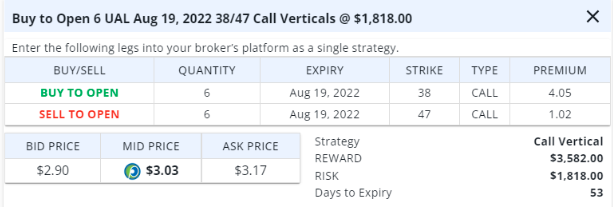

$UAL

DailyPlay – Opening Trade (UAL) – June 27, 2022

Bullish Opening Trade Signal

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Sell to Open 6 Contracts Aug 19, 2022 $38/$47 Call Verticals @ $3.03 Debit.

Total Risk: This trade has a max risk of $1,818 (6 Contracts x $303 per contract).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 5/10

OptionsPlay Score: 102

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

Our bullish trade idea today is United Airlines (UAL). Airline stocks have decline across the board due to recession fears. Looking at the JETS airline ETF, price has bounced from channel support indicating further upside ahead. Additionally, UAL is outperforming JETS on a relative basis and has bounced higher from support. From a fundamental perspective, airline bookings continue to grow despite the recent pullback in price. This provides a good risk/reward bullish opportunity with the next resistance level at $47 acting as a potential target.

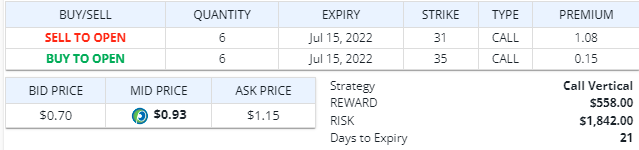

DailyPlay – Opening Trade (COPX) – June 24, 2022

Bearish Opening Trade Signal

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell to Open 6 Contracts July 15, 2022 $31/$35 Call Verticals @ $0.93 Credit.

Total Risk: This trade has a max risk of $1,842 (6 Contracts x $307 per contract).

Trend Continuation Signal: This is a Bearish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 4/10

OptionsPlay Score: 88

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

Copper has been under pressure since early April, but yesterday it cracked beneath prior important lows to put in what should be a fairly substantial top, with over a year worth of buyers now trapped. As such, we will look to sell a Global X Copper Miners ETF (COPX) July 15th $31/$35 call spread. (Last night this closed at $0.925 mid.) This has 22 days to expiration, and we’re taking in 23% of the spread. It’s a bit less than I’d typically like to collect, but with so many likely sellers coming on any rally, I don’t think it can move up much.

COPX – Daily

$GLD

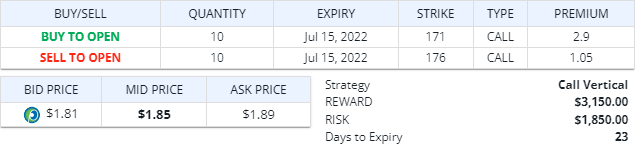

DailyPlay – Opening Trade (GLD) – June 23, 2022

Bullish Opening Trade Signal

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 10 Contracts July 15, 2022 $171/$176 Call Verticals @ $1.85 Debit.

Total Risk: This trade has a max risk of $1,850 (10 Contracts x $185 per contract).

Trend Continuation Signal: This is a Bullish trade on a stock that is experiencing a bullish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 9/10

OptionsPlay Score: 108

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

Gold has been hampered all year by a bullish dollar, and if it weren’t for the greenback’s strength, I think there were good chances that it would be up over $2000/oz. – especially with what has happened to the equity market.

The two-month bullion decline brought the SPDR Gold Trust ETF (GLD) back down to a 2022 weekly uptrend line – a line that now has four additional touches to it on top of the two you need to first create the line. It has also played with but stayed above the bearish Propulsion Momentum level of $170.28 for three weeks running. As such – along with my feeling that the dollar may have run its course – we will look to buy a GLD July 15 $171/$176 call spread for $1.85 (based upon Wednesday’s closing mid prices).

GLD – Weekly

$ARKK

DailyPlay – Closing Trade (ARKK) – June 22, 2022

Closing Trade

- ARKK: 33.33% Gain: Buy to Close 10 Contracts June 24, 2022 $39/$37 Put Verticals @ $0.88 Debit. DailyPlay Portfolio: By closing the remaining 10 of the 20 Contracts, we will be paying $880. We took partial profits for this trade on June 3 at a $0.46 Debit. Therefore, the average gain on this trade was 49.24% and the average cost basis to exit this trade is $0.67 Debit.

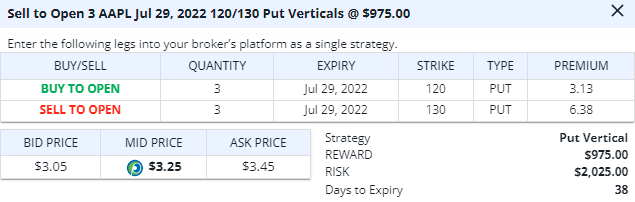

$AAPL, $V

DailyPlay – Opening Trade (AAPL) Partial Closing Trade (V) – June 21, 2002

Partial Closing Trade

V: 179% Gain: Sell to Close1 Contract July 15, 2022 $210/$190 Put Verticals @ $13.42 Credit. DailyPlay Portfolio: By closing 1 of the 2 Contracts, we will be receiving $1,342.

Bullish Opening Trade Signal

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 3 Contracts July 29, 2022 $130/$120 Put Verticals @ $3.25 Credit.

Total Risk: This trade has a max risk of $2,025 (3 Contracts x $675 per contract).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 4/10

OptionsPlay Score: 85

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investment Rationale

Match Group Inc. (MTCH) is currently in a clear bearish trend and the price is currently trading at the top Our bullish trade idea today is Apple Inc (AAPL). AAPL has declined to the $130 area forming a new lower low, however, momentum indicators show positive divergence which indicates a potential reversal higher at oversold levels. From a fundamental perspective, AAPL’s shift to a more service focused model will provide more consistent revenues.

$CVS, $MTCH

DailyPlay – Closing Trades (CVS, MTCH) – June 17, 2022

Closing Trades

- CVS: 88.41% Gain: Sell to Close 3 June 17, 2022 $95/$85 Put Verticals @5.20 Credit. DailyPlay Portfolio: By Closing the remaining 3 of the 7 Contracts, we will be receiving $1,560. We took partial profits for this trade on June 14 at a $4.14 Credit. Therefore, the average gain on this trade was 124.25% and the average cost basis to exit this trade is $4.59 Credit.

- MTCH: 34.33% Gain: Buy to Close1 July 22, 2022 $77/$88 Call Verticals @ $2.64 Debit. DailyPlay Portfolio: By closing 1 of the 3 Contracts, we will be paying $264.

Investment Rationale

Make sure you are out of the long CVS June 17 $95/$85 put spread as it expires today.

Today is the quarterly quadruple witching day, meaning that tens of thousands of options and futures contracts expire today. These days usually have significant intraday volatility, and with the markets also closed this coming Monday, many will be squaring up positions before the 3-day weekend.

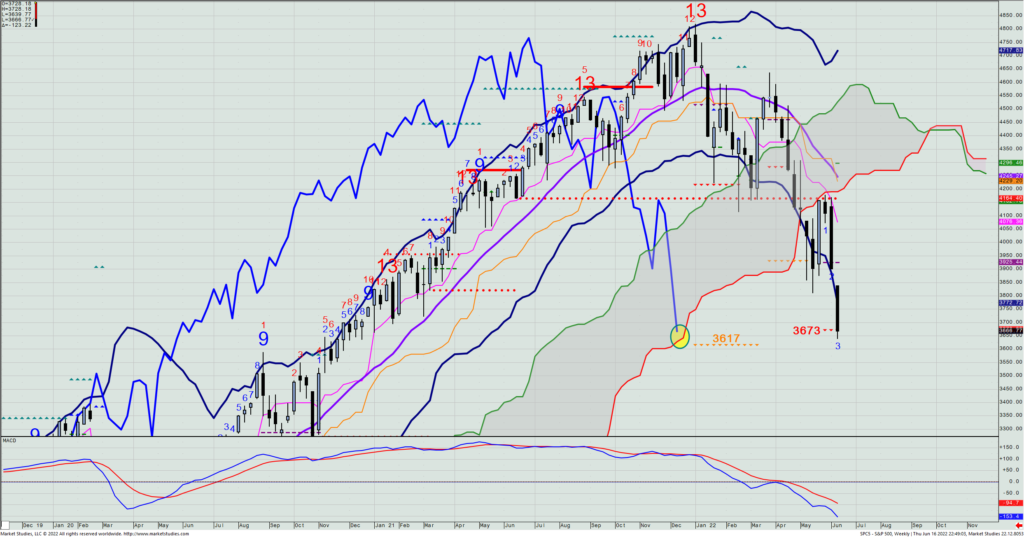

Yesterday the SPX closed a few points beneath the weekly Propulsion Exhaustion level at 3673, and now the market is but 50 points above the 3617 target I put out two months ago. To me, that means I’m apt to be taking partial profits on short positions from here down to that 3617 target. In the bigger picture, I can’t tell you that I think the big decline is over, but in the near-term, we certainly may be closer to a trading low.

One key thing to continue watching is the weekly SPX’s Lagging Line vs. its cloud bottom. It is holding for now, and it certainly could lead to some bottom-fishers coming in.

SPX – Weekly

We’re in the midst of a negative earnings revision cycle, and the market price is still too high relative to the implications of those revisions. Therefore, I’d still be looking to sell rallies when and if they come, but at levels that have a reason to do so. (Some of the wickedest up moves come in the midst of bear market rallies.) For now, I’d be watching the Conversion Line (currently 4076) as the first real resistance and what capped the market just two weeks ago.

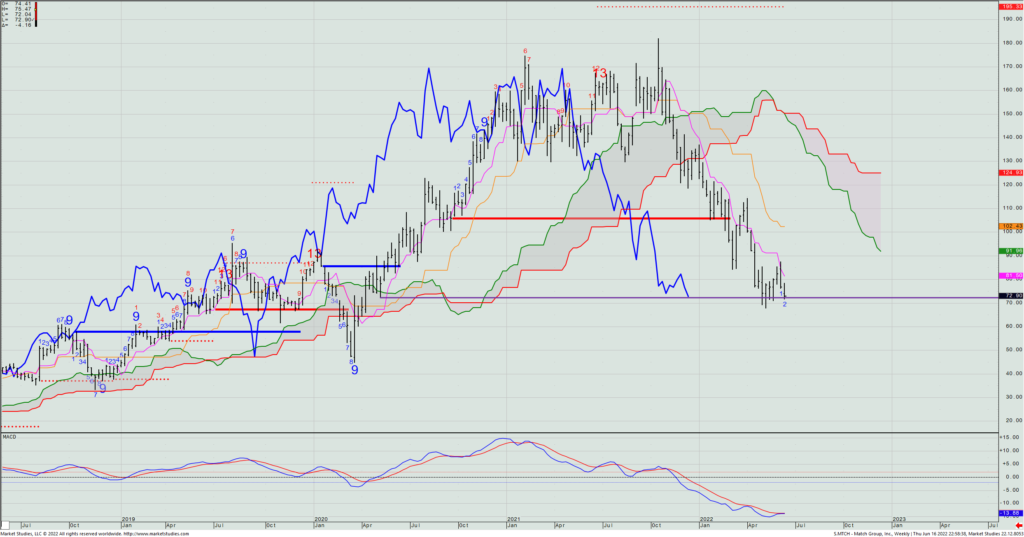

Lastly, we are short three July 22 MTCH $77/$88 call spreads. With 5 of the last 7 weeks having the same low near $73, let’s buy back one of those three spreads today to lock in some profit against support.

MTCH – Weekly

$CLF

DailyPlay – Opening Trade (CLF) – June 16, 2022

View CLF Trade

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish

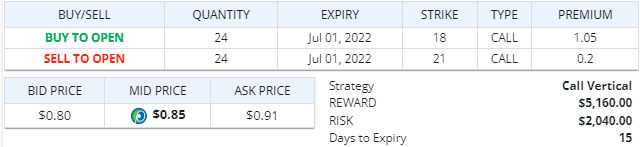

Details: Buy to Open 24 Contracts July 1, 2022 $18/$21 Call Verticals @ $0.85 Debit.

Total Risk: This trade has a max risk of $2,040 (24 Contracts x $0.85 per contract).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 5/10

OptionsPlay Score: 100

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

The Fed gave us the 75 bps. rate hike that was recently turned into the consensus figure, and investors mildly celebrated with a post- press conference rally to send the SPX up 1.5% (though it was already up about 1.25% before the 2pm announcement), so it wasn’t as much of a victory as the media might want you to believe.

S&P futures are up about 0.6% as I write this Wednesday evening, and gosh, there is such a desire by folks to want this to be the start of a significant move higher. We’d all much be playing with a safe “buy the dip” environment than a scary “sell the rally” one, but can we yet do that and get away with it? In other words, will the Fed’s rate hike be enough to lock in what was a new 2022 low just two trading days ago and start that rally move?

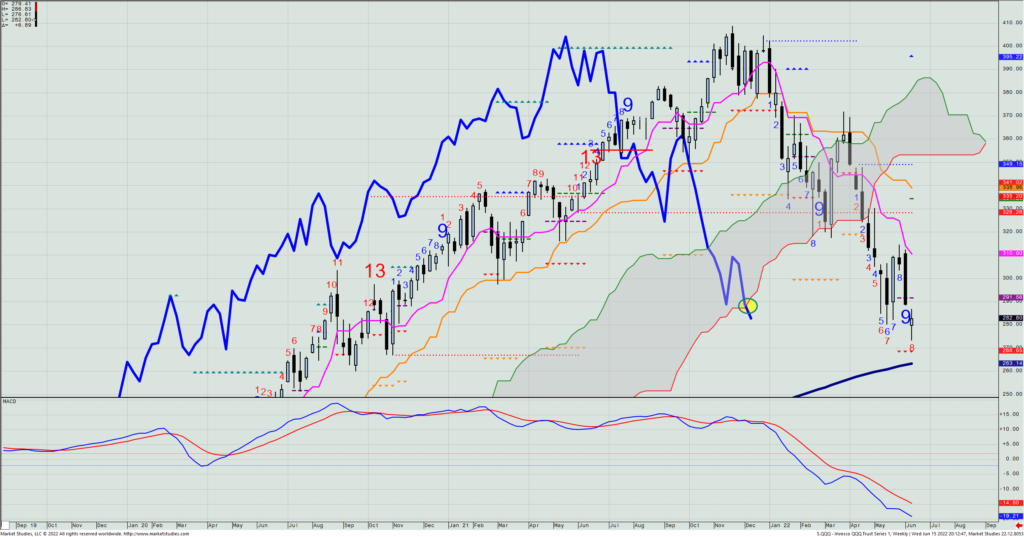

It’s a darn tough call to make, and I’ll show you why in the weekly QQQ chart: this week’s new 2022 low “perfected” the Setup -9 count (meaning we like to see bar -8 or -9 be the low of a downmove. Bar -7 was the low.). But now, the -9 from last week is a “validated” as a potential turning point. We add to this that the cloud’s Lagging Line just came out of the bottom of its cloud, and could become a one bar fake out, OR, it’s still the signal that the even more bearish structural damage from the Lagging Line penetration will lead to further losses. Truly, it’s a tough call.

QQQ – Weekly

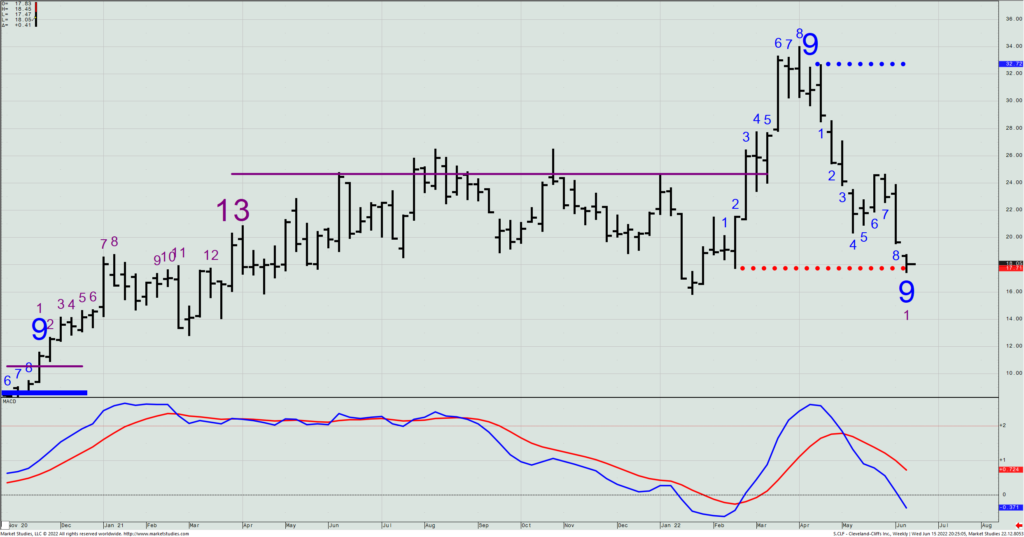

So, let’s go look at a name that we previously made money with and is again presenting itself as an opportunity to play the long side: Cleveland Cliffs (CLF). It’s on a weekly Setup -9 right on its most recent weekly TDST Line. This is as good a place as we’d likely find to play for a bounce. As such, let’s to buy the July 1 $18/$21 call (yesterday it closed at $0.80 mid). We’re paying about 27% of the strike differential, and make money if the stock gets above $18.80 at expiration (which is very doable with any type market rally).

CLF – Weekly

$ORCL

DailyPlay – Closing Trade (ORCL) – June 15, 2022

Closing Trade

ORCL: 62.30% Loss: Buy to Close 6 Contracts June 17, 2022 $167.50/$172.50 Put Verticals @ $1.98 Debit. DailyPlay Portfolio: By closing 6 of the 6 Contracts, we will be paying $1,188.

DailyPlay Updates

With our CVS long put option expiring on Friday, we’ll wait till the end of the day today to determine what we’ll do with the balance of our position. If CVS is up on the day heading into the close, then we’ll cover the balance then. If it’s down on the day going into the close, we’ll cover the balance tomorrow.

————-

Today is Fed day, and the Street is guessing how much the FOMC is going to raise rates. What was a heavy bet on 50 bps. just days ago has now turned into a consensus 75 bps. bump up this afternoon. We don’t know how investors are going to react to what the Fed does, and we’ll have to see what Chair Powell’s news conference does to the initial knee-jerk reaction when the figure comes out at 2pm. ET.

I surely am not looking to put a new trade on this morning, and can’t possibly now tell you what you might occur in the afternoon. So, yes, we sit and watch.

What I can tell you is that regardless of the reaction tomorrow, I do not think that the market woes are over. Earnings revisions are coming down faster than the market has priced in, so the upside remains limited, and we’ll still be looking into selling rallies until there is both more equilibrium in that relationship and we get a sense that interest rates are done going up. Until that happens, it’s hard to make a case for investing in equities. Add to that mix a US dollar that keeps rallying and a potential crisis brewing in Italy that may ultimately force them out of the EU, and you have the makings of a situation that isn’t close to a resolution favoring bullish activity.

Could the market rally from these deeply oversold levels? Sure; anytime. But will we likely get a lasting rally? I wouldn’t bet on it. So, while all major equity indexes’ weekly cloud model’s Conversion Lines remain as resistance, I’m gonna stay in the bear camp and look to lean into rallies. (I just hope they come.)

$NVDA, $AXP, $NFLX, $ALGN, $V, $CVS

DailyPlay – Closing Trades (NVDA, AXP, NFLX, ALGN, V, CVS) – June 14, 2022

Closing Trades

- NVDA: 166.02% Loss: Buy to Close 1 Contract June 17, 2022 $182.5/$167.5 Put Verticals @12.73 Debit. DailyPlay Portfolio: By closing 1 of the 2 Contracts, we will be paying $1,273. We took partial profits for this trade on June 3 at a $2.57 Debit. Therefore, the average loss on this trade was 58.11% and the average cost basis to exit this trade is $7.65 debit.

- AXP: 136.00% Loss: Buy to Close 1 Contract June 24, 2022 $160/$150 Put Verticals @ $6.88 Debit. DailyPlay Portfolio: By closing 1 of the 3 Contracts, we will be paying $688. We took partial profits for this trade on June 3 at a $1.36 Debit. Therefore, the average loss on this trade was 19.70% and the average cost basis to exit this trade is $3.20 Debit.

- NFLX: 4.15% Loss: Buy to Close 1 Contract July 15, 2022 $170/$190 Put Verticals @ $12.18 Debit. DailyPlay Portfolio: By closing 1 of the 2 Contracts, we will be paying $1,218. We took partial profits for this trade on June 3 at a $4.55 Debit. Therefore, the average gain on this trade was 28.47% and the average cost basis to exit this trade is $8.37 Debit.

- ALGN: 86.40% Loss: Buy to Close 2 Contracts July 8, 2022 $265/$245 Put Verticals @ $11.65 Debit. DailyPlay Portfolio: By closing 2 of the 2 Contracts, we will be paying $2,330.

- V: 50.00% Gain: Sell to Close 2 Contracts July 15, 2022 $210/$190 Put Verticals @ $12.08 Credit. DailyPlay Portfolio: By closing 2 of the 4 Contracts, we will be receiving $2,416.

- CVS: 151.14% Gain: Sell to Close 4 Contracts June 17, 2022 $95/$85 Put Verticals @ $4.14 Credit. DailyPlay Portfolio: By closing 4 of the 7 Contracts, we will be receiving $1,656

Investment Rationale

With the severe decline we’ve seen the past three trading days – along with technical patterns suggesting more downside is likely coming before all is said and done – I want to clean up the bullish trades we have on by exiting them today. This includes remaining short put spreads in NVDA; AXP; ALGN; and NFLX, and you can choose whether to do them in the morning, midday, or towards the close.

ORCL reported after the close yesterday and beat, and in after-hours trading it was up some 10%, putting it back to near the $70 level. With our short $72.5/$67.50 expiring on Friday this week, we’ll take advantage of the hopeful large move up and exit this today, too.

On the flip side, we are long V July 15 $210/$190 put spreads. We have a nice profit on that and will exit 2 of the 4 contracts today.

We are also long a CVS June 17th $95/$85 put spread expiring in 4 days. With the stock trading at near $91, we’ll take half off today, too.

Lastly, we are short the June 24th ARKK $41/$39 spread, which served us well till the past three days. The stock is at $36.58 with 10 more trading days to go till expiration. I’m inclined to be a holder of this, but I’d understand if you wanted to exit it, too.

If anything, the last few days have shown me that we likely really need to play short-dated options while the volatility is elevated and bearish action prevalent. Figuring out where the market will be one month out is pretty difficult, so I’m more inclined to keep ideas now to something closer to the two-week range.

$MTCH

DailyPlay – Opening Trade (MTCH) – June 13, 2022

View MTCH Trade

Strategy Details

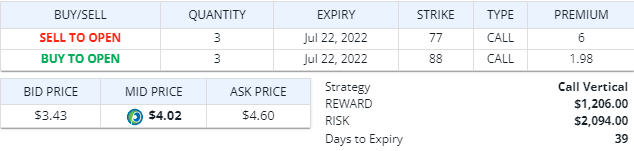

Strategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell to Open 3 Contracts July 22, 2022 $77/$88 Call Verticals @ $4.02 Credit.

Total Risk: This trade has a max risk of $2,094 (3 Contracts x $698 per contract).

Trend Continuation Signal: This is a Bearish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 2/10

OptionsPlay Score: 104

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

Match Group Inc. (MTCH) is currently in a clear bearish trend and the price is currently trading at the top of this downwards trend formation. This provides an excellent risk/reward for downwards exposure. Its recent outperformance relative to its sector, the Technology Sector, could indicate that we are now entering a period of underperformance relative to its sector. Despite Revenue growth on this stock, almost no Earnings growth has been seen lately, indicating that this stock is still over-valued.