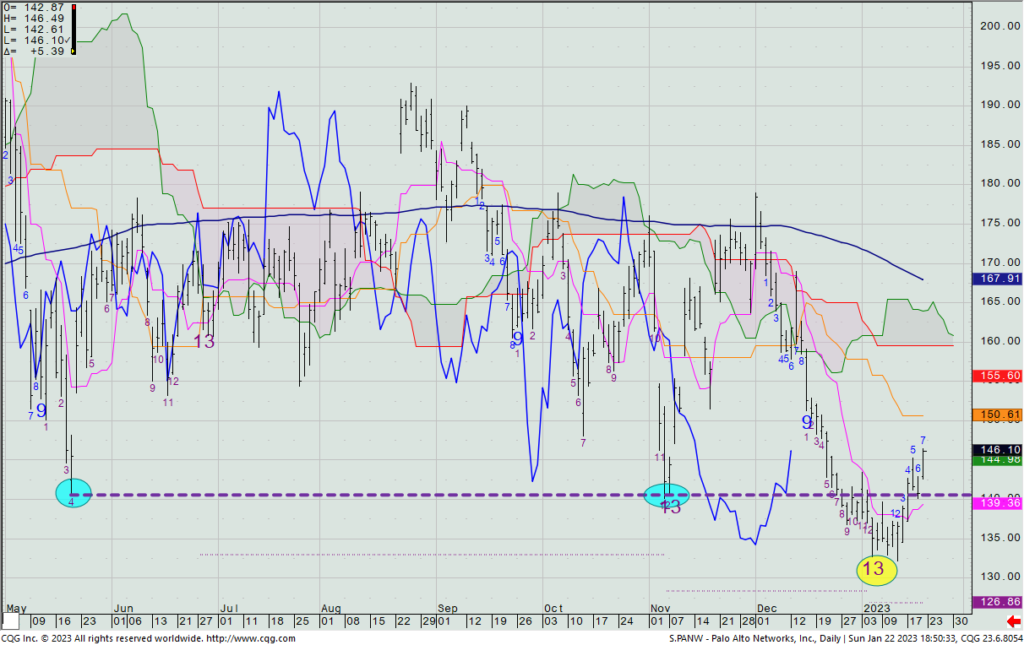

PANW – Daily

What I like is that price is back above its May and November lows, where it had previously double-bottomed before hitting sell-stops beneath $140 late last year and into early January. Now that it’s back above there, I’m looking to get long on any minor pullback to the $140 area — especially if it occurs by Wednesday’s close this week. If it does, let’s look to buy a Feb. 17th $140/$155 call spread at what then is its then current mid-price. Right now, calls are somewhat expensive, and puts are too cheap to sell, but an orderly pullback in price may help make the calls a bit cheaper. PANW reports on Feb. 21st, so we won’t be paying the extra premium for that report by using the 2/17 expiration.

$GLD

DailyPlay – Conditional Opening Trades (GLD) Partial Closing Trades (MDT, META, SPY, TLT, ABBV) – January 17, 2023

Partial Closing Trades

- MDT – 44.33% Loss: Sell to Close 1 Contract (or 25% of the remaining position) Jan 20th $80/87.5 Call Vertical Spread @ $1.13 Credit. DailyPlay Portfolio: By Closing 1 of the remaining 4 Contracts, we will be receiving $113.

- META – 52.68% Gain: Buy to Close 1 Contract (or 33% of the remaining position) Feb 3rd $123/$113 Put Vertical Spread @ $1.76 Debit. DailyPlay Portfolio: By Closing 1 of the 3 Contracts, we will be paying $176.

- SPY – 40.76% Gain: Sell to Close 1 Contract (or 33% of the remaining position) Feb 10th $387/$405 Call Vertical Spread @ $11.12 Credit. DailyPlay Portfolio: By Closing 1 of the 3 Contracts, we will be receiving $1,112.

- TLT – 78.92% Gain: Buy to Close 1 Contract (or 25% of the remaining position) Feb 17th $100/$95 Put Vertical Spread @ $0.39 Debit. DailyPlay Portfolio: By Closing 1 of the remaining 4 Contracts, we will be paying $39.

- ABBV – 63.97% Gain: Sell to Close 1 Contract (or 50% of the remaining position) Feb 17th $160/$145 Put Vertical Spread @ $6.28 Credit. DailyPlay Portfolio: By Closing 1 of the remaining 2 Contracts, we will be receiving $628.

GLD Conditional Bullish Opening Trades

GLD Conditional Trade 1

View GLD Trade 1

Strategy Details

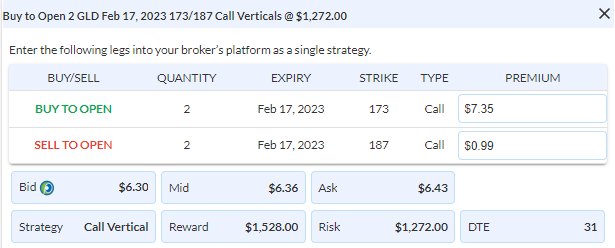

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 2 Contracts Feb 17th $173/$187 Call Vertical Spread @ $6.36 Debit.

Total Risk: This trade has a max risk of $1,272 (2 Contracts x $636).

Trend Continuation Signal: This is a Bullish trade on a stock that is experiencing a bullish trend.

1M/6M Trends: Bullish/Bullish

Technical Score: 8/10

OptionsPlay Score: 106

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note that this is a Conditional trade. The condition that has to be met, before you enter this bullish trade is if we see a pullback to $173. Therefore, the Debit for this trade will be different than what we are showing here, which is only acting as a guideline.

GLD Conditional Trade 2

View GLD Trade 2

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 2 Contracts Feb 17th $168/$187 Call Vertical Spread @ $10.66 Debit.

Total Risk: This trade has a max risk of $2,132 (2 Contracts x $1,066).

Trend Continuation Signal: This is a Bullish trade on a stock that is experiencing a bullish trend.

1M/6M Trends: Bullish/Bullish

Technical Score: 8/10

OptionsPlay Score: 108

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note that this is a Conditional trade. The condition that has to be met, before you enter this bullish trade is if we see a pullback to $168. Therefore, the Debit for this trade will be different than what we are showing here, which is only acting as a guideline.

Investment Rationale

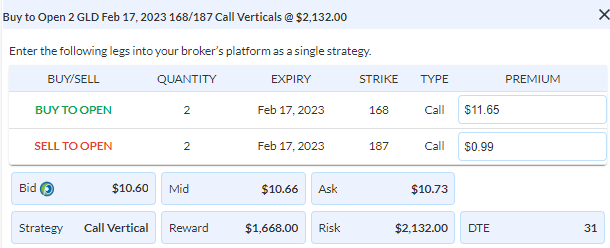

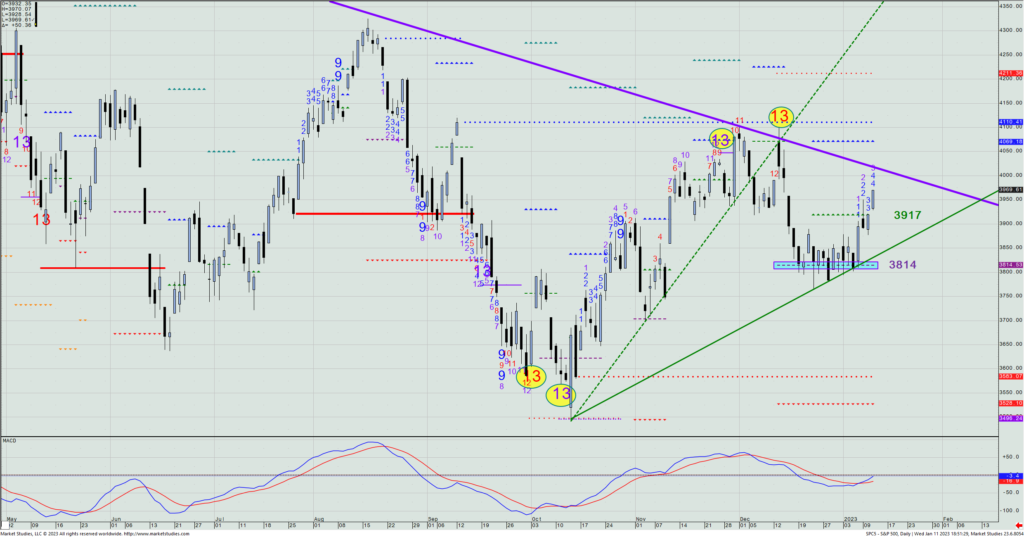

Stock futures traded mildly lower on Monday as US markets were closed for MLK Day. The market has had a very strong first-half of January, and the SPX is again poking right up against its downtrend line from all-time highs – the same line that it has failed against a few times last year.

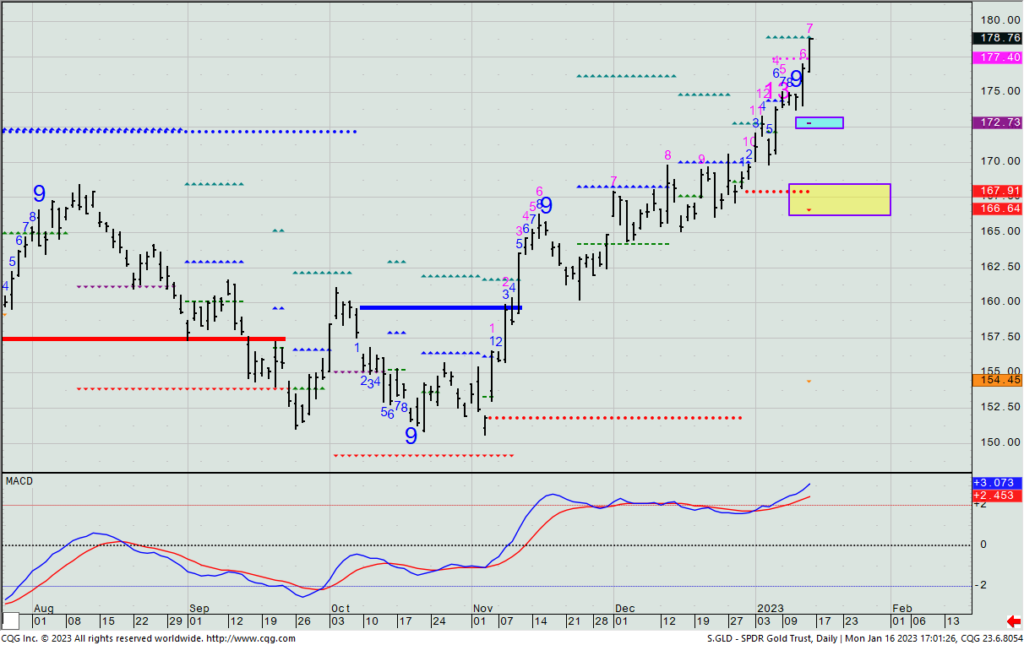

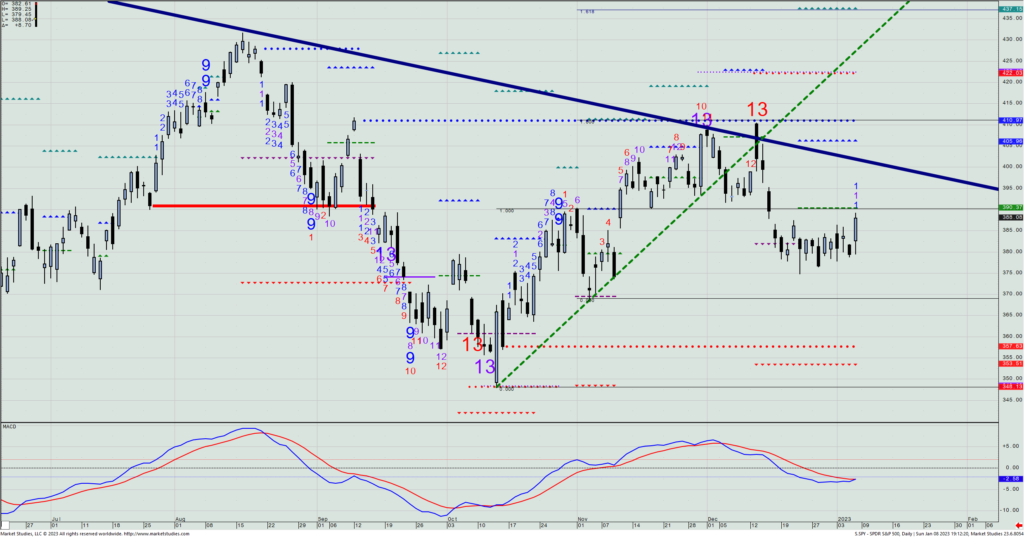

SPX – Weekly

I recently wrote about wanting to get long gold on a pullback, and it hasn’t given us a chance to yet give in, recently hitting $1900/oz. and now less than 10% from all-time highs. The opportunity to get in may be coming as bullish consensus has reached 92% bulls in my preferred sentiment poll. As its most associated liquid ETF, the SPDR Gold Trust (GLD), hasn’t even once pulled back to its daily bullish Propulsion Momentum level on this rally. (It’s currently at $172.73.)

If the opportunity comes to get long near $173, let’s buy a 1% position of a Feb. 17th $173/$187 call spread for what is the then current mid-price. If GLD were to sell off even further to the $168 level, then I’d look to put on an additional 2% position there, buying a ~45 day out $168/$187 call spread at the then mid-price level.

GLD – Daily

We also have on 5 open positions that I have recently gotten you into, namely: MDT, META, SPY, TLT, and ABBV. The MDT is down 44%, and the others are up 53%, 41%, 79%, and 64%, respectively. I’d like to remove one spread in each of those 5 different positions today.

DailyPlay Update – January 12, 2023

Stocks continued their recent rally on Tuesday with gains of 1.76% in the NDX; 1.3% in the SPX; and 0.75% in the Dow, as investors reverse last year’s weakness in direct opposite magnitude of what was beaten down the most. The SPX marked a qualified and confirmed upside breakout of its daily bullish Propulsion Momentum level (3917) to next target 4069. (Of course, it still has to get above the downtrend line to get there.) With today being the much looked at monthly CPI figure, be prepared for any and everything to happen by the market’s close.

SPX -Daily

We’ve recently added some new positions, including longs in the SPY and SPOT and a short in ABBV. All are working to start, but today is anyone’s guess what’s going to happen. I’m hearing some talk that the CPI will come in better than expected (thus, the rally we’ve seen the past few days) and that those who bought ahead of the number will lighten up on a rally after the number comes out. Recall, that is what happened last month, too.

No new ideas today until we see what the CPI brings us. Tomorrow financial stocks will be in play as several key earnings reports in that space come out Friday morn. In the meantime, expect some craziness today.

$SPY

DailyPlay – Conditional Opening Trades (SPY) Partial Closing Trade (TLT) – January 9, 2023

Partial Closing Trade

- TLT – 64.32% Gain: Buy to Close 2 Contracts Feb 17th $100/$95 Put Vertical Spreads @ $0.66 Debit. DailyPlay Portfolio: By Closing 2 of the 6 Contracts, we will be paying $132.

SPY Conditional Bullish Opening Trades

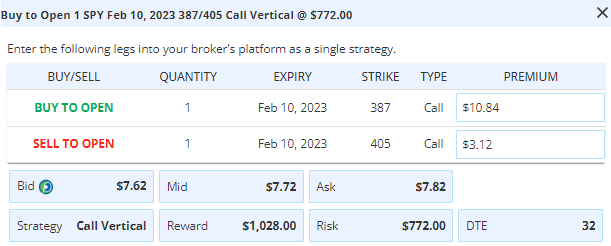

SPY Conditional Trade 1

View SPY Trade 1

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 1 Contract Feb 10th $387/$405 Call Vertical Spread @ $7.72 Debit.

Total Risk: This trade has a max risk of $772 (1 Contract x $772).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a neutral to bearish trend.

1M/6M Trends: Neutral/Bearish

Technical Score: 5/10

OptionsPlay Score: 91

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note that this is a Conditional trade. The condition that has to be met, before you enter this bullish trade is if we see a pullback to between $387.70 and $387. Therefore, the credit received for this trade will be different than what we are showing here, which is only acting as a guideline.

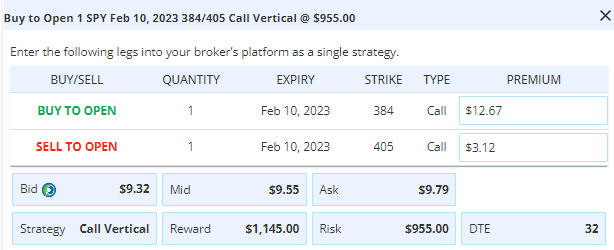

SPY Conditional Trade 2

View SPY Trade 2

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 1 Contract Feb 10th $384/$405 Call Vertical Spread @ $9.55 Debit.

Total Risk: This trade has a max risk of $955 (1 Contract x $955).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a neutral to bearish trend.

1M/6M Trends: Neutral/Bearish

Technical Score: 5/10

OptionsPlay Score: 90

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note that this is a Conditional trade. The condition that has to be met, before you enter this bullish trade is if we see a pullback to just north of $384. Therefore, the credit received for this trade will be different than what we are showing here, which is only acting as a guideline.

Investment Rationale

With stocks bouncing sharply on Friday and remaining above the SPX daily (3814) and weekly (3769) bearish Propulsion Momentum levels without any qualified and confirm closes beneath them, respectively, in the past 2+ weeks, Friday’s 86-point SPX gain keeps the early-2023 picture bullish.

When I look more closely into Friday’s rally in the SPY – as well as the past 15 trading days since price gapped down on Dec. 16th – I see three distinct areas of support that I can discern from both Friday and then collectively since mid-December: They are $387.70 to $387; just north of $384; and $379.50 (the latter being the heaviest-volumed price of all SPY trading over the past three weeks and right by Friday’s low).

As Friday only marked a Setup +1 count – suggesting that we’re not near upside exhaustion from timing models along with a VIX right near 21 – we’ll look to get long two separate 1% portfolio positions on a pullback in price to the first and second of the above written support areas: 1) a Feb. 10th $387/$405 call spread, and then, 2) a Feb. 10th $384/$405 call spread. Each of these spreads are to be entered when price declines to near the first of the two strike prices at what then are their real-time trading mid-prices.

SPY – Daily

Elsewhere, we had on a very good long natural gas call spread in UNG that then collapsed in price as natgas lost over one-third of its value very quickly. Fortunately, we previously sold half the spreads for good profits, greatly reduce the loss on the other half which will go out worthless later this week.

The short Feb. 6th TLT $100/$95 put call is working nicely in just the few days since we put it on last week. We’re up 64% on it right now, so let’s remove 2 of the 6 today.

DailyPlay Update – January 6, 2023

Jobs numbers didn’t give bulls the look they wanted, and stocks again came off to now finally see the SPX close beneath the 3814 level. A close back above there today probably doesn’t make yesterday’s breach meaningful, but another down day today would not be a good look for recent buyers. A close beneath 3769 today would be a bigger problem without next week materially rallying.

Today is the first Friday of the month, so it’s the big employment report day for the market. It’s a possible make or break day for the market, and it’s the bulls who need to prove themselves because they are continually fighting the downtrend and the onus is on them to show why there is any merit to that approach.

Today is also a weekly option expiration, and when it comes to the SPX, the nearest highest open interest strikes are the 3825 calls (1604) and the 3825 puts (6736). The 3850 calls have 8244 contracts set to expire worthless, and the 3750 puts have 11,545 contracts still open also set to go out worthless. It will be interesting to see if either the 3850s or 3750s get targeted late in the day.

I may very well end up using what happens today to make portfolio changes on Monday, potentially reducing or fully exiting bullish option positions I’ve given you if today dives.

As a heads up, if the GLD high from this week ($173.30) stays the high through today’s close, the Conversion Line will move up to $166.76 next week. We’ll look to play a pullback to that level by then selling the March 17th $166/$162 put spread.