$AIG

DailyPlay – Opening Trade (AIG) Partial Closing Trade (SPY) – October 26, 2022

Partial Closing Trade

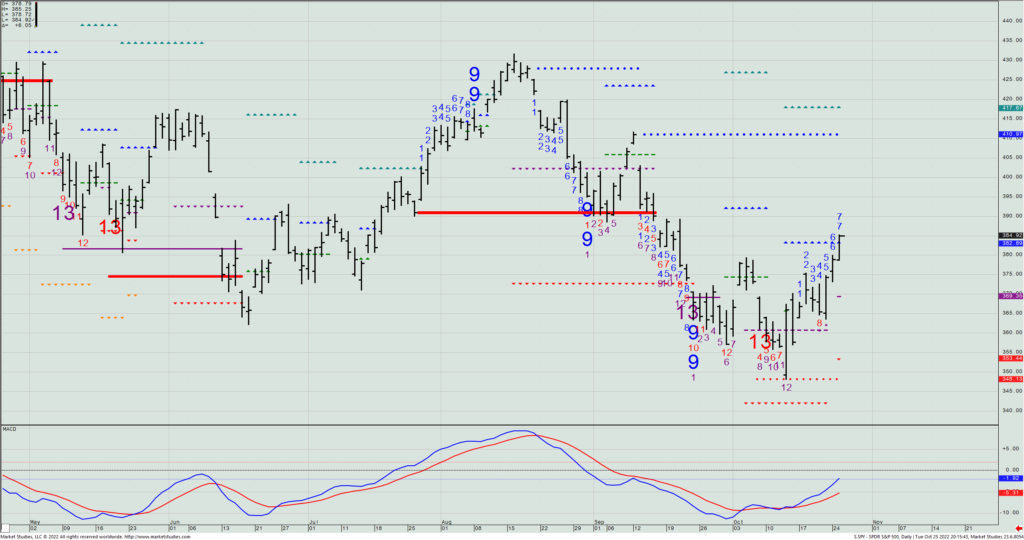

- SPY -58.00% Gain: Buy to Close 2 Contracts Nov. 9th $365/$361 Put Verticals @ $0.63 Debit. DailyPlay Portfolio: By Closing 2 of the 8 Contracts, we will be paying $136.

AIG Bearish Opening Trade

View AIG Trade

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish

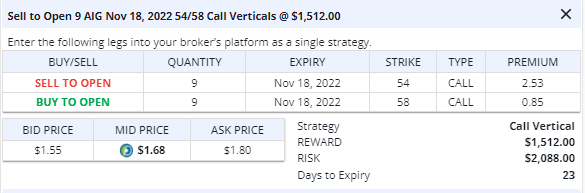

Details: Sell to Open 9 Contracts Nov. 18 $54/$58 Call Vertical Spreads @ $1.68 Credit.

Total Risk: This trade has a max risk of $2,088 (9 Contracts x $232).

Counter Trend Signal: This is a Bearish trade on a stock that is experiencing a bullish trend.

1M/6M Trends: Bullish/ Mildly Bullish

Technical Score: 7/10

OptionsPlay Score: 104

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

Stocks again rallied sharply on Tuesday, pushing up through some important resistance at 3819. But before you get too bullish, that level is a prior weekly TDST support line, and we’re just today getting to the midpoint of the week, with stocks looking lower after Microsoft’s earnings miss and Google’s slowing sales growth. (In yesterday’s DP comments I alluded to my belief that major multi-nationals were likely to have troubled numbers this reporting season from the impact of the very high dollar. The bottom line is that we haven’t yet seen a breakout above that level until we see where the SPX closes on Friday.

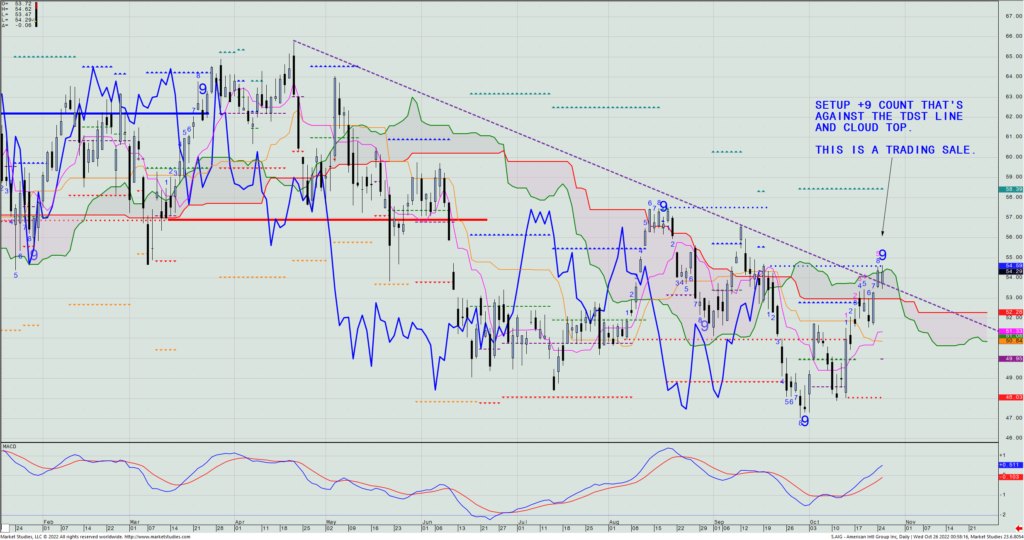

For a new trade idea today, I see that yesterday marked a daily Setup +9 count in AIG, while also stalling two days in a row against its TDST Line ($54.59) and the top of its daily cloud. This, to me, is a trader’s sale. (If it doesn’t work, so be it, but these are the type multiple unrelated indicators lining up in the same place that make sense to me to be looking at.) So, let’s sell the Nov. 18th $54/$58 call spread. Yesterday this closed at $1.625 mid, or 41% of the strike differential. The firm reports earnings on Nov. 8th and we will likely be out of it by then.

AIG – Daily

As I write this Tuesday night, S&P futures are down some 35 points. Thus, with yesterday seeing the SPY reach its daily Propulsion Exhaustion level, let’s look to exit 2 of the 8 short Nov. 9th $365/$361 put spreads we have on. I’d likely do one of those two sometime this morning, and the other if the SPX approaches unchanged over the course of the day. Anything even with 10 pts. of becoming unchanged today would be a place I’d remove the second spread.

SPY – Daily

$NFLX

DailyPlay – Closing Trade (NFLX) – October 25, 2022

Closing Trade

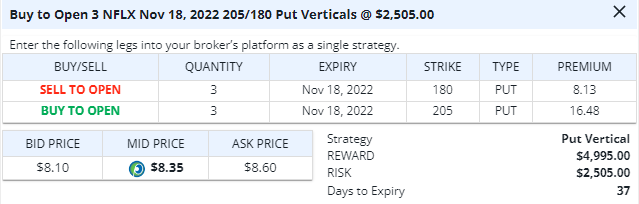

NFLX -94.13% Loss: Sell to Close 3 Contracts Nov. 18th $205/$180 Put Verticals @ $0.49 Credit. DailyPlay Portfolio: By Closing all 3 of the 3 Contracts, we will be receiving $147.

Investment Rationale

The S&P saw a solid rally yesterday and to its highest close (3797) since Sept. 20th. The immediate question becomes whether major earning reports this week can push and keep the SPX above its prior broken weekly TDST level (3819), the level I’ve identified for a month as being one of the more important resistance levels that investors will need to deal with.

In the meantime, there’s increased talk that the Fed is not only way behind raising rates as much as they need to do, but that continually doing so could spill a firm (or multiple ones) into some type of financial accident. When I put this all-together, along with upcoming key earnings reports this week (which I suspect will be mixed with several of the multi-nationals having worse than expected numbers because of dollar strength), I give the edge to the near-term bullish call (I went out with a couple of weeks ago) to continue. The bigger picture, however, is far less bullish, and when I feel as if this current rally has hit its peak, I will again play for another move down.

Let’s update the following two positions, for those that have not closed them out yet:

- Short NEE Nov. 18th $205/$180 put spread: Given the -13 low; major support level holding; and my thinking that natgas is bottoming, let’s close this out completely.

NEE – Daily

- Long Nov. 18th $18.5/$17 put spreads: With a triple bottom at ~$16.75, with two of them accompanied by either a -13 or -9, we will close this out completely.

SLV – Daily

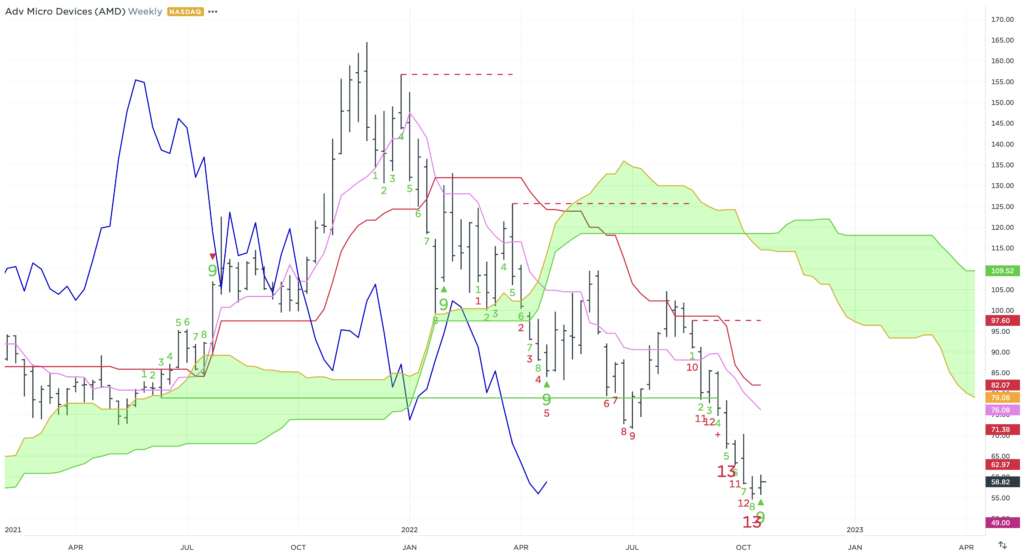

AMD

DailyPlay – Opening Trade (AMD) – October 24, 2022

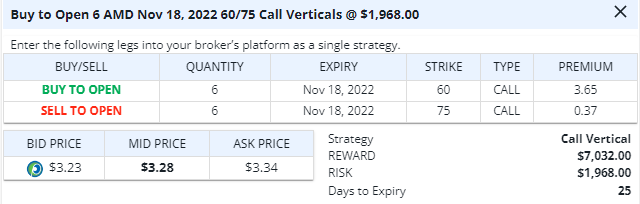

AMD Bullish Opening Trade

View AMD Trade

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 6 Contracts Nov.18 $60/$75 Call Vertical Spreads @ $3.28 Debit.

Total Risk: This trade has a max risk of $1,968 (6 Contracts x $328).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 2/10

OptionsPlay Score: 79

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

After the Nasdaq-100 completed the Weekly Setup – 9 Count for the 3rd time this year, it adds to the odds of a sustained rally into Election Day and potentially further beyond. One of the industries that have seen the largest declines and multiple contraction has been semiconductors.

The SOXX Semiconductor ETF also printed a Weekly Setup -9 Count last week, providing an opportunity to seek long exposure going into a tech heavy earnings week for semis. For today’s DailyPlay we are going to look at AMD, which also printed a Weekly Setup – 9 Count, targeting the $75 conversion line to the upside.

Trading at 15x next year’s earnings and 11x EV/EBIDTA valuation while expecting 8% EPS growth in 2023 translates to gaining long exposure to this stock at half of the valuation from 2021. With an IV Rank of 74 and earnings in 8 days I’m going to use a short dated Debit Vertical Spread structure to play for potential pop higher on earnings while risking only 5.5% of the stock’s price and a roughly 3.5x reward to risk potential.

Buy to Open 1 AMD Nov 18, 2022 60/75 Call Vertical @ $328.00

AMD – Weekly

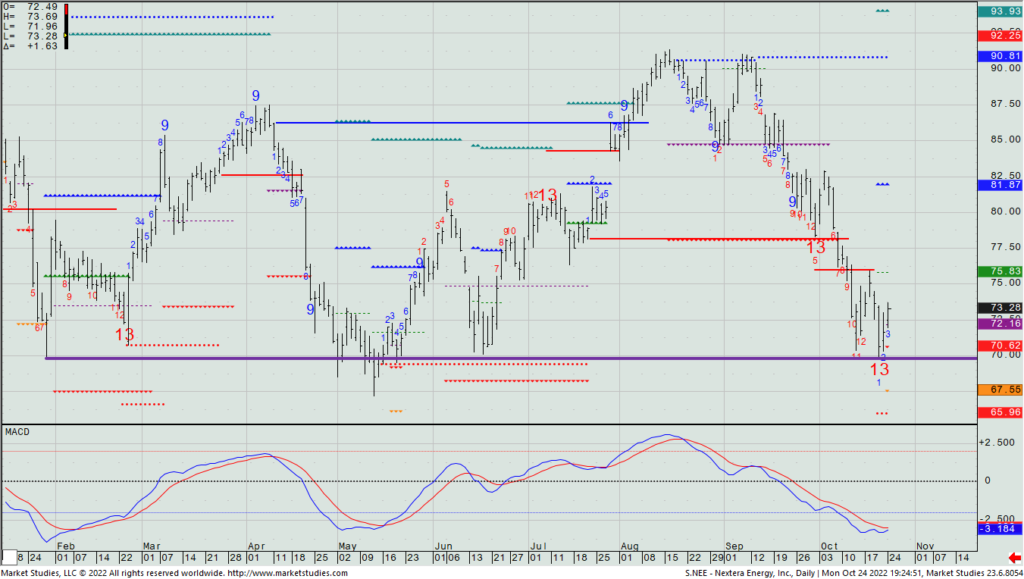

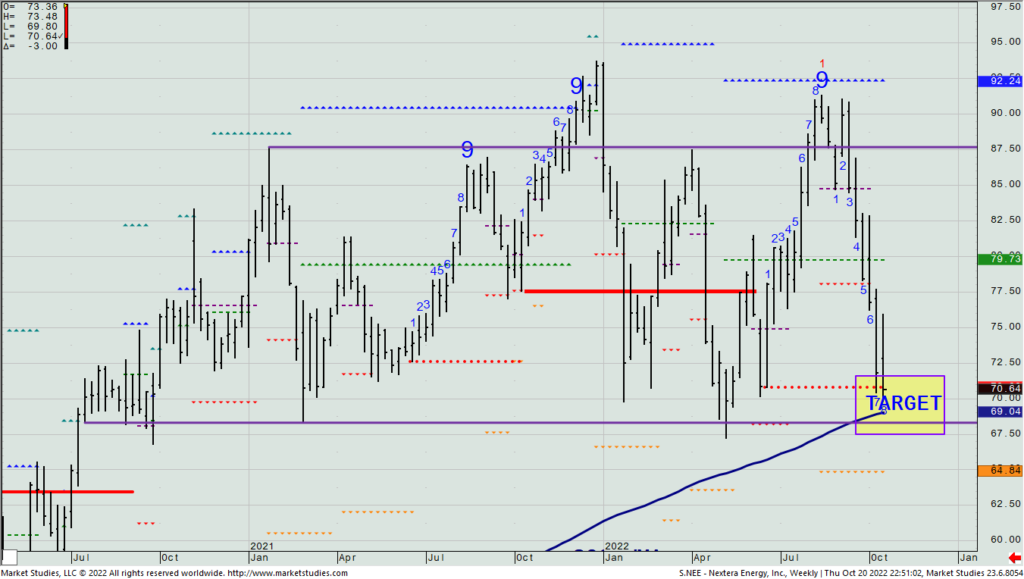

$NEE

DailyPlay – Closing Trade (NEE) – October 21, 2022

Closing Trade

- NEE -74.62% Gain: Buy to Close 2 Contracts Nov. 18th $77.50/$82.50 Call Verticals @ $0.50 Debit. DailyPlay Portfolio: By Closing the remaining 2 of the original 6 Contracts, we will be paying $100. We took partial profits for this trade on October 14 at a $1.12 Debit by closing 2 Contracts, and then again on October 18 at a @ $1.16 Debit by closing 2 Contracts. Therefore, the average gain on this trade is 52.96% and the average cost basis to exit this trade is $0.93 Debit.

Investment Rationale

The SPX is still teetering near the 3693 level. Not closing above it today actually locks the weekly Setup -9 signal, and gives a better reason to keep my view that the current low should hold up through Election Day on Nov. 8th.

This morning we’ll see earnings from Verizon, American Express, and Barclays. So far, peers on these three names have done well this reporting season. Today is also a weekly option expiration. The 3700 puts and calls open interest is the highest of any strike nearby, and has well more combined unclosed contracts than the 3650s.

With natgas still selling off, our Nextera short $77.50/$82.50 call spread keeps making more money. Given the decline into what was my target area when I put it on, and it also getting to near its 200-WMA, prior lows, and on a weekly Setup -8 count, I’m going to suggest that we close out the last two spreads today.

NEE – Weekly

$SPY

DailyPlay – Opening Trade (SPY) Trade Update (INTC) – October 20, 2022

INTC Update

- We will let this short $35 leg that expires this Friday expire worthless. We will then only be long the $35 leg that expires on Jan 20, 2023

SPY Bullish Opening Trade

View SPY Trade

Strategy Details

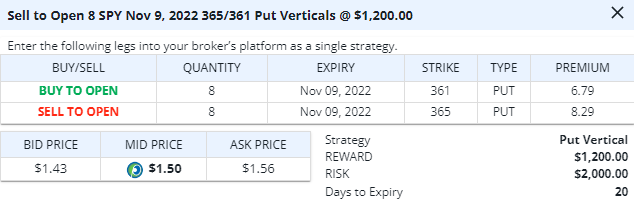

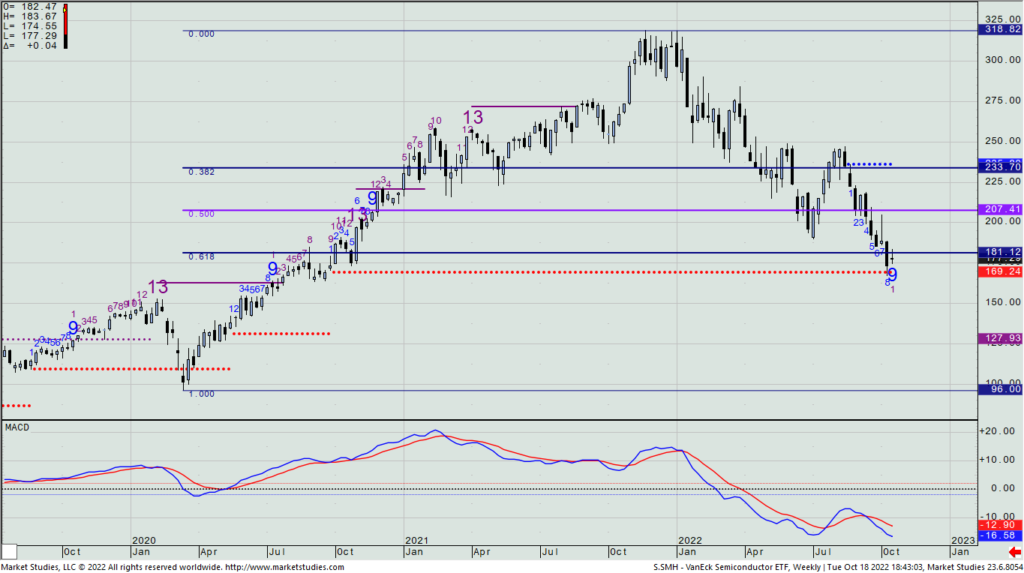

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 8 Contracts Nov. 9th $365/$361 Put Vertical Spreads @ $1.50 Credit.

Total Risk: This trade has a max risk of $2,000 (8 Contracts x $250).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a neutral to bearish trend.

1M/6M Trends: Neutral/Bearish

Technical Score: 5/10

OptionsPlay Score: 90

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

Stocks saw a minor pullback on Wednesday, mostly from interest rates not starting a possible trend reversal like we have begun to see in the dollar and equity markets. Will rates continually edging to new 2022 highs be a problem for dollar bears and stock market bulls? Probably.

In September I called for a stock market trading bottom to come in mid-October, looking for the first SPX weekly Setup -9 of the year to give bulls something to lean on. We came into this week on a Setup -8 count through last Friday, and many just jumped at the visible Setup -9 count on their charts on Monday, sending stocks up over 2%. But as I said earlier this week, that count will flip from a -9 to a +1 on Friday (killing the downward count) should the SPX close above 3693.26 tomorrow. That wouldn’t mean that the SPX couldn’t rally, but it would take away a good reason for it to do so from when it did.

If I am going to be right that the market holds up through Election Day, then I’m willing to be a seller of a SPY Nov. 9 $365/$361 put spread, collecting $1.50 (based on yesterday’s closing mid prices) or 37% of the 4-pt. spread differential that is a bit out-of-the-money.

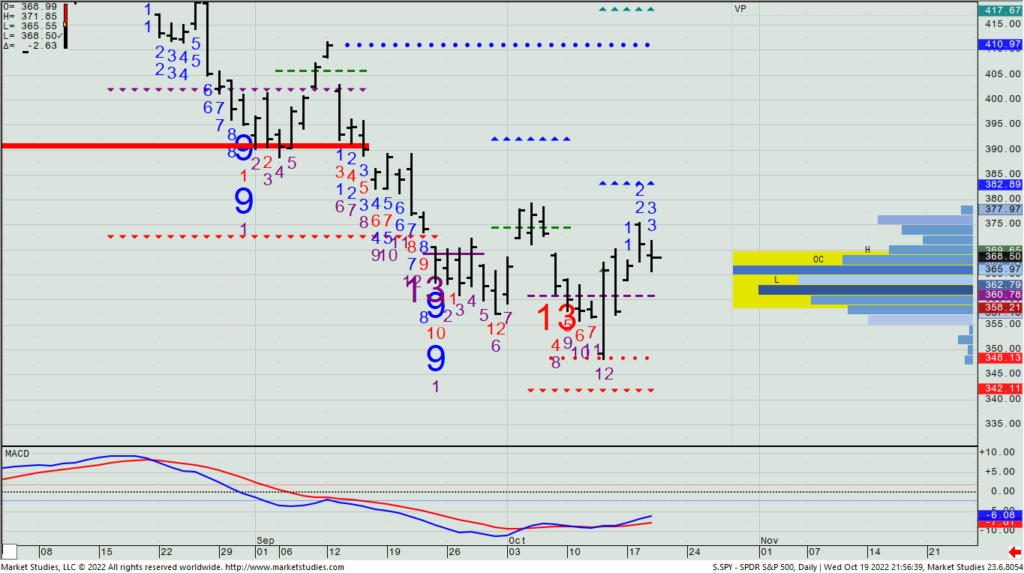

SPY – Daily

We also have an INTC calendar call spread on, the first leg of which we are short the $35 call that expires on Friday. We’re going to let it go out and keep our previously received premium, and stay long the January $35 call.

Lastly, we are long the final 2 SRE Oct 21 $165/$145 put spreads, with yesterday closing just under $144. Let’s close these two contracts out today as they expire tomorrow, and it’s been a big winner for us.

$SMH

DailyPlay – Opening Trade (SMH) Closing Trade (DHR) – October 19, 2022

Closing Trade

- DHR – 10.55% Gain: Buy to Close 1 Contract Oct. 21st $265/$282.5 Call Vertical @ $5.68 Debit. DailyPlay Portfolio: By Closing the remaining 1 of 2 Contracts, we will be paying $568. We took partial profits for this trade on August 10 at a $7.50 Debit by closing 1 Contract. Therefore, the average loss on this trade is -3.78% and the average cost basis to exit this trade is $6.59 Debit.

SMH Bullish Opening Trade

View SMH Trade

Strategy Details

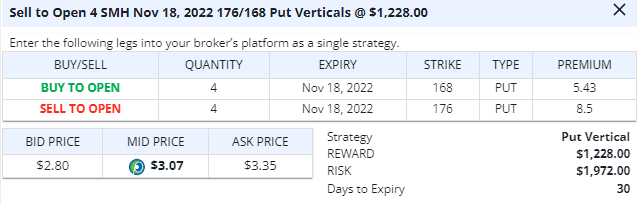

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 4 Contracts Nov. 18th $176/$168 Put Vertical Spreads @ $3.07 Credit.

Total Risk: This trade has a max risk of $1,972 (4 Contracts x $493).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 3/10

OptionsPlay Score: 88

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

Stocks started sharply higher yesterday on follow-through buying from Monday, as there’s been a decided bullish sentiment shift this week. Despite a few attempts to knock them down over the course of Tuesday’s session, sellers couldn’t even get them down to unchanged, and the SPX tacked on another 1.14% while the Nasdaq 100 added 77 bps.

As I wrote in yesterday’s DP, yes, one should be doing some buying after the liftoff from last week’s new 2022 lows. Though we haven’t seen the mid-3400s level I wanted to be a buyer at, I do respect the slew of daily -13s; the weekly Setup -9 (that will only actually be marked if Friday’s close is less than 3693); and the monthly Setup -9 that exists (so long as the Oct. 31 close is less than 3785).

Today, let’s look to a new long idea in the very beaten down semiconductor space. When I look at the VanEck Semiconductor ETF (SMH), we see both a weekly Setup -9 that has precisely held support right at its weekly TDST Line at $169.24 on last week’s low. Thus, we’ll look to sell a Nov. 18th $176/$168 put spread, looking for this to hold up above those lows for the next month. This spread collects 38% of its 8-point strike differential (based upon Tuesday’s closing mid price of $3.08.)

SMH – Weekly

Also, a reminder to cover the remaining 2 SRE Oct. 21 $165/$145 put spreads on any day this week that going into the NYSE 4pm ET close is above $146.46.

And, let’s cover our last remaining DHR short $165/$182.5 call spread that expires on Friday. The stock is near our short strike so it’s time to exit.

$CNC

DailyPlay – Opening Trade (CNC) Partial Closing Trade (NEE) Closing Trade (SRE) – October 18, 2022

Partial Closing Trade

- NEE -41.12% Gain: Buy to Close 2 Contracts Nov. 18th $77.50/$82.50 Call Verticals @ $1.16 Debit. DailyPlay Portfolio: By Closing 2 of the remaining 4 Contracts, we will be paying $232.

Closing Trade

- SRE -312.50% Gain: Sell to Close 2 Contracts Oct. 21st $165/$145 Put Verticals @ $18.15 Credit. DailyPlay Portfolio: By Closing the remaining 2 of 5 Contracts, we will be receiving $3630. Please note that this trade is for those that have not exited this trade completely, or only have 1 Contract open, based on our previous conditional closing trade alerts for SRE.

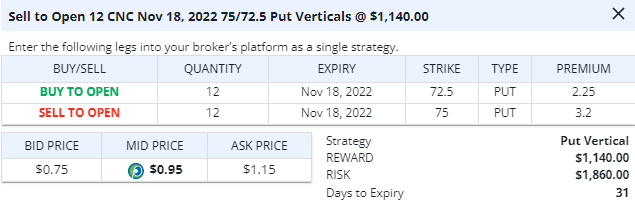

CNC Bullish Opening Trade

View CNC Trade

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 12 Contracts Nov. 18th $75/$72.50 Put Vertical Spreads @ $0.95 Credit.

Total Risk: This trade has a max risk of $1,860 (12 Contracts x $155).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 5/10

OptionsPlay Score: 85

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

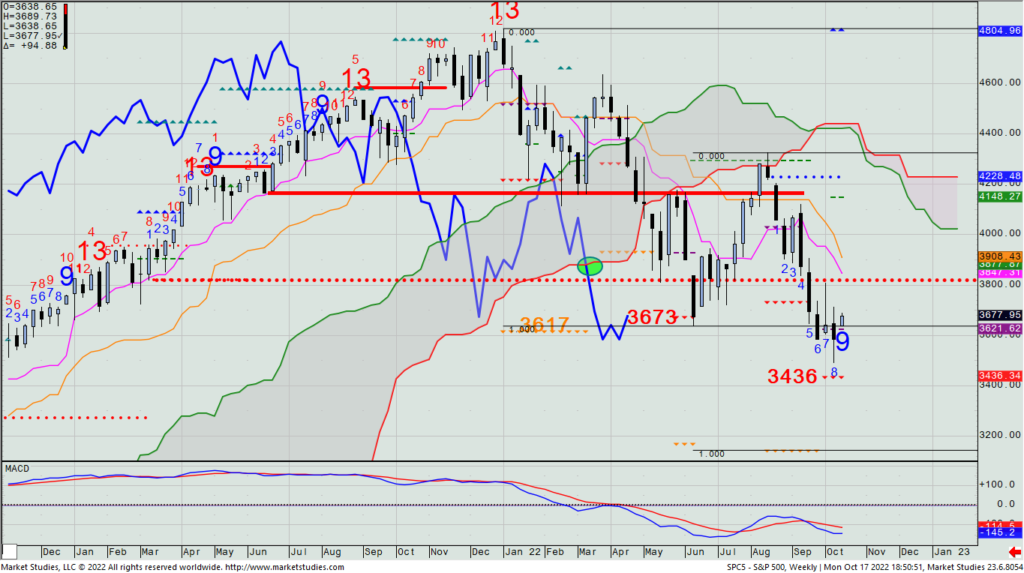

Stocks rallied sharply, making the past three days with major moves as investors are trying to decipher where the next even larger move heads. Monday’s large move higher came as institutional traders were well aware of the DeMark weekly Setup -9 count showing up this week. (What’s ironic is that if the SPX closes north of 3693 this week, the 9 count disappears – just like it has on every other prior attempt this year to mark this important signal.)

SPX – Weekly

The question I know that you are all waiting for me to answer is “Is it time to buy?”, and the answer is “Yes”. But this is not an “All-in” signal, but one to start putting some long exposure on. And I’ll be buying some more if we see the 3460/3400 zone trade. But I will be leaving the bulk of my investable dollars for a move down to the 3270/3116 zone I’ve previously highlighted as the likely ultimate low for the move, which could easily come sometime over the next couple of quarters. That being said, the potential weekly Setup -9 count coming along with a current monthly Setup -9 (the latter being quite rare in the total history of the SPX) makes me think that we should start to look putting some tactical long exposure on.

SPX – Monthly

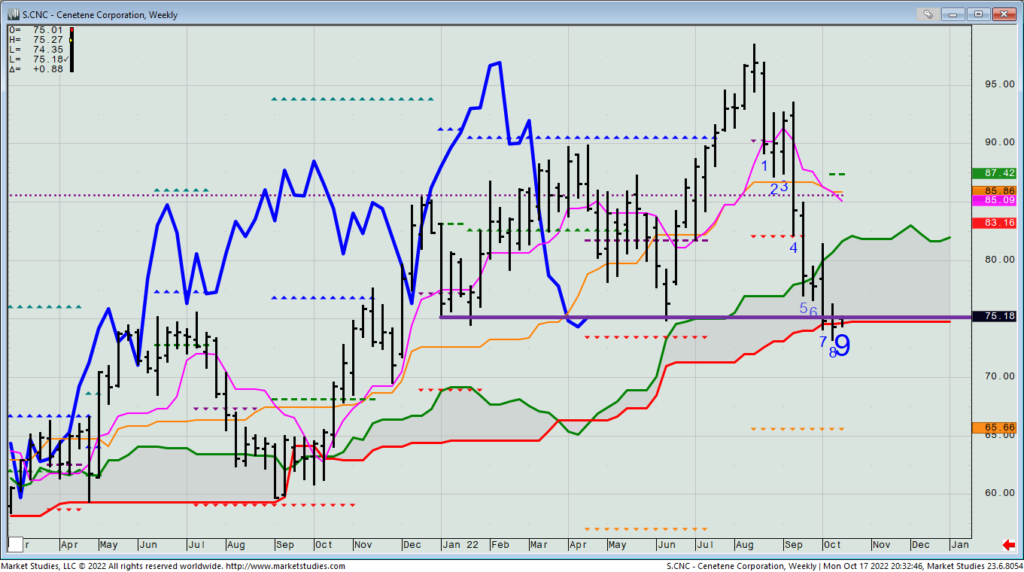

A new idea for today: One of the biggest companies in the country is Centrene (CNC), a Midwest headquartered managed health care firm that acts as an intermediary between government-sponsored and privately insured health care programs. What I like about the chart is that it has toyed with the bottom of its weekly cloud for three weeks in a row, while also marking a Setup -9 this week while also finding support right at other lows from earlier this year.

CNC – Weekly

As such, let’s look to short the Nov. 18th $75/$72.5 put spread for what yesterday closed at 95 cents mid. That collects 38% of the strike differential, and puts time on our side if it sits here for a little bit.

Let’s also make some portfolio adjustments:

Let’s take off another 2 NEE short Nov. 18th $77.5/$82.5 call spreads today. Let’s cover the remaining 2 SRE Oct. 21 $165/$145 put spreads on any day this week that going into the NYSE 4pm ET close is above $146.46.

$NEE, $SLV, $SRE

DailyPlay – Partial Closing Trades (NEE, SLV, SRE) – October 14

Partial Closing Trades

- NEE -43.15% Gain: Buy to Close 2 Contracts Nov. 18th $77.50/$82.50 Call Verticals @ $1.12 Debit. DailyPlay Portfolio: By Closing the 2 of the 6 Contracts, we will be paying $224.

- SLV -161.76% Gain: Sell to Close 12 Contracts Nov. 18th $18.50/$17 Put Verticals @ $0.89 Credit. DailyPlay Portfolio: By Closing 12 of the 36 Contracts, we will be receiving $1,068.

- SRE -315.91% Gain: Sell to Close 1 Contract Oct. 21st $165/$145 Put Vertical @ $18.30 Credit. DailyPlay Portfolio: By Closing the 1 of the remaining 2 Contracts, we will be receiving $1,830. Please note that our target price range of $136 – $135 was not hit yesterday. This trade is therefore for those that did not close out the remaining 2 SRE Contracts yesterday.

Investment Rationale

Yesterday’s intraday turnaround was significant, but not entirely unexpected given our prior call for a mid-October bounce that would likely give markets a lift into Election Day. I’ve had good-till-cancelled bids in the SPY for my own account at the equivalent of my downside SPX target of 3465—3435. Unfortunately, I missed getting filled yesterday at my desired entry level, but there is a point to this: Have resting bids at where you want to be a buyer, because in real-time it’s a lot harder deciding in a market dive where to be a buyer. Have your buy/sell levels established before the market gets there.

Thursday’s action would appear to have completed Wave 3 of Wave III, despite it not quite having hit my downside target. It will make me look to be a buyer on a pullback into yesterday’s intraday support levels that you can determine by looking at where volume hardly traded yesterday on any name that you are looking to bid on. Those low-traded volume levels often end up being support.

There are several position adjustments I suggest you do today:

Make sure you are out of the TLT trade that expires today

Let’s take 2 of 6 short NEE Nov. 6th $77.50/$82.50 call spreads. We’re up 43% on them so far.

Let’s take off 12 of 36 SLV Nov 18th $18.5/$17 put spreads we have on. (We’re up 162% on them so far.)

Yesterday I recommended removing the final 2 SRE Oct. 21st $165/$145 put spreads if we sold down to $136 – $135 over the next several days. Thursday’s low got down to $136.54 and then it exploded higher to close at $143.03. Let’s take off one of two remaining spreads today after that type rejection of our target.

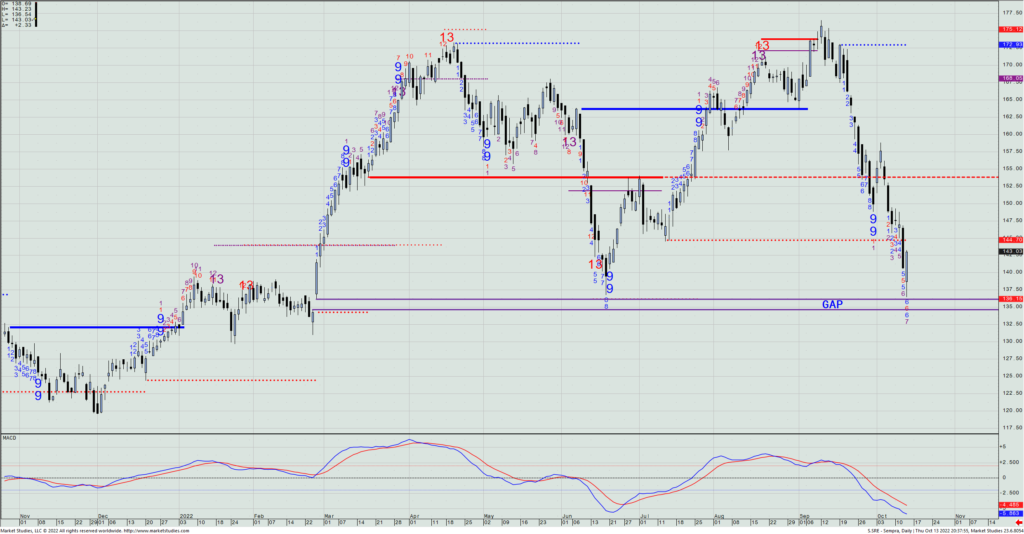

SRE – Daily

$TLT, $SRE

DailyPlay – Closing Trades (TLT, SRE) – October 13, 2022

Closing Trades

- TLT – 48.74% Loss: Buy to Close 1 Contract Oct. 14th $102/$98 Put Verticals @ $1.77 Debit. DailyPlay Portfolio: By Closing the remaining 1 of the original 6 Contracts, we will be paying $177. We took partial profits for this trade on August 19 at a $2.74 Debit by closing 3 Contracts, and then again on October 12 at $1.98 Debit by closing 2 Contacts. Therefore, the average gain on this trade is 2.16% and the average cost basis to exit this trade is $2.33 Debit.

- SRE – 323.86% Gain: Sell to Close 2 Contracts Oct. 21st $165/$145 Put Verticals @ $18.65 Credit. DailyPlay Portfolio: By Closing the remaining 2 of the original 5 Contracts, we will be receiving $3,730. We took partial profits for this trade on September 27 at a $7.75 Credit by closing 1 Contract, and then on September 28 at a $9.95 Credit by closing 1 Contract, and then again on September 30 at a $11.65 Credit when we closed 1 Contract. Therefore, the average gain on this trade is 202.95% and the average cost basis to exit this trade is $13.33 Credit. Please note that we will be waiting for our target price of $136 – $135 to be hit before we close this trade, so the profitability as well as the cost basis will differ somewhat from what we list here.

Investment Rationale

Stocks traded in a fairly narrow range yesterday, waiting for the FOMC minutes, which when they came out, did nothing material to the market. That puts the key earnings coming out today and tomorrow as the main catalyst for how stocks will trade the next two days – and possibly well after that.

In the meantime, the SPX is right by the 2022 lows made earlier this week. Many are looking for the growing number of daily Sequential -13s to indicate a rally is coming. I’m not pressing the downside bets hear and now, but will look for clues for the next 100- to 150-point move to try to take advantage of. I’m still thinking that we can see the mid-3400s trade this month, but it’s getting harder to play for an ~ 120-pt. downmove when we’d now need risk more than that on the upside.

Tomorrow the last remaining 1 spread we have on in TLT expire. Make sure you are out of them today.

Also, we have 2 remaining long put spreads in SRE that expire in 8 days. We’ve got a huge win on this trade, with these final two spreads trading at about 4x the price we paid for them. Should we see a move to the $136 to $135 take place in the next few trading days, we’ll exit the balance of the trade at the then current mid-price of the Oct. 21st $165/$145 put spread as it fills the gap area I have on the below chart.

SRE – Daily

$NFLX

DailyPlay – Opening Trade (NFLX) Partial Closing Trade (TLT) – October 12, 2022

Partcial Closing Trade

- TLT -66.39% Loss: Buy to Close 2 Contracts Oct. 14th $102/$98 Put Verticals @ $1.98 Debit. DailyPlay Portfolio: By Closing 2 of the remaining 4 Contracts, we will be paying $396.

NFLX Bearish Opening Trade

View NFLX Trade

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 3 Contracts Nov. 18th $205/$180 Put Vertical Spreads @ $8.35 Debit.

Total Risk: This trade has a max risk of $2,505 (3 Contracts x $835).

Trend Continuation Signal: This is a Bearish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 3/10

OptionsPlay Score: 125

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

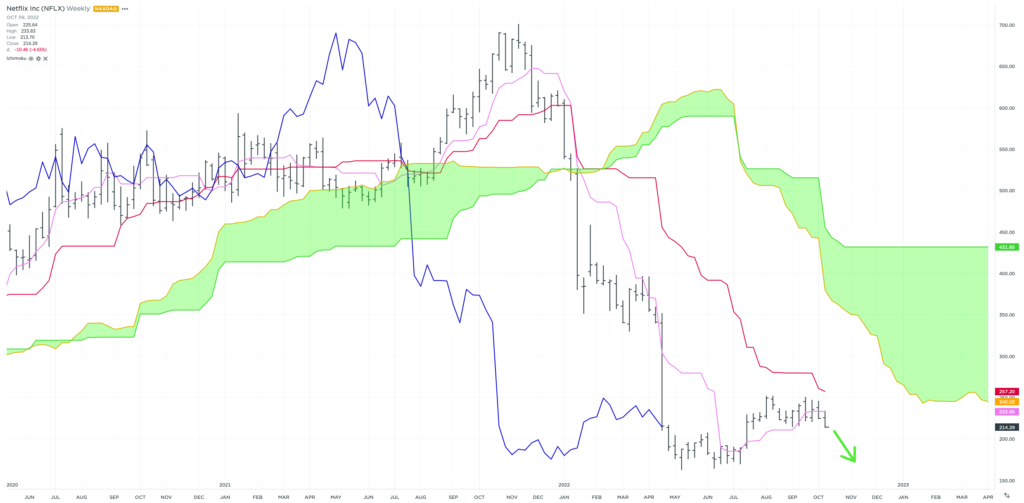

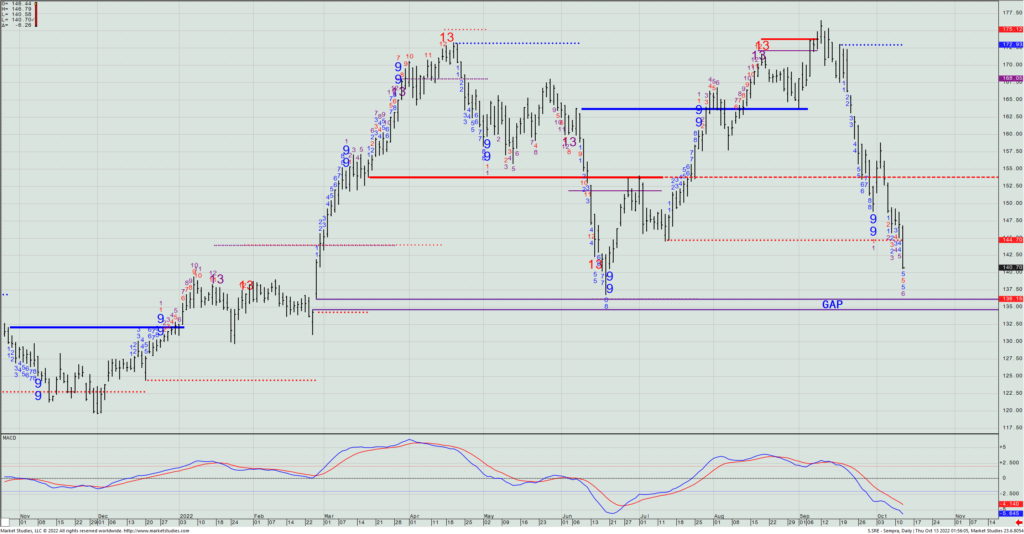

As equities trade near new relative lows going into new earnings season, all eyes turn to Q3 corporate earnings for how 2022 will end. With the banks reporting this week, we will get a glimpse into the health of the US economy. Looking ahead into next week’s big earnings week, one name stands out to me as a potential bearish opportunity. After 2 disastrous back to back earnings, all things have been quiet on the NFLX front. After an attempt to base and trade higher into the $200’s, Netflix’s outlook has not improved and at risk of a pullback into the $100’s. Currently trading at 20x next year’s earnings estimate (which I feel is still very optimistic) is a hefty premium after seeing a 10% decline in earnings for 2022. Trading at 16x would target $175 to the downside. Additionally, the weekly cloud model shows NFLX just broke below its conversion line after finding support above it in July. This leads me to believe that the base formed above $225 has been broken and NFLX will likely head back towards its previous lows of $170.

I’m looking to buy the Nov $205/$180 Put Vertical @ $8.35 Debit for a bearish earnings play.

NFLX – Weekly